Rostov-on-Don Department of education Gymnasium 34 Vladislav Pismenskiy Form 10 “Б” Research project in English Science Topic : Global Financial Crisis (GFC) or the "Great Recession“ Project supervisor : Dolgopolskaya I.B. 2012

Содержание

- 2. The notion of economic crisis General grounds Causes of the crisis Impact on financial markets Global

- 3. Global Financial Crisis (GFC) is claimed to be the worst financial crisis since the Great Depression

- 4. There is hardly ever any sphere of society that GFC didn’t touch. That’s why changes both

- 5. The term financial crisis is applied broadly to a variety of situations in which some financial

- 6. The source of financial crisis of 2008 lies in the banking system of the USA. It

- 7. Causes

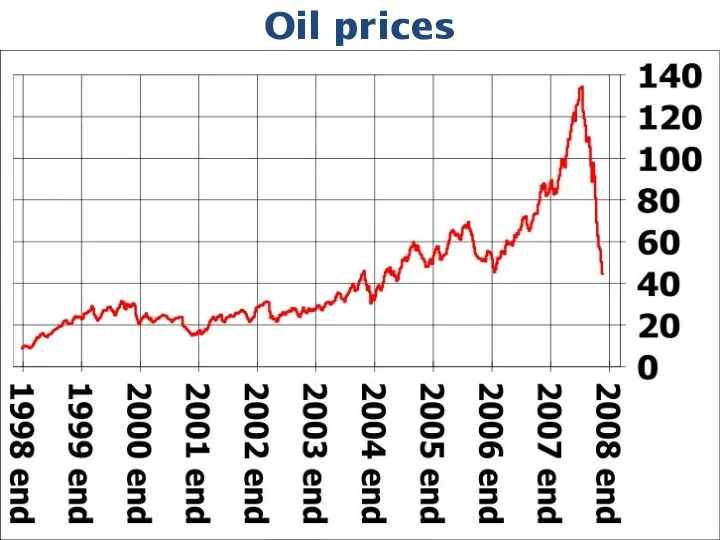

- 9. Oil prices

- 10. The International Monetary Fund estimated that large U.S. and European banks lost more than $1 trillion

- 11. List of largest U.S. bank failures

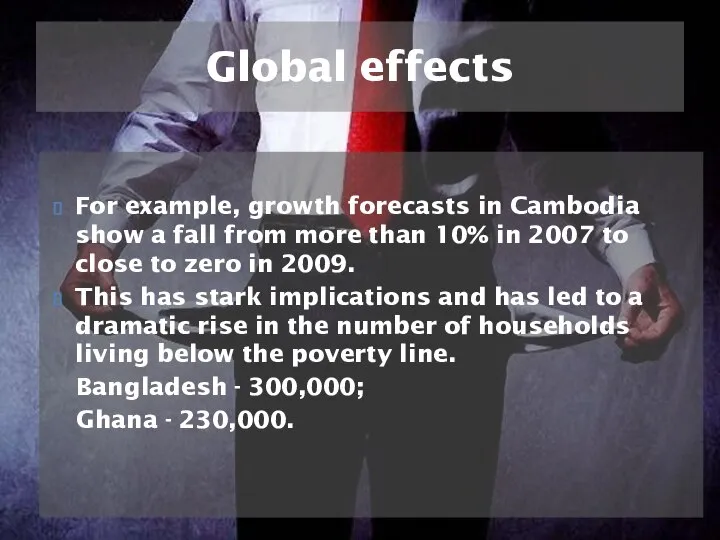

- 12. For example, growth forecasts in Cambodia show a fall from more than 10% in 2007 to

- 13. The recession that began in December 2007 ended in June 2009, according to U.S. National Bureau

- 14. The financial crisis was not widely predicted by mainstream economists, who instead spoke of the Great

- 15. Mass media focused great attention to the world financial crises. It has generated many articles, books,

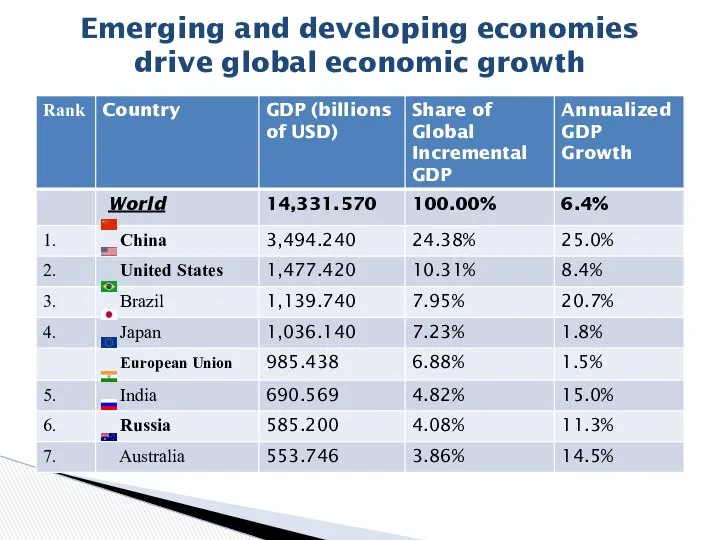

- 16. Emerging and developing economies drive global economic growth

- 17. November 14, 2008 Leaders of the Group of Twenty (G20) gathered at an anti-crisis summit. Following

- 18. Summing up, the investigation outlined the reasons of the crisis and its consequences and mainly the

- 20. Скачать презентацию

The Past Simple Tense

The Past Simple Tense If you feel like singing. A Bicycle Built For Two

If you feel like singing. A Bicycle Built For Two  Seasons and months of the year

Seasons and months of the year Good manners lera Osadchuk and Tania Grigor

Good manners lera Osadchuk and Tania Grigor  My fireplace

My fireplace Slang. Acronyms

Slang. Acronyms The Past Perfect Tense

The Past Perfect Tense  Oklahoma Made by: Natalie Luca

Oklahoma Made by: Natalie Luca Аттестационная работа. Программа внеурочной деятельности по английскому языку для обучающихся 6 класса Говорим по-английски

Аттестационная работа. Программа внеурочной деятельности по английскому языку для обучающихся 6 класса Говорим по-английски Extreme sports action sport adventure sport

Extreme sports action sport adventure sport Spider-Man: Into the Spider-Verse

Spider-Man: Into the Spider-Verse Future Simple Tense Подготовил: учитель английского языка МОУ Рамонская СОШ №2 Шапорова Галина Анатольевна

Future Simple Tense Подготовил: учитель английского языка МОУ Рамонская СОШ №2 Шапорова Галина Анатольевна  Forms of Business

Forms of Business  Презентация к уроку английского языка "Counting with sound" - скачать

Презентация к уроку английского языка "Counting with sound" - скачать  Форма залога. Пассивный залог

Форма залога. Пассивный залог The British Parliament

The British Parliament  Ood one out games 3

Ood one out games 3 Презентация к уроку английского языка "Best Expert on Britain Tournament" - скачать бесплатно

Презентация к уроку английского языка "Best Expert on Britain Tournament" - скачать бесплатно irregular .ImagineEnglish

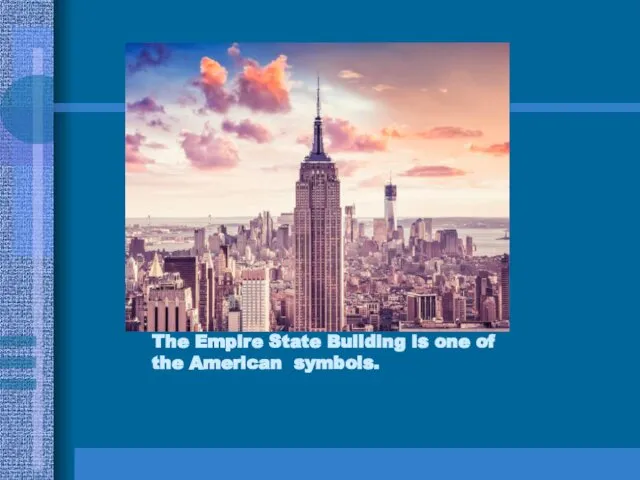

irregular .ImagineEnglish The Empire State Building is one of the American symbols

The Empire State Building is one of the American symbols How to organize your answer. Use the following guide to plan, organize and paragraph an essay in IELTS Writing

How to organize your answer. Use the following guide to plan, organize and paragraph an essay in IELTS Writing Презентация к уроку английского языка "Independence and Individualism of Young People in America" - скачать

Презентация к уроку английского языка "Independence and Individualism of Young People in America" - скачать  Фонетическая зарядка на английском языке. Сказка о язычке Выполнила: Абдрахимова Регина Ринатовна

Фонетическая зарядка на английском языке. Сказка о язычке Выполнила: Абдрахимова Регина Ринатовна  "Народные пословицы служат отражением народного ума, характера, верований, воззрений на природу "

"Народные пословицы служат отражением народного ума, характера, верований, воззрений на природу "  Christmas the snowman game

Christmas the snowman game Russia; Russia; People we are proud of; History of Russia; Moscow; Traditions; Famous places in St’Petersburg

Russia; Russia; People we are proud of; History of Russia; Moscow; Traditions; Famous places in St’Petersburg  A Busy Life. Unit 1.1

A Busy Life. Unit 1.1 IS or ARE

IS or ARE