Содержание

- 2. Risk and Uncertainty Risk and uncertainty are similar in that they both present the problem of

- 3. Four major Sources of Uncertainty Possible inaccuracy of cash-flow estimates used in the study Type of

- 4. Possible Inaccuracy of Cash-flow estimates How much source information is available How dependable is the source

- 5. Type of Business Involved Relative to Health of Economy Some businesses will typically be more at

- 6. Type of Physical Plant and Equipment Involved Some types of structures and equipment have definite economic

- 7. Length of Study Period The longer the study period, the greater the level of uncertainty of

- 8. Sensitivity Analysis Sensitivity – The degree to which a measure of merit (i.e., PW, IRR, etc…)

- 9. Breakeven Analysis Technique commonly used when an uncertain single factor (EG: capacity utilization) determines the selection

- 10. Breakeven Analysis Indifference between alternatives (EWA = f1(y); EWB = f2(y) EWA = EWB; f1(y) =

- 11. Breakeven Problem Involving Two Alternatives Most easily approached mathematically by equating an equivalent worth of the

- 12. Breakeven Analysis for Economic Acceptability of an Engineering Project Most easily approached by equating an equivalent

- 13. Example applications of Breakeven Analysis Annual revenue and expenses Rate of return Market (or salvage) value

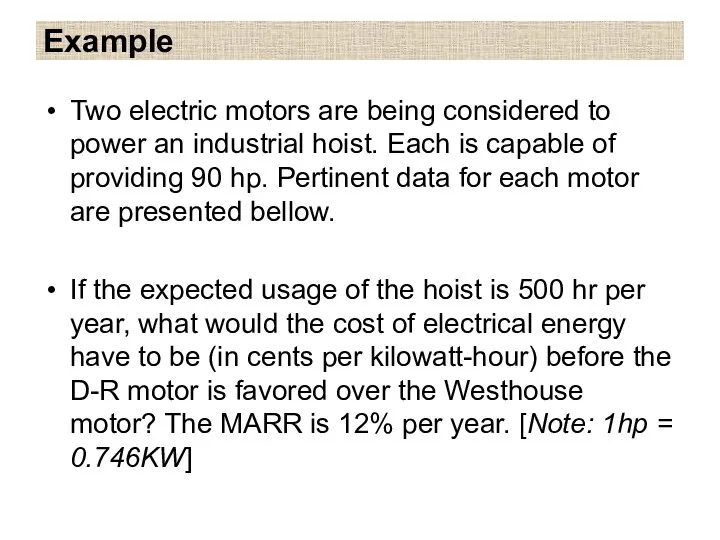

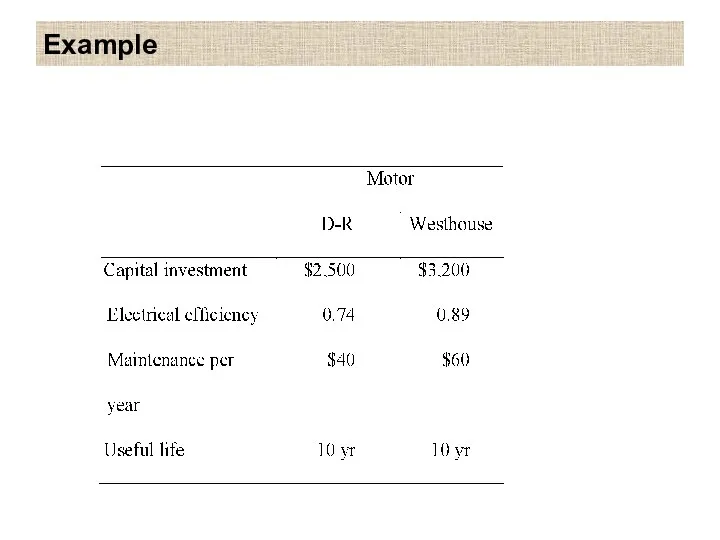

- 14. Example Two electric motors are being considered to power an industrial hoist. Each is capable of

- 15. Example

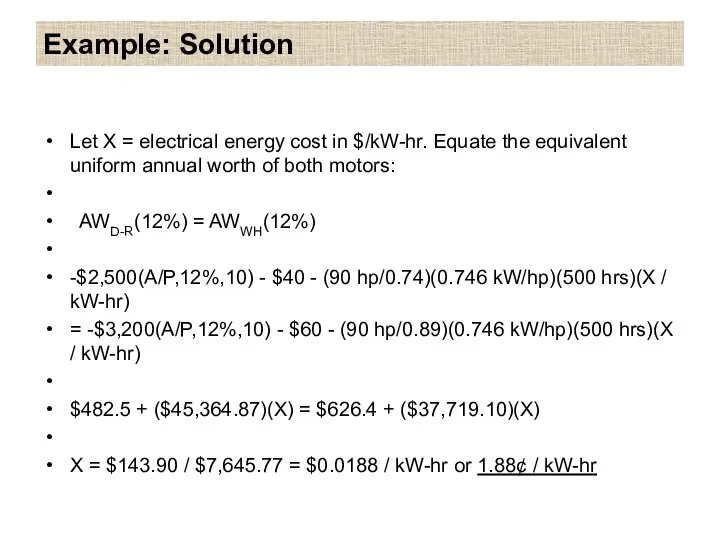

- 16. Example: Solution Let X = electrical energy cost in $/kW-hr. Equate the equivalent uniform annual worth

- 17. Sensitivity Grapfh (Spider-plot) An analysis tool applicable when the breakeven analysis does not fit the project

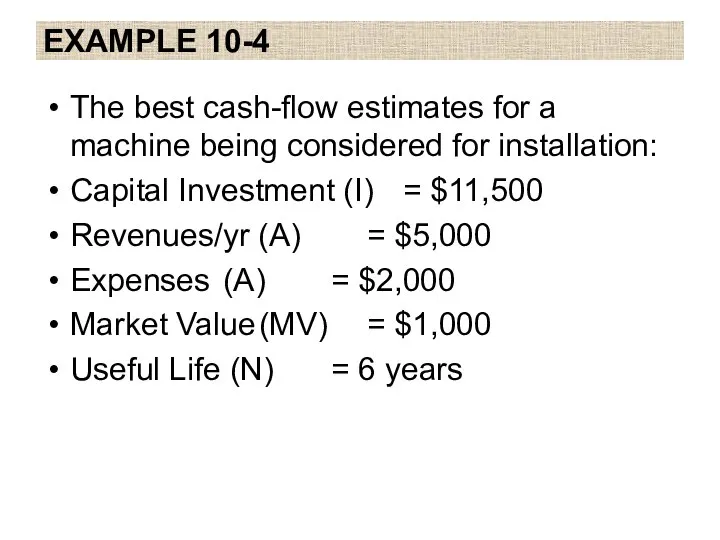

- 18. EXAMPLE 10-4 The best cash-flow estimates for a machine being considered for installation: Capital Investment (I)

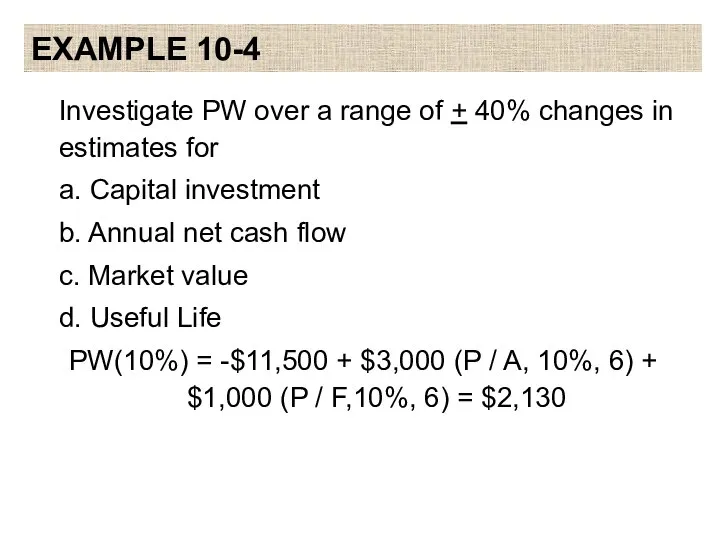

- 19. EXAMPLE 10-4 Investigate PW over a range of + 40% changes in estimates for a. Capital

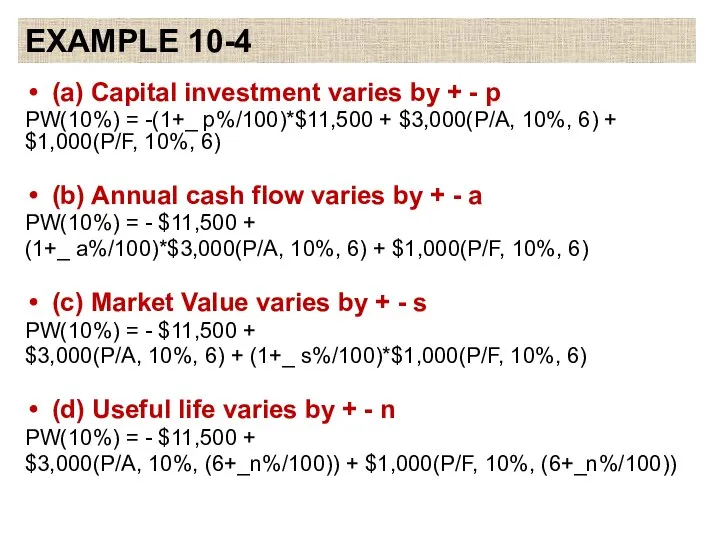

- 20. EXAMPLE 10-4 (a) Capital investment varies by + - p PW(10%) = -(1+_ p%/100)*$11,500 + $3,000(P/A,

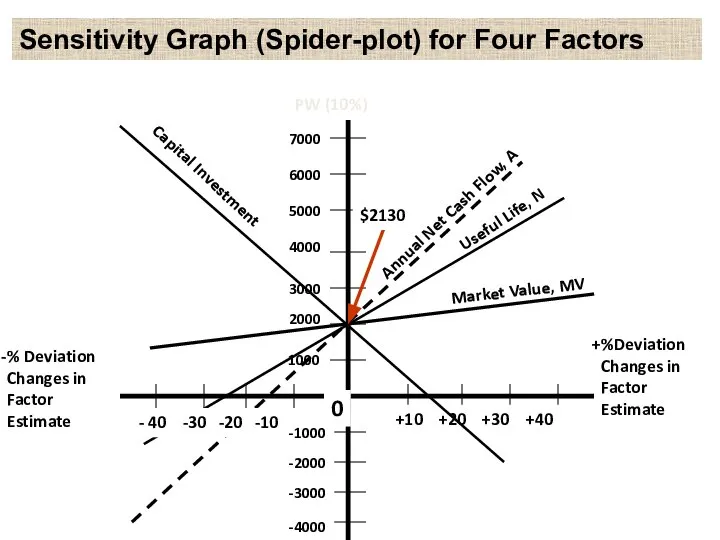

- 21. Annual Net Cash Flow, A Useful Life, N Market Value, MV 2000 Sensitivity Graph (Spider-plot) for

- 22. Revelations of Spider-plot Shows the sensitivity of the present worth to percent deviation changes in each

- 23. Revelations of spider-plot In this example Present worth is insensitive to MV Present worth is sensitive

- 24. Measuring Sensitivity by a Combination of Factors Develop a sensitivity graph for the project a. For

- 25. Pitfalls of Risk Adjusted MARR A widely used industrial practice for including some consideration of uncertainty

- 27. Скачать презентацию

Презентация по экономике Анализ спроса и потребительское поведение

Презентация по экономике Анализ спроса и потребительское поведение  Цена в условиях совершенной конкуренции

Цена в условиях совершенной конкуренции Экономика Норвегии

Экономика Норвегии Перспективные проекты упрощения процедур торговли в Евразийском экономическом сообществе

Перспективные проекты упрощения процедур торговли в Евразийском экономическом сообществе ЧИСТАЯ МОНОПОЛИЯ Главная прелесть монополии в том, что она дарует безмятежную жизнь. Дж. Р. Хикс, английский экономист

ЧИСТАЯ МОНОПОЛИЯ Главная прелесть монополии в том, что она дарует безмятежную жизнь. Дж. Р. Хикс, английский экономист Основные макроэкономические показатели

Основные макроэкономические показатели Экономика и политическая карта Древнего Востока

Экономика и политическая карта Древнего Востока Государственное регулирование инновационной деятельности

Государственное регулирование инновационной деятельности Устойчивость функционирования объектов экономики

Устойчивость функционирования объектов экономики Типы экономических систем

Типы экономических систем Предмет и метод институциональной экономики

Предмет и метод институциональной экономики Оценочные показатели размещения производительных сил и социально-экономического развития регионов

Оценочные показатели размещения производительных сил и социально-экономического развития регионов Семинары FIABCI в Городе Киров. Путь к успеху и процветанию на основе международного опыта. Инновации рынка недвижимости

Семинары FIABCI в Городе Киров. Путь к успеху и процветанию на основе международного опыта. Инновации рынка недвижимости Управление запасами

Управление запасами Спрос и предложение. Дополнительные аспекты

Спрос и предложение. Дополнительные аспекты Документальное оформление поступления и расходования материальных ценностей

Документальное оформление поступления и расходования материальных ценностей Организация производственного процесса. Лекция 3

Организация производственного процесса. Лекция 3 Предмет, система методов и функции экономической теории. Общие проблемы экономического развития

Предмет, система методов и функции экономической теории. Общие проблемы экономического развития Макроэкономика. Критика теории реального экономического цикла. (Лекция 3)

Макроэкономика. Критика теории реального экономического цикла. (Лекция 3) Теоретические основы денежно-кредитного регулирования

Теоретические основы денежно-кредитного регулирования Механизм саморегуляции рынка

Механизм саморегуляции рынка Планирование производства и сбыта продукции

Планирование производства и сбыта продукции Общественный выбор: коллективное принятие решений

Общественный выбор: коллективное принятие решений Изменения численности населения мира. Причины и следствия

Изменения численности населения мира. Причины и следствия Решаем кейсы: с чего начать?

Решаем кейсы: с чего начать? Презентация Особенности возбуждения уголовных дел

Презентация Особенности возбуждения уголовных дел Участие Республики Хорватия в интеграционном взаимодействии

Участие Республики Хорватия в интеграционном взаимодействии Особые экономические зоны

Особые экономические зоны