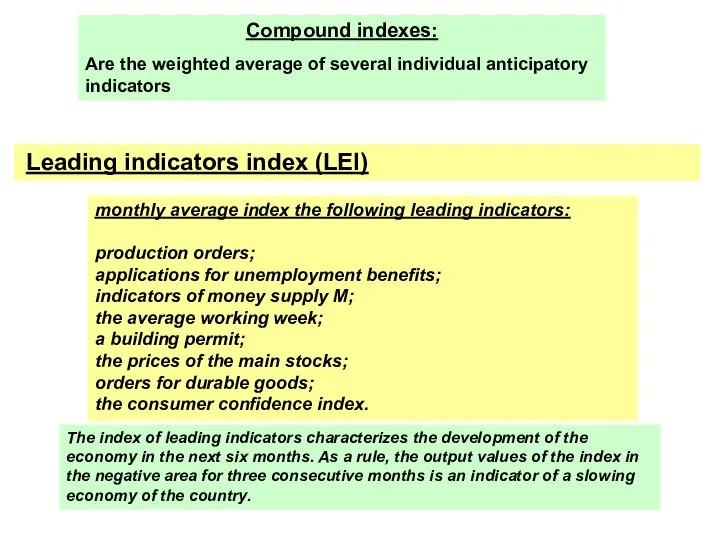

Leading indicators index (LEI)

monthly average index the following leading indicators:

production

orders;

applications for unemployment benefits;

indicators of money supply M;

the average working week;

a building permit;

the prices of the main stocks;

orders for durable goods;

the consumer confidence index.

The index of leading indicators characterizes the development of the economy in the next six months. As a rule, the output values of the index in the negative area for three consecutive months is an indicator of a slowing economy of the country.

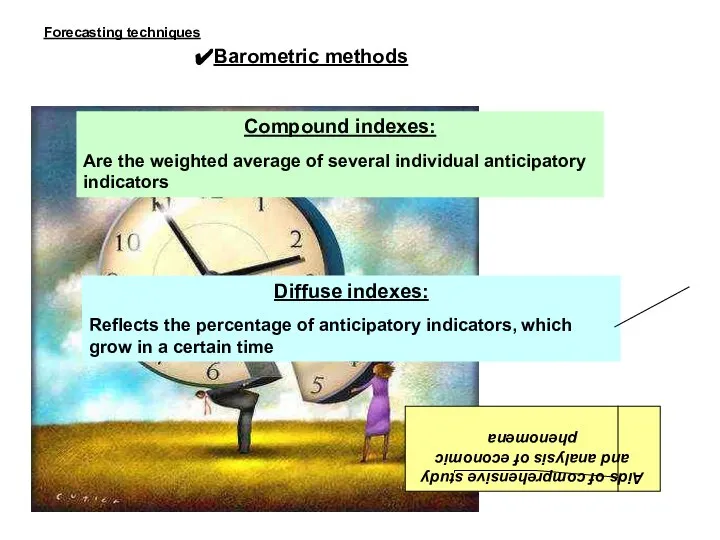

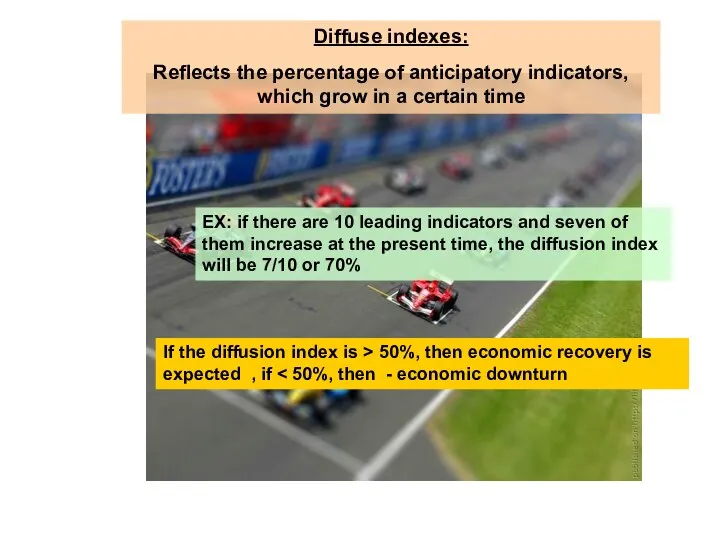

Compound indexes:

Are the weighted average of several individual anticipatory indicators

Семья и семейное хозяйство (для школьников)

Семья и семейное хозяйство (для школьников) Рыночная экономика

Рыночная экономика Бизнес-план 2017. Регион: Брянск

Бизнес-план 2017. Регион: Брянск Технология “воронка продаж”

Технология “воронка продаж” США. Экономика

США. Экономика Сравнение вариантов СЭС в условиях плановой экономики

Сравнение вариантов СЭС в условиях плановой экономики Макроэкономика Национальная экономика как целое

Макроэкономика Национальная экономика как целое Принципы Ямайской валютной системы

Принципы Ямайской валютной системы Предпосылки экономики. Производство, распределение, обмен, потребление и воспроизводственный процесс

Предпосылки экономики. Производство, распределение, обмен, потребление и воспроизводственный процесс Основы экономической теории

Основы экономической теории Роль образования в развитии экономики

Роль образования в развитии экономики Мероприятие по разработке систем энергосбережения в средствах размещения

Мероприятие по разработке систем энергосбережения в средствах размещения Экономическая безопасность. Нормативно-правовые основы экономической безопасности. (лекция 2)

Экономическая безопасность. Нормативно-правовые основы экономической безопасности. (лекция 2) Российская экономика на пути к рынку

Российская экономика на пути к рынку Экономическая мысль древнейших цивилизаций

Экономическая мысль древнейших цивилизаций Монополистическая конкуренция: понятие и распространение

Монополистическая конкуренция: понятие и распространение Внутренний этап всероссийского чемпионата по решению топливно-энергетических кейсов Сase-in

Внутренний этап всероссийского чемпионата по решению топливно-энергетических кейсов Сase-in Современное общество потребления и его влияние на экологию

Современное общество потребления и его влияние на экологию Государство в рыночной экономике

Государство в рыночной экономике Зовнішньоторговельні потоки Італії

Зовнішньоторговельні потоки Італії Эконометрика. Нелинейные модели. Логит- и пробит-модели. Практика

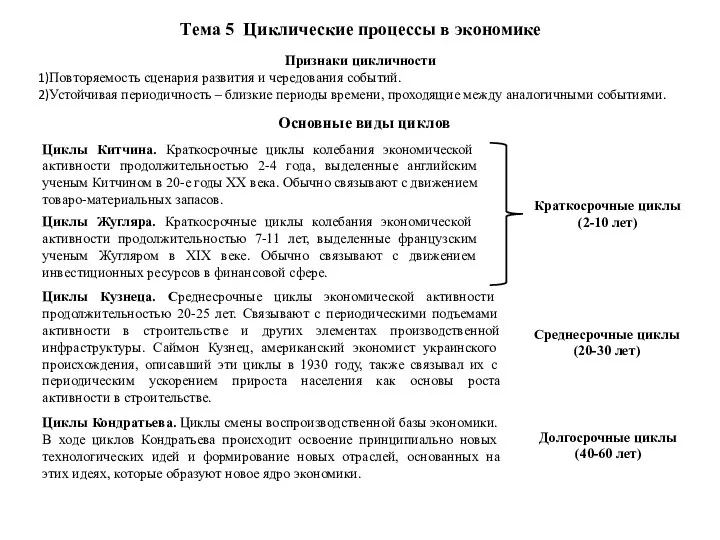

Эконометрика. Нелинейные модели. Логит- и пробит-модели. Практика Циклические процессы в экономике. Признаки цикличности

Циклические процессы в экономике. Признаки цикличности Значение системы «антиплагиат» для обеспечения качества научно-исследовательской работы. Выполнил: Студент 2-го курса группы э121

Значение системы «антиплагиат» для обеспечения качества научно-исследовательской работы. Выполнил: Студент 2-го курса группы э121 Анализ федерального бюджета на 2016 год

Анализ федерального бюджета на 2016 год Монопольний ринок

Монопольний ринок Федеральная резервная система США

Федеральная резервная система США СТРАХОВА КОМПАНІЯ “ІНДІГО”

СТРАХОВА КОМПАНІЯ “ІНДІГО” Кейнсианство. История возникновения кейнсианства

Кейнсианство. История возникновения кейнсианства