Содержание

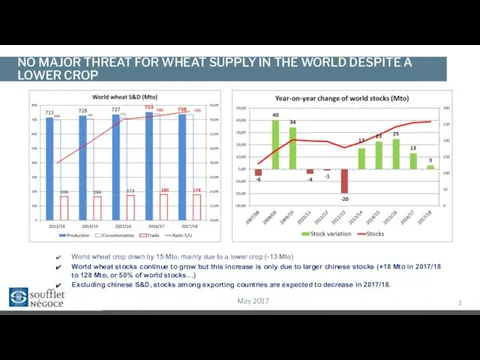

- 2. NO MAJOR THREAT FOR WHEAT SUPPLY IN THE WORLD DESPITE A LOWER CROP May 2017 World

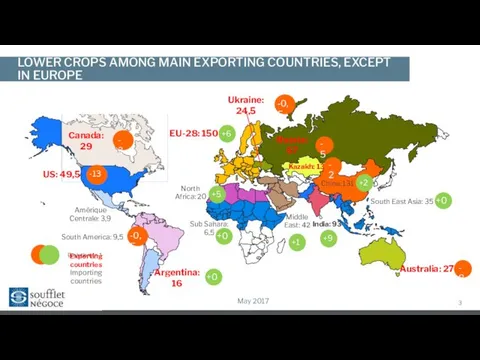

- 3. LOWER CROPS AMONG MAIN EXPORTING COUNTRIES, EXCEPT IN EUROPE May 2017 EU-28: 150 Sub Sahara: 6,5

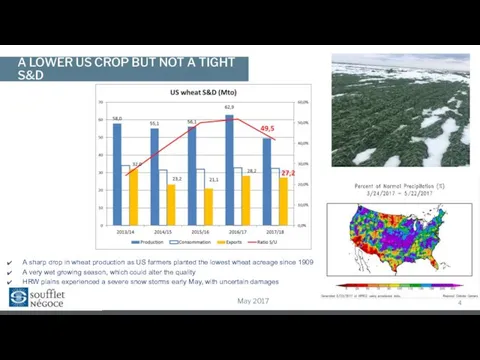

- 4. A LOWER US CROP BUT NOT A TIGHT S&D May 2017 A sharp drop in wheat

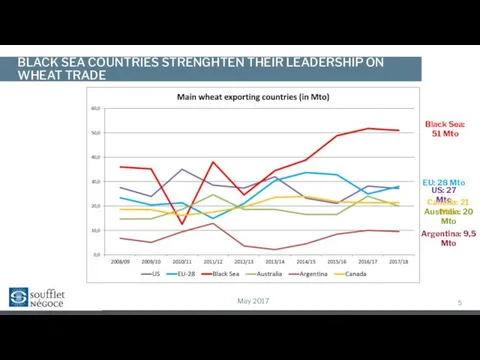

- 5. BLACK SEA COUNTRIES STRENGHTEN THEIR LEADERSHIP ON WHEAT TRADE May 2017 Black Sea: 51 Mto US:

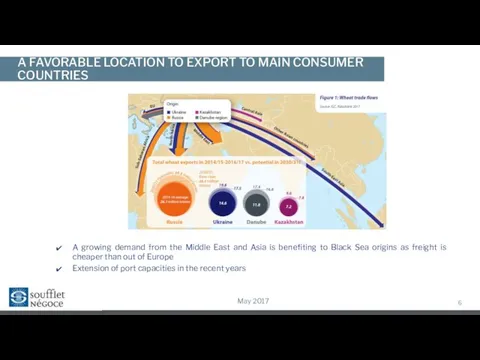

- 6. A FAVORABLE LOCATION TO EXPORT TO MAIN CONSUMER COUNTRIES May 2017 A growing demand from the

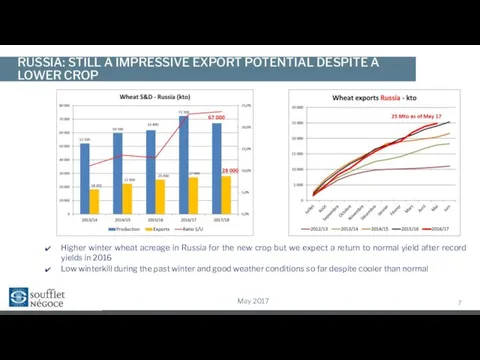

- 7. RUSSIA: STILL A IMPRESSIVE EXPORT POTENTIAL DESPITE A LOWER CROP May 2017 Higher winter wheat acreage

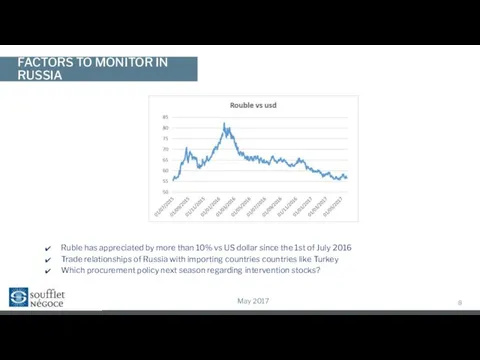

- 8. FACTORS TO MONITOR IN RUSSIA May 2017 Ruble has appreciated by more than 10% vs US

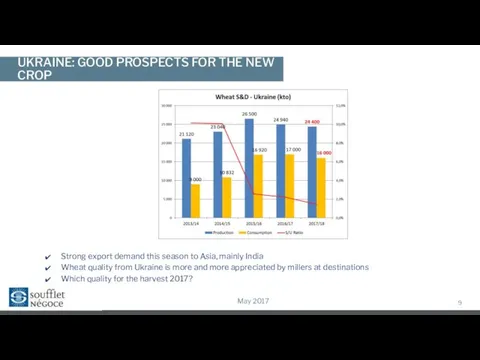

- 9. UKRAINE: GOOD PROSPECTS FOR THE NEW CROP May 2017 Strong export demand this season to Asia,

- 10. MAIN DESTINATIONS OF UKRAINIAN AND RUSSIAN WHEAT May 2017

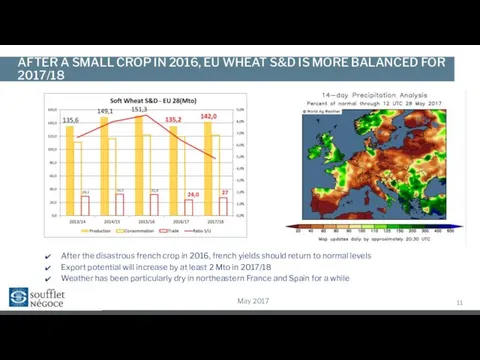

- 11. AFTER A SMALL CROP IN 2016, EU WHEAT S&D IS MORE BALANCED FOR 2017/18 May 2017

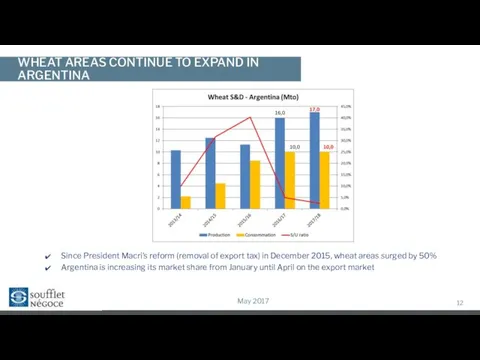

- 12. WHEAT AREAS CONTINUE TO EXPAND IN ARGENTINA May 2017 Since President Macri’s reform (removal of export

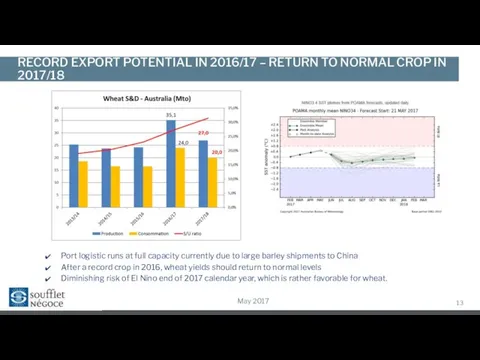

- 13. RECORD EXPORT POTENTIAL IN 2016/17 – RETURN TO NORMAL CROP IN 2017/18 May 2017 Port logistic

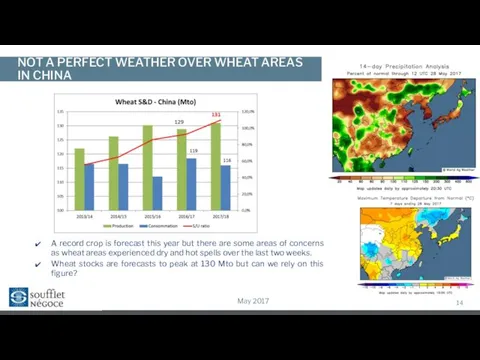

- 14. NOT A PERFECT WEATHER OVER WHEAT AREAS IN CHINA May 2017 A record crop is forecast

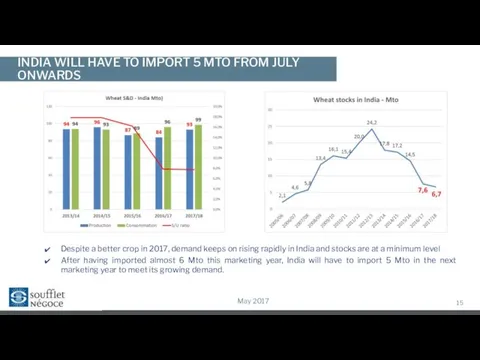

- 15. INDIA WILL HAVE TO IMPORT 5 MTO FROM JULY ONWARDS May 2017 Despite a better crop

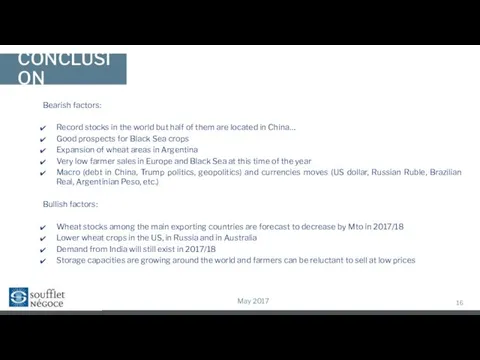

- 16. CONCLUSION May 2017 Bearish factors: Record stocks in the world but half of them are located

- 17. May 2017 Prospects for corn market

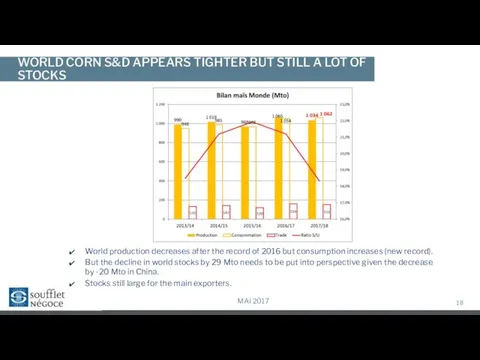

- 18. WORLD CORN S&D APPEARS TIGHTER BUT STILL A LOT OF STOCKS MAI 2017 World production decreases

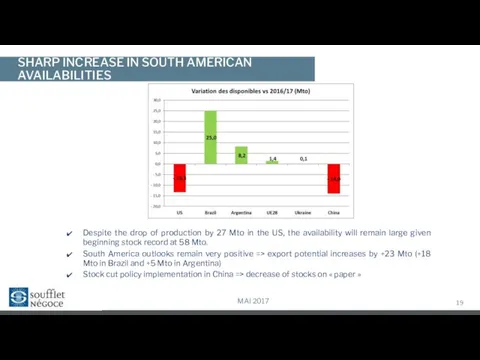

- 19. SHARP INCREASE IN SOUTH AMERICAN AVAILABILITIES MAI 2017 Despite the drop of production by 27 Mto

- 20. A LOWER CROP BUT STILL A COMFORTABLE S&D MAI 2017 Growth of soybean areas in the

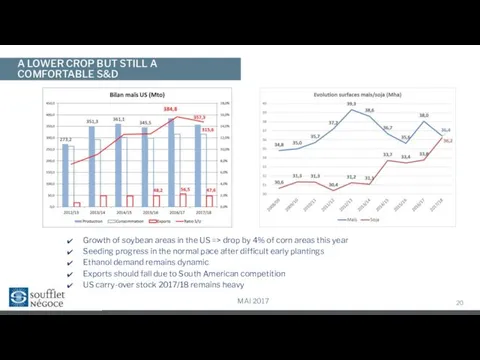

- 21. STRONG COME BACK OF SOUTH AMERICA IN 2017/18 MAI 2017 Argentina and Brazil FOB prices very

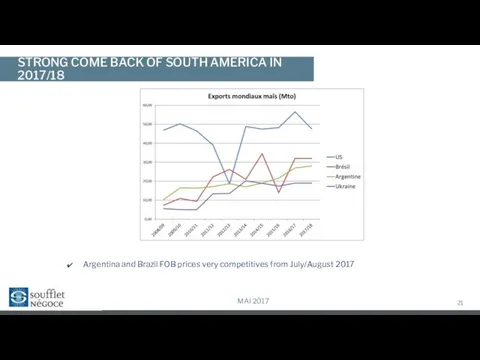

- 22. BRAZIL: SAFRINHA EXPECTED TO RISE BY 21/22 MTO MAI 2017 +26 Mto After the last year

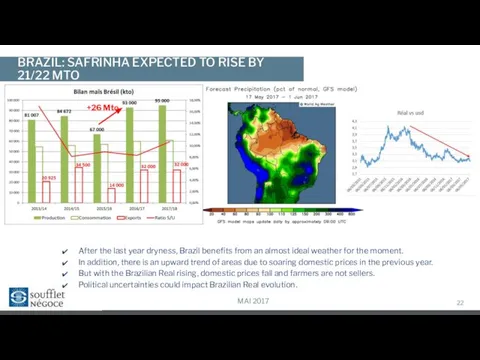

- 23. ARGENTINA: RECORD HARVEST WHICH SHOULD WEIGH ON PRICES MAI 2017 Despite very rainy weather on some

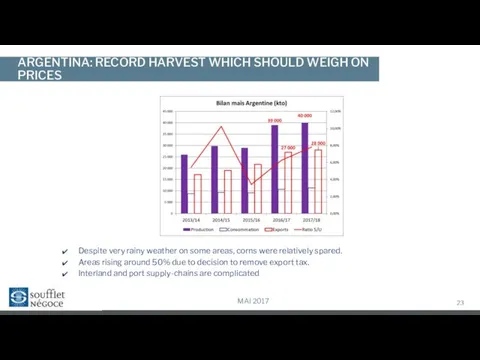

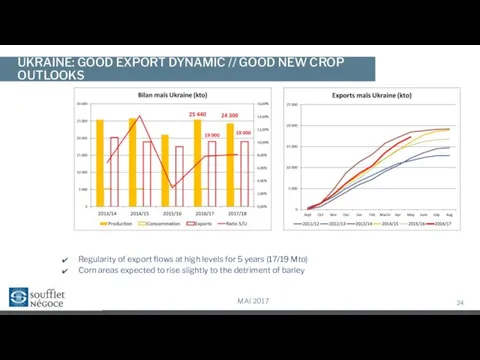

- 24. UKRAINE: GOOD EXPORT DYNAMIC // GOOD NEW CROP OUTLOOKS MAI 2017 Regularity of export flows at

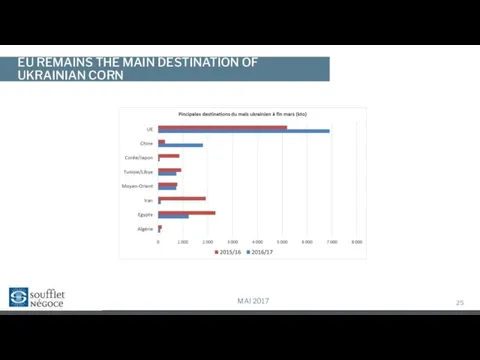

- 25. EU REMAINS THE MAIN DESTINATION OF UKRAINIAN CORN MAI 2017

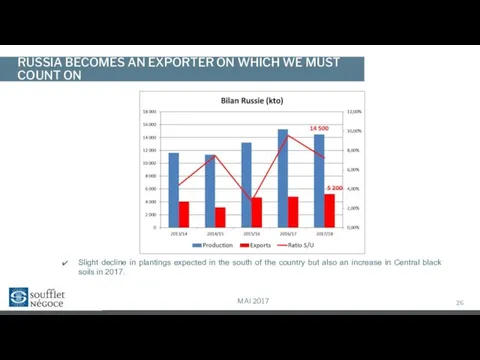

- 26. RUSSIA BECOMES AN EXPORTER ON WHICH WE MUST COUNT ON MAI 2017 Slight decline in plantings

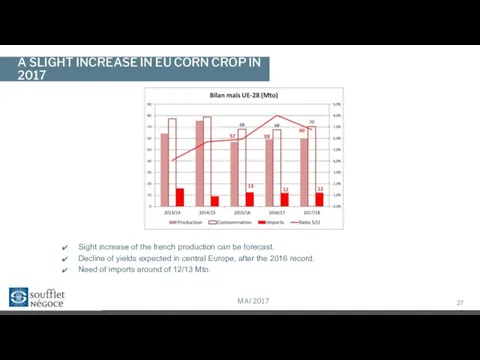

- 27. A SLIGHT INCREASE IN EU CORN CROP IN 2017 MAI 2017 Sight increase of the french

- 28. DOWNWARD TREND OF PRODUCTION IN FRANCE MAI 2017 Downward trend of corn areas in France French

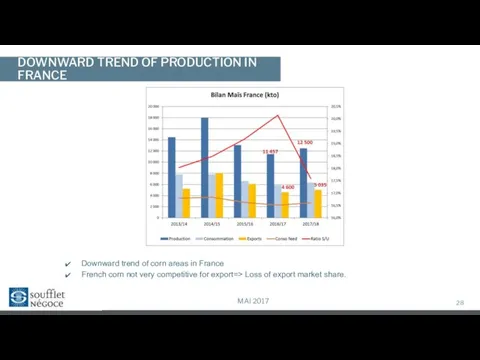

- 29. FRENCH EXPORTS IN DECLINE MAI 2017

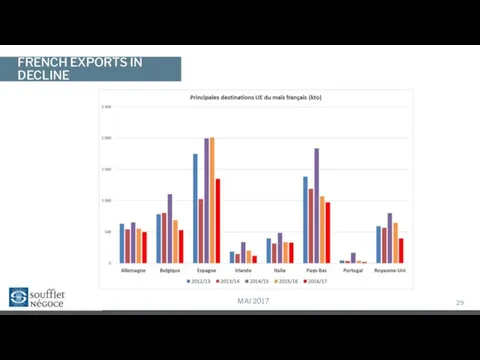

- 30. THEORICAL DROP OF CHINESE STOCKS MAI 2017 Stocks down by 20 Mto according to USDA (production

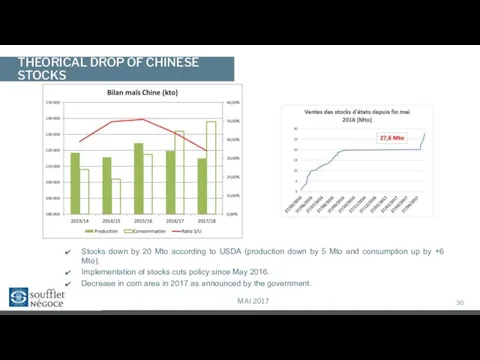

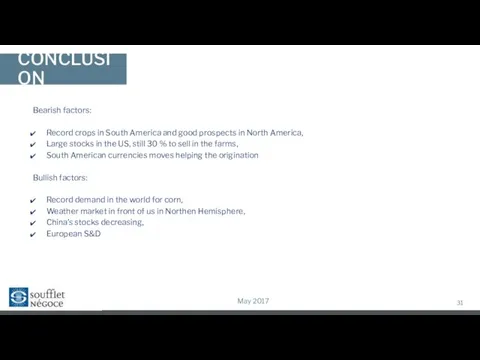

- 31. CONCLUSION May 2017 Bearish factors: Record crops in South America and good prospects in North America,

- 33. Скачать презентацию

Размещение и размеры предприятия

Размещение и размеры предприятия Бюджетно налоговая политика РФ

Бюджетно налоговая политика РФ Производство - основа экономики

Производство - основа экономики Державне казначейство Великобританії

Державне казначейство Великобританії Создание и реорганизация коммерческих организаций с предварительного согласия. Закон о защите конкуренции

Создание и реорганизация коммерческих организаций с предварительного согласия. Закон о защите конкуренции Teoria racjonalnego zachowania się konsumenta

Teoria racjonalnego zachowania się konsumenta Кәсіпорындағы дебиторлармен және кредиторлармен есеп айырысу есебі

Кәсіпорындағы дебиторлармен және кредиторлармен есеп айырысу есебі Таможенные пошлины, их виды, порядок установления и применения

Таможенные пошлины, их виды, порядок установления и применения Импортозамещение, как основа совершенствования качества реализуемой продукции Станичным казачьим обществом Лебедянского района

Импортозамещение, как основа совершенствования качества реализуемой продукции Станичным казачьим обществом Лебедянского района Мастер-класс на тему: «Планируем на перспективу»

Мастер-класс на тему: «Планируем на перспективу» Оптимизация процесса складирования и отпуска ТМЦ на Главном складе Красноярской дирекции материально-технического обеспечения

Оптимизация процесса складирования и отпуска ТМЦ на Главном складе Красноярской дирекции материально-технического обеспечения Кадровая политика организации

Кадровая политика организации Инновационный продукт: робот фермер

Инновационный продукт: робот фермер Показатели рентабельности производства мебели

Показатели рентабельности производства мебели Методология экономической науки. Этическая проблематика и экономическая наука

Методология экономической науки. Этическая проблематика и экономическая наука Формы индексов: расчёт, правила построения и применения

Формы индексов: расчёт, правила построения и применения Дальневосточный молодежный форум «Амур»

Дальневосточный молодежный форум «Амур» Global economy (economics)(ge) and World Economic Relations (WER)

Global economy (economics)(ge) and World Economic Relations (WER) Основы анализа хозяйственно-финансовой деятельности аптек. Методы системного и организационно-экономического анализа

Основы анализа хозяйственно-финансовой деятельности аптек. Методы системного и организационно-экономического анализа Базові положення основ прикладної економіки. Правове забезпечення економічної діяльності підприємств

Базові положення основ прикладної економіки. Правове забезпечення економічної діяльності підприємств Презентация Субъект и объект в познании

Презентация Субъект и объект в познании Елдердің ЖІӨ бойынша экономикалық даму деңгей

Елдердің ЖІӨ бойынша экономикалық даму деңгей FDI of Russia after sanction

FDI of Russia after sanction Шаршуашылығы. Сыртқы экономикалық байланыстар

Шаршуашылығы. Сыртқы экономикалық байланыстар Инновационная деятельность и повышение ее инвестиционной привлекательности

Инновационная деятельность и повышение ее инвестиционной привлекательности Актуальные проблемы экономики таможенного дела. Лекция № 3

Актуальные проблемы экономики таможенного дела. Лекция № 3 Тектология А.А. Богданова

Тектология А.А. Богданова Макроэкономика после Дж.М. Кейнса

Макроэкономика после Дж.М. Кейнса