Содержание

- 2. Outline Introduction: Why ARCH? ARCH Models Extensions: GARCH, T-GARCH, Q-GARCH, GARCH-M, Box-Cox GARCH Estimation Multivariate GARCH

- 3. 1. Introduction: Why ARCH?

- 4. Why ARCH? ARMA and VAR models are based on the conditional mean of the distribution where

- 5. Some example series: UST10Y

- 6. Dow Jones Symmetric Shocks? Homoskedastic?

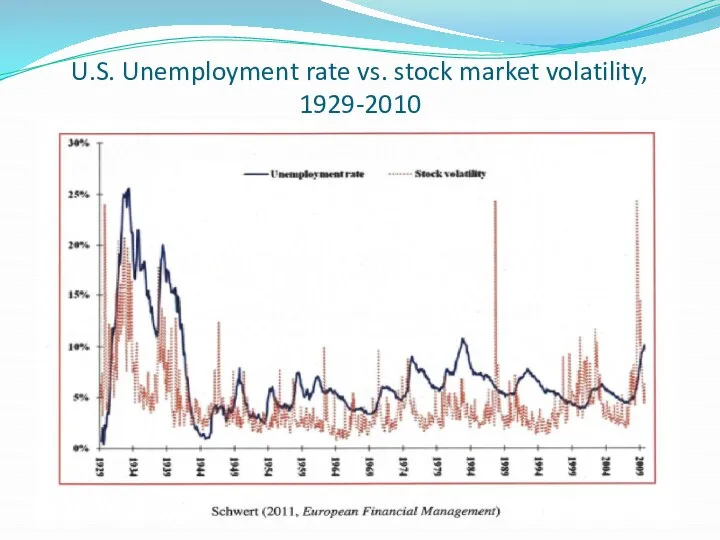

- 7. U.S. Unemployment rate vs. stock market volatility, 1929-2010

- 8. U.S. Realized Volatility (kernel based) 1997-2009

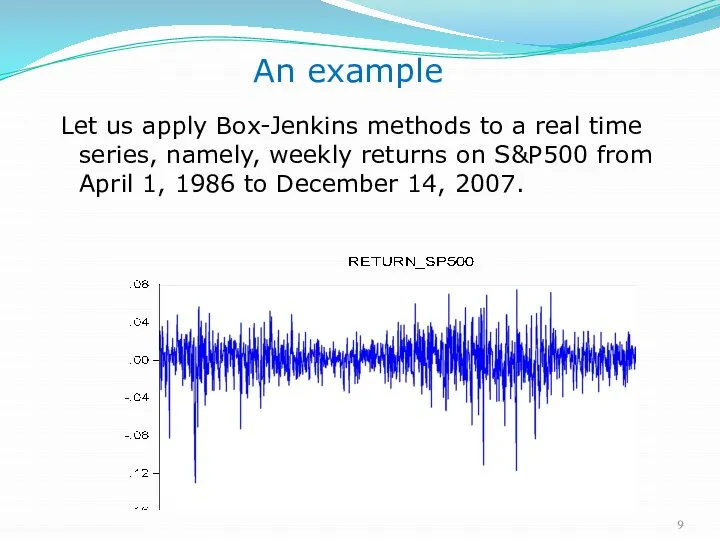

- 9. An example Let us apply Box-Jenkins methods to a real time series, namely, weekly returns on

- 10. Example (cont.) Note: Tranquil period Volatile period

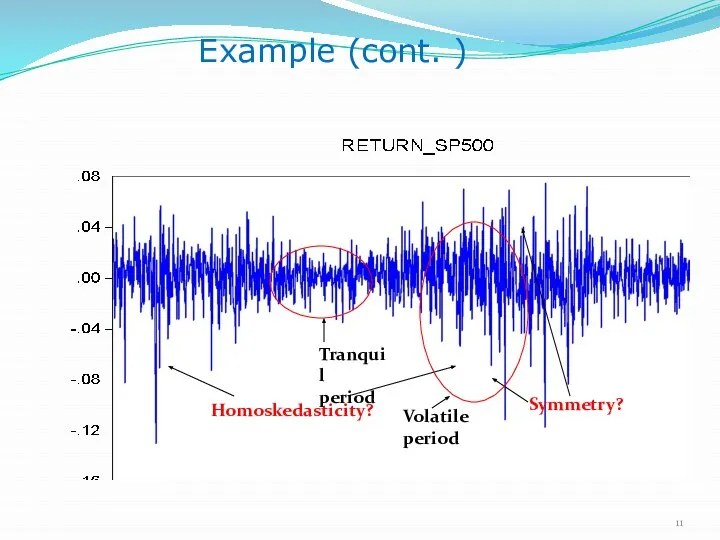

- 11. Example (cont. ) Homoskedasticity? Symmetry? Tranquil period Volatile period

- 12. Example (cont.) Both ACF and PACF are flat, suggesting p=0 and q=0 if we stay in

- 13. Example (cont. ) Look at the histogram and some summary statistics of the data: Asymmetry Fat

- 14. Skewness The shape of a uni-modal distribution can be symmetric or skewed to one side. If

- 15. Kurtosis Kurtosis measures the height and sharpness of the peak relative to the rest of the

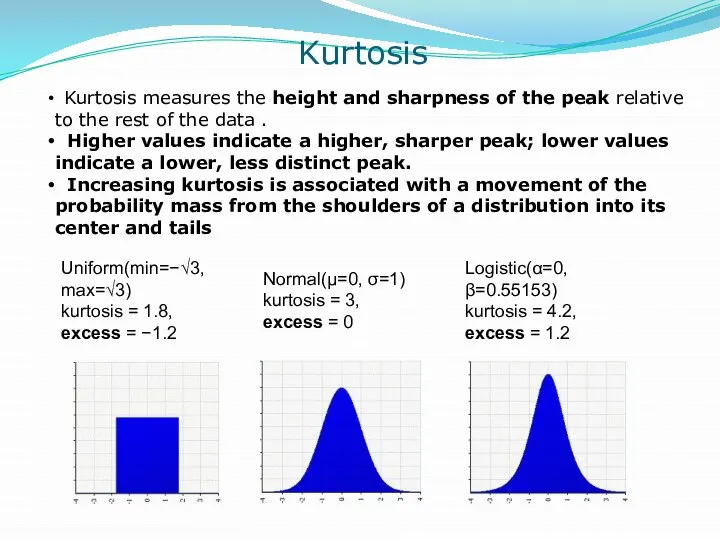

- 16. Remarks Gaussian ARMA models are not able to generate asymmetric or fat-tailed behavior. The previous time

- 17. Example Variance of financial returns is often referred to as volatility. To understand the dynamics of

- 18. EViews Example – Daily S&P 500 Returns

- 19. When we learn about GARCH(1,1)…

- 20. We’ll be able to make squared residuals white noise

- 21. Quality of TGARCH predictions: 1% quantiles, VaR(0.01), from August 1, 2007

- 22. 2. ARCH Models

- 24. ARCH(q) AR(J)-ARCH(q) AR(J)-ARCH(q) ARCH(q) Steady-State

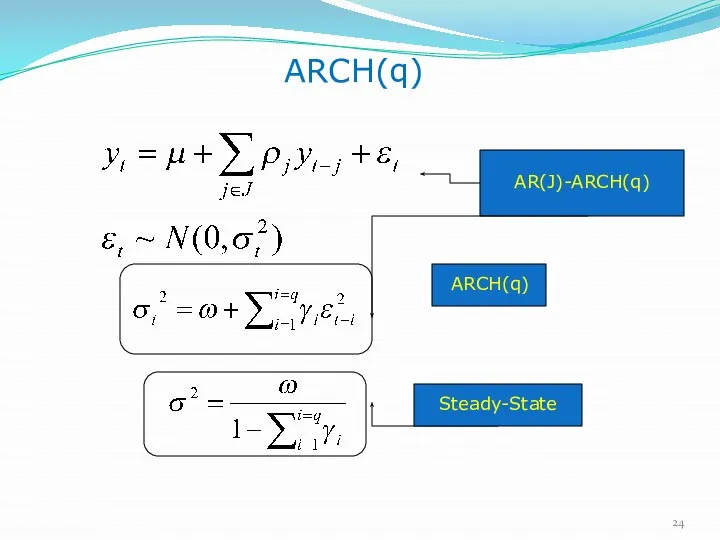

- 25. A special case: ARCH(1) Properties [It-1 = y1,..,yt-1] with the AR coefficient γ1 If , the

- 26. Testing for the ARCH effects Regress on . Calculate , which is an LM statistic. Under

- 27. 3. Extensions

- 28. GARCH(p,q) AR(J)-ARCH(q) AR(J)-GARCH(p,q) GARCH(p,q) Steady-State Additivity No negativity

- 29. GARCH(1,1) The most popular ARCH-type model Volatility ( ) VaR=1.645σ

- 30. Properties of GARCH(1,1) 1. follows an ARMA(1,1) with the AR coefficient , and the MA coefficient

- 31. I-GARCH If the coefficients of the GARCH model sum to 1, then the model has “integrated”

- 32. The speed of decrease in the IRFs is determined by Impulse response functions (IRFs) of GARCH(1,1)

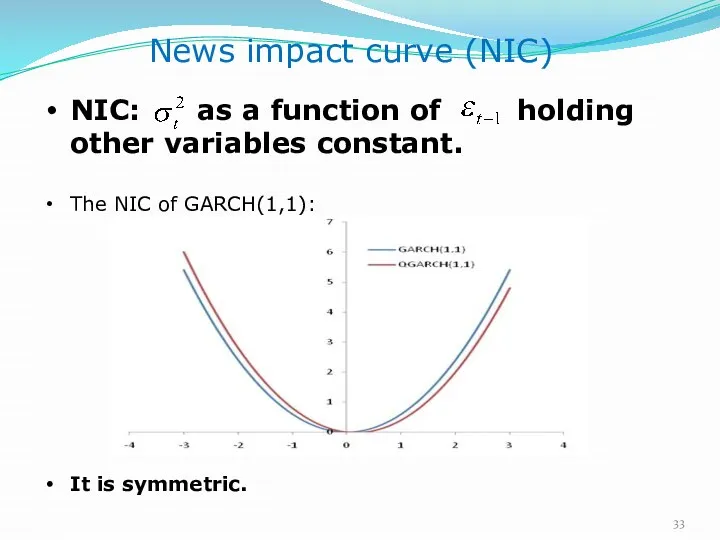

- 33. NIC: as a function of holding other variables constant. The NIC of GARCH(1,1): It is symmetric.

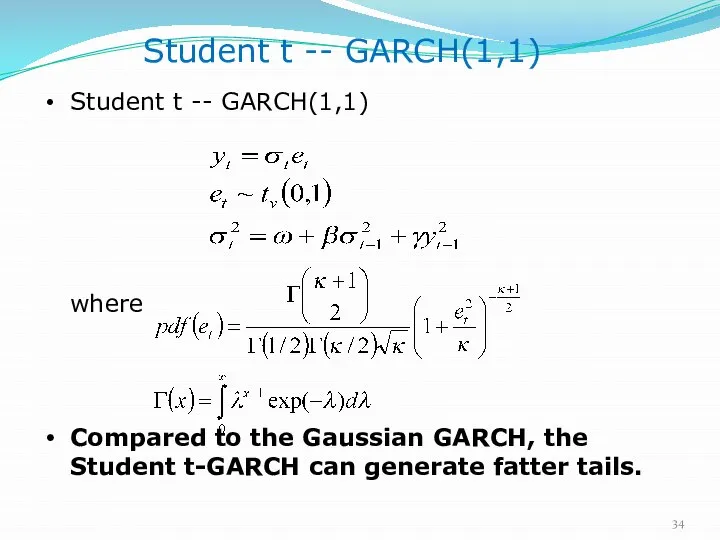

- 34. Student t -- GARCH(1,1) where Compared to the Gaussian GARCH, the Student t-GARCH can generate fatter

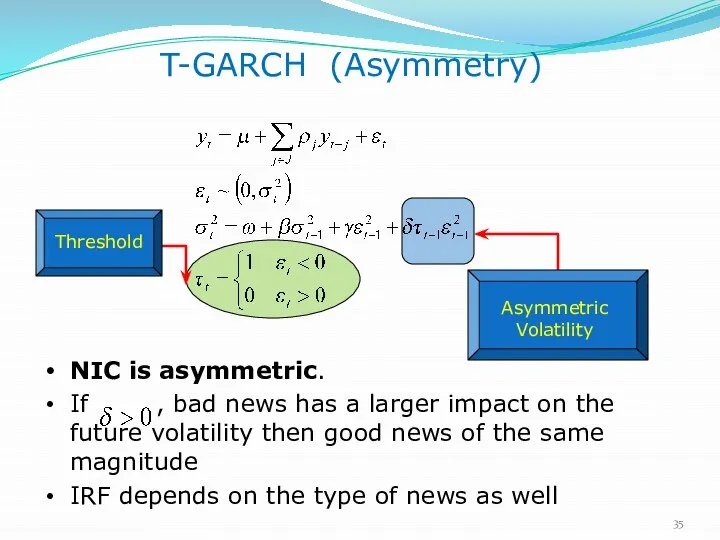

- 35. T-GARCH (Asymmetry) NIC is asymmetric. If , bad news has a larger impact on the future

- 36. IRFs T-GARCH (Asymmetry)

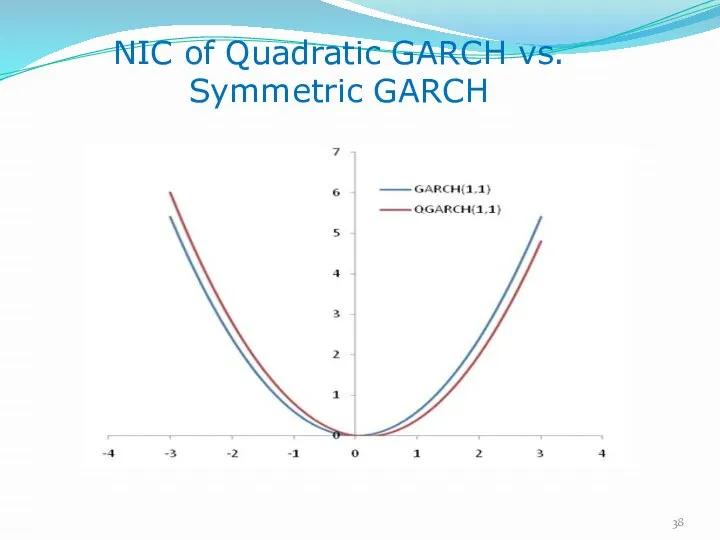

- 37. NIC is asymmetric as long as Asymmetric Volatility Q(uadratic)-GARCH (Asymmetry)

- 38. NIC of Quadratic GARCH vs. Symmetric GARCH

- 39. GARCH-M An important application of the ARCH-type models is in modeling the trade-off between the mean

- 40. Box-Cox GARCH(1,1) We model the power transformation of volatility. As long as , NIC is asymmetric

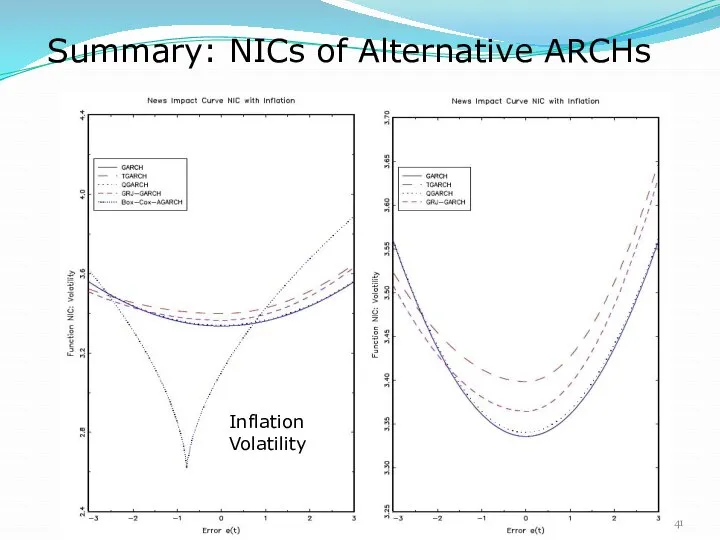

- 41. Summary: NICs of Alternative ARCHs Inflation Volatility

- 42. Summing up (see Appendix for an expanded list) Asymmetric Models Non linear

- 43. 3. Estimation

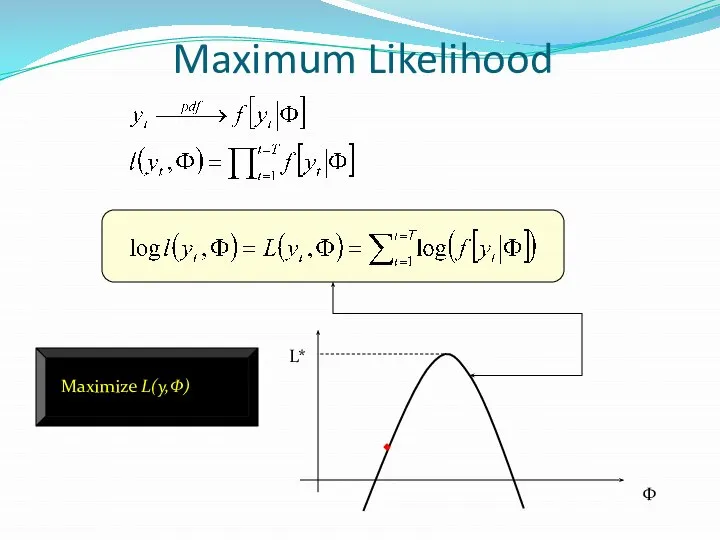

- 44. Maximum Likelihood Maximize L(y,Φ) Φ L*

- 45. Maximum Likelihood (continued) The maximum likelihood decomposes in a “mean” and a “variance” component. Estimation has

- 46. Optimization Newton’s Method Stochastic Newton Method Gradient and Hill Climbing Techniques

- 47. Multiple Solutions Monte Carlo Genetic Algorithms

- 48. 4. Multivariate models

- 49. Multivariate GARCH Models A natural extension of the time-varying variance models based on the univariate GARCH

- 50. Vech Model (2 variables) The conditional variance of each variable depends on its own lagged value,

- 51. BEKK Model C is a NxN lower triangular matrix of unknown parameters A and B are

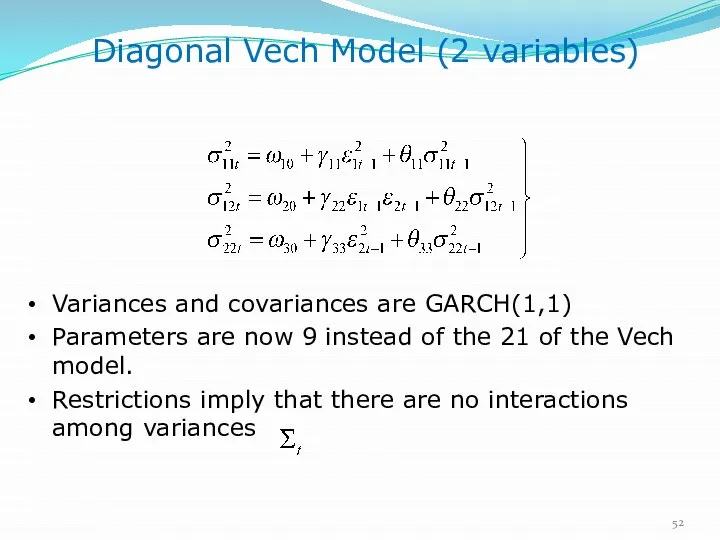

- 52. Diagonal Vech Model (2 variables) Variances and covariances are GARCH(1,1) Parameters are now 9 instead of

- 53. CCC (Constant Conditional Correlation) Model 3 variables The correlation coefficients are all time invariant

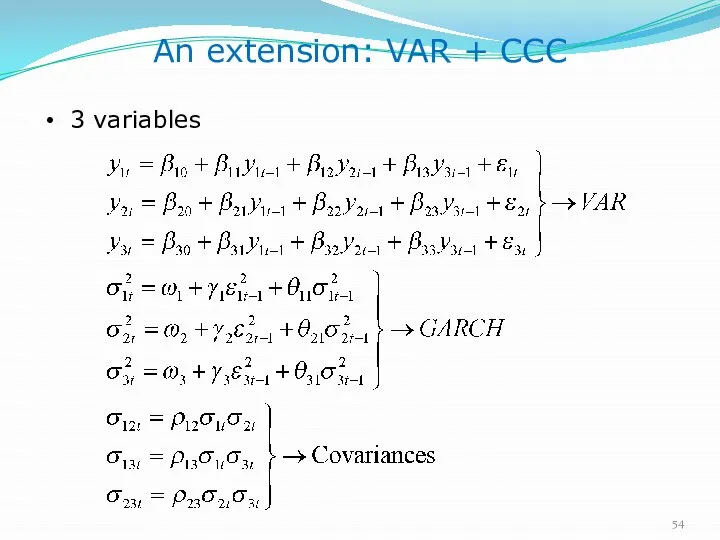

- 54. An extension: VAR + CCC 3 variables

- 55. A further extension: VAR + CCC+ GARCH-M Interactions between Markets Contagion

- 56. An example of volatility “contagion’’

- 57. 5. Application: Value-at-Risk (VaR)

- 58. VaR What is the most I can lose on an investment? VaR tries to provide an

- 59. Value-at-Risk (VaR) VaR summarizes the expected maximum loss over a time horizon within a given confidence

- 60. Value-at-Risk (VaR) - Continued The simplest assumption: daily gains/losses are normally distributed and independent. Calculate VaR

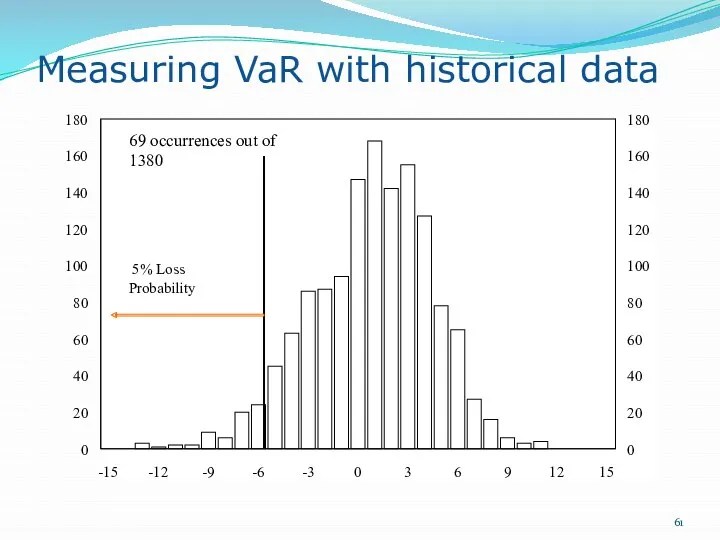

- 61. Measuring VaR with historical data 0 20 40 60 80 100 120 140 160 180 -15

- 62. Assuming a Normal distribution Mean Return (μ) Standard Deviation (σ) Assume that asset returns are normally

- 63. VaR with Normally Distributed Returns The probability of the return falling below a certain threshold depends

- 64. Portfolio VaR When we have more than one asset in our portfolio we can exploit the

- 65. An Example Let us consider the following investment US$200 million invested in 5-year zero coupon US

- 66. An Example (cont.) Suppose we want to compute the 95% VaR. The critical threshold is 1.65

- 67. An Example of Portfolio VaR Two securities 30-year zero-coupon U.S. Treasury bond 5-year zero-coupon U.S. Treasury

- 68. An Example of Portfolio VaR 95% confidence level 30 year zero VaR 1.65 * 0.01409 *

- 69. VaR of the Portfolio Suppose the correlation between the two bonds is ρ12=0.88 Remember that Portfolio

- 70. The problem with Normality: Kurtosis Extreme asset price changes occur more often than the normal distribution

- 71. Fat Tails and underestimation of VaR If we assume that returns are normally distributed when they

- 72. Backtesting Model backtesting involves systematic comparisons of the calculated VaRs with the subsequent realized profits and

- 73. Relevance: Basel VaR Guidelines VaR computed daily, holding period is 10 days. The confidence interval is

- 74. Summing up A host of research has examined a. how best to compute VaR with assumptions

- 75. Thank you!

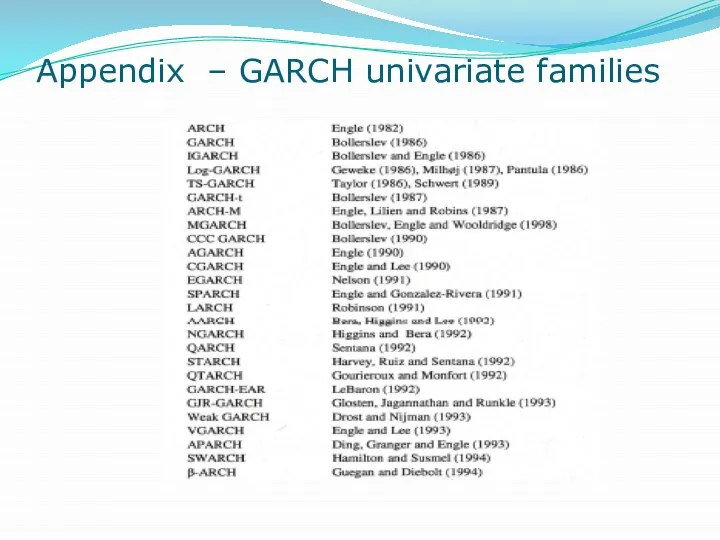

- 76. Appendix – GARCH univariate families

- 77. Source: Bollerslev 2010, Engle Festschrift

- 79. APPENDIX II – Software

- 81. Скачать презентацию

![A special case: ARCH(1) Properties [It-1 = y1,..,yt-1] with the AR](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/1434015/slide-24.jpg)

Современное состояние и перспективы развития инновационной составляющей экономики Украины

Современное состояние и перспективы развития инновационной составляющей экономики Украины Предпочтения и выбор

Предпочтения и выбор Борьба с безработицей

Борьба с безработицей Концептуальные основы регионального развития в России

Концептуальные основы регионального развития в России Приоритетные направления инновационного развития

Приоритетные направления инновационного развития Роль государства в рыночной экономике

Роль государства в рыночной экономике Возникновение экономики и её роль в государстве

Возникновение экономики и её роль в государстве Типы рыночных структур

Типы рыночных структур Глобализация, её проявления и последствия

Глобализация, её проявления и последствия Рынок. Модели. Спрос. Предложение. Равновесие

Рынок. Модели. Спрос. Предложение. Равновесие Товарная политика. Лекция 3

Товарная политика. Лекция 3 Модель кейнсианского креста

Модель кейнсианского креста Экономическое взаимодействие России и Китая

Экономическое взаимодействие России и Китая Проект Комфортная городская среда в Великоустюгском муниципальном районе

Проект Комфортная городская среда в Великоустюгском муниципальном районе Планирование и прогнозирование в условиях рынка

Планирование и прогнозирование в условиях рынка Методы экономического анализа

Методы экономического анализа Компанияның қаржы жағдайына жалпы баға беру

Компанияның қаржы жағдайына жалпы баға беру Обмен. Торговля. Реклама (7 класс)

Обмен. Торговля. Реклама (7 класс) Рыночные отношения в экономике

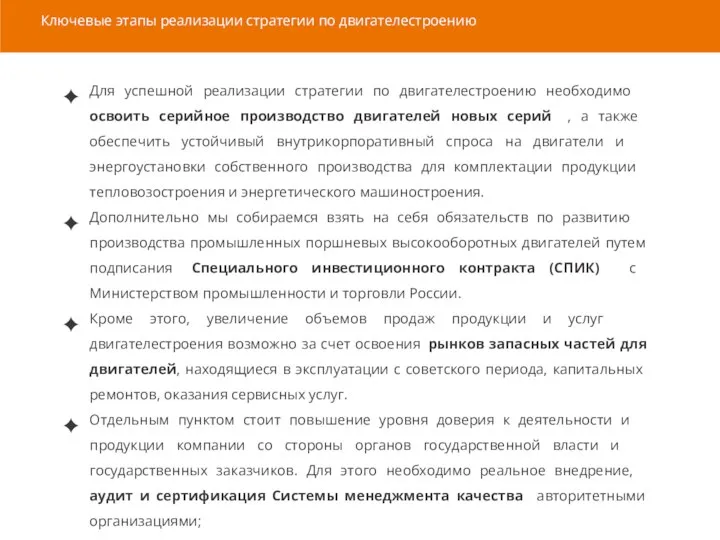

Рыночные отношения в экономике Ключевые этапы реализации стратегии по двигателестроению

Ключевые этапы реализации стратегии по двигателестроению Identification de marché. Identification des clients. Verifier auprés des clients l’attent des produits et services

Identification de marché. Identification des clients. Verifier auprés des clients l’attent des produits et services Потребности в перемещении людей и товаров,

Потребности в перемещении людей и товаров, Стратегии социального развития России в 21 веке

Стратегии социального развития России в 21 веке Рынок ресурсов

Рынок ресурсов Презентация Анализ конкурентоспособности экономики

Презентация Анализ конкурентоспособности экономики Поточні витрати торговельного підприємства. (Лекція 12)

Поточні витрати торговельного підприємства. (Лекція 12) Контрольные цифры проекта бюджета Санкт-Петербурга

Контрольные цифры проекта бюджета Санкт-Петербурга Курсовая работа по методике обучения экономике

Курсовая работа по методике обучения экономике