Содержание

- 2. What is Crowdfunding? Crowdfunding is an online money-raising strategy that began as a way for the

- 3. What is Crowdfunding? The concept has recently been promoted as a way of assisting small businesses

- 4. What is Crowdfunding? Traditionally, investment opportunities are offered by professionals, such as broker-dealer firms and investment

- 5. What is Crowdfunding? Through crowdfunding, individuals are able to invest in entrepreneurial start-ups through an intermediary,

- 6. What is a Funding Portal? A funding portal is a website, also called a “platform,” that

- 7. How Crowdfunding Works Today . . . Mary’s small business sells goat cheese made from her

- 8. How Crowdfunding Works Coming Soon . . . New legislation has directed the SEC to write

- 9. Why Investors Should be Cautious About Crowdfunding Crowdfunding investments cannot be offered legally until the SEC

- 10. Issuers using funding portals to raise money may be inexperienced. Their track records maybe unproven, unsubstantiated

- 11. Because state regulators are not allowed to review crowdfunding issuers or their offerings, full and complete

- 12. Investors may have limited legal ability to take action against the issuer should the investment not

- 13. Crowdfunding investments are mostly illiquid and investors must be prepared to hold their investments indefinitely. It

- 14. Funding portals must be registered with the Securities and Exchange Commission (SEC), belong to a self-regulating

- 15. Crowdfunding portals claiming an accreditation or “seal of approval” from a standards program or board may

- 16. Bottom Line for Investors It pays to be skeptical of investment opportunities you learn about through

- 18. Скачать презентацию

Отчет ревизионной комиссии за 2020 год

Отчет ревизионной комиссии за 2020 год Тема 4.Расчетно-кассовые операции

Тема 4.Расчетно-кассовые операции Учетно-информационная система предприятия

Учетно-информационная система предприятия Какие льготы и бонусы от государства приготовлены для инвестора?

Какие льготы и бонусы от государства приготовлены для инвестора? МП компании Вертера. Надежность, стабильность и быстрый рост

МП компании Вертера. Надежность, стабильность и быстрый рост Система регистрации сделок на заводе ЗАО Ремеза

Система регистрации сделок на заводе ЗАО Ремеза Аналіз звіту про фінансовий стан підприємства (балансу)

Аналіз звіту про фінансовий стан підприємства (балансу) Контроллинг инвестиций

Контроллинг инвестиций Регистрация пенсионеров посредством портала Госуслуги

Регистрация пенсионеров посредством портала Госуслуги Дистанционное банковское обслуживание

Дистанционное банковское обслуживание Конкурсный отбор в 2018 году на предоставление грантов. Субсидии на поддержку проектов, связанных с инновациями в образовании

Конкурсный отбор в 2018 году на предоставление грантов. Субсидии на поддержку проектов, связанных с инновациями в образовании Статистика заработной платы

Статистика заработной платы Кому принадлежат СМИ?

Кому принадлежат СМИ? Роль управленческого учета в финансово хозяйственной деятельности организации

Роль управленческого учета в финансово хозяйственной деятельности организации Транспортный налог

Транспортный налог Финансовая грамотность

Финансовая грамотность Портфель Value USD

Портфель Value USD Задачи на доходность депозита

Задачи на доходность депозита Выявление результатов инвентаризации и порядок отражения их в БУ

Выявление результатов инвентаризации и порядок отражения их в БУ Государственные и муниципальные финансовые ресурсы

Государственные и муниципальные финансовые ресурсы Венчурное финансирование

Венчурное финансирование Иркутская область в зеркале статистики

Иркутская область в зеркале статистики Лекция 2-3. Таможенно-тарифное регулирование в условиях ВТО

Лекция 2-3. Таможенно-тарифное регулирование в условиях ВТО Tax and other incentives for start-ups in some European countries

Tax and other incentives for start-ups in some European countries Statement of Profit & Loss. Lecture 6

Statement of Profit & Loss. Lecture 6 Bilanzierungs und bewertungs grundsätze

Bilanzierungs und bewertungs grundsätze Модели для рынка ценных бумаг. (Лекция 4)

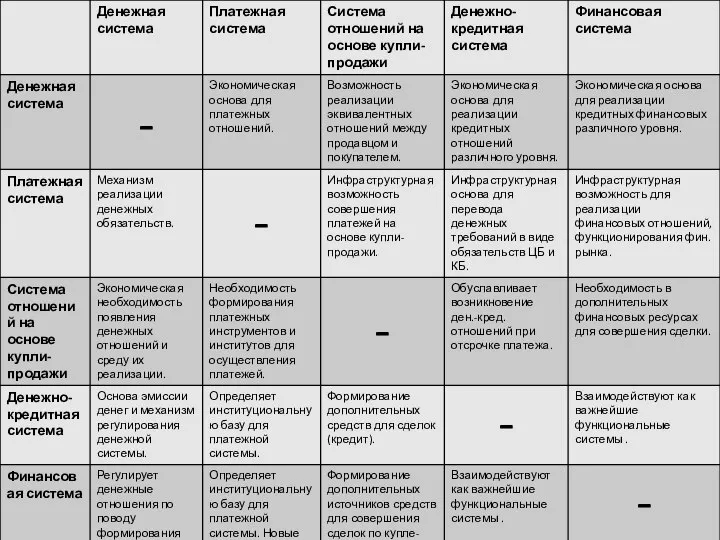

Модели для рынка ценных бумаг. (Лекция 4) Денежная система. Матрица

Денежная система. Матрица