Содержание

- 2. Introduction Foreign direct investment (FDI) occurs when a firm invests directly in new facilities to produce

- 3. Foreign Direct Investment In The World Economy The flow of FDI refers to the amount of

- 4. Trends In FDI There has been a marked increase in both the flow and stock of

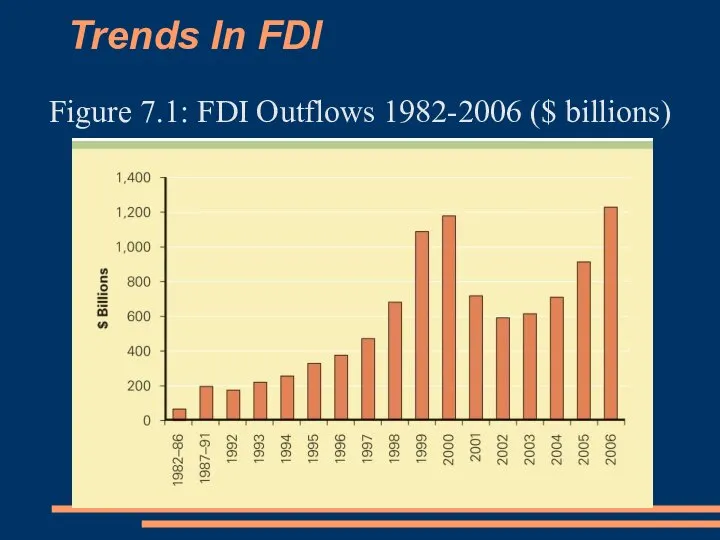

- 5. Trends In FDI Figure 7.1: FDI Outflows 1982-2006 ($ billions)

- 6. The Direction Of FDI Most FDI has historically been directed at the developed nations of the

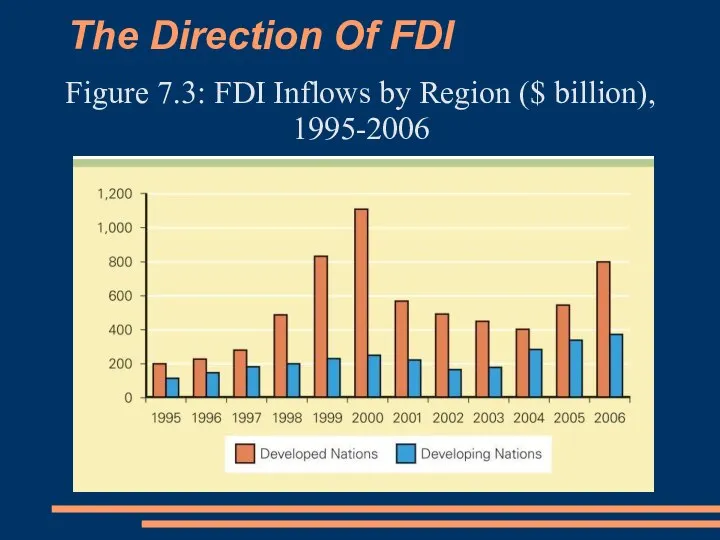

- 7. The Direction Of FDI Figure 7.3: FDI Inflows by Region ($ billion), 1995-2006

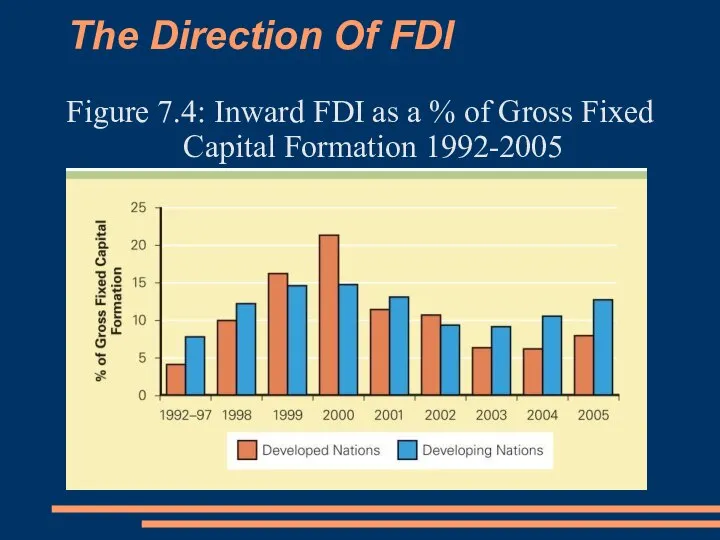

- 8. The Direction Of FDI Gross fixed capital formation summarizes the total amount of capital invested in

- 9. The Direction Of FDI Figure 7.4: Inward FDI as a % of Gross Fixed Capital Formation

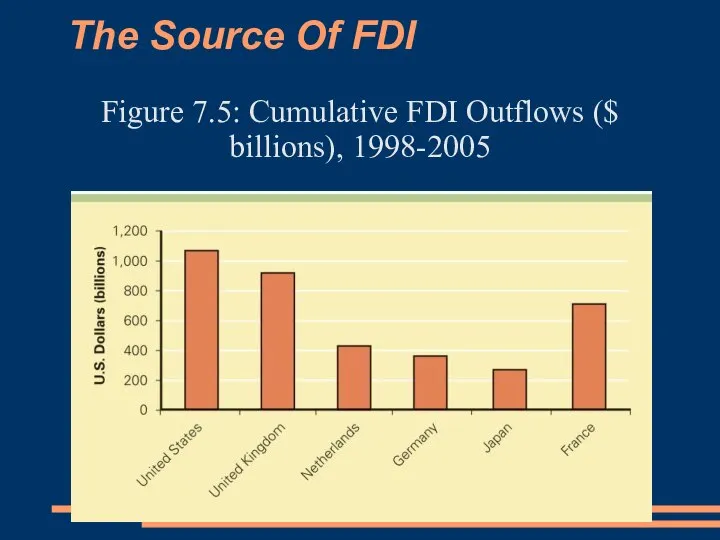

- 10. The Source Of FDI Since World War II, the U.S. has been the largest source country

- 11. The Source Of FDI Figure 7.5: Cumulative FDI Outflows ($ billions), 1998-2005

- 12. The Form Of FDI: Acquisitions Versus Greenfield Investments Most cross-border investment is in the form of

- 13. The Shift To Services FDI is shifting away from extractive industries and manufacturing, and towards services

- 14. Theories Of Foreign Direct Investment Why do firms invest rather than use exporting or licensing to

- 15. Why Foreign Direct Investment? Why do firms choose FDI instead of: exporting - producing goods at

- 16. Why Foreign Direct Investment? An export strategy can be constrained by transportation costs and trade barriers

- 17. Why Foreign Direct Investment? Internalization theory (also known as market imperfections theory) suggests that licensing has

- 18. The Pattern Of Foreign Direct Investment Firms in the same industry often undertake foreign direct investment

- 19. The Pattern Of Foreign Direct Investment Vernon argued that firms undertake FDI at particular stages in

- 20. The Pattern Of Foreign Direct Investment According to the eclectic paradigm, in addition to the various

- 21. Political Ideology And Foreign Direct Investment Ideology toward FDI ranges from a radical stance that is

- 22. The Radical View The radical view traces its roots to Marxist political and economic theory It

- 23. The Free Market View According to the free market view, international production should be distributed among

- 24. Pragmatic Nationalism Pragmatic nationalism suggests that FDI has both benefits, such as inflows of capital, technology,

- 25. Shifting Ideology Recently, there has been a strong shift toward the free market stance creating: a

- 26. Benefits And Costs Of FDI Government policy is often shaped by a consideration of the costs

- 27. Host-Country Benefits There are four main benefits of inward FDI for a host country: 1. resource

- 28. Host-Country Benefits 3. balance of payments effects - a country’s balance-of-payments account is a record of

- 29. Host-Country Benefits 4. effects on competition and economic growth - FDI in the form of greenfield

- 30. Host-Country Costs Inward FDI has three main costs: 1. the possible adverse effects of FDI on

- 31. Host-Country Costs 2. adverse effects on the balance of payments with the initial capital inflows that

- 32. Host-Country Costs 3. the perceived loss of national sovereignty and autonomy key decisions that can affect

- 33. Home-Country Benefits The benefits of FDI for the home country include: the effect on the capital

- 34. Home-Country Costs The home country’s balance of payments can suffer: from the initial capital outflow required

- 35. International Trade Theory And FDI International trade theory suggests that home country concerns about the negative

- 36. Government Policy Instruments And FDI Home countries and host countries use various policies to regulate FDI

- 37. Home-Country Policies Governments can encourage and restrict FDI: To encourage outward FDI, many nations now have

- 38. Host-Country Policies Governments can encourage or restrict inward FDI To encourage inward FDI, governments offer incentives

- 39. International Institutions And The Liberalization Of FDI Until the 1990s, there was no consistent involvement by

- 40. Implications For Managers What are the implications of foreign direct investment for managers? Managers need to

- 41. The Theory Of FDI The direction of FDI can be explained through the location-specific advantages argument

- 43. Скачать презентацию

Цель исследования : Цель исследования : Разработка мер по совершенствованию государственного финансового контроля в Росси

Цель исследования : Цель исследования : Разработка мер по совершенствованию государственного финансового контроля в Росси Презентация "Эконометрика" - скачать презентации по Экономике__

Презентация "Эконометрика" - скачать презентации по Экономике__ Алгебра и начала анализа. Тема урока: Преобразование графиков функций на координатной плоскости.

Алгебра и начала анализа. Тема урока: Преобразование графиков функций на координатной плоскости. Manual QA course. Виды тестирования

Manual QA course. Виды тестирования Права і свободи людини і громадянина

Права і свободи людини і громадянина Искусство Новгородских земель XI-XIII вв. Пригороды Великого Новгорода. Антониев монастырь

Искусство Новгородских земель XI-XIII вв. Пригороды Великого Новгорода. Антониев монастырь кабинет учителя-логопеда Рекомендации методиста Коклягиной И.А.

кабинет учителя-логопеда Рекомендации методиста Коклягиной И.А. BERLIN (Spitzname von Berlin ist “Spree-Athen”)

BERLIN (Spitzname von Berlin ist “Spree-Athen”) Проектирования системы пожарной сигнализации и оповещения о пожаре

Проектирования системы пожарной сигнализации и оповещения о пожаре Реляционная модель данных. Нормализация. Нормальные формы.

Реляционная модель данных. Нормализация. Нормальные формы. Бизнес план по прокату велосипедов

Бизнес план по прокату велосипедов Операции, операторы, операнды

Операции, операторы, операнды Кәсіби сала қызметінде қолданылатын құрал-жабдықтар. Сипаттамасы. Жасалу тарихы

Кәсіби сала қызметінде қолданылатын құрал-жабдықтар. Сипаттамасы. Жасалу тарихы Роль фельдшера в реализации права социального страхования от несчастных случаев на производстве

Роль фельдшера в реализации права социального страхования от несчастных случаев на производстве Практика в ООО ТЕКОМ. Тестирование

Практика в ООО ТЕКОМ. Тестирование Методы усиления интеллекта

Методы усиления интеллекта Системы и технологии программирования. Этапы реализации задачи на ЭВМ

Системы и технологии программирования. Этапы реализации задачи на ЭВМ Архитектура Древнего Рима VIII в. до н.э. – V в. н.э.

Архитектура Древнего Рима VIII в. до н.э. – V в. н.э. Презентация Microsoft Office PowerPoint

Презентация Microsoft Office PowerPoint Исследование по теме: Спутниковая связь и ее роль в жизни человека

Исследование по теме: Спутниковая связь и ее роль в жизни человека Распорядительные документы

Распорядительные документы Основные термины и определения системы ТОРиР

Основные термины и определения системы ТОРиР Нормативно-правовые документы, обеспечивающие функционирование КСЗИ

Нормативно-правовые документы, обеспечивающие функционирование КСЗИ Опасные и вредные факторы среды обитания и их воздействие на жизнедеятельность человека

Опасные и вредные факторы среды обитания и их воздействие на жизнедеятельность человека Робототехника

Робототехника Банковская система

Банковская система Базальные ядра полушарий. Лимбическая система

Базальные ядра полушарий. Лимбическая система Методы защиты человека

Методы защиты человека