Содержание

- 2. Introduce

- 3. General Anti-Avoidance Rule

- 4. Methods Country of residence &

- 5. Methods Double taxation Taxing nonresidents Income is earned Income is earned again in CoR

- 6. Methods Legal entities

- 7. Methods Legal vagueness Tax results depend on definitions of legal terms which are usually vague

- 8. Methods Tax shelters Tax shelters are investments that allow a reduction in one's income tax liability

- 9. Tax avoiders: UK HMRC estimates that the overall cost of tax avoidance in the UK in

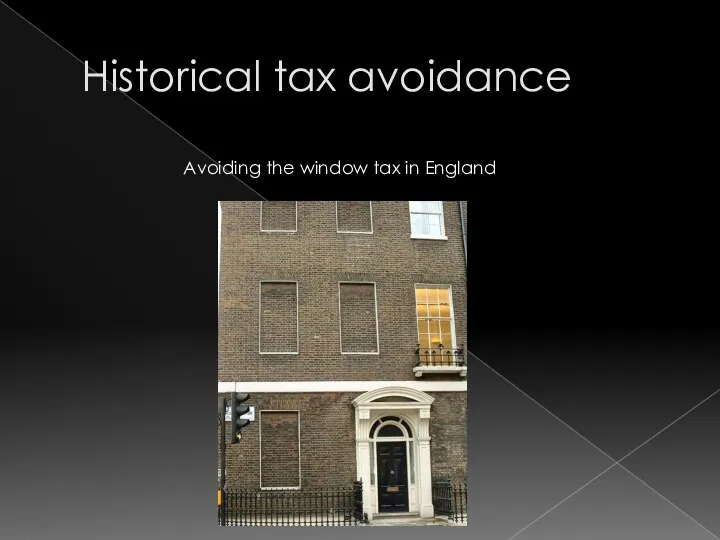

- 10. Historical tax avoidance Avoiding the window tax in England

- 12. Скачать презентацию

Синдром дефицита внимания и гиперактивности Выполнила: Mаслова О. И.

Синдром дефицита внимания и гиперактивности Выполнила: Mаслова О. И. Диагностика двигателя легкового автомобиля

Диагностика двигателя легкового автомобиля БАЗЫ ДАННЫХ

БАЗЫ ДАННЫХ Дисфункциональные маточные кровотечения (ДМК

Дисфункциональные маточные кровотечения (ДМК Брейн-ринг «М.В. Ломоносов – великий сын России»

Брейн-ринг «М.В. Ломоносов – великий сын России» Факторы внешней среды, как способ лечебной физической культуры Крымский государственный медицинский университет им. С. И. Георги

Факторы внешней среды, как способ лечебной физической культуры Крымский государственный медицинский университет им. С. И. Георги Великая Отечественная война глазами художников

Великая Отечественная война глазами художников «Души своей открою тайники…» Задачи: Учиться вести дневниковые записи Выражать свое душевное состояние с помощью изобразительных средств Учиться делать выводы Анализировать свои поступки

«Души своей открою тайники…» Задачи: Учиться вести дневниковые записи Выражать свое душевное состояние с помощью изобразительных средств Учиться делать выводы Анализировать свои поступки Презентация на тему «Исследование особенностей налогообложения предприятий-участников внешнеэкономической деятельности»

Презентация на тему «Исследование особенностей налогообложения предприятий-участников внешнеэкономической деятельности» Антикоррупционное мировоззрение как фактор национальной безопасности (09)

Антикоррупционное мировоззрение как фактор национальной безопасности (09) Теоретические основы ноксологии

Теоретические основы ноксологии Патентоведение / защита интеллектуальной собственности

Патентоведение / защита интеллектуальной собственности Конституция РФ

Конституция РФ Социокультурные основы политических предпочтений

Социокультурные основы политических предпочтений Python

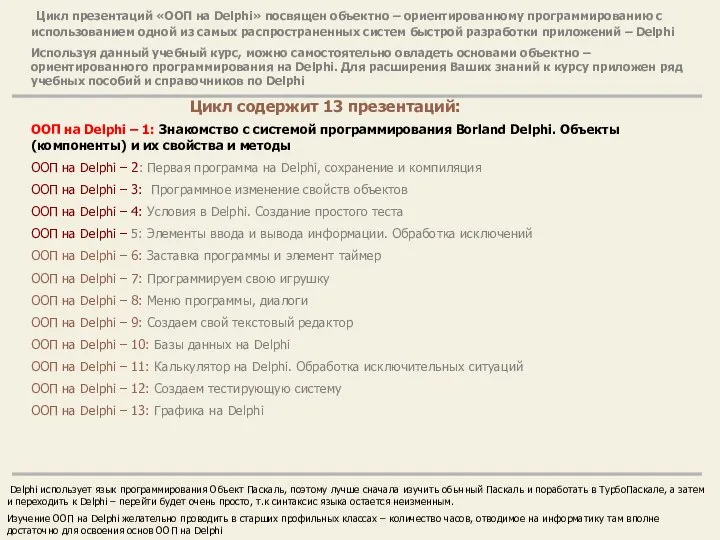

Python ООП на Delphi - 1. Знакомство с системой программирования Borland Delphi

ООП на Delphi - 1. Знакомство с системой программирования Borland Delphi Ежен Делакруа

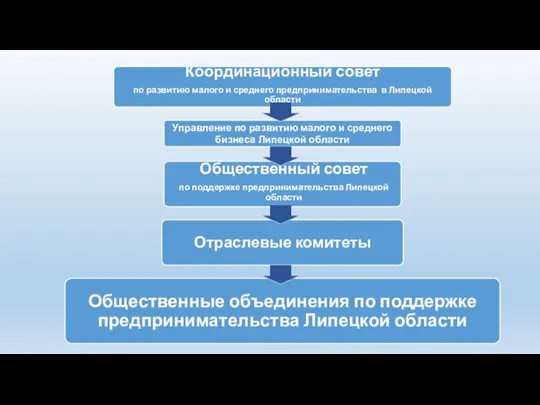

Ежен Делакруа Координационный совет по развитию предпринимательской деятельности

Координационный совет по развитию предпринимательской деятельности  Периодический закон Менделеева

Периодический закон Менделеева  Terrorism. 6 things you should know about the terrorism

Terrorism. 6 things you should know about the terrorism Презентация Валютно -Финансовые условия внешнеторговых контрактов

Презентация Валютно -Финансовые условия внешнеторговых контрактов Программируемое радио. Основные определения

Программируемое радио. Основные определения Требования международно-правовых документов по ограничению или запрещению различных видов оружия

Требования международно-правовых документов по ограничению или запрещению различных видов оружия Алгоритм создания библиографического указателя Поток 86 Группа 1

Алгоритм создания библиографического указателя Поток 86 Группа 1 Разработка обучающих тестов по химии для средней школы

Разработка обучающих тестов по химии для средней школы Образ коня в изобразительном искусстве

Образ коня в изобразительном искусстве Образ современного учителя

Образ современного учителя Принципы международного права

Принципы международного права