Содержание

- 2. Lecture Objectives Introduce the idea and rationale for forecast averaging Identify forecast averaging implementation issues Become

- 3. Introduction Usually, multiple forecasts are available to decision makers Differences in forecasts reflect: differences in subjective

- 4. Introduction Disadvantages of using a single forecasting model: may contain misspecifications of an unknown form e.g.,

- 5. Outline of the lecture What is a combination of forecasts? The theoretical problem and implementation issues

- 6. Part I. What is a combination of forecasts? General framework and notation The forecast combination problem

- 7. General framework Today (at time T) we want to forecast the value of (at T+h) We

- 8. Notation is the value of Y at time t (today is T ) h is the

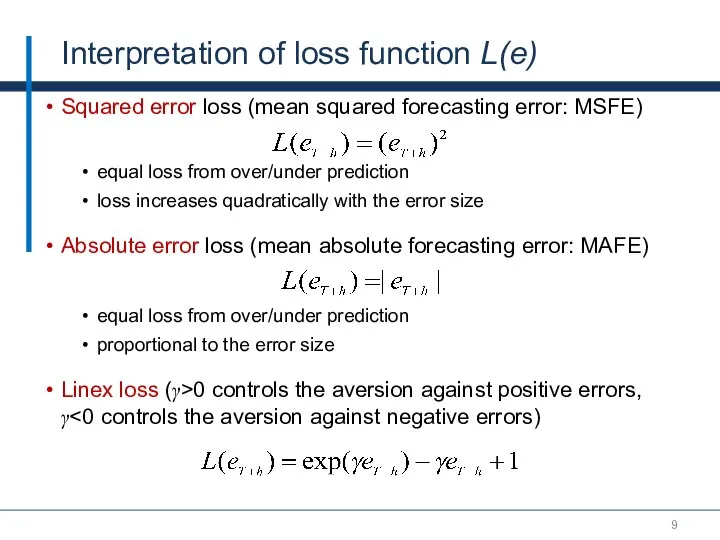

- 9. Interpretation of loss function L(e) Squared error loss (mean squared forecasting error: MSFE) equal loss from

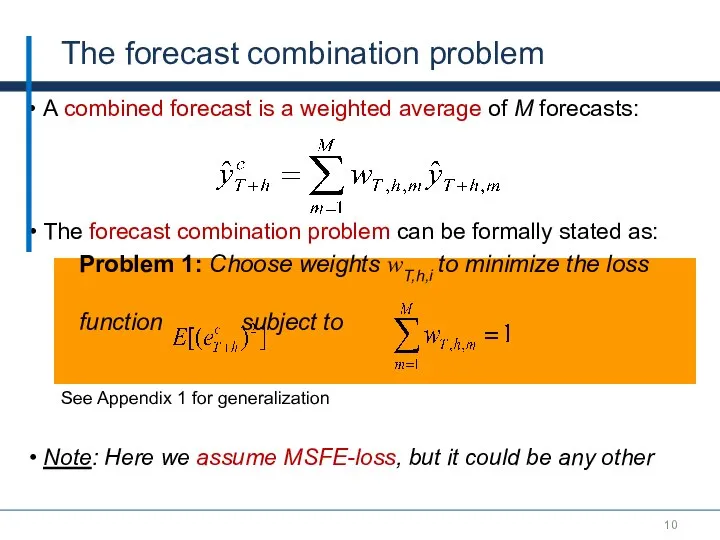

- 10. A combined forecast is a weighted average of M forecasts: The forecast combination problem can be

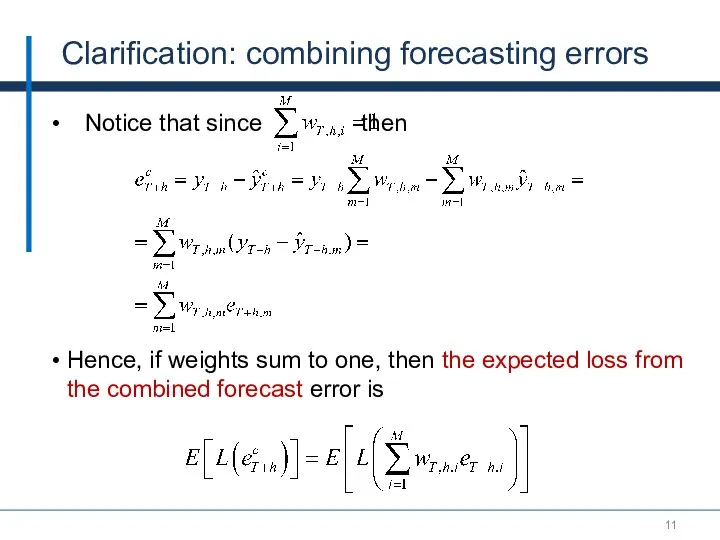

- 11. Clarification: combining forecasting errors Notice that since then Hence, if weights sum to one, then the

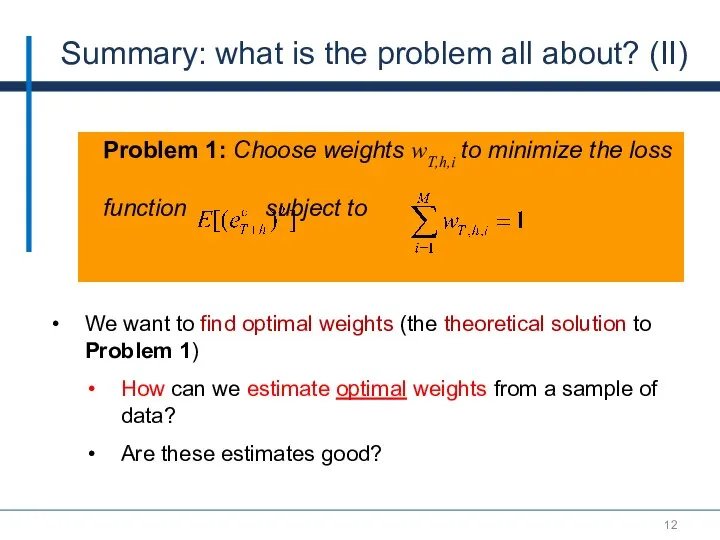

- 12. Summary: what is the problem all about? (II) We want to find optimal weights (the theoretical

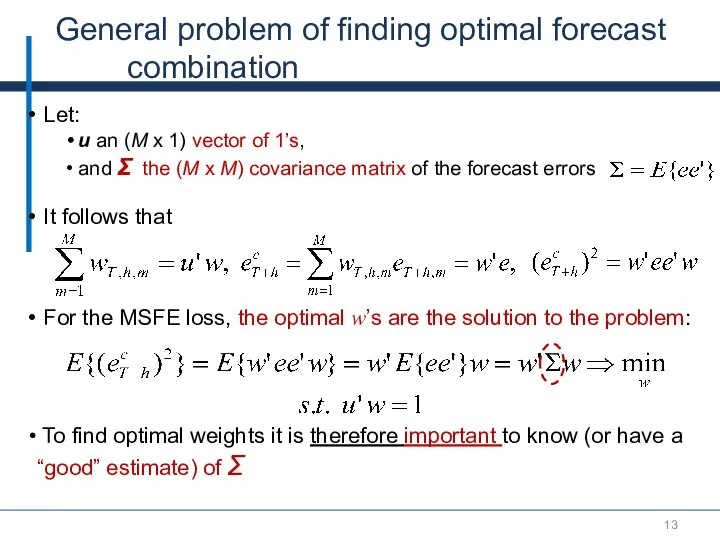

- 13. General problem of finding optimal forecast combination Let: u an (M x 1) vector of 1’s,

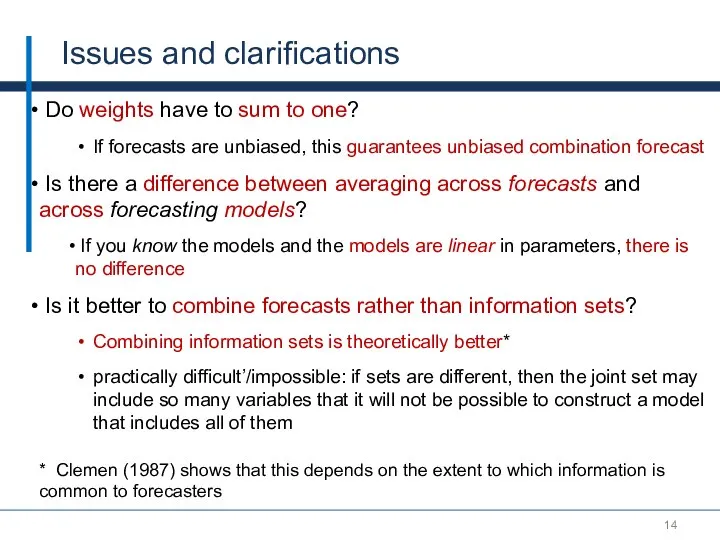

- 14. Issues and clarifications Do weights have to sum to one? If forecasts are unbiased, this guarantees

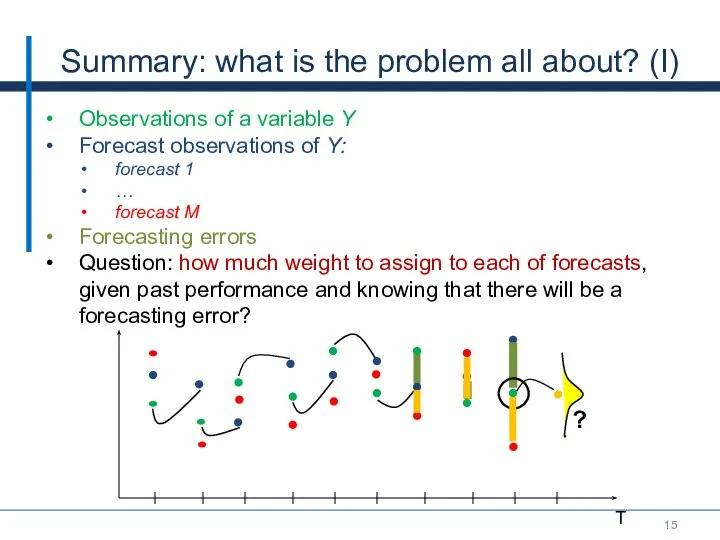

- 15. Summary: what is the problem all about? (I) Observations of a variable Y Forecast observations of

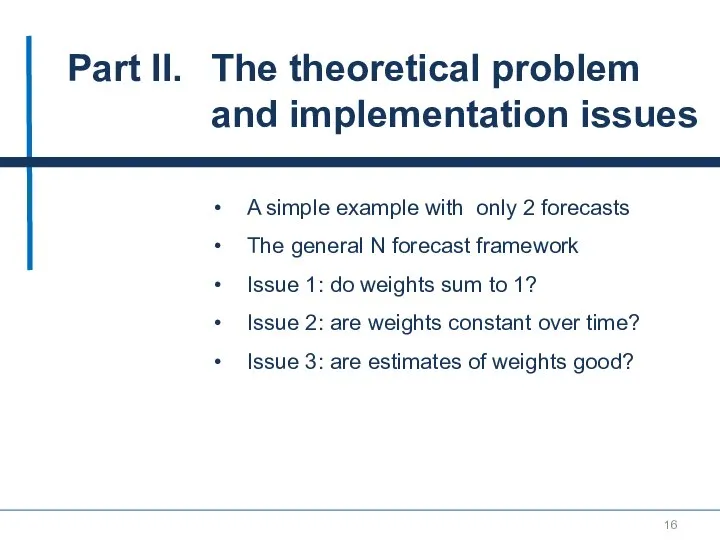

- 16. Part II. The theoretical problem and implementation issues A simple example with only 2 forecasts The

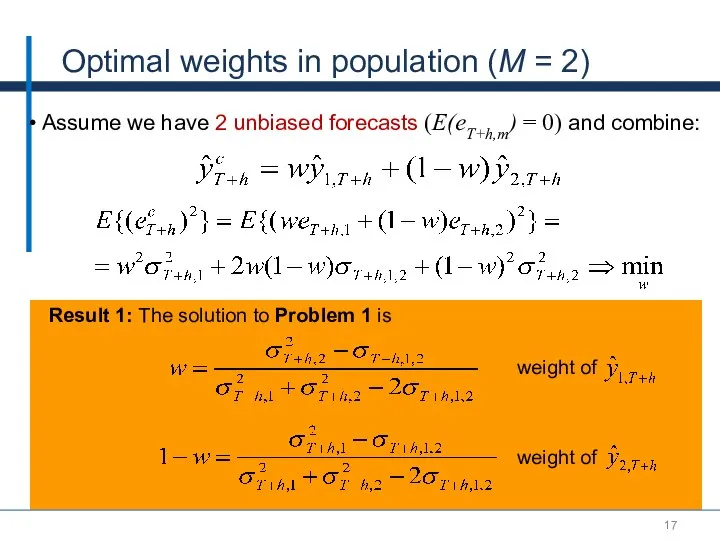

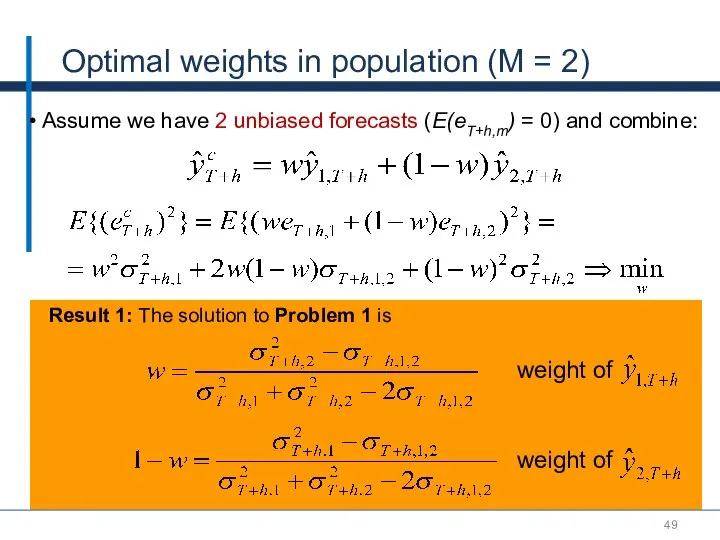

- 17. Optimal weights in population (M = 2) Result 1: The solution to Problem 1 is weight

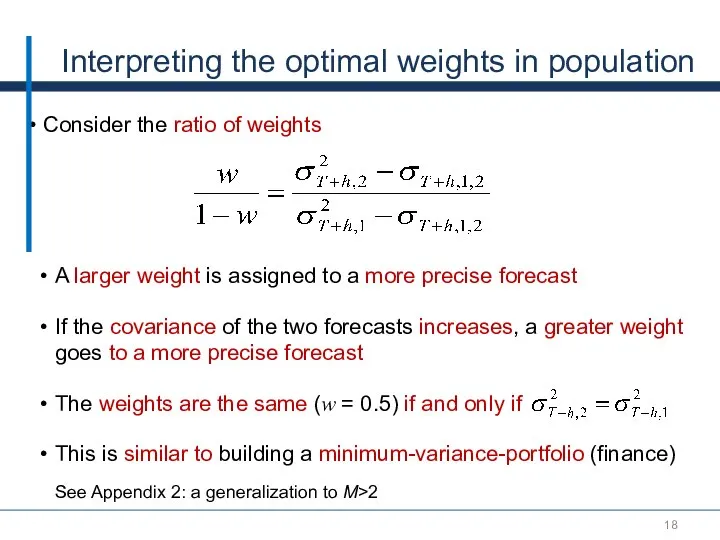

- 18. Interpreting the optimal weights in population Consider the ratio of weights A larger weight is assigned

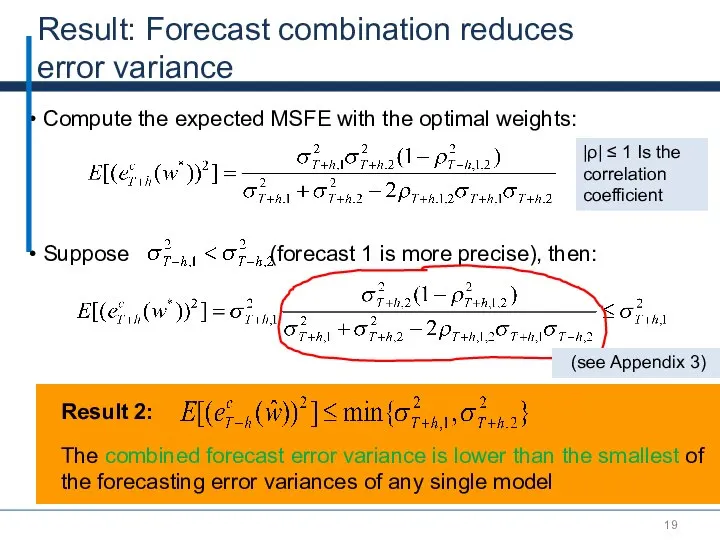

- 19. Result: Forecast combination reduces error variance Compute the expected MSFE with the optimal weights: |ρ| ≤

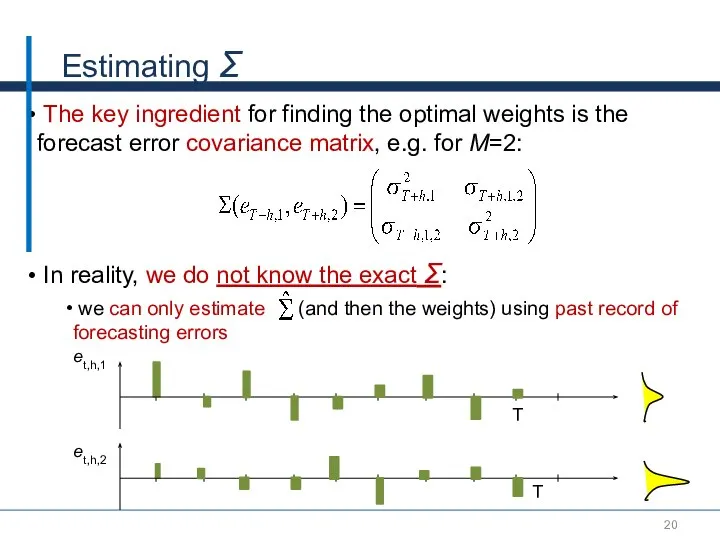

- 20. Estimating Σ The key ingredient for finding the optimal weights is the forecast error covariance matrix,

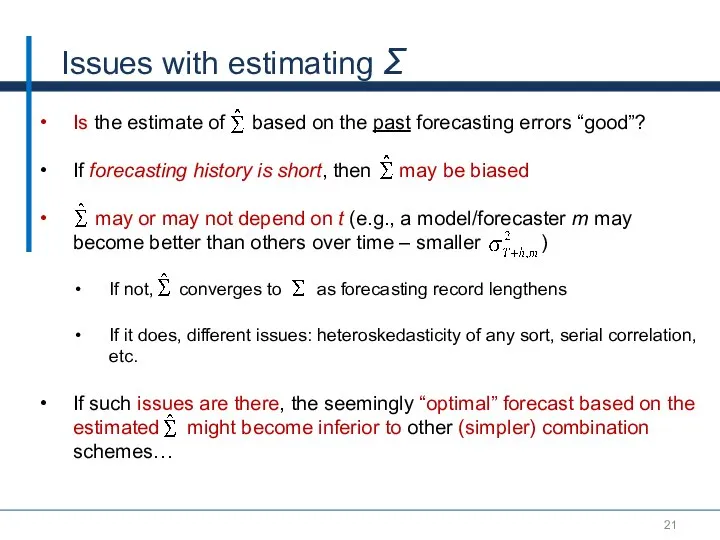

- 21. Issues with estimating Σ Is the estimate of based on the past forecasting errors “good”? If

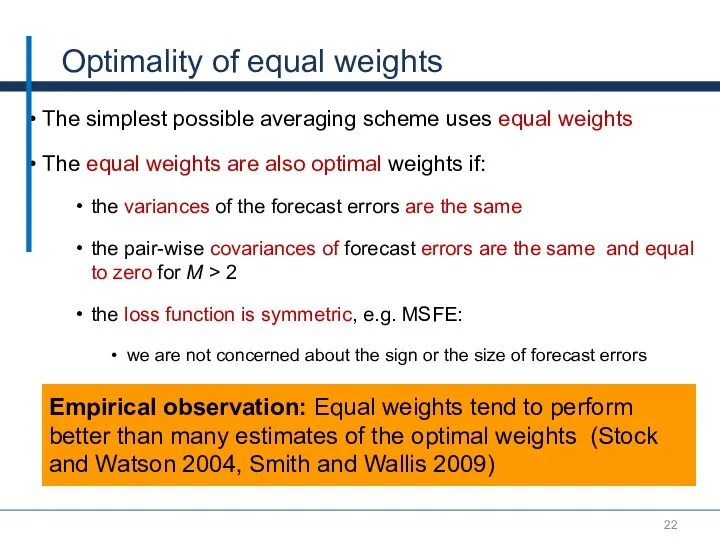

- 22. Optimality of equal weights The simplest possible averaging scheme uses equal weights The equal weights are

- 23. Part III. Methods to estimate the weights: M is small relative to T (M

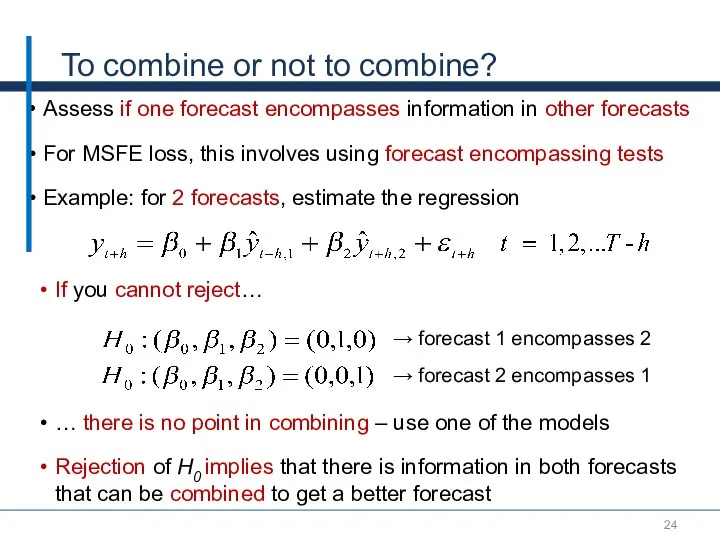

- 24. To combine or not to combine? Assess if one forecast encompasses information in other forecasts For

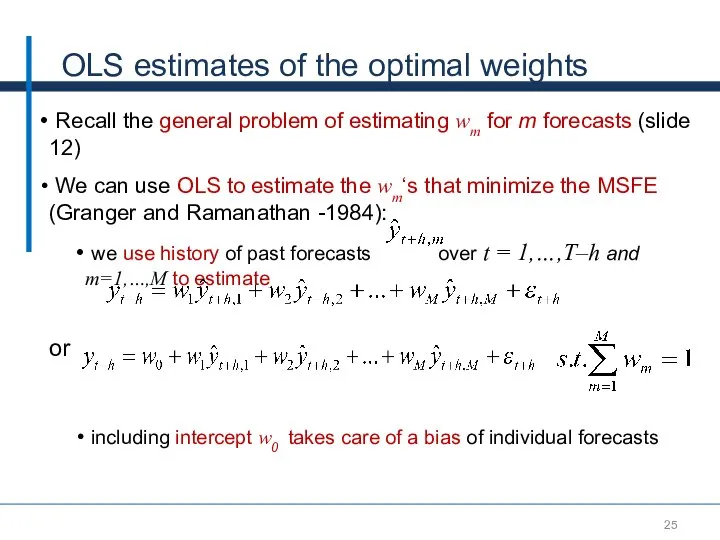

- 25. OLS estimates of the optimal weights Recall the general problem of estimating wm for m forecasts

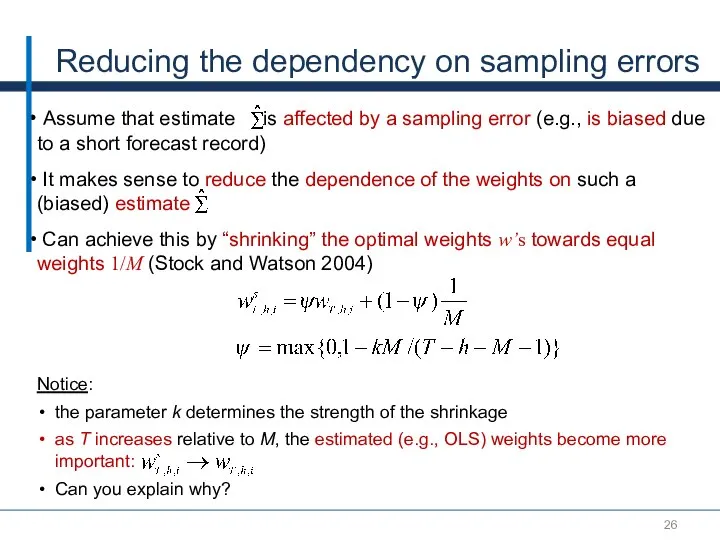

- 26. Reducing the dependency on sampling errors Assume that estimate is affected by a sampling error (e.g.,

- 27. Part IV. Methods to estimate the weights: when M is large relative to T

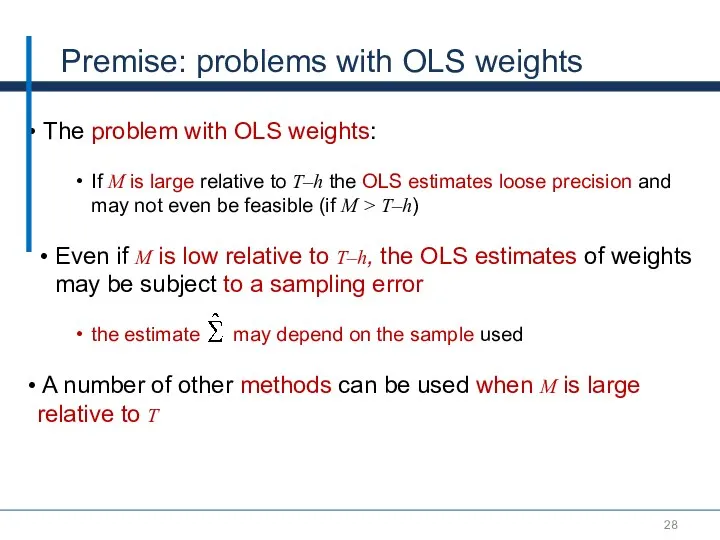

- 28. Premise: problems with OLS weights The problem with OLS weights: If M is large relative to

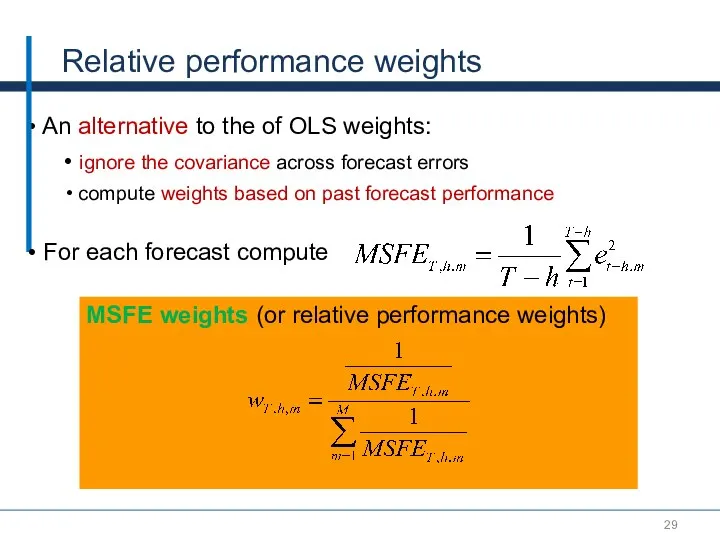

- 29. MSFE weights (or relative performance weights) Relative performance weights An alternative to the of OLS weights:

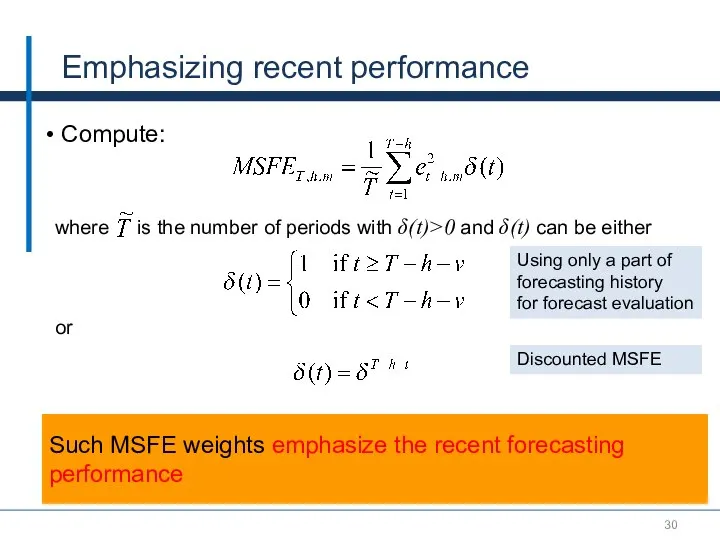

- 30. Emphasizing recent performance Compute: where is the number of periods with δ(t)>0 and δ(t) can be

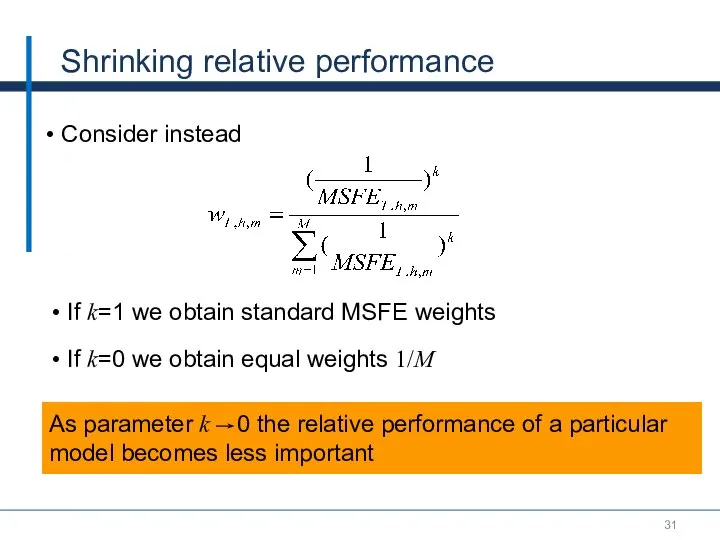

- 31. Shrinking relative performance Consider instead As parameter k 0 the relative performance of a particular model

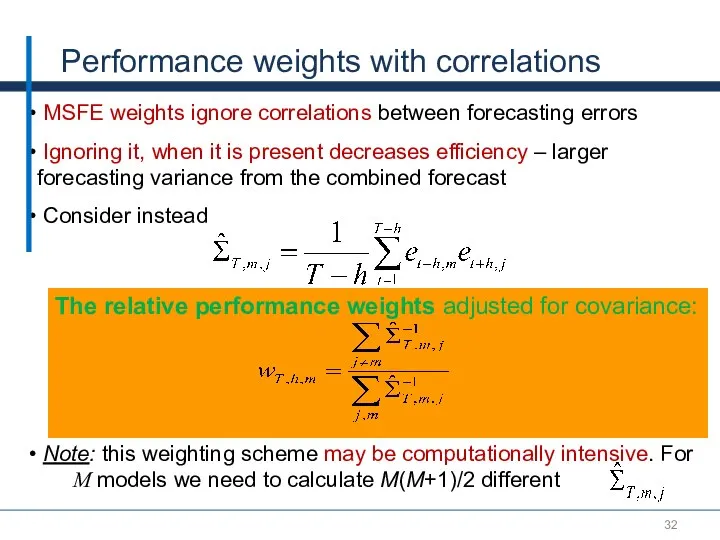

- 32. MSFE weights ignore correlations between forecasting errors Ignoring it, when it is present decreases efficiency –

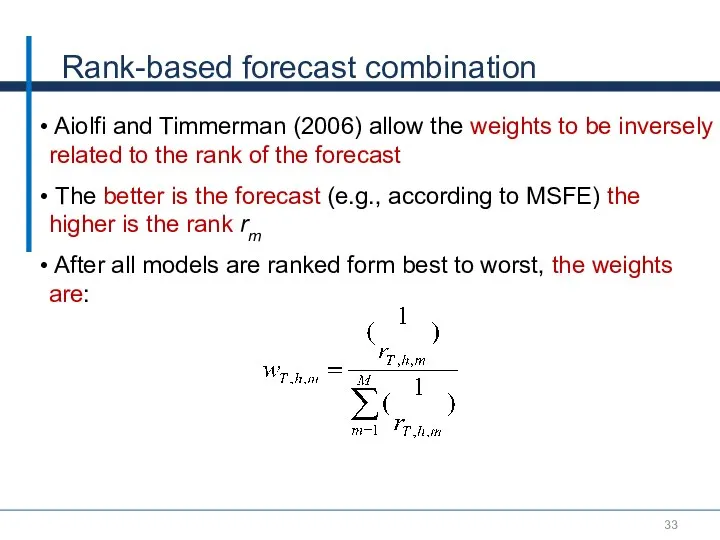

- 33. Rank-based forecast combination Aiolfi and Timmerman (2006) allow the weights to be inversely related to the

- 34. Trimming In forecast combination, it is often advantageous to discard models with the worst and best

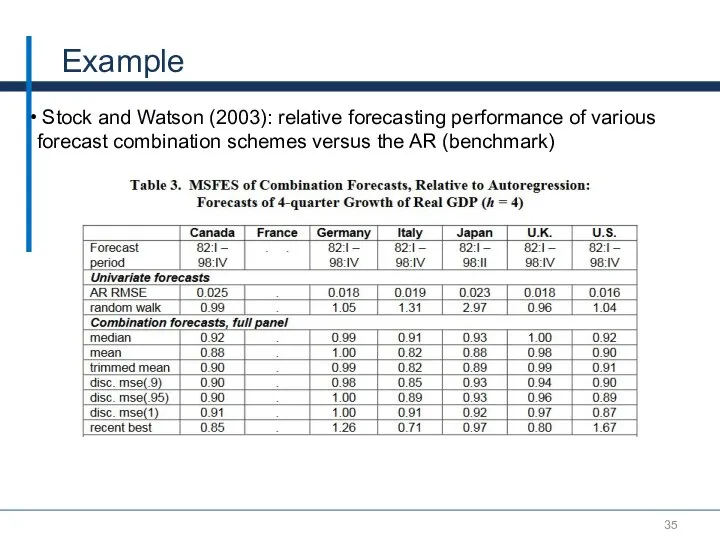

- 35. Example Stock and Watson (2003): relative forecasting performance of various forecast combination schemes versus the AR

- 36. Part V. Improving the Estimates of the Theoretical Model Performance: Knowing the parameters in the model

- 37. Question So far we assumed that we do not know models from which forecasts originate Would

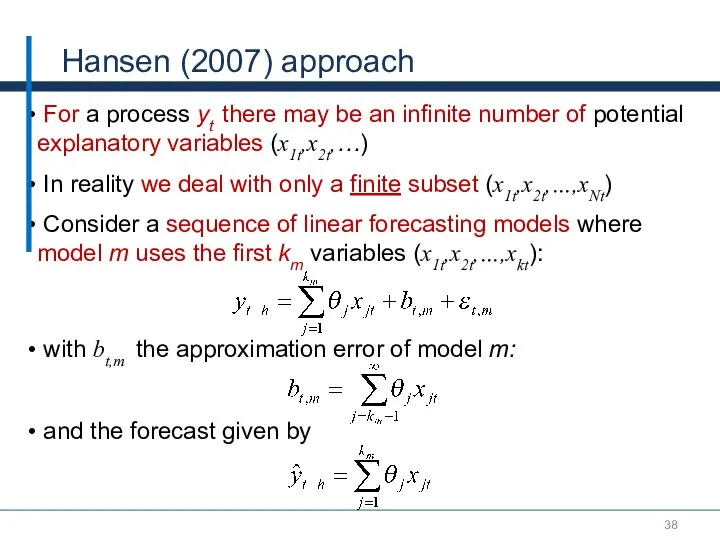

- 38. Hansen (2007) approach For a process yt there may be an infinite number of potential explanatory

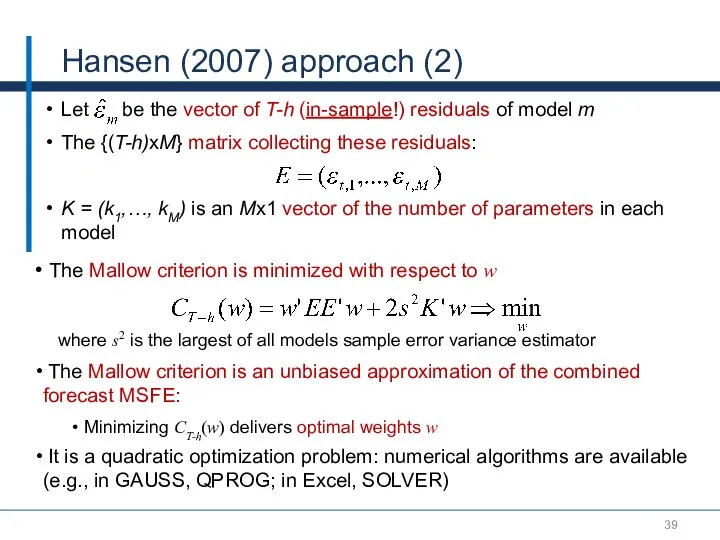

- 39. Hansen (2007) approach (2) Let be the vector of T-h (in-sample!) residuals of model m The

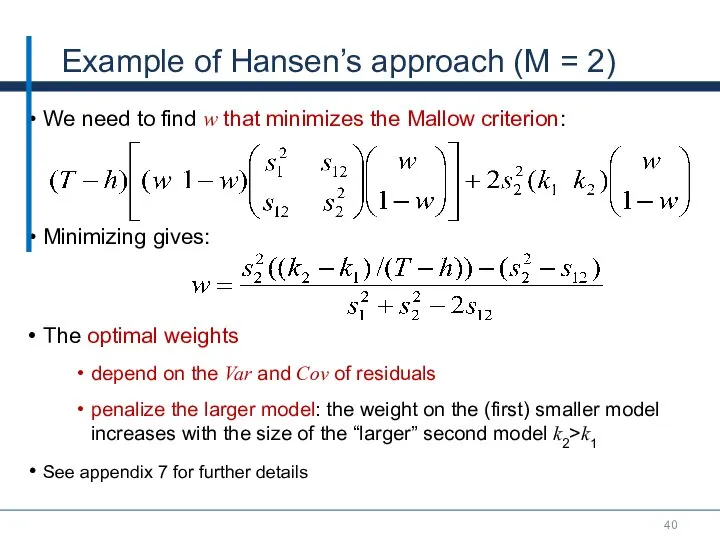

- 40. Example of Hansen’s approach (M = 2) We need to find w that minimizes the Mallow

- 41. Conclusions – Key Takeaways Combined forecasts imply diversification of risk (provided not all the models suffer

- 42. Thank You!

- 43. References Aiolfi, Capistran and Timmerman, 2010, “Forecast Combinations“, in Forecast Handbook, Oxford, Edited by Michael Clements

- 44. Appendix

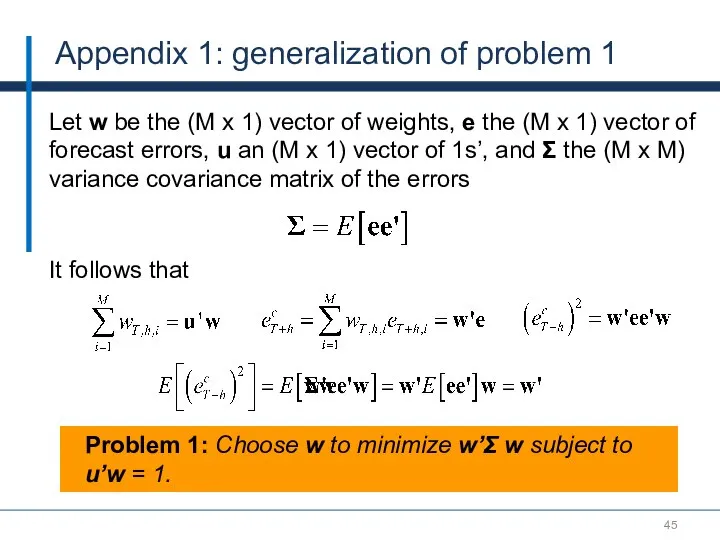

- 45. Appendix 1: generalization of problem 1 Let w be the (M x 1) vector of weights,

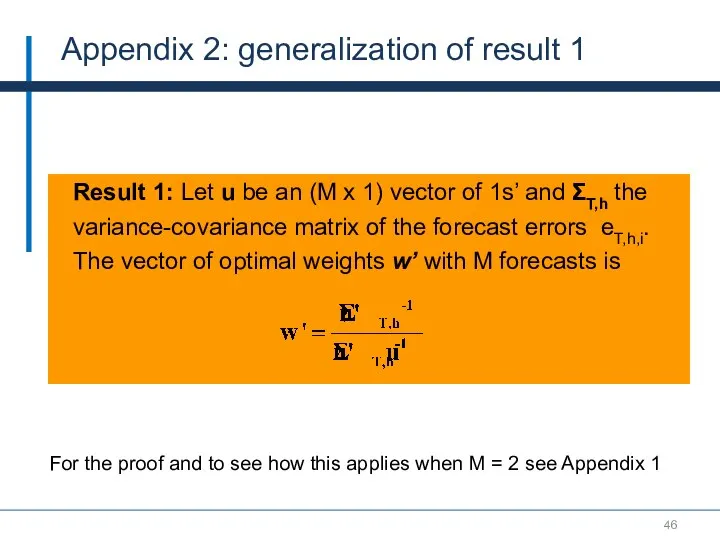

- 46. Result 1: Let u be an (M x 1) vector of 1s’ and ΣT,h the variance-covariance

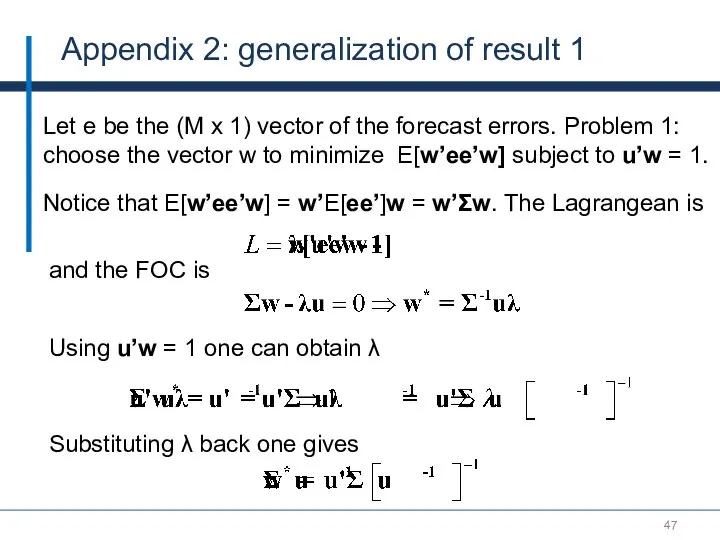

- 47. Appendix 2: generalization of result 1 Let e be the (M x 1) vector of the

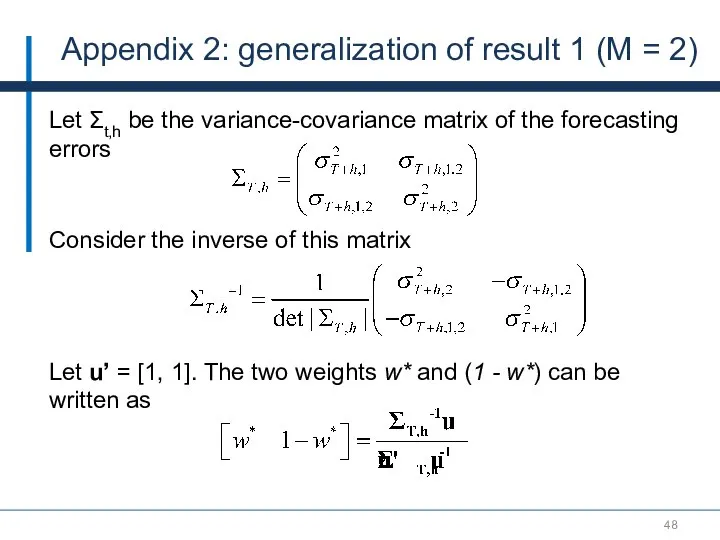

- 48. Appendix 2: generalization of result 1 (M = 2) Let Σt,h be the variance-covariance matrix of

- 49. Optimal weights in population (M = 2) Result 1: The solution to Problem 1 is weight

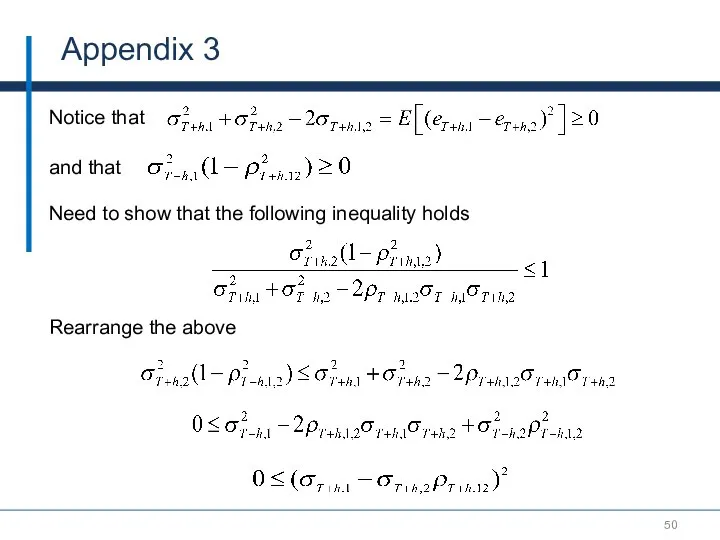

- 50. Appendix 3 Notice that Need to show that the following inequality holds and that Rearrange the

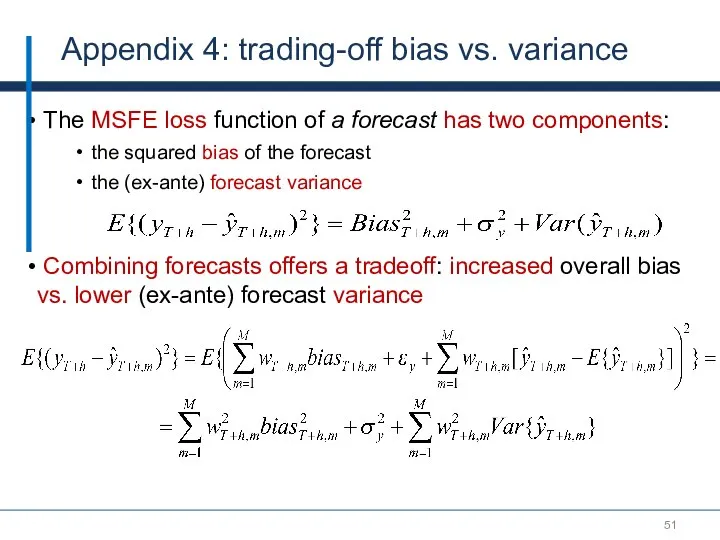

- 51. Appendix 4: trading-off bias vs. variance The MSFE loss function of a forecast has two components:

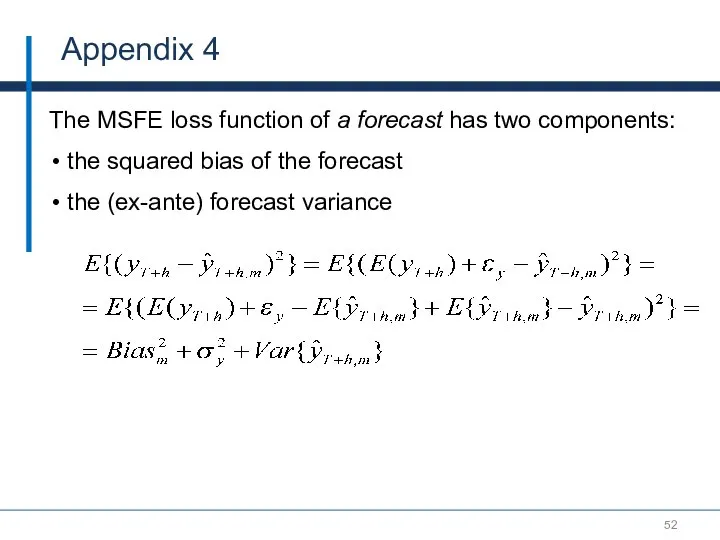

- 52. Appendix 4 The MSFE loss function of a forecast has two components: the squared bias of

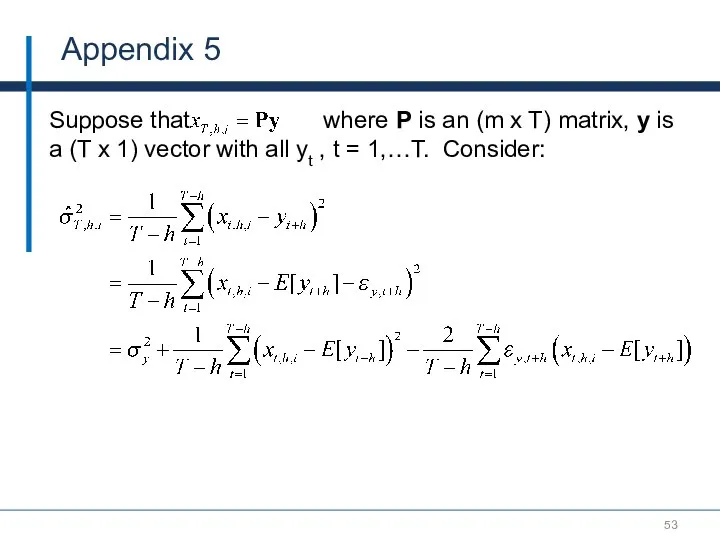

- 53. Appendix 5 Suppose that where P is an (m x T) matrix, y is a (T

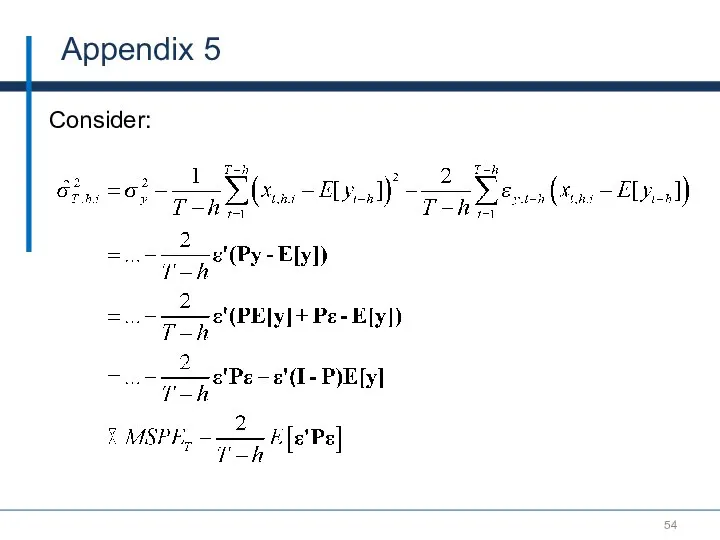

- 54. Appendix 5 Consider:

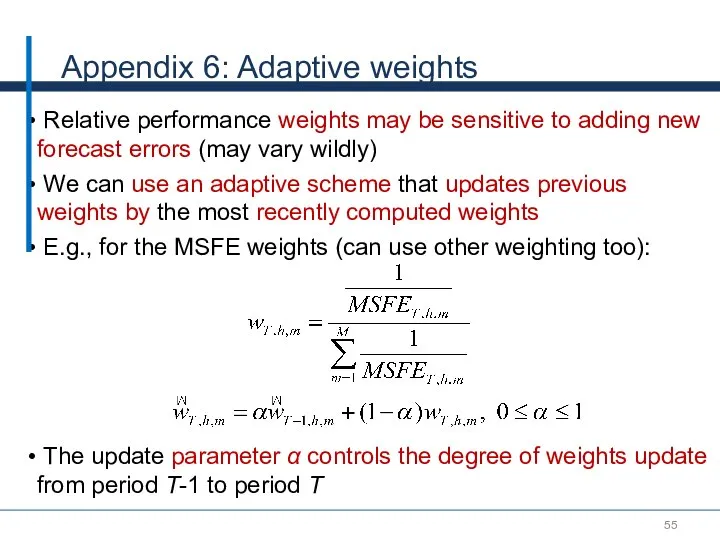

- 55. Appendix 6: Adaptive weights Relative performance weights may be sensitive to adding new forecast errors (may

- 57. Скачать презентацию

Трудовые ресурсы. Экономика предприятия. Лекция 7

Трудовые ресурсы. Экономика предприятия. Лекция 7 Место судебно-экономической экспертизы в ряду судебных экспертиз, ее особенности. Другие виды судебно-экономических экспертиз

Место судебно-экономической экспертизы в ряду судебных экспертиз, ее особенности. Другие виды судебно-экономических экспертиз Сущность процесса создания и продвижения инновации: эволюция подходов и участники взаимодействия

Сущность процесса создания и продвижения инновации: эволюция подходов и участники взаимодействия Конкуренция и ее виды в России

Конкуренция и ее виды в России Економічна система, типи економічних систем, економічний кругообіг

Економічна система, типи економічних систем, економічний кругообіг Эндогенные теории экономического роста

Эндогенные теории экономического роста Анализ рынка парфюмерии и косметики

Анализ рынка парфюмерии и косметики Основы экономики. Основной капитал

Основы экономики. Основной капитал Эволюция управленческой мысли

Эволюция управленческой мысли Биржевое направление Открой все тайны финансового мира! - презентация

Биржевое направление Открой все тайны финансового мира! - презентация Оценка эффективности информатизации

Оценка эффективности информатизации Технические регламенты и порядок их разработки

Технические регламенты и порядок их разработки Общее равновесие, эффективность и общественное благосостояние (Тема 7)

Общее равновесие, эффективность и общественное благосостояние (Тема 7) Государство Гватемала

Государство Гватемала Детерминанты развития экономико-исторического процесса

Детерминанты развития экономико-исторического процесса Макроэкономическая политика реиндустриализации и импортозамещения

Макроэкономическая политика реиндустриализации и импортозамещения Экономические системы. Виды, механизм функционирования

Экономические системы. Виды, механизм функционирования Международный рейтинг конкурентоспособности стран в цифровой среде

Международный рейтинг конкурентоспособности стран в цифровой среде Споживчий кошик українця

Споживчий кошик українця Структура и методы оценки основных фондов автомобильного транспорта

Структура и методы оценки основных фондов автомобильного транспорта Прогнозирование и планирование финансов

Прогнозирование и планирование финансов Содержание и назначение системы национального счетоводства

Содержание и назначение системы национального счетоводства Энергосбережение. Теоретические основы поисков и разведки нефти и газа

Энергосбережение. Теоретические основы поисков и разведки нефти и газа Инвистициалардың даму проблемалары мен перспективалары

Инвистициалардың даму проблемалары мен перспективалары Интеграция. Факторы интеграции

Интеграция. Факторы интеграции Платежный баланс как отражение международных валютнокредитных операций страны

Платежный баланс как отражение международных валютнокредитных операций страны Презентация Долговые ценные бумаги

Презентация Долговые ценные бумаги Глобализация. Современные символы глобализации

Глобализация. Современные символы глобализации