Содержание

- 2. Управление оборотным капиталом Вы кому-то дали деньги в долг Вам надо оплатить ваши расходы Вам надо

- 3. Управление оборотным капиталом Собрать деньги, которые Вам должны Оплатить только те счета, по которым настал срок

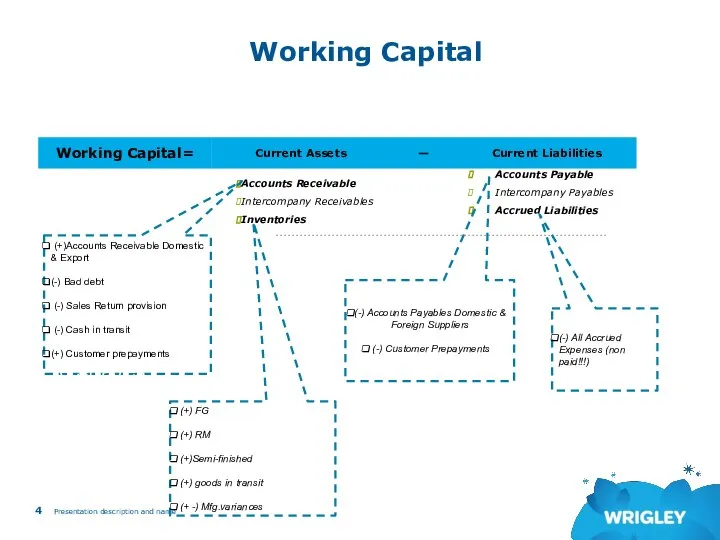

- 4. Working Capital Presentation description and name Accounts Receivable Intercompany Receivables Inventories Accounts Payable Intercompany Payables Accrued

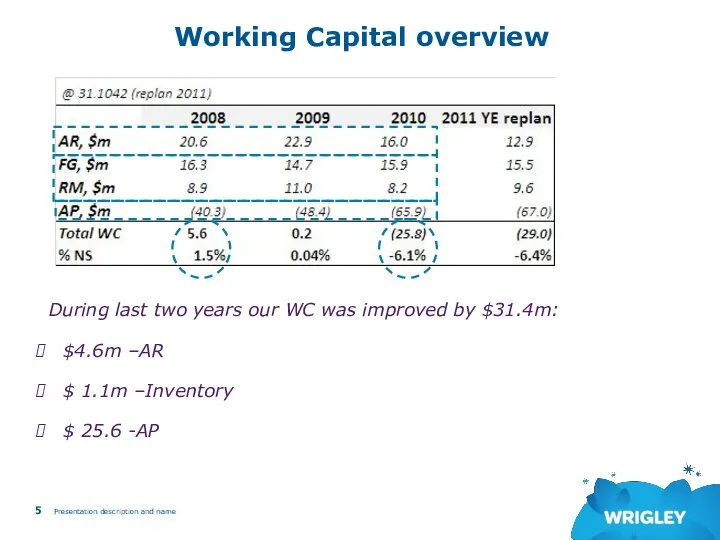

- 5. Working Capital overview Presentation description and name During last two years our WC was improved by

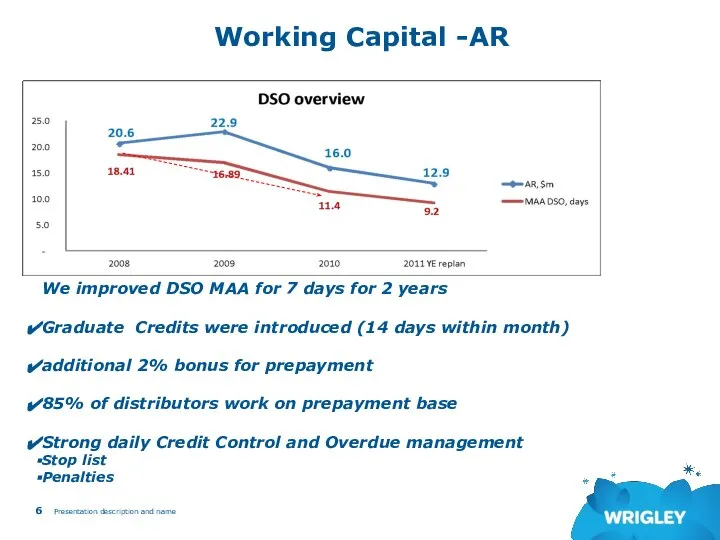

- 6. Working Capital -AR Presentation description and name We improved DSO MAA for 7 days for 2

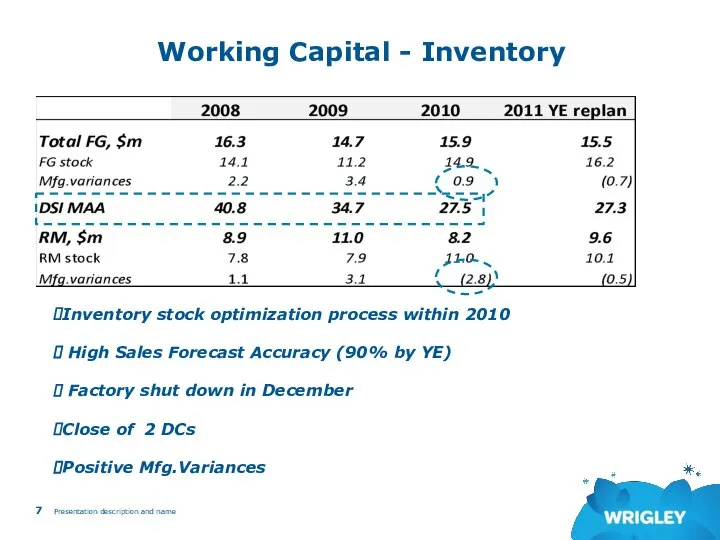

- 7. Working Capital - Inventory Presentation description and name Inventory stock optimization process within 2010 High Sales

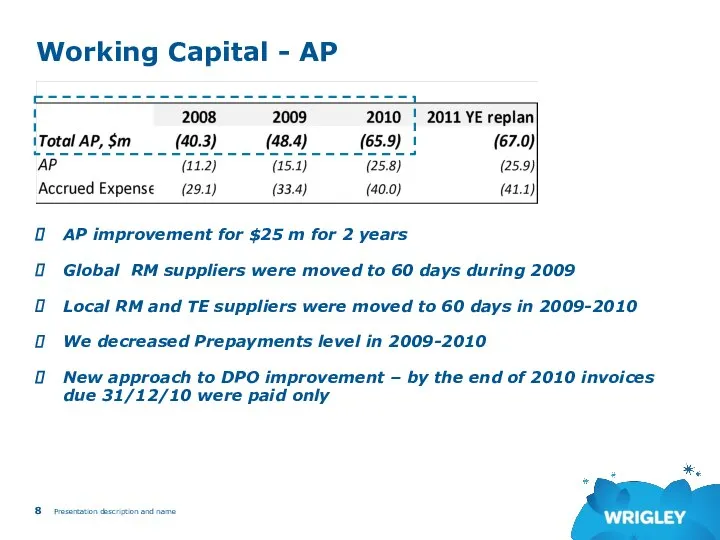

- 8. Working Capital - AP Presentation description and name AP improvement for $25 m for 2 years

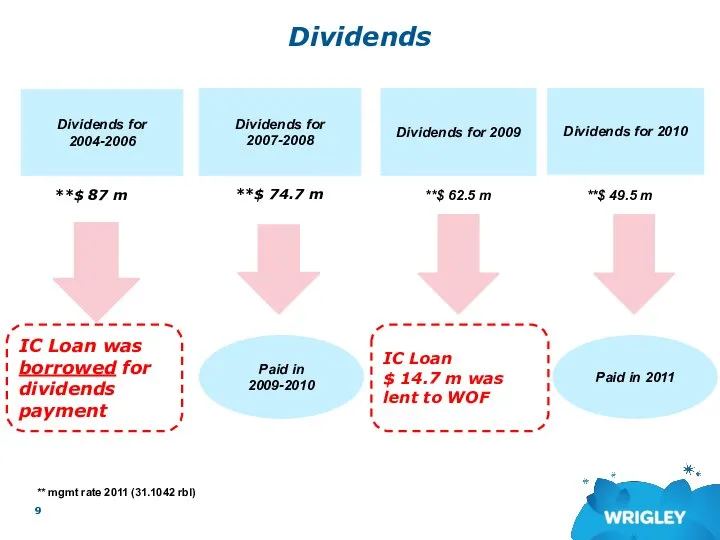

- 9. Dividends Dividends for 2004-2006 Paid in 2007 Dividends for 2007-2008 Paid in 2009-2010 Dividends for 2009

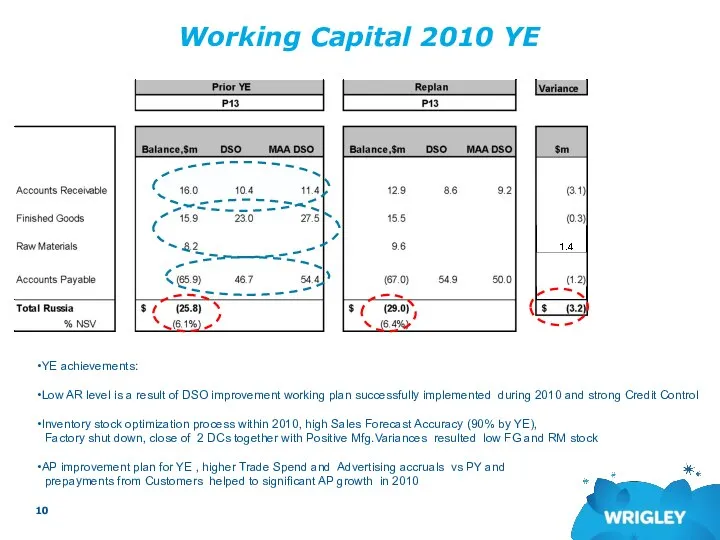

- 10. Working Capital 2010 YE YE achievements: Low AR level is a result of DSO improvement working

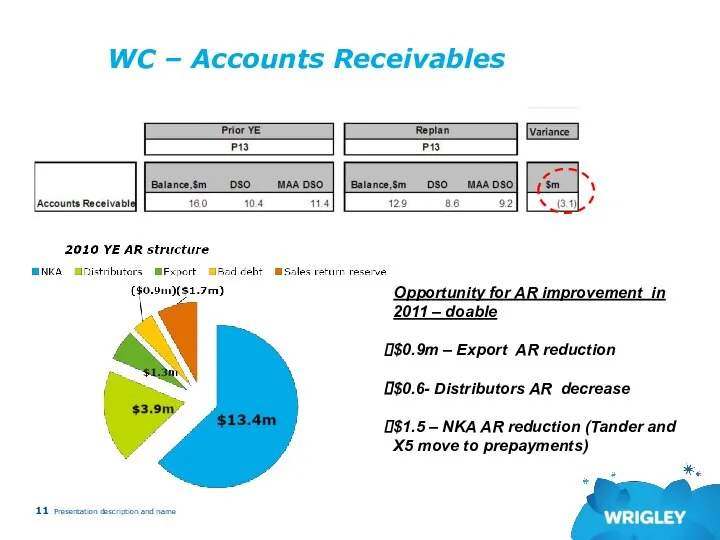

- 11. WC – Accounts Receivables Presentation description and name Opportunity for AR improvement in 2011 – doable

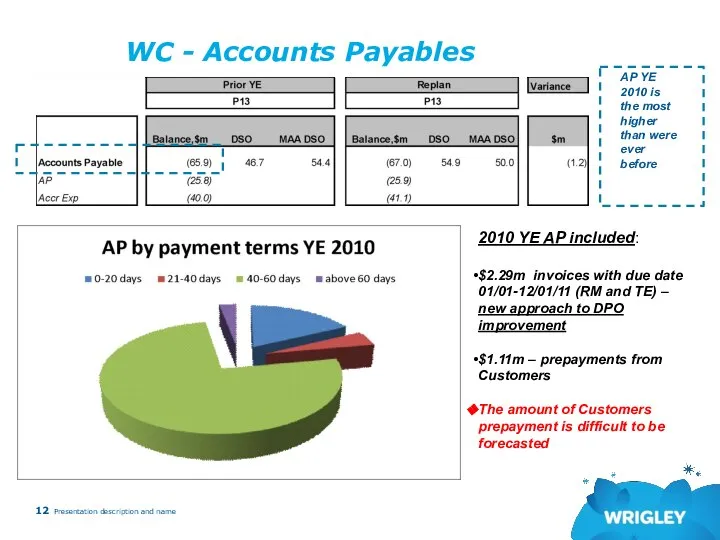

- 12. WC - Accounts Payables Presentation description and name 2010 YE AP included: $2.29m invoices with due

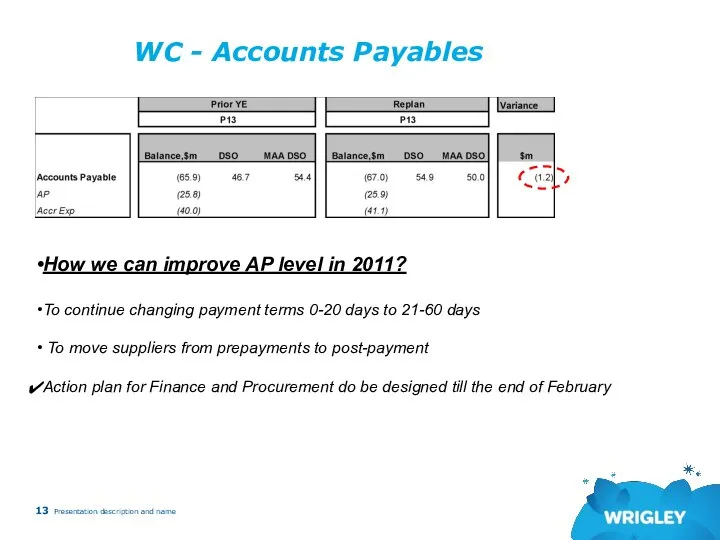

- 13. WC - Accounts Payables Presentation description and name How we can improve AP level in 2011?

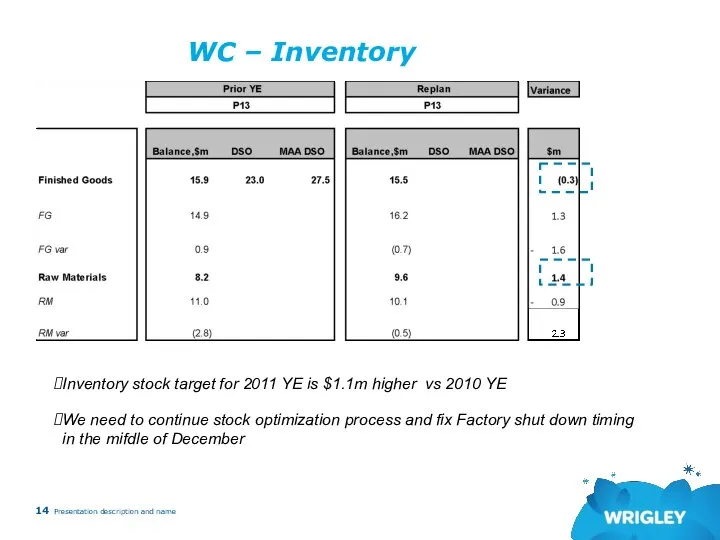

- 14. WC – Inventory Presentation description and name Inventory stock target for 2011 YE is $1.1m higher

- 16. Скачать презентацию

Производство экономических благ. Издержки производства. (Тема 4)

Производство экономических благ. Издержки производства. (Тема 4) Новая экономическая политика Казахстана «Нұрлы Жол»

Новая экономическая политика Казахстана «Нұрлы Жол» Основные этапы развития экономической теории

Основные этапы развития экономической теории Производственный процесс и его организация

Производственный процесс и его организация Порядок контроля таможенной стоимости при выпуске товаров Чехранова Юлия Андреевна Ю-113б

Порядок контроля таможенной стоимости при выпуске товаров Чехранова Юлия Андреевна Ю-113б Қазақстандағы әлеуметтік-экономикалық жағдай-тәуелсіздік үшін күрестің алғышарттары

Қазақстандағы әлеуметтік-экономикалық жағдай-тәуелсіздік үшін күрестің алғышарттары Соотношение управления и самоорганизации

Соотношение управления и самоорганизации Реализованные инвестиционные проекты

Реализованные инвестиционные проекты Рынок образовательных услуг в России

Рынок образовательных услуг в России Банковская система России

Банковская система России Международные (всемирные) экономические отношения (МЭО)

Международные (всемирные) экономические отношения (МЭО) Организация и управление архитектурными проектами

Организация и управление архитектурными проектами Производство – основа экономики

Производство – основа экономики Прикладная экономика

Прикладная экономика Основные понятия и определения туризма как сферы деятельности

Основные понятия и определения туризма как сферы деятельности ҚазақстанРеспубликасы президент Н. Назарбаевтың Қазақстан халқына жолдауы

ҚазақстанРеспубликасы президент Н. Назарбаевтың Қазақстан халқына жолдауы 7 ошибок в воспитании детей Подготовила: Порошина Лидия Владимировна, студентка очной формы обучения юридического факультета, гр

7 ошибок в воспитании детей Подготовила: Порошина Лидия Владимировна, студентка очной формы обучения юридического факультета, гр Оценка материальных затрат НИОКР

Оценка материальных затрат НИОКР Aggregate demand and aggregate supply analysis

Aggregate demand and aggregate supply analysis Інтелектуальний капітал країни

Інтелектуальний капітал країни Глобальные проблемы мировой экономики

Глобальные проблемы мировой экономики Октябрьские дебаты. Программа: риски, безопасность, контроль. Факультет анализа рисков и экономической безопасности

Октябрьские дебаты. Программа: риски, безопасность, контроль. Факультет анализа рисков и экономической безопасности Экономика и экономическая наука

Экономика и экономическая наука Первая сеть для риэлторов и агентств недвижимости Черногории

Первая сеть для риэлторов и агентств недвижимости Черногории Курсовая работа по дисциплине “Экономика организации”

Курсовая работа по дисциплине “Экономика организации” Макроэкономика

Макроэкономика Рынок: его сущность, функции, структура. Экономические субъекты рыночной экономики

Рынок: его сущность, функции, структура. Экономические субъекты рыночной экономики Организация и планирование работ на очистном участке в условиях АО «Суэк - Кузбасс»

Организация и планирование работ на очистном участке в условиях АО «Суэк - Кузбасс»