Содержание

- 2. Externalities Externality The uncompensated impact of one person’s actions on the well-being of a bystander Market

- 3. Externalities Examples of negative externalities: Exhaust from automobiles Barking dogs Examples of positive externalities: Restored historic

- 4. Externalities and Market Inefficiency Externalities Cause markets to allocate resources inefficiently Welfare economics: a recap Demand

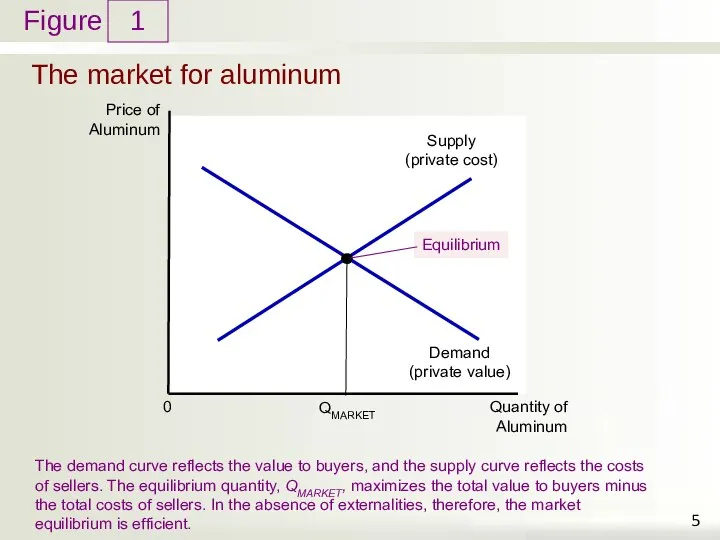

- 5. The market for aluminum 1 The demand curve reflects the value to buyers, and the supply

- 6. Externalities and Market Inefficiency Negative externalities Pollution Cost to society (of producing aluminum) Larger than the

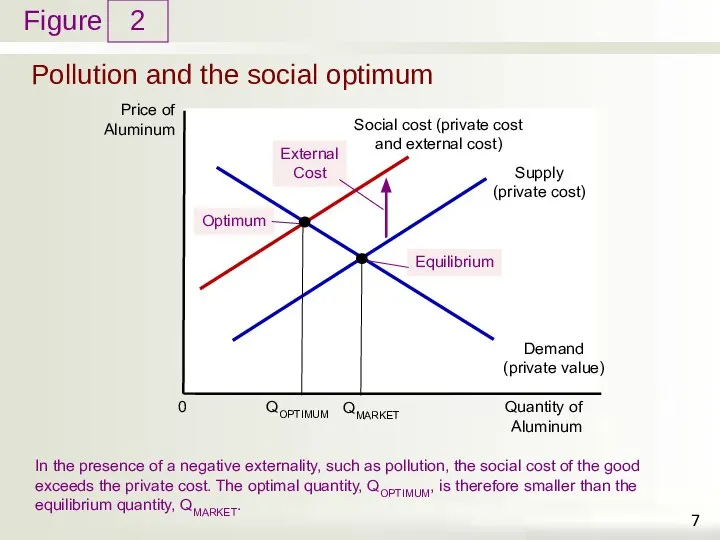

- 7. Pollution and the social optimum 2 In the presence of a negative externality, such as pollution,

- 8. Externalities and Market Inefficiency Negative externalities Optimum quantity produced Maximize total welfare Smaller than market equilibrium

- 9. Externalities and Market Inefficiency Positive externalities Education Benefit of education – private Externalities: better government, lower

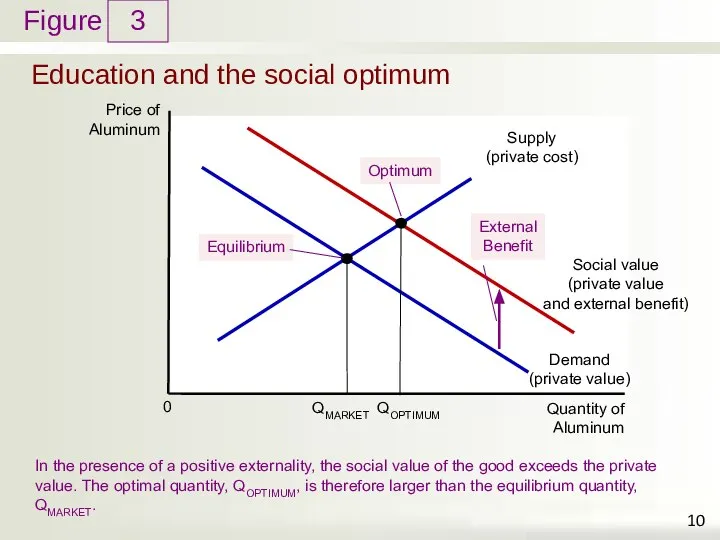

- 10. Education and the social optimum 3 In the presence of a positive externality, the social value

- 11. Externalities and Market Inefficiency Positive externalities Socially optimal quantity Greater than market equilibrium quantity Government –

- 12. Externalities and Market Inefficiency Negative externalities Markets - produce a larger quantity than is socially desirable

- 13. Technology spillover = Positive externality Impact of one firm’s research and production efforts on other firms’

- 14. Public Policies Toward Externalities Command-and-control policies: regulation Regulate behavior directly Making certain behaviors either required or

- 15. Public Policies Toward Externalities Market-based policies Provide incentives Private decision makers - choose to solve the

- 16. The gas tax = corrective tax Three negative externalities Congestion Accidents Pollution Doesn’t cause deadweight losses

- 17. How high should the tax on gasoline be? Most European countries Gasoline taxes - much higher

- 18. Public Policies Toward Externalities Market-based policies 2. Tradable pollution permits Voluntary transfer of the right to

- 19. Public Policies Toward Externalities 2. Tradable pollution permits Advantage of free market for pollution permits Initial

- 20. Public Policies Toward Externalities Reducing pollution using pollution permits or corrective taxes Firms pay for their

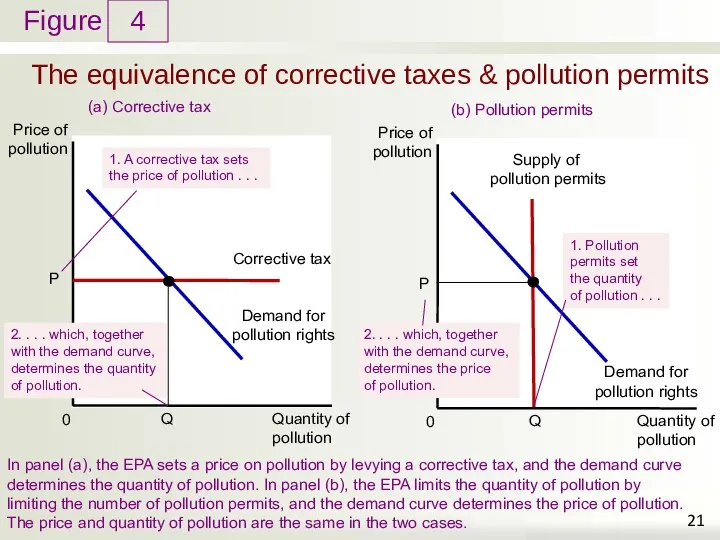

- 21. The equivalence of corrective taxes & pollution permits 4 In panel (a), the EPA sets a

- 22. Public Policies Toward Externalities Objections to the economic analysis of pollution “We cannot give anyone the

- 23. Public Policies Toward Externalities Clean environment - is a normal good Positive income elasticity Rich countries

- 24. Private Solutions to Externalities The types of private solutions Moral codes and social sanctions Charities Self-interest

- 25. Private Solutions to Externalities The Coase theorem If private parties can bargain without cost over the

- 27. Скачать презентацию

Эластичность предложения

Эластичность предложения Презентация Трудовые пенсии по инвалидности

Презентация Трудовые пенсии по инвалидности  Разработка мероприятий по повышению эффективности хозяйственной деятельности АО Плава

Разработка мероприятий по повышению эффективности хозяйственной деятельности АО Плава Выявление закономерности снижение цен на нефть и повышение пенсионного возраста

Выявление закономерности снижение цен на нефть и повышение пенсионного возраста Підприємницька ідея: механізм генерування та впровадження

Підприємницька ідея: механізм генерування та впровадження Налоги. Функции налогов

Налоги. Функции налогов Региональная экономика и управление

Региональная экономика и управление Трудовые ресурсы, песонал и трудовой потенциал общества

Трудовые ресурсы, песонал и трудовой потенциал общества Оснвные средства предприятий

Оснвные средства предприятий Экономика. Экономическая деятельность

Экономика. Экономическая деятельность Производство человеческого капитала. Инвестиции в человеческий капитал

Производство человеческого капитала. Инвестиции в человеческий капитал Пути и методы повышения конкурентоспособности услуг на примере салон-парикмахерской «Ассоль»

Пути и методы повышения конкурентоспособности услуг на примере салон-парикмахерской «Ассоль» Япония с конца 1940 по 2010 год

Япония с конца 1940 по 2010 год Мировое хозяйство на современном этапе

Мировое хозяйство на современном этапе Презентация Оценка производственных запасов

Презентация Оценка производственных запасов Инвестиционная политика предприятия и обоснование ее реализации

Инвестиционная политика предприятия и обоснование ее реализации Интерналии и экстерналии

Интерналии и экстерналии Планетарная модель атома. Постулаты Бора Подготовила: Порошина Лидия Владимировна, студентка очной формы обучения юридического ф

Планетарная модель атома. Постулаты Бора Подготовила: Порошина Лидия Владимировна, студентка очной формы обучения юридического ф Производительность и эффективность труда

Производительность и эффективность труда Современные проблемы стран Европы и Америки. Запад в условиях вызовов современности

Современные проблемы стран Европы и Америки. Запад в условиях вызовов современности Теоретические вопросы дисциплины Экономика образования, тема 1

Теоретические вопросы дисциплины Экономика образования, тема 1 Ординалистская, порядковая теория полезности. Лекция 7

Ординалистская, порядковая теория полезности. Лекция 7 Уральский экономический район. Географическое положение, природные условия и ресурсы

Уральский экономический район. Географическое положение, природные условия и ресурсы Бинарные (фиктивные) переменные

Бинарные (фиктивные) переменные Анализ динамики цен на товары и услуги за последние 10 лет

Анализ динамики цен на товары и услуги за последние 10 лет Презентация Смерч

Презентация Смерч Кризисы 1970-1980-х гг. Становление информационного общества

Кризисы 1970-1980-х гг. Становление информационного общества НЕРАВЕНСТВО ДОХОДОВ В ОБЩЕСТВЕ

НЕРАВЕНСТВО ДОХОДОВ В ОБЩЕСТВЕ