Содержание

- 2. Slide Enterprise risk management Significant increase in risks faced by people and organizations Corporate governance and

- 3. Slide Operational Risk Management Operational risk: Expected and unexpected economic impact of inadequate or failed internal

- 4. Slide Operational risk management ORM role: Ensure operational risks identified and effectively and efficiently managed Reduce

- 5. Slide Operational risk management The ORM structure: Clearly defined Clearly identifies roles and responsibilities Risk owners

- 6. Slide Operational risk management Five key steps of ORM process: Identification and classification Assessment, measurement and

- 7. Slide Operational risk management Elements supporting ORM Risk and control self assessment Key risk indicators Loss-event

- 8. Slide ORM: Risk and control self assessment Risk and control self assessment (RCSA) as management tool

- 9. Slide ORM: Risk and control self assessment Identification and classification of operational risks Identify events that

- 10. Slide ORM: Risk and control self assessment Identification of controls Key objective: reduce operational risk exposure

- 11. Slide ORM: Risk and control self assessment Assessment Operational risk exposure Severity: most likely monetary loss

- 12. Slide ORM: Risk and control self assessment Inherent risk value Identify significant potential loss exposure Identify

- 13. Slide ORM: Risk and control self assessment Control assessment Control design effectiveness Level of risk mitigation

- 14. Slide ORM: Risk and control self assessment Measurement Failure rates of control design and control operating

- 15. Slide ORM: Risk and control self assessment Mitigation Compare expected losses with a predefined risk acceptance

- 16. Slide ORM: Key risk indicators Key risk indicators (KRI) Measures that provide information about organization or

- 17. Slide ORM: Loss-event database Loss event database Loss event: occurrence that leads to a financial cost,

- 18. Slide ORM: Audits Audits Crucial function of ORM Through audits, operational processes can be checked, issues

- 19. Slide ORM: Sarbanes-Oxley Act Sarbanes-Oxley Act (SOX) Introduced by US Congress in 2002 after major US

- 20. Slide ORM: Sarbanes-Oxley Act SOX compliance requirement: All applicable companies must establish financial accounting framework that

- 21. Slide ORM awareness ORM awareness Essential part of effective risk management. Raised throughout company by implementing

- 22. Slide Increased awareness of operational risks triggered by corporate failures made operational risk management integral part

- 23. Why ORM? To Ensure Necessary Risks are Taken ORM: Is an important tool for training realism

- 24. What is Operational Risk Management? Natural evolution from traditional risk management Systematic decision-making tool that balances

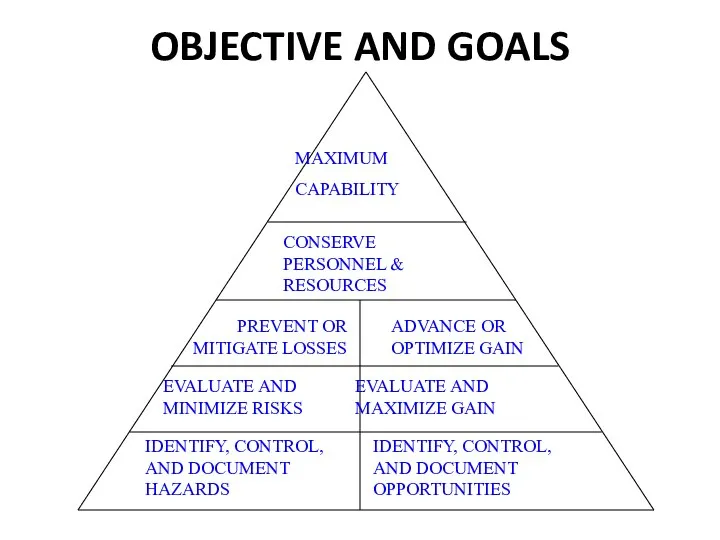

- 25. OBJECTIVE AND GOALS IDENTIFY, CONTROL, AND DOCUMENT HAZARDS IDENTIFY, CONTROL, AND DOCUMENT OPPORTUNITIES EVALUATE AND MINIMIZE

- 26. 4 KEY ORM PRINCIPLES 1. Accept no unnecessary risks. 2. Make risk decisions at the appropriate

- 27. BUT.... NOBODY TAKES “UNNECESSARY” RISKS? If all the hazards that could have been detected have not

- 28. 2. Make Risk Decisions at the Appropriate Level Factors below become basis of a decision- making

- 29. WHAT HAPPENS WHEN AN ORGANIZATION STOPS TAKING RISKS? WEBSTER: “BUREAUCRACY: A system of administration characterized by

- 30. Operational Process Operational Process Operational Process Loss Control Staff Injects Operational Leaders Add-On This is the

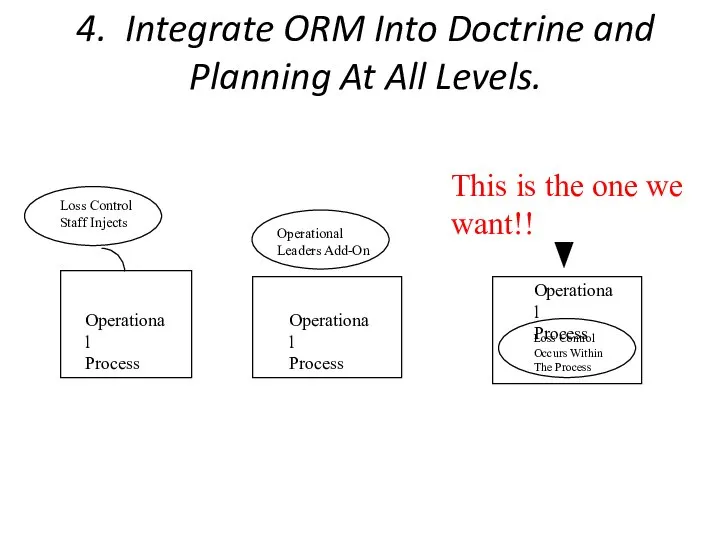

- 31. and all their sub-processes WHAT IS AN “OPERATIONAL PROCESS”?

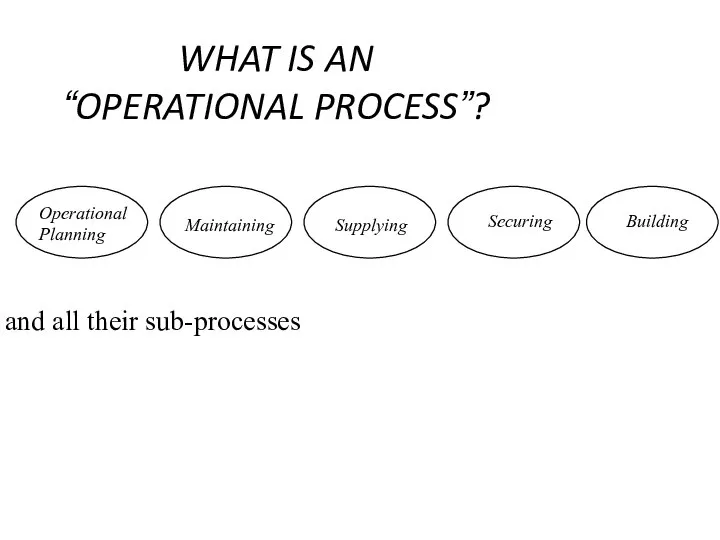

- 32. ORM IS BASED ON SYSTEMS MANAGEMENT CONCEPTS

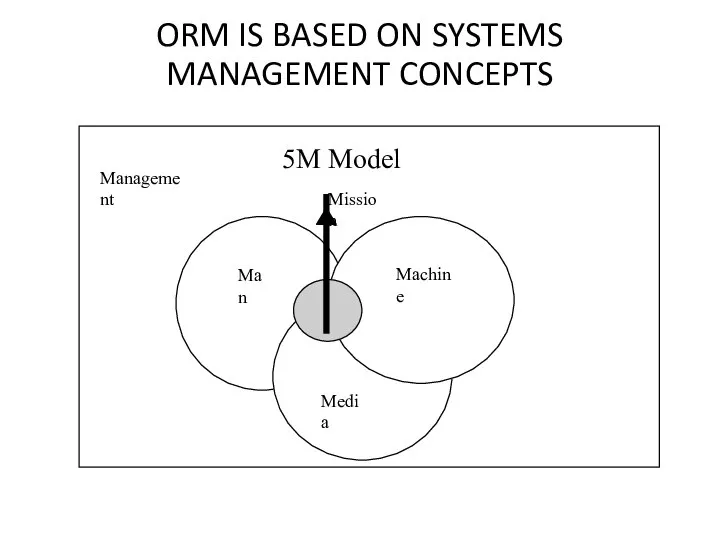

- 33. THE ORM 6-STEP PROCESS

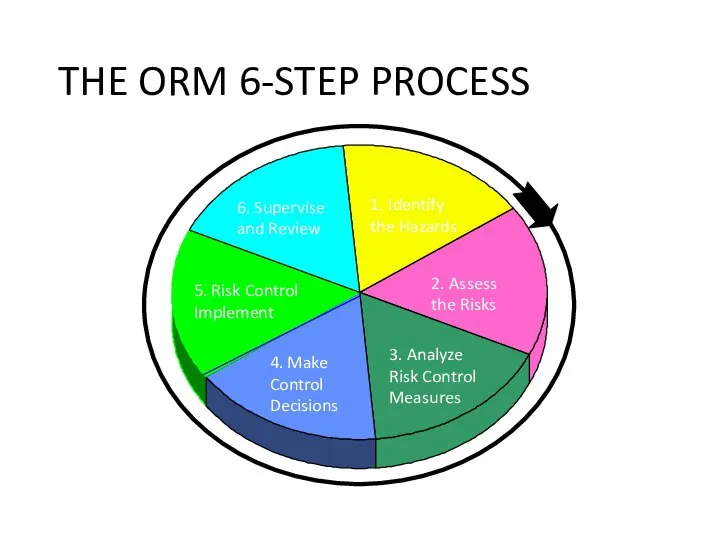

- 34. Step 1 - Identify the Hazard Process: Emphasize hazard ID tools. Adds rigor and early detection.

- 35. 7 Primary Hazard ID Tools Operations Analysis/Flow Diagram Preliminary Hazard Analysis What If Scenario Logic Diagrams

- 36. Specialized and Advanced Hazard ID Tools Specialized tools accomplish specific ORM objectives. Map analysis, interface analysis,

- 37. EXAMPLE: THE DRIVE TO WORK What if the car catches fire. WHAT IF ANALYSIS What if

- 38. Step 2 - Assess the Risk Process: All hazards evaluated for total impact on mission or

- 39. THE ASSESSMENT TOOLS ADD OBJECTIVITY TO THE EVALUATION OF RISK Risk assessment matrix: Requires specific evaluations

- 40. THE RISK ASSESSMENT MATRIX KEY TOOL FOR RISK ASSESSMENT

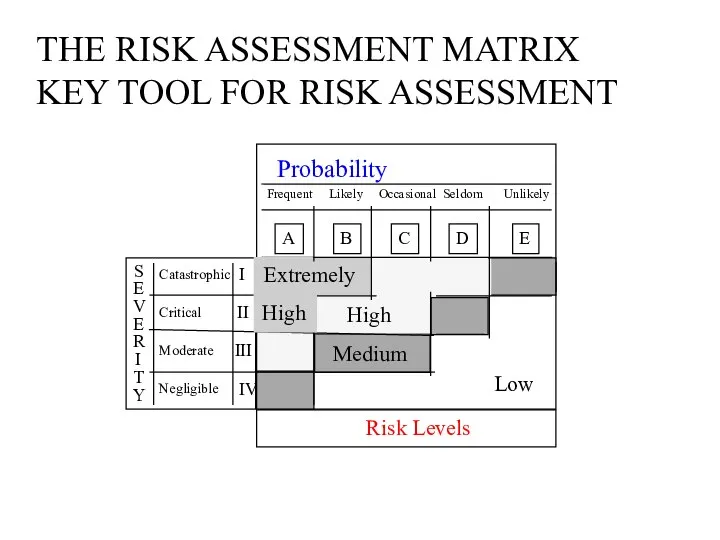

- 41. EXAMPLE: THE DRIVE TO WORK What if the car catches fire. What if a carjack is

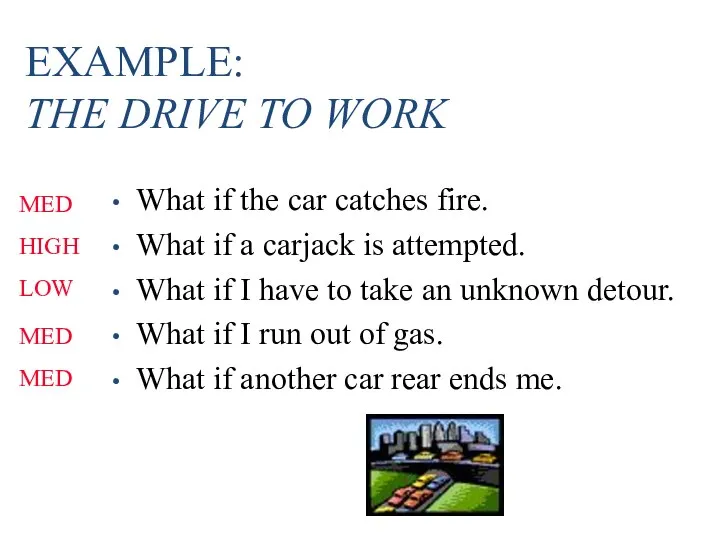

- 42. Step 3 - Analyze Risk Control Measures Process: Comprehensive risk control options are developed for risks

- 43. The Risk Control Option Tools Add Scope & Depth Basic or “macro” risk control options: Reject,

- 44. EXAMPLE: THE DRIVE TO WORK What if the car catches fire Macro options: Transfer - Insurance

- 45. Step 4 - Make Control Decisions Process: A decision-making system gets risk decisions to the right

- 46. ORM Uses Proven Decision-making Tools Decision-making systems get the decision to the right person, at the

- 47. ESTABLISHING A DECISION MAKING GUIDELINE EXAMPLE RISK LEVEL DECISION LEVEL Extremely High Wing Commander or specifically

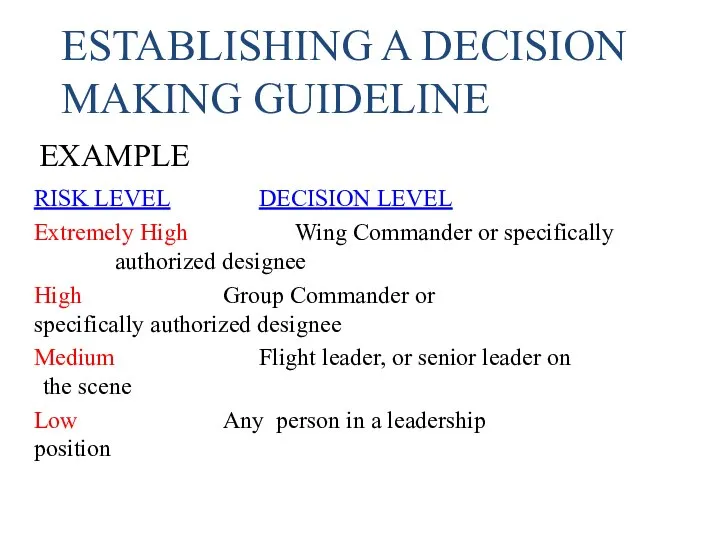

- 48. EXAMPLE: THE DRIVE TO WORK What if the car catches fire Who decides: Vehicle owner(s) Control:

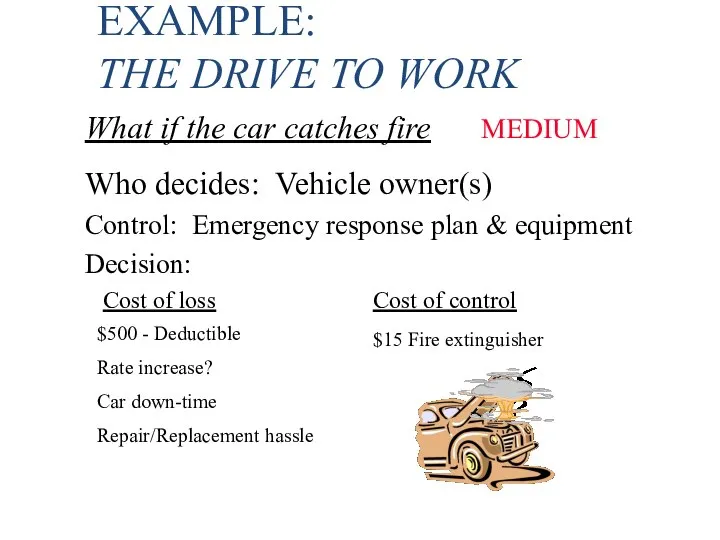

- 49. Step 5 - Risk Control Implementation Process: Leaders lead, operators are involved, all are accountable. Output:

- 50. ORM Implementation Tools & Guidelines Help Controls Click with Operators The involvement continuum guides the high

- 51. EXAMPLE: THE DRIVE TO WORK What if the car catches fire Transfer - Insurance OPR: Dad

- 52. Step 6 - Supervise and Review Process: Progress measured through increased mission effectiveness, mishap results and

- 53. Review and Feedback Procedures Measure & Leverage ORM Results Eliminate invalid statistical uses of mishap rates

- 54. USING THE 6-STEP PROCESS THE RISK MANAGEMENT CONTINUUM

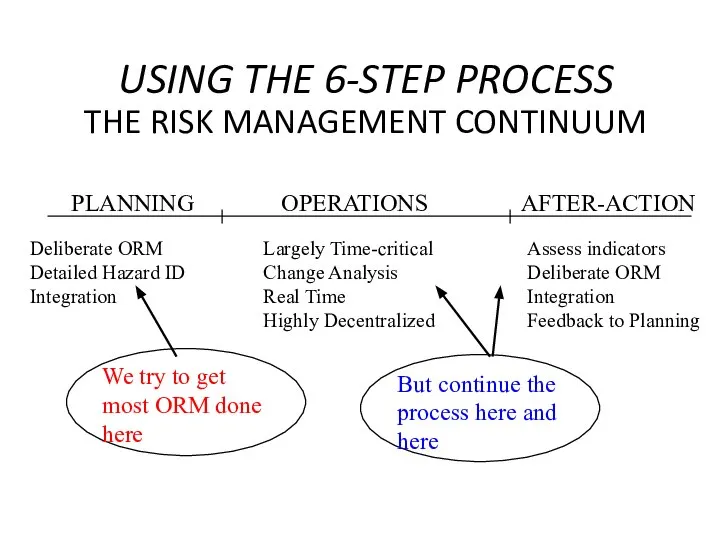

- 55. USING THE 6-STEP PROCESS LEVELS OF EFFORT Little Time Resources Risk Lot of Time Resources Risk

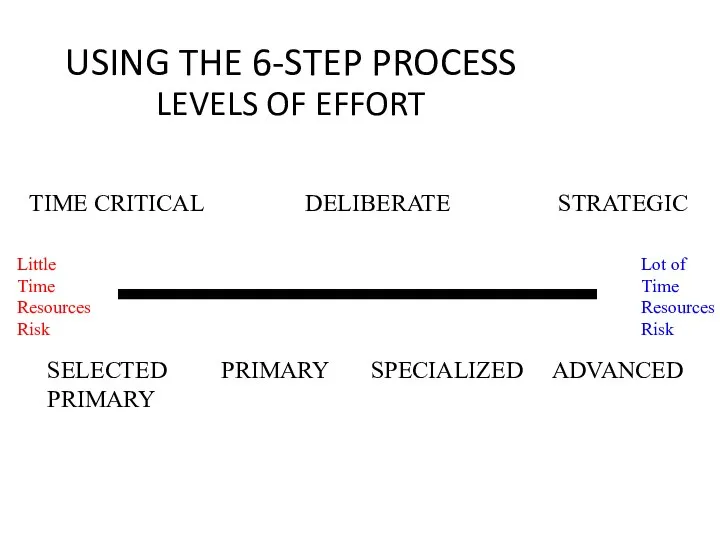

- 56. Why integration is critical? 12 Strategies for ORM integration. The importance of pace. Integrating the ORM

- 57. WHY INTEGRATION IS CRITICAL? Integration: Forces balancing of loss control and other mission needs Captures more

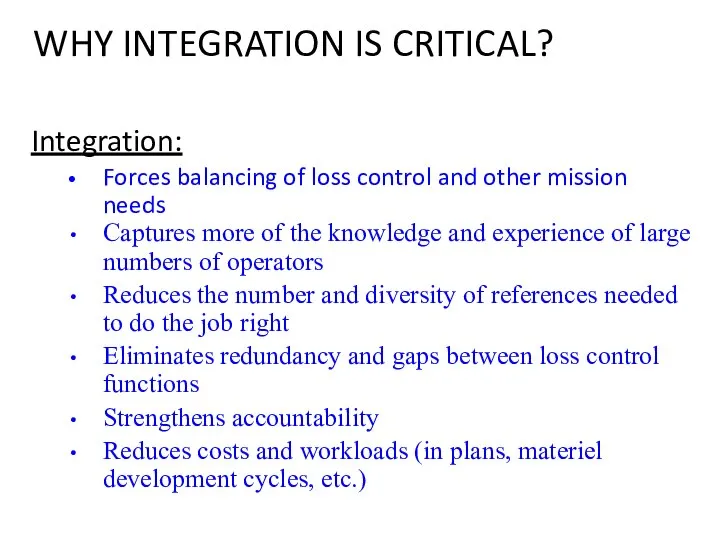

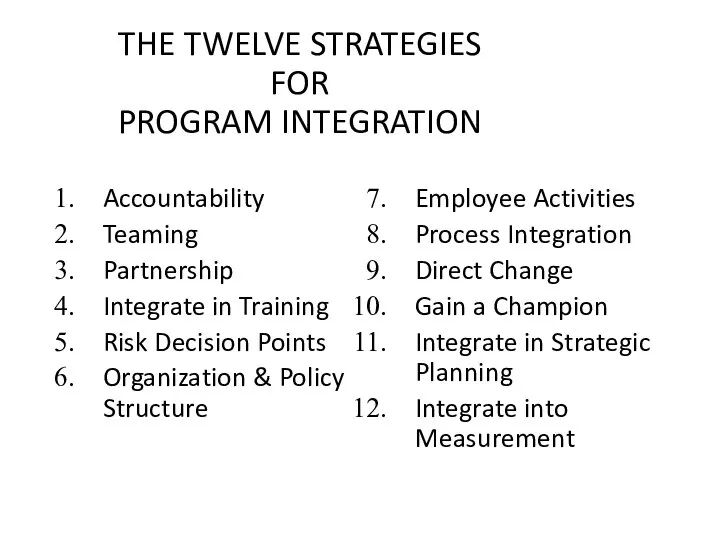

- 58. THE TWELVE STRATEGIES FOR PROGRAM INTEGRATION Accountability Teaming Partnership Integrate in Training Risk Decision Points Organization

- 59. THE IMPORTANCE OF PACE Don’t use the shotgun Don’t get out in front of the organization

- 60. USAF ORM MATURATION Vision USAF Approach Background Strategy

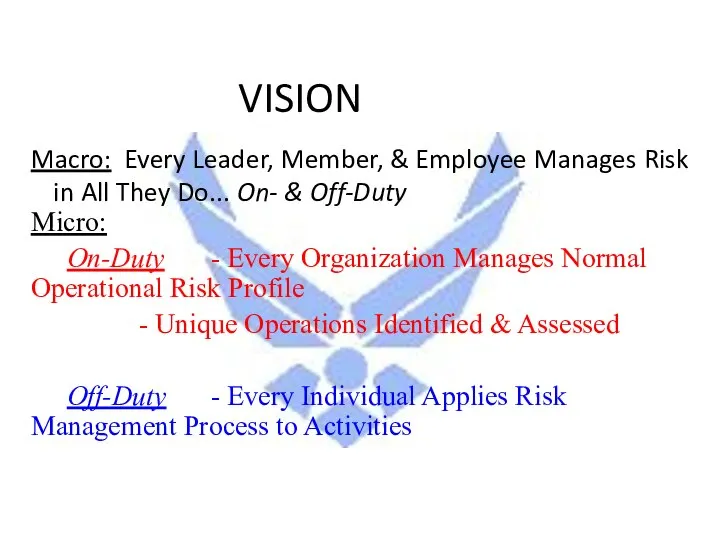

- 61. VISION Macro: Every Leader, Member, & Employee Manages Risk in All They Do... On- & Off-Duty

- 62. CAP APPROACH Top-Down Approach Strong Senior Leader Backing Decentralized Implementation Moderate Implementation Tempo Safety Lead Role

- 63. ORM STRATEGY Miscellaneous Initiatives Automated “Tools” Doctrine Integration Crosstell NEWS Release(s) Video(s)

- 64. The leader’s role will be a decisive factor in the success or failure of ORM

- 65. ORM Leadership Opportunities 1. Commit to Breakthrough Improvement Objectives: Put improvement of risk performance (control-opportunity) on

- 66. ORM Leadership Opportunities Continued 3. Set a Personal Example Objectives: To assure credibility of the ORM

- 67. ORM Leadership Opportunities Continued 5. Induce Loss Control Community Functional Integration Objectives: Build increasing cooperation and

- 68. ORM Leadership Opportunities Continued 7. Resource ORM Activities Objectives: Allocate resources to ORM (control-opportunity) at a

- 69. ORM Leadership Opportunities Continued 9. Detect & Correct Gambling Objectives: Develop an organization in which risk

- 70. ORM Leadership Opportunities Continued 11. Regularly Monitor ORM Progress Objectives: Periodically assess a set of data

- 71. 3 Definition Basel II – Operational risk is the risk of loss resulting from inadequate or

- 72. 4 Definition Who are these people? What does this have to do with us?

- 73. 5 Definition Basel Committee on Banking Supervision – Committee of banking supervisory authorities that provides a

- 74. 6 Definition Basel II was intended to create an international standard for banking regulators to control

- 75. 7 Definition Market liquidity is the risk that a security can not be sold at all

- 76. 8 Definition Solvency II codifies and harmonizes EU insurance regulation. Solvency II definition - Operational risk

- 77. 9 Definition Legal risk - risk of loss due to legal actions or uncertainty in the

- 78. 10 Definition Better definition - Operational risk is the risk arising from execution of a company’s

- 79. 11 Definition Operational risk does not include strategic risk – the risk that arises from decisions

- 80. 12 Types of Operational Risk Basel II List Internal fraud – misappropriation of assets, tax evasion,

- 81. 13 Types of Operational Risk Operational risk losses usually are idiosyncratic to a particular institution. Operational

- 82. 14 Operational Risk Management Framework Basel II Risk organizational and governance structure Policies, procedures and processes

- 83. 15 Operational Risk Management Framework Enterprise Risk Management Steps 1. Identify risks 2. Describe and/or quantify

- 84. 16 Operational Risk Management Framework Basel II differentiates between verification and validation. Verification tests the effectiveness

- 85. 17 Operational Risk Management Framework Essential elements for verification and validation: Independence Capacity – adequately staffed

- 86. 18 Quantification Basel Committee on Banking Supervision “Operational Risk – Supervisory Guidelines for the Advanced Measurement

- 87. 19 Quantification It all starts with scenarios. Ask “What if…?” Don’t know what internal and external

- 88. 20 Quantification Internal Loss Data (ILD) Internal to the organization Used to estimate loss frequencies Used

- 89. 21 Quantification External Data (ED) External to the organization Used to estimate loss severity, particularly for

- 90. 22 Quantification Scenario Analysis (SA) Scenario outputs form part of the input into the Advanced Measurement

- 91. 23 Quantification Business Environment and Internal Controls Factors (BEICF) Highly subjective Often used as indirect input

- 92. 24 Mitigation Goals Have business continuity Mitigate financial loss Reduce reputational risk

- 93. 25 Mitigation The size of loss a company is willing to accept compared to the cost

- 94. 26 Mitigation Low frequency, low severity – may do nothing. Low frequency, high severity – analyze

- 95. 27 Mitigation Insurance companies sell products that mitigate others’ operational risks.

- 96. 28 Mitigation Basel Committee on Banking Supervision - “Principles for the Sound Management of Operational Risk”

- 97. 29 Mitigation Three lines of defense: Business line management An independent corporate operational risk management function

- 98. 30 Monitoring Key Performance Indicator (KPI) – Are we achieving our desired level of performance? Key

- 99. 31 Risk Identification and Mitigation Examples Fine Dining Restaurant Family owned Open only for dinner Monday

- 100. 32 Risk Identification and Mitigation Examples Fine Dining Restaurant Internal policies, practices, and procedures What can

- 101. 33 Risk Identification and Mitigation Examples Large Taxi Company In major city Owned by one private

- 102. 34 Risk Identification and Mitigation Examples Large Taxi Company Internal policies, practices, and procedures What can

- 103. 35 Risk Identification and Mitigation Examples Insurance Company Privately held Much of board is family members

- 104. 36 Risk Identification and Mitigation Examples Insurance Company Internal policies, practices, and procedures What can go

- 105. 37 Risk Identification and Mitigation Examples Insurance Company Internal policies, practices, and procedures (continued) What can

- 106. 38 Risk Identification and Mitigation Examples Insurance Company Operational risk losses usually are idiosyncratic to a

- 107. 39 Words of Wisdom Strategic decisions affect operations. Have an “open door” policy. Manage by walking

- 108. 40 Words of Wisdom Some processes need to be “hard-wired” in: no exceptions. Manage by exception.

- 109. 41 Words of Wisdom Be aware of what is going on outside the company: Clients/customers Service

- 110. 42 Words of Wisdom Be more proactive than reactive. Keep an open mind. See what is

- 112. Скачать презентацию

Замки Европы

Замки Европы Организация видов работ при эксплуатации и реконструкции строительных объектов

Организация видов работ при эксплуатации и реконструкции строительных объектов Эмбриология человека

Эмбриология человека  Электронные платежные системы в Интернет и их особенности. Выполнил: Студент 3 курса (ШФ) ЮРГИ Факультет «Прикладная информатика

Электронные платежные системы в Интернет и их особенности. Выполнил: Студент 3 курса (ШФ) ЮРГИ Факультет «Прикладная информатика Луговые цветы

Луговые цветы Строительная механика. Основы теории метода конечных элементов

Строительная механика. Основы теории метода конечных элементов Композиторы «Могучей кучки» Художественная культура пореформенной Руси

Композиторы «Могучей кучки» Художественная культура пореформенной Руси Физиологические основы сна

Физиологические основы сна  Биологический диктант Закономерности наследственности и изменчивости изучает …. Основоположником генетики является…. Объектом своих исследований Г. Мендель выбрал…. Тип опыления у гороха…. Женская и мужская особь обозначается…. Родители и гибр

Биологический диктант Закономерности наследственности и изменчивости изучает …. Основоположником генетики является…. Объектом своих исследований Г. Мендель выбрал…. Тип опыления у гороха…. Женская и мужская особь обозначается…. Родители и гибр Freunde in unserem Leben und das Leben der Familie

Freunde in unserem Leben und das Leben der Familie Военная доктрина республики Казахстан

Военная доктрина республики Казахстан Муниципальное дошкольное образовательное учреждение Центр развития ребенка- детский сад №36 Педагогический совет №2 «Здоровье

Муниципальное дошкольное образовательное учреждение Центр развития ребенка- детский сад №36 Педагогический совет №2 «Здоровье Устройство фотоаппарата

Устройство фотоаппарата Культура народов России в XVII веке

Культура народов России в XVII веке Louis Pasteur 1822-1894

Louis Pasteur 1822-1894  Подкоренная функция

Подкоренная функция Влияние на рост школьника занятия тяжелой атлетикой. 8 класс

Влияние на рост школьника занятия тяжелой атлетикой. 8 класс СТАРИННЫЕ ЗАДАЧИ НА ДРОБИ Открытый урок учителя математики 1 категории Черновой Галины Петровны

СТАРИННЫЕ ЗАДАЧИ НА ДРОБИ Открытый урок учителя математики 1 категории Черновой Галины Петровны  Netiquette is the code of the user’s behaviour

Netiquette is the code of the user’s behaviour IDEF3

IDEF3  ТЕПЛОВОЕ ИЗЛУЧЕНИЕ. Основные экспериментальные закономерности

ТЕПЛОВОЕ ИЗЛУЧЕНИЕ. Основные экспериментальные закономерности Иммануил Кант

Иммануил Кант Устройство и принцип работы крана вспомогательного тормоза 254

Устройство и принцип работы крана вспомогательного тормоза 254 Строительные конструкции. Перегородки

Строительные конструкции. Перегородки Презентация на тему "Информационные технологии в образовательном процессе" - скачать презентации по Педагогике

Презентация на тему "Информационные технологии в образовательном процессе" - скачать презентации по Педагогике Весёлый алфавит - презентация для начальной школы_

Весёлый алфавит - презентация для начальной школы_ Плоские электромагнитные волны в изотропных средах

Плоские электромагнитные волны в изотропных средах Исследование трупа новорожденного младенца

Исследование трупа новорожденного младенца