- Главная

- Математика

- Time series models. Static models and models with lags

Содержание

- 2. 2 HOUS is aggregate consumer expenditure on housing services and DPI is aggregate disposable personal income.

- 3. 3 PRELHOUS is a relative price index for housing services constructed by dividing the nominal price

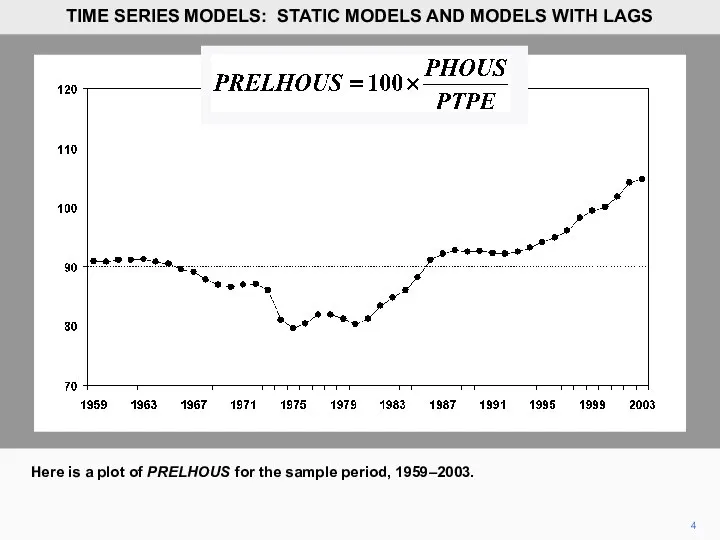

- 4. 4 Here is a plot of PRELHOUS for the sample period, 1959–2003. TIME SERIES MODELS: STATIC

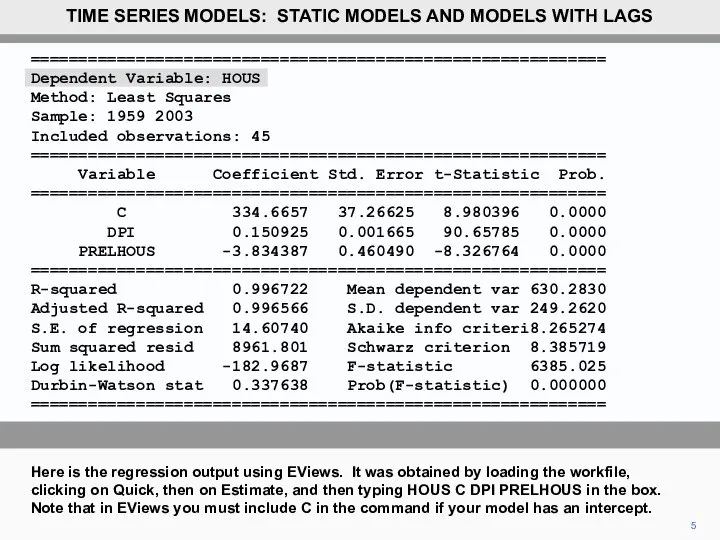

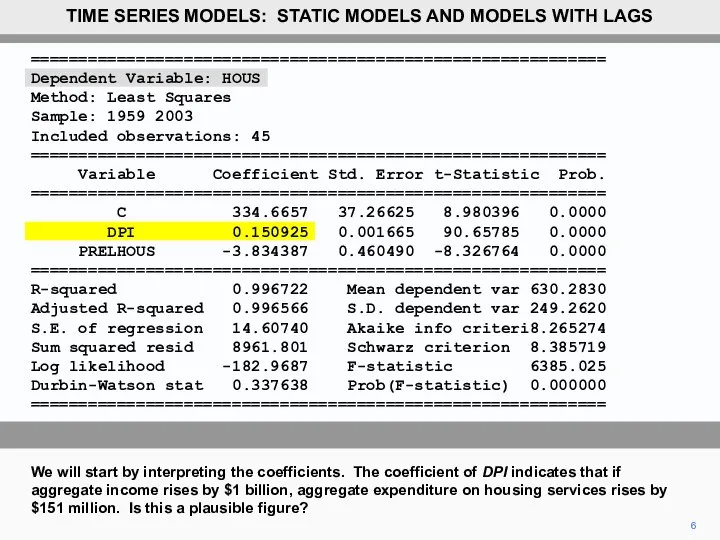

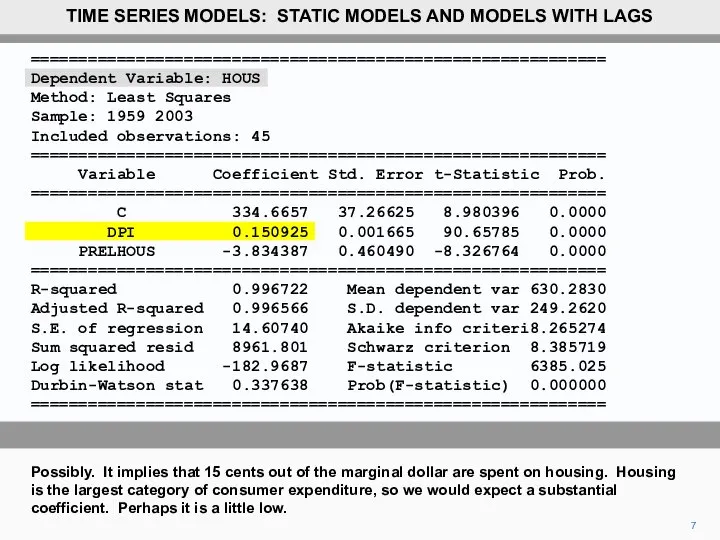

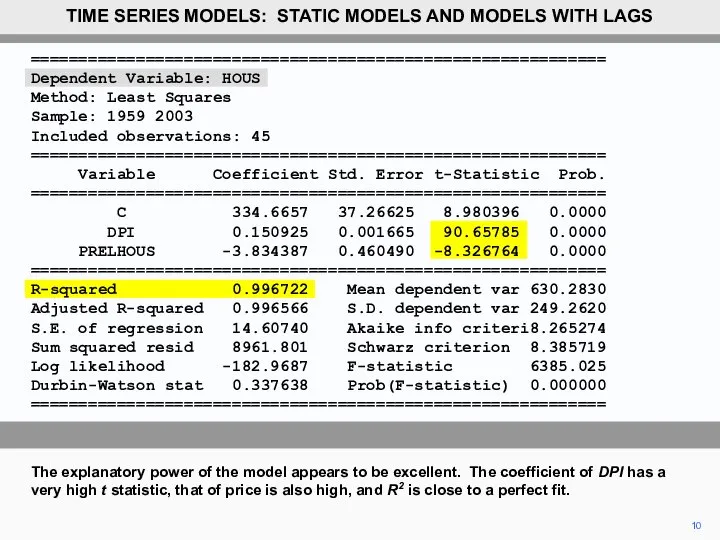

- 5. ============================================================ Dependent Variable: HOUS Method: Least Squares Sample: 1959 2003 Included observations: 45 ============================================================ Variable Coefficient

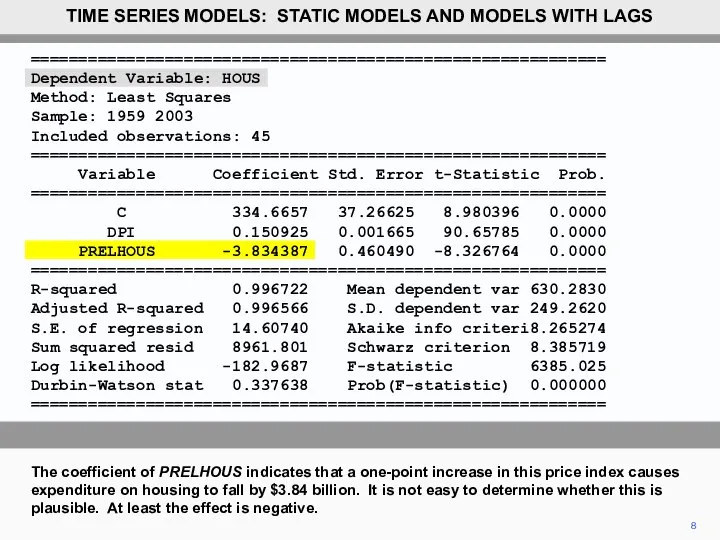

- 6. ============================================================ Dependent Variable: HOUS Method: Least Squares Sample: 1959 2003 Included observations: 45 ============================================================ Variable Coefficient

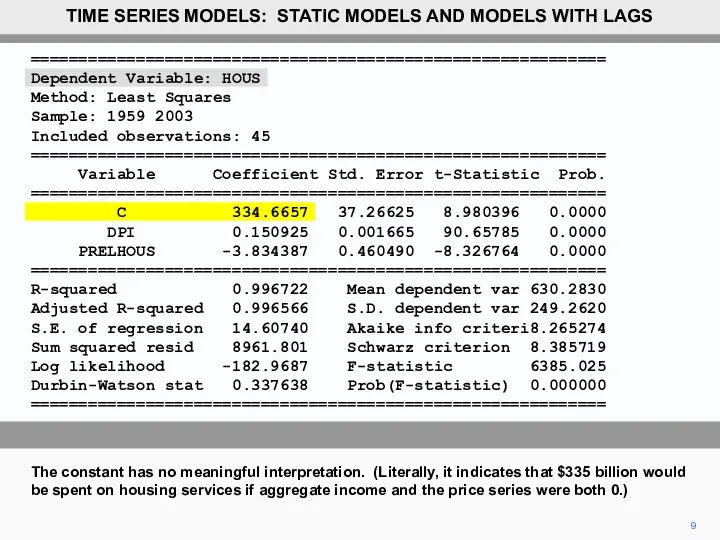

- 7. 7 Possibly. It implies that 15 cents out of the marginal dollar are spent on housing.

- 8. 8 The coefficient of PRELHOUS indicates that a one-point increase in this price index causes expenditure

- 9. 9 The constant has no meaningful interpretation. (Literally, it indicates that $335 billion would be spent

- 10. ============================================================ Dependent Variable: HOUS Method: Least Squares Sample: 1959 2003 Included observations: 45 ============================================================ Variable Coefficient

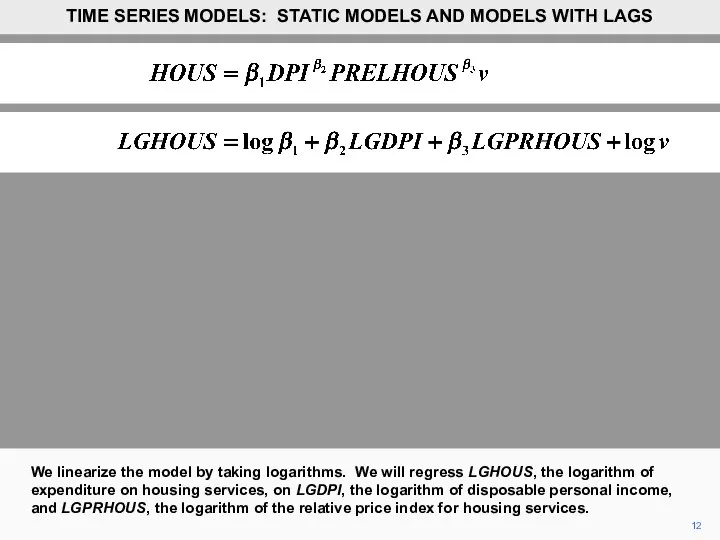

- 11. 11 Constant elasticity functions are usually considered preferable to linear functions in models of consumer expenditure.

- 12. 12 We linearize the model by taking logarithms. We will regress LGHOUS, the logarithm of expenditure

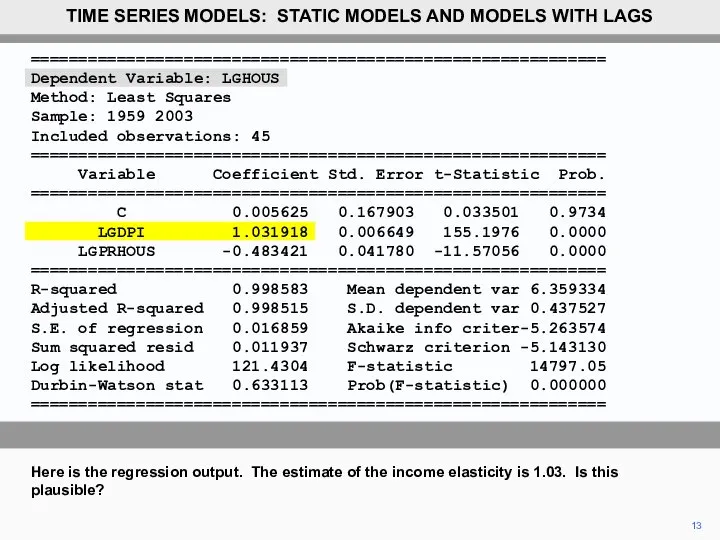

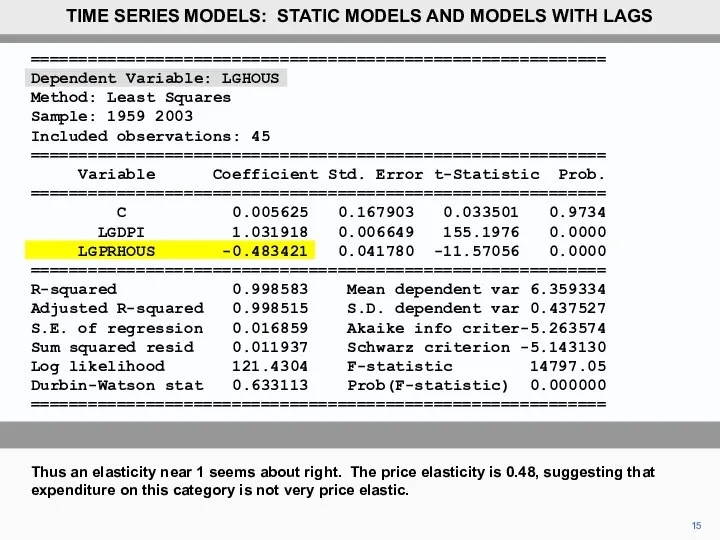

- 13. ============================================================ Dependent Variable: LGHOUS Method: Least Squares Sample: 1959 2003 Included observations: 45 ============================================================ Variable Coefficient

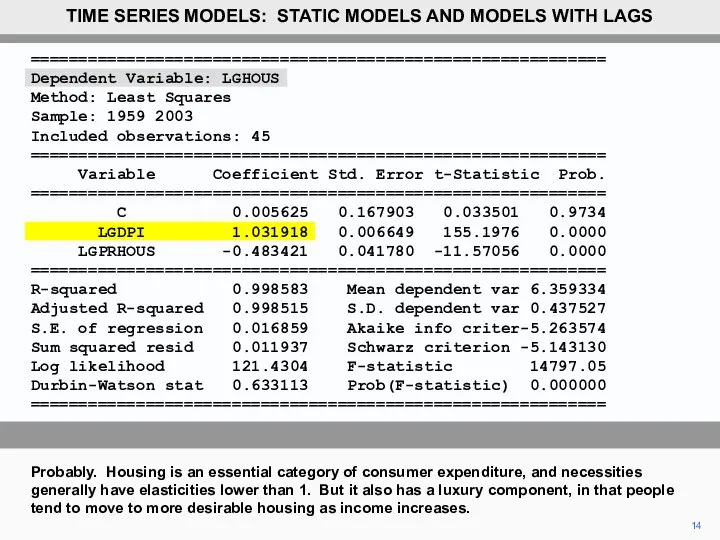

- 14. 14 Probably. Housing is an essential category of consumer expenditure, and necessities generally have elasticities lower

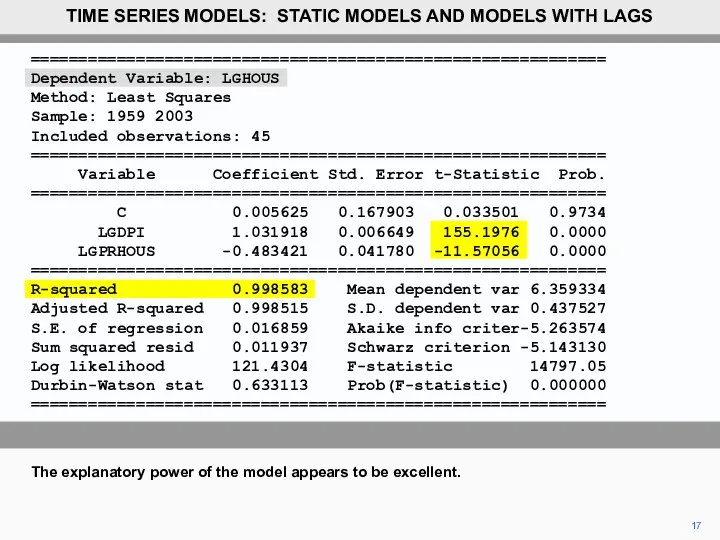

- 15. 15 Thus an elasticity near 1 seems about right. The price elasticity is 0.48, suggesting that

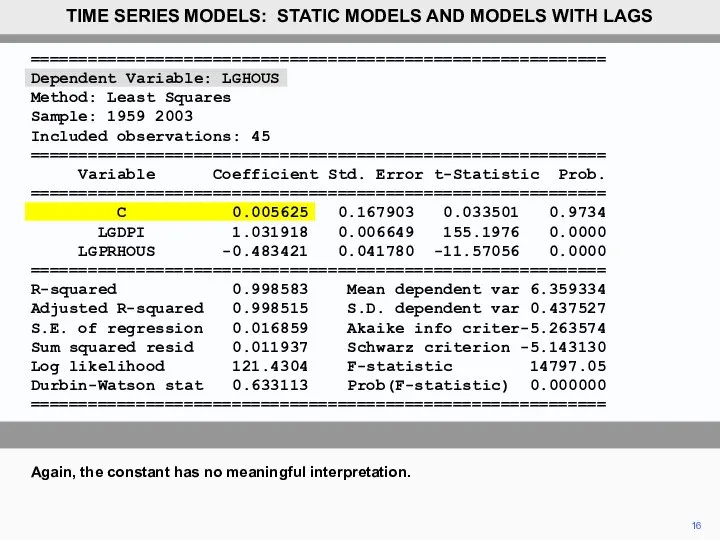

- 16. 16 Again, the constant has no meaningful interpretation. TIME SERIES MODELS: STATIC MODELS AND MODELS WITH

- 17. 17 The explanatory power of the model appears to be excellent. TIME SERIES MODELS: STATIC MODELS

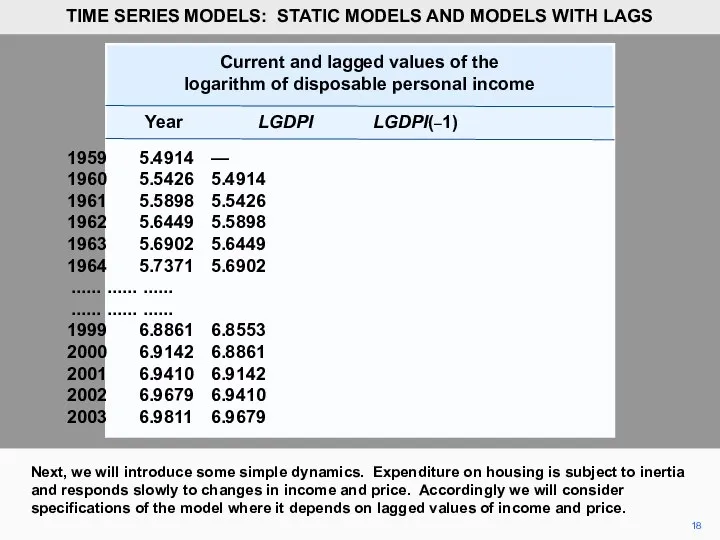

- 18. 18 Next, we will introduce some simple dynamics. Expenditure on housing is subject to inertia and

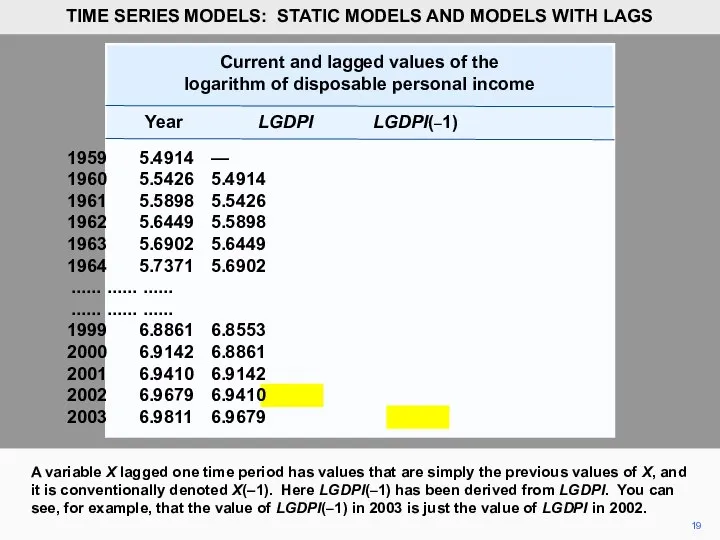

- 19. 19 A variable X lagged one time period has values that are simply the previous values

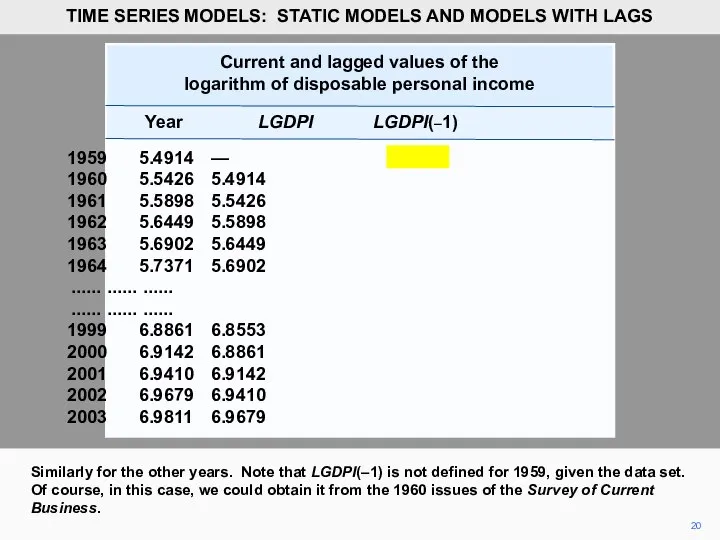

- 20. Current and lagged values of the logarithm of disposable personal income Year LGDPI LGDPI(–1) 1959 5.4914

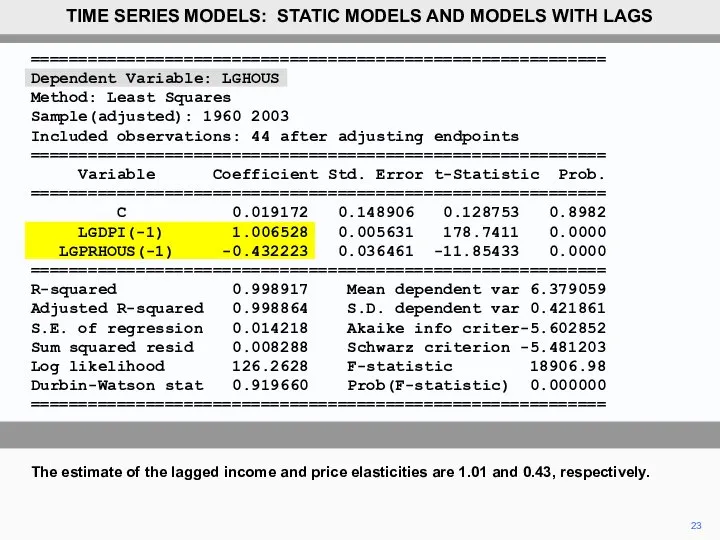

- 21. Current and lagged values of the logarithm of disposable personal income Year LGDPI LGDPI(–1) LGDPI(–2) 1959

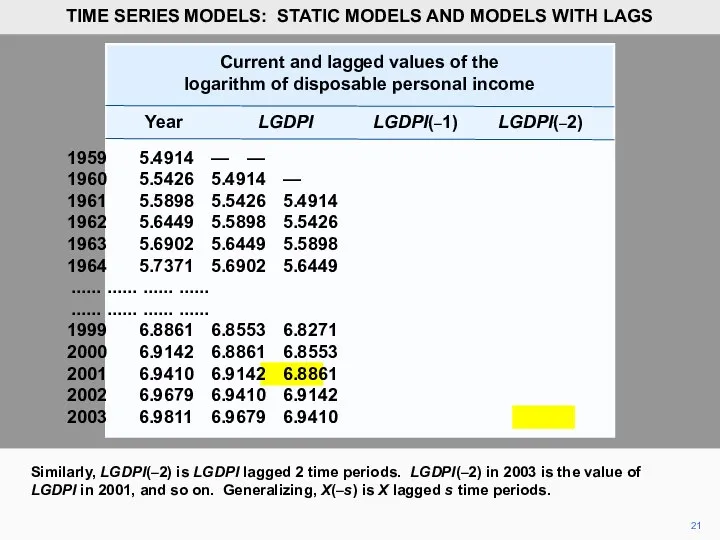

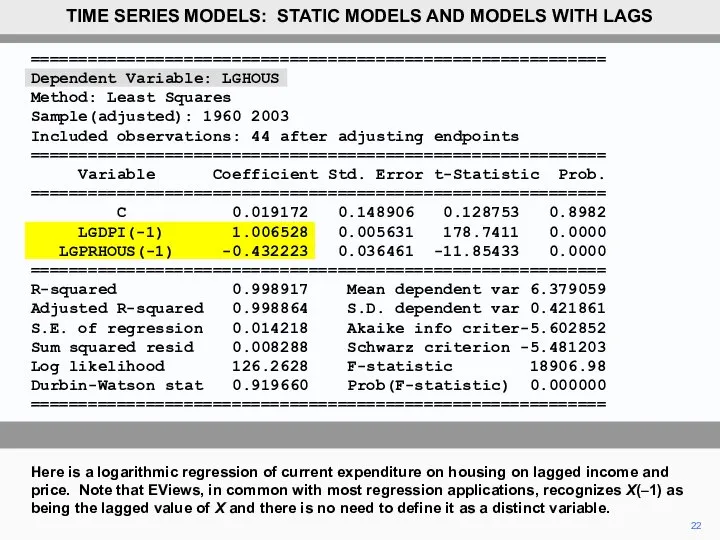

- 22. ============================================================ Dependent Variable: LGHOUS Method: Least Squares Sample(adjusted): 1960 2003 Included observations: 44 after adjusting endpoints

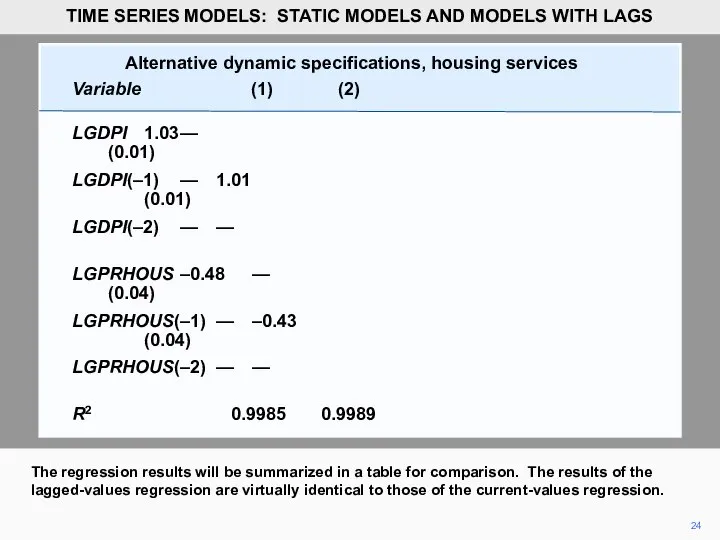

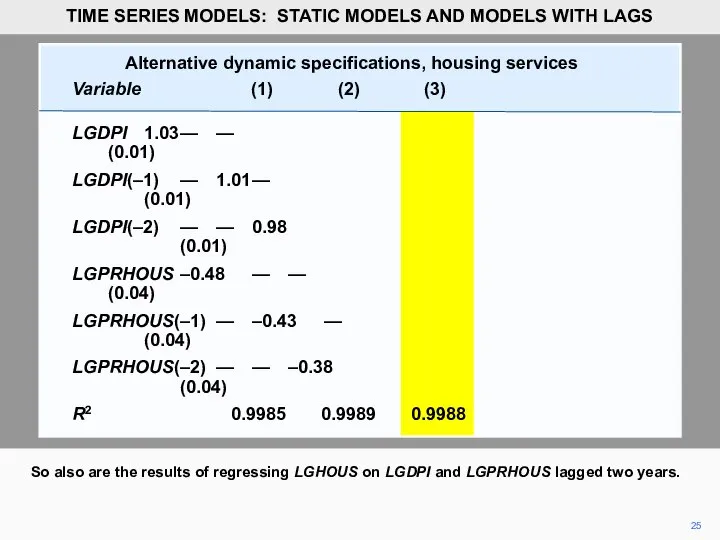

- 23. 23 The estimate of the lagged income and price elasticities are 1.01 and 0.43, respectively. TIME

- 24. 24 The regression results will be summarized in a table for comparison. The results of the

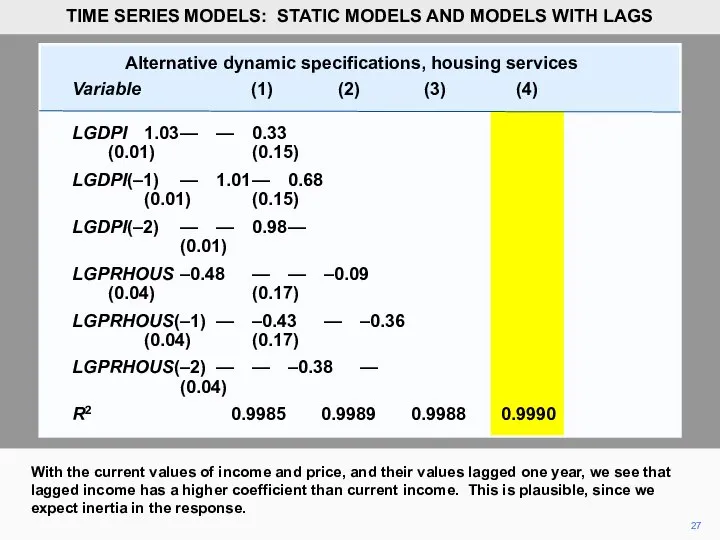

- 25. 25 So also are the results of regressing LGHOUS on LGDPI and LGPRHOUS lagged two years.

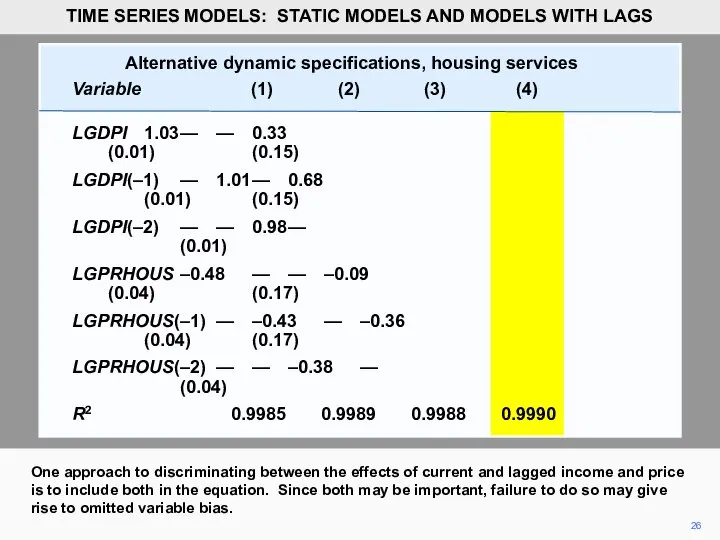

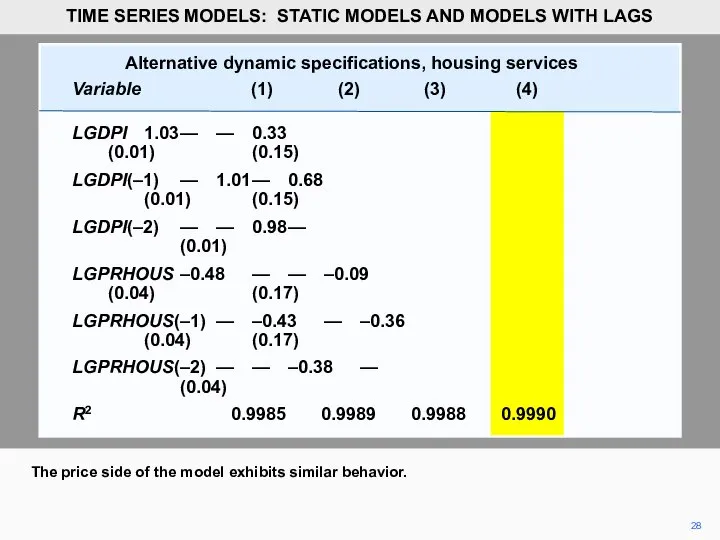

- 26. 26 One approach to discriminating between the effects of current and lagged income and price is

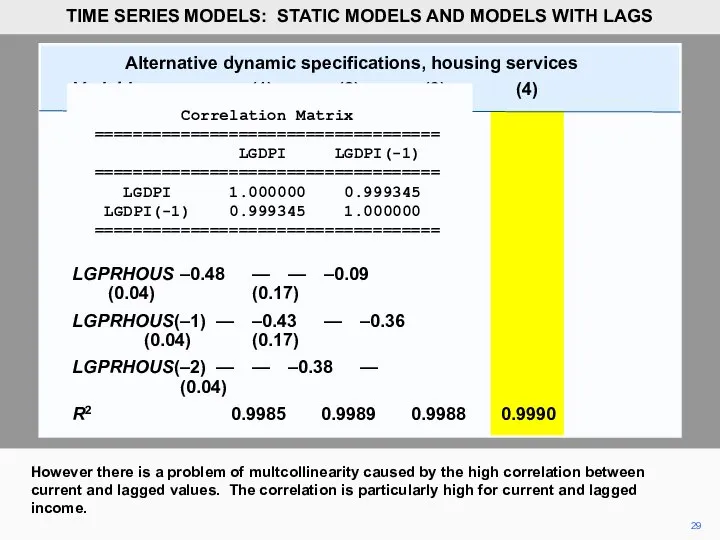

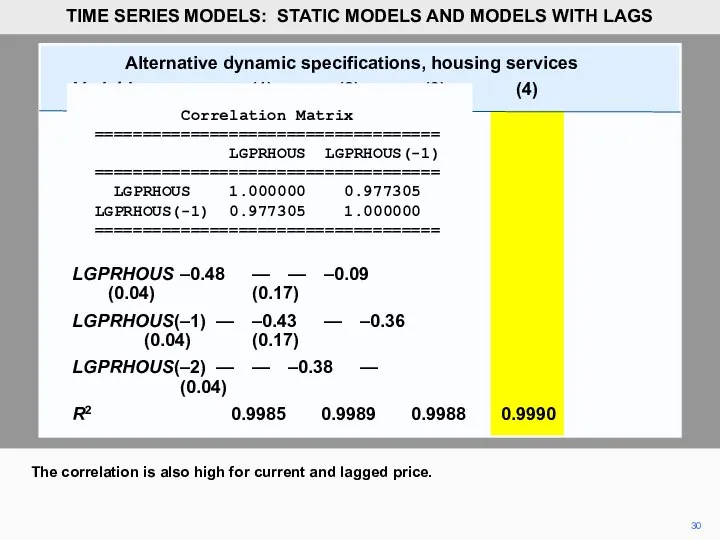

- 27. 27 With the current values of income and price, and their values lagged one year, we

- 28. 28 The price side of the model exhibits similar behavior. TIME SERIES MODELS: STATIC MODELS AND

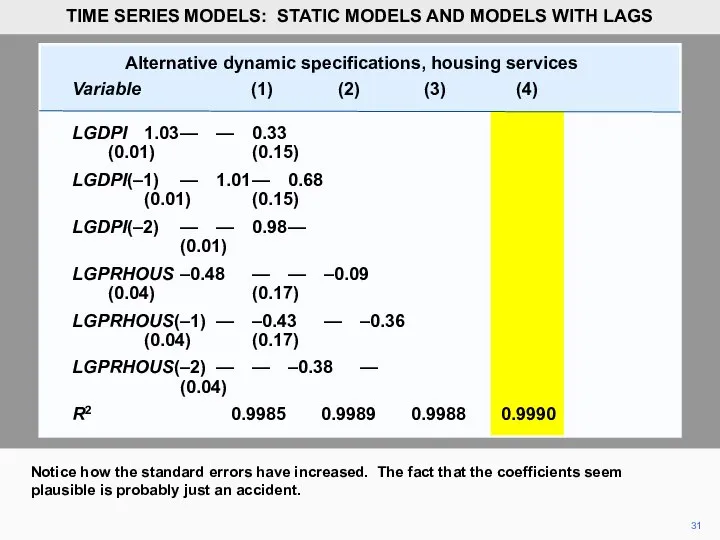

- 29. 29 However there is a problem of multcollinearity caused by the high correlation between current and

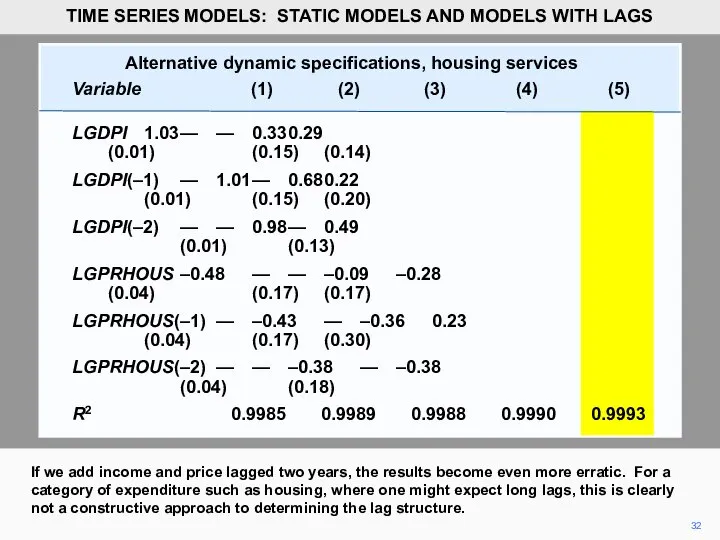

- 30. Alternative dynamic specifications, housing services Variable (1) (2) (3) (4) LGDPI 1.03 — — 0.33 (0.01)

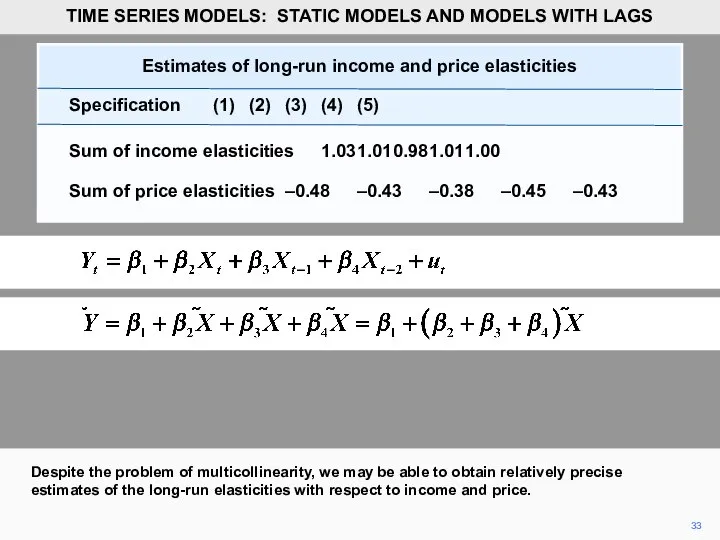

- 31. 31 Notice how the standard errors have increased. The fact that the coefficients seem plausible is

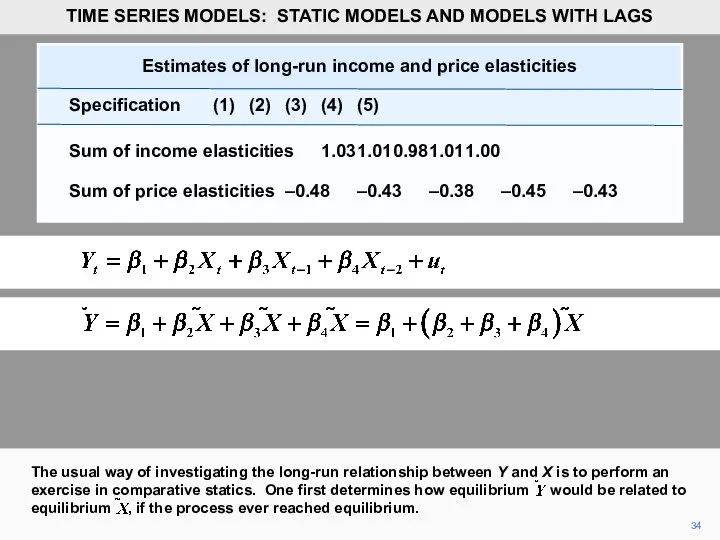

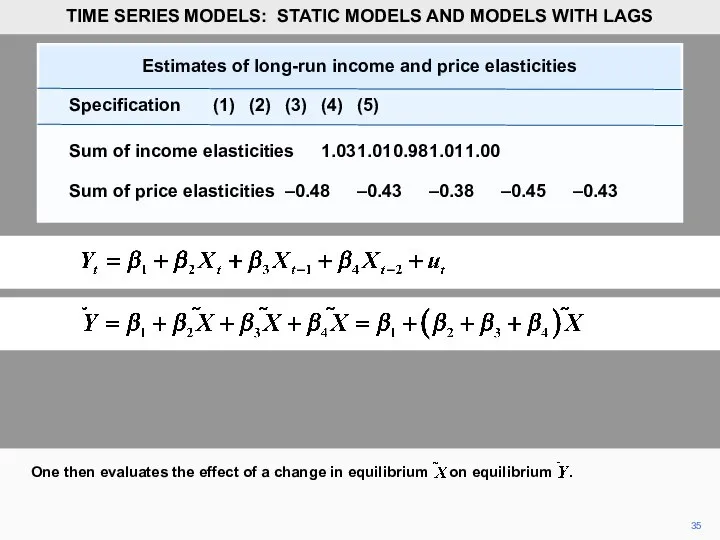

- 32. Alternative dynamic specifications, housing services Variable (1) (2) (3) (4) (5) LGDPI 1.03 — — 0.33

- 33. 33 Despite the problem of multicollinearity, we may be able to obtain relatively precise estimates of

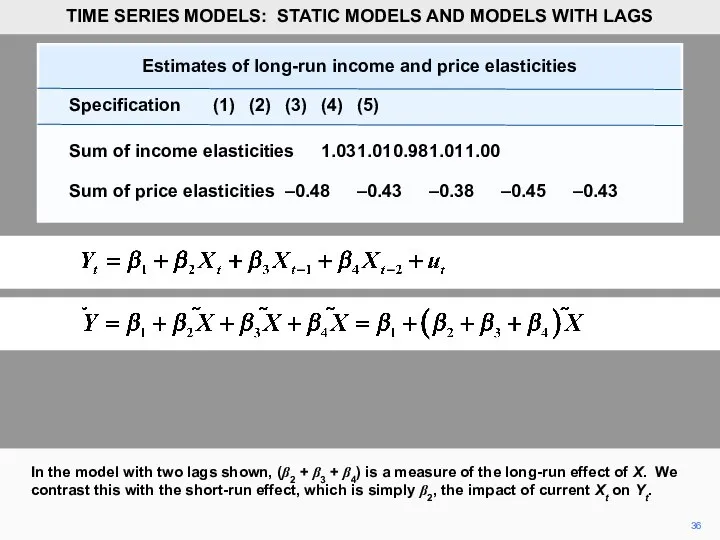

- 34. 34 The usual way of investigating the long-run relationship between Y and X is to perform

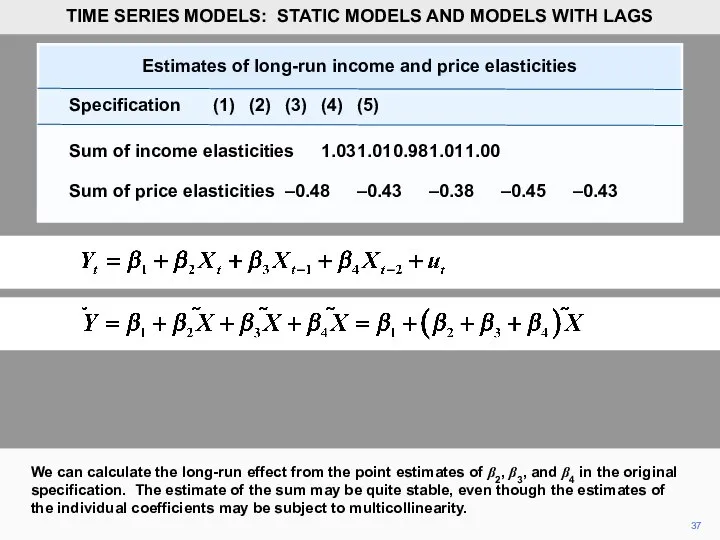

- 35. 35 One then evaluates the effect of a change in equilibrium on equilibrium . TIME SERIES

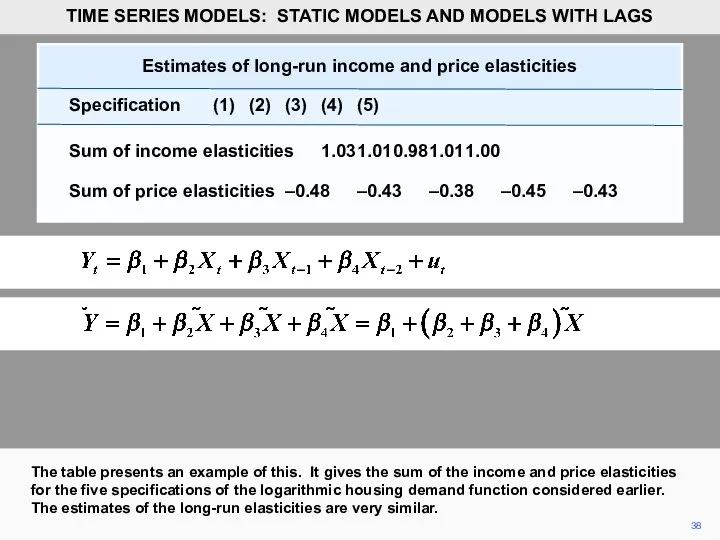

- 36. 36 In the model with two lags shown, (β2 + β3 + β4) is a measure

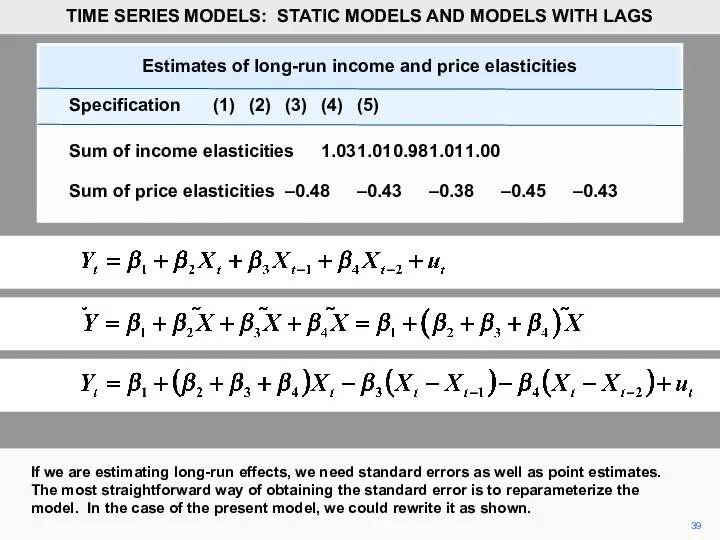

- 37. 37 We can calculate the long-run effect from the point estimates of β2, β3, and β4

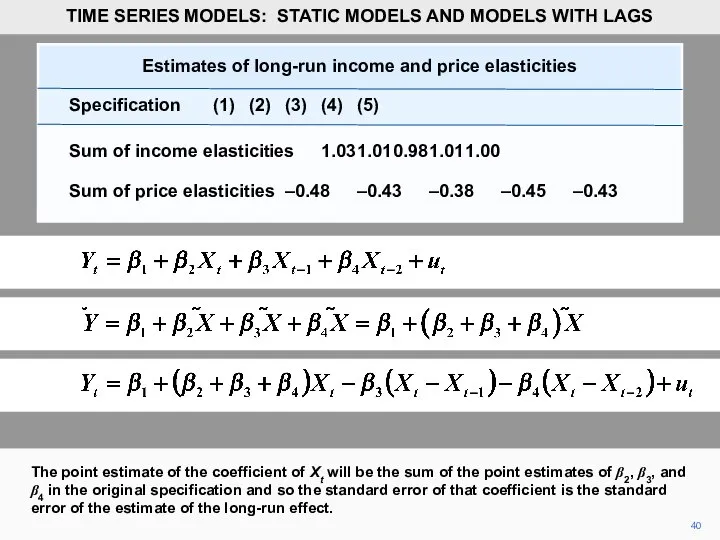

- 38. 38 The table presents an example of this. It gives the sum of the income and

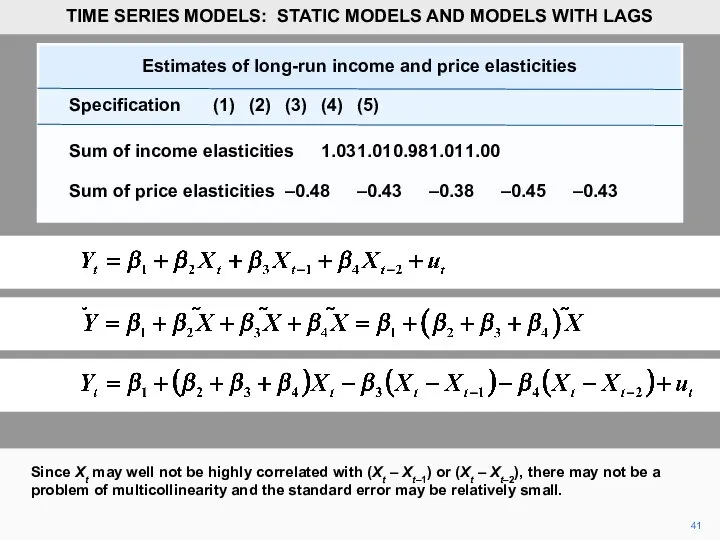

- 39. 39 If we are estimating long-run effects, we need standard errors as well as point estimates.

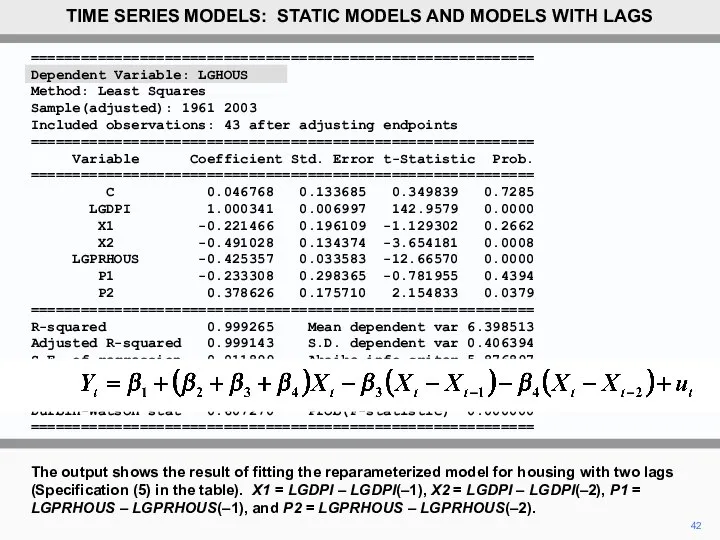

- 40. 40 The point estimate of the coefficient of Xt will be the sum of the point

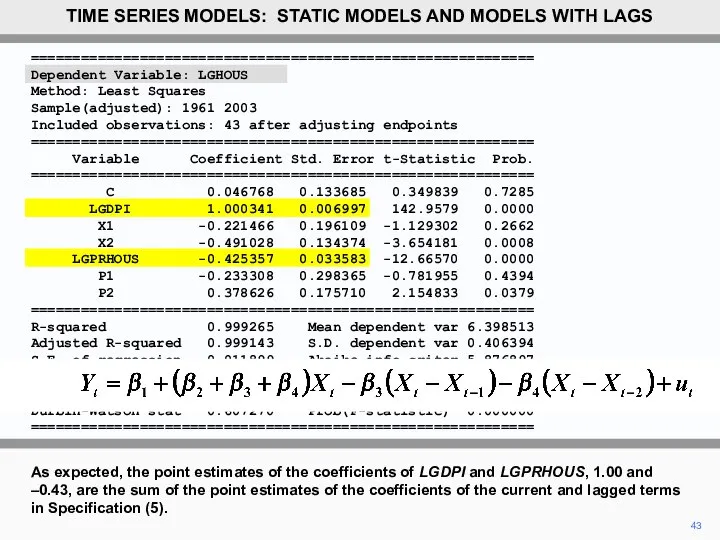

- 41. 41 Since Xt may well not be highly correlated with (Xt – Xt–1) or (Xt –

- 42. ============================================================ Dependent Variable: LGHOUS Method: Least Squares Sample(adjusted): 1961 2003 Included observations: 43 after adjusting endpoints

- 43. 43 As expected, the point estimates of the coefficients of LGDPI and LGPRHOUS, 1.00 and –0.43,

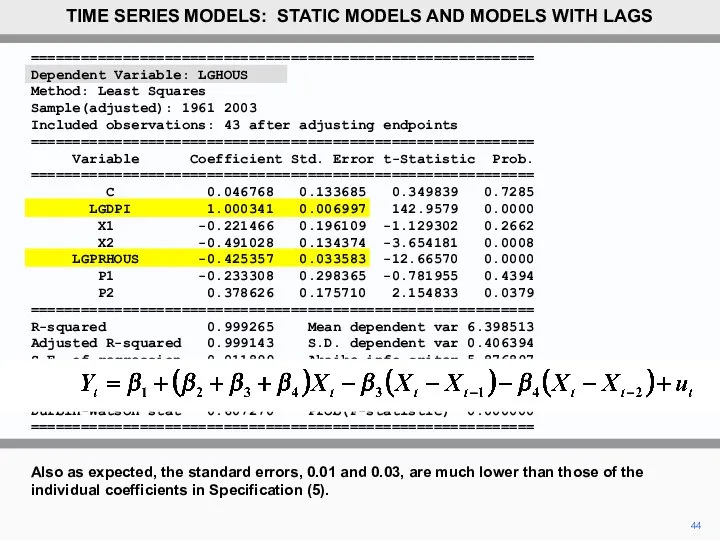

- 44. 44 Also as expected, the standard errors, 0.01 and 0.03, are much lower than those of

- 46. Скачать презентацию

2

HOUS is aggregate consumer expenditure on housing services and DPI is

2

HOUS is aggregate consumer expenditure on housing services and DPI is

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

3

PRELHOUS is a relative price index for housing services constructed by

3

PRELHOUS is a relative price index for housing services constructed by

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

4

Here is a plot of PRELHOUS for the sample period, 1959–2003.

TIME

4

Here is a plot of PRELHOUS for the sample period, 1959–2003.

TIME

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 334.6657 37.26625 8.980396 0.0000

DPI 0.150925 0.001665 90.65785 0.0000

PRELHOUS -3.834387 0.460490 -8.326764 0.0000

============================================================

R-squared 0.996722 Mean dependent var 630.2830

Adjusted R-squared 0.996566 S.D. dependent var 249.2620

S.E. of regression 14.60740 Akaike info criteri8.265274

Sum squared resid 8961.801 Schwarz criterion 8.385719

Log likelihood -182.9687 F-statistic 6385.025

Durbin-Watson stat 0.337638 Prob(F-statistic) 0.000000

============================================================

5

Here is the regression output using EViews. It was obtained by loading the workfile, clicking on Quick, then on Estimate, and then typing HOUS C DPI PRELHOUS in the box. Note that in EViews you must include C in the command if your model has an intercept.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 334.6657 37.26625 8.980396 0.0000

DPI 0.150925 0.001665 90.65785 0.0000

PRELHOUS -3.834387 0.460490 -8.326764 0.0000

============================================================

R-squared 0.996722 Mean dependent var 630.2830

Adjusted R-squared 0.996566 S.D. dependent var 249.2620

S.E. of regression 14.60740 Akaike info criteri8.265274

Sum squared resid 8961.801 Schwarz criterion 8.385719

Log likelihood -182.9687 F-statistic 6385.025

Durbin-Watson stat 0.337638 Prob(F-statistic) 0.000000

============================================================

6

We will start by interpreting the coefficients. The coefficient of DPI indicates that if aggregate income rises by $1 billion, aggregate expenditure on housing services rises by $151 million. Is this a plausible figure?

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

7

Possibly. It implies that 15 cents out of the marginal dollar

7

Possibly. It implies that 15 cents out of the marginal dollar

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 334.6657 37.26625 8.980396 0.0000

DPI 0.150925 0.001665 90.65785 0.0000

PRELHOUS -3.834387 0.460490 -8.326764 0.0000

============================================================

R-squared 0.996722 Mean dependent var 630.2830

Adjusted R-squared 0.996566 S.D. dependent var 249.2620

S.E. of regression 14.60740 Akaike info criteri8.265274

Sum squared resid 8961.801 Schwarz criterion 8.385719

Log likelihood -182.9687 F-statistic 6385.025

Durbin-Watson stat 0.337638 Prob(F-statistic) 0.000000

============================================================

8

The coefficient of PRELHOUS indicates that a one-point increase in this

8

The coefficient of PRELHOUS indicates that a one-point increase in this

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 334.6657 37.26625 8.980396 0.0000

DPI 0.150925 0.001665 90.65785 0.0000

PRELHOUS -3.834387 0.460490 -8.326764 0.0000

============================================================

R-squared 0.996722 Mean dependent var 630.2830

Adjusted R-squared 0.996566 S.D. dependent var 249.2620

S.E. of regression 14.60740 Akaike info criteri8.265274

Sum squared resid 8961.801 Schwarz criterion 8.385719

Log likelihood -182.9687 F-statistic 6385.025

Durbin-Watson stat 0.337638 Prob(F-statistic) 0.000000

============================================================

9

The constant has no meaningful interpretation. (Literally, it indicates that $335

9

The constant has no meaningful interpretation. (Literally, it indicates that $335

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 334.6657 37.26625 8.980396 0.0000

DPI 0.150925 0.001665 90.65785 0.0000

PRELHOUS -3.834387 0.460490 -8.326764 0.0000

============================================================

R-squared 0.996722 Mean dependent var 630.2830

Adjusted R-squared 0.996566 S.D. dependent var 249.2620

S.E. of regression 14.60740 Akaike info criteri8.265274

Sum squared resid 8961.801 Schwarz criterion 8.385719

Log likelihood -182.9687 F-statistic 6385.025

Durbin-Watson stat 0.337638 Prob(F-statistic) 0.000000

============================================================

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Dependent Variable: HOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 334.6657 37.26625 8.980396 0.0000

DPI 0.150925 0.001665 90.65785 0.0000

PRELHOUS -3.834387 0.460490 -8.326764 0.0000

============================================================

R-squared 0.996722 Mean dependent var 630.2830

Adjusted R-squared 0.996566 S.D. dependent var 249.2620

S.E. of regression 14.60740 Akaike info criteri8.265274

Sum squared resid 8961.801 Schwarz criterion 8.385719

Log likelihood -182.9687 F-statistic 6385.025

Durbin-Watson stat 0.337638 Prob(F-statistic) 0.000000

============================================================

10

The explanatory power of the model appears to be excellent. The coefficient of DPI has a very high t statistic, that of price is also high, and R2 is close to a perfect fit.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

11

Constant elasticity functions are usually considered preferable to linear functions in

11

Constant elasticity functions are usually considered preferable to linear functions in

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

12

We linearize the model by taking logarithms. We will regress LGHOUS,

12

We linearize the model by taking logarithms. We will regress LGHOUS,

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample: 1959 2003

Included observations:

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.005625 0.167903 0.033501 0.9734

LGDPI 1.031918 0.006649 155.1976 0.0000

LGPRHOUS -0.483421 0.041780 -11.57056 0.0000

============================================================

R-squared 0.998583 Mean dependent var 6.359334

Adjusted R-squared 0.998515 S.D. dependent var 0.437527

S.E. of regression 0.016859 Akaike info criter-5.263574

Sum squared resid 0.011937 Schwarz criterion -5.143130

Log likelihood 121.4304 F-statistic 14797.05

Durbin-Watson stat 0.633113 Prob(F-statistic) 0.000000

============================================================

13

Here is the regression output. The estimate of the income elasticity is 1.03. Is this plausible?

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

14

Probably. Housing is an essential category of consumer expenditure, and necessities

14

Probably. Housing is an essential category of consumer expenditure, and necessities

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.005625 0.167903 0.033501 0.9734

LGDPI 1.031918 0.006649 155.1976 0.0000

LGPRHOUS -0.483421 0.041780 -11.57056 0.0000

============================================================

R-squared 0.998583 Mean dependent var 6.359334

Adjusted R-squared 0.998515 S.D. dependent var 0.437527

S.E. of regression 0.016859 Akaike info criter-5.263574

Sum squared resid 0.011937 Schwarz criterion -5.143130

Log likelihood 121.4304 F-statistic 14797.05

Durbin-Watson stat 0.633113 Prob(F-statistic) 0.000000

============================================================

15

Thus an elasticity near 1 seems about right. The price elasticity

15

Thus an elasticity near 1 seems about right. The price elasticity

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.005625 0.167903 0.033501 0.9734

LGDPI 1.031918 0.006649 155.1976 0.0000

LGPRHOUS -0.483421 0.041780 -11.57056 0.0000

============================================================

R-squared 0.998583 Mean dependent var 6.359334

Adjusted R-squared 0.998515 S.D. dependent var 0.437527

S.E. of regression 0.016859 Akaike info criter-5.263574

Sum squared resid 0.011937 Schwarz criterion -5.143130

Log likelihood 121.4304 F-statistic 14797.05

Durbin-Watson stat 0.633113 Prob(F-statistic) 0.000000

============================================================

16

Again, the constant has no meaningful interpretation.

TIME SERIES MODELS: STATIC MODELS

16

Again, the constant has no meaningful interpretation.

TIME SERIES MODELS: STATIC MODELS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.005625 0.167903 0.033501 0.9734

LGDPI 1.031918 0.006649 155.1976 0.0000

LGPRHOUS -0.483421 0.041780 -11.57056 0.0000

============================================================

R-squared 0.998583 Mean dependent var 6.359334

Adjusted R-squared 0.998515 S.D. dependent var 0.437527

S.E. of regression 0.016859 Akaike info criter-5.263574

Sum squared resid 0.011937 Schwarz criterion -5.143130

Log likelihood 121.4304 F-statistic 14797.05

Durbin-Watson stat 0.633113 Prob(F-statistic) 0.000000

============================================================

17

The explanatory power of the model appears to be excellent.

TIME SERIES

17

The explanatory power of the model appears to be excellent.

TIME SERIES

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample: 1959 2003

Included observations: 45

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.005625 0.167903 0.033501 0.9734

LGDPI 1.031918 0.006649 155.1976 0.0000

LGPRHOUS -0.483421 0.041780 -11.57056 0.0000

============================================================

R-squared 0.998583 Mean dependent var 6.359334

Adjusted R-squared 0.998515 S.D. dependent var 0.437527

S.E. of regression 0.016859 Akaike info criter-5.263574

Sum squared resid 0.011937 Schwarz criterion -5.143130

Log likelihood 121.4304 F-statistic 14797.05

Durbin-Watson stat 0.633113 Prob(F-statistic) 0.000000

============================================================

18

Next, we will introduce some simple dynamics. Expenditure on housing is

18

Next, we will introduce some simple dynamics. Expenditure on housing is

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Current and lagged values of the

logarithm of disposable personal income

Year LGDPI LGDPI(–1)

1959 5.4914 —

1960 5.5426 5.4914

1961 5.5898 5.5426

1962 5.6449 5.5898

1963 5.6902 5.6449

1964 5.7371 5.6902

...... ...... ......

...... ...... ......

1999 6.8861 6.8553

2000 6.9142 6.8861

2001 6.9410 6.9142

2002 6.9679 6.9410

2003 6.9811 6.9679

19

A variable X lagged one time period has values that are

19

A variable X lagged one time period has values that are

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Current and lagged values of the

logarithm of disposable personal income

Year LGDPI LGDPI(–1)

1959 5.4914 —

1960 5.5426 5.4914

1961 5.5898 5.5426

1962 5.6449 5.5898

1963 5.6902 5.6449

1964 5.7371 5.6902

...... ...... ......

...... ...... ......

1999 6.8861 6.8553

2000 6.9142 6.8861

2001 6.9410 6.9142

2002 6.9679 6.9410

2003 6.9811 6.9679

Current and lagged values of the

logarithm of disposable personal income

Year

Current and lagged values of the

logarithm of disposable personal income

Year

1959 5.4914 —

1960 5.5426 5.4914

1961 5.5898 5.5426

1962 5.6449 5.5898

1963 5.6902 5.6449

1964 5.7371 5.6902

...... ...... ......

...... ...... ......

1999 6.8861 6.8553

2000 6.9142 6.8861

2001 6.9410 6.9142

2002 6.9679 6.9410

2003 6.9811 6.9679

20

Similarly for the other years. Note that LGDPI(–1) is not defined for 1959, given the data set. Of course, in this case, we could obtain it from the 1960 issues of the Survey of Current Business.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Current and lagged values of the

logarithm of disposable personal income

Year

Current and lagged values of the

logarithm of disposable personal income

Year

1959 5.4914 — —

1960 5.5426 5.4914 —

1961 5.5898 5.5426 5.4914

1962 5.6449 5.5898 5.5426

1963 5.6902 5.6449 5.5898

1964 5.7371 5.6902 5.6449

...... ...... ...... ......

...... ...... ...... ......

1999 6.8861 6.8553 6.8271

2000 6.9142 6.8861 6.8553

2001 6.9410 6.9142 6.8861

2002 6.9679 6.9410 6.9142

2003 6.9811 6.9679 6.9410

21

Similarly, LGDPI(–2) is LGDPI lagged 2 time periods. LGDPI(–2) in 2003 is the value of LGDPI in 2001, and so on. Generalizing, X(–s) is X lagged s time periods.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1960 2003

Included observations:

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1960 2003

Included observations:

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.019172 0.148906 0.128753 0.8982

LGDPI(-1) 1.006528 0.005631 178.7411 0.0000

LGPRHOUS(-1) -0.432223 0.036461 -11.85433 0.0000

============================================================

R-squared 0.998917 Mean dependent var 6.379059

Adjusted R-squared 0.998864 S.D. dependent var 0.421861

S.E. of regression 0.014218 Akaike info criter-5.602852

Sum squared resid 0.008288 Schwarz criterion -5.481203

Log likelihood 126.2628 F-statistic 18906.98

Durbin-Watson stat 0.919660 Prob(F-statistic) 0.000000

============================================================

22

Here is a logarithmic regression of current expenditure on housing on lagged income and price. Note that EViews, in common with most regression applications, recognizes X(–1) as being the lagged value of X and there is no need to define it as a distinct variable.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

23

The estimate of the lagged income and price elasticities are 1.01

23

The estimate of the lagged income and price elasticities are 1.01

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1960 2003

Included observations: 44 after adjusting endpoints

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.019172 0.148906 0.128753 0.8982

LGDPI(-1) 1.006528 0.005631 178.7411 0.0000

LGPRHOUS(-1) -0.432223 0.036461 -11.85433 0.0000

============================================================

R-squared 0.998917 Mean dependent var 6.379059

Adjusted R-squared 0.998864 S.D. dependent var 0.421861

S.E. of regression 0.014218 Akaike info criter-5.602852

Sum squared resid 0.008288 Schwarz criterion -5.481203

Log likelihood 126.2628 F-statistic 18906.98

Durbin-Watson stat 0.919660 Prob(F-statistic) 0.000000

============================================================

24

The regression results will be summarized in a table for comparison.

24

The regression results will be summarized in a table for comparison.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Alternative dynamic specifications, housing services

Variable (1) (2)

LGDPI 1.03 —

(0.01)

LGDPI(–1) — 1.01

(0.01)

LGDPI(–2) — —

LGPRHOUS –0.48 —

(0.04)

LGPRHOUS(–1) — –0.43

(0.04)

LGPRHOUS(–2) — —

R2 0.9985 0.9989

25

So also are the results of regressing LGHOUS on LGDPI and

25

So also are the results of regressing LGHOUS on LGDPI and

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Alternative dynamic specifications, housing services

Variable (1) (2) (3)

LGDPI 1.03 — —

(0.01)

LGDPI(–1) — 1.01 —

(0.01)

LGDPI(–2) — — 0.98

(0.01)

LGPRHOUS –0.48 — —

(0.04)

LGPRHOUS(–1) — –0.43 —

(0.04)

LGPRHOUS(–2) — — –0.38

(0.04)

R2 0.9985 0.9989 0.9988

26

One approach to discriminating between the effects of current and lagged

26

One approach to discriminating between the effects of current and lagged

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985 0.9989 0.9988 0.9990

27

With the current values of income and price, and their values

27

With the current values of income and price, and their values

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985 0.9989 0.9988 0.9990

28

The price side of the model exhibits similar behavior.

TIME SERIES MODELS:

28

The price side of the model exhibits similar behavior.

TIME SERIES MODELS:

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985 0.9989 0.9988 0.9990

29

However there is a problem of multcollinearity caused by the high

29

However there is a problem of multcollinearity caused by the high

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985 0.9989 0.9988 0.9990

Correlation Matrix

====================================

LGDPI LGDPI(-1)

====================================

LGDPI 1.000000 0.999345

LGDPI(-1) 0.999345 1.000000

====================================

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985

30

Correlation Matrix

====================================

LGPRHOUS LGPRHOUS(-1)

====================================

LGPRHOUS 1.000000 0.977305

LGPRHOUS(-1) 0.977305 1.000000

====================================

The correlation is also high for current and lagged price.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

31

Notice how the standard errors have increased. The fact that the

31

Notice how the standard errors have increased. The fact that the

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4)

LGDPI 1.03 — — 0.33

(0.01) (0.15)

LGDPI(–1) — 1.01 — 0.68

(0.01) (0.15)

LGDPI(–2) — — 0.98 —

(0.01)

LGPRHOUS –0.48 — — –0.09

(0.04) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36

(0.04) (0.17)

LGPRHOUS(–2) — — –0.38 —

(0.04)

R2 0.9985 0.9989 0.9988 0.9990

Alternative dynamic specifications, housing services

Variable (1) (2) (3) (4) (5)

LGDPI 1.03 — — 0.33 0.29

(0.01) (0.15) (0.14)

LGDPI(–1) — 1.01 — 0.68 0.22

(0.01) (0.15) (0.20)

LGDPI(–2) — — 0.98 — 0.49

(0.01) (0.13)

LGPRHOUS –0.48 — — –0.09 –0.28

(0.04) (0.17) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36 0.23

(0.04) (0.17) (0.30)

LGPRHOUS(–2) — — –0.38 — –0.38

(0.04) (0.18)

R2 0.9985

Variable (1) (2) (3) (4) (5)

LGDPI 1.03 — — 0.33 0.29

(0.01) (0.15) (0.14)

LGDPI(–1) — 1.01 — 0.68 0.22

(0.01) (0.15) (0.20)

LGDPI(–2) — — 0.98 — 0.49

(0.01) (0.13)

LGPRHOUS –0.48 — — –0.09 –0.28

(0.04) (0.17) (0.17)

LGPRHOUS(–1) — –0.43 — –0.36 0.23

(0.04) (0.17) (0.30)

LGPRHOUS(–2) — — –0.38 — –0.38

(0.04) (0.18)

R2 0.9985

32

If we add income and price lagged two years, the results become even more erratic. For a category of expenditure such as housing, where one might expect long lags, this is clearly not a constructive approach to determining the lag structure.

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

33

Despite the problem of multicollinearity, we may be able to obtain

33

Despite the problem of multicollinearity, we may be able to obtain

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

34

The usual way of investigating the long-run relationship between Y and

34

The usual way of investigating the long-run relationship between Y and

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

35

One then evaluates the effect of a change in equilibrium on

35

One then evaluates the effect of a change in equilibrium on

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

36

In the model with two lags shown, (β2 + β3 +

36

In the model with two lags shown, (β2 + β3 +

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

37

We can calculate the long-run effect from the point estimates of

37

We can calculate the long-run effect from the point estimates of

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

38

The table presents an example of this. It gives the sum

38

The table presents an example of this. It gives the sum

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

39

If we are estimating long-run effects, we need standard errors as

39

If we are estimating long-run effects, we need standard errors as

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

40

The point estimate of the coefficient of Xt will be the

40

The point estimate of the coefficient of Xt will be the

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

41

Since Xt may well not be highly correlated with (Xt –

41

Since Xt may well not be highly correlated with (Xt –

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

Estimates of long-run income and price elasticities

Specification (1) (2) (3) (4) (5)

Sum of income elasticities 1.03 1.01 0.98 1.01 1.00

Sum of price elasticities –0.48 –0.43 –0.38 –0.45 –0.43

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1961 2003

Included observations:

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1961 2003

Included observations:

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.046768 0.133685 0.349839 0.7285

LGDPI 1.000341 0.006997 142.9579 0.0000

X1 -0.221466 0.196109 -1.129302 0.2662

X2 -0.491028 0.134374 -3.654181 0.0008

LGPRHOUS -0.425357 0.033583 -12.66570 0.0000

P1 -0.233308 0.298365 -0.781955 0.4394

P2 0.378626 0.175710 2.154833 0.0379

============================================================

R-squared 0.999265 Mean dependent var 6.398513

Adjusted R-squared 0.999143 S.D. dependent var 0.406394

S.E. of regression 0.011899 Akaike info criter-5.876897

Sum squared resid 0.005097 Schwarz criterion -5.590190

Log likelihood 133.3533 F-statistic 8159.882

Durbin-Watson stat 0.607270 Prob(F-statistic) 0.000000

============================================================

42

The output shows the result of fitting the reparameterized model for housing with two lags (Specification (5) in the table). X1 = LGDPI – LGDPI(–1), X2 = LGDPI – LGDPI(–2), P1 = LGPRHOUS – LGPRHOUS(–1), and P2 = LGPRHOUS – LGPRHOUS(–2).

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

43

As expected, the point estimates of the coefficients of LGDPI and

43

As expected, the point estimates of the coefficients of LGDPI and

–0.43, are the sum of the point estimates of the coefficients of the current and lagged terms in Specification (5).

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1961 2003

Included observations: 43 after adjusting endpoints

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.046768 0.133685 0.349839 0.7285

LGDPI 1.000341 0.006997 142.9579 0.0000

X1 -0.221466 0.196109 -1.129302 0.2662

X2 -0.491028 0.134374 -3.654181 0.0008

LGPRHOUS -0.425357 0.033583 -12.66570 0.0000

P1 -0.233308 0.298365 -0.781955 0.4394

P2 0.378626 0.175710 2.154833 0.0379

============================================================

R-squared 0.999265 Mean dependent var 6.398513

Adjusted R-squared 0.999143 S.D. dependent var 0.406394

S.E. of regression 0.011899 Akaike info criter-5.876897

Sum squared resid 0.005097 Schwarz criterion -5.590190

Log likelihood 133.3533 F-statistic 8159.882

Durbin-Watson stat 0.607270 Prob(F-statistic) 0.000000

============================================================

44

Also as expected, the standard errors, 0.01 and 0.03, are much

44

Also as expected, the standard errors, 0.01 and 0.03, are much

TIME SERIES MODELS: STATIC MODELS AND MODELS WITH LAGS

============================================================

Dependent Variable: LGHOUS

Method: Least Squares

Sample(adjusted): 1961 2003

Included observations: 43 after adjusting endpoints

============================================================

Variable Coefficient Std. Error t-Statistic Prob.

============================================================

C 0.046768 0.133685 0.349839 0.7285

LGDPI 1.000341 0.006997 142.9579 0.0000

X1 -0.221466 0.196109 -1.129302 0.2662

X2 -0.491028 0.134374 -3.654181 0.0008

LGPRHOUS -0.425357 0.033583 -12.66570 0.0000

P1 -0.233308 0.298365 -0.781955 0.4394

P2 0.378626 0.175710 2.154833 0.0379

============================================================

R-squared 0.999265 Mean dependent var 6.398513

Adjusted R-squared 0.999143 S.D. dependent var 0.406394

S.E. of regression 0.011899 Akaike info criter-5.876897

Sum squared resid 0.005097 Schwarz criterion -5.590190

Log likelihood 133.3533 F-statistic 8159.882

Durbin-Watson stat 0.607270 Prob(F-statistic) 0.000000

============================================================

Теория систем. Вводная лекция

Теория систем. Вводная лекция Решение уравнений и неравенств, содержащих параметр, с использованием параллельного переноса вдоль оси Oy

Решение уравнений и неравенств, содержащих параметр, с использованием параллельного переноса вдоль оси Oy Принцип Дирихле

Принцип Дирихле Целые числа. Рациональные числа

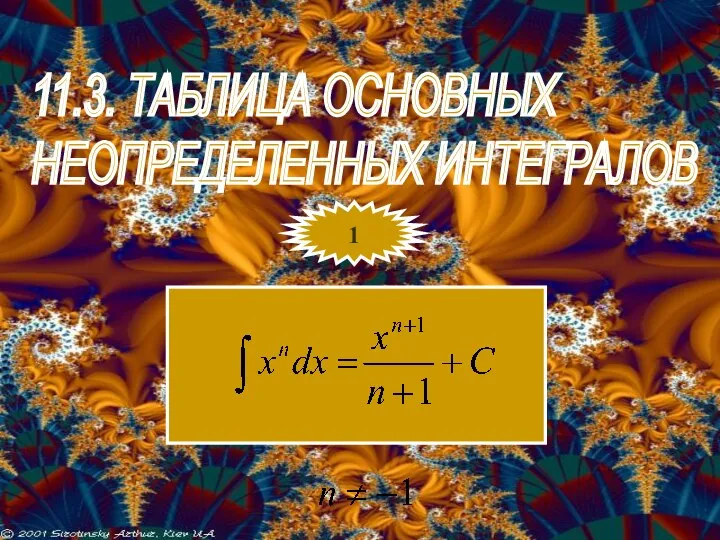

Целые числа. Рациональные числа Таблица основных неопределенных интегралов

Таблица основных неопределенных интегралов Доли и дроби

Доли и дроби Презентация по математике "Показательная функция, её свойства и график" - скачать

Презентация по математике "Показательная функция, её свойства и график" - скачать  Деление и степень числа. Тест

Деление и степень числа. Тест Доли числа

Доли числа Случаи вычитания 14 -

Случаи вычитания 14 - Применение распределительного свойства умножения. 6 класс

Применение распределительного свойства умножения. 6 класс Решение задач ЕГЭ по матеиатике

Решение задач ЕГЭ по матеиатике Подготовка к контрольной работе по теме «Системы линейных уравнений»

Подготовка к контрольной работе по теме «Системы линейных уравнений» Алгебраическая дробь. Сокращение дробей

Алгебраическая дробь. Сокращение дробей Треугольники

Треугольники Скалярное произведение векторов и его свойства

Скалярное произведение векторов и его свойства Презентация . На тему: «Золотое сечение и применение золотого сечения в жизни. Автор работы: Полянских Александр ученик 10 «б» клас

Презентация . На тему: «Золотое сечение и применение золотого сечения в жизни. Автор работы: Полянских Александр ученик 10 «б» клас Признаки подобия треугольников

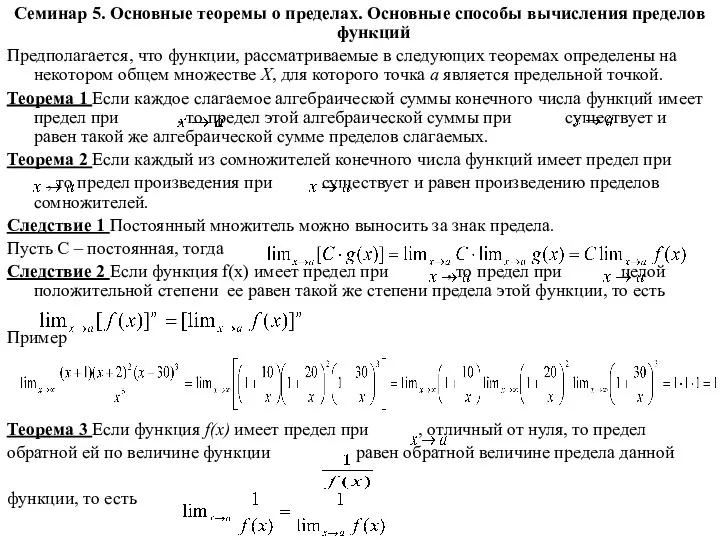

Признаки подобия треугольников Основные теоремы о пределах. Способы вычисления пределов функций. (Семинар 5)

Основные теоремы о пределах. Способы вычисления пределов функций. (Семинар 5) Формулы сокращенного умнажения

Формулы сокращенного умнажения Решение уравнений Математика, 5 класс

Решение уравнений Математика, 5 класс Наименьшее общее кратное (НОК);

Наименьшее общее кратное (НОК); Проверка непараметрических статистических гипотез

Проверка непараметрических статистических гипотез Презентация по математике "Нормальное распределение: свойства и следствия из них" -

Презентация по математике "Нормальное распределение: свойства и следствия из них" -  Функция у = sin x , её свойства и график

Функция у = sin x , её свойства и график Решение задач на площадь треугольника

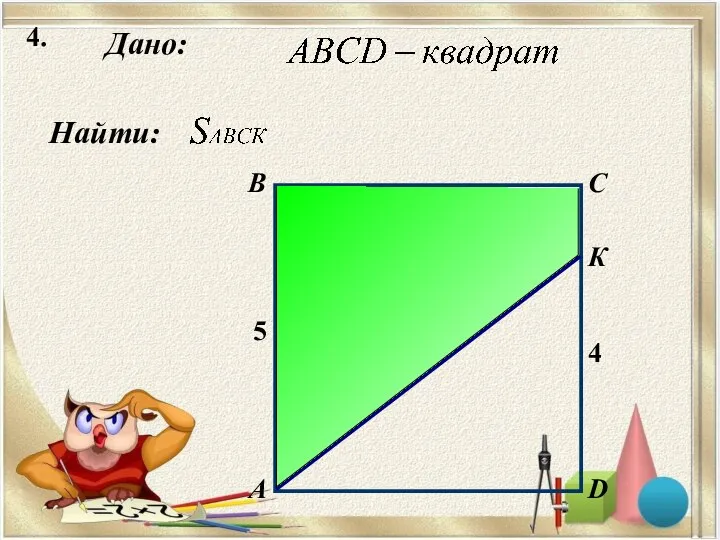

Решение задач на площадь треугольника Обыкновенная дробь. 5 класс

Обыкновенная дробь. 5 класс Пропорциональные отрезки в прямоугольном треугольнике (8 класс)

Пропорциональные отрезки в прямоугольном треугольнике (8 класс)