Содержание

- 2. Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

- 3. The Walt Disney Company Entertainment Conglomerate consisting of Media, Studio Entertainment, Consumer Products and Theme Parks

- 4. Disney’s Interest in China Long-term Consistently searching for areas of expansion where there are un-captured markets

- 5. Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

- 6. Background: Disney Parks Disneyland, Anaheim: 1955 Walt Disney World, Orlando: 1971 Tokyo Disneyland:1983 Owned and operated

- 7. Hong Kong Disneyland $1.8 Billion USD Project 60% Debt 80% Government 20% Commercial 40% Equity 43%

- 8. Background: China Largest population in the world with relatively slow projected population growth 1.26 B (2001)

- 9. Theme Parks in China Most parks in China were American-themed Few have survived mainly because of

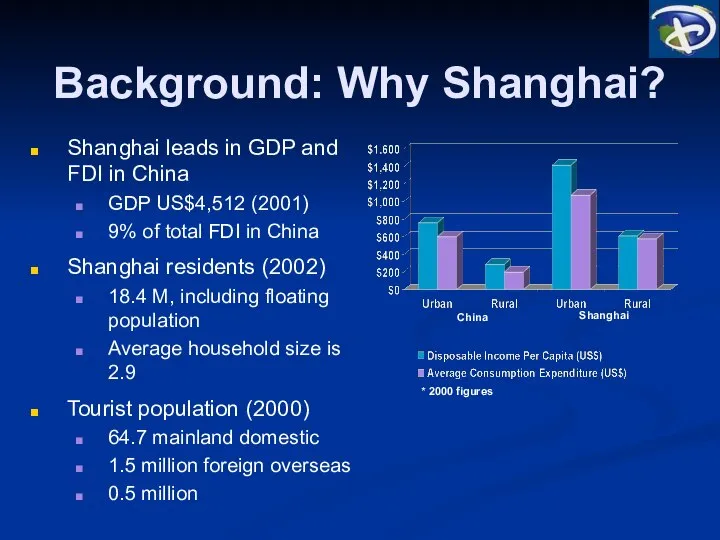

- 10. Background: Why Shanghai? China Shanghai Shanghai leads in GDP and FDI in China GDP US$4,512 (2001)

- 11. Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

- 12. Park Location is Key Significant infrastructure development is occurring to support the 2010 Expo Expo Site

- 13. Target Market * Based on 2008F Population numbers

- 14. Project Structure 1.27 Billion US$ total capital investment 60% Debt 80% Government 20% Commercial 40% Equity

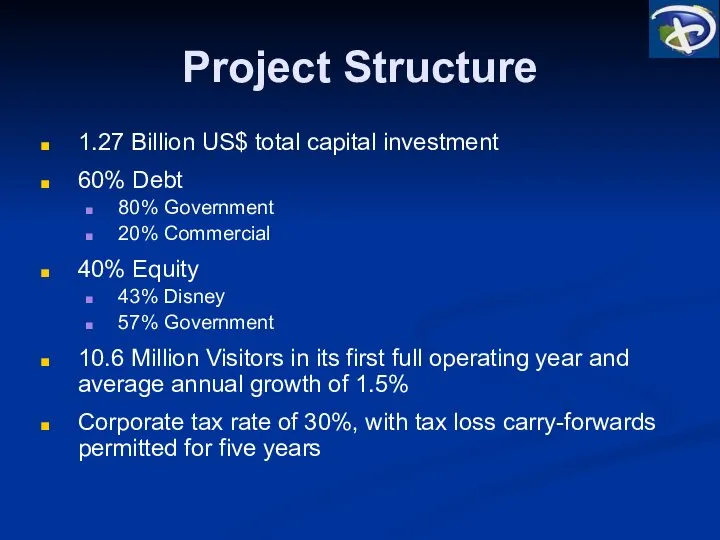

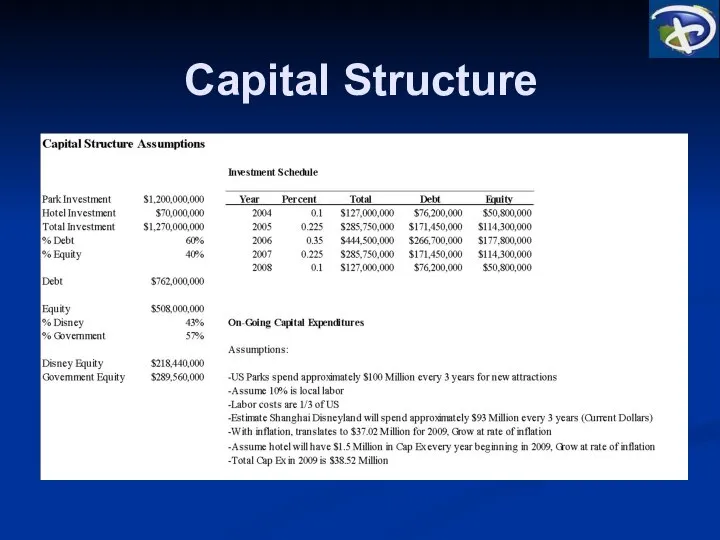

- 15. Operating Cash Flows Admissions (50%) Food and beverage (24.5%) Merchandise (24.5%) Main entrance (1%) Park labor

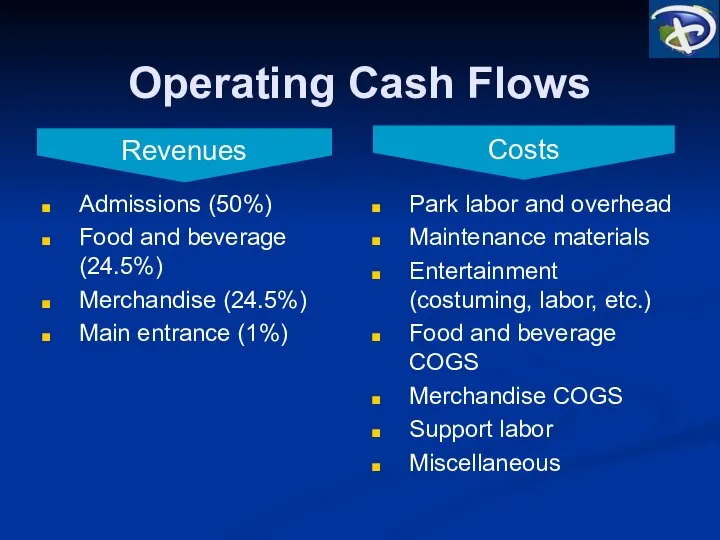

- 16. Discussion

- 17. Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

- 18. Risk Analysis - Sovereign Currency risk is not mitigated by this project since the majority of

- 19. Risk Analysis – Operating and Financial The technology for this project will be provided by Disney

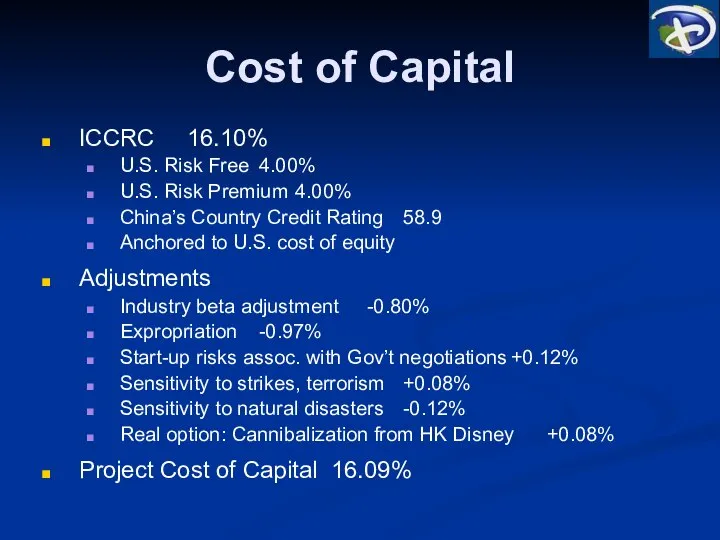

- 20. Cost of Capital ICCRC 16.10% U.S. Risk Free 4.00% U.S. Risk Premium 4.00% China’s Country Credit

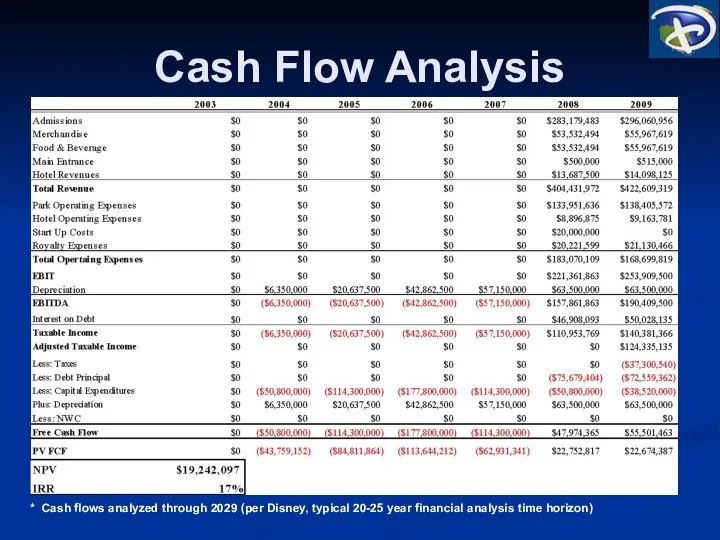

- 21. Cash Flow Analysis * Cash flows analyzed through 2029 (per Disney, typical 20-25 year financial analysis

- 22. Real Options Option to wait until Universal Studios opens Already losing any first mover advantage Universal’s

- 23. Agenda Case Introduction Background Project Description Our Analysis Recommendation Questions?

- 24. Recommendation Begin negotiations with Chinese government Government equity stake and debt provisions Land and infrastructure provisions

- 25. Questions?

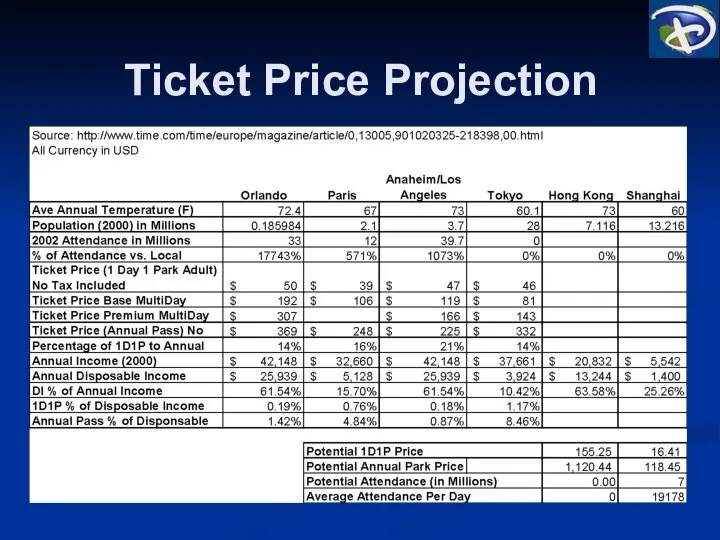

- 26. Ticket Price Projection

- 27. Demand Projections

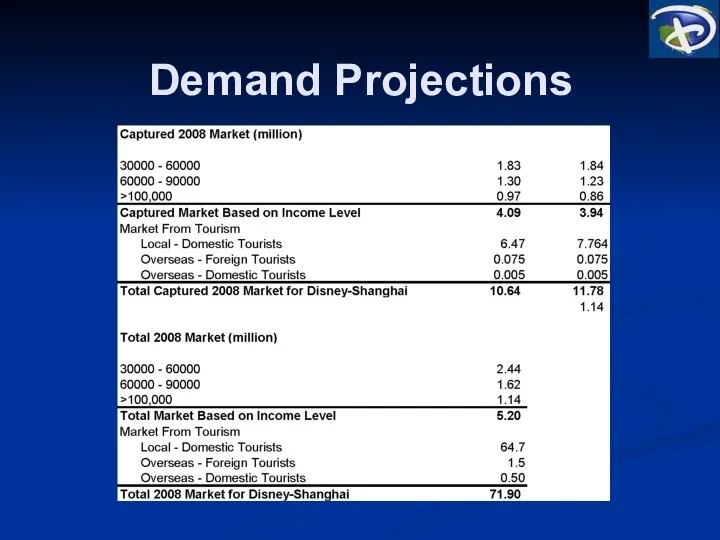

- 28. Revenue Projections

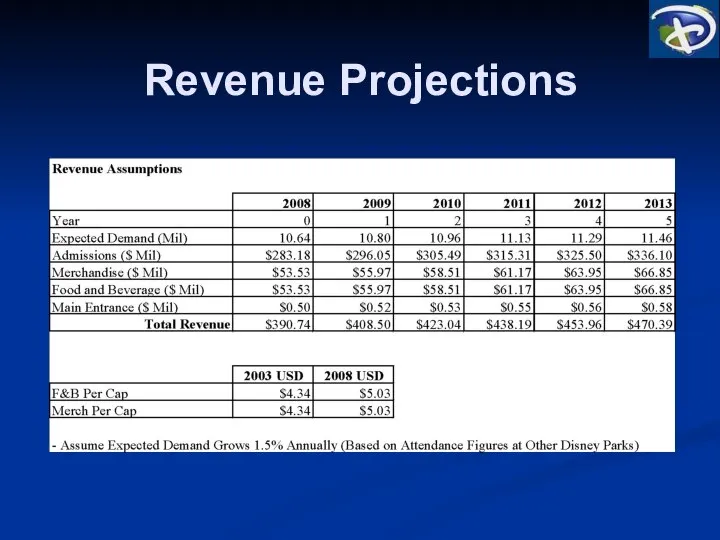

- 29. Operating Costs

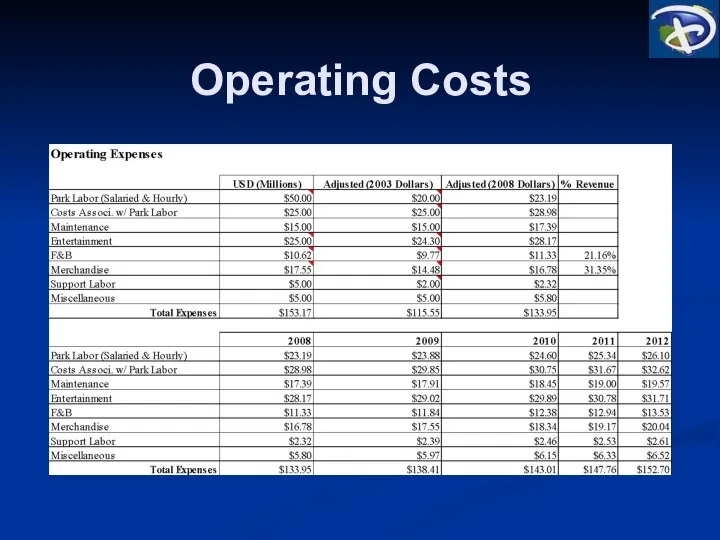

- 30. Capital Structure

- 32. Скачать презентацию

Describing opinions and reactions

Describing opinions and reactions Черные дыры и темная материя Подготовили Михальцова Анна и Герко Татьяна, 11 «М» класс

Черные дыры и темная материя Подготовили Михальцова Анна и Герко Татьяна, 11 «М» класс  Famous persons in the uk Presentation prepeare Pupil of 11 group Vlad Muzychenko

Famous persons in the uk Presentation prepeare Pupil of 11 group Vlad Muzychenko  Emotions

Emotions Аттестационая работа. Программа внеурочной деятельности по английскому языку English Project, 4 класс

Аттестационая работа. Программа внеурочной деятельности по английскому языку English Project, 4 класс Buckingham Palace

Buckingham Palace Merlin's magic book

Merlin's magic book Listen, read, to learn new words

Listen, read, to learn new words Famous people of Great Britain and Russia

Famous people of Great Britain and Russia Chapter 3 Audit Reports

Chapter 3 Audit Reports  Weather Forecast for the Weekend in Washington

Weather Forecast for the Weekend in Washington Business English

Business English Своя игра

Своя игра English is a global language

English is a global language The Taming of the Shrew (almost according to W. Shakespeare)

The Taming of the Shrew (almost according to W. Shakespeare) The Gerund

The Gerund Promoting of the Internationalization of the Bulgarian Enterprises

Promoting of the Internationalization of the Bulgarian Enterprises  Present Simple Do/Does

Present Simple Do/Does The world of work

The world of work The most beautiful waterfalls in the world

The most beautiful waterfalls in the world  Return random integer in range [a, b], including both end points

Return random integer in range [a, b], including both end points Buzuluk Financial – Economic College – the branch of Finance University under the Government of Russia Chair of Foreign Languages Composition On the subject: «My future profession. Career»

Buzuluk Financial – Economic College – the branch of Finance University under the Government of Russia Chair of Foreign Languages Composition On the subject: «My future profession. Career» There is, there are

There is, there are Focus 4 (b2+) living spaces

Focus 4 (b2+) living spaces Millionaire

Millionaire Michelangelo Merisi da Caravaggio (28 September 1571 – 18 July 1610)

Michelangelo Merisi da Caravaggio (28 September 1571 – 18 July 1610)  Countable and uncountablе nouns

Countable and uncountablе nouns