Содержание

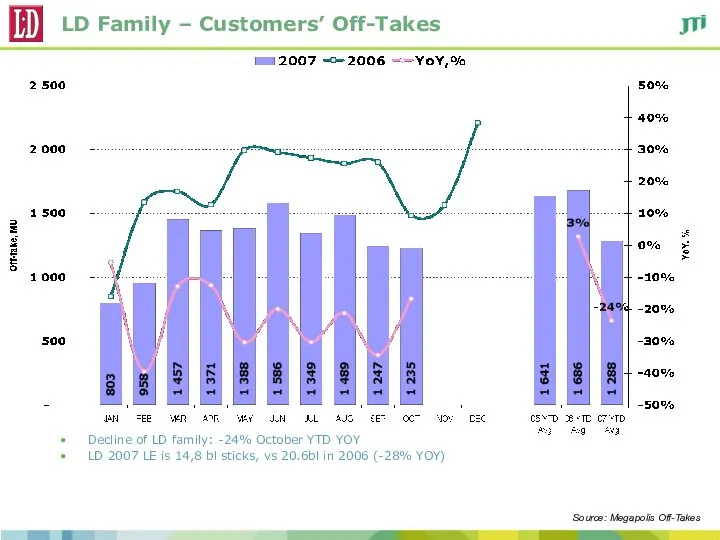

- 2. LD Family – Customers’ Off-Takes Decline of LD family: -24% October YTD YOY LD 2007 LE

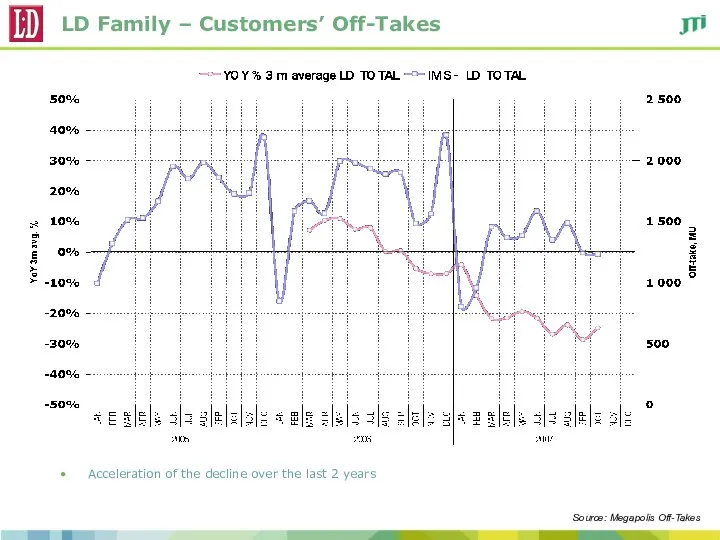

- 3. LD Family – Customers’ Off-Takes Acceleration of the decline over the last 2 years Source: Megapolis

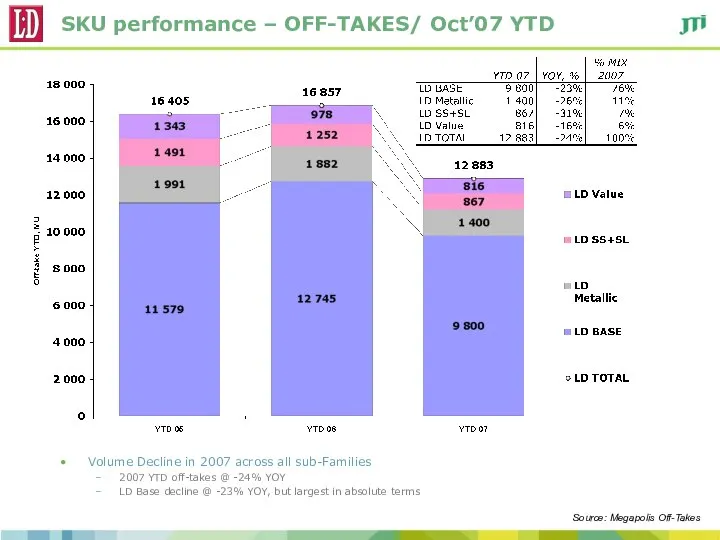

- 4. SKU performance – OFF-TAKES/ Oct’07 YTD Volume Decline in 2007 across all sub-Families 2007 YTD off-takes

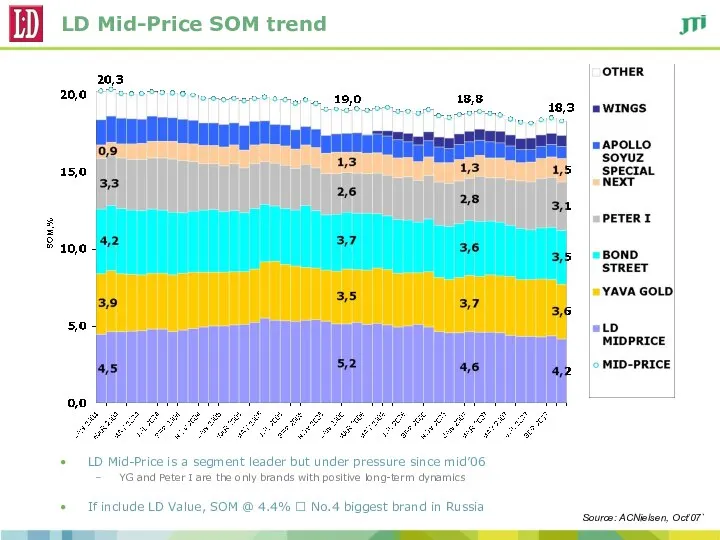

- 5. LD Mid-Price SOM trend LD Mid-Price is a segment leader but under pressure since mid’06 YG

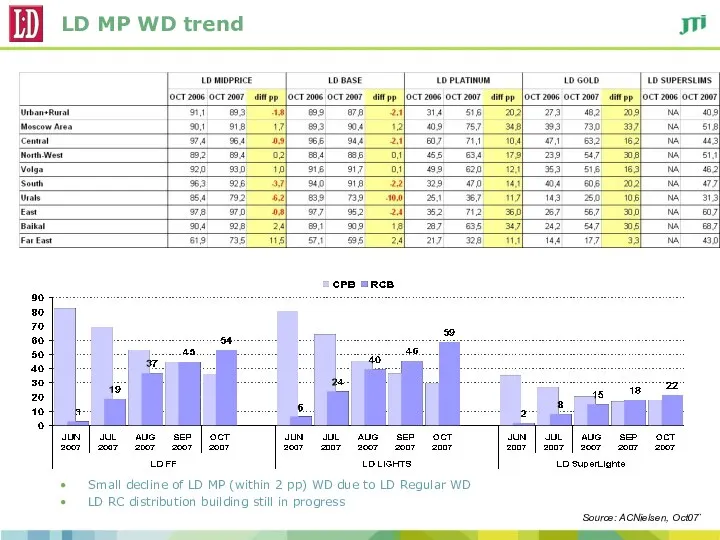

- 6. LD MP WD trend Small decline of LD MP (within 2 pp) WD due to LD

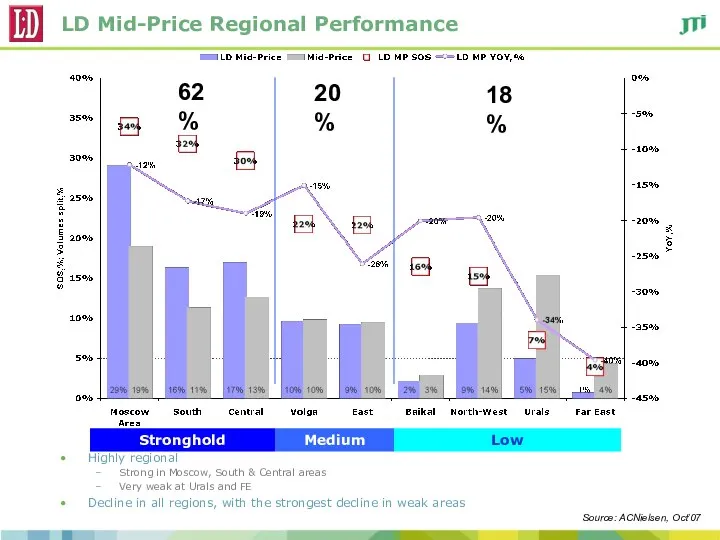

- 7. LD Mid-Price Regional Performance Highly regional Strong in Moscow, South & Central areas Very weak at

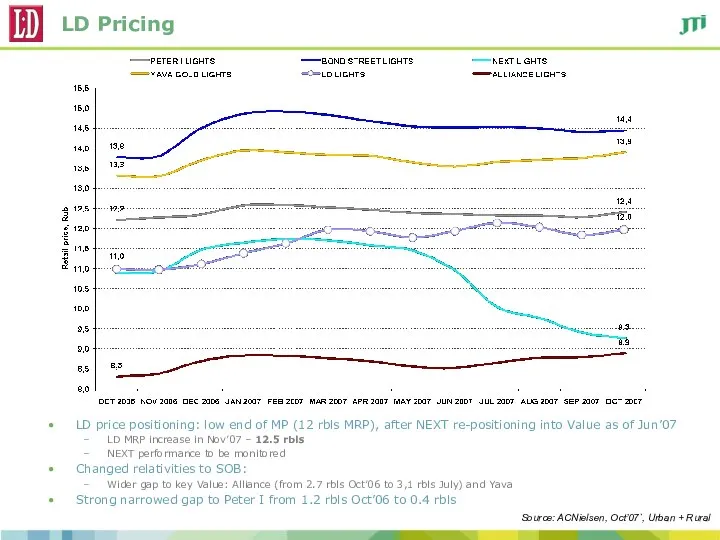

- 8. LD Pricing LD price positioning: low end of MP (12 rbls MRP), after NEXT re-positioning into

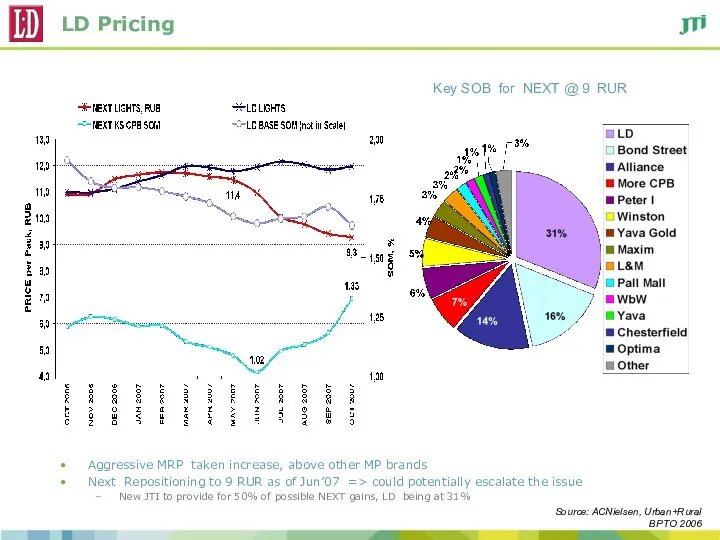

- 9. LD Pricing Aggressive MRP taken increase, above other MP brands Next Repositioning to 9 RUR as

- 10. LD Performance Summary No.1 Mid-Price brand and No.4 largest brand in Russia but volume under pressure

- 11. Line Extensions

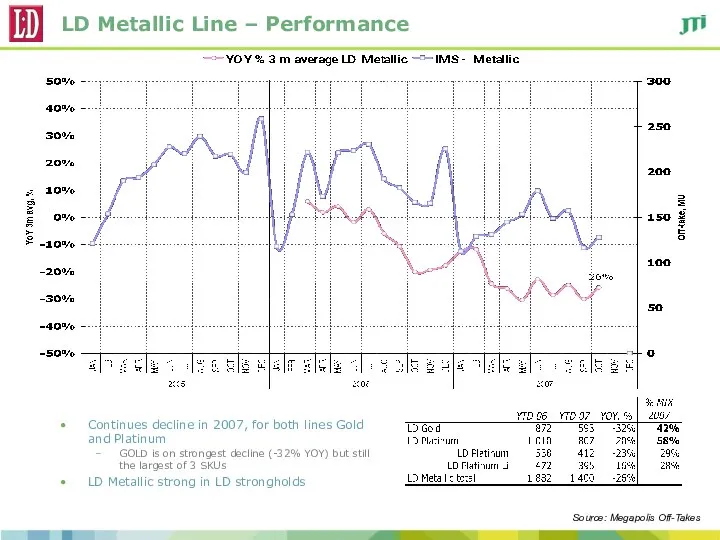

- 12. LD Metallic Line – Performance Continues decline in 2007, for both lines Gold and Platinum GOLD

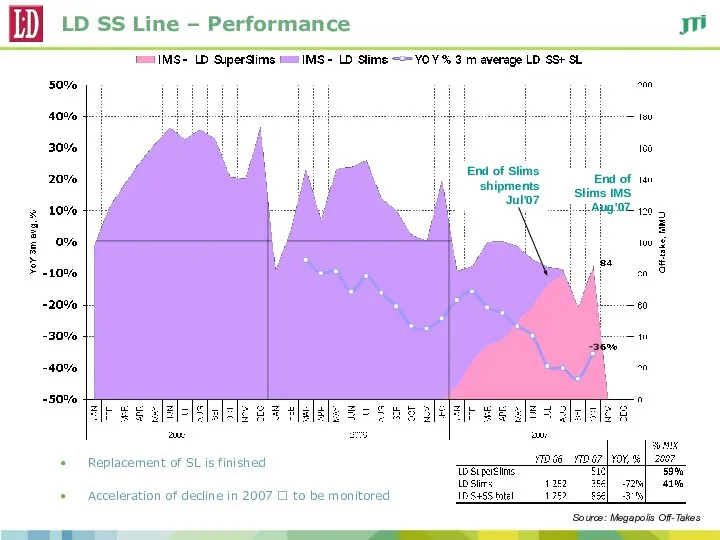

- 13. LD SS Line – Performance Replacement of SL is finished Acceleration of decline in 2007 ?

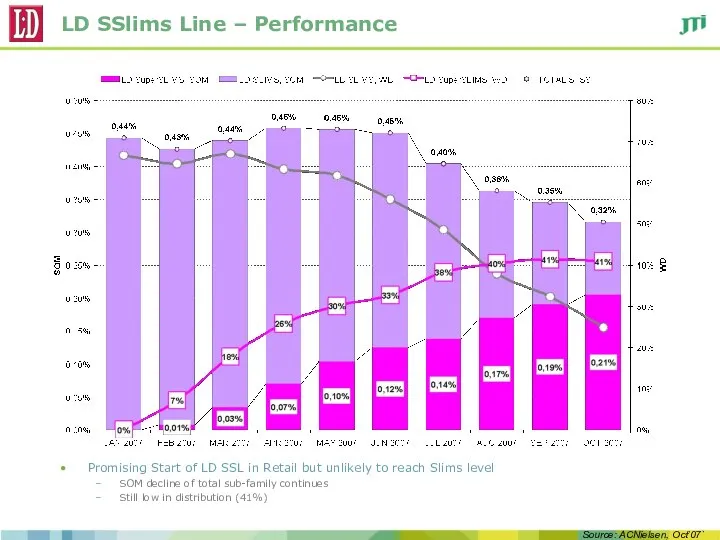

- 14. LD SSlims Line – Performance Promising Start of LD SSL in Retail but unlikely to reach

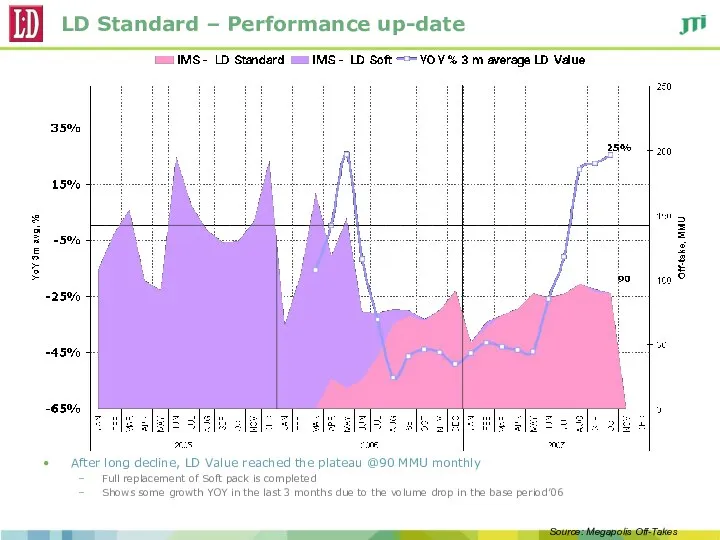

- 15. LD Standard – Performance up-date After long decline, LD Value reached the plateau @90 MMU monthly

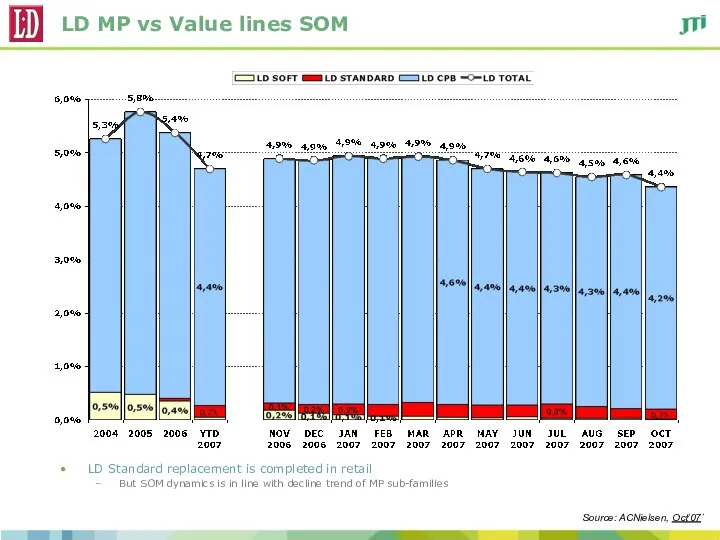

- 16. LD MP vs Value lines SOM LD Standard replacement is completed in retail But SOM dynamics

- 17. LD Families Performance Summary Appeal of Metallic line is dependent on the LD position in the

- 18. Programs Q3’2007 LD NCP “SUMMER MOTION 2007” RESULTS

- 19. Objectives, GEO, Timing, Mechanics Objectives: To support loyalty to the LD brand family / Stimulate Trial

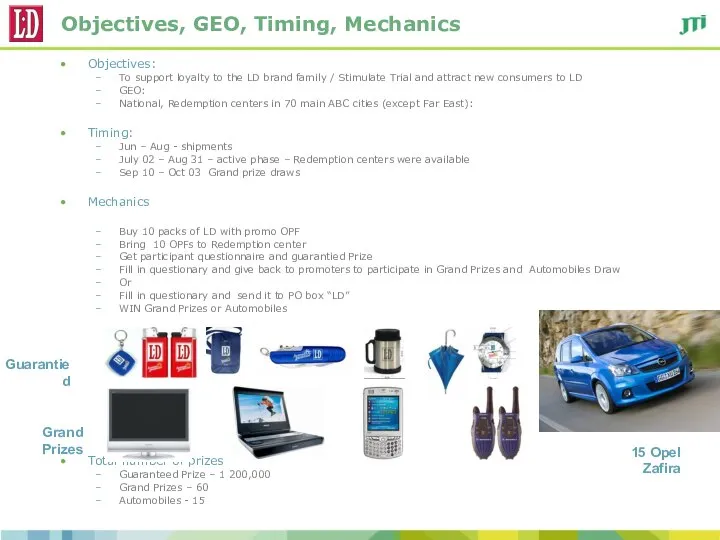

- 20. Communication Support Pre-printed OPF POSM (for retail outlets + KRA outlets equipment + X5 retail group

- 21. Weekly Statistics – Number of Entries (10 POP’s) The Overall result was in line with 2006

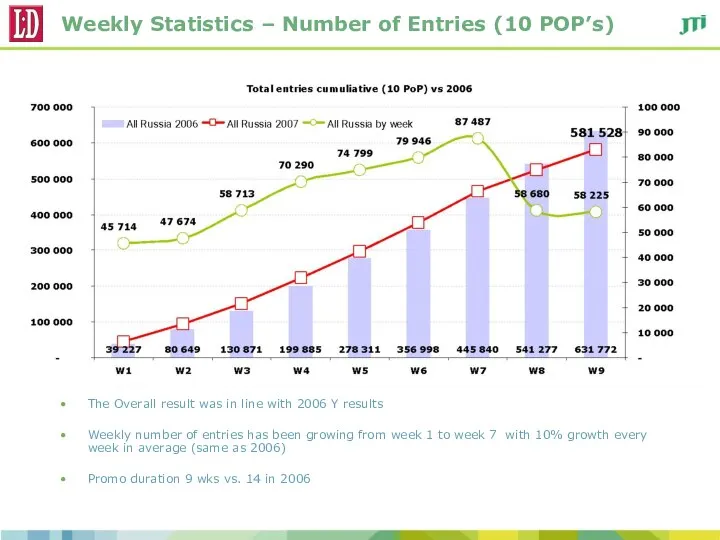

- 22. Results - Hard KPI’s vs. other JTI NCP’s Average industry redemption rate 4% achieved; Investment/POP for

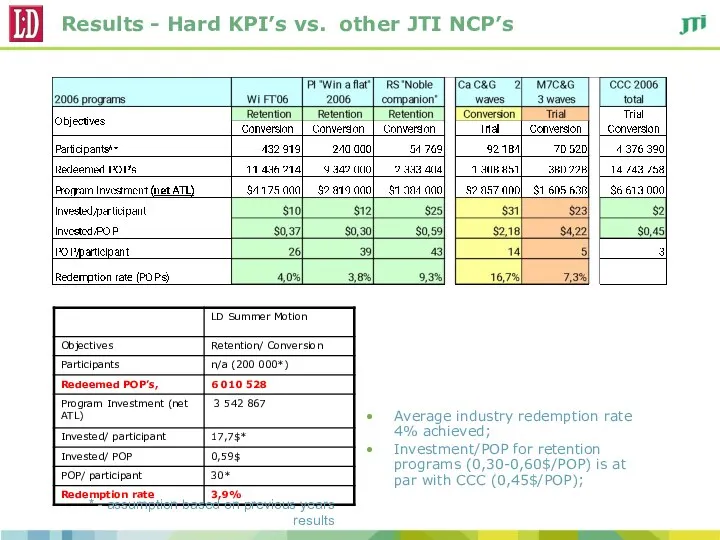

- 23. Key Learnings & Recommendation Program targets (1 200 000 entries) were too optimistic/ over-estimated Free of

- 24. Programs Q4’2007 LD Round corner re-launch Nov-Dec’07

- 25. LD – RC launch support (Nov-Dec) LD Round corner launch support Nov-Dec’07 Shipments of non-promo RC

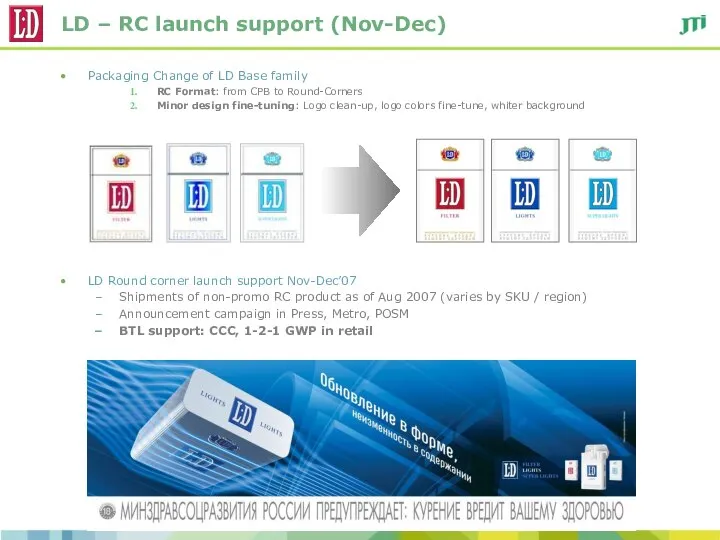

- 26. LD – Round Corner Launch Campaign Awareness/ image Press: mass press with high coverage, 34% TA

- 27. Retail Visibility materials Mini display Retail Visibility Dominant Visibility flight: Multi Facings; POSMs Nov’07 to Feb’08

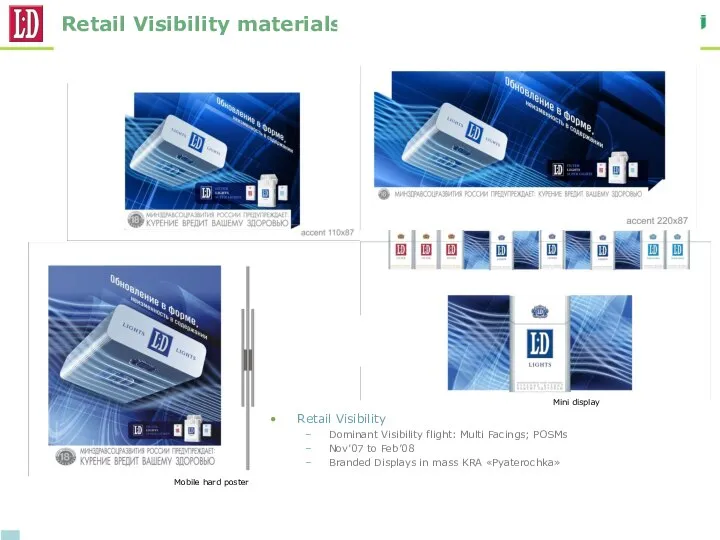

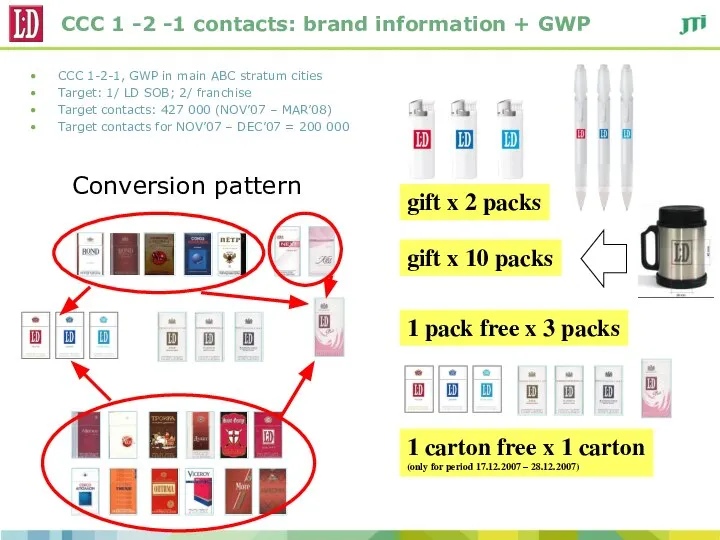

- 28. CCC 1 -2 -1 contacts: brand information + GWP CCC 1-2-1, GWP in main ABC stratum

- 29. 2008 Brand Objectives and Support

- 30. 2008 Strategic Focus / Opportunities LD Objective: Consolidate the dominant position in Mid-Price to fuel Winston

- 31. Key LD Brand Initiatives 2007-08 LD Barrier-to-Entry Brand assessment Results on Dec 18, 2007 LD BASE

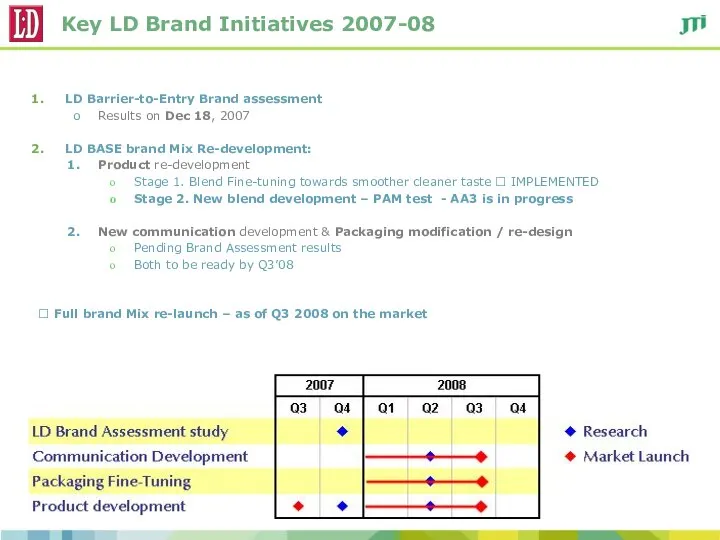

- 32. LD Support Plan Maximize the investments behind BTL programs Franchise Retention Conversion of SOB Value smokers

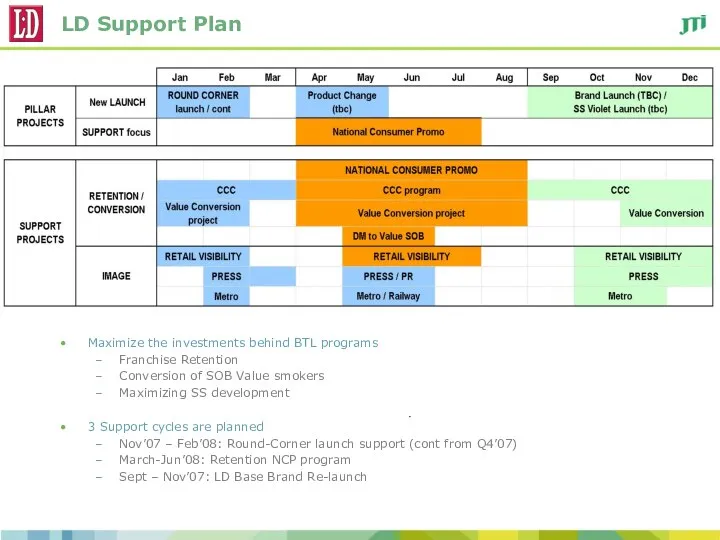

- 33. LD Program Details (1) - Jan-Feb’08 Round-Corner launch Support – 2nd Follow-up flight Support OBJECTIVE: to

- 34. LD – CCC Support in Q1 2008 CCC mechanics and gifts Gifts for Jan-Mar’08 Lighter with

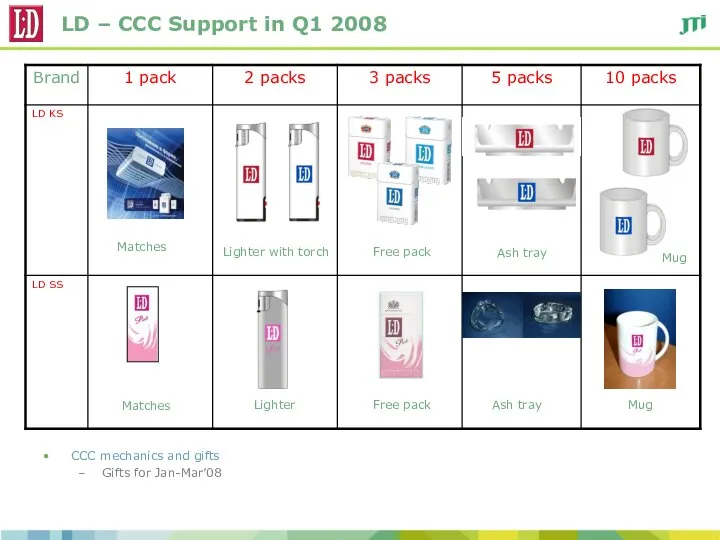

- 35. LD Program Details (2) – Value Conversion Value Conversion Program (delayed due to production) Objective: drive

- 36. LD Program Details (3) - NCP National Consumer Promotion Objective: Franchise retention and SOB conversion (Value

- 38. Скачать презентацию

Жизненный цикл информационных систем

Жизненный цикл информационных систем Метод інженерії вимог А. Джекобсона

Метод інженерії вимог А. Джекобсона Системы управления базами данных

Системы управления базами данных Мехатронные системы в различных сферах производственной деятельности

Мехатронные системы в различных сферах производственной деятельности Презентация на тему Внешняя память, ее виды

Презентация на тему Внешняя память, ее виды Жанры игр

Жанры игр Проблеми пропаганди цінностей здорового способу життя засобами масової інформації України

Проблеми пропаганди цінностей здорового способу життя засобами масової інформації України Создание программы для расчета термодинамических свойств воды и водяного пара в состоянии насыщения

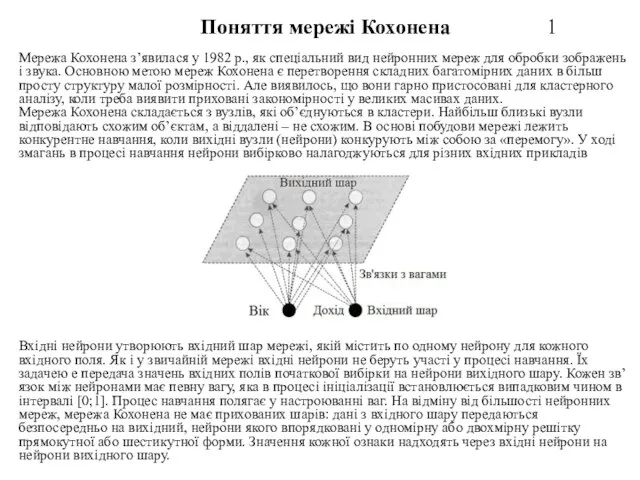

Создание программы для расчета термодинамических свойств воды и водяного пара в состоянии насыщения Мережа Кохонена

Мережа Кохонена История развития вычислительной техники

История развития вычислительной техники Военно-музыкальный фестиваль Спасская башня 2016 Инструкция по предоставлению данных для прохождения процедуры аккредитации

Военно-музыкальный фестиваль Спасская башня 2016 Инструкция по предоставлению данных для прохождения процедуры аккредитации Проект “Super hard Mario Bros”

Проект “Super hard Mario Bros” Проект Выполнили: Макаров П. Михайлов А. Бирюков Е. Руководитель проекта: Сарапкина М.М.

Проект Выполнили: Макаров П. Михайлов А. Бирюков Е. Руководитель проекта: Сарапкина М.М.  Класс Object. Занятие 18

Класс Object. Занятие 18 Работа с Microsoft Word

Работа с Microsoft Word Отсечение многоугольной областью

Отсечение многоугольной областью Библиотека в программировании

Библиотека в программировании ОПЕРАТОРЫ РИСОВАНИЯ QBasic

ОПЕРАТОРЫ РИСОВАНИЯ QBasic Проектирование ООП

Проектирование ООП Безопасность в сети интернет

Безопасность в сети интернет Тематическое моделирование

Тематическое моделирование Разработка интеллектуальной системы управления контентом предприятия

Разработка интеллектуальной системы управления контентом предприятия Презентация "Глобальная компьютерная сеть. Интернет" - скачать презентации по Информатике

Презентация "Глобальная компьютерная сеть. Интернет" - скачать презентации по Информатике Програмні засоби навчального призначення. Інформаційні технології у навчанні

Програмні засоби навчального призначення. Інформаційні технології у навчанні Строки и функции (язык C)

Строки и функции (язык C) Компьютерные вирусы, типы вирусов, методы борьбы с вирусами (9 класс)

Компьютерные вирусы, типы вирусов, методы борьбы с вирусами (9 класс) Разработка приложения Квест с использованием веб-технологии

Разработка приложения Квест с использованием веб-технологии Алгоритм. Свойства. Способы записи. Линейные алгоритмы

Алгоритм. Свойства. Способы записи. Линейные алгоритмы