Содержание

- 2. Chapter 20 Long-Term Debt 20.1 Long Term Debt: A Review 20.2 The Public Issue of Bonds

- 3. 20.1 Long Term Debt: A Review Corporate debt can be short-term (maturity less than one year)

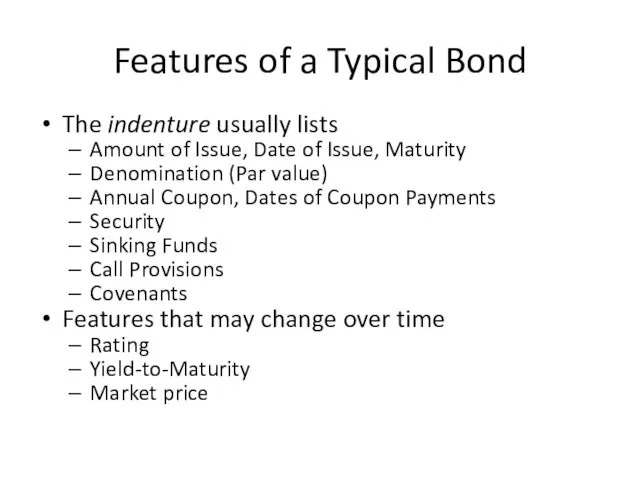

- 4. Features of a Typical Bond The indenture usually lists Amount of Issue, Date of Issue, Maturity

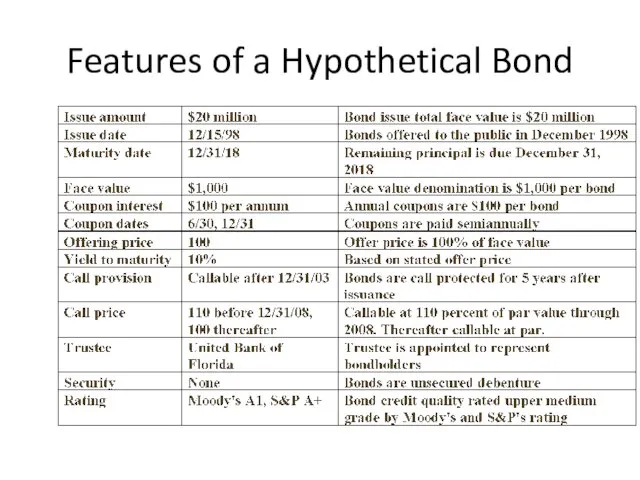

- 5. Features of a Hypothetical Bond

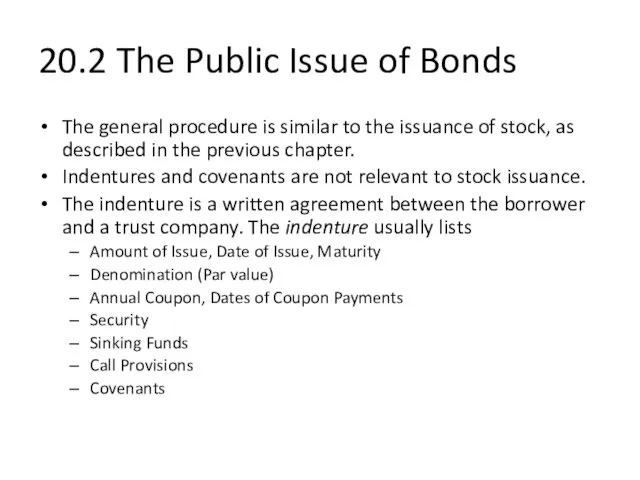

- 6. 20.2 The Public Issue of Bonds The general procedure is similar to the issuance of stock,

- 7. Principal Repayment Term bonds versus serial bonds Sinking funds: How do they work? Fractional repayment each

- 8. Protective Covenants Agreements to protect bondholders Negative covenant: Thou shalt not: pay dividends beyond specified amount

- 9. The Sinking Fund There are many different kinds of sinking-fund arrangements: Most start between 5 and

- 10. The Call Provision A call provision lets the company repurchase or call the entire bond issue

- 11. 20.3 Bond Refunding Replacing all or part of a bond issue is called refunding. Bond refunding

- 12. Should firms issue callable bonds? Common sense tells us that call provisions have value. A call

- 13. Why are callable bonds issued in the real world? Four specific reasons why a company might

- 14. Callable Bonds versus Noncallable Bonds Most bonds are callable; some sensible reasons for call provisions include:

- 15. Calling Bonds: When does it make sense? In a world with no transaction costs, it can

- 16. 20.4 Bond Ratings What is rated: The likelihood that the firm will default. The protection afforded

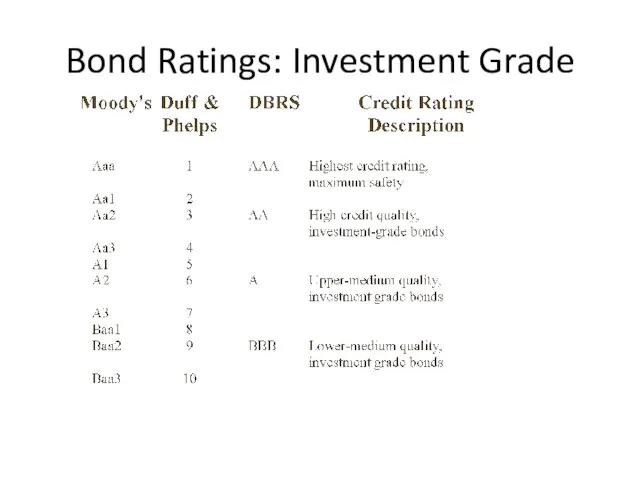

- 17. Bond Ratings: Investment Grade

- 18. Bond Ratings: Below Investment Grade

- 19. Junk bonds Anything less than an S&P “BB” or a Moody’s “Ba” is a junk bond.

- 20. 20.5 Different Types of Bonds Callable Bonds Puttable Bonds Convertible Bonds Zero Coupon Bonds Floating-Rate Bonds

- 21. Puttable bonds Put provisions Put price Put date Put deferment Extendible bonds Value of the put

- 22. Convertible Bonds Why are they issued? Why are they purchased? Conversion ratio: Number of shares of

- 23. Convertible Bond Prices

- 24. Example of a Convertible Bond

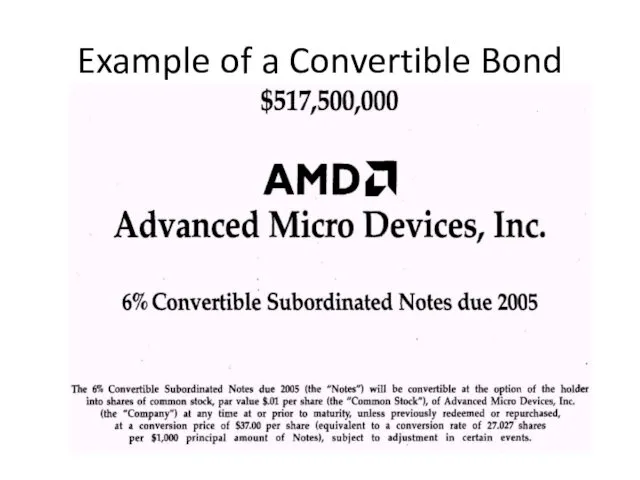

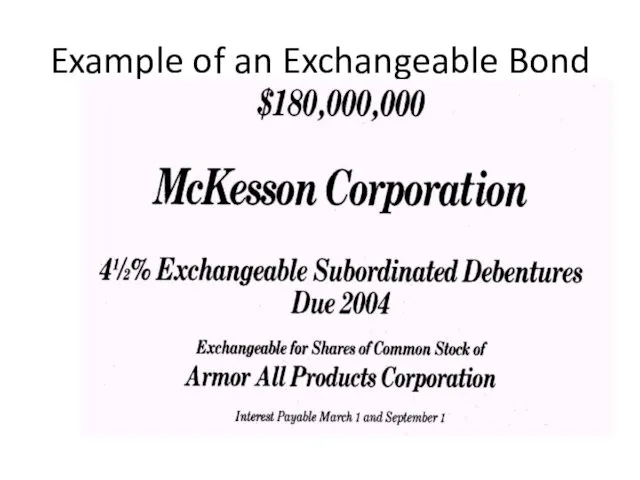

- 25. More on Convertibles Exchangeable bonds Convertible into a set number of shares of a third company’s

- 26. Example of an Exchangeable Bond

- 27. Zero-Coupon Bonds A bond that pays no coupons at all must be offered at a price

- 28. Floating Rate Bonds With floating rate bonds, the coupon payments are adjustable.The adjustments are tied to

- 29. Financial Engineering and Bonds Income bonds: coupon payments are dependent on company income. Retractable bonds: allow

- 30. 20.6 Direct Placement Compared to Public Issues There are two basic forms of direct private long-term

- 31. 20.7 Long-Term Syndicated Bank Loans A syndicated loan is a corporate loan made by a group

- 32. 20.8 Summary and Conclusions The details of the long-term debt contract are contained in the indenture.

- 34. Скачать презентацию

Учет процесса производства

Учет процесса производства Тинькофф. 7 день

Тинькофф. 7 день Программа Trade Forward Bot (для инвесторов). Валютный рынок Forex

Программа Trade Forward Bot (для инвесторов). Валютный рынок Forex Ценообразование на рынке консалтинговых услуг

Ценообразование на рынке консалтинговых услуг Значение финансов в деятельности предпринимателя

Значение финансов в деятельности предпринимателя Теория затрат

Теория затрат Бухгалтерский баланс в системе бухгалтерской отчетности

Бухгалтерский баланс в системе бухгалтерской отчетности Виды медицинского страхования!

Виды медицинского страхования! Село Верховонданка. Проект по поддержке местных инициатив

Село Верховонданка. Проект по поддержке местных инициатив Виды инвестирования

Виды инвестирования МСФО (IAS) 1. Представление финансовой отчетности

МСФО (IAS) 1. Представление финансовой отчетности Механизм реализации пилотных проектов по созданию доходных домов в Югре

Механизм реализации пилотных проектов по созданию доходных домов в Югре Strategic Alliance

Strategic Alliance Мой первый финансовый план. Как подростку накопить на мечту

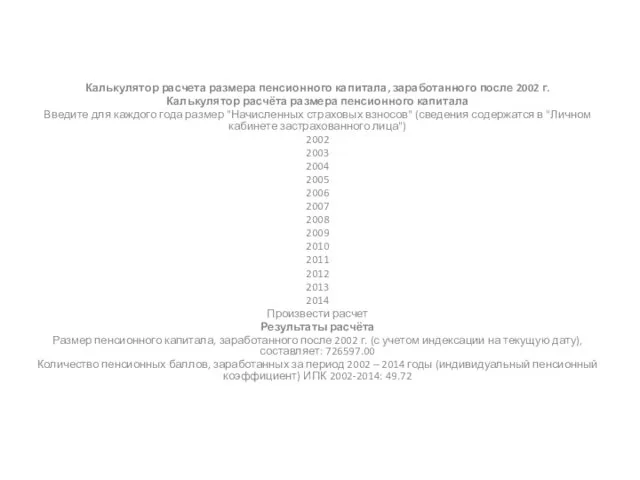

Мой первый финансовый план. Как подростку накопить на мечту Калькулятор расчёта размера пенсионного капитала

Калькулятор расчёта размера пенсионного капитала АО “Почта банк”. Продукт “Дом по почте”

АО “Почта банк”. Продукт “Дом по почте” Онлайн образование. Практический семинар

Онлайн образование. Практический семинар Деньги, кредит и банки

Деньги, кредит и банки Налог на прибыль организаций в Российской Федерации: актуальные проблемы и пути совершенствования механизма исчисления

Налог на прибыль организаций в Российской Федерации: актуальные проблемы и пути совершенствования механизма исчисления Органы финансово-экономического контроля

Органы финансово-экономического контроля Финансовые ресурсы

Финансовые ресурсы Application International Trade. What determines whether a country imports or exports a good

Application International Trade. What determines whether a country imports or exports a good О порядке предоставления субсидий на оказание несвязанной поддержки в области растениеводства

О порядке предоставления субсидий на оказание несвязанной поддержки в области растениеводства Financial Accounting Training program

Financial Accounting Training program Основы теории налогообложения. Основные понятия и определения

Основы теории налогообложения. Основные понятия и определения Управление реальными инвестициями

Управление реальными инвестициями Стан управління у банківській системі України. ПАТ КРЕДОБАНК

Стан управління у банківській системі України. ПАТ КРЕДОБАНК Бюджет семьи. Доходная и расходная части бюджета

Бюджет семьи. Доходная и расходная части бюджета