Содержание

- 2. Entrepreneurship across industries Entrepreneurial dynamics differs greatly between industries (Eckhardt, 2002) Historical explanation: appropriability regimes differ

- 3. Role of opportunities Entrepreneurship is pursuit of opportunities regardless of resources one controls (Stevenson & Jarillo,

- 4. Understanding entrepreneurial opportunities Some sort of ‘newness’ is a must Schumpeterian newness: new to the world

- 5. Arbitrage opportunities Arbitrage as “free lunch” Recognizing shown-to-exist but not yet widespread combinations of resources that

- 6. Prior experience and recognition of arbitrage opportunities Ability to recognize opportunities is conditioned by the prior

- 7. Narrow industry membership Narrow industry membership allows to identify new-to-the-firm combinations of resources that the firm

- 8. Arbitrage opportunities and entrepreneurial dynamics Innovation is risky (Thomas Edison example) Innovation is costly Innovation is

- 9. Appropriability regime unpacked Because arbitrageurs replicate someone else’s know how, there are unique risks in the

- 10. Effectiveness of patent protection Innovators are required to disclose the vital information in exchange for protection

- 11. Effectiveness of secrecy Exploitation of technological arbitrage opportunities is contingent on the ability of the arbitrageur

- 12. Effectiveness of lead time When lead time gives innovators substantial advantage, resource owners may re-price the

- 13. Data Compustat data on 26 industries over 1999-2003 10,650 firm-year observations Labor and capital as inputs;

- 14. Data (continued) U.S. Census Bureau – information on the number of firms by industries (by NAICS

- 15. Variables (DV, IV, moderators) Net startup rates: ratio of the difference in the stock of active

- 16. Control variables Innovative opportunities (average R&D intensity of the industry firms) (Malerba & Orsenigo, 1997; Dosi

- 17. Models and estimations Model 1: control variables Model 2: direct effects Model 3: interactions Estimation: Random

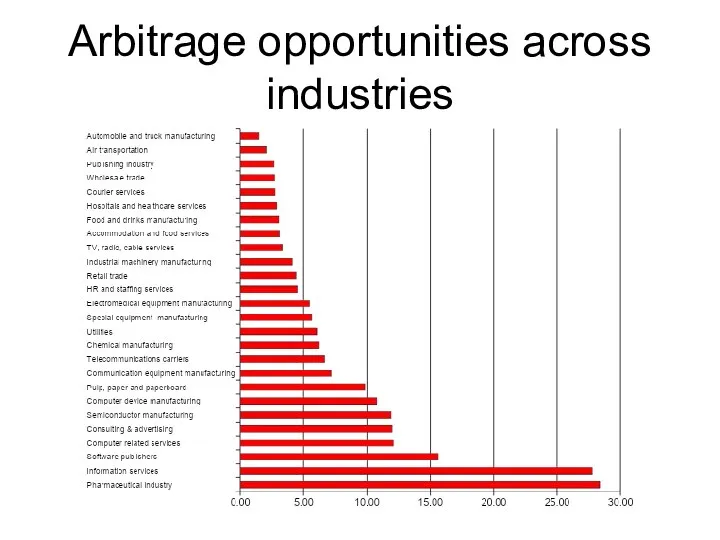

- 18. Arbitrage opportunities across industries

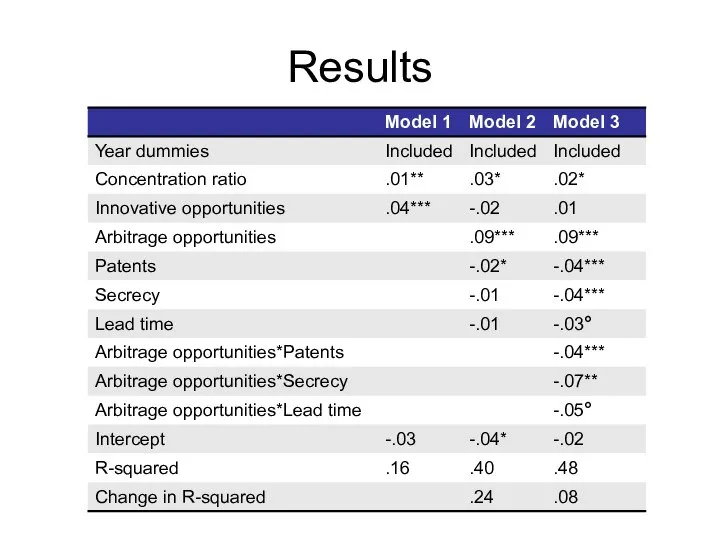

- 19. Results

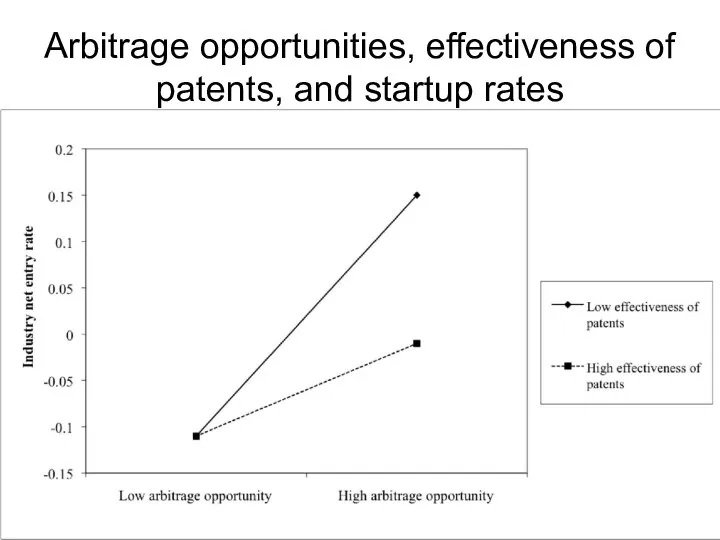

- 20. Arbitrage opportunities, effectiveness of patents, and startup rates

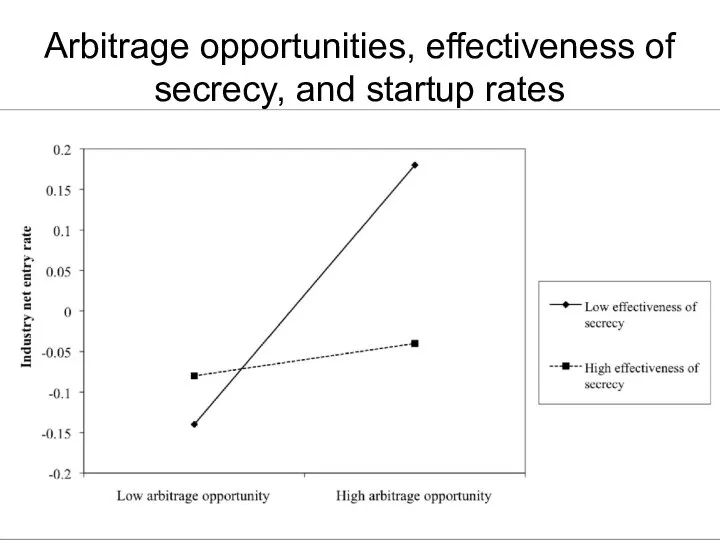

- 21. Arbitrage opportunities, effectiveness of secrecy, and startup rates

- 22. Arbitrage opportunities, effectiveness of lead time, and startup rates

- 23. Validation Similar results were obtained when using alternative sources of information on entrepreneurship: Share of self-employed

- 24. Discussion Arbitrage opportunities vary a great deal across industries Arbitrage opportunities explain startup rates across industries

- 25. Questions?

- 27. Скачать презентацию

Бизнес-план развития пассажирского вагонного депо на основе экономического анализа хозяйственной деятельности

Бизнес-план развития пассажирского вагонного депо на основе экономического анализа хозяйственной деятельности Экономическая теория. Циклический характер развития экономики и экономический рост. (Модуль 2.6)

Экономическая теория. Циклический характер развития экономики и экономический рост. (Модуль 2.6) Рынок труда. Занятость и безработица

Рынок труда. Занятость и безработица Т.Р. Мальтус: закон народонаселения и его место в классической политэкономии

Т.Р. Мальтус: закон народонаселения и его место в классической политэкономии Министерство финансов Республики Казахстан

Министерство финансов Республики Казахстан Префектура Ибараки

Префектура Ибараки Совокупный спрос

Совокупный спрос Анализ территориальной репрезентативности ООПТ в административно-экономических районах

Анализ территориальной репрезентативности ООПТ в административно-экономических районах Актуальные проблемы управления земельным фондом в РФ

Актуальные проблемы управления земельным фондом в РФ Особенности декларирования и уплаты таможенных пошлин, налогов товаров при перемещений трубопроводным транспортом, а также при в

Особенности декларирования и уплаты таможенных пошлин, налогов товаров при перемещений трубопроводным транспортом, а также при в Конкуренция, как способ реализации предпринимательства

Конкуренция, как способ реализации предпринимательства Китай и Россия в БРИКС

Китай и Россия в БРИКС Презентация Влияние денежной эмиссии на уровень цен

Презентация Влияние денежной эмиссии на уровень цен Цикличность экономического развития как закономерность макроэкономики. Лекция 9

Цикличность экономического развития как закономерность макроэкономики. Лекция 9 Модель реального экономического цикла (бизнес - цикла)

Модель реального экономического цикла (бизнес - цикла) Транснациональные корпорации, прямые иностранные инвестиции и международное производство

Транснациональные корпорации, прямые иностранные инвестиции и международное производство Մոնոպոլիան շուկայական էկոնոմիկայում

Մոնոպոլիան շուկայական էկոնոմիկայում Презентация Предмет,цели и задачи товароведения.

Презентация Предмет,цели и задачи товароведения. Презентация Экономическая культура.

Презентация Экономическая культура. Конкуренция и монополия

Конкуренция и монополия Сферы экономики (в них проявляется различная экономическая деятельность)

Сферы экономики (в них проявляется различная экономическая деятельность) Причины нового падения цен на нефть

Причины нового падения цен на нефть Понятие и структура экономического механизма в сфере использования и охраны земель

Понятие и структура экономического механизма в сфере использования и охраны земель Макроэкономическая нестабильность. Инфляция и безработица

Макроэкономическая нестабильность. Инфляция и безработица Экономическое развитие страны

Экономическое развитие страны  Понятие «технологического разрыва» Ричарда Фостера

Понятие «технологического разрыва» Ричарда Фостера Понятие и причины текучести кадров. Расчет коэффициента текучести

Понятие и причины текучести кадров. Расчет коэффициента текучести Особая экономическая зона как инструмент развития региона

Особая экономическая зона как инструмент развития региона