Содержание

- 2. Inflation Inflation in historical perspective low inflation in 1950s and 60s high inflation in 1970s and

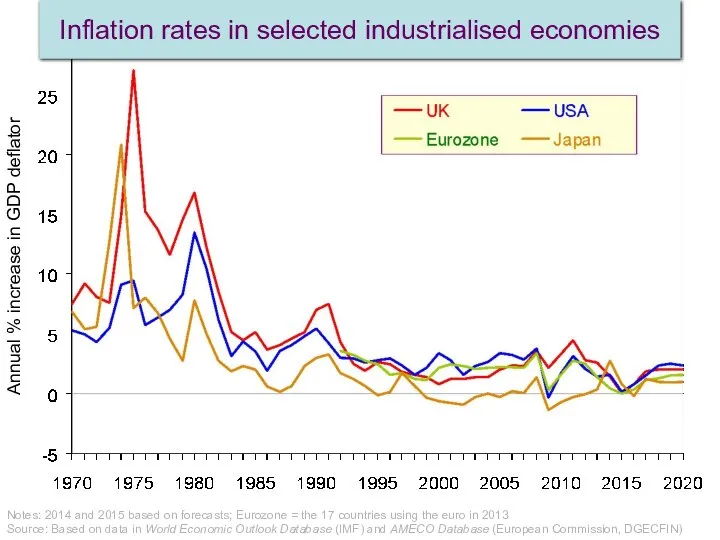

- 3. Annual % increase in GDP deflator Inflation rates in selected industrialised economies Notes: 2014 and 2015

- 4. The distinction between real and nominal values. Nominal figures are those using current prices, interest rates,

- 5. Q In a period of rapid inflation which of the following would be the least desirable

- 6. Inflation Aggregate demand & supply and prices The level of prices in the economy is determined

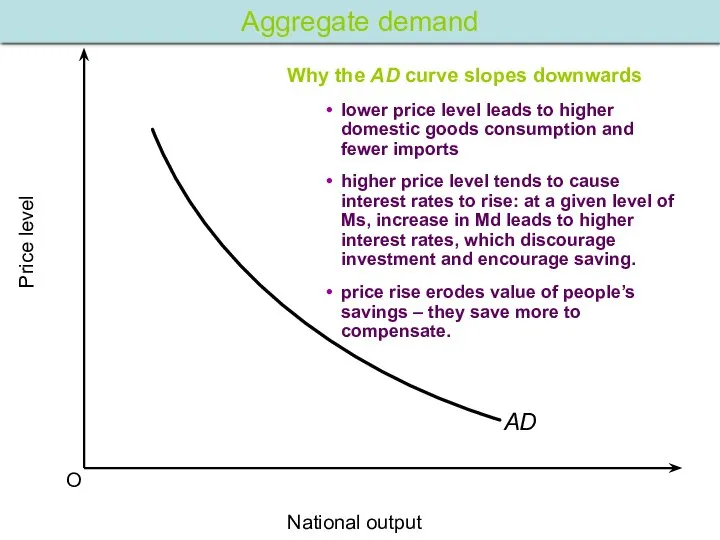

- 7. O Price level National output Aggregate demand Why the AD curve slopes downwards lower price level

- 8. Inflation Aggregate demand & supply and prices aggregate demand curve aggregate supply curve The aggregate supply

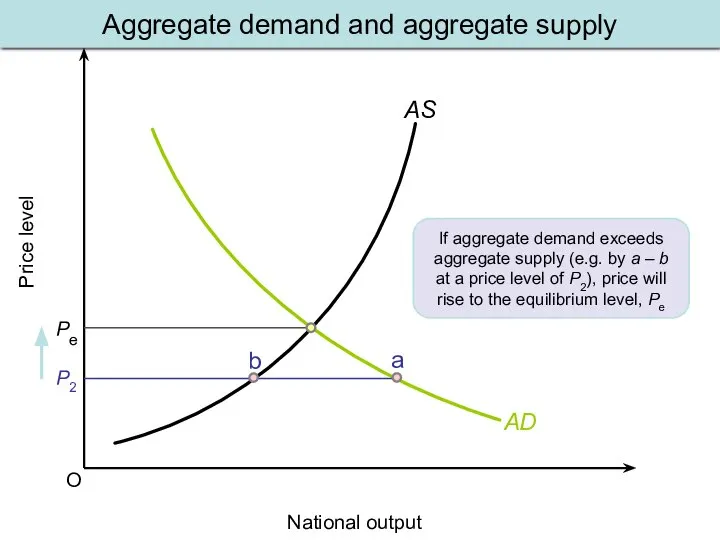

- 9. O Price level National output AS AD Aggregate demand and aggregate supply If aggregate demand exceeds

- 10. Inflation Aggregate demand & supply and prices aggregate demand curve aggregate supply curve why AS curves

- 11. Q As the price level in the economy rises, which of the following occurs? (i) The

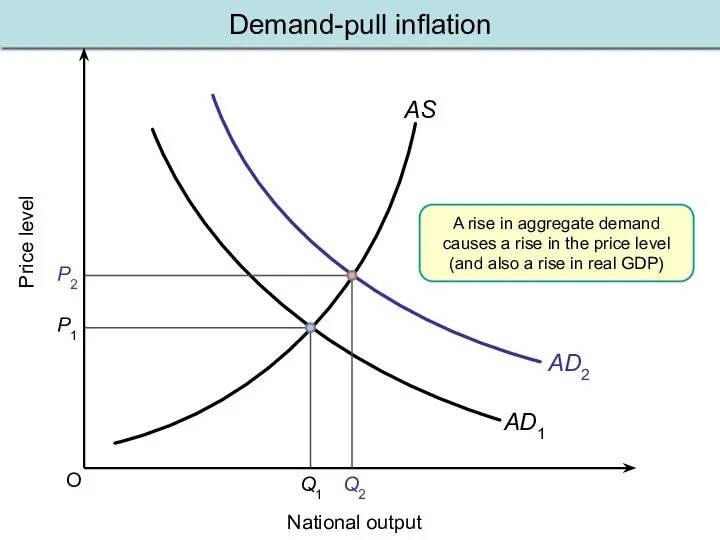

- 12. Inflation Causes of inflation demand pull When the AD curve shifts to the right, output will

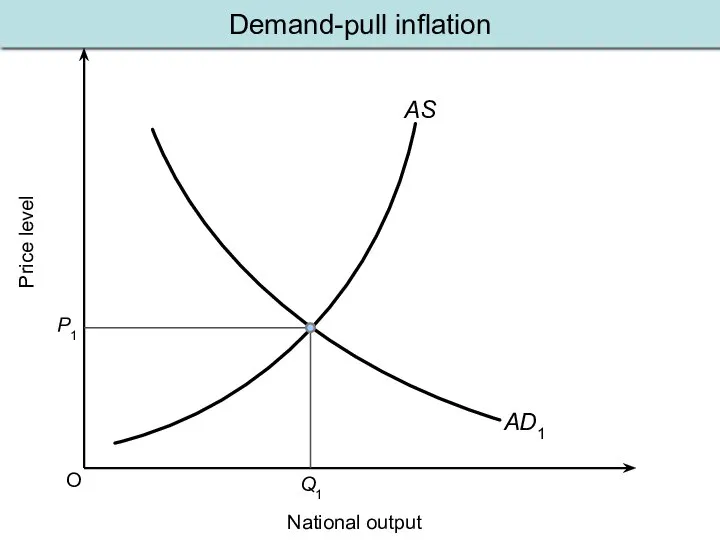

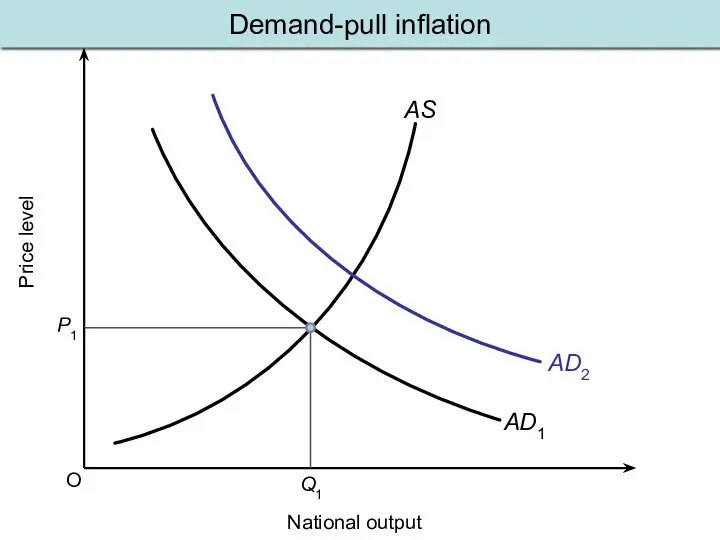

- 13. Demand-pull inflation O Price level National output AS AD1 P1 Q1

- 14. O Price level National output AS AD1 P1 Q1 AD2 Demand-pull inflation

- 15. O Price level National output AS AD1 P1 Q1 AD2 P2 A rise in aggregate demand

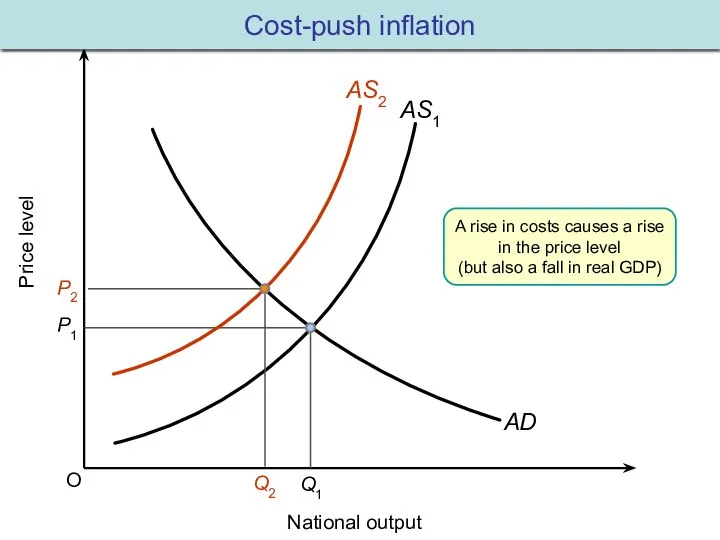

- 16. Inflation Causes of inflation cost push inflation is associated with continuing rises in costs and hence

- 17. Inflation Rise in costs may come from: wage push increase in wages due to trade unions

- 18. In all these cases, inflation occurs because one or more groups are exercising economic power. The

- 19. Q Which one of the following would be the cause of cost-push inflation? A cut in

- 20. Cost-push inflation O Price level National output AS1 AD P1 Q1

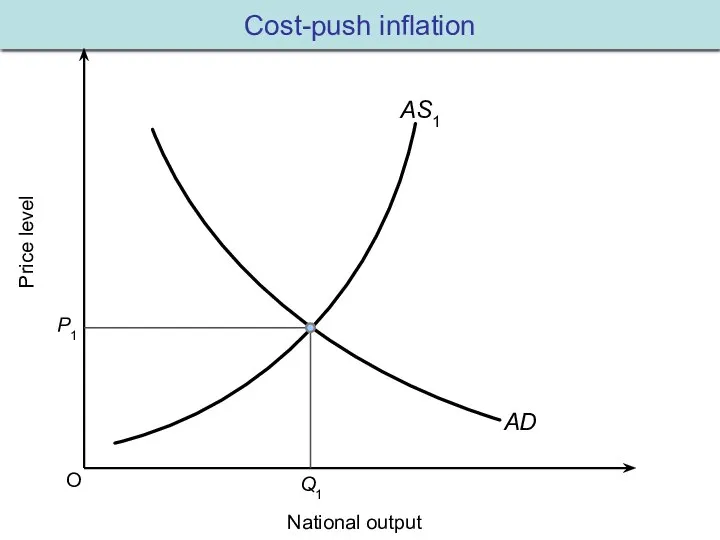

- 21. O Price level National output AS1 AD P1 Q1 AS2 Cost-push inflation

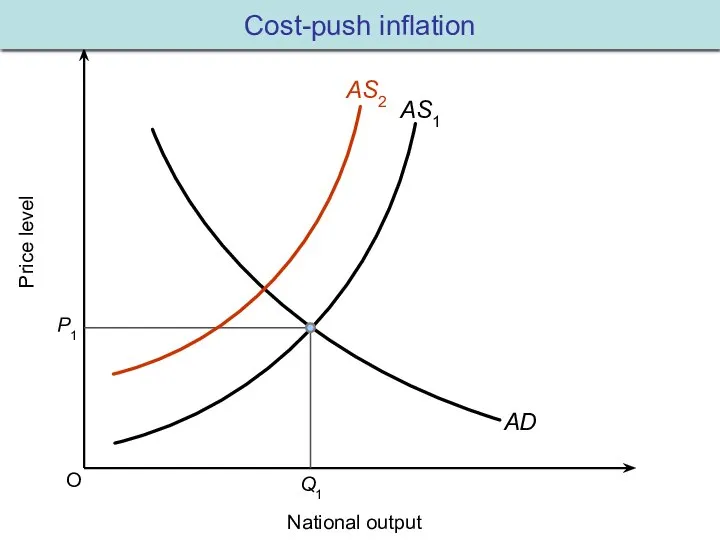

- 22. O Price level National output AS1 AD P1 Q1 AS2 P2 A rise in costs causes

- 23. With the growth in demand for raw materials and food (China, India, Brazil) rising costs became

- 24. Demand-pull and cost-push inflation can occur together since wage and price rises can be caused both

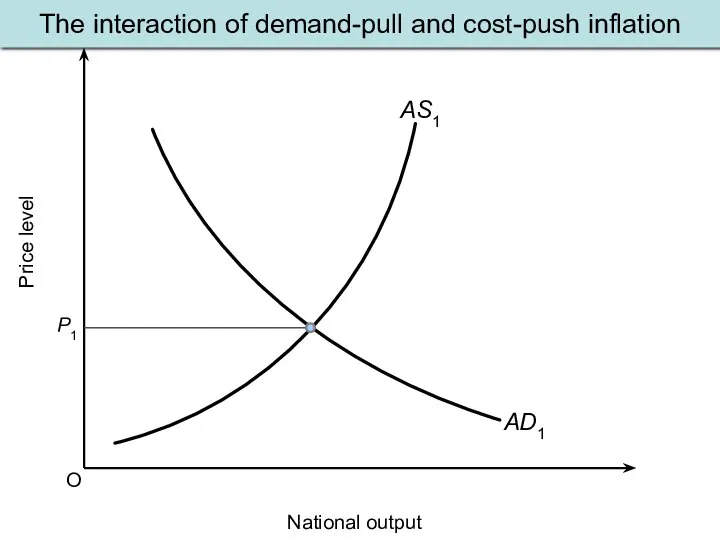

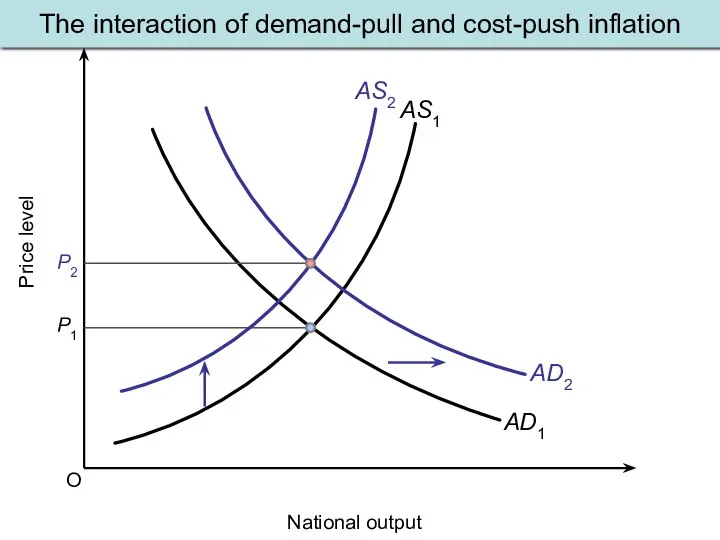

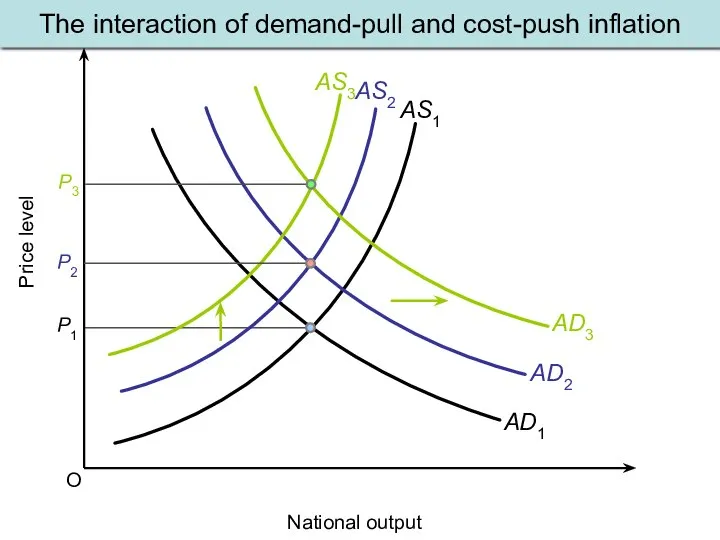

- 25. The interaction of demand-pull and cost-push inflation O Price level National output AS1 AD1 P1

- 26. O Price level National output AS1 AD1 P1 AS2 AD2 The interaction of demand-pull and cost-push

- 27. O Price level National output AS1 AD1 P1 AD2 P2 AS3 AD3 AS2 The interaction of

- 28. Inflation Expectations and inflation Workers and firms take account of the expected rate of inflation when

- 29. Lecture 4.1 Fiscal and Monetary Policy

- 30. Aims of this session: Add Government spending and foreign trade as additional components of aggregate demand

- 31. Fiscal policy Fiscal policy is the government’s decisions about spending and taxes. Automatic stabilisers reduce fluctuations

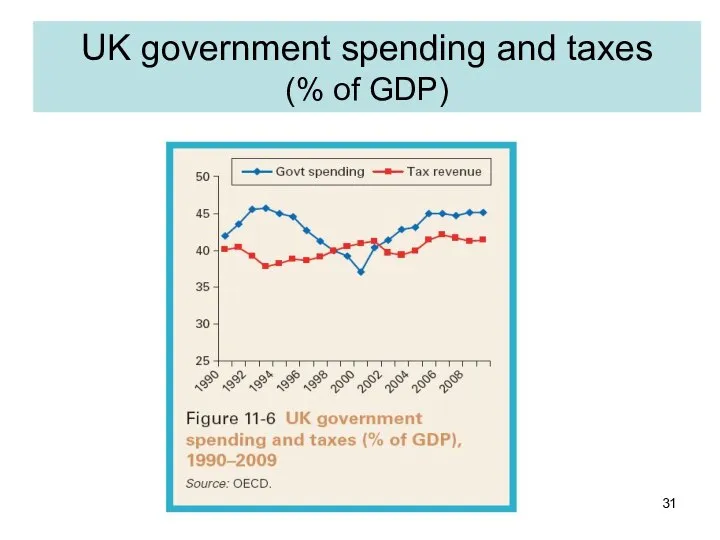

- 32. UK government spending and taxes (% of GDP)

- 33. Government and aggregate demand 1 Government purchases (G) of final output add directly to aggregate demand:

- 34. Government and aggregate demand 2 Government levies taxes and pays out transfer benefits Tax revenue and

- 35. The open economy: foreign trade and output determination Introducing exports (X) & imports (Z) Trade balance

- 36. UK Foreign trade (% of GDP)

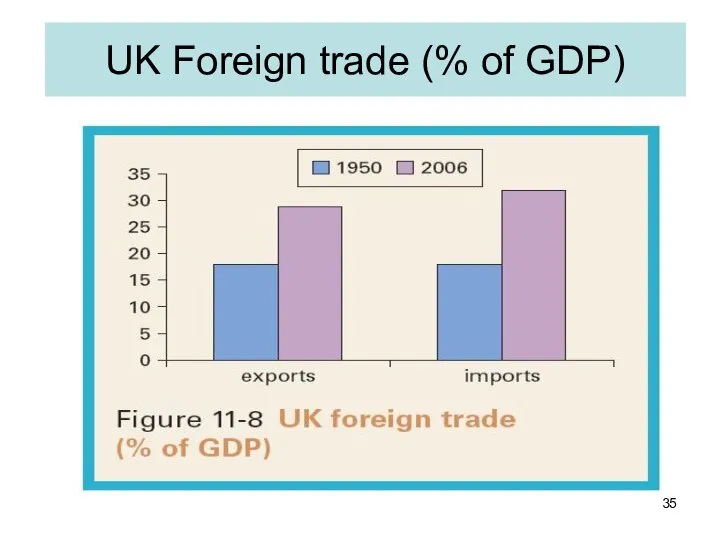

- 37. Monetary Policy I Interest rates are the instrument of monetary policy The monetary instrument is the

- 38. Monetary Policy II Monetary policy is the decision by the Central Bank about what the interest

- 39. Nominal vs Real Interest Rates The real interest rate is the difference between the nominal interest

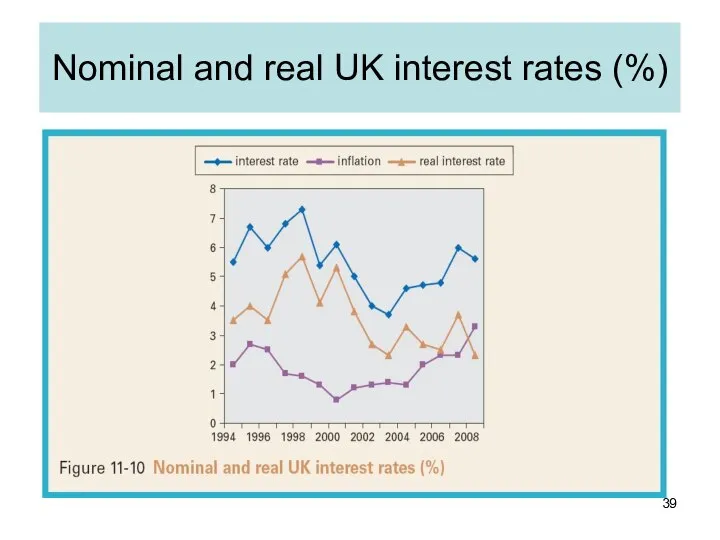

- 40. Nominal and real UK interest rates (%)

- 41. How interest rates affect the economy Interest rates influence: personal consumption by changing the cost of

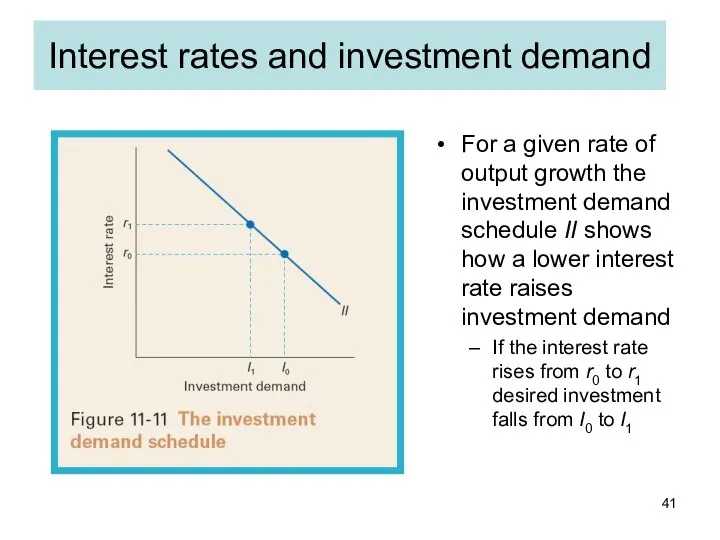

- 42. Interest rates and investment demand For a given rate of output growth the investment demand schedule

- 43. Lower interest rates increase aggregate demand 1 Lower interest rates induce an increase in personal consumption

- 45. Скачать презентацию

Новые денежные знаки Республики Беларусь

Новые денежные знаки Республики Беларусь Международные экономические организации

Международные экономические организации Субъекты внешнеэкономической деятельности

Субъекты внешнеэкономической деятельности Экономический рост. Понятие ВВП. Роль государства в экономике

Экономический рост. Понятие ВВП. Роль государства в экономике Экономика и государство

Экономика и государство Структурная схема использования ресурсов предприятия и формирования конечного результата

Структурная схема использования ресурсов предприятия и формирования конечного результата Предметные области и особенности основных направлений институциональной экономики

Предметные области и особенности основных направлений институциональной экономики Оценка конкурентоспособности предприятия на примере ОАО «Пуховичский пищекомбинат»

Оценка конкурентоспособности предприятия на примере ОАО «Пуховичский пищекомбинат» Формирование общего электроэнергетического рынка Евразийского экономического союза

Формирование общего электроэнергетического рынка Евразийского экономического союза Причины образования. Цели и задачи НАФТА

Причины образования. Цели и задачи НАФТА Эволюция кейнсианства. Неокейнсианство и посткейнсианство

Эволюция кейнсианства. Неокейнсианство и посткейнсианство Рынок несовершенной конкуренции (Монопольная власть на рынке)

Рынок несовершенной конкуренции (Монопольная власть на рынке) Экономика и её роль в жизни общества

Экономика и её роль в жизни общества Ринок, його властивості. Роль держави у формуванні ринкових відносин

Ринок, його властивості. Роль держави у формуванні ринкових відносин Культура Германии

Культура Германии Экономический эффект от использования логистики

Экономический эффект от использования логистики Казахстан в новой глобальной реальности: рост, реформы, развитие

Казахстан в новой глобальной реальности: рост, реформы, развитие Структура и динамика национальной экономики США

Структура и динамика национальной экономики США Инновационное развитие страны

Инновационное развитие страны Предпринимательство в России и за рубежом

Предпринимательство в России и за рубежом Экономика и государство

Экономика и государство Эластичность спроса и предложения

Эластичность спроса и предложения París climate del welcomed

París climate del welcomed Современная система международных экономических отношений

Современная система международных экономических отношений США: проблемы и вызовы

США: проблемы и вызовы Топливно-энергетический комплекс России (ТЭК) и его роль в экономике страны

Топливно-энергетический комплекс России (ТЭК) и его роль в экономике страны 加州开办幼儿园投资案 兼办理投资移民

加州开办幼儿园投资案 兼办理投资移民 Роль комплексного анализа в управлении предприятием

Роль комплексного анализа в управлении предприятием