Содержание

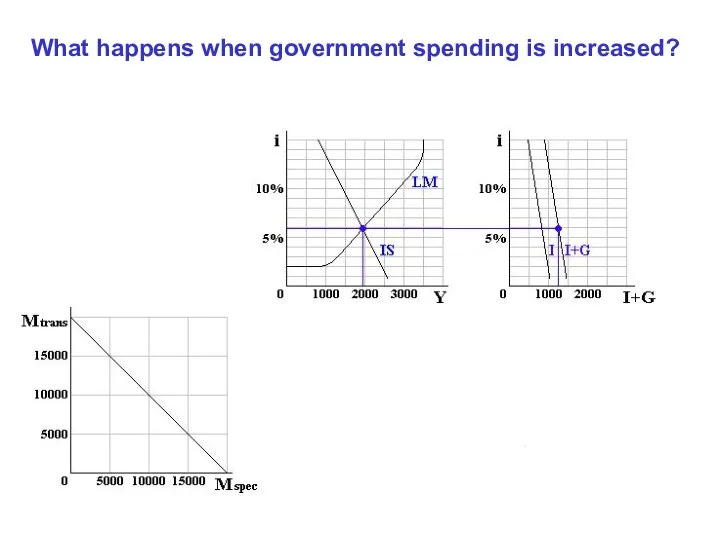

- 3. What happens when government spending is increased?

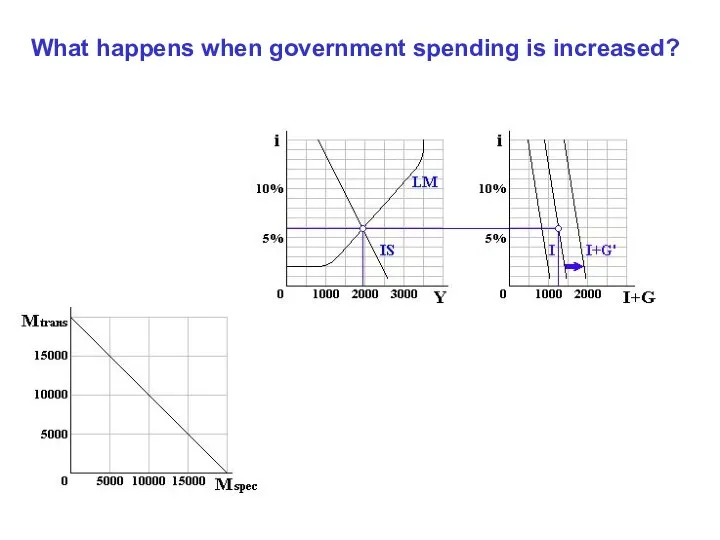

- 4. What happens when government spending is increased?

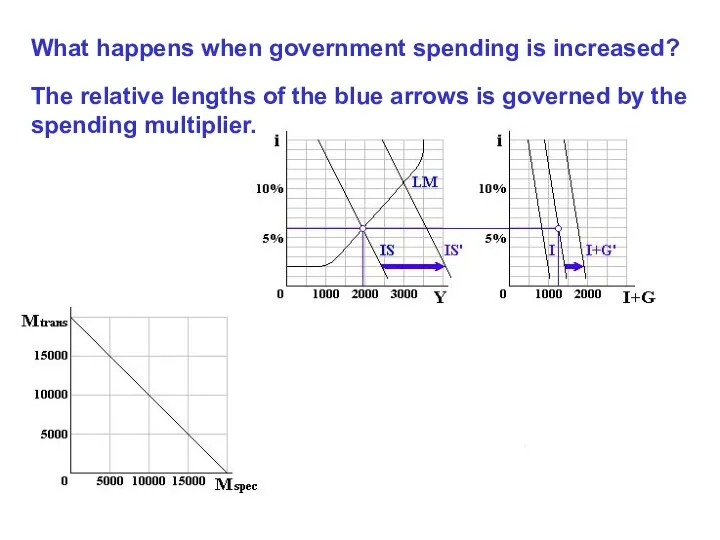

- 5. What happens when government spending is increased? The relative lengths of the blue arrows is governed

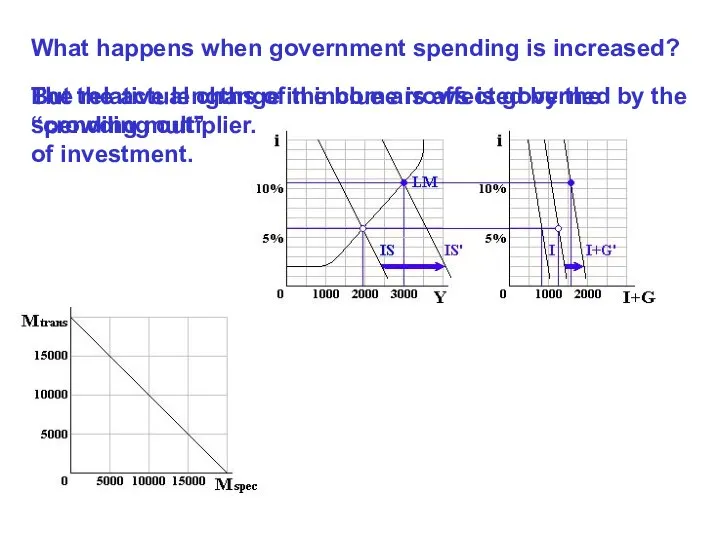

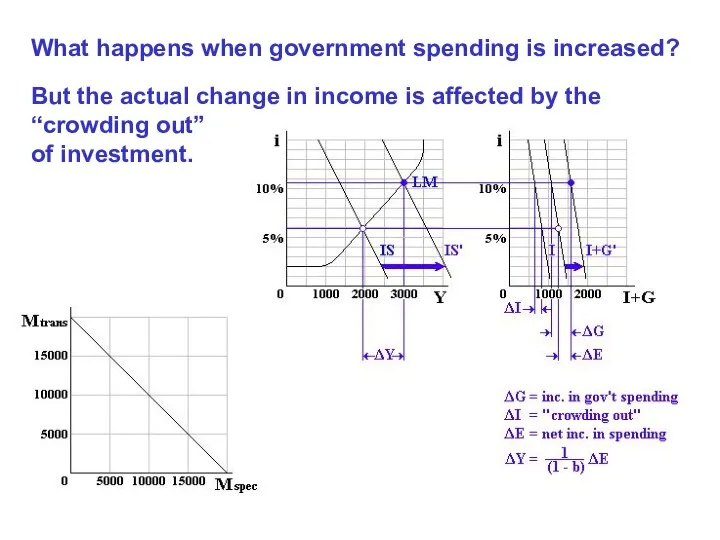

- 6. What happens when government spending is increased? But the actual change in income is affected by

- 7. What happens when government spending is increased? But the actual change in income is affected by

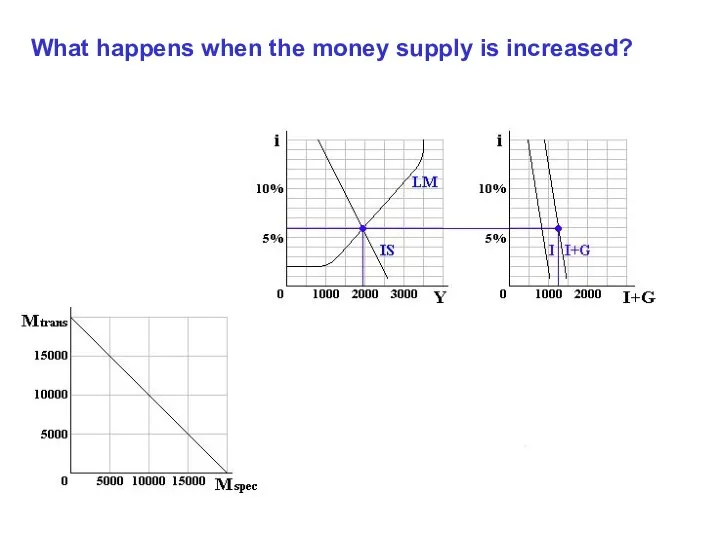

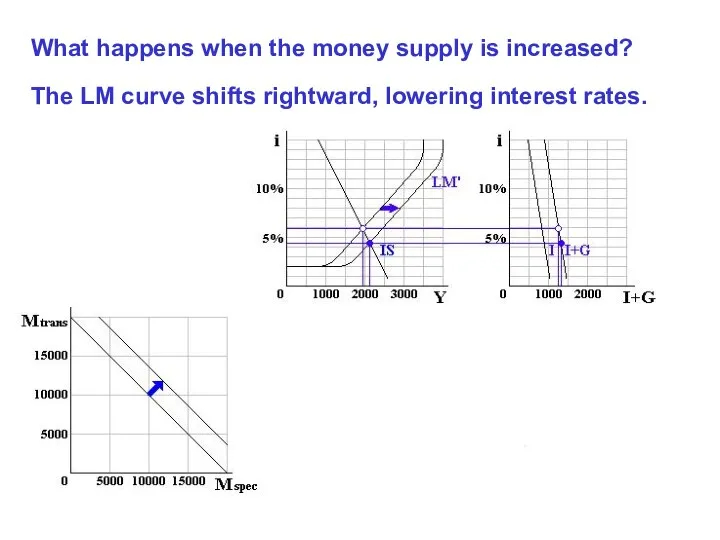

- 8. What happens when the money supply is increased?

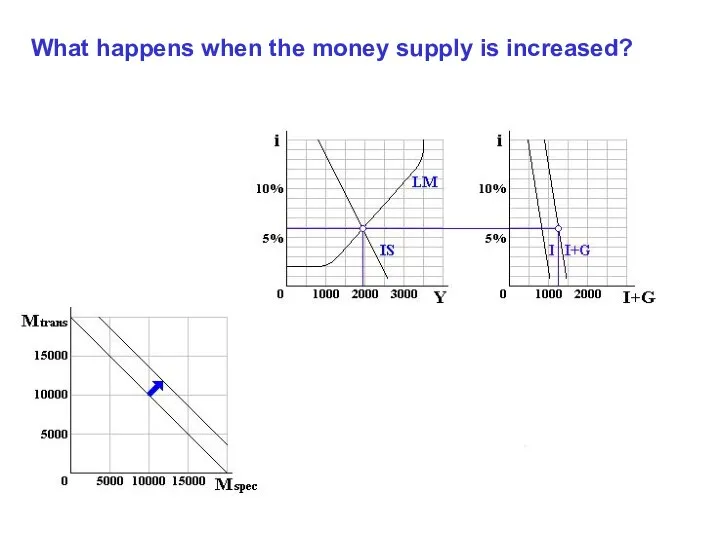

- 9. What happens when the money supply is increased?

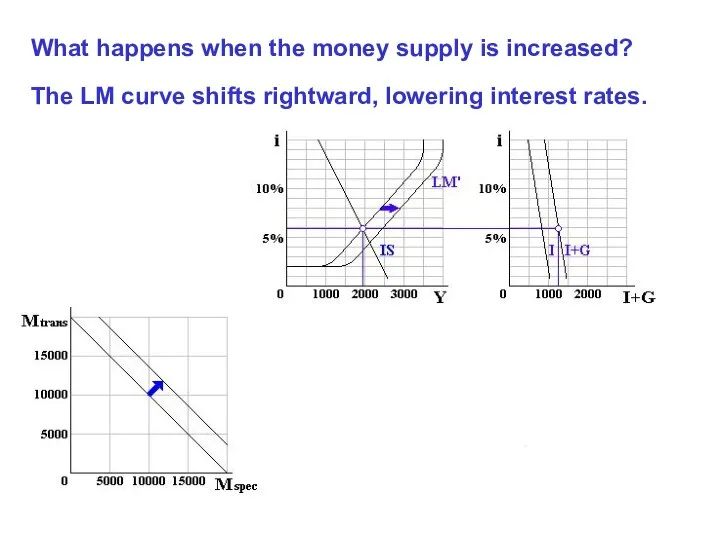

- 10. The LM curve shifts rightward, lowering interest rates. What happens when the money supply is increased?

- 11. What happens when the money supply is increased? The LM curve shifts rightward, lowering interest rates.

- 12. What happens when the money supply is increased? The LM curve shifts rightward, lowering interest rates.

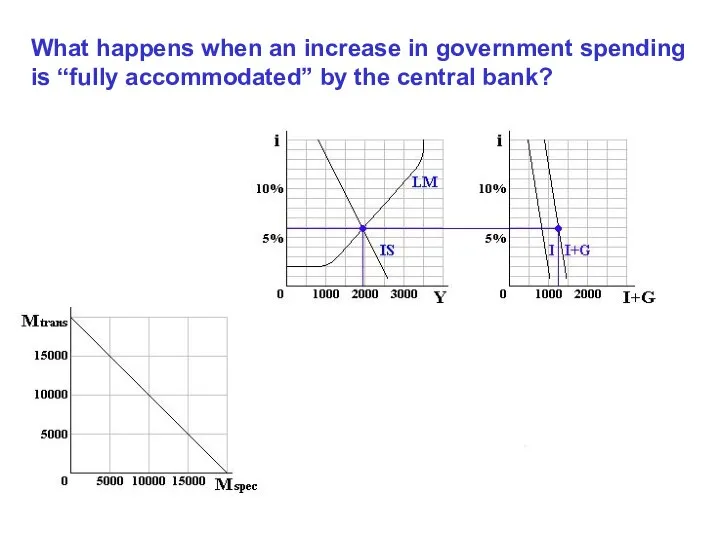

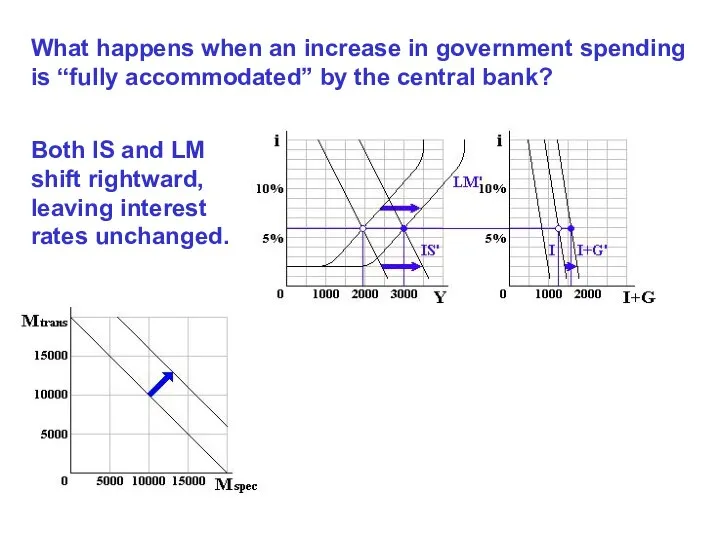

- 13. What happens when an increase in government spending is “fully accommodated” by the central bank?

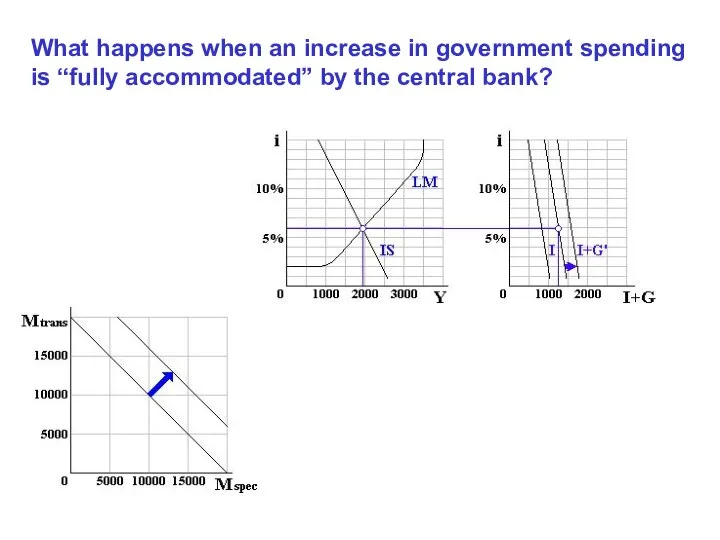

- 14. What happens when an increase in government spending is “fully accommodated” by the central bank?

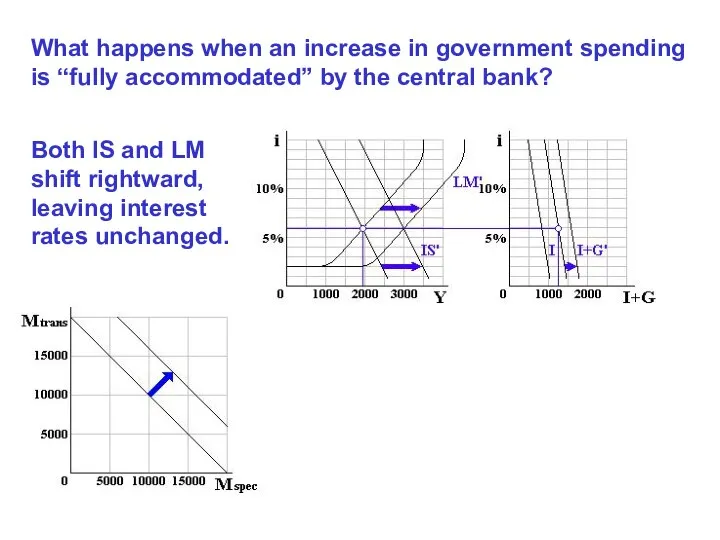

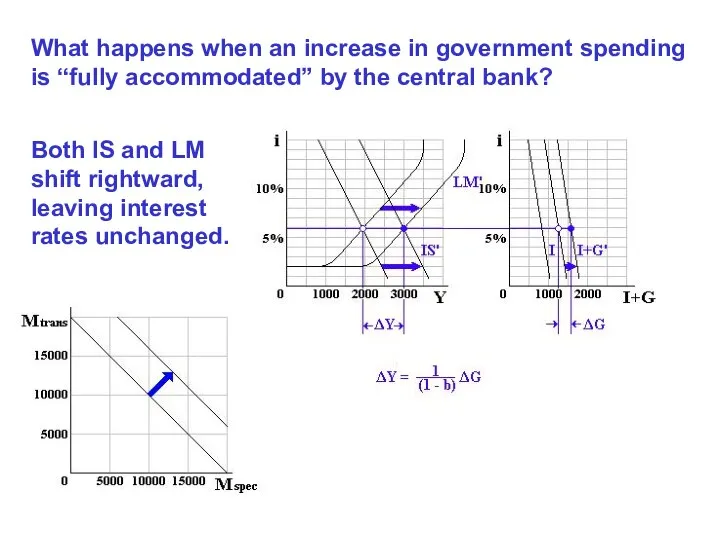

- 15. What happens when an increase in government spending is “fully accommodated” by the central bank? Both

- 16. What happens when an increase in government spending is “fully accommodated” by the central bank? Both

- 17. What happens when an increase in government spending is “fully accommodated” by the central bank? Both

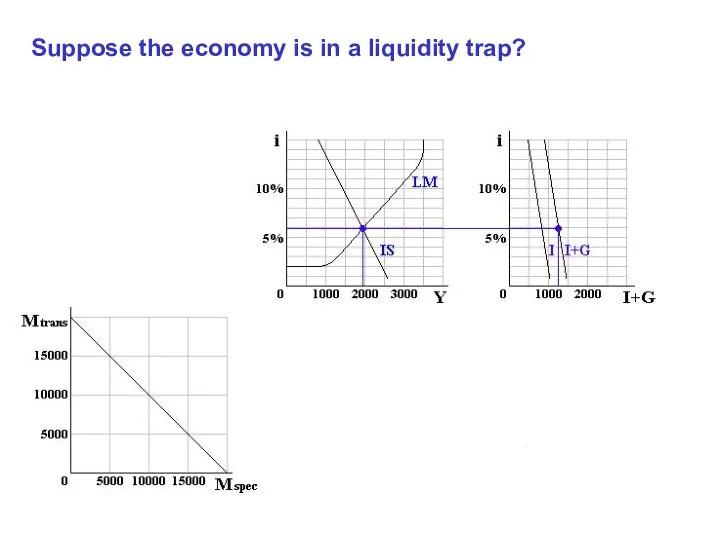

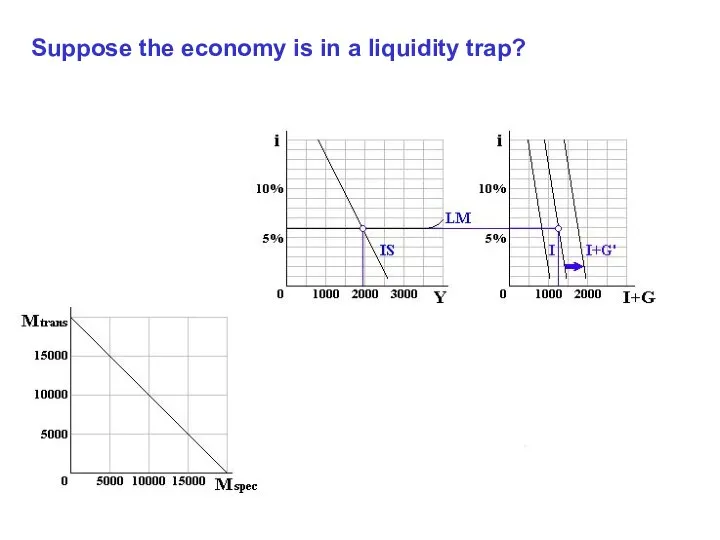

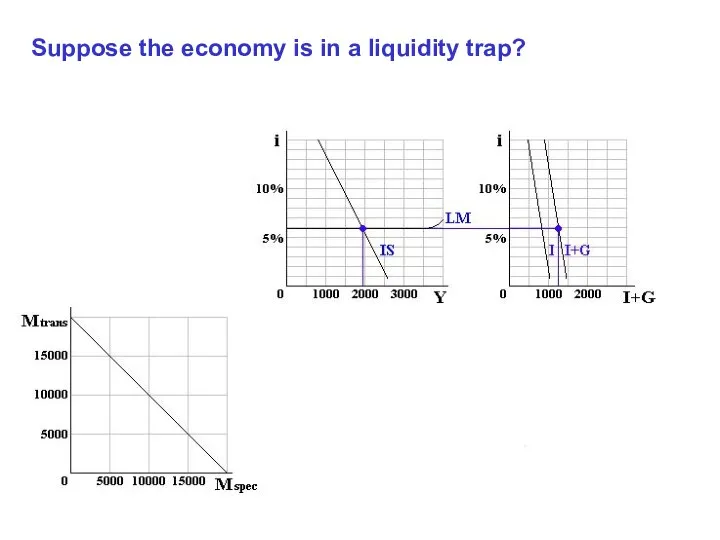

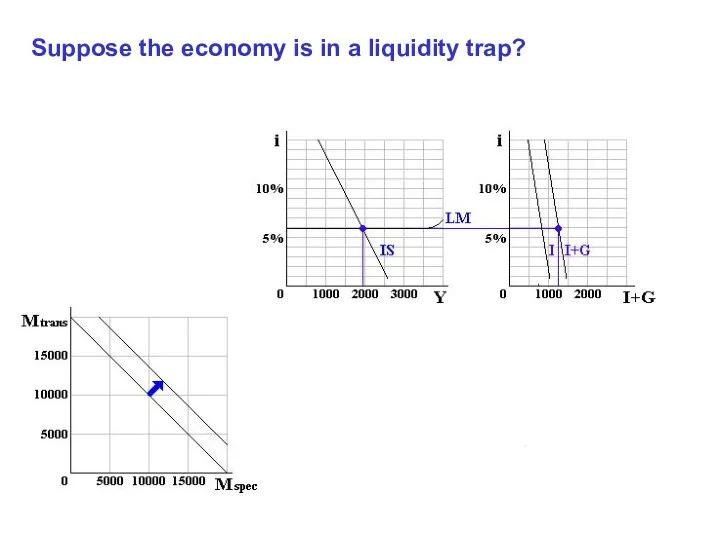

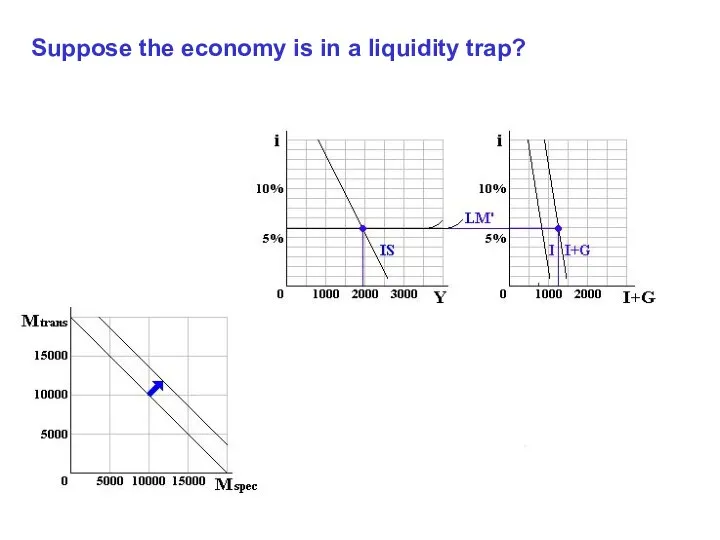

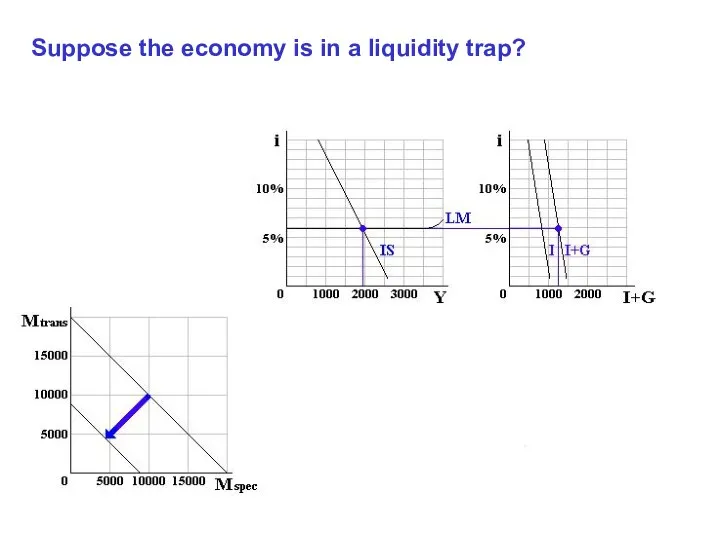

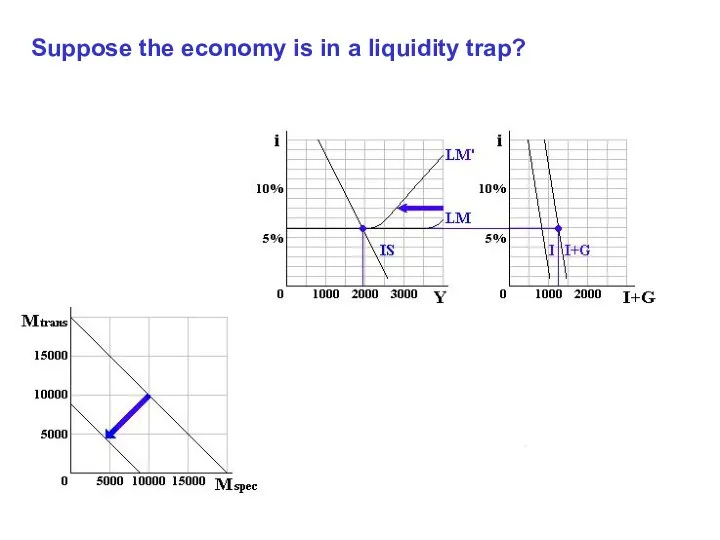

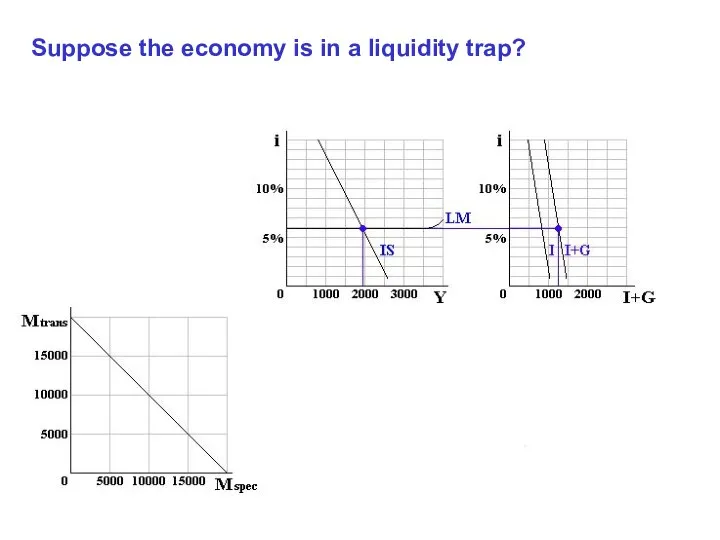

- 18. Suppose the economy is in a liquidity trap?

- 19. Suppose the economy is in a liquidity trap?

- 20. Suppose the economy is in a liquidity trap?

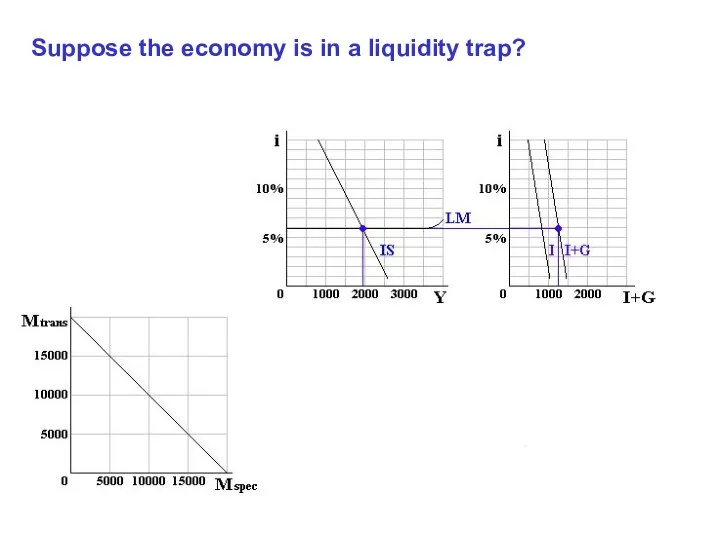

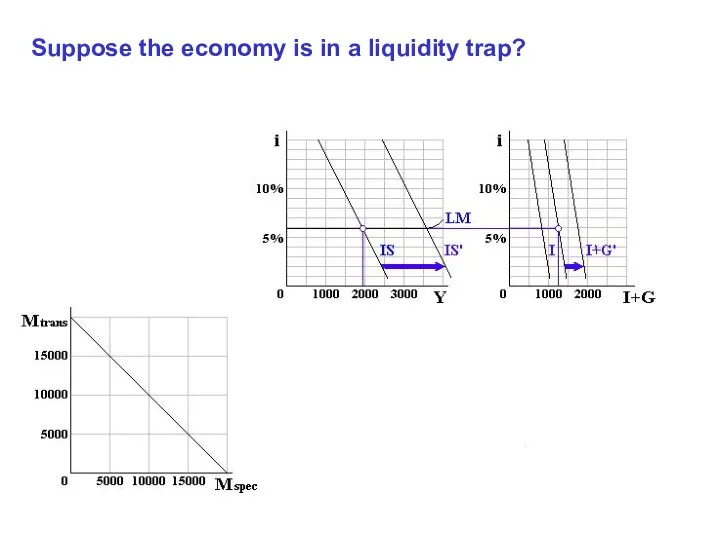

- 21. Suppose the economy is in a liquidity trap?

- 22. Suppose the economy is in a liquidity trap?

- 23. Suppose the economy is in a liquidity trap?

- 24. Suppose the economy is in a liquidity trap?

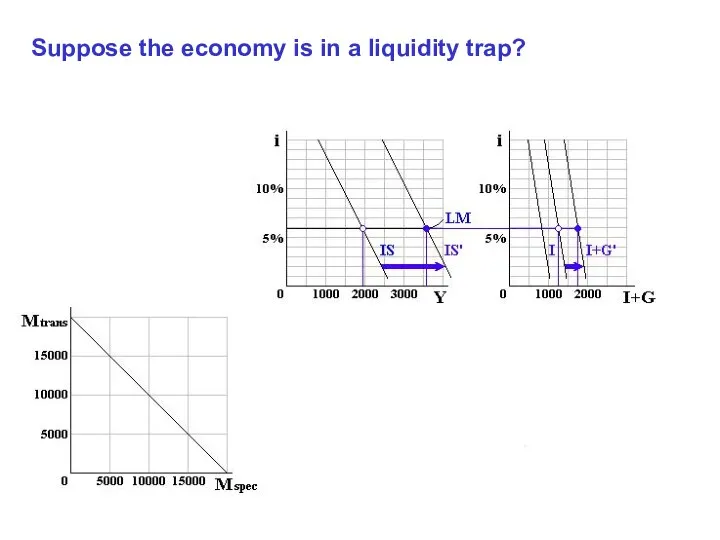

- 25. Suppose the economy is in a liquidity trap?

- 26. Suppose the economy is in a liquidity trap?

- 27. Suppose the economy is in a liquidity trap?

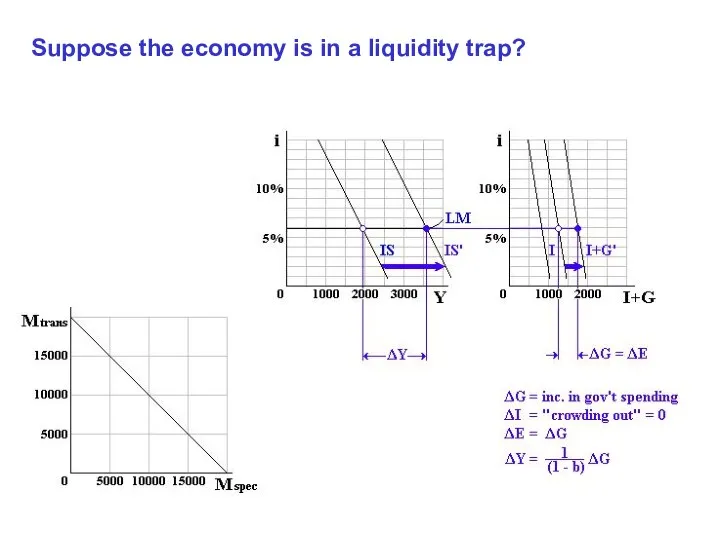

- 28. Suppose the economy is in a liquidity trap?

- 29. Suppose the economy is in a liquidity trap?

- 30. Suppose the economy is in a liquidity trap?

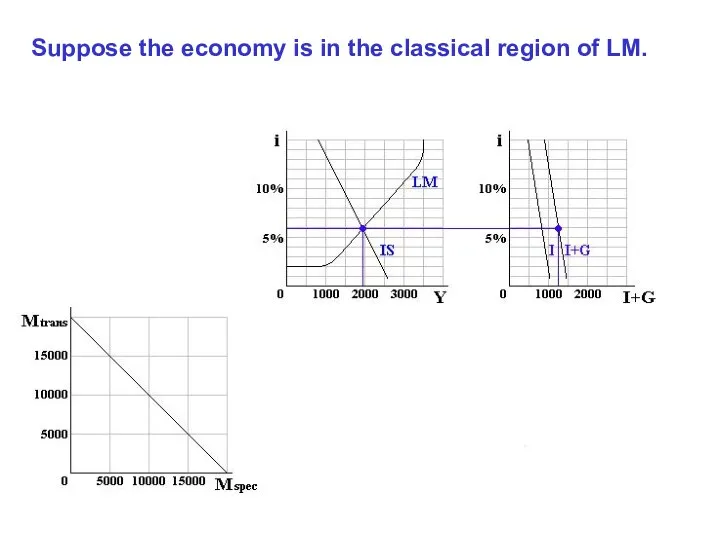

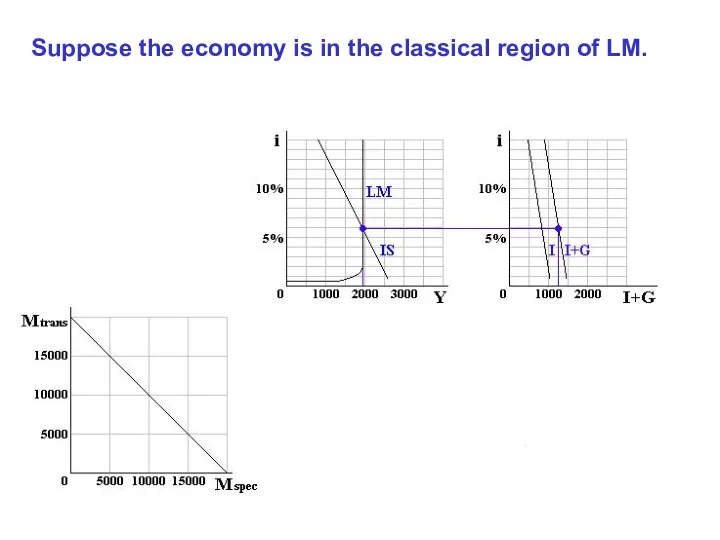

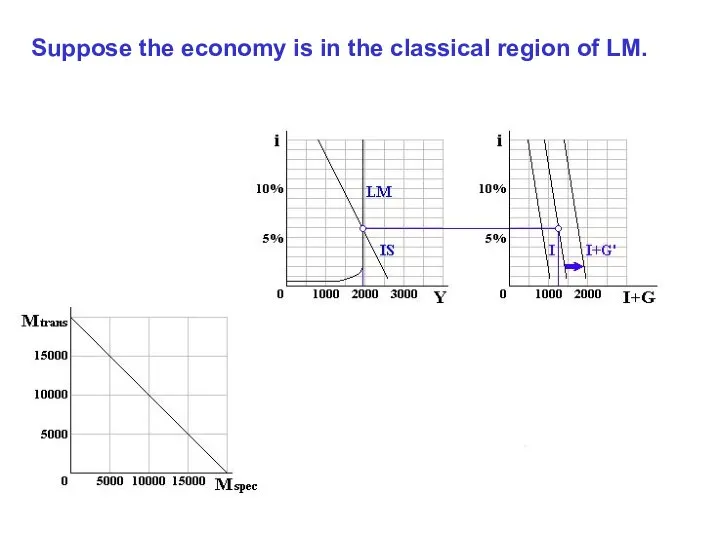

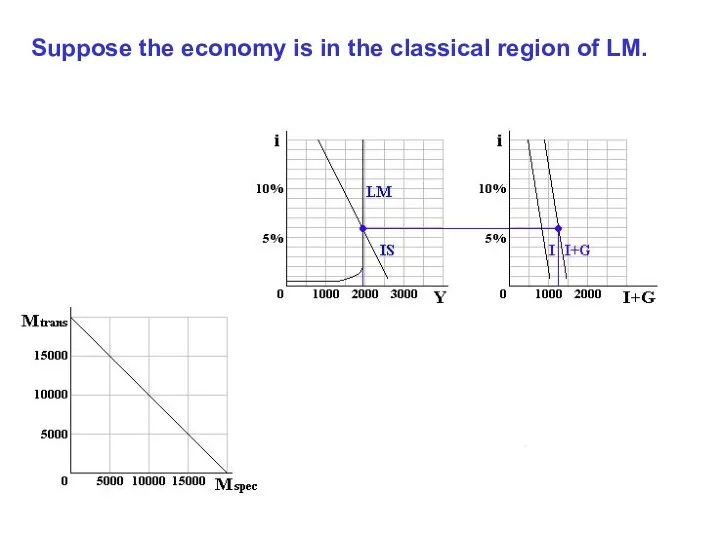

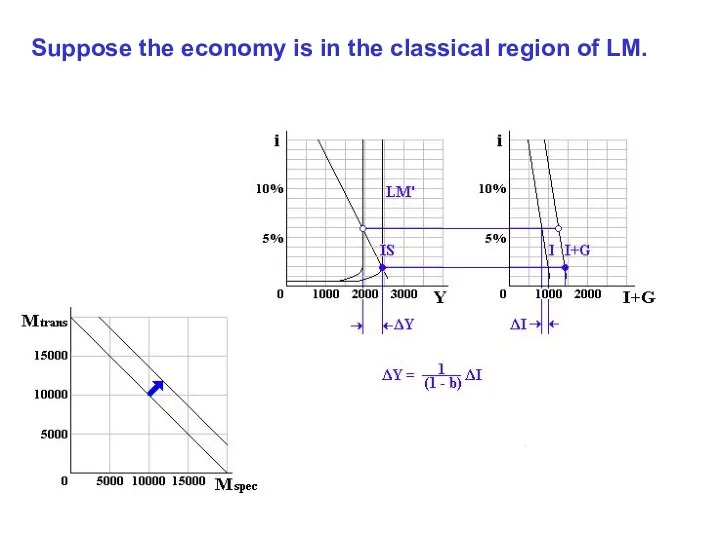

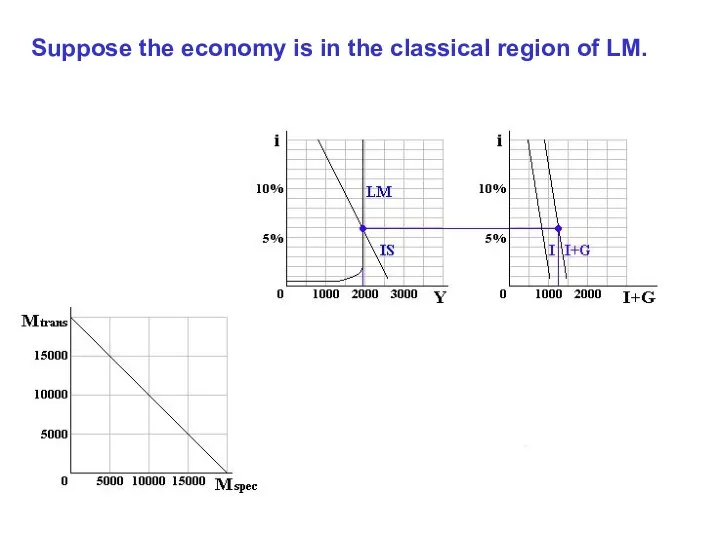

- 31. Suppose the economy is in the classical region of LM.

- 32. Suppose the economy is in the classical region of LM.

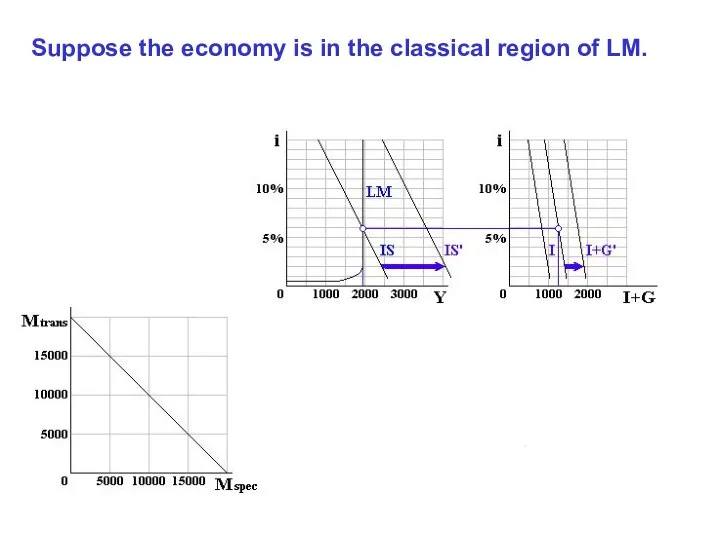

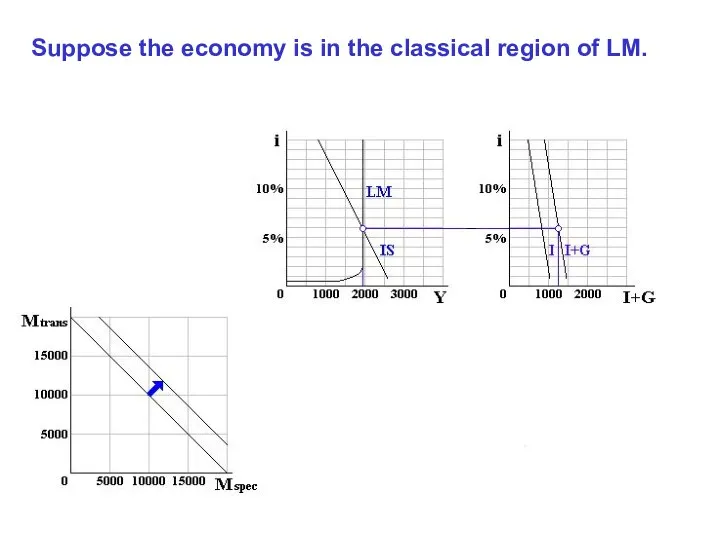

- 33. Suppose the economy is in the classical region of LM.

- 34. Suppose the economy is in the classical region of LM.

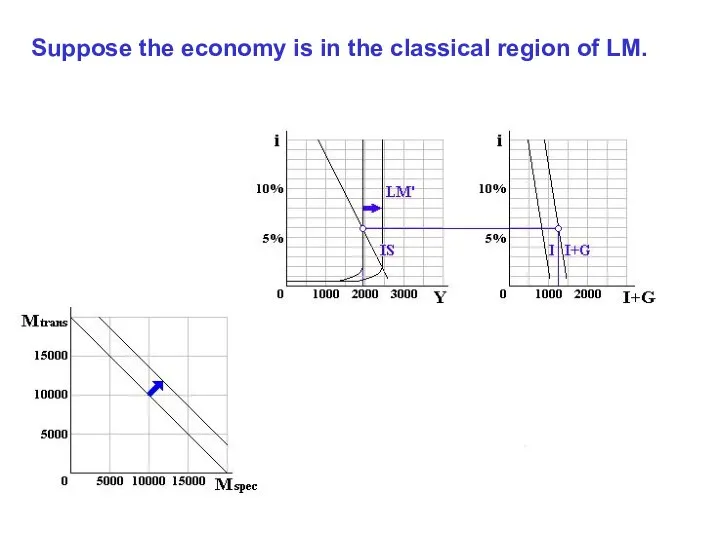

- 35. Suppose the economy is in the classical region of LM.

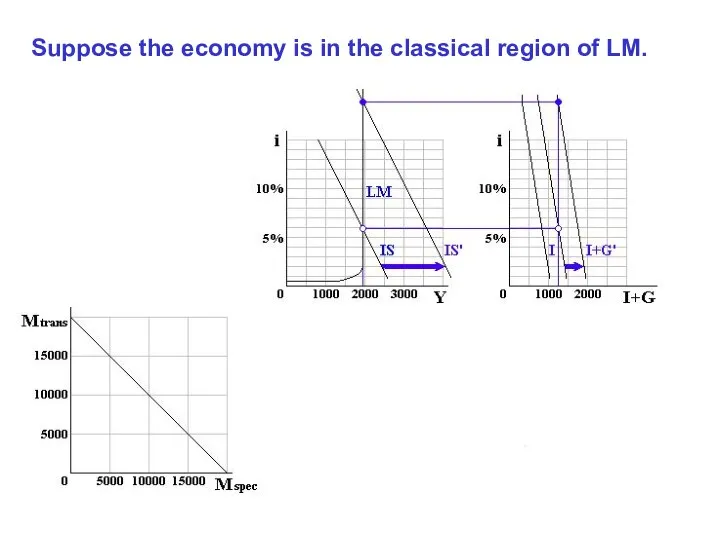

- 36. Suppose the economy is in the classical region of LM.

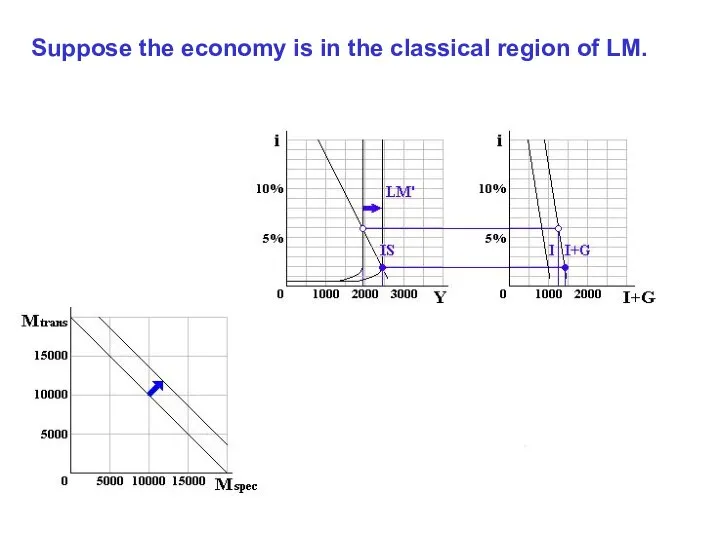

- 37. Suppose the economy is in the classical region of LM.

- 38. Suppose the economy is in the classical region of LM.

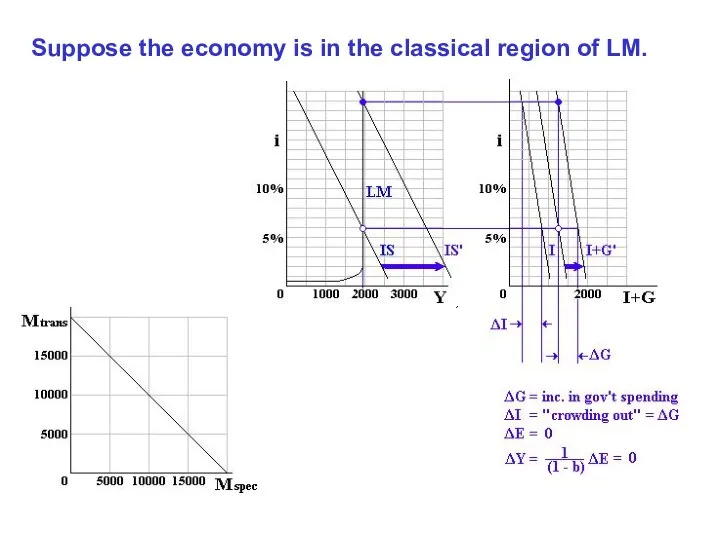

- 39. Suppose the economy is in the classical region of LM.

- 40. Suppose the economy is in the classical region of LM.

- 41. Suppose the economy is in the classical region of LM.

- 42. Suppose the economy is in the classical region of LM.

- 43. Suppose the economy is in the classical region of LM.

- 44. Suppose the economy is in the classical region of LM.

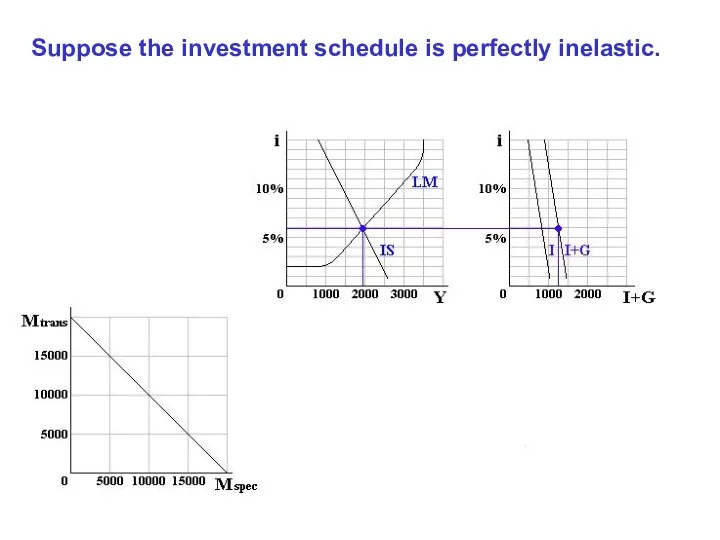

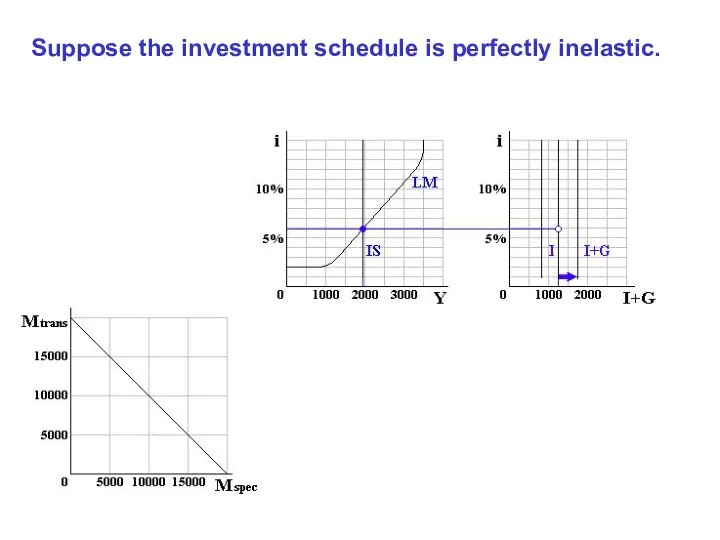

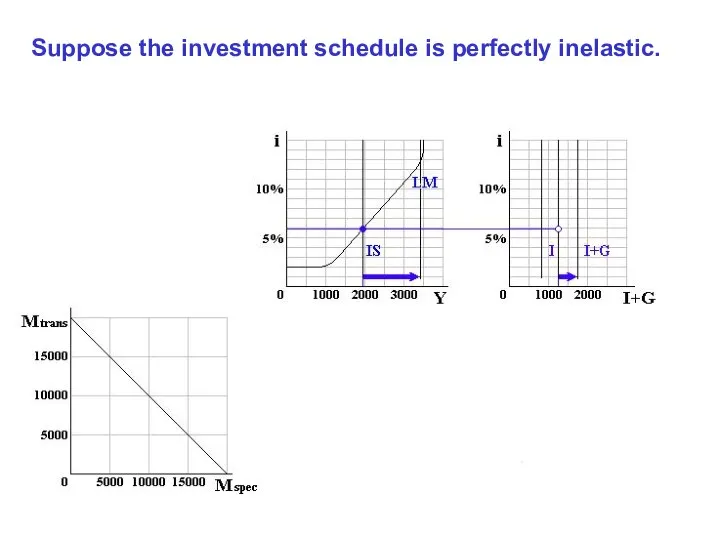

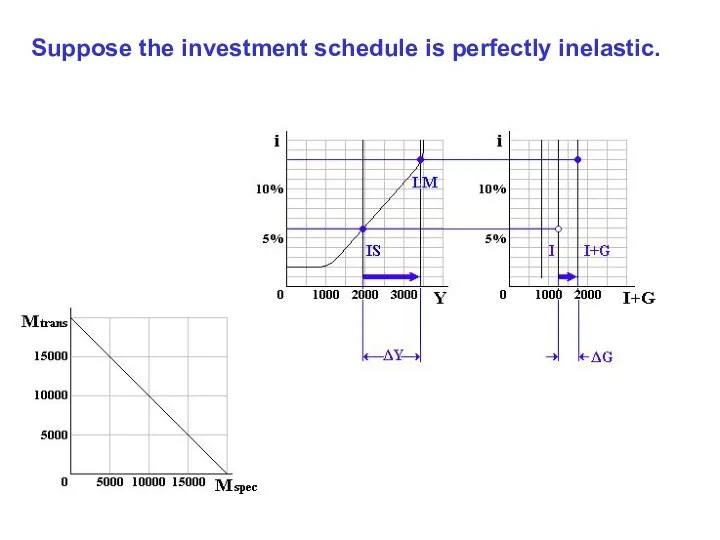

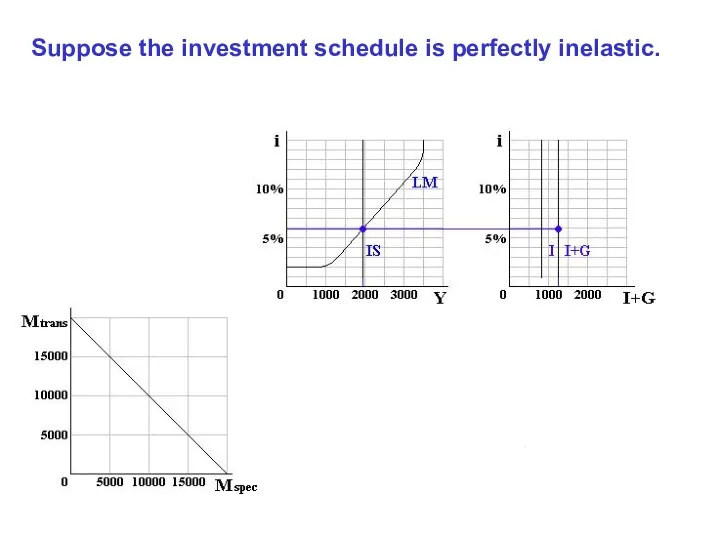

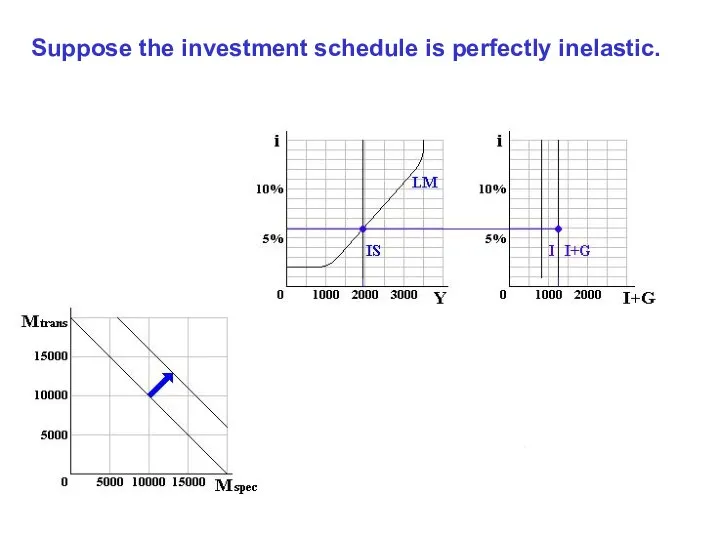

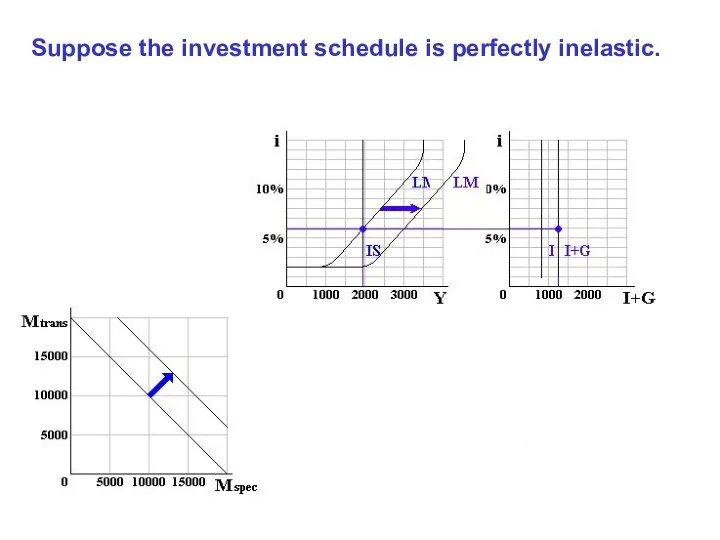

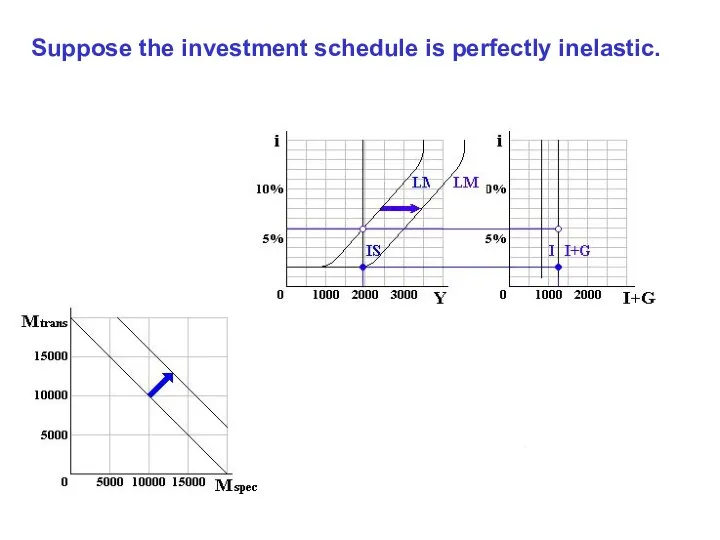

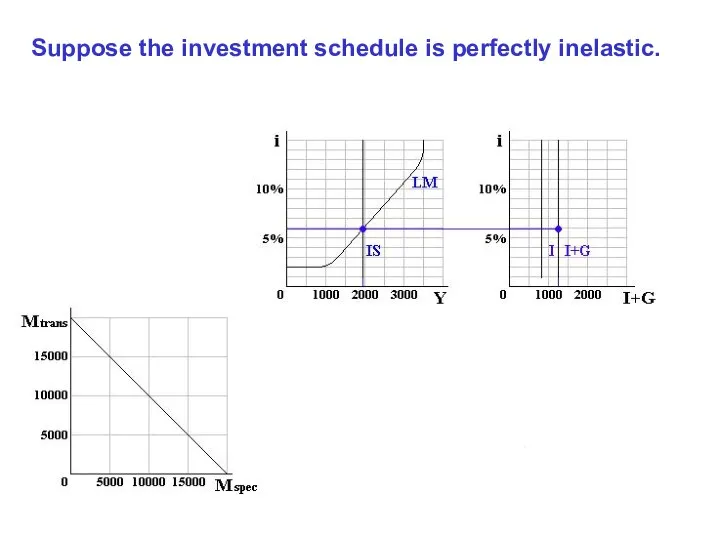

- 45. Suppose the investment schedule is perfectly inelastic.

- 46. Suppose the investment schedule is perfectly inelastic.

- 47. Suppose the investment schedule is perfectly inelastic.

- 48. Suppose the investment schedule is perfectly inelastic.

- 49. Suppose the investment schedule is perfectly inelastic.

- 50. Suppose the investment schedule is perfectly inelastic.

- 51. Suppose the investment schedule is perfectly inelastic.

- 52. Suppose the investment schedule is perfectly inelastic.

- 53. Suppose the investment schedule is perfectly inelastic.

- 54. Suppose the investment schedule is perfectly inelastic.

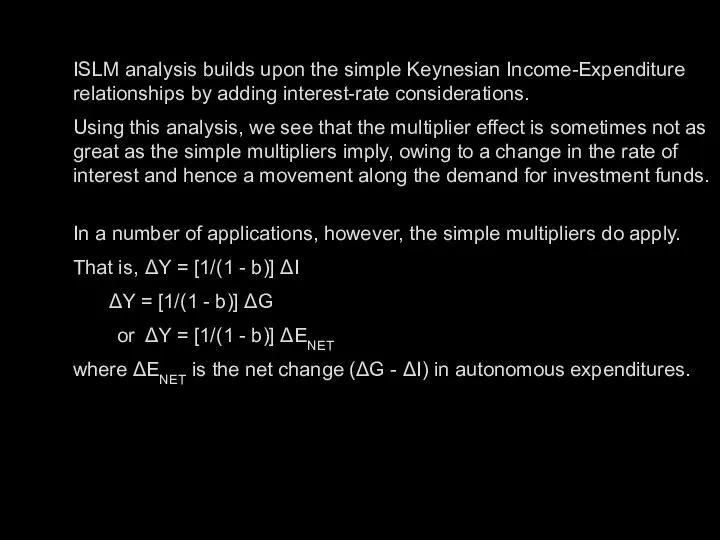

- 56. ISLM analysis builds upon the simple Keynesian Income-Expenditure relationships by adding interest-rate considerations. Using this analysis,

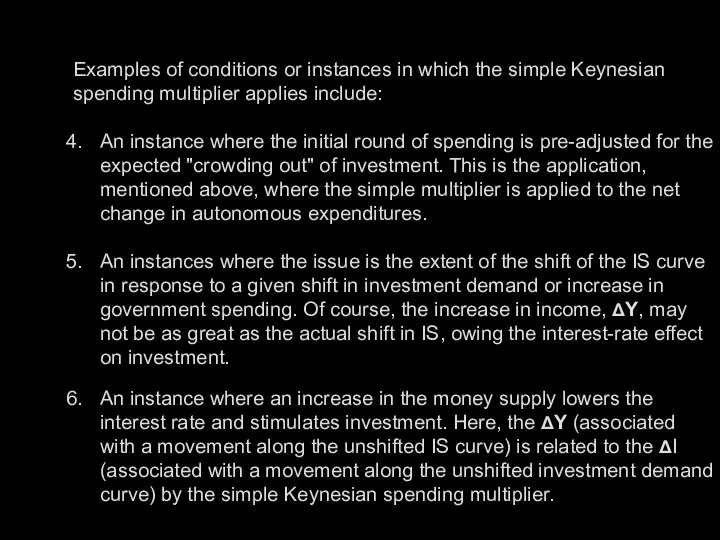

- 57. Examples of conditions or instances in which the simple Keynesian spending multiplier applies include: An economy

- 58. Examples of conditions or instances in which the simple Keynesian spending multiplier applies include: An instance

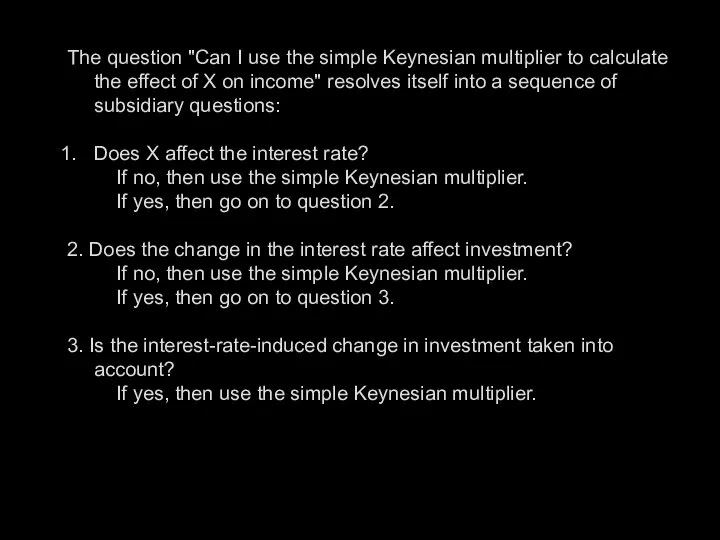

- 59. The question "Can I use the simple Keynesian multiplier to calculate the effect of X on

- 61. Скачать презентацию

Планирование и прогнозирование экономического роста, структуры экономики

Планирование и прогнозирование экономического роста, структуры экономики Рыночный механизм. Понятие рынка и его функции

Рыночный механизм. Понятие рынка и его функции Північноамериканська зона вільної торгівлі. Нафта

Північноамериканська зона вільної торгівлі. Нафта Макроэкономические проблемы: инфляция и безработица (часть 1)

Макроэкономические проблемы: инфляция и безработица (часть 1) Статистика инноваций в России

Статистика инноваций в России Предмет и методы Экономики

Предмет и методы Экономики Public Goods and Common Resource

Public Goods and Common Resource Инфляция: сущность, причины, измерение

Инфляция: сущность, причины, измерение Экономика для АНО «Одаренная молодежь»

Экономика для АНО «Одаренная молодежь» Поиск возможностей развития сельского поселения

Поиск возможностей развития сельского поселения Законы спроса и предложения

Законы спроса и предложения Инвестиционный паспорт Республики Ингушетия

Инвестиционный паспорт Республики Ингушетия Координация деятельности в сфере международных и внешнеэкономических связей. Опыт администрации города Перми

Координация деятельности в сфере международных и внешнеэкономических связей. Опыт администрации города Перми Современный механизм организации и управления ВЭС России

Современный механизм организации и управления ВЭС России Переробка та утилізація електронних відходів

Переробка та утилізація електронних відходів Показатели национальной экономики

Показатели национальной экономики Современные экономические теории

Современные экономические теории Социальное измерение экономики

Социальное измерение экономики FDI of Russia after sanction

FDI of Russia after sanction Предложение. Эластичность предложения. Понятие предложения

Предложение. Эластичность предложения. Понятие предложения Канада

Канада Потребитель и предприниматель в рыночной экономике

Потребитель и предприниматель в рыночной экономике Понятие о научно - техническом потенциале. Его составляющие

Понятие о научно - техническом потенциале. Его составляющие Ценообразующие факторы на мировом товарном рынке

Ценообразующие факторы на мировом товарном рынке Unemployment rate

Unemployment rate Безработица: причины, виды, последствия

Безработица: причины, виды, последствия Макроэкономическое равновесие и механизм его обеспечения

Макроэкономическое равновесие и механизм его обеспечения Постоянные и переменные затраты

Постоянные и переменные затраты