Содержание

- 2. All of your financial decisions and activities have an effect on your financial health now and

- 3. Do the Math – Net Worth and Personal Budgets Money comes in, money goes out. As

- 4. A personal budget is an important financial tool, because it can help you:

- 5. The income and expense categories you include in your budget will depend on your situation and

- 6. Once you’ve made the appropriate projections, subtract your expenses from your income. If you have money

- 7. Recognize Needs Vs. Wants “Needs” are things you have to have in order to survive: food,

- 9. Скачать презентацию

All of your financial decisions and activities have an effect on

All of your financial decisions and activities have an effect on

“don’t buy a house that costs more than 2.5 years’ worth of income”

“you should always save at least 10% of your income towards retirement”

Do the Math – Net Worth and Personal Budgets

Money comes in,

Do the Math – Net Worth and Personal Budgets

Money comes in,

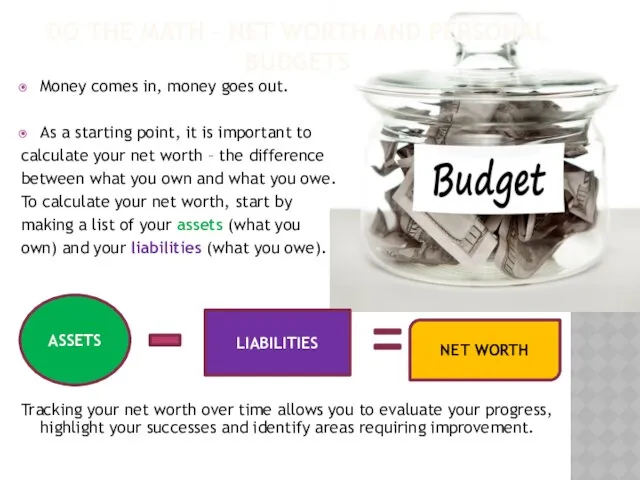

As a starting point, it is important to

calculate your net worth – the difference

between what you own and what you owe.

To calculate your net worth, start by

making a list of your assets (what you

own) and your liabilities (what you owe).

Tracking your net worth over time allows you to evaluate your progress, highlight your successes and identify areas requiring improvement.

ASSETS

LIABILITIES

NET WORTH

A personal budget is an important financial tool, because it can

A personal budget is an important financial tool, because it can

The income and expense categories you include in your budget will

The income and expense categories you include in your budget will

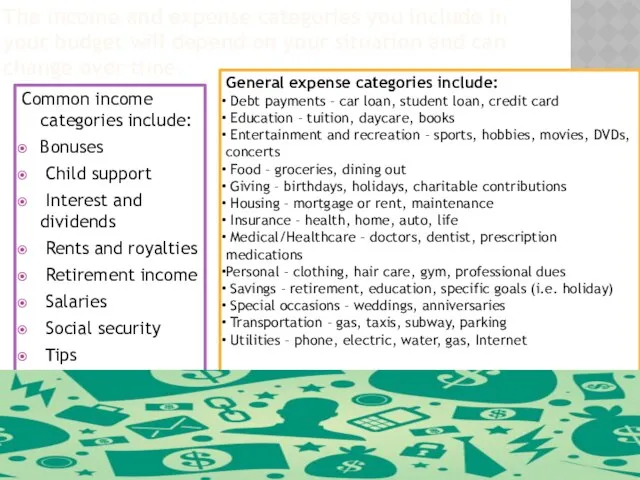

Common income categories include:

Bonuses

Child support

Interest and dividends

Rents and royalties

Retirement income

Salaries

Social security

Tips

General expense categories include:

Debt payments – car loan, student loan, credit card

Education – tuition, daycare, books

Entertainment and recreation – sports, hobbies, movies, DVDs, concerts

Food – groceries, dining out

Giving – birthdays, holidays, charitable contributions

Housing – mortgage or rent, maintenance

Insurance – health, home, auto, life

Medical/Healthcare – doctors, dentist, prescription medications

Personal – clothing, hair care, gym, professional dues

Savings – retirement, education, specific goals (i.e. holiday)

Special occasions – weddings, anniversaries

Transportation – gas, taxis, subway, parking

Utilities – phone, electric, water, gas, Internet

Once you’ve made the appropriate projections, subtract your expenses from

Once you’ve made the appropriate projections, subtract your expenses from

If you have money left over, you have a surplus and you can decide how to spend, save or invest the money.

If your expenses exceed your income, however, you will have to adjust your budget by increasing your income or by reducing your expenses.

Recognize Needs Vs. Wants

“Needs” are things you have to have in

Recognize Needs Vs. Wants

“Needs” are things you have to have in

“wants” are things you would like to have, but that you don’t need for survival

Схеми на свързване на ОУ с ООВ Гл.ас. д-р Малинка Иванова

Схеми на свързване на ОУ с ООВ Гл.ас. д-р Малинка Иванова Отдел кадров Филиал Приволжский

Отдел кадров Филиал Приволжский Принципы сканирующей зондовой микроскопии. Сканирующий туннельный микроскоп. Атомно-силовой микроскоп

Принципы сканирующей зондовой микроскопии. Сканирующий туннельный микроскоп. Атомно-силовой микроскоп (з†бвм-ѓа®ЂЃ¶•≠®•)-КРУГИ ЭЙЛЕРА

(з†бвм-ѓа®ЂЃ¶•≠®•)-КРУГИ ЭЙЛЕРА ПРУТСКИЙ ПОХОД Подготовила: Рычкова К.А., студентка 1 курса юридического факультета группы ЮБ 1404

ПРУТСКИЙ ПОХОД Подготовила: Рычкова К.А., студентка 1 курса юридического факультета группы ЮБ 1404  3.1. ЭМ предприятия/организации – переход к интегрированной модели 3.1. ЭМ предприятия/организации – переход к интегрированной

3.1. ЭМ предприятия/организации – переход к интегрированной модели 3.1. ЭМ предприятия/организации – переход к интегрированной  Технологическая карта по физической культуре для студентов-инвалидов

Технологическая карта по физической культуре для студентов-инвалидов My favorite team

My favorite team Сетевые графики

Сетевые графики ИСТОРИЯ СОЗДАНИЯ ЛЕНИНСКОГО РАЙОНА ГОРОДА НИЖНЕГО НОВГОРОДА Автор презентации: команда «КЛИО», школа №185 города Нижнего Новгород

ИСТОРИЯ СОЗДАНИЯ ЛЕНИНСКОГО РАЙОНА ГОРОДА НИЖНЕГО НОВГОРОДА Автор презентации: команда «КЛИО», школа №185 города Нижнего Новгород ГЕОИНФОРМАЦИОННАЯ ТЕХНОЛОГИЯ ОПТИМИЗАЦИИ ОХРАНЫ ПОЧВ ОТ ЭРОЗИИ

ГЕОИНФОРМАЦИОННАЯ ТЕХНОЛОГИЯ ОПТИМИЗАЦИИ ОХРАНЫ ПОЧВ ОТ ЭРОЗИИ МЕРЫ ВАРИАЦИИ

МЕРЫ ВАРИАЦИИ  Методика оптимизации портфеля ценных бумаг на основании нейросетевого прогнозирования Исполнитель: Воронова М.А. Руководитель:

Методика оптимизации портфеля ценных бумаг на основании нейросетевого прогнозирования Исполнитель: Воронова М.А. Руководитель:  Внешние факторы роста значения региональной дипломатии. (Часть 2)

Внешние факторы роста значения региональной дипломатии. (Часть 2) Элементы квантовой механики

Элементы квантовой механики  Единый государственный экзамен Основные тенденции и перспективы

Единый государственный экзамен Основные тенденции и перспективы Функциональный степенной ряд

Функциональный степенной ряд Сборочные чертежи

Сборочные чертежи ВКР: Организация ремонта электрооборудования в условиях ЗАО «Белый Ручей»

ВКР: Организация ремонта электрооборудования в условиях ЗАО «Белый Ручей» Презентация Кроссворд ценовые стратегии

Презентация Кроссворд ценовые стратегии Возникновение искусства и религиозных верований

Возникновение искусства и религиозных верований Система команд МП

Система команд МП Аудирование как средство совершенствования лексического навыка

Аудирование как средство совершенствования лексического навыка Мораль, право и политика в социологии международных отношений

Мораль, право и политика в социологии международных отношений Create Direct – Новая Бизнес-кампания: Мой Санта ! или Как заключить договора на 100.000 EURO за три месяца 15.12.2010 – 31.12.2010. - презентация

Create Direct – Новая Бизнес-кампания: Мой Санта ! или Как заключить договора на 100.000 EURO за три месяца 15.12.2010 – 31.12.2010. - презентация Презентация на тему "Сурдопедагогика. Кривощёкова Н.И. Всегда говори правду (урок)" - скачать презентации по Педагогике

Презентация на тему "Сурдопедагогика. Кривощёкова Н.И. Всегда говори правду (урок)" - скачать презентации по Педагогике Презентация на тему "Создание здоровье сберегающего пространства" - скачать презентации по Педагогике

Презентация на тему "Создание здоровье сберегающего пространства" - скачать презентации по Педагогике Теоретические основы правового статуса личности

Теоретические основы правового статуса личности