Содержание

- 2. COST-VOLUME-PROFIT (CVP) ANALYSIS CVP analysis examines the interaction of a firm’s sales volume, selling price, cost

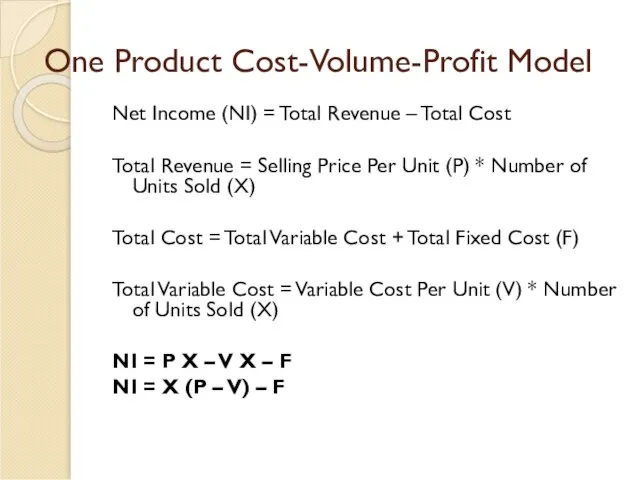

- 3. One Product Cost-Volume-Profit Model Net Income (NI) = Total Revenue – Total Cost Total Revenue =

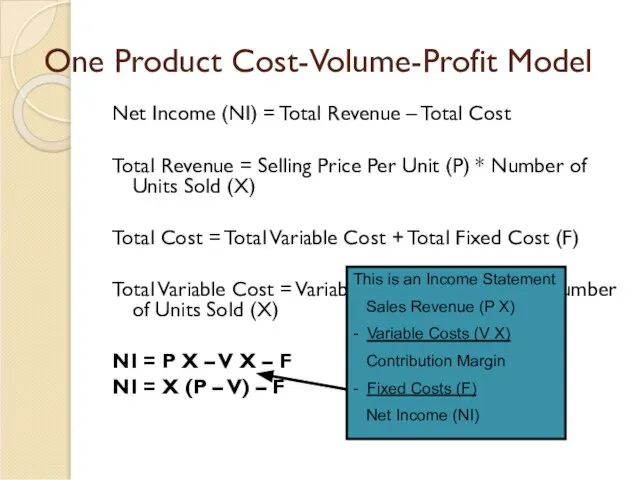

- 4. One Product Cost-Volume-Profit Model Net Income (NI) = Total Revenue – Total Cost Total Revenue =

- 5. CVP Model – Assumptions Key assumptions of CVP model Selling price is constant Costs are linear

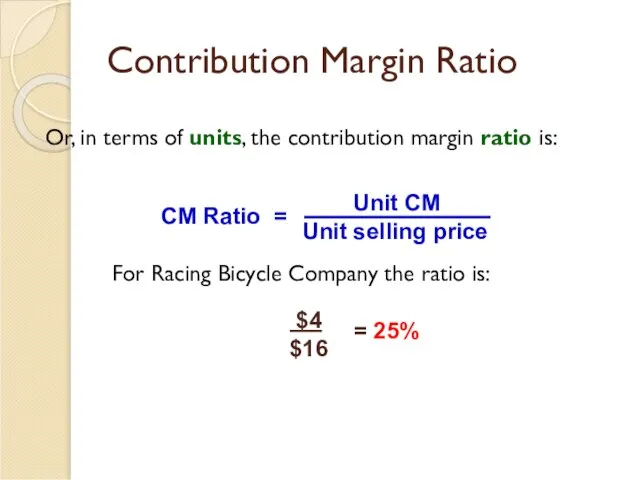

- 6. Contribution Margin Ratio Or, in terms of units, the contribution margin ratio is: For Racing Bicycle

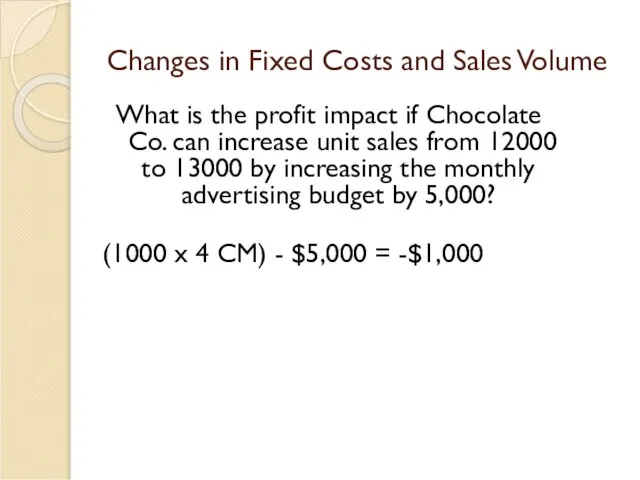

- 7. Changes in Fixed Costs and Sales Volume What is the profit impact if Chocolate Co. can

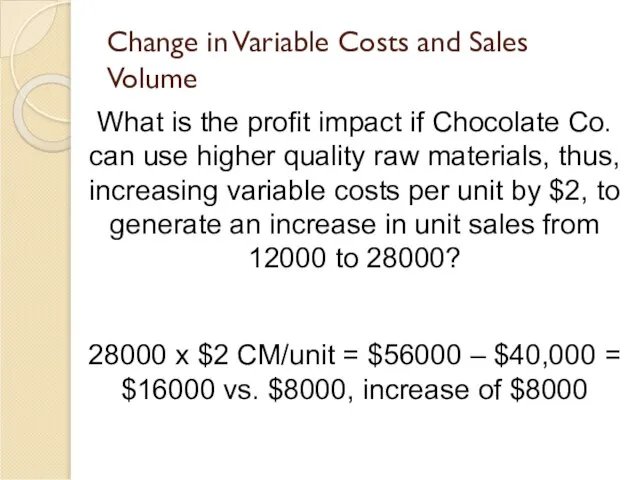

- 8. Change in Variable Costs and Sales Volume What is the profit impact if Chocolate Co. can

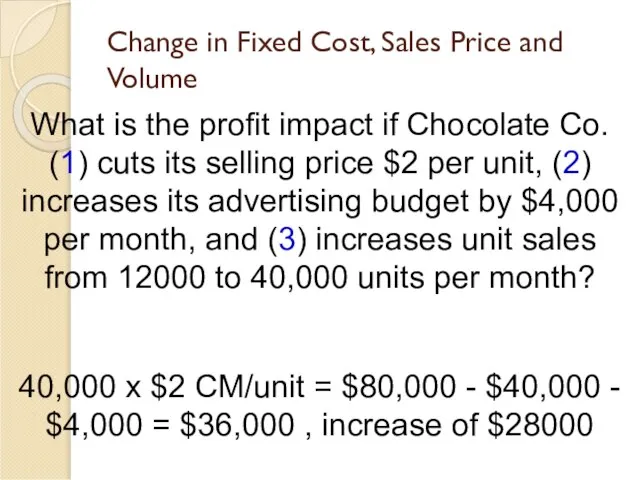

- 9. Change in Fixed Cost, Sales Price and Volume What is the profit impact if Chocolate Co.

- 10. Break-Even Analysis Break-even analysis can be approached in two ways: Equation method Contribution margin method

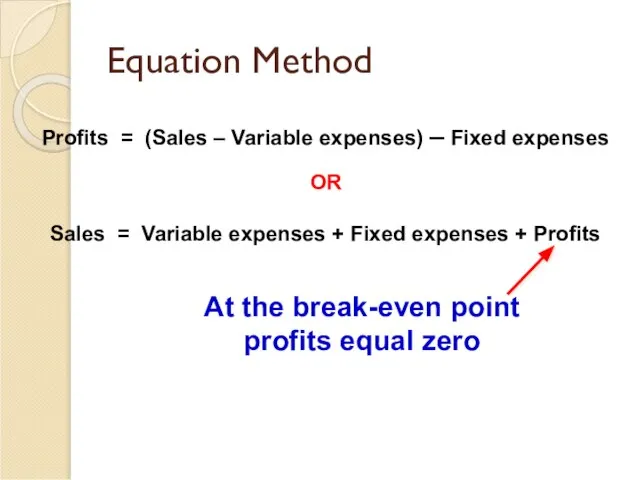

- 11. Equation Method Profits = (Sales – Variable expenses) – Fixed expenses Sales = Variable expenses +

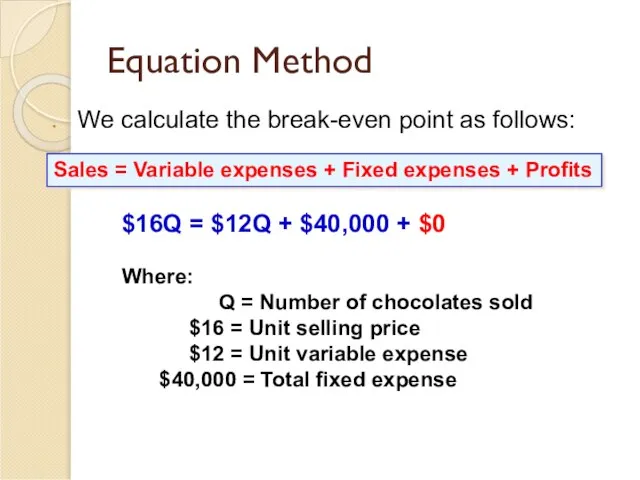

- 12. Equation Method $16Q = $12Q + $40,000 + $0 Where: Q = Number of chocolates sold

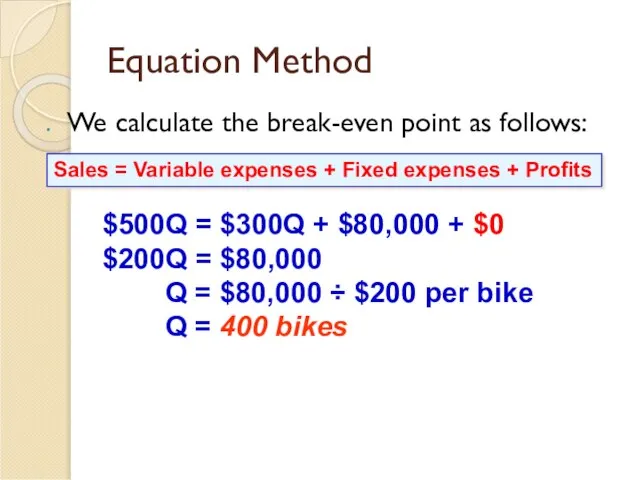

- 13. Equation Method We calculate the break-even point as follows: $500Q = $300Q + $80,000 + $0

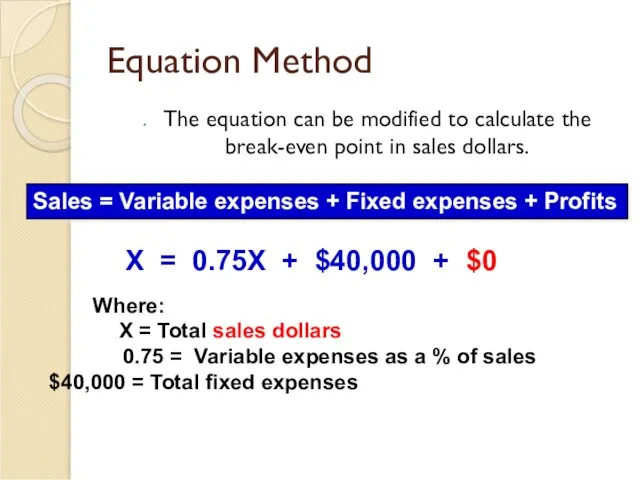

- 14. Equation Method The equation can be modified to calculate the break-even point in sales dollars. Sales

- 15. Equation Method X = 0.75X + $40,000 + $0 0.25X = $40,000 X = $40,000 ÷

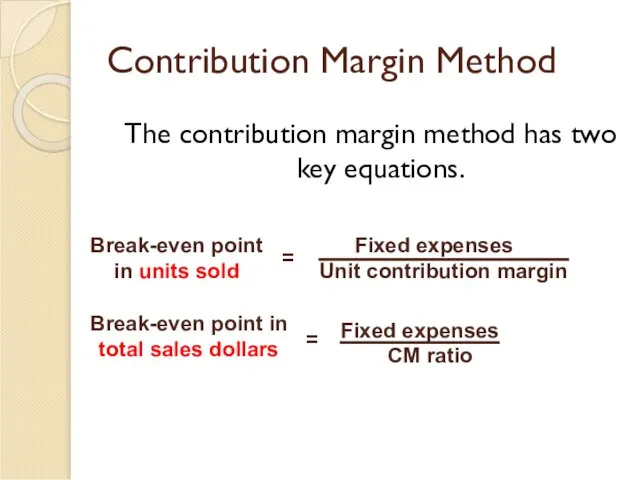

- 16. Contribution Margin Method The contribution margin method has two key equations.

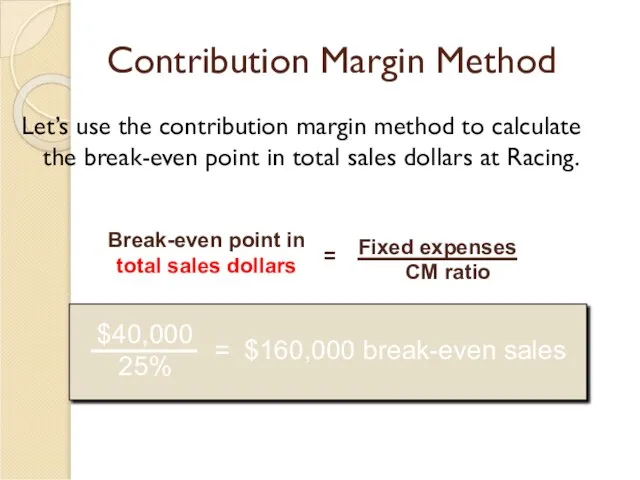

- 17. Contribution Margin Method Let’s use the contribution margin method to calculate the break-even point in total

- 18. Target Profit Analysis The equation and contribution margin methods can be used to determine the sales

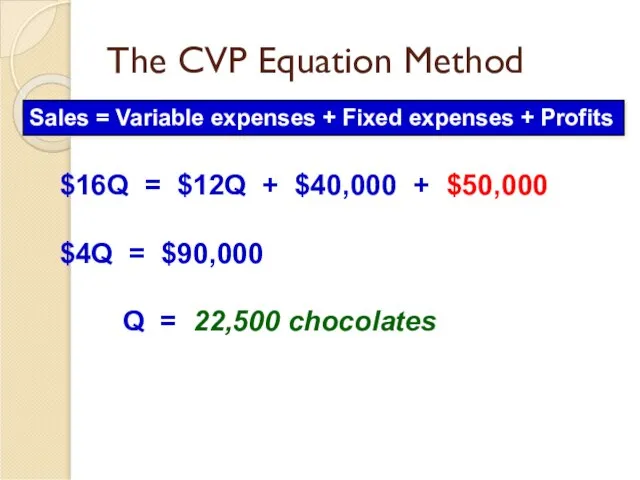

- 19. The CVP Equation Method Sales = Variable expenses + Fixed expenses + Profits $16Q = $12Q

- 20. The Contribution Margin Approach The contribution margin method can be used to determine that 900 bikes

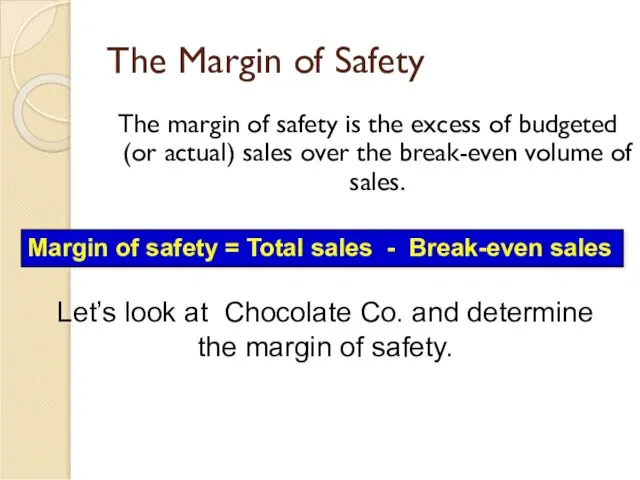

- 21. The Margin of Safety The margin of safety is the excess of budgeted (or actual) sales

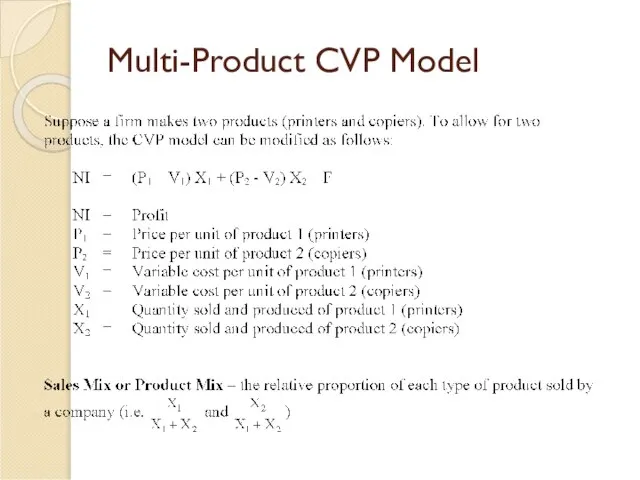

- 22. Multi-Product CVP Model

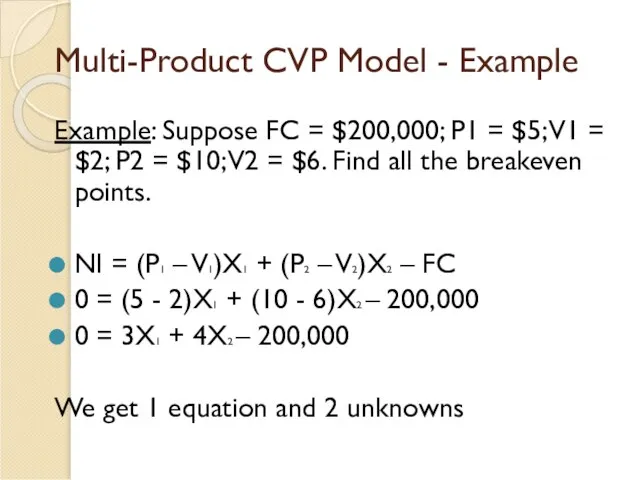

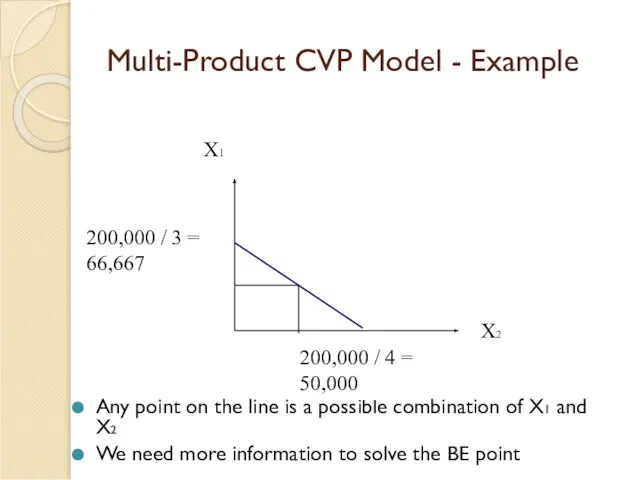

- 23. Multi-Product CVP Model - Example Example: Suppose FC = $200,000; P1 = $5; V1 = $2;

- 24. Multi-Product CVP Model - Example Any point on the line is a possible combination of X1

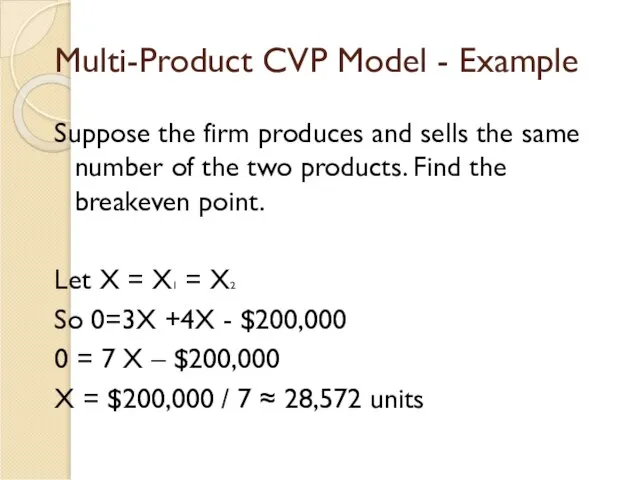

- 25. Multi-Product CVP Model - Example Suppose the firm produces and sells the same number of the

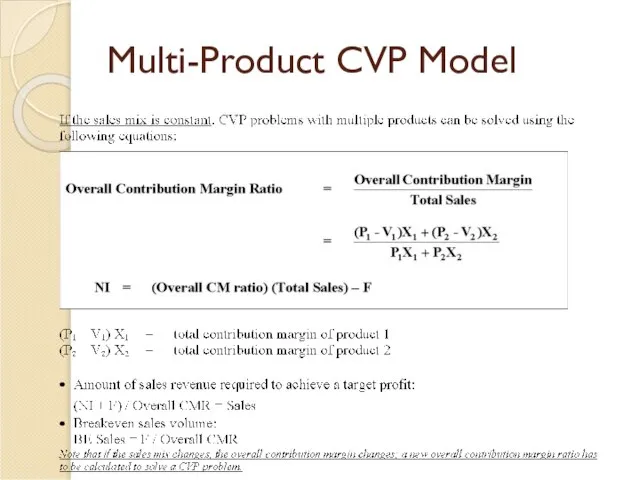

- 26. Multi-Product CVP Model

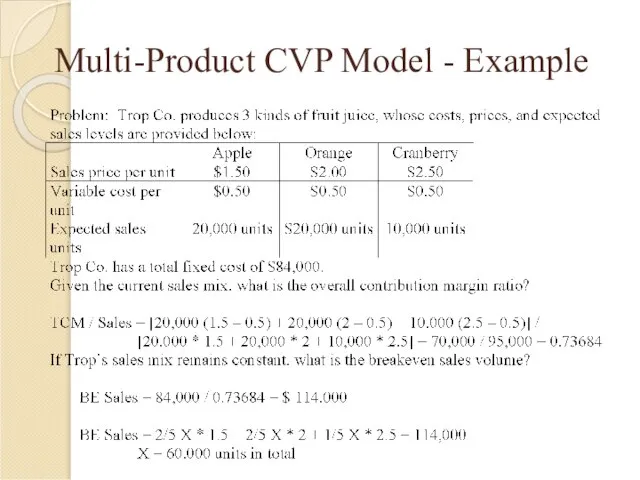

- 27. Multi-Product CVP Model - Example

- 28. Operating Leverage

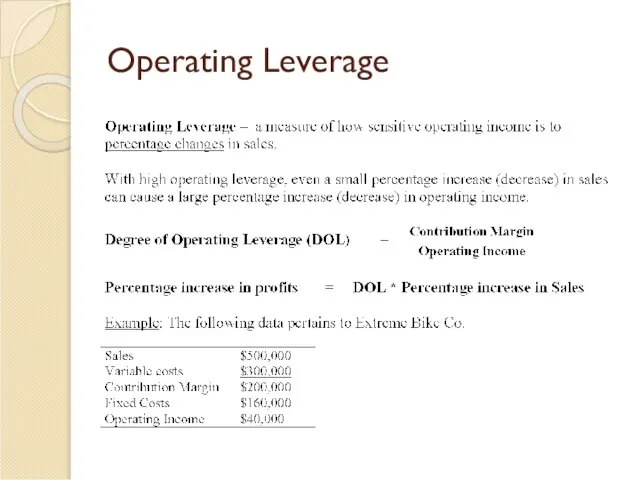

- 29. Operating Leverage - Example Calculate Extreme’s degree of operating leverage DOL = $200,000 / $40,000 =

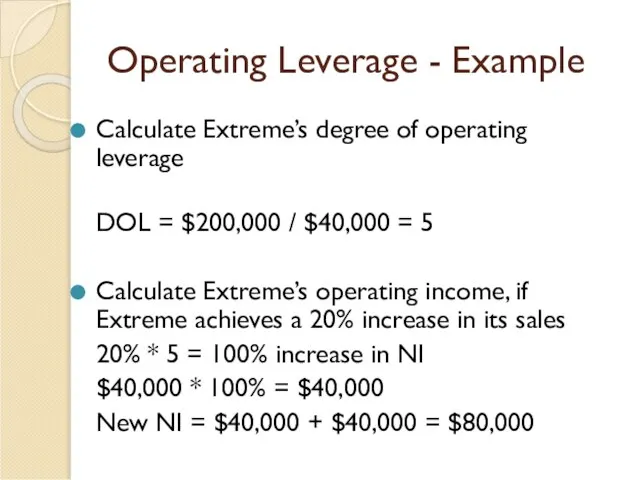

- 30. Operating Leverage - Example Sales $600,000 VC 360,000 CM 240,000 FC 160,000 NI $ 80,000

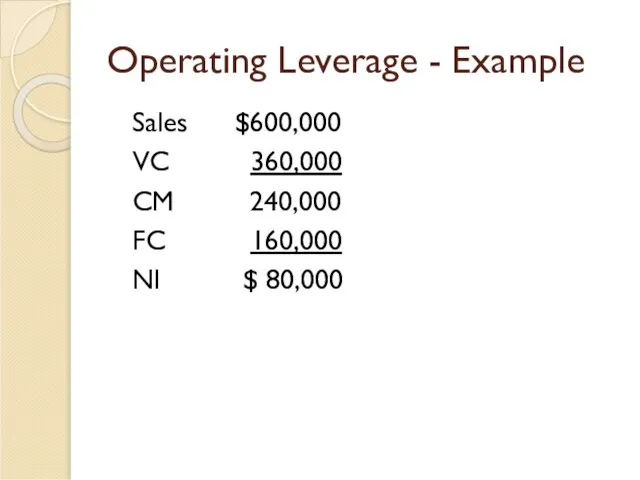

- 31. Operating Leverage - Example Calculate Extreme’s operating income, if Extreme experiences a drop of 30% in

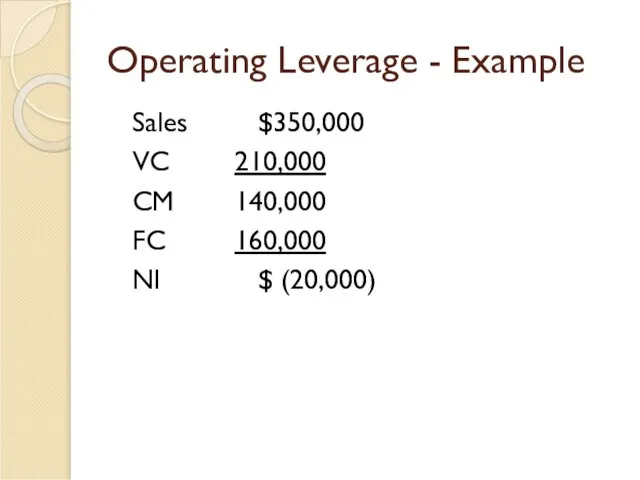

- 32. Operating Leverage - Example Sales $350,000 VC 210,000 CM 140,000 FC 160,000 NI $ (20,000)

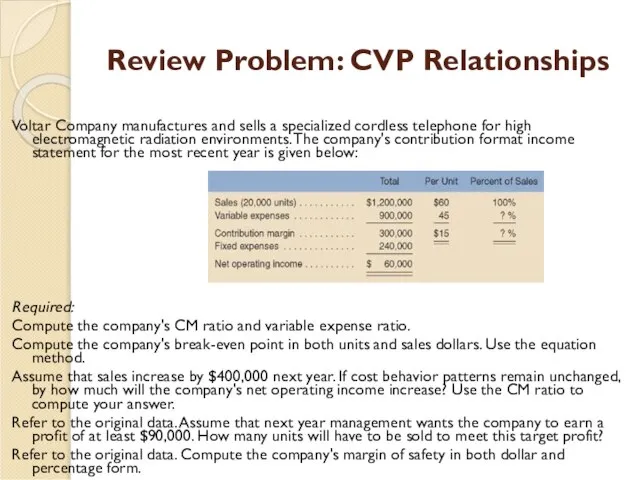

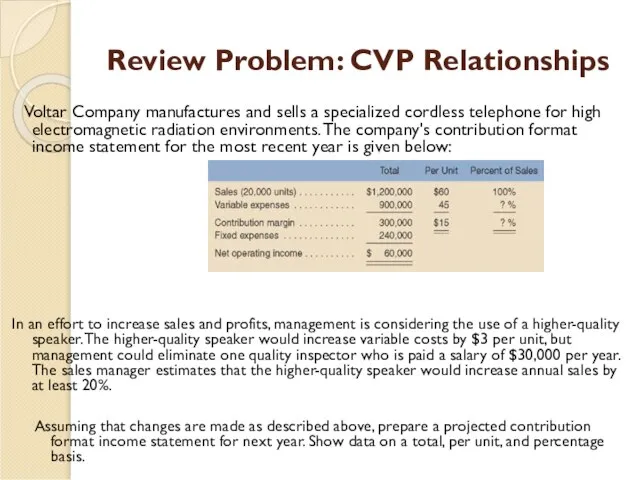

- 33. Review Problem: CVP Relationships Voltar Company manufactures and sells a specialized cordless telephone for high electromagnetic

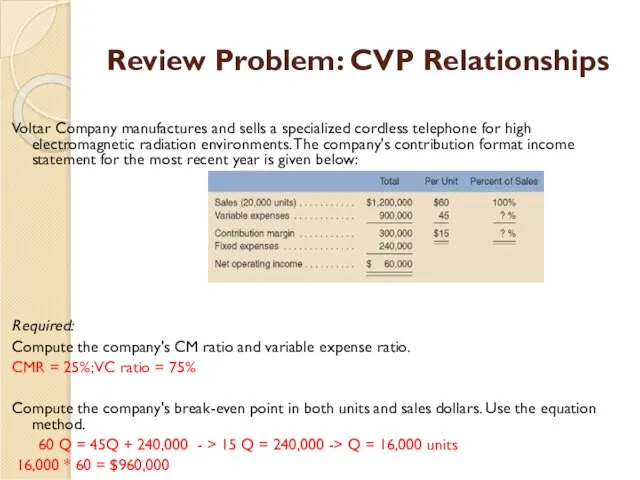

- 34. Review Problem: CVP Relationships Voltar Company manufactures and sells a specialized cordless telephone for high electromagnetic

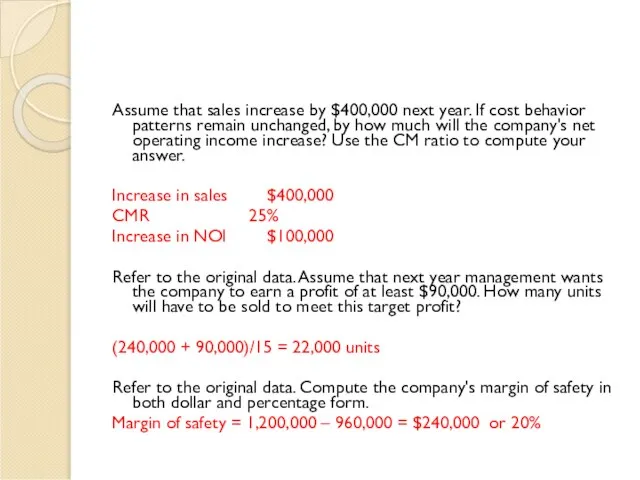

- 35. Assume that sales increase by $400,000 next year. If cost behavior patterns remain unchanged, by how

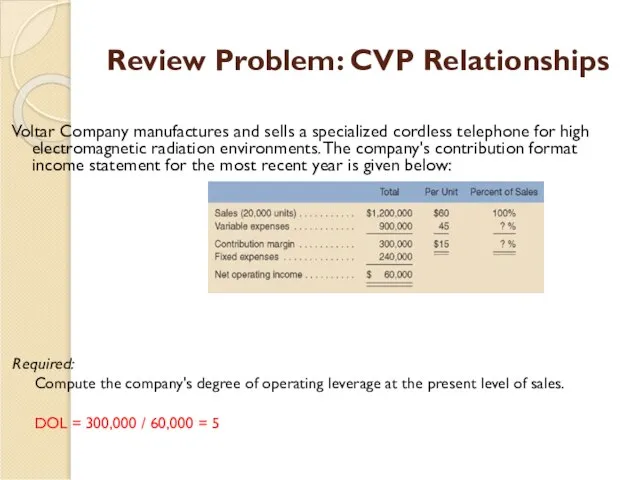

- 36. Review Problem: CVP Relationships Voltar Company manufactures and sells a specialized cordless telephone for high electromagnetic

- 37. Assume that through a more intense effort by the sales staff, the company's sales increase by

- 38. Sales $1,296,000 VC 972,000 CM 324,000 FC 240,000 NOI $84,000 40% increase

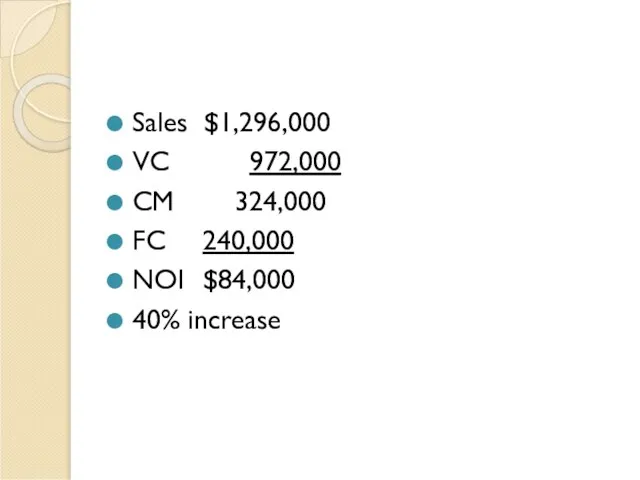

- 39. Review Problem: CVP Relationships Voltar Company manufactures and sells a specialized cordless telephone for high electromagnetic

- 41. Скачать презентацию

Предприятия в экономике

Предприятия в экономике Понятие о мировом рынке. Международное экономическое сотрудничество

Понятие о мировом рынке. Международное экономическое сотрудничество Инвестиционный паспорт муниципального образования «Медвежьегорский муниципальный район»

Инвестиционный паспорт муниципального образования «Медвежьегорский муниципальный район» Имитационно-ролевая игра

Имитационно-ролевая игра Экономические системы. Виды, механизм функционирования

Экономические системы. Виды, механизм функционирования Анализ рынка и оффер

Анализ рынка и оффер Мировая экономика и международные экономические отношения в начале XXI века. (Тема 1)

Мировая экономика и международные экономические отношения в начале XXI века. (Тема 1) Рыночные операции: исходный анализ спроса и предложения и его применение

Рыночные операции: исходный анализ спроса и предложения и его применение Человек и техника. Проблемы и перспективы взаимодействия

Человек и техника. Проблемы и перспективы взаимодействия Финансы коммерческих организаций. (Тема 4)

Финансы коммерческих организаций. (Тема 4) Слияния и поглощения и стратегические альянсы

Слияния и поглощения и стратегические альянсы Анализ обеспеченности предприятия трудовыми ресурсами и их использования

Анализ обеспеченности предприятия трудовыми ресурсами и их использования История развития экономико-географических теорий и концепций: научно-практические труды выдающихся географов

История развития экономико-географических теорий и концепций: научно-практические труды выдающихся географов Инфляция и ее виды

Инфляция и ее виды Економічна розвідка як фактор у конкурентній боротьбі

Економічна розвідка як фактор у конкурентній боротьбі Риски ВЭД

Риски ВЭД Поддержка малого и среднего предпринимательства в Саратовской области

Поддержка малого и среднего предпринимательства в Саратовской области Проектирование урока экономики. Лекция 3

Проектирование урока экономики. Лекция 3 Теоретические основы современных технологий

Теоретические основы современных технологий Рост производительности труда. (Задача 12)

Рост производительности труда. (Задача 12) Потребности, блага, экономический выбор

Потребности, блага, экономический выбор Предмет изучения институциональной экономики и ее место в современной экономической теории

Предмет изучения институциональной экономики и ее место в современной экономической теории Модели эндогенного роста

Модели эндогенного роста Региональная экономическая диагностика

Региональная экономическая диагностика Продукция организации (предприятия)

Продукция организации (предприятия) Развитие супермаркетов на розничном рынке: зарубежная практика

Развитие супермаркетов на розничном рынке: зарубежная практика Рынки факторов производства и спрос на экономические ресурсы

Рынки факторов производства и спрос на экономические ресурсы Экономико-правовое содержание собственности

Экономико-правовое содержание собственности