Содержание

- 2. The economy of Canada is a highly developed market economy. It is the 10th largest GDP

- 3. As with other developed nations, the country's economy is dominated by the service industry which employs

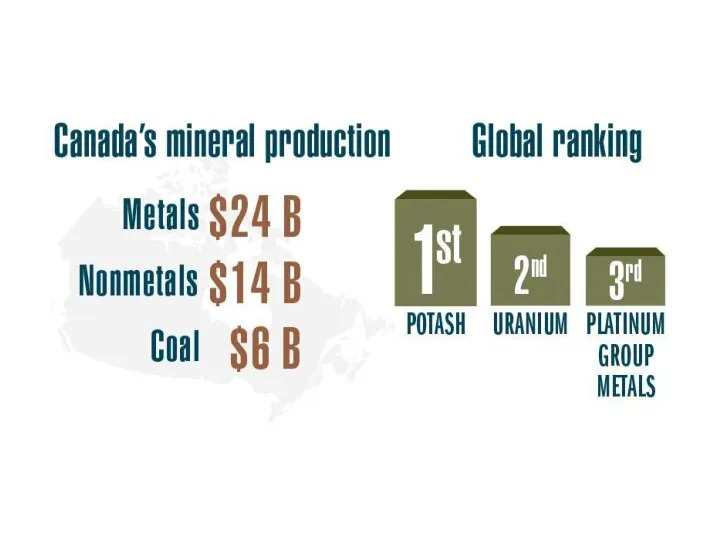

- 4. Canada's mining industry is one of the largest in the world. Producing more than 60 metals

- 5. Canada is the global leader in the production of potash and ranks among the top five

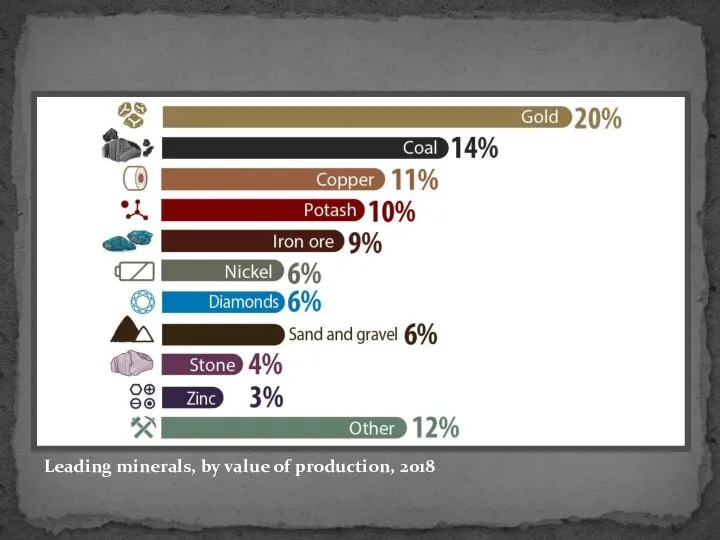

- 7. Leading minerals, by value of production, 2018

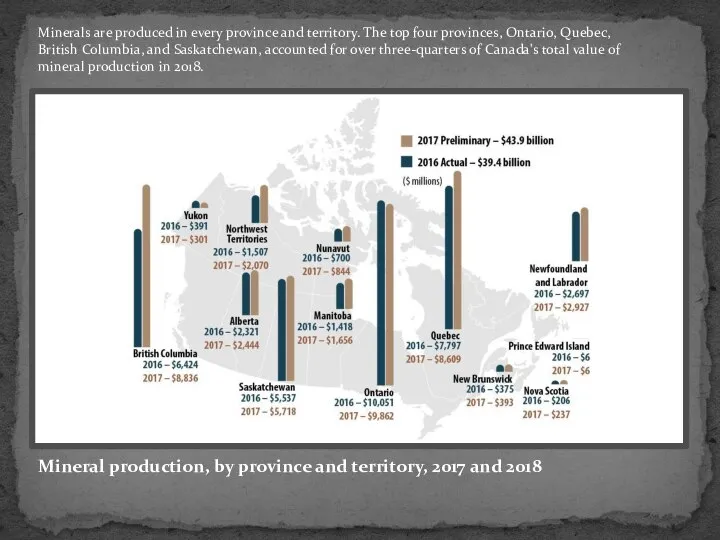

- 8. Mineral production, by province and territory, 2017 and 2018 Minerals are produced in every province and

- 9. Canadian cities provide regional bases for supporting exploration, mining and allied industries through specialized equipment and

- 10. Mineral exploration is the search for materials in the Earth's crust, where concentration and quantity allow

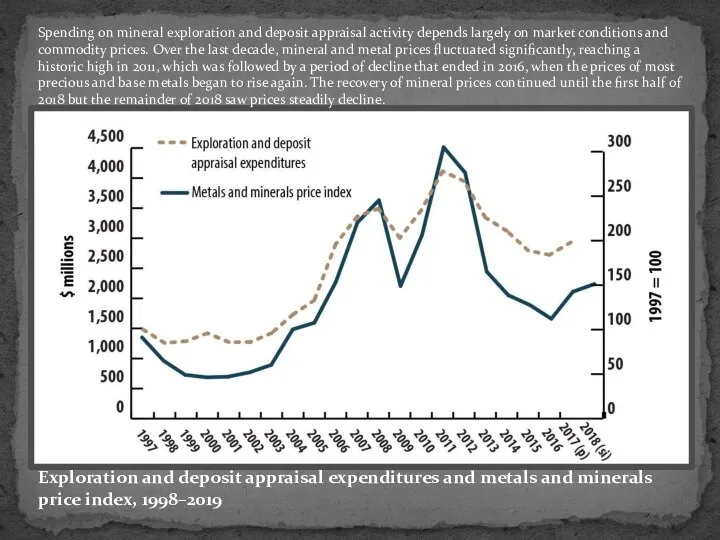

- 11. Exploration and deposit appraisal expenditures and metals and minerals price index, 1998–2019 Spending on mineral exploration

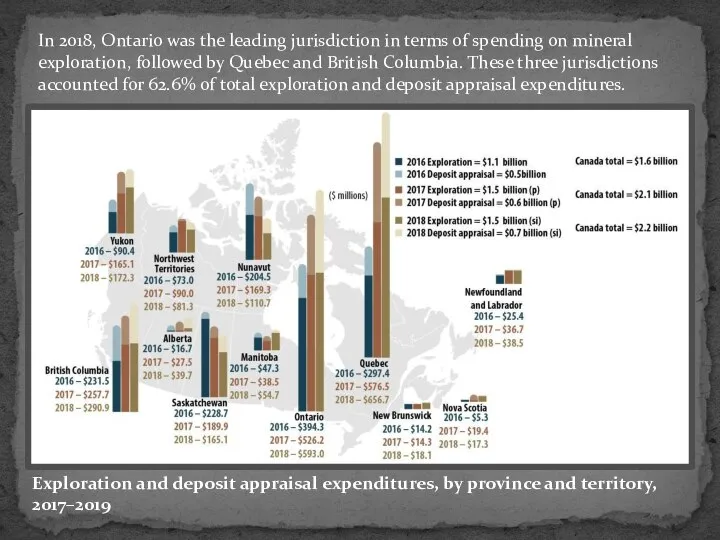

- 12. Exploration and deposit appraisal expenditures, by province and territory, 2017–2019 In 2018, Ontario was the leading

- 13. Two types of companies work in mineral exploration: Senior companies normally derive recurring operating revenues from

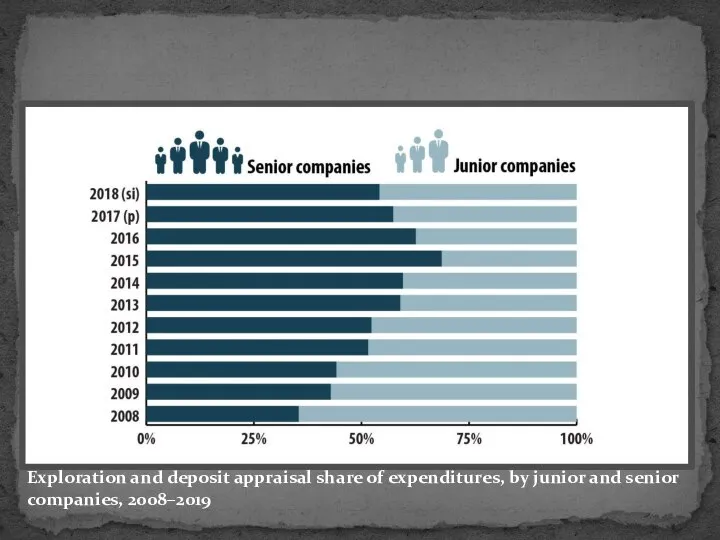

- 14. Exploration and deposit appraisal share of expenditures, by junior and senior companies, 2008–2019

- 15. Canadian exploration and mining companies are active across the globe. The extent of their presence can

- 16. Canadian mining assets, 2017

- 17. The Natural Resources Canada's Lands and Minerals Sector is committed to promoting Indigenous participation in mineral

- 18. More than 16,500 Indigenous people are employed in the minerals sector Indigenous people account for 12%

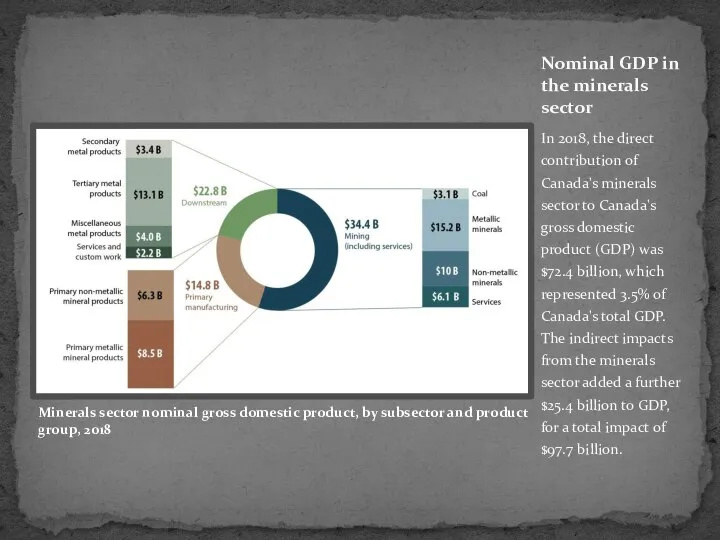

- 19. In 2018, the direct contribution of Canada's minerals sector to Canada's gross domestic product (GDP) was

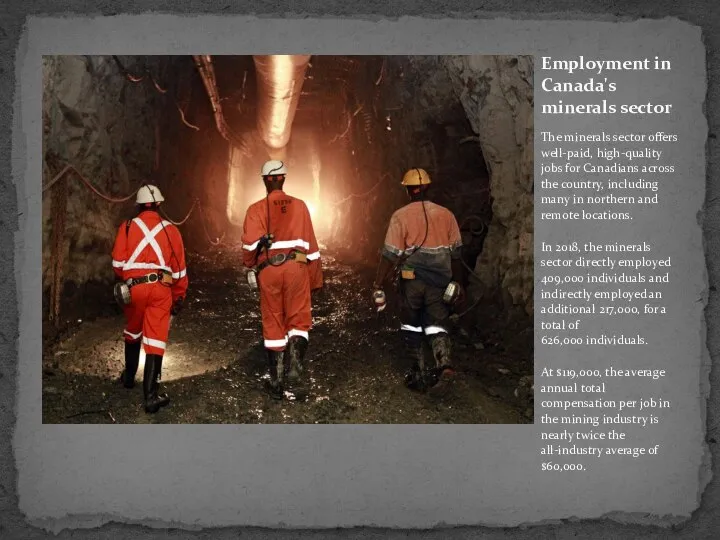

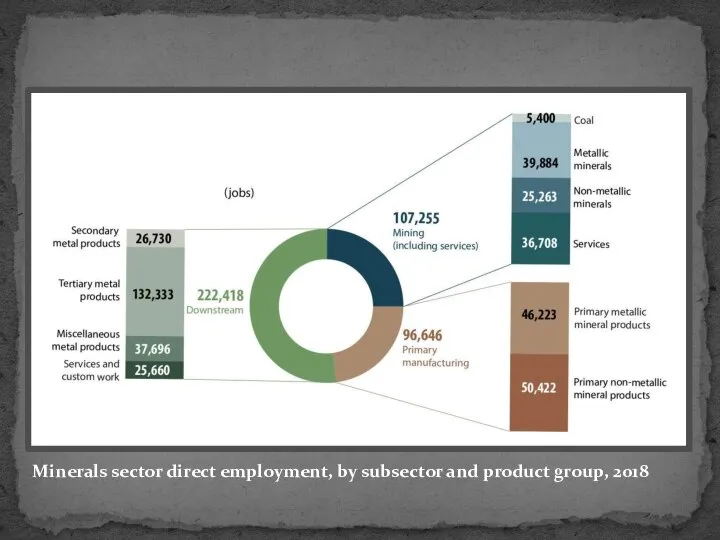

- 20. The minerals sector offers well-paid, high-quality jobs for Canadians across the country, including many in northern

- 21. Minerals sector direct employment, by subsector and product group, 2018

- 22. The Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) are the world's primary listing venues

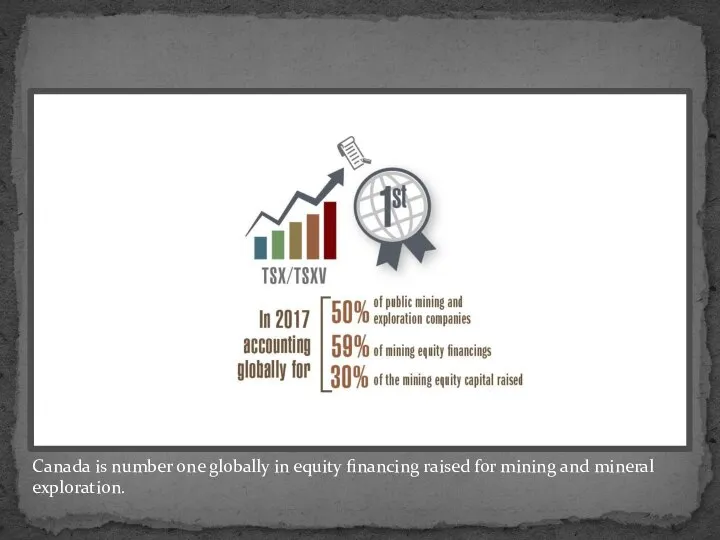

- 23. Canada is number one globally in equity financing raised for mining and mineral exploration.

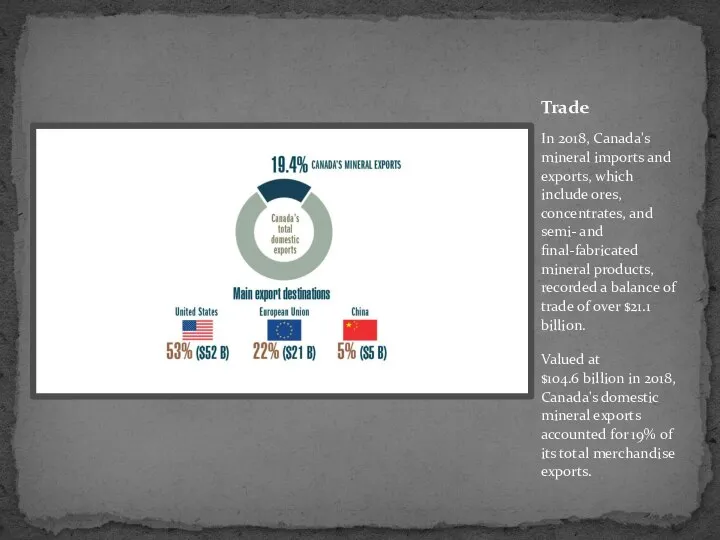

- 24. In 2018, Canada's mineral imports and exports, which include ores, concentrates, and semi- and final-fabricated mineral

- 25. Developing Canada's minerals sector in clean and sustainable ways will ensure that it can continue to

- 26. The Green Mining Initiative, led by Natural Resources Canada in close partnership with provincial/territorial governments, industry,

- 27. Canada is primed to respond to increased demand for both traditional and emerging commodities needed in

- 29. Скачать презентацию

отим Галецкий

отим Галецкий logicheskie_zadachi

logicheskie_zadachi Современные проблемы благоустройства и озеленения города

Современные проблемы благоустройства и озеленения города Электр тарихы. Электр энергетикасы ұғымы. Қазақстанның электр энергетикасы

Электр тарихы. Электр энергетикасы ұғымы. Қазақстанның электр энергетикасы Система обмена файлами и сообщениями для организации образовательного процесса

Система обмена файлами и сообщениями для организации образовательного процесса Информирование. Информационные слайды

Информирование. Информационные слайды ОМПТ-2. Часть 2

ОМПТ-2. Часть 2 АУДИТ - 315

АУДИТ - 315 Информационное письмо

Информационное письмо rooms - furniture

rooms - furniture Электричество

Электричество Интеллектуальная игра Умники и умницы на 23 февраля

Интеллектуальная игра Умники и умницы на 23 февраля Развитие русской иконописи в XIV - XV веках. Сравнение иконописи Ф. Грека и А. Рублёва

Развитие русской иконописи в XIV - XV веках. Сравнение иконописи Ф. Грека и А. Рублёва Презентация1

Презентация1 Разработка высоковольтного асинхронного взрывобезопасного двигателя мощностью 200 кВт с повышенной перегрузочной способностью

Разработка высоковольтного асинхронного взрывобезопасного двигателя мощностью 200 кВт с повышенной перегрузочной способностью Внутреннее и внешнее устройство храма и правила поведения в храме

Внутреннее и внешнее устройство храма и правила поведения в храме Провешивание поверхностей отвесом

Провешивание поверхностей отвесом Куроводство в сфере птицеводства

Куроводство в сфере птицеводства Материнская плата

Материнская плата Распределительные трансформаторы 6 -35 кВ

Распределительные трансформаторы 6 -35 кВ санпин

санпин Использование радиолокатора и САРП для обеспечения безопасности плавания

Использование радиолокатора и САРП для обеспечения безопасности плавания 20160828_vperyodsyny_ellady

20160828_vperyodsyny_ellady Рекомендации к родительскому собранию Не допустить беды

Рекомендации к родительскому собранию Не допустить беды социология 13.04.17

социология 13.04.17 Стретчинг

Стретчинг Ноотропы. Как подготовить мозг к сессии

Ноотропы. Как подготовить мозг к сессии 20140911_vosstanie_spartaka_1

20140911_vosstanie_spartaka_1