Содержание

- 2. Russia (Russian: Росси́я, tr. Rossiya, IPA: [rɐˈsʲijə]), officially the Russian Federation (Russian: Росси́йская Федера́ция, tr. Rossiyskaya

- 3. In 2014, the volume of direct foreign investment in the economy Russia has shrunk compared to

- 4. Investments in fixed assets, January-August 2015 Statistics for the first eight months of 2015 show that

- 5. Leaders and outsiders on the dynamics of investment in QA in 2015.

- 6. Factors of territorial investment attractiveness Investment attractiveness of the country / region - a full set

- 7. Findings • The total volume of investments in Russia (including foreign ones) has decreased significantly and

- 9. Скачать презентацию

Russia (Russian: Росси́я, tr. Rossiya, IPA: [rɐˈsʲijə]), officially the Russian Federation (Russian: Росси́йская Федера́ция, tr. Rossiyskaya Federatsiya, IPA: [rɐˈsʲijskəjə fʲɪdʲɪˈratsɨjə]), is a transcontinental country in Eastern Europe and North

Russia (Russian: Росси́я, tr. Rossiya, IPA: [rɐˈsʲijə]), officially the Russian Federation (Russian: Росси́йская Федера́ция, tr. Rossiyskaya Federatsiya, IPA: [rɐˈsʲijskəjə fʲɪdʲɪˈratsɨjə]), is a transcontinental country in Eastern Europe and North

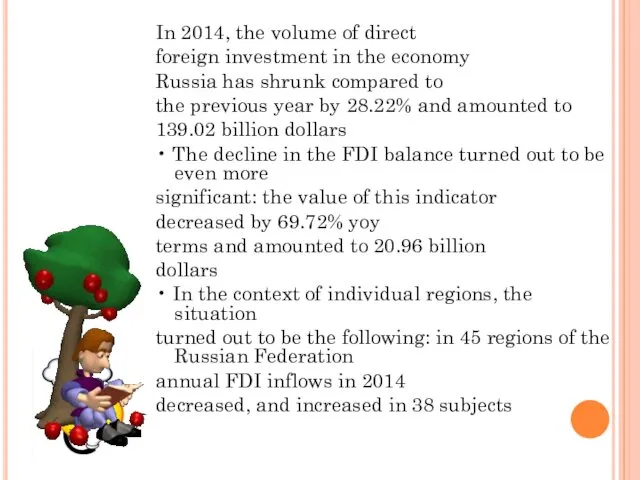

In 2014, the volume of direct

foreign investment in the economy

Russia has

In 2014, the volume of direct

foreign investment in the economy

Russia has

the previous year by 28.22% and amounted to

139.02 billion dollars

• The decline in the FDI balance turned out to be even more

significant: the value of this indicator

decreased by 69.72% yoy

terms and amounted to 20.96 billion

dollars

• In the context of individual regions, the situation

turned out to be the following: in 45 regions of the Russian Federation

annual FDI inflows in 2014

decreased, and increased in 38 subjects

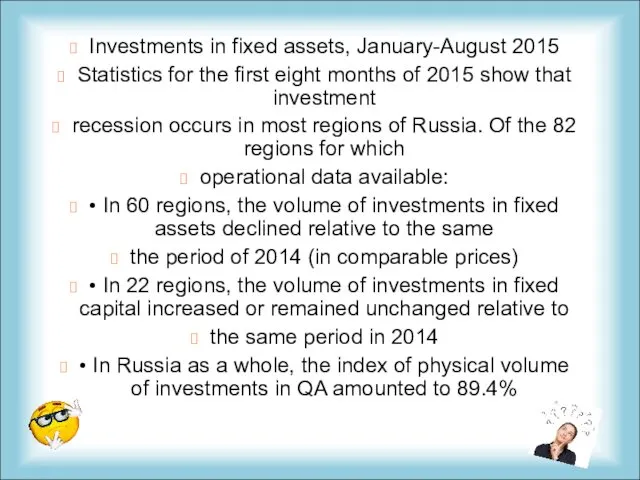

Investments in fixed assets, January-August 2015

Statistics for the first eight months

Investments in fixed assets, January-August 2015

Statistics for the first eight months

recession occurs in most regions of Russia. Of the 82 regions for which

operational data available:

• In 60 regions, the volume of investments in fixed assets declined relative to the same

the period of 2014 (in comparable prices)

• In 22 regions, the volume of investments in fixed capital increased or remained unchanged relative to

the same period in 2014

• In Russia as a whole, the index of physical volume of investments in QA amounted to 89.4%

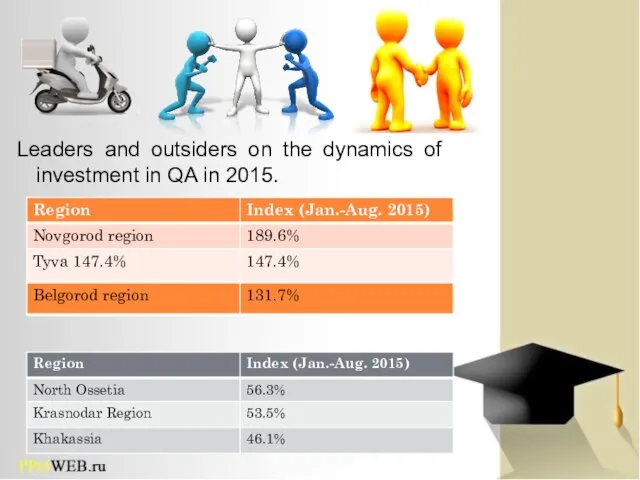

Leaders and outsiders on the dynamics of investment in QA in

Leaders and outsiders on the dynamics of investment in QA in

Factors of territorial investment attractiveness

Investment attractiveness of the country / region

-

Factors of territorial investment attractiveness

Investment attractiveness of the country / region

-

yield of investment projects implemented within the boundaries

this territorial entity

("A full set of benefits for the investor")

Base Terms -

investment factors

attractions that are not

subject to change as a result

human activities

(factors of "first nature")

Investment climate -

investment factors

attractions that can

change as a result of activities

states and societies

(factors of "second nature")

Findings

• The total volume of investments in Russia (including foreign ones)

Findings

• The total volume of investments in Russia (including foreign ones)

will return soon to the pre-crisis level

• Replication of the best investment climate practices in the framework of the “Regional Investment

standard "formally smoothes differences between regions with similar economic models

• The competition for attracting limited investment resources between

regions

![Russia (Russian: Росси́я, tr. Rossiya, IPA: [rɐˈsʲijə]), officially the Russian Federation](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/462685/slide-1.jpg)

Мировое хозяйство. 10 класс

Мировое хозяйство. 10 класс Экономика

Экономика Социально-экономическое развитие Республики Крым и Севастополя на период до 2020 года

Социально-экономическое развитие Республики Крым и Севастополя на период до 2020 года Экономико-статистические методы, используемые при разработке стратегии и программ

Экономико-статистические методы, используемые при разработке стратегии и программ Контрольная работа. Дисциплина: Экономика отрасли инфокоммуникаций

Контрольная работа. Дисциплина: Экономика отрасли инфокоммуникаций Заработная плата и её виды. Профессии. Карьера

Заработная плата и её виды. Профессии. Карьера Экономическая теория и микроэкономика

Экономическая теория и микроэкономика Презентация урока по дисциплине «Основы менеджмента

Презентация урока по дисциплине «Основы менеджмента Проблемы регулирования и внедрения конкуренции на регулируемые рынки естественных монополий

Проблемы регулирования и внедрения конкуренции на регулируемые рынки естественных монополий Изучение рынка мяса птицы в г. Улан-Удэ

Изучение рынка мяса птицы в г. Улан-Удэ Концентрация производства и капитала. Создание монополий

Концентрация производства и капитала. Создание монополий Человек в техносфере. Экономические, социокультурные и экологические последствия развития техники

Человек в техносфере. Экономические, социокультурные и экологические последствия развития техники Основные фонды предприятия

Основные фонды предприятия Макроэкономическая нестабильность и экономический рост

Макроэкономическая нестабильность и экономический рост Экономический риск и его оценка

Экономический риск и его оценка Программа "Мастера жизни"

Программа "Мастера жизни" Ұлттық экономикадағы қаржы және ақша-несие жүйесі

Ұлттық экономикадағы қаржы және ақша-несие жүйесі Комитет по развитию предпринимательства и потребительского рынка Санкт-Петербурга

Комитет по развитию предпринимательства и потребительского рынка Санкт-Петербурга Модернизация предприятия на основе новейших технологий

Модернизация предприятия на основе новейших технологий Рыночная экономика

Рыночная экономика Анализ эффективности мер государственной поддержки реализации программ импортозамещения в России

Анализ эффективности мер государственной поддержки реализации программ импортозамещения в России Характеристика и функциональные принципы ФСБ Выполнили: Губанова.М, Галибина Л., Климушина Ю., Кучеров И.

Характеристика и функциональные принципы ФСБ Выполнили: Губанова.М, Галибина Л., Климушина Ю., Кучеров И.  Совокупный спрос и совокупное предложение. Сущность, ценовые и неценовые факторы

Совокупный спрос и совокупное предложение. Сущность, ценовые и неценовые факторы Задачи и функции отдела организации труда и заработной платы

Задачи и функции отдела организации труда и заработной платы Демографическое и экологическое влияние на сотрудничество в области распределения благ

Демографическое и экологическое влияние на сотрудничество в области распределения благ Ұлттық экономикамыздың жетекші күші – кәсіпкерлікті жан-жақты қолдау

Ұлттық экономикамыздың жетекші күші – кәсіпкерлікті жан-жақты қолдау Preţurile în cadrul comerţului internaţional

Preţurile în cadrul comerţului internaţional Экономический цикл

Экономический цикл