Содержание

- 2. Topics Covered Present Value Net Present Value NPV Rule ROR Rule Opportunity Cost of Capital Managers

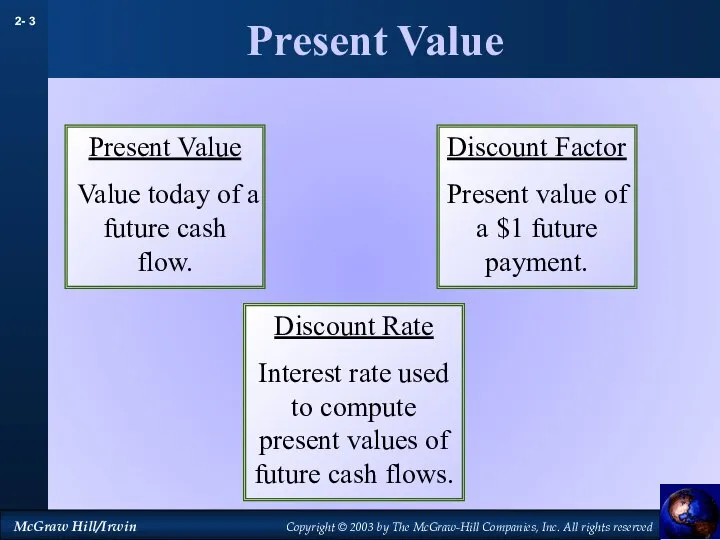

- 3. Present Value Present Value Value today of a future cash flow. Discount Rate Interest rate used

- 4. Present Value

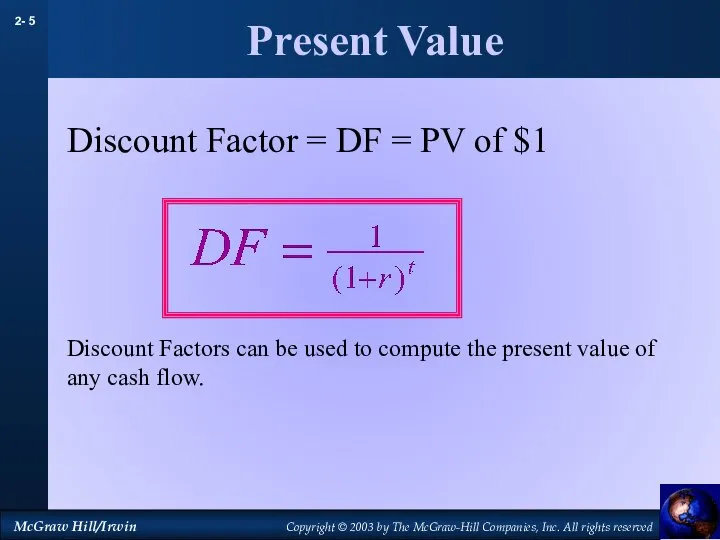

- 5. Present Value Discount Factor = DF = PV of $1 Discount Factors can be used to

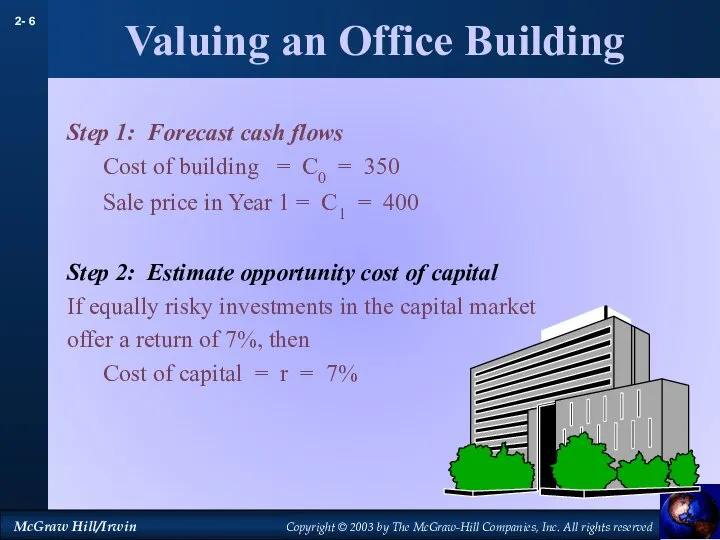

- 6. Valuing an Office Building Step 1: Forecast cash flows Cost of building = C0 = 350

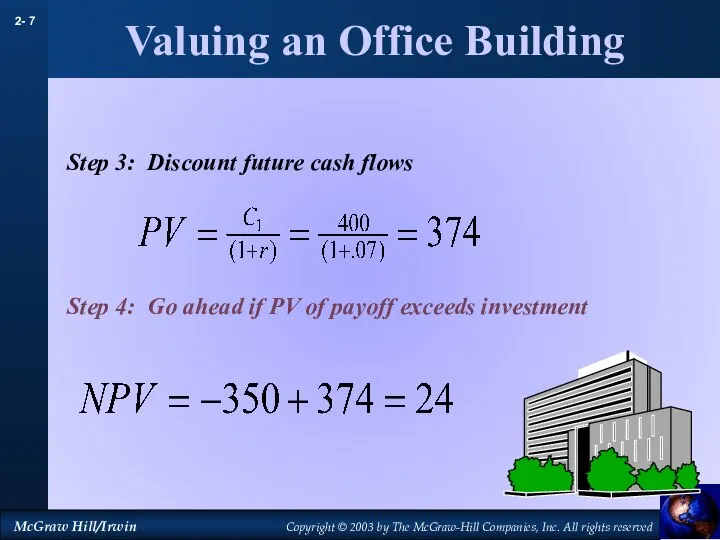

- 7. Valuing an Office Building Step 3: Discount future cash flows Step 4: Go ahead if PV

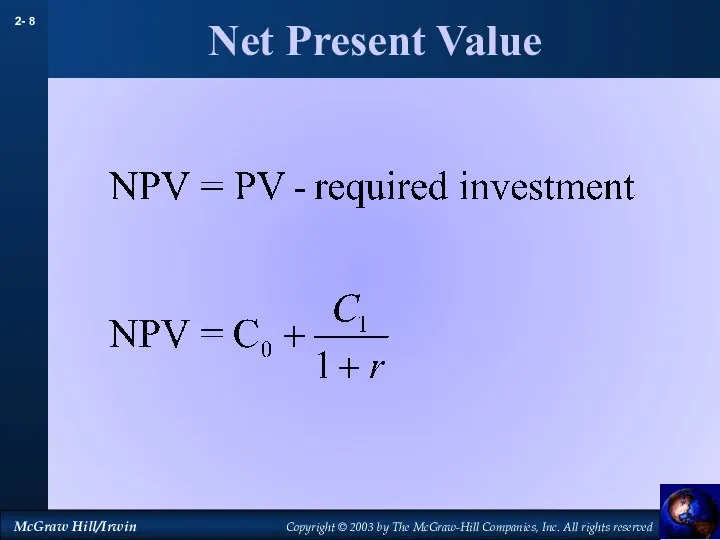

- 8. Net Present Value

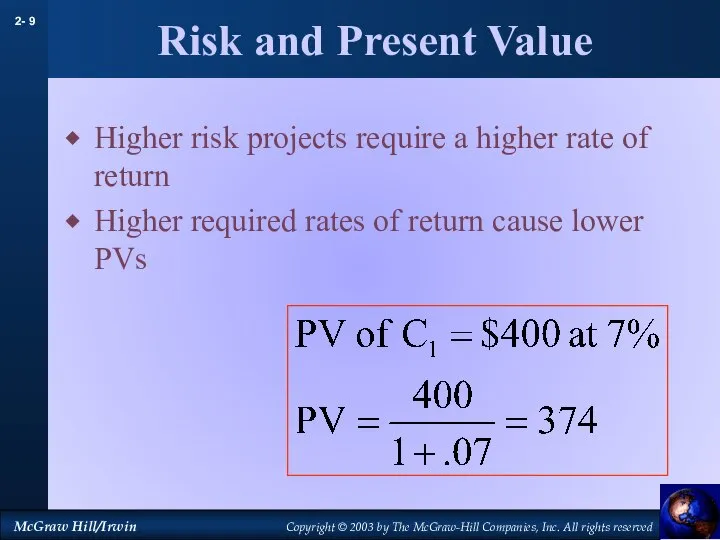

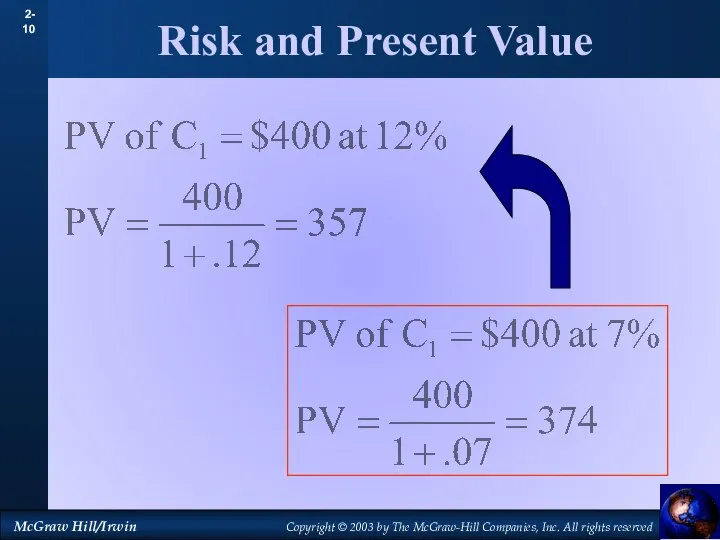

- 9. Risk and Present Value Higher risk projects require a higher rate of return Higher required rates

- 10. Risk and Present Value

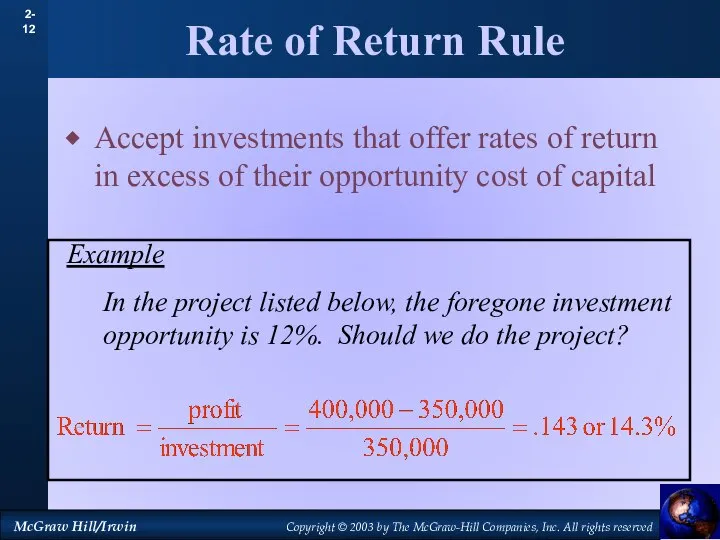

- 11. Rate of Return Rule Accept investments that offer rates of return in excess of their opportunity

- 12. Rate of Return Rule Accept investments that offer rates of return in excess of their opportunity

- 13. Net Present Value Rule Accept investments that have positive net present value

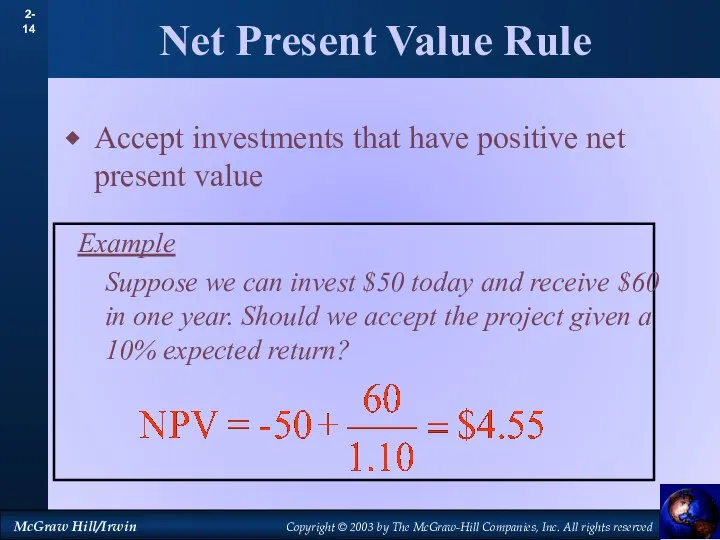

- 14. Net Present Value Rule Accept investments that have positive net present value Example Suppose we can

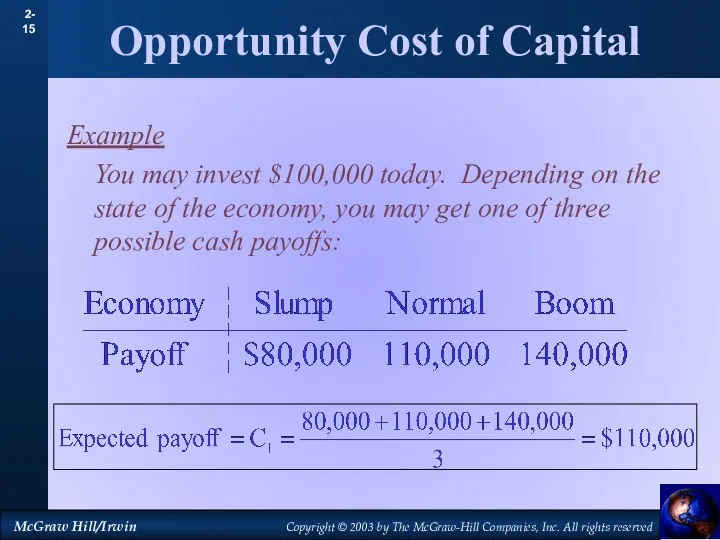

- 15. Opportunity Cost of Capital Example You may invest $100,000 today. Depending on the state of the

- 16. Opportunity Cost of Capital Example - continued The stock is trading for $95.65. Next year’s price,

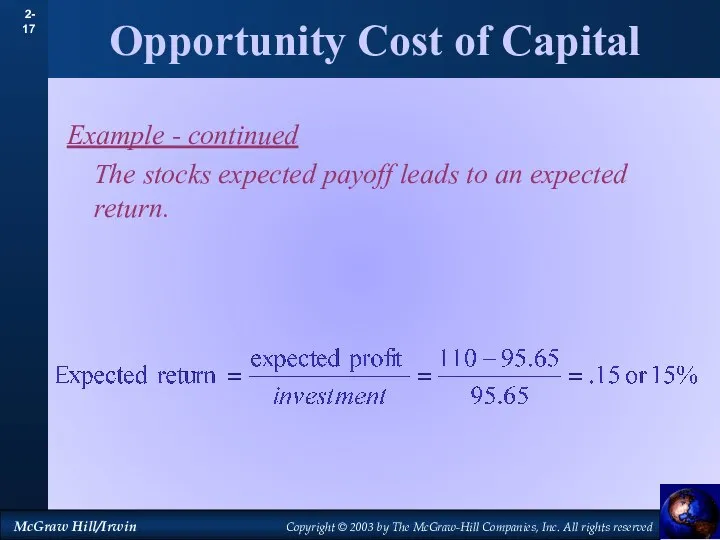

- 17. Opportunity Cost of Capital Example - continued The stocks expected payoff leads to an expected return.

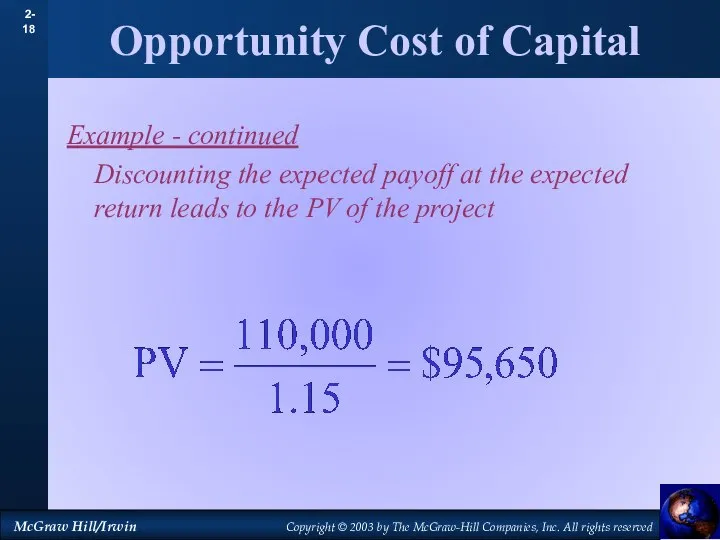

- 18. Opportunity Cost of Capital Example - continued Discounting the expected payoff at the expected return leads

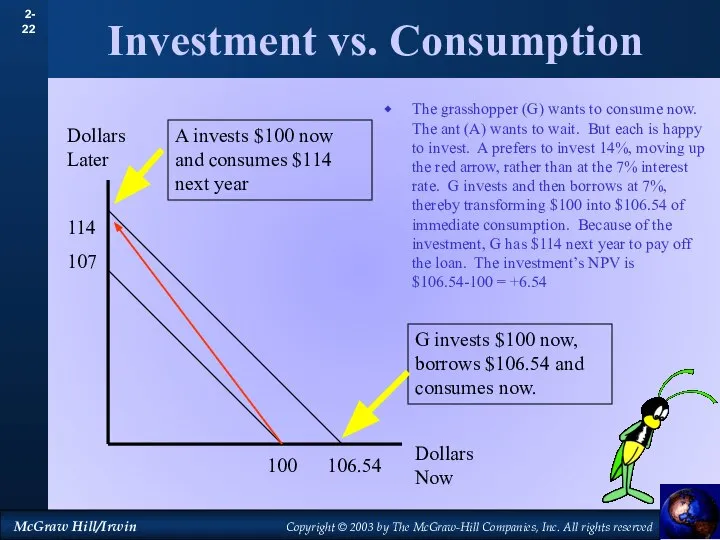

- 19. Investment vs. Consumption Some people prefer to consume now. Some prefer to invest now and consume

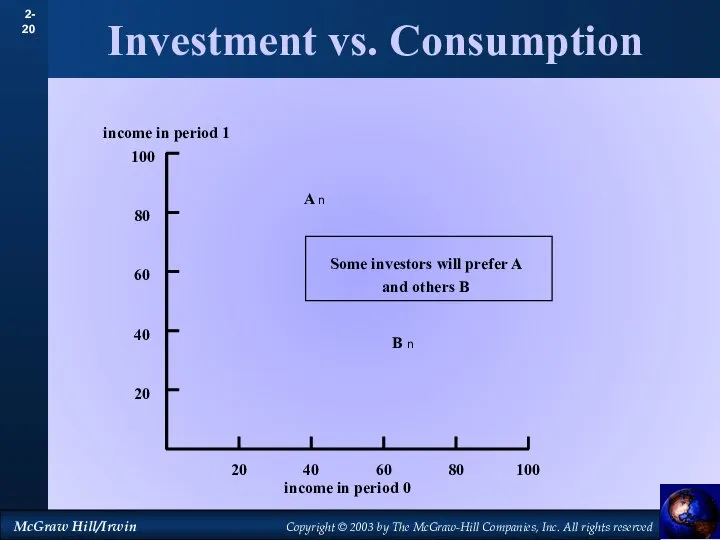

- 20. Investment vs. Consumption

- 21. Investment vs. Consumption The grasshopper (G) wants to consume now. The ant (A) wants to wait.

- 22. Investment vs. Consumption The grasshopper (G) wants to consume now. The ant (A) wants to wait.

- 24. Скачать презентацию

Исследование организации складского хозяйства и его совершенствование на предприятии ООО «ИТС Аир»

Исследование организации складского хозяйства и его совершенствование на предприятии ООО «ИТС Аир» Презентация Четвертый этап развития ЭА в России - период рыночной экономики и ее глобализации

Презентация Четвертый этап развития ЭА в России - период рыночной экономики и ее глобализации Бейтарифтік шара үлкен екі топқа бөлінеді

Бейтарифтік шара үлкен екі топқа бөлінеді План риска

План риска Презентация Ответственность сторон по договору подряда

Презентация Ответственность сторон по договору подряда Economics. Principles and applications by

Economics. Principles and applications by Экономическая наука

Экономическая наука Статистика уровня жизни населения

Статистика уровня жизни населения Становлення ринкового господарства в період становлення національних держав. Економічна думка

Становлення ринкового господарства в період становлення національних держав. Економічна думка Рабочие вопросы: временное трудоустройство подростков в свободное от учебы время

Рабочие вопросы: временное трудоустройство подростков в свободное от учебы время Завод в центре: искривление советской географии

Завод в центре: искривление советской географии Презентация Экономическое содержание налога на добавленную стоимость, его роль в формировании доходов федерального бюджета

Презентация Экономическое содержание налога на добавленную стоимость, его роль в формировании доходов федерального бюджета Теоретические предпосылки исследования экономической безопасности

Теоретические предпосылки исследования экономической безопасности Нормирование геодезических работ и нормативные документы

Нормирование геодезических работ и нормативные документы Типы экономических систем

Типы экономических систем Презентация Понятие и виды международного таможенного права

Презентация Понятие и виды международного таможенного права Прогнозирование и планирование в государственном регулировании экономики

Прогнозирование и планирование в государственном регулировании экономики Экономическое регулирование в области охраны окружающей среды. (Лекция 4)

Экономическое регулирование в области охраны окружающей среды. (Лекция 4) Платежный баланс как отражение международных валютнокредитных операций страны

Платежный баланс как отражение международных валютнокредитных операций страны Товарные запасы торгового предприятия

Товарные запасы торгового предприятия Қор биржасы

Қор биржасы Презентация Политические провакации

Презентация Политические провакации Экономическое назначение развития организации

Экономическое назначение развития организации Тема 4. Экономическое содержание инновационной деятельности

Тема 4. Экономическое содержание инновационной деятельности Экономика и государство. Сравнительная характеристика командной и рыночной экономики

Экономика и государство. Сравнительная характеристика командной и рыночной экономики Проблеми реформування адміністративно-територіального устрою

Проблеми реформування адміністративно-територіального устрою Оценка качества работы управляющих организаций за I полугодие 2017

Оценка качества работы управляющих организаций за I полугодие 2017 Социальная политика государства. Политика доходов. Экономика домашнего хозяйства, семьи

Социальная политика государства. Политика доходов. Экономика домашнего хозяйства, семьи