Содержание

- 2. Damn lucky for someone who has never studied accounting. Then he would have immediately realized that

- 3. A good accountant is expensive, and a bad one is much more expensive Stanislav Jerzy Lez

- 4. Definition Accounting is the formation of documented systematized information about objects provided for by law, in

- 5. Types of accounting Financial accounting - focused on external users of information (this is traditional accounting);

- 6. Maintaining accounting records All organizations are required to maintain accounting records. Some organizations (small businesses) may

- 7. Regulation of accounting Accounting is regulated by special documents -standards. The accounting standard is a document

- 8. Regulation of accounting federal accounting standards; branches of industry accounting standards; regulatory acts of the Central

- 9. Regulation of accounting In addition to national accounting standards, there are also international financial reporting standards

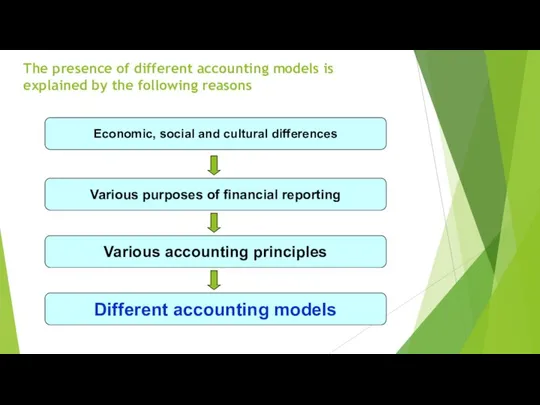

- 10. The presence of different accounting models is explained by the following reasons Economic, social and cultural

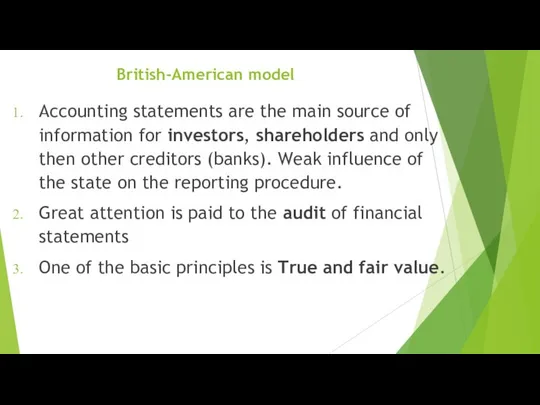

- 11. British-American model Accounting statements are the main source of information for investors, shareholders and only then

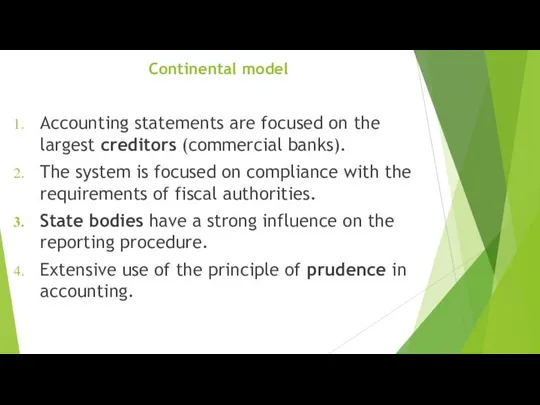

- 12. Continental model Accounting statements are focused on the largest creditors (commercial banks). The system is focused

- 13. Other models Some authors, in addition to these two models, distinguish other accounting models: the South-American

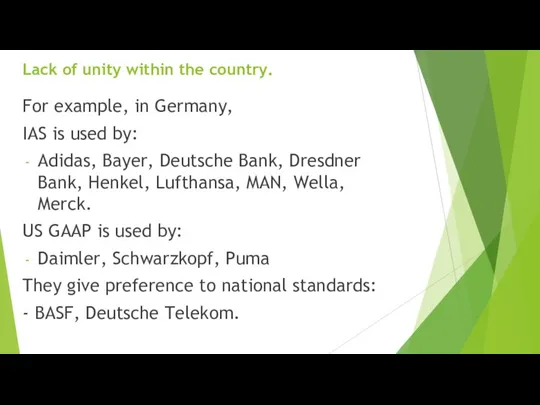

- 14. Lack of unity within the country. For example, in Germany, IAS is used by: Adidas, Bayer,

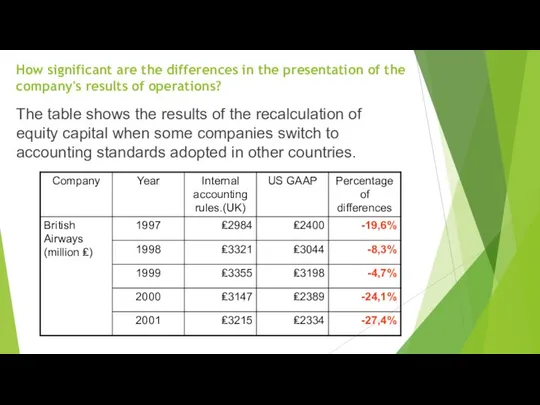

- 15. How significant are the differences in the presentation of the company's results of operations? The table

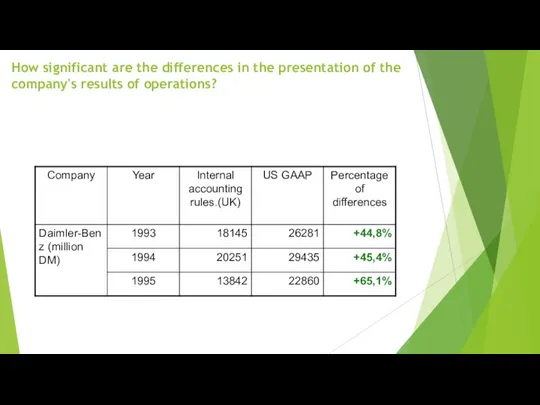

- 16. How significant are the differences in the presentation of the company's results of operations?

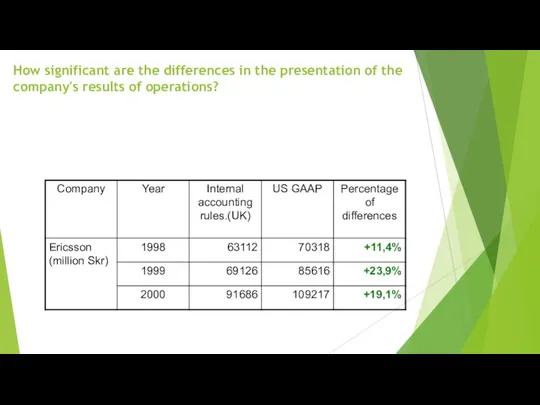

- 17. How significant are the differences in the presentation of the company's results of operations?

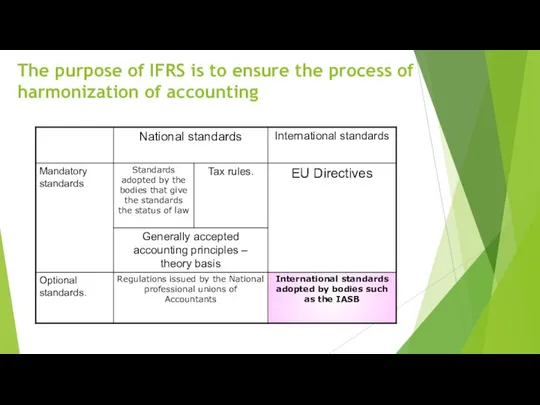

- 18. The purpose of IFRS is to ensure the process of harmonization of accounting

- 19. Application of the IFRS in the world There are several variants for applying IFRS: 1. Applying

- 20. Application of the IFRS in the world 2. National organizations of the development of financial reporting

- 21. Application of the IFRS in the world 3. Stock exchanges and bodies regulating the securities market

- 22. Application of the IFRS in the world 4. Using of the IFRS in the preparation of

- 23. Application of the IFRS in the world 5. Using of the IFRS by the companies themselves

- 24. Benefits of using the IFRS for business Improving the quality of information for decision-making by managers;

- 25. Benefits of using the IFRS for potential investors Improving the quality of information for making investment

- 26. Benefits of using the IFRS for the state Strengthening the capital market and increasing its attractiveness;

- 27. International Accounting Standards Board The main goal of the IASB is to provide a process for

- 28. The IFRS development process Creation of a Preparatory Committee from a wide range of specialists in

- 29. The IFRS development process 2. Development and publication of the original document - the primary draft

- 30. The IFRS development process 3. Preparation of a working draft of the provisions of the standard,

- 31. The IFRS development process 4. Issue of the final international financial reporting standard - IFRS (formerly

- 32. The IFRS development process 5. Introduction of the standard – in most cases, new standards begin

- 33. Types of standards IAS - International accounting standards - were issued until 2003. IAS 1-41 were

- 34. Types of standards In addition, there are interpretations to the standards (sequences) - SIC - Standards

- 35. Bookkeeping Accounting and storage of accounting documents are organized by the head of an organization. The

- 36. Requirements for the chief accountant in Russia For chief accountants of some organizations (PJSCs, investment funds,

- 37. Bookkeeping The totality of accounting methods forms the accounting policy of the organization. An organization independently

- 38. Accounting objects facts of economic life; assets; liabilities; sources of funding for its activities (capital); incomes;

- 39. Accounting objects A fact of economic life is a transaction, event, operation that has or is

- 40. Source documents Mandatory details of the document: 1) the title of the document; 2) date of

- 41. In addition to the required details, extra information can be included in the documents. Moreover, if

- 42. Source documents The primary accounting document must be drawn up when the fact of economic life

- 43. Source documents Requirements of the chief accountant in writing form that are connected with the procedure

- 44. Source documents The primary accounting document is drawn up on paper and (or) in the form

- 45. The documents must be kept in the form in which they were drawn up. Translation of

- 46. Source documents in Russia The documents are prepared in Russian. If the primary document is in

- 47. The date of drawing up the primary document is the day of its signing by the

- 48. When drawing up primary documents, you can draw up several related facts of economic life with

- 49. It is possible to draw up lasting facts of economic life (accrual of interest, depreciation), as

- 50. It is allowed to use as primary documents that one that was drawn up or received

- 51. The list of persons entitled to sign documents is established by the head of the organization.

- 52. Bookkeeping The data contained in primary accounting documents are subject to timely registration and accumulation in

- 53. Financial statements The financial statements should provide a reliable representation of the financial position of an

- 54. The unprecedented thickness of this report protected it from the danger of being read. W. Churchill

- 55. Financial statements There are three types of lying: bragging, lying, and reporting. J. Bulatovich (Polish publicist)

- 56. Отчетность в высказываниях Automation can never completely replace accounting. It is not profitable V. Borisov (Russian

- 57. Отчетность в высказываниях If you want to take control of your life, you must regularly prepare

- 58. Financial statements Financial statements are provided to external users of information Users

- 59. Who are external users? Shareholders Investors Suppliers Users with direct financial interest

- 60. Who are external users? Tax authorities Banks Government bodies Auditing companies Buyers Users with indirect financial

- 61. Who are external users? Exchanges Statistical bodies Judiciary Users without financial interest

- 62. What is reporting for? Analysis of financial condition Evaluation of the efficiency of functioning Planning for

- 63. Assumptions of Formation of Financial Reporting Indicators The assets and liabilities of an organization exist separately

- 64. Assumptions of Formation of Financial Reporting Indicators The organization will continue its activities for the foreseeable

- 65. Assumptions of Formation of Financial Reporting Indicators Business continuity - going concern

- 66. Assumptions of Formation of Financial Reporting Indicators The accounting policy adopted by the organization is applied

- 67. Assumptions of Formation of Financial Reporting Indicators They are reflected in the accounting and reporting of

- 68. General requirements for financial statements The reporting should give a reliable view of the financial position

- 69. Financial statements Annual financial statements consist of a balance sheet, a statement of financial results and

- 70. Financial statements It is mandatory to draw up annual financial statements (for a calendar year). Preparation

- 71. Financial statements The financial statements are considered to be drawn up after they are signed by

- 72. Financial statements State information resource - a set of financial statements of economic entities, as well

- 73. Accounting method

- 74. Method elements Traditionally, there are 8 elements of the accounting method: - Documentation - Inventory -

- 75. Inventory Inventory is a check of the compliance of the actual availability of assets with their

- 76. Inventory - documents 1. Order to conduct an inventory 2. Inventory list (including receipt of the

- 77. Inventory - results 1. Surplus (other incomes at market prices (fair value)) "... Inventory, like any

- 78. Natural loss Methodological recommendations for the development of norms of natural loss (Order of the Ministry

- 79. Example The frozen berry was received on 08/10/19. Net weight 1000 kg. The berry was released:

- 80. Example Losses during storage of berries released on 12/14/19 (4 months 5 days) 600 * 0.65%

- 81. The culprit has not been identified Letter of the Ministry of Finance dated 20.05.14 No. 03-03-07

- 82. Doubtful accounts receivable The receivables of the organization are considered doubtful if they are not repaid

- 83. Doubtful accounts receivable Since 2011, organizations are required to create reserves for doubtful debts. Basis -

- 84. Doubtful accounts receivable Accounts receivable are recognized as doubtful from the date of due date of

- 85. Monetary measurement Accounting objects are subject to monetary measurement. Monetary measurement of accounting objects in the

- 86. Calculation (costing) In some cases, it is not possible to directly determine the cost estimate of

- 87. Costing - Cost Allocation Let the transported goods occupy the following volumes and have masses: cotton

- 88. Costing - Cost Allocation Accordingly, the amount of transportation costs can be distributed among the goods

- 89. Costing - Cost Allocation Let the transported goods occupy the following volumes and have masses: cotton

- 90. Costing - Cost Allocation Accordingly, the amount of transportation costs can be distributed among the goods

- 91. Recommendation Try to account as many cost drivers as possible. For this, it is possible to

- 92. Costing - Cost Allocation Let the transported goods occupy the following volumes and have masses: cotton

- 93. Costing - Cost Allocation First, let's calculate the distribution ratios for each base. 1. Ratios by

- 94. Costing - Cost Allocation Then we calculate the total bases for each product: cotton wool -

- 95. Costing - Cost Allocation Let's add one more factor to the model - cost cotton wool

- 96. Costing - Cost Allocation

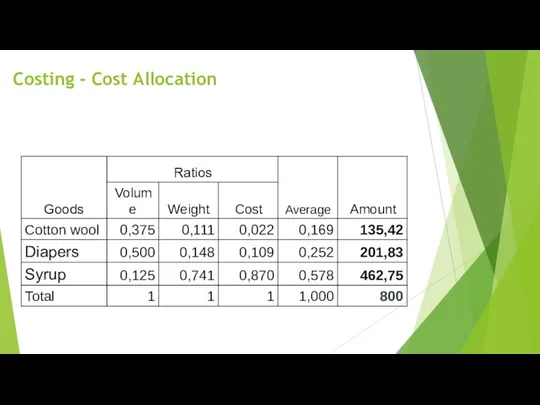

- 97. Costing - Cost Allocation The multi-factor distribution allows you to take into account many factors that

- 98. Accounts In accordance with the classical definition, an account is a special two-sided table that allows

- 99. Активные счета – на них отражается имущество организации Dt Ct Bal 100 200 300 500 Turn

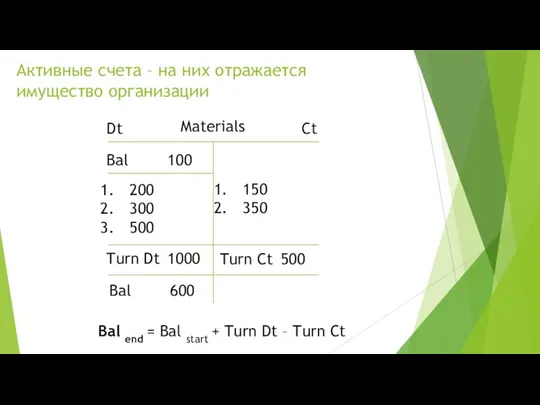

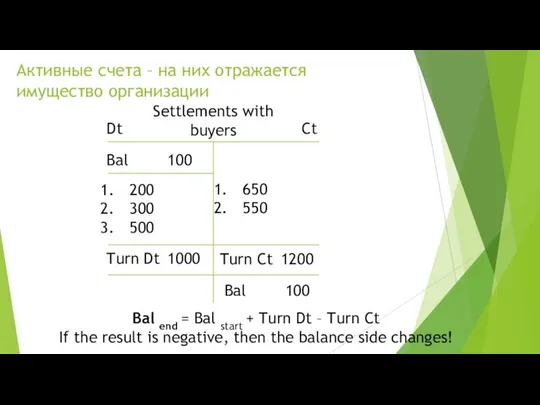

- 100. Пассивные счета – на них отражаются источники формирования имущество организации Dt Ct Bal 100 200 300

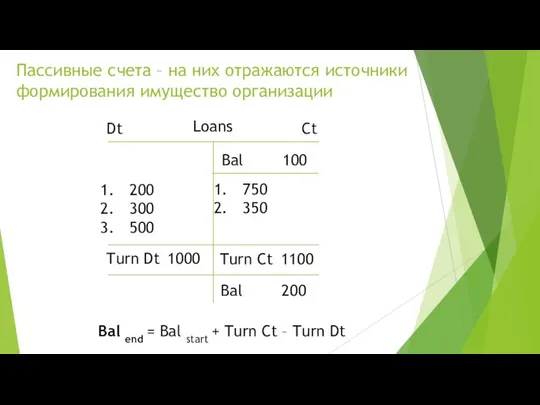

- 101. Активные счета – на них отражается имущество организации Dt Ct Bal 100 200 300 500 Turn

- 102. Double entry The simultaneous reflection of a debit transaction on one account and a credit on

- 103. Double entry Dt Ct Bal 400 200 Turn Dt 200 Turn Ct 0 Materials Bal 600

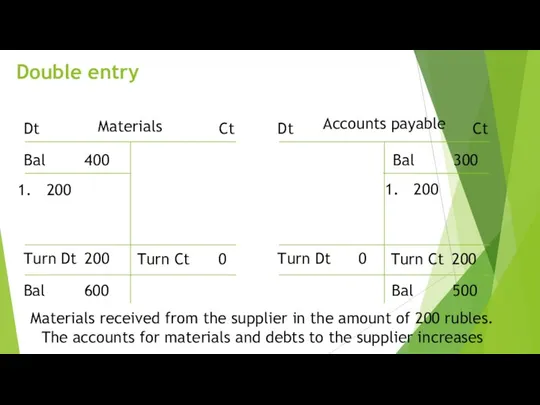

- 104. Double entry There are 4 types of business transactions in total Asset + = Liability +

- 105. Double entry (A- = P-) Dt Ct Bal 500 200 Turn Dt 0 Turn Ct 200

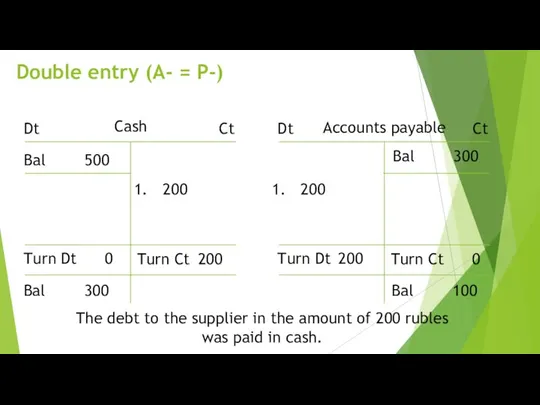

- 106. Double entry (A ± = P) Dt Ct Bal 600 150 Turn Dt 0 Turn Ct

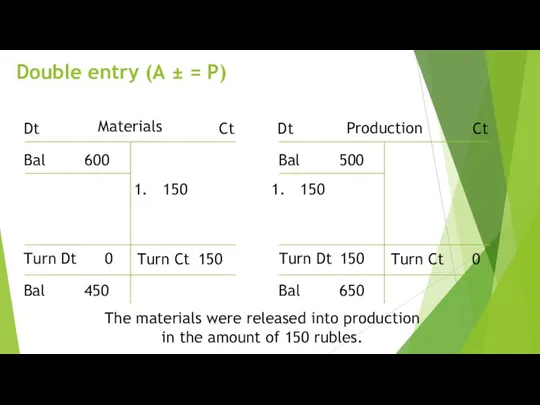

- 107. Double entry (A = P ±) Dt Ct Bal 400 250 Turn Dt 0 Turn Ct

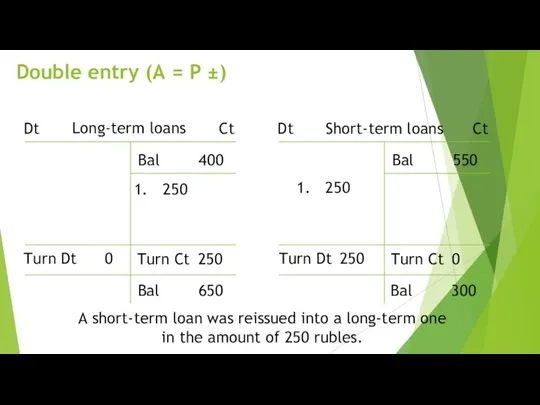

- 108. Accounting objects

- 109. Assets Assets are resources whose value can be estimated and from which the company expects to

- 110. Cash Cash means cash and non-cash funds of an organization stored in the cash desk and

- 111. Cash Non-cash funds are kept in current accounts in banks. Currently, almost all interaction of organizations

- 112. Cash In some cases, transactions on current accounts may be blocked. This usually happens at the

- 113. Cash To store currency, organizations may use foreign currency accounts. However, on the territory of the

- 114. Cash In addition to current and foreign currency accounts, organizations may have special bank accounts. Today,

- 115. Cash Operations with cash is called cash flow. The cash flows of the organization are divided

- 116. Cash a) receipts from the sale of products and goods to buyers; b) payments to suppliers

- 117. Cash An entity's cash flows from transactions related to the acquisition, creation or disposal of an

- 118. Cash a) payments to suppliers and employees of the organization in connection with the acquisition, creation,

- 119. Cash The cash flows of the organization from operations related to the attraction of financing by

- 120. Cash a) monetary payments of owners to the capital, proceeds from the issue of shares, an

- 121. Cash documents Monetary documents are special protected in some way documents (pin codes, passwords, etc.), purchased

- 122. Cash equivalents Cash equivalents are highly liquid financial investments that can be easily converted into a

- 123. Short-term financial investments Financial investments are investments in other companies made through the acquisition of financial

- 124. Short-term financial investments The main differences between short-term financial investments and cash equivalents are: - duration

- 125. Short-term financial investments All financial investments are divided into two groups: - financial investments, for which

- 126. Short-term financial investments If the current market value can be determined (for example, at the rate

- 127. Accounts receivables Accounts receivable are amounts owed to this organization by other participants in economic relations,

- 128. Accounts receivables Accounts receivable are funds withdrawn from the organization's turnover. At the moment, these funds

- 129. Accounts receivables A receivable is recognized as doubtful if the organization has no assurance about the

- 130. Accounts receivables Organizations can use several tools to manage doubtful accounts receivable. One of the most

- 131. Accounts receivables An extreme case of doubtful accounts receivable is bad accounts receivable. Bad debts (that

- 132. Accounts receivables In addition the debtors of the organization may be its own employees (for example,

- 133. VAT The amounts of VAT on the purchased values are actually a kind of accounts receivable,

- 134. Stocks Inventories are one of the main group of assets, which includes several important components: -

- 135. Fixed assets Fixed assets are assets that have a tangible form that can bring economic benefits

- 136. Fixed assets - buildings and constructions. In recent years, this subgroup is increasingly referred to as

- 137. Fixed assets Organizations are given the right to revalue fixed assets, that is, to bring their

- 138. Intangible assets These are non-monetary assets protected by certain copyrights. These include: - works of science,

- 139. Goodwill One of the most specific types of intangible assets is goodwill - business reputation. Goodwill

- 140. Investments in future non-current assets Fixed assets and intangibles sometimes have a long period of preparation

- 141. Profitable investments in material assets Income investments in tangible assets include those fixed assets that are

- 142. Long-term financial investments Long-term financial investments are investments in securities for a period of more than

- 143. Capital - sources of property formation The sources of property formation are divided into two groups:

- 144. Accounts payable Accounts payable is a debt owed by this organization to someone. There are many

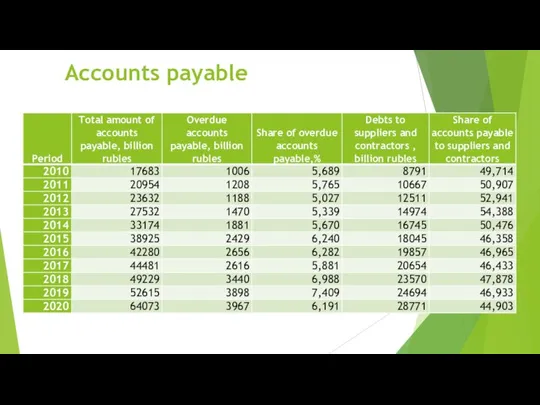

- 145. Accounts payable Accounts payable to suppliers and contractors for goods, works, services - this type of

- 146. Accounts payable When the liability is extinguished in cash or other assets, then there is a

- 147. Accounts payable

- 148. Short-term credit and loans Short-term credits and short-term loans provided to organizations by other entities, for

- 149. Provisions Provisions are liabilities with an uncertain amount or period that either will necessarily arise in

- 150. Long credit and loans Long-term credit and borrowings provided to organizations by other entities for the

- 151. Equity The authorized capital is the valuation of the organization's property, which was contributed to it

- 152. Equity The share in the authorized capital belonging to the participants of the established organization gives

- 153. Equity Additional capital ("air capital") - capital resulting from the revaluation of fixed assets. Gradually over

- 154. Equity In addition to the revaluation of fixed assets, share premium can also be a source

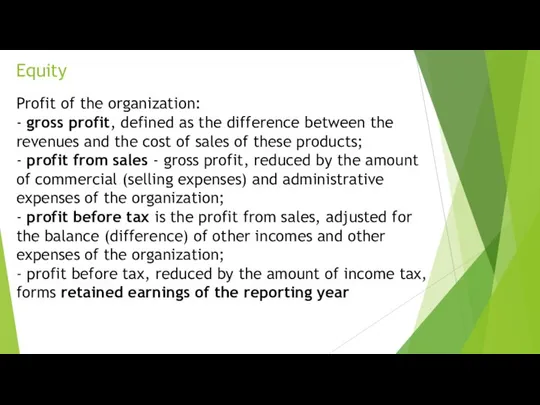

- 155. Equity Profit of the organization: - gross profit, defined as the difference between the revenues and

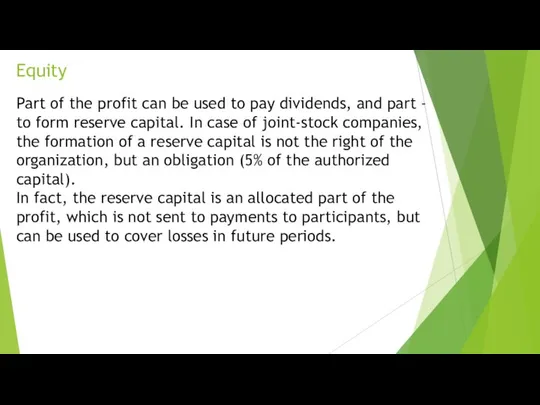

- 156. Equity Part of the profit can be used to pay dividends, and part - to form

- 158. Скачать презентацию

Построение схемы Налоги и сборы в РФ

Построение схемы Налоги и сборы в РФ Действующие налоги и сборы. Специальные налоговые режимы в РФ

Действующие налоги и сборы. Специальные налоговые режимы в РФ Антикризисное управление предприятием

Антикризисное управление предприятием Чистый оборотный капитал организации

Чистый оборотный капитал организации Этапы становления бухгалтерского учета как науки

Этапы становления бухгалтерского учета как науки Проект бюджета на 2020 год и плановый период 2021 и 2022 годов города Котельнича Кировской области

Проект бюджета на 2020 год и плановый период 2021 и 2022 годов города Котельнича Кировской области Тема лекции Объекты учета затрат в системе управленческого учета

Тема лекции Объекты учета затрат в системе управленческого учета Совершенствоание организации сбытовой деятельности предприятия ОАО Агрокомбинат Южный

Совершенствоание организации сбытовой деятельности предприятия ОАО Агрокомбинат Южный Таможенная стоимость и методы её определения

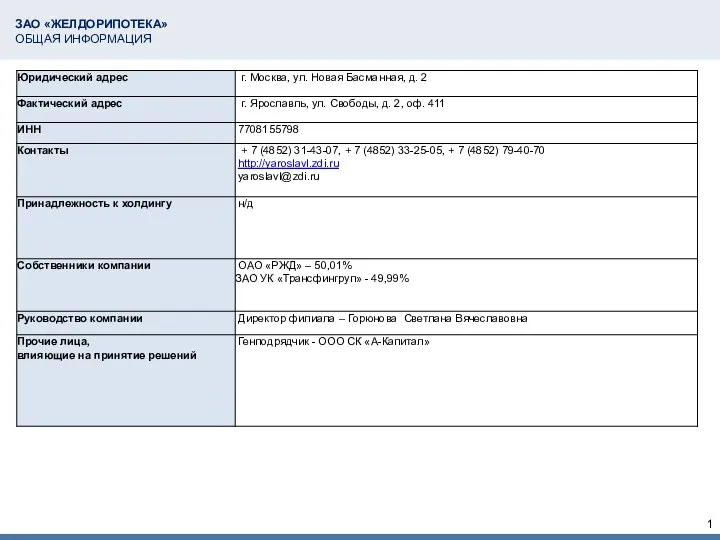

Таможенная стоимость и методы её определения ЗАО Желдорипотека. Общая информация

ЗАО Желдорипотека. Общая информация Виды и классификация затрат на производство

Виды и классификация затрат на производство Доходы бюджетов

Доходы бюджетов Бюджетный процесс: совставление, рассмотрение, утверждение и исполнение бюджетов п хвеньям бюджетной системы

Бюджетный процесс: совставление, рассмотрение, утверждение и исполнение бюджетов п хвеньям бюджетной системы Добровольное медицинское страхование

Добровольное медицинское страхование ВКР: Прогнозирование величины арендной платы

ВКР: Прогнозирование величины арендной платы Расчет затрат на создание ИС

Расчет затрат на создание ИС Учёт на торговом объекте

Учёт на торговом объекте Учет денежных средств

Учет денежных средств Сравнительный подход

Сравнительный подход Метод бухгалтерского учета

Метод бухгалтерского учета Ипотечные и кредитные каникулы

Ипотечные и кредитные каникулы Valuation Финансовый клуб ВШМ

Valuation Финансовый клуб ВШМ Кредитные карты. Кредит Европа Банк

Кредитные карты. Кредит Европа Банк Стратегия продвижения банковских продуктов на примере АКБ СОЮЗ (ОАО)

Стратегия продвижения банковских продуктов на примере АКБ СОЮЗ (ОАО) Презентация ОТ -2019

Презентация ОТ -2019 Листовка для информирования ЗП 10%

Листовка для информирования ЗП 10% Практика использования платёжных банковских карт в коммерческом банке и пути её совершенствования

Практика использования платёжных банковских карт в коммерческом банке и пути её совершенствования Биржа LME

Биржа LME