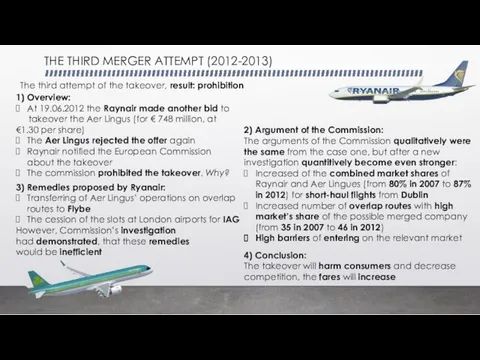

The third attempt of the takeover, result: prohibition

1) Overview:

At 19.06.2012

the Raynair made another bid to

takeover the Aer Lingus (for € 748 million, at €1.30 per share)

The Aer Lingus rejected the offer again

Raynair notified the European Commission about the takeover

The commission prohibited the takeover. Why?

2) Argument of the Commission:

The arguments of the Commission qualitatively were the same from the case one, but after a new investigation quantitively become even stronger:

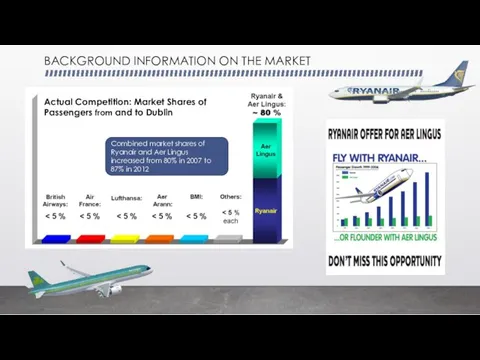

Increased of the combined market shares of Raynair and Aer Lingues (from 80% in 2007 to 87% in 2012) for short-haul flights from Dublin

Increased number of overlap routes with high market’s share of the possible merged company (from 35 in 2007 to 46 in 2012)

High barriers of entering on the relevant market

3) Remedies proposed by Ryanair:

Transferring of Aer Lingus’ operations on overlap routes to Flybe

The cession of the slots at London airports for IAG

However, Commission’s investigation

had demonstrated, that these remedies

would be inefficient

4) Conclusion:

The takeover will harm consumers and decrease competition, the fares will increase

THE THIRD MERGER ATTEMPT (2012-2013)

Равновесие потребителя

Равновесие потребителя Сбалансированность развития экономики

Сбалансированность развития экономики Классический этап экономической теории. Жан Батист Сэи

Классический этап экономической теории. Жан Батист Сэи Развитие экономики. (Тема 1)

Развитие экономики. (Тема 1) Презентация Валютный курс: понятие, виды, методы регулирования

Презентация Валютный курс: понятие, виды, методы регулирования Структура производственного процесса

Структура производственного процесса Планирование себестоимости продукции

Планирование себестоимости продукции Акт постановки на баланс остатков алкогольной продукции в ЕГАИС

Акт постановки на баланс остатков алкогольной продукции в ЕГАИС Рынки, близкие к совершенной конкуренции. Природа и виды монополии

Рынки, близкие к совершенной конкуренции. Природа и виды монополии Ресурсы мировой экономики

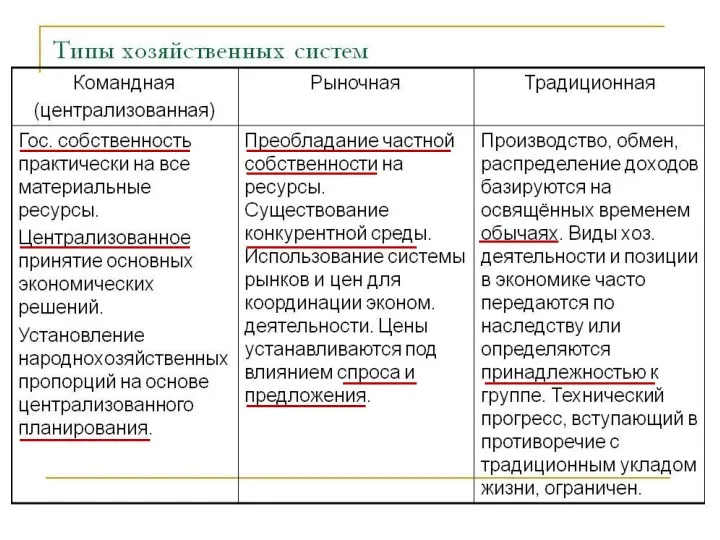

Ресурсы мировой экономики Типы хозяйственных систем. Правомочия собственника

Типы хозяйственных систем. Правомочия собственника Экономика кооперационно-сетевых взаимодействий. М к лекц 2 ФПКП

Экономика кооперационно-сетевых взаимодействий. М к лекц 2 ФПКП Эффект замещения. Эффект дохода

Эффект замещения. Эффект дохода Эффективность предпринимательской деятельности. Формирование собственных финансовых ресурсов

Эффективность предпринимательской деятельности. Формирование собственных финансовых ресурсов Максимизация прибыли. Виды рыночных структур. Тема 7

Максимизация прибыли. Виды рыночных структур. Тема 7 Классическая экономическая школа

Классическая экономическая школа Бюджетный процесс в РФ

Бюджетный процесс в РФ Налоги на прибыль

Налоги на прибыль Контролирующие иностранные компании и контролирующие лица

Контролирующие иностранные компании и контролирующие лица Региональные интеграционные блоки. Ирландия

Региональные интеграционные блоки. Ирландия Экономические вопросы в ЕГЭ по обществознанию

Экономические вопросы в ЕГЭ по обществознанию Обеспечение транспортной интеграции экономики Республики Тыва с глобальными рынками (российскими и мировыми)

Обеспечение транспортной интеграции экономики Республики Тыва с глобальными рынками (российскими и мировыми) Проблемы фискальной и монетарной политики. Макроэкономическая политика и инфляция. (Лекция 4)

Проблемы фискальной и монетарной политики. Макроэкономическая политика и инфляция. (Лекция 4) Основы предпринимательской деятельности

Основы предпринимательской деятельности ІДЗ регіональна економіка. Київська область

ІДЗ регіональна економіка. Київська область Презентация Организация и оплата труда на предприятии

Презентация Организация и оплата труда на предприятии налоги

налоги Рынок и рыночные структуры

Рынок и рыночные структуры