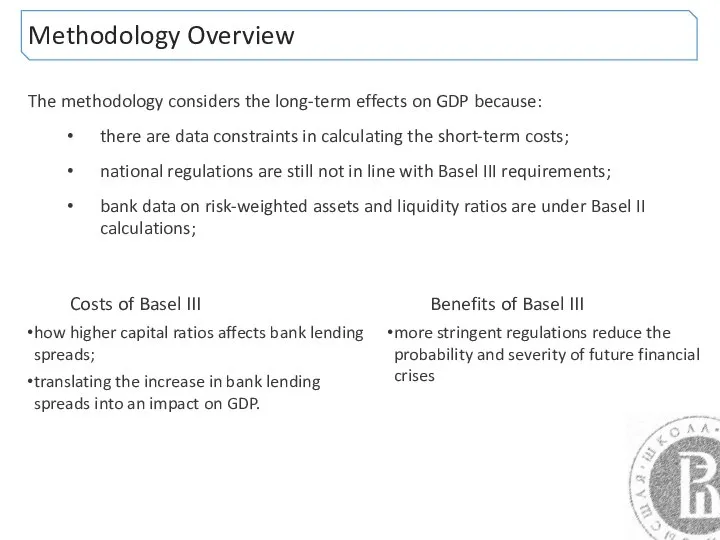

Methodology Overview

The methodology considers the long-term effects on GDP because:

there are

data constraints in calculating the short-term costs;

national regulations are still not in line with Basel III requirements;

bank data on risk-weighted assets and liquidity ratios are under Basel II calculations;

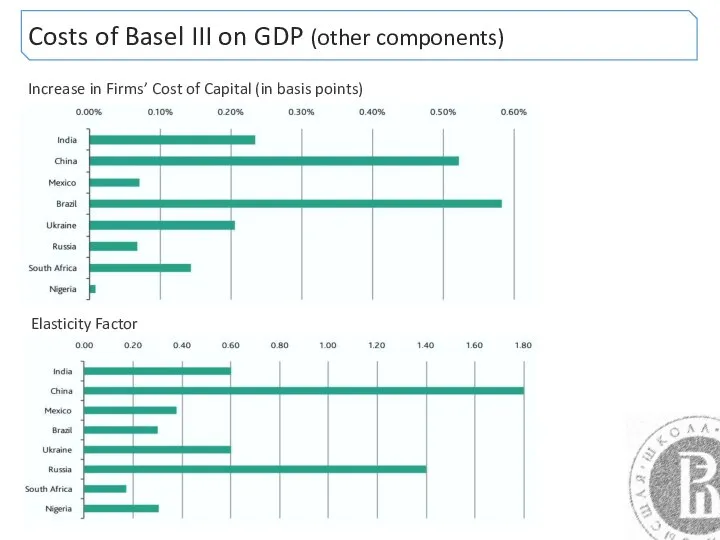

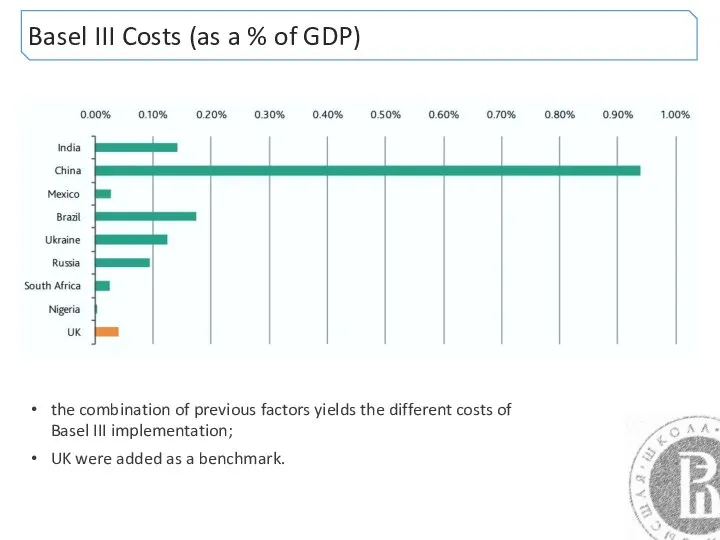

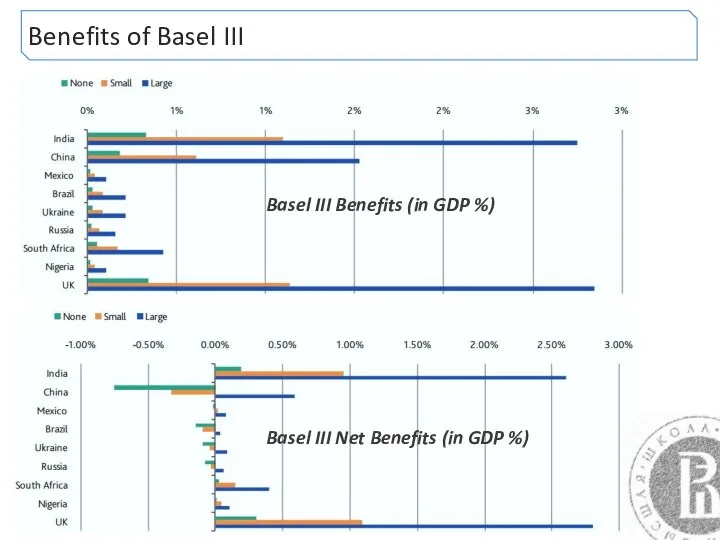

Costs of Basel III

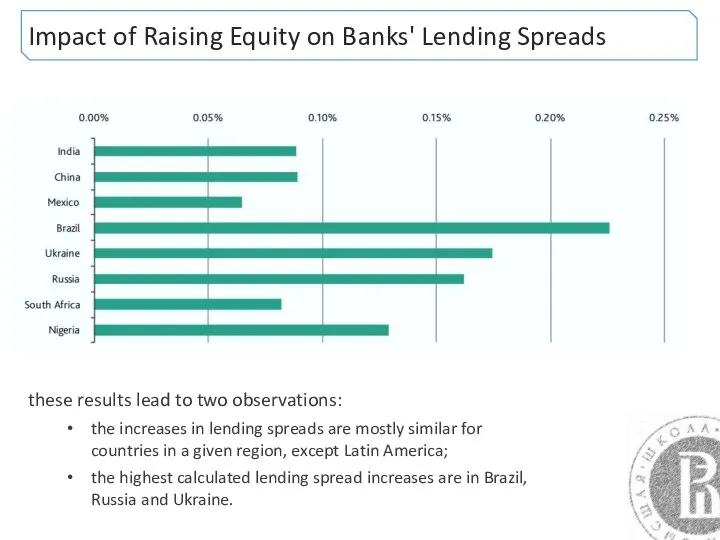

how higher capital ratios affects bank lending spreads;

translating the increase in bank lending spreads into an impact on GDP.

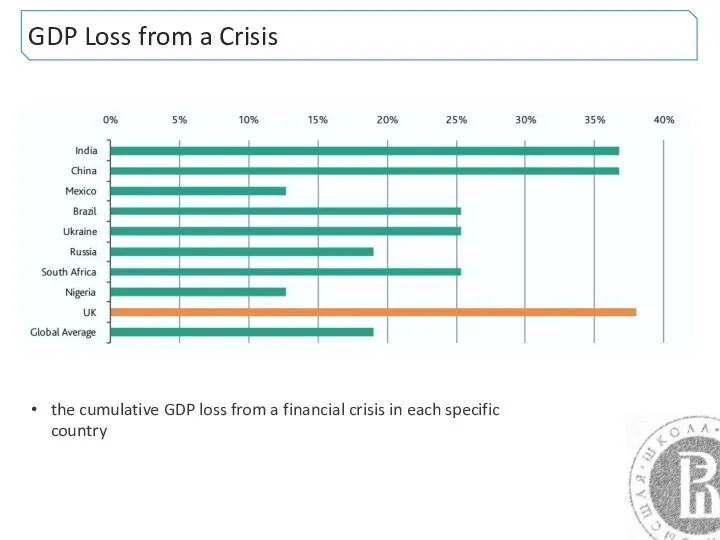

Benefits of Basel III

more stringent regulations reduce the probability and severity of future financial crises

Инвестиционный климат территории и методы его оценки

Инвестиционный климат территории и методы его оценки Основа экономики

Основа экономики Тест по теме: Рынок и рыночный механизм

Тест по теме: Рынок и рыночный механизм Регион как объект стратегического управления

Регион как объект стратегического управления Издержки производства и прибыль

Издержки производства и прибыль Индексный анализ производительности

Индексный анализ производительности Макроэкономика. ВВП и ВНП

Макроэкономика. ВВП и ВНП Наиболее известные научные работы в области экономики транспорта. Их авторы

Наиболее известные научные работы в области экономики транспорта. Их авторы Основы экономики. Основной капитал

Основы экономики. Основной капитал Фондовый рынок

Фондовый рынок Макроэкономическое равновесие в классической модели

Макроэкономическое равновесие в классической модели Методы краткосрочного прогнозирования экономических явлений. Сглаживание и экстраполяция

Методы краткосрочного прогнозирования экономических явлений. Сглаживание и экстраполяция Экономическая природа прибыли и механизм её образования

Экономическая природа прибыли и механизм её образования Enterprise Resource Planning (ERP) systems

Enterprise Resource Planning (ERP) systems Рынок труда и доходы населения в Волгоградской области

Рынок труда и доходы населения в Волгоградской области Развитые страны

Развитые страны Общее экономическое равновесие и экономика благосостояния

Общее экономическое равновесие и экономика благосостояния Проектирование организационных структур

Проектирование организационных структур Методы микроэкономики

Методы микроэкономики Экономика предприятия. Основные фонды и инвестиционная деятельность предприятия. (Лекция 6)

Экономика предприятия. Основные фонды и инвестиционная деятельность предприятия. (Лекция 6) Безработица

Безработица Экономика. Тренировочные задания

Экономика. Тренировочные задания Международные экономические отношения

Международные экономические отношения Лесной комплекс Российской Федерации

Лесной комплекс Российской Федерации Вводная лекция по дисциплине “Введение в макроэкономику” для ПД И НБ

Вводная лекция по дисциплине “Введение в макроэкономику” для ПД И НБ Суть концепції сталого розвитку України

Суть концепції сталого розвитку України Государственные закупки

Государственные закупки Бағалы қағаздар нарығы

Бағалы қағаздар нарығы