Содержание

- 2. Budget Budget is a quantitative expression for a set time period of proposed future plan of

- 3. Budgets covering the financial aspects quantify management’s expectations regarding future income, cash flows, and financial position.

- 4. Well-managed organizations usually have the following budgeting cycle: Planning the organization as a whole as well

- 5. Investigating variations from plans. If necessary, corrective action follows investigation. Planning again, considering feedback and changed

- 6. Master budget Master budget coordinates all the financial projections in the organization’s individual budgets in a

- 7. Operating decisions center on the acquisition and use of scare resources. Financing decisions center on how

- 8. Pro forma statements The terminology used to describe budgets varies among organizations. For example, budgeted financial

- 9. The budgeted financial statements of many companies include the budgeted income statement, the budgeted balance sheet,

- 10. Coordination Coordination is the meshing and balancing of all factors of production or service and of

- 11. Communication Communication is getting those objectives understood and accepted by all departments and functions.

- 12. Coordination forces executives to think of relationships among individual operations, departments, and the company as a

- 13. For coordination to succeed, communication is essential. The production manager must know the sales plan. The

- 14. Budgets should not be administered rapidly. Changing conditions call for changes in plans. A manager may

- 15. The most frequently used budget period is one year. The annual budget is often subdivided by

- 16. Rolling budget Businesses are increasingly using rolling budgets. Rolling budget is a budget or plan that

- 17. Thus, a 12-month rolling budget for the March 2000 to February 2001 period becomes a 12-month

- 18. Halifax Engineering is a machine shop that uses skilled labor and metal alloys to manufacture two

- 19. The only source of revenue is sales of two parts. Non-sales-related revenue, such as interest income,

- 20. Unit costs of direct materials purchased and finished goods sold remain unchanged throughout the budget year

- 21. After carefully examining all relevant factors, the executives of Halifax Engineering forecast the following figures for

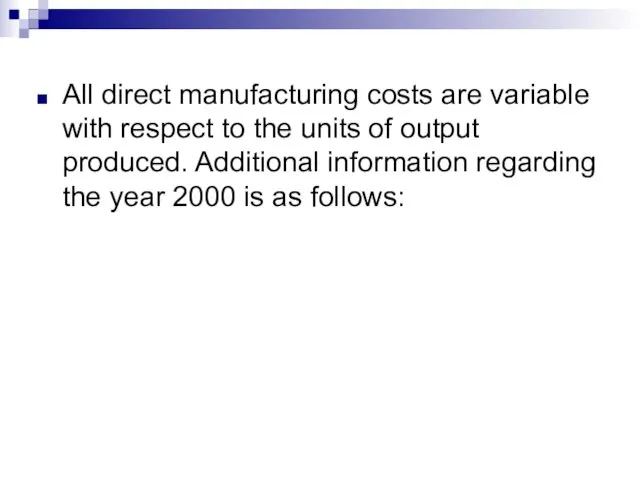

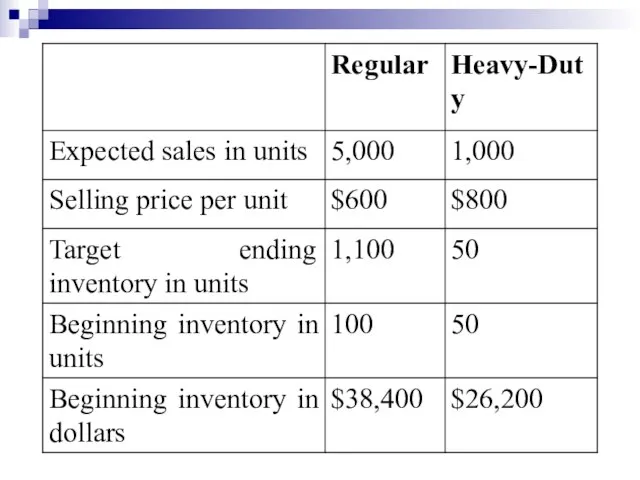

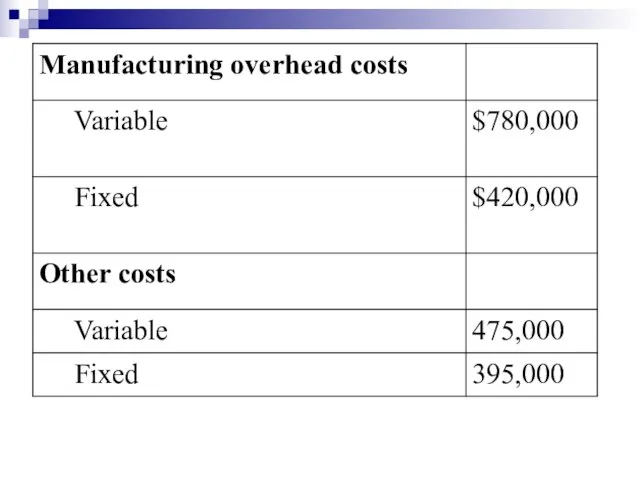

- 23. All direct manufacturing costs are variable with respect to the units of output produced. Additional information

- 26. At the anticipated output levels for the Regular and Heavy Duty aircraft parts, management believes the

- 28. Our task is to prepare a budgeted income statement for the year 2000.

- 29. STEPS IN PREPARING AN OPERATING BUDGET

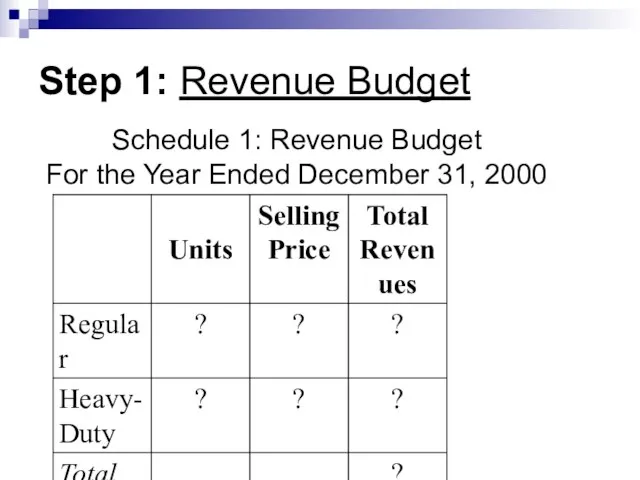

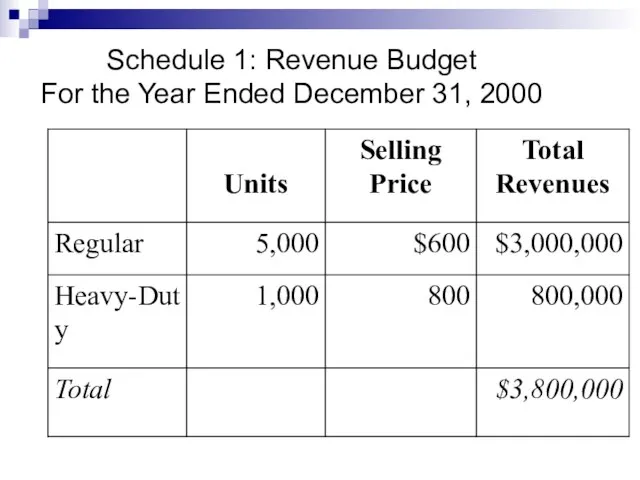

- 30. Step 1: Revenue Budget Schedule 1: Revenue Budget For the Year Ended December 31, 2000

- 31. Schedule 1: Revenue Budget For the Year Ended December 31, 2000

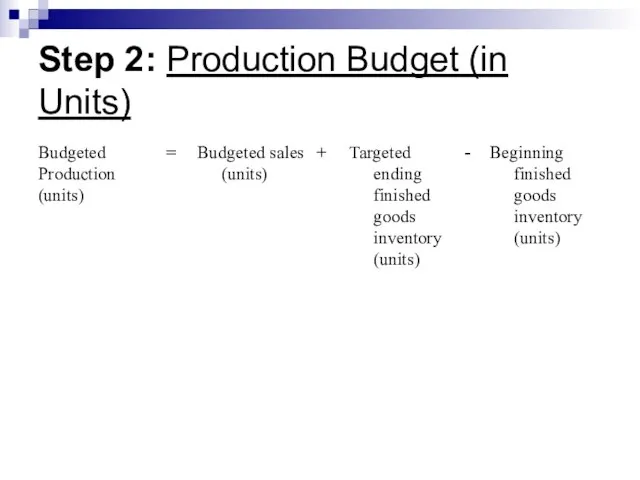

- 32. Step 2: Production Budget (in Units)

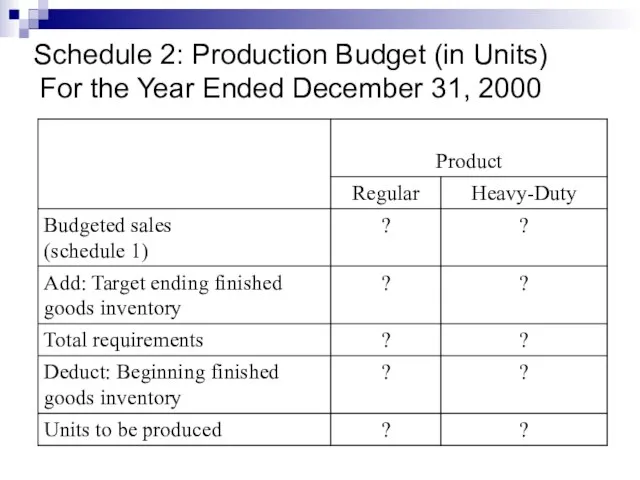

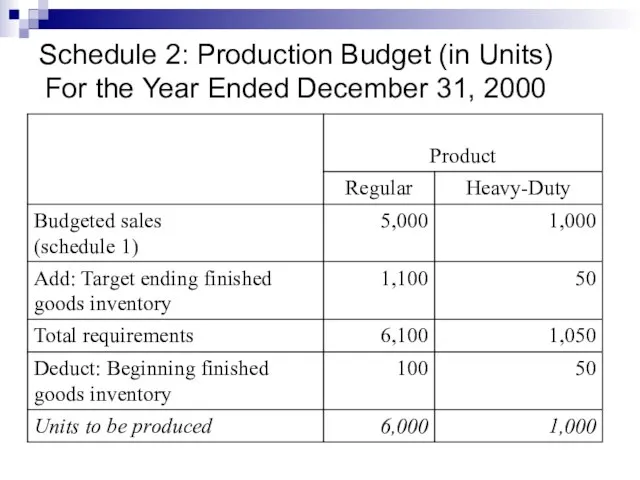

- 33. Schedule 2: Production Budget (in Units) For the Year Ended December 31, 2000

- 34. Schedule 2: Production Budget (in Units) For the Year Ended December 31, 2000

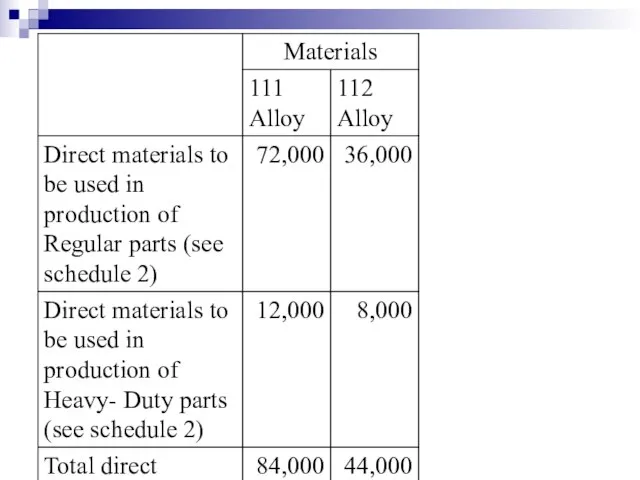

- 35. Step 3: Direct Materials Usage Budget and Direct Materials Purchase Budget Schedule 3A: Direct Materials Usage

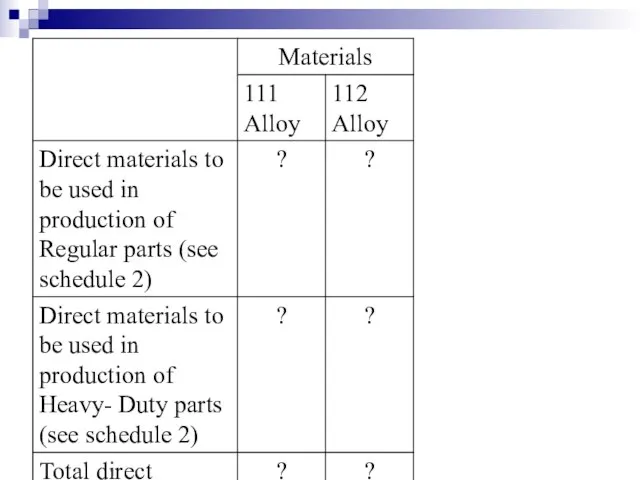

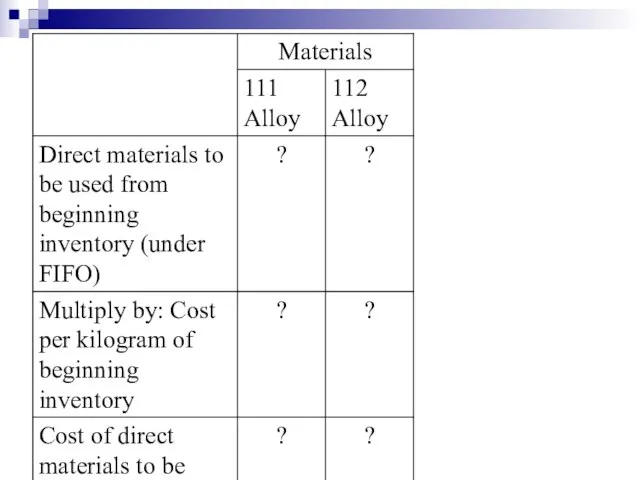

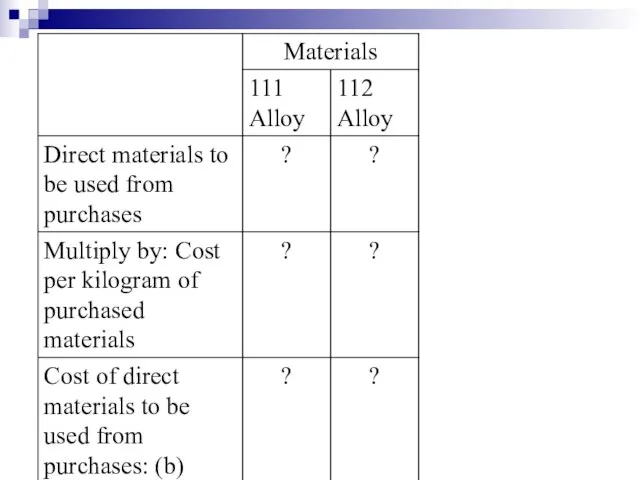

- 39. Schedule 3A: Direct Materials Usage Budget in Kilograms and Dollars For the Year Ended December 31,

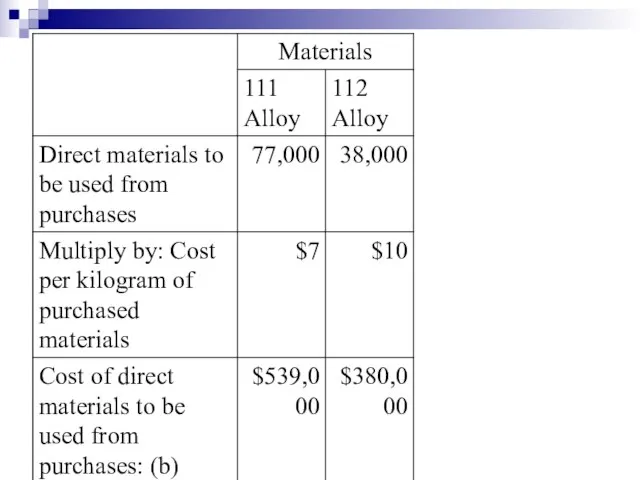

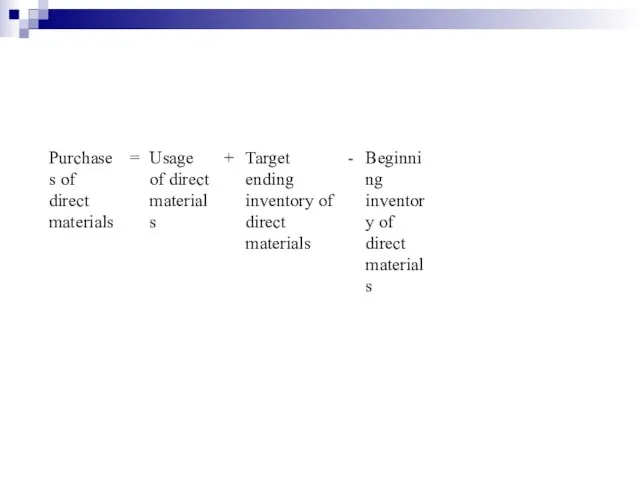

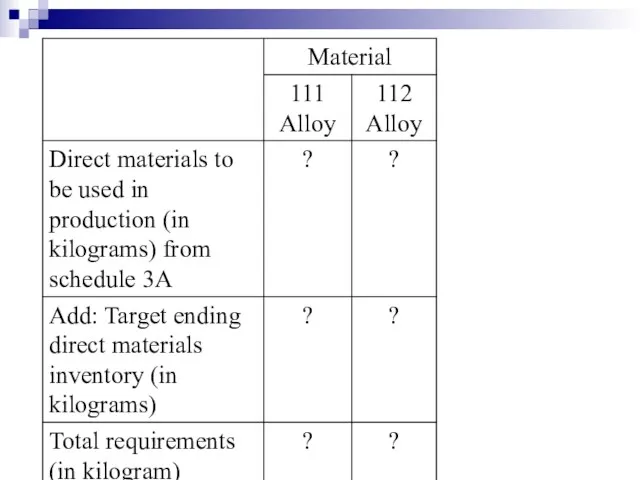

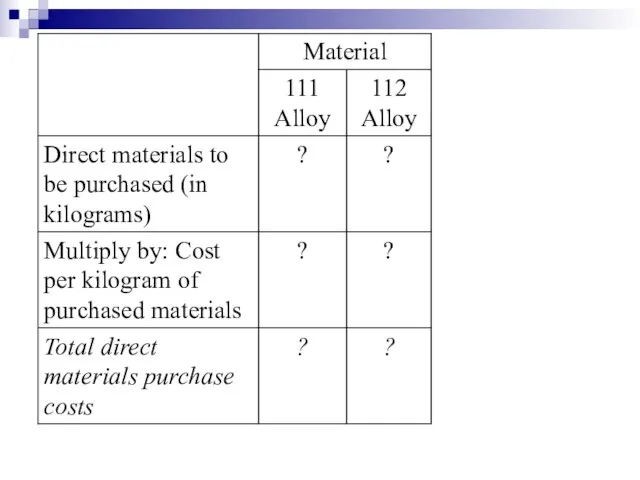

- 44. Schedule 3B: Direct Materials Purchases Budget For the Year Ended December 31, 2000

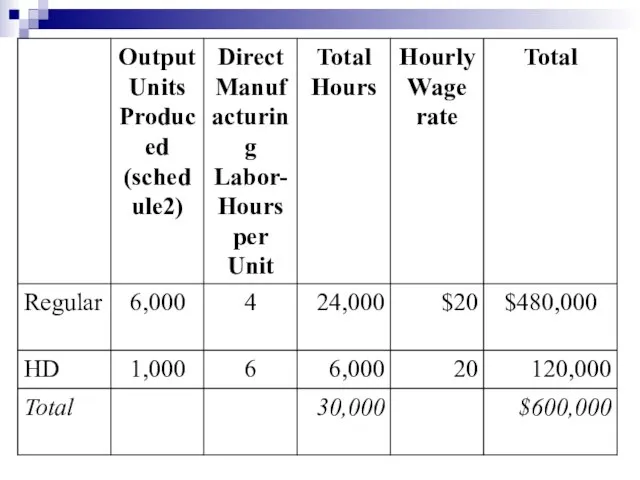

- 51. Step 4: Direct Manufacturing Labor Budget Schedule 4: Direct Manufacturing Labor Budget For the Year Ended

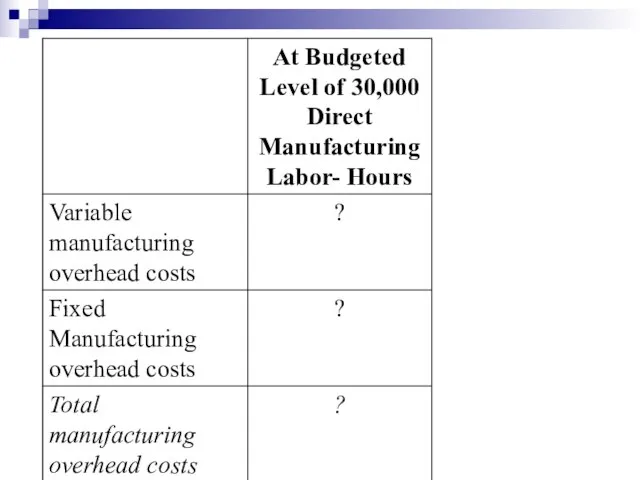

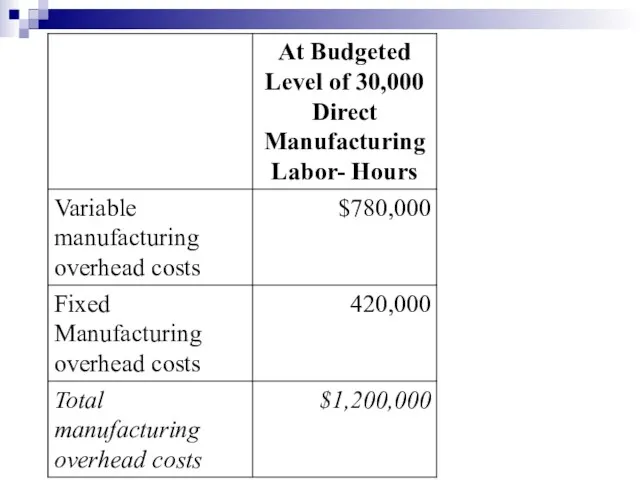

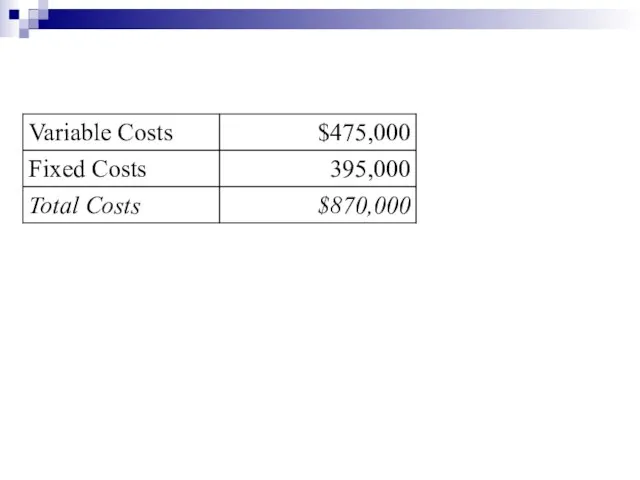

- 54. Step 5: Manufacturing Overhead Budget Schedule 5: Manufacturing Overhead Budget For the Year Ended December 31,

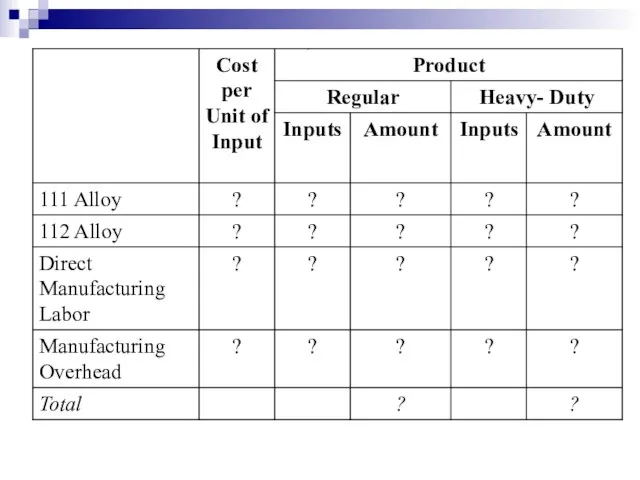

- 57. Step 6: Ending Inventory Budget Schedule 6A: Computation of Unit Costs of Manufacturing Finished Goods in

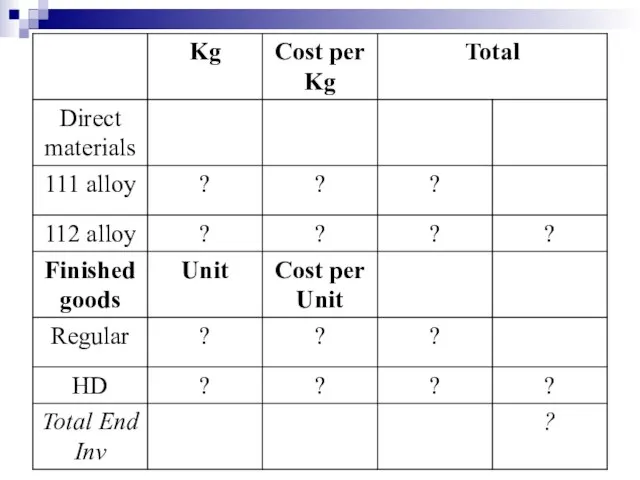

- 60. Schedule 6B: Ending Inventory Budget December 31, 2000

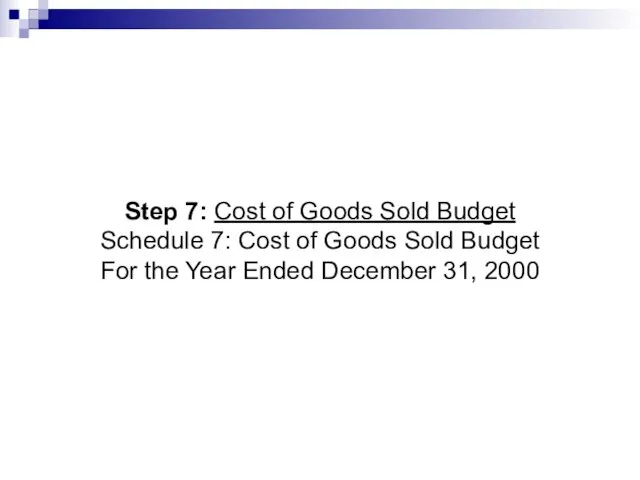

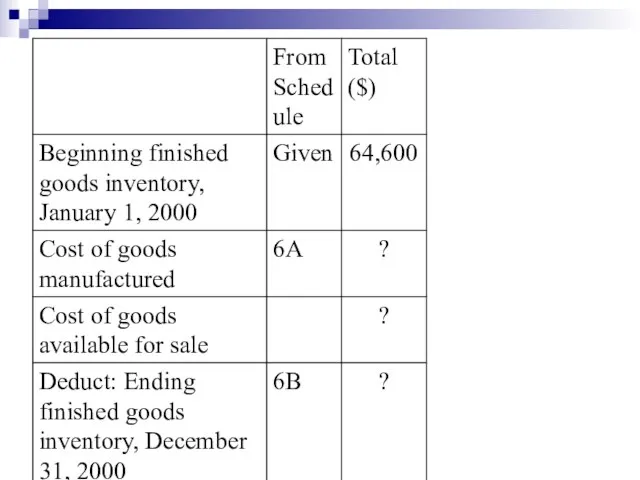

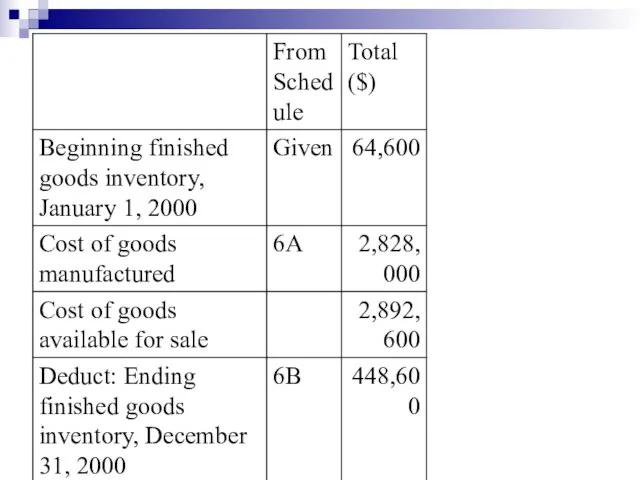

- 63. Step 7: Cost of Goods Sold Budget Schedule 7: Cost of Goods Sold Budget For the

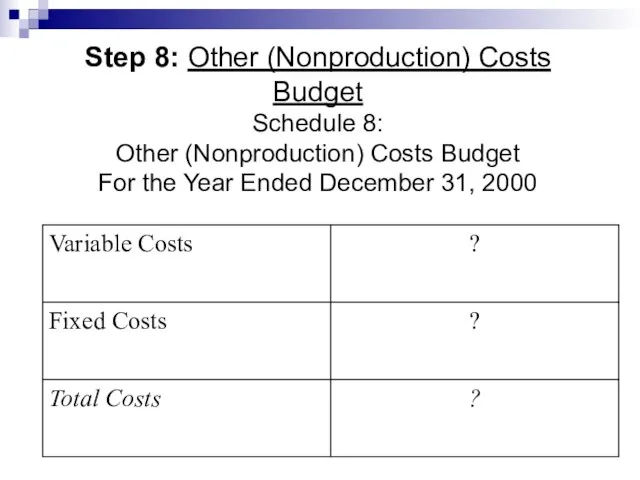

- 66. Step 8: Other (Nonproduction) Costs Budget Schedule 8: Other (Nonproduction) Costs Budget For the Year Ended

- 68. Halifax Engineering Budgeted Income Statement For the Year Ended December 31, 2000

- 71. Скачать презентацию

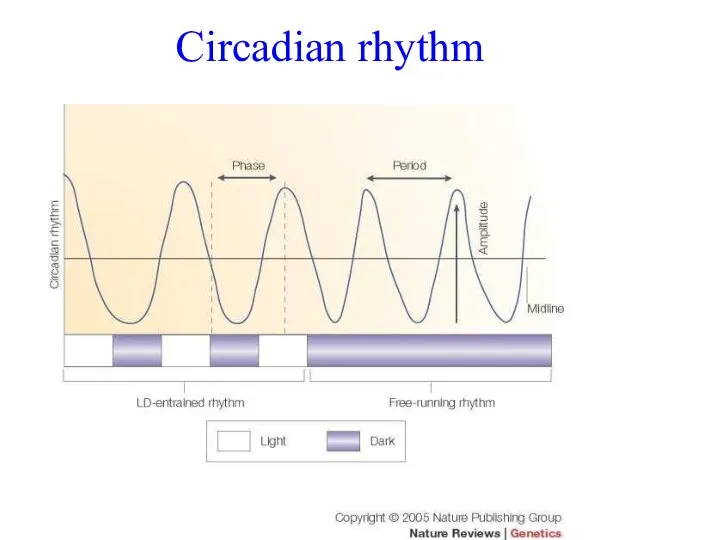

Circadian rhythm

Circadian rhythm  The Review Amnesia: The Dark Descent

The Review Amnesia: The Dark Descent  THE QUEEN AND THE ROYAL FAMILY ‘A family on the throne is an interesting idea... It brings down the pride of sovereignty to the level of petty life.’ The Victorian constitutionalist Walter Bagehot

THE QUEEN AND THE ROYAL FAMILY ‘A family on the throne is an interesting idea... It brings down the pride of sovereignty to the level of petty life.’ The Victorian constitutionalist Walter Bagehot Jersey Stil

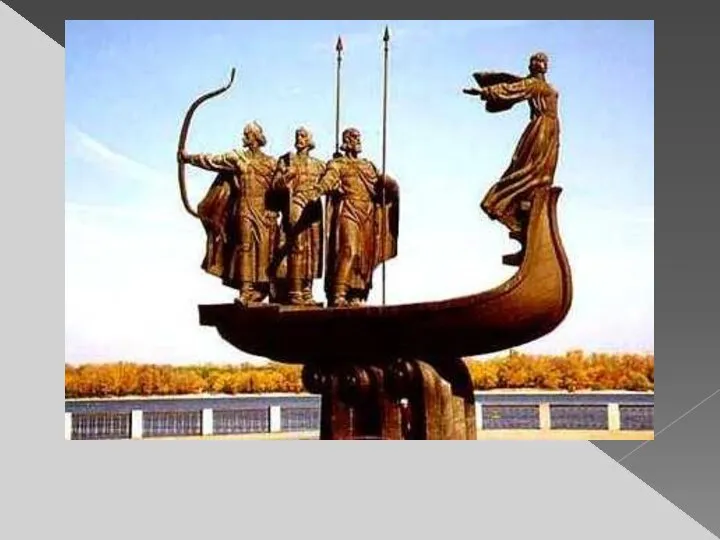

Jersey Stil Презентация к уроку английского языка "Kiev" - скачать

Презентация к уроку английского языка "Kiev" - скачать  Life stages

Life stages Презентация к уроку английского языка "Английские буквы и звуки" - скачать бесплатно

Презентация к уроку английского языка "Английские буквы и звуки" - скачать бесплатно Where is the monkey

Where is the monkey Present simple by herber

Present simple by herber Необычное путешествие Учитель английского языка МАОУ лицей № 28 им. Н. А. Рябова г. Тамбов Забавникова Анна Николаевна

Необычное путешествие Учитель английского языка МАОУ лицей № 28 им. Н. А. Рябова г. Тамбов Забавникова Анна Николаевна Работа над проектом “Riddles about animals” Авторы проекта: ученицы МБОУ СОШ № 27 г. Мытищи Московской области Кузнецова Наталья и Копташкина Татьяна Руководитель учитель английского языка Копташкина Н.В.

Работа над проектом “Riddles about animals” Авторы проекта: ученицы МБОУ СОШ № 27 г. Мытищи Московской области Кузнецова Наталья и Копташкина Татьяна Руководитель учитель английского языка Копташкина Н.В. Презентация к уроку английского языка "Биболетова 5 класс" - скачать бесплатно

Презентация к уроку английского языка "Биболетова 5 класс" - скачать бесплатно Презентация к уроку английского языка "The students' conference is dedicated to the third centenary since his birth." - скачать бесплатно

Презентация к уроку английского языка "The students' conference is dedicated to the third centenary since his birth." - скачать бесплатно WHY DO WE LIKE CHOCOLATE? Polina Chernysheva Nastya Rozhkova Dasha Kazakova Albina Mutallapova and Irina Vasiljevna Varfolomeeva

WHY DO WE LIKE CHOCOLATE? Polina Chernysheva Nastya Rozhkova Dasha Kazakova Albina Mutallapova and Irina Vasiljevna Varfolomeeva Revise vocabulary Discuss cities: reading, vocabulary, opinion Grammar: perfect forms

Revise vocabulary Discuss cities: reading, vocabulary, opinion Grammar: perfect forms Cooking lessons

Cooking lessons The Parks of London

The Parks of London Gender Differences In Business Role

Gender Differences In Business Role  Сослагательное наклонение

Сослагательное наклонение St. Petersburg Our favorite places of interest

St. Petersburg Our favorite places of interest To say, to tell, to speak, to talk Preparation for exam

To say, to tell, to speak, to talk Preparation for exam  Атеросклероз. Прямая и косвенная речь. Особенности трансформации повествовательных предложений

Атеросклероз. Прямая и косвенная речь. Особенности трансформации повествовательных предложений Packed & ready

Packed & ready Leisure Activities What is a hobby? What kind of leisure activities do you know? What do you prefer to do in your free time? Are hobbies the same in different countries?

Leisure Activities What is a hobby? What kind of leisure activities do you know? What do you prefer to do in your free time? Are hobbies the same in different countries? Сычева Ольга Михайловна, учитель английского языка ГОУ СОШ №1168 г.Москвы

Сычева Ольга Михайловна, учитель английского языка ГОУ СОШ №1168 г.Москвы Lesson 6 - flashcards

Lesson 6 - flashcards Great Britain In pictures

Great Britain In pictures  Facial expression

Facial expression