Содержание

- 2. The "fiscal cliff" is a term used to describe a bundle of momentous U.S. federal tax

- 3. In the 1970s and 80s, it was used to describe the precarious state of city, state

- 4. The fiscal cliff would increase tax rates and decrease government spending through sequestration, and lead to

- 5. The Congressional Budget Office estimates the economy would contract in 2013 by 0.5% and unemployment would

- 7. Скачать презентацию

Слайд 2

The "fiscal cliff" is a term used to describe a bundle

The "fiscal cliff" is a term used to describe a bundle

of momentous U.S. federal tax increases and spending cuts

The so-called fiscal cliff describes the automatic tax increases and spending cuts due to take effect on 1 January, a combination which economists say would push the US into recession - with global consequences.

The so-called fiscal cliff describes the automatic tax increases and spending cuts due to take effect on 1 January, a combination which economists say would push the US into recession - with global consequences.

Слайд 3

In the 1970s and 80s, it was used to describe the

In the 1970s and 80s, it was used to describe the

precarious state of city, state and federal budgets, most notably in relation to New York City's brush with bankruptcy in 1975.

One of its first uses in the Obama era was by Senator Jim DeMint in 2008, speaking about the president's spending programme.

One of its first uses in the Obama era was by Senator Jim DeMint in 2008, speaking about the president's spending programme.

Слайд 4

The fiscal cliff would increase tax rates and decrease government spending

The fiscal cliff would increase tax rates and decrease government spending

through sequestration, and lead to an operating deficit (the amount by which government spending exceeds its revenue) which was projected to be reduced by roughly half in 2013.

The previously enacted laws leading to the fiscal cliff had been projected to result in a 19.63% increase in revenue and 0.25% reduction in spending from fiscal years 2012 to 2013.

The previously enacted laws leading to the fiscal cliff had been projected to result in a 19.63% increase in revenue and 0.25% reduction in spending from fiscal years 2012 to 2013.

Слайд 5

The Congressional Budget Office estimates the economy would contract in 2013 by 0.5%

The Congressional Budget Office estimates the economy would contract in 2013 by 0.5%

and unemployment would rise to 9.1%.

But the White House and Congress are trying to agree a package of measures that would divert the country from the fiscal cliff.

But the White House and Congress are trying to agree a package of measures that would divert the country from the fiscal cliff.

Личность

Личность ТЫЖ Программист

ТЫЖ Программист Работа по решению любой задачи с использованием компьютера

Работа по решению любой задачи с использованием компьютера Культура общения: сотовый телефон Кочкина Е.Г., МАОУ «МСОШ №20», Миасс

Культура общения: сотовый телефон Кочкина Е.Г., МАОУ «МСОШ №20», Миасс  Київ тепер і колись До дня Києва

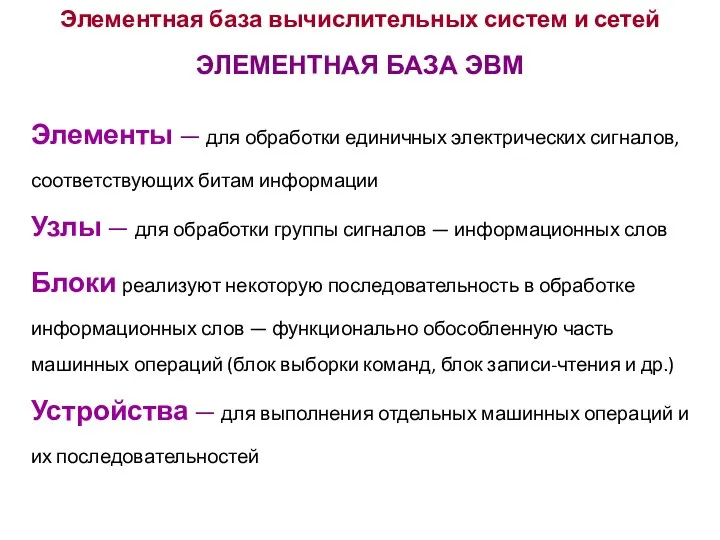

Київ тепер і колись До дня Києва Элементная база вычислительных систем и сетей

Элементная база вычислительных систем и сетей Народные гуляния как традиция, исторически сложившаяся в советскую эпоху

Народные гуляния как традиция, исторически сложившаяся в советскую эпоху Free Love маркетинг

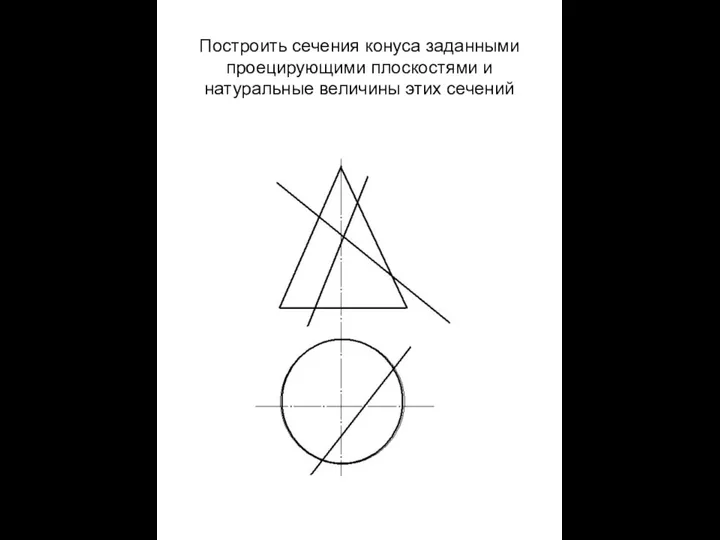

Free Love маркетинг Пересечение поверхностей геометрических тел

Пересечение поверхностей геометрических тел Исторический жанр тесты для 7 класса, по программе Б. Неменского

Исторический жанр тесты для 7 класса, по программе Б. Неменского Расчет и определение оптимальной комплектации водосточной системы

Расчет и определение оптимальной комплектации водосточной системы Презентация «ЗАЕМ И КРЕДИТ»

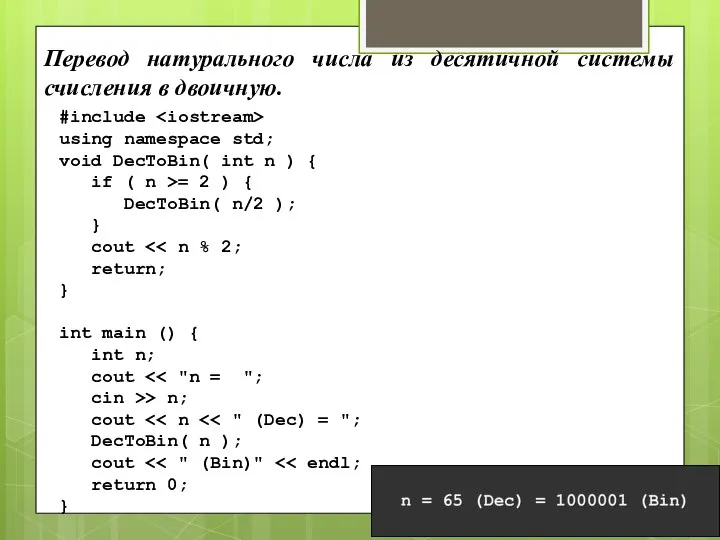

Презентация «ЗАЕМ И КРЕДИТ» Перевод натурального числа из десятичной системы счисления в двоичную

Перевод натурального числа из десятичной системы счисления в двоичную Презентация "Казаковская филигрань" - скачать презентации по МХК

Презентация "Казаковская филигрань" - скачать презентации по МХК Складні випадки правопису апострофа

Складні випадки правопису апострофа Презентация на тему "Творческая группа учителей начальных классов МОУ Набережная СОШ" - скачать презентации по Педагогике

Презентация на тему "Творческая группа учителей начальных классов МОУ Набережная СОШ" - скачать презентации по Педагогике Построение диаграмм и графиков

Построение диаграмм и графиков  Мухта́р Омарханович Ауэ́зов 1897-1961

Мухта́р Омарханович Ауэ́зов 1897-1961 Стивен Джордж Таллентс

Стивен Джордж Таллентс Введение в корпус Апостольских посланий. Соборные послания. Послания Иакова и Иуды

Введение в корпус Апостольских посланий. Соборные послания. Послания Иакова и Иуды Самые известные православные храмы России

Самые известные православные храмы России Новоселицький НВК «ДНЗ-ЗОШ І-ІІІ ступенів»

Новоселицький НВК «ДНЗ-ЗОШ І-ІІІ ступенів» Марина Цветаева

Марина Цветаева Интеллектуалдық меншік құқығы деп

Интеллектуалдық меншік құқығы деп Графики функции Подготовил: студент группы К-11 Лысенко Владислав

Графики функции Подготовил: студент группы К-11 Лысенко Владислав  Знакомство

Знакомство Транспортно-экспедиционное обслуживание при международных автомобильных перевозках

Транспортно-экспедиционное обслуживание при международных автомобильных перевозках Работу выполнила ученица 7а класса Кирасирова Амина. Учитель : Кирасирова Хавва Вильдановна

Работу выполнила ученица 7а класса Кирасирова Амина. Учитель : Кирасирова Хавва Вильдановна