Содержание

- 2. This text in macroeconomics focuses on the idea how to save money without paying taxes to

- 3. 1. Background and explanatory information Nowadays there are a lot of seminars, business courses training how

- 4. The main points are:

- 5. 2. Every country has its own offshore zone

- 6. The main objective of the entrepreneur is profit dead: to minimize it as it possible not

- 7. There four basic advantages of the offshored business:

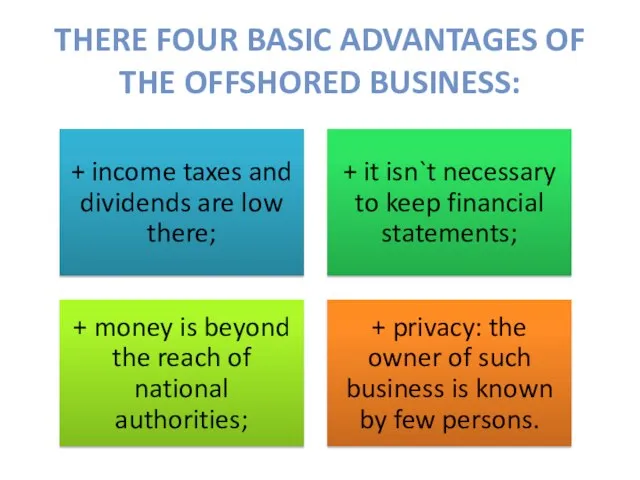

- 8. 3. Why the offshore is permitted if it causes huge losses of the Budget? The answer

- 10. Скачать презентацию

This text in macroeconomics focuses on the idea how to save

This text in macroeconomics focuses on the idea how to save

1. Background and explanatory information

Nowadays there are a lot of seminars,

1. Background and explanatory information

Nowadays there are a lot of seminars,

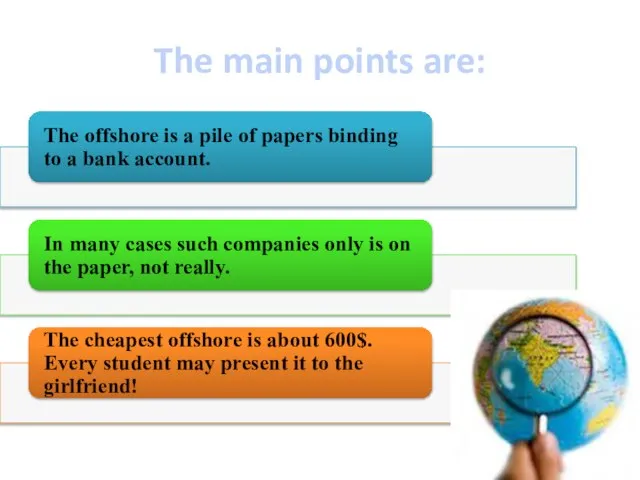

The main points are:

The main points are:

2. Every country has its own offshore zone

2. Every country has its own offshore zone

The main objective of the entrepreneur is profit dead:

to minimize it

The main objective of the entrepreneur is profit dead:

to minimize it

The situation is similar to the joke: they purchase something for 2 rubles, then sell it for 4 rubles, and 50% is in the pocket. The scheme is as simple as possible. For example, one offshore company ostensibly renders services of marketing or consulting and gets paid for it. The businessman writes this money into expenses reducing net profit and its taxes. Everybody can steal money from the Government!

There four basic advantages of the offshored business:

There four basic advantages of the offshored business:

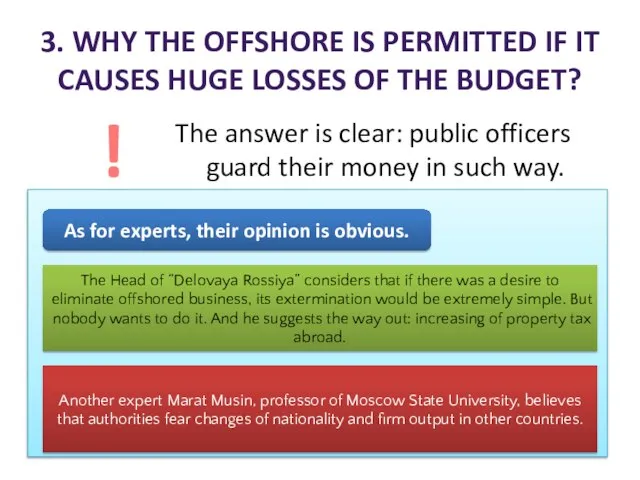

3. Why the offshore is permitted if it causes huge losses

3. Why the offshore is permitted if it causes huge losses

The answer is clear: public officers guard their money in such way.

!

As for experts, their opinion is obvious.

The Head of “Delovaya Rossiya” considers that if there was a desire to eliminate offshored business, its extermination would be extremely simple. But nobody wants to do it. And he suggests the way out: increasing of property tax abroad.

Another expert Marat Musin, professor of Moscow State University, believes that authorities fear changes of nationality and firm output in other countries.

Объекты и типы

Объекты и типы Транзистор

Транзистор Традиционные формы дипломатической переписки

Традиционные формы дипломатической переписки Configure a Switch

Configure a Switch Подготовка к экзаменам Полезная информация

Подготовка к экзаменам Полезная информация InterSystems Ensemble Преимущества при выполнении SOA-проектов и внедрении SOA-решений

InterSystems Ensemble Преимущества при выполнении SOA-проектов и внедрении SOA-решений В театре Чехова.

В театре Чехова. Тема 5. Система ФОССТИС и КМК Понятие и сущность системы ФОССТИС Цели, задачи и методы формирования спроса и стимулирования сбыта

Тема 5. Система ФОССТИС и КМК Понятие и сущность системы ФОССТИС Цели, задачи и методы формирования спроса и стимулирования сбыта  Услуги в сфере строительства и управления недвижимостью ООО АУСТЕНА

Услуги в сфере строительства и управления недвижимостью ООО АУСТЕНА Modern mobile phones addiction: reasons and consequences

Modern mobile phones addiction: reasons and consequences тест5tp1вопр30

тест5tp1вопр30 Диаграмма причинно-следственных связей Выполнила студентка 3го курса группы Э101 Овсянникова Надежда

Диаграмма причинно-следственных связей Выполнила студентка 3го курса группы Э101 Овсянникова Надежда Звенья второго порядка Добротности и частоты нулей и полюсов

Звенья второго порядка Добротности и частоты нулей и полюсов Создание и продвижение промо видео, реклама, анимация, корпоративные фильмы. Er-production.ru медиа студия

Создание и продвижение промо видео, реклама, анимация, корпоративные фильмы. Er-production.ru медиа студия Презентация на тему "БАС ҚАҢҚАСЫ. БЕТ СҮЙЕКТЕРІ" - скачать презентации по Медицине

Презентация на тему "БАС ҚАҢҚАСЫ. БЕТ СҮЙЕКТЕРІ" - скачать презентации по Медицине психология взаимовлияния группы и личности

психология взаимовлияния группы и личности Вся грамматика немецкого языка в таблицах

Вся грамматика немецкого языка в таблицах Марина Цветаева

Марина Цветаева Разноцветное путешествие зайчишки - презентация для начальной школы

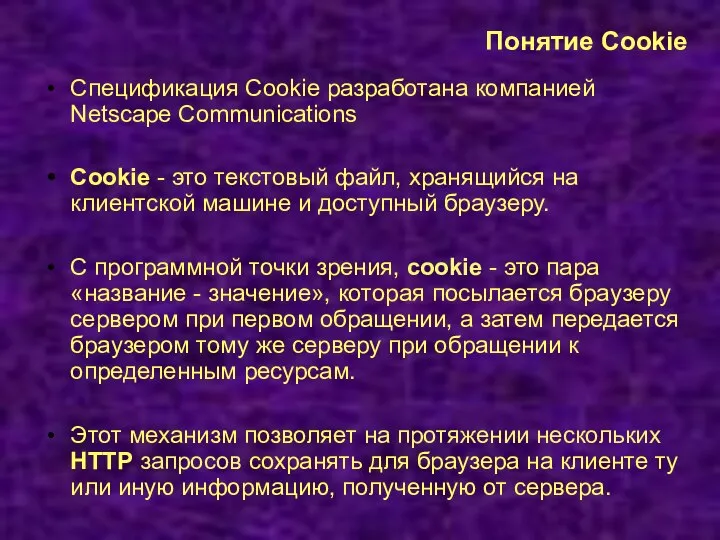

Разноцветное путешествие зайчишки - презентация для начальной школы Понятие Cookie. Класс javax.servlet.http.Cookie

Понятие Cookie. Класс javax.servlet.http.Cookie Alexey Vorobyov

Alexey Vorobyov Узлы. Виды узлов

Узлы. Виды узлов Разработка базы для информационной системы брикетировочного цеха завода «Эковер» по утилизации отходов минераловатного произв

Разработка базы для информационной системы брикетировочного цеха завода «Эковер» по утилизации отходов минераловатного произв Спортивные игры и забавы на Руси

Спортивные игры и забавы на Руси організація і контроль міжнародної маркетингової діяльності

організація і контроль міжнародної маркетингової діяльності Материальная ответственность

Материальная ответственность Политические партии и партийные системы

Политические партии и партийные системы Нормализация БД

Нормализация БД