Содержание

- 2. SCP case study: The American agriculture industry

- 3. Introduction High correlation between the fraction of labor force engaged in agriculture and GDP per capita.

- 4. Structure – Supply and demand Farmers must make substantial investments before production starts [sunk costs] Investments

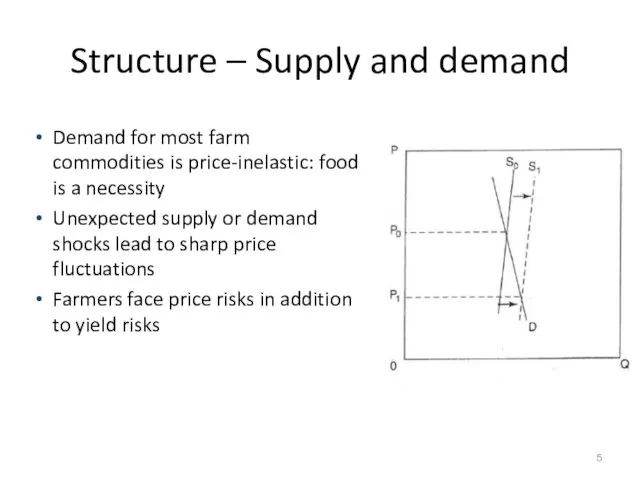

- 5. Structure – Supply and demand Demand for most farm commodities is price-inelastic: food is a necessity

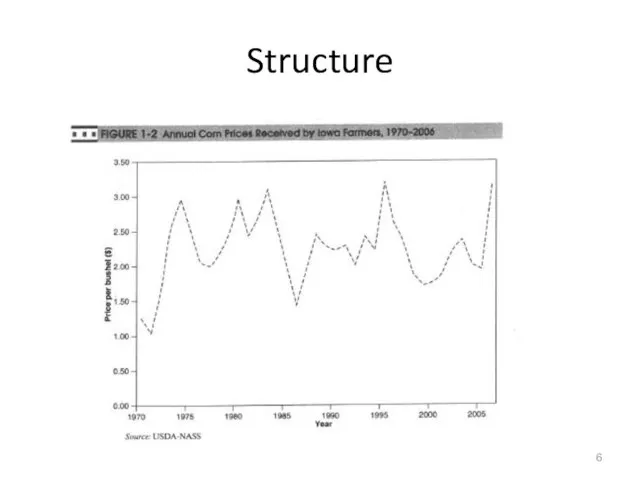

- 6. Structure

- 7. Structure Short-run supply is inelastic, but easy entry makes long-term supply curves elastic Rapid productivity growth

- 8. Structure

- 9. Trends in US farm structure The number of farms peaked at 6.8 million in 1935, and

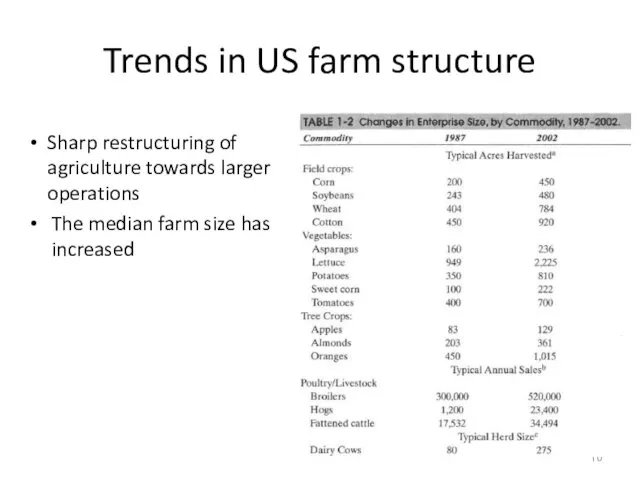

- 10. Trends in US farm structure Sharp restructuring of agriculture towards larger operations The median farm size

- 11. Family farms, profits and household income, 2003 Large farms are more profitable than small farms ?

- 12. Variation in profitability Considerable variation in profitability, many small farms remain profitable: Risk variability (climate, natural

- 13. Structure: commodity markets Farmers are price takers in almost all commodity markets The same is not

- 14. Vertical linkages A large share of farmers rely on long-term contracts with a specific buyer, ranging

- 15. Conduct: Farmer cooperatives Farmers are price takers, but they buy from and sell to firms with

- 16. Conduct: Farmer cooperatives Farmers seek pricing power by organizing cooperatives → attainment of market power is

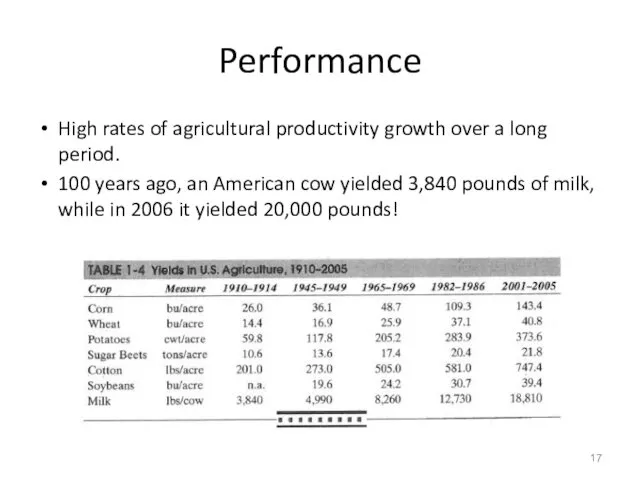

- 17. Performance High rates of agricultural productivity growth over a long period. 100 years ago, an American

- 18. Performance Total factor productivity accounts for the quantity of all inputs that is used to produce

- 19. Sources of technological change/innovations in agriculture Equipment: mechanical power replaced human/animal power; machines became faster and

- 20. Sources of technological change/innovations in agriculture Farmers rarely develop the innovations themselves. Most are developed by

- 21. Overall performance over time More efficient production over time. Larger farms have tended to be more

- 22. Revision

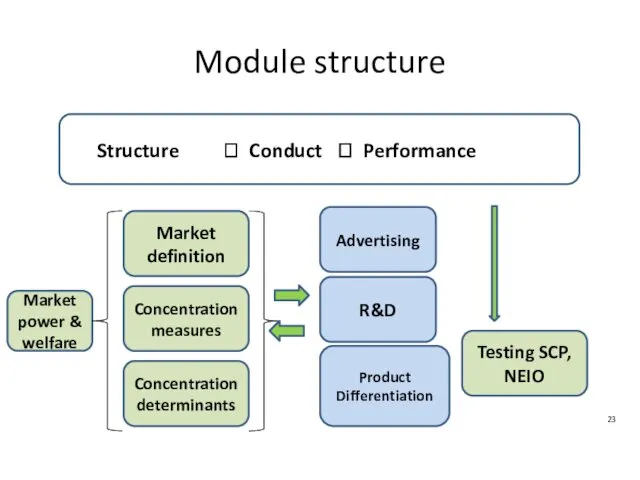

- 23. Module structure Structure ? Conduct ? Performance Market definition Concentration measures Concentration determinants Testing SCP, NEIO

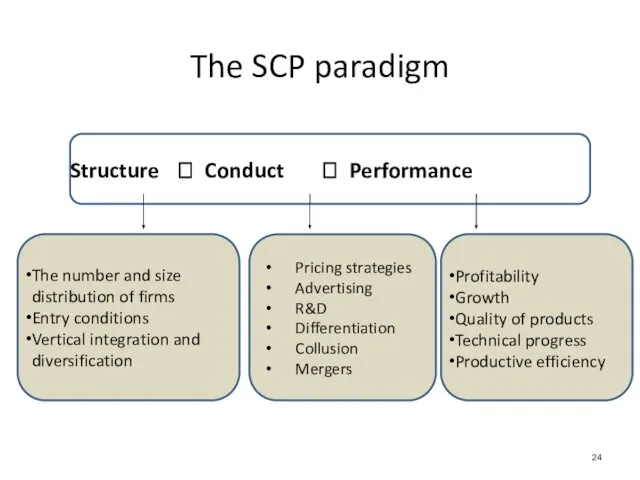

- 24. Structure ? Conduct ? Performance The SCP paradigm The number and size distribution of firms Entry

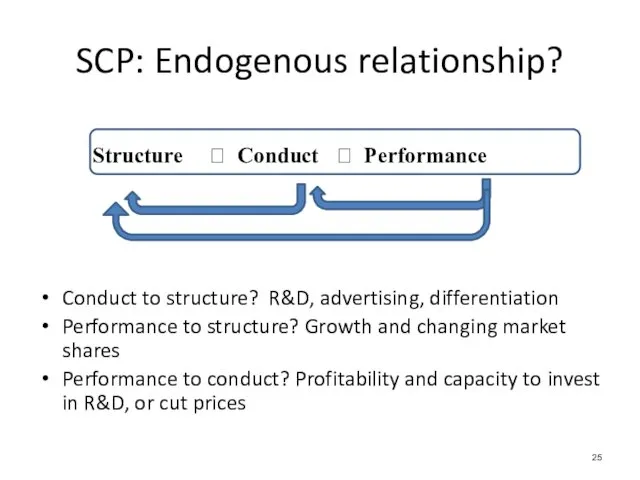

- 25. Structure ? Conduct ? Performance Conduct to structure? R&D, advertising, differentiation Performance to structure? Growth and

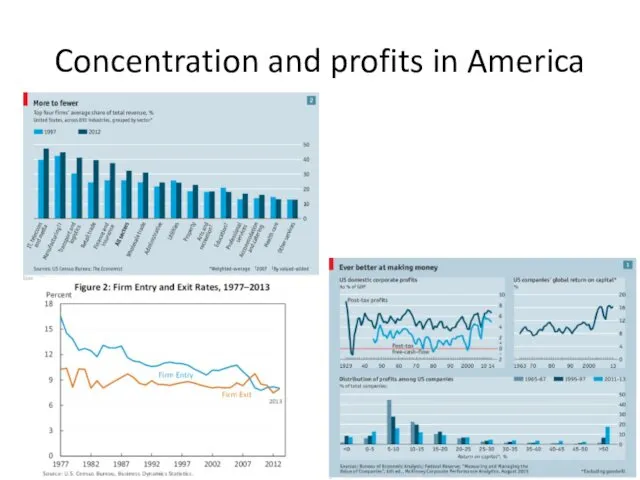

- 26. Concentration and profits in America

- 27. Market power and welfare

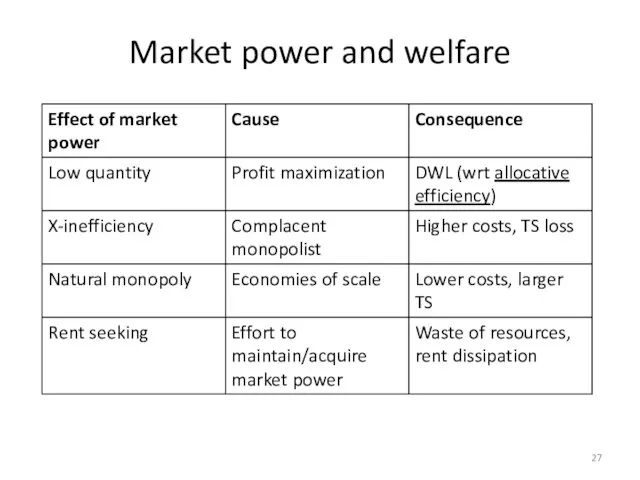

- 28. Market power and welfare Application to internet monopolies Does the internet favour such quasi-monopolies? Are digital

- 29. Market definition Relevant product market

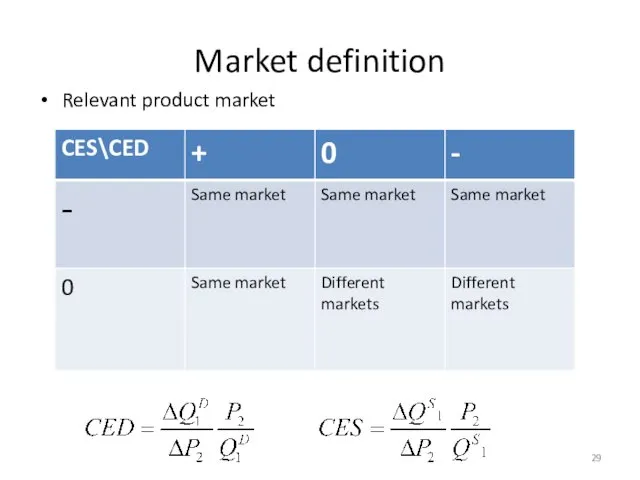

- 30. Market definition Relevant geographic market CED and CES analysis Limitations of market definition Market definition remains

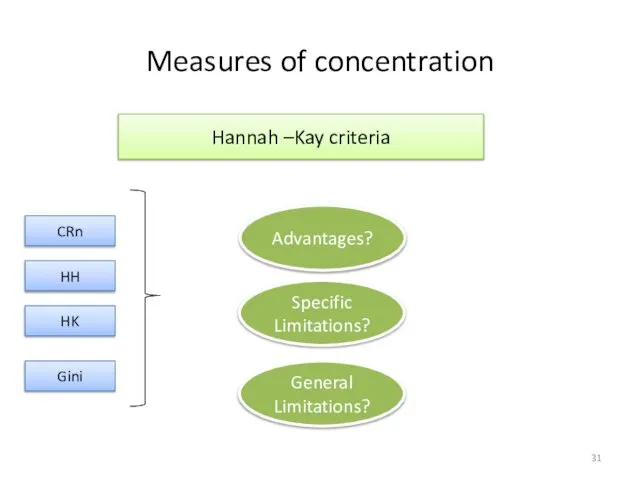

- 31. Measures of concentration Hannah –Kay criteria CRn HH HK Gini Advantages? General Limitations? Specific Limitations?

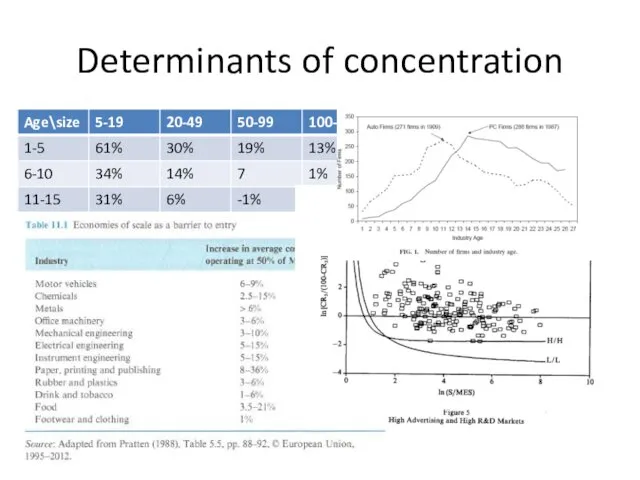

- 32. Determinants of concentration More concentration Less concentration Sunk costs: endogenous or exogenous Industry life cycle Gibrat’s

- 33. Determinants of concentration

- 34. Views on SCP Abuse of market power Concentration Profits Efficiency Profitability Firm Growth Concentration SCP: Chicago:

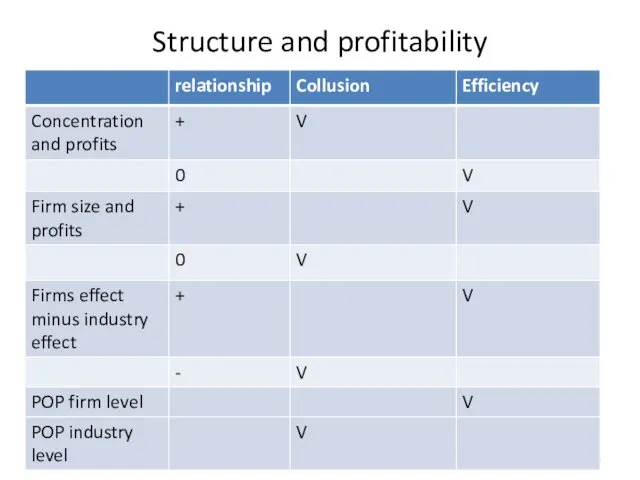

- 35. Structure and profitability

- 36. NEIO Revenue test (Rosse Panzar) Monopoly: H Perfect competition: H=1 Effect of costs on revenue Structural

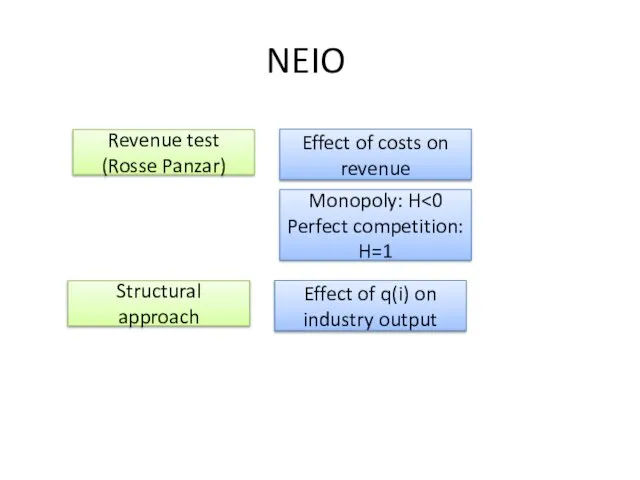

- 37. Conduct Implications of market structure Advertising R&D Product differentiation

- 38. Market structure and advertising Dorfman-Steiner condition Monopoly advertising Oligopoly advertising Keywords: AED/PED, impact of advertising on

- 39. Market structure and advertising Concentration Advertising Dorfman-Steiner Entry barriers, sunk costs, Informative vs. persuasive advertising

- 40. Welfare and advertising Persuasive advertising Which preferences to consider? Advertising can increase/decrease welfare New or original

- 41. R&D and market structure Schumpeter hypothesis Prospect of monopoly power Arrow Replacement effect High concentration Perfect

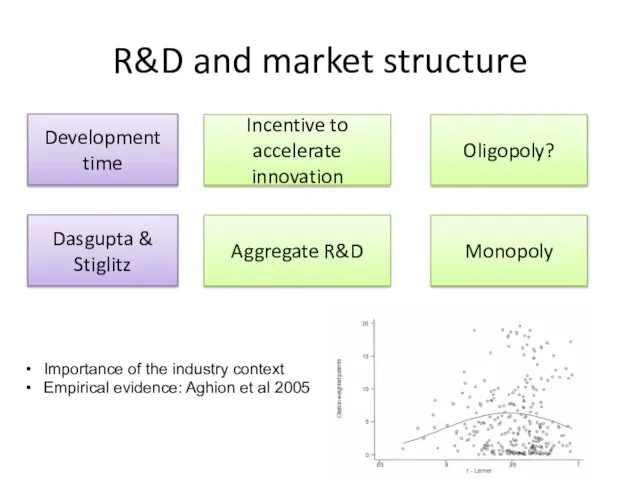

- 42. R&D and market structure Development time Incentive to accelerate innovation Oligopoly? Dasgupta & Stiglitz Aggregate R&D

- 43. Innovation protection Patents Optimal patent system Trade-off: R&D expenditures and DWL Length vs. breadth Side effects

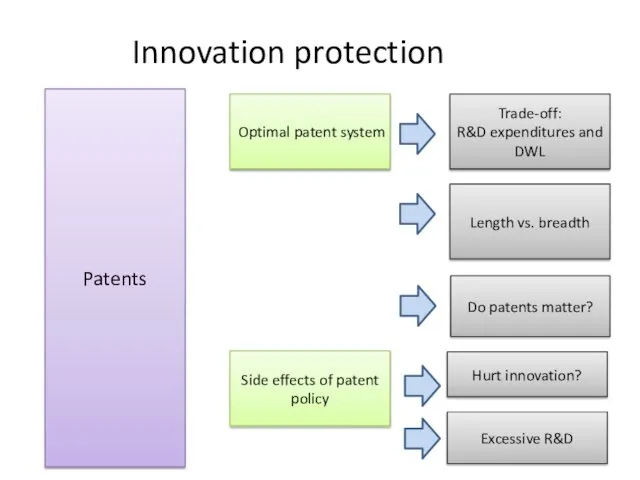

- 44. Product differentiation Sources of differentiation Geography Technology Brand Preferences Services Factors influencing differentiation Monopolistic competition Elasticity

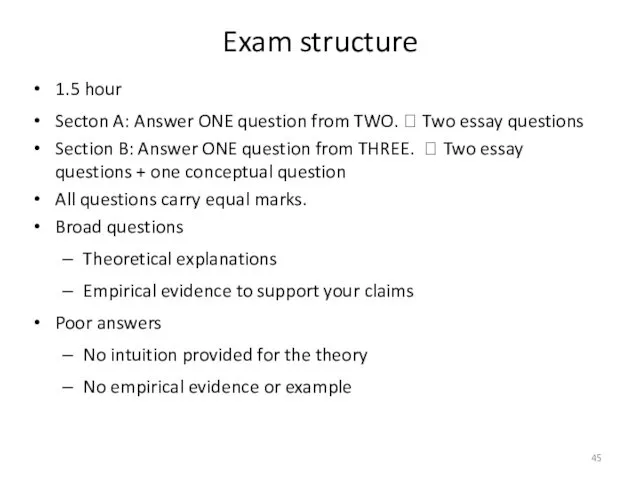

- 45. Exam structure 1.5 hour Secton A: Answer ONE question from TWO. ? Two essay questions Section

- 46. Do not reproduce prepared essays without regard to what the question asks Before you answer… Choose

- 47. Good Practice Use examples whenever possible to support arguments Define technical terms as you introduce them,

- 48. More Good Practice Label graph axes etc. Explain diagrammes or figures Equations/figures etc that are merely

- 49. Bullet Points Answers? Reproducing bullet points does not constitute a good answer, even if the points

- 51. Скачать презентацию

Международная торговля товарами и услугами

Международная торговля товарами и услугами Мировое хозяйство

Мировое хозяйство Экономическая деятельность ВНП

Экономическая деятельность ВНП Қазақстандағы әртүрлі әлеуметтік және мәдени топтар арасындағы қатынастар

Қазақстандағы әртүрлі әлеуметтік және мәдени топтар арасындағы қатынастар Экономическая система общества. Типы экономических систем

Экономическая система общества. Типы экономических систем Слайды. Винницкая область

Слайды. Винницкая область Интернет-исследование. Виниловые наклейки

Интернет-исследование. Виниловые наклейки Макроэкономические показатели и система национального счетоводства

Макроэкономические показатели и система национального счетоводства Виды, причины и последствия инфляции

Виды, причины и последствия инфляции AGC Automotive Europe. Базовые принципы 2014

AGC Automotive Europe. Базовые принципы 2014 Урбанизация и её последствия

Урбанизация и её последствия Количественная оценка экономических рисков

Количественная оценка экономических рисков Licensed products vs pirates

Licensed products vs pirates Особенности инновационных работ

Особенности инновационных работ Регион как целостное образование. Комплексный подход при характеристике региональных взаимосвязей

Регион как целостное образование. Комплексный подход при характеристике региональных взаимосвязей Роль государства в экономике. ВВП. ВНП. НД

Роль государства в экономике. ВВП. ВНП. НД Международная экономическая интеграция. Сущность, формы и роль в современной мировой экономике

Международная экономическая интеграция. Сущность, формы и роль в современной мировой экономике Выявление перспективных рынков сбыта промышленной продукции крымских предприятий в условиях санкций

Выявление перспективных рынков сбыта промышленной продукции крымских предприятий в условиях санкций Микроэкономическое обоснование макроэкономических моделей: потребительская и инвестиционная функции

Микроэкономическое обоснование макроэкономических моделей: потребительская и инвестиционная функции Проект «Биогазовый комплекс»

Проект «Биогазовый комплекс» Адам Сміт

Адам Сміт Финансы организаций. Оборотные средства. (Тема 3.3)

Финансы организаций. Оборотные средства. (Тема 3.3) OEE – czyli całkowita efektywność wyposażenia,

OEE – czyli całkowita efektywność wyposażenia, Анализ рисков в проекте

Анализ рисков в проекте Определение экономически выгодной толщины теплоизоляции трубопровода тепловой сети

Определение экономически выгодной толщины теплоизоляции трубопровода тепловой сети Эконометрика-II. Оценивание SVAR в EViews 6

Эконометрика-II. Оценивание SVAR в EViews 6 Формирование и развитие объектов инфраструктуры муниципального образования на примере городского поселения Видное

Формирование и развитие объектов инфраструктуры муниципального образования на примере городского поселения Видное Географические объекты и явления

Географические объекты и явления