Содержание

- 2. Lecture 2. Basics of the Word trade theory

- 3. Understanding international trade The core areas for understanding international trade: - the reasons for trade -

- 4. 2. Basics of the Word trade theory The starting point for studying international trade: Why do

- 5. Adam Smith Adam Smith had shown the gains of trade in the presence of absolute advantage;

- 6. Adam Smith = Appears a reason for trade = if the good is cheaper in another

- 7. David Ricardo model Ricardo’s model shows that mutual gains from trade (and specialisation) arise even when

- 8. The assumptions of the Ricardian model Each good is produced with the aid of one factor

- 9. Comparative advantage England is more efficient at the production of both goods. Less labor is required

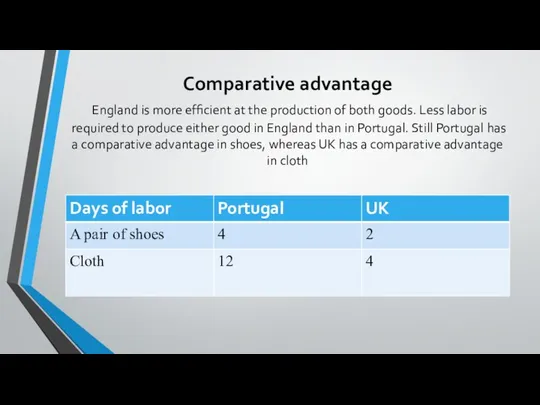

- 10. The Ricardian model Developed by David Ricardo in the early nineteenth century to provide intellectual support

- 11. Opportunity cost Example of two countries –USA and Colombia. And 2 products roses and PCs Some

- 12. Opportunity cost In the USA the flowers must be grown in heated greenhouses, at great expense

- 13. Opportunity cost Suppose that the United States grows 10 million roses and that the resources used

- 14. Opportunity cost Colombian workers are less efficient than their U.S. counterparts at making sophisticated goods such

- 15. Opportunity cost The opportunity cost of roses in terms of computers is the number of computers

- 16. Comparative advantage. Gains of specialization Let the US stop grow roses and start produce more PCs

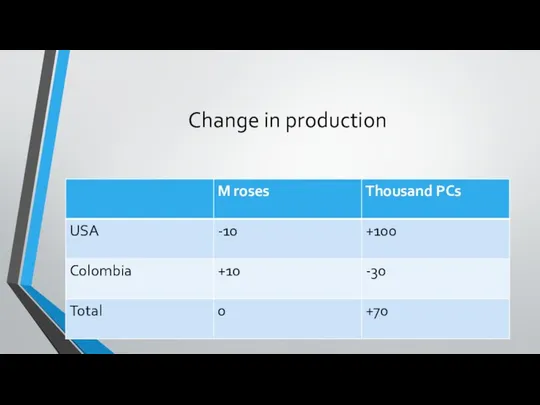

- 17. Change in production

- 18. Comparative advantage. Gains of specialization More generally, it can be shown that free trade, and hence

- 19. Gains from trade The reason that international trade makes an increase in world output is that

- 20. Importance of trade Trade brings not only benefits of choosing lower priced goods in another country

- 21. Testing the model The empirical evidence validates the predictions of the Ricardian model that: 1. Except

- 23. Скачать презентацию

Бюджетно- налоговая политика. Расходы и долг государства

Бюджетно- налоговая политика. Расходы и долг государства ТЭК управляет миром

ТЭК управляет миром Спрос. Сдвиг кривой спроса

Спрос. Сдвиг кривой спроса Ущерб от загрязнения окружающей природной среды

Ущерб от загрязнения окружающей природной среды Совершенная конкуренция и монополия

Совершенная конкуренция и монополия Приоритеты программной стратегии России

Приоритеты программной стратегии России Основы экономики

Основы экономики Зеленый город. Экологический проект. Зарабатывайте вместе с нами

Зеленый город. Экологический проект. Зарабатывайте вместе с нами Eesti, Läti ja Leedu majandusareng aastatel 2000-2013

Eesti, Läti ja Leedu majandusareng aastatel 2000-2013 Региональная политика государства

Региональная политика государства Европейский Союз

Европейский Союз Innowacje w gospodarce opartej na wiedzy (GOW)

Innowacje w gospodarce opartej na wiedzy (GOW) Effectiveness of NGOs. (Lecture 5)

Effectiveness of NGOs. (Lecture 5) Анализ отраслевых рынков. Как фирмы в условиях конкуренции могут расширяться и получать прибыль

Анализ отраслевых рынков. Как фирмы в условиях конкуренции могут расширяться и получать прибыль Эффективные способы взаимодействия бизнеса и власти для развития моногородов

Эффективные способы взаимодействия бизнеса и власти для развития моногородов Особенности модели кругооборота благ и доходов в масштабах национального хозяйства в открытой экономике

Особенности модели кругооборота благ и доходов в масштабах национального хозяйства в открытой экономике Формирования программы "Точки роста" по развитию Забайкальского Края

Формирования программы "Точки роста" по развитию Забайкальского Края Экономическая эффективность отраслевых производств

Экономическая эффективность отраслевых производств Экономика стран. Вопросы

Экономика стран. Вопросы Минэкономразвитие России по формированию перечня пилотных программ развития территориальных инновационных кластеров

Минэкономразвитие России по формированию перечня пилотных программ развития территориальных инновационных кластеров Валюта и её типы

Валюта и её типы Розничный товарооборот организаций торговли и экономический механизм его обоснования

Розничный товарооборот организаций торговли и экономический механизм его обоснования Несовершенная конкуренция: монополия

Несовершенная конкуренция: монополия Лекции № 8-9. Поведение потребителя на рынке товаров и услуг

Лекции № 8-9. Поведение потребителя на рынке товаров и услуг Экономическая сфера

Экономическая сфера Занятость и безработица. Рынок труда

Занятость и безработица. Рынок труда Микроэкономика. Макроэкономика

Микроэкономика. Макроэкономика Внешние эффекты и гражданское общество

Внешние эффекты и гражданское общество