Technical analysis is an analysis methodology for forecasting the direction of

prices through the study of past market data, primarily price and volume.

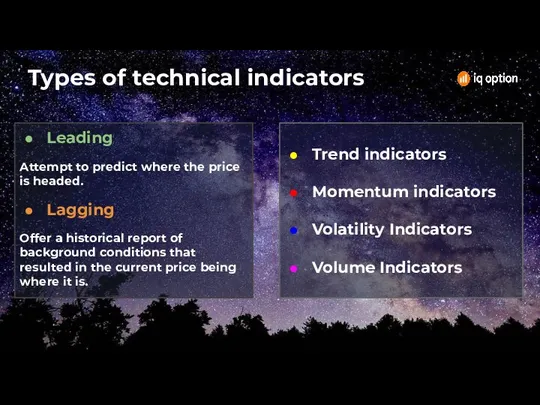

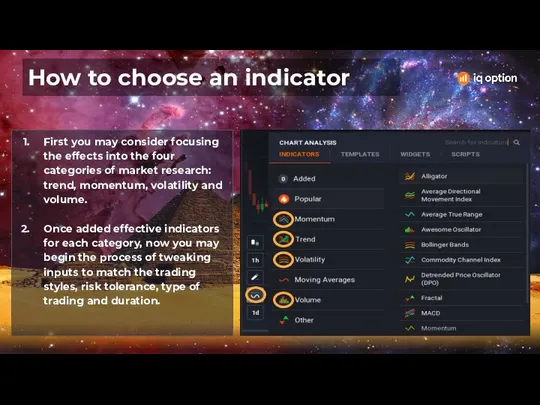

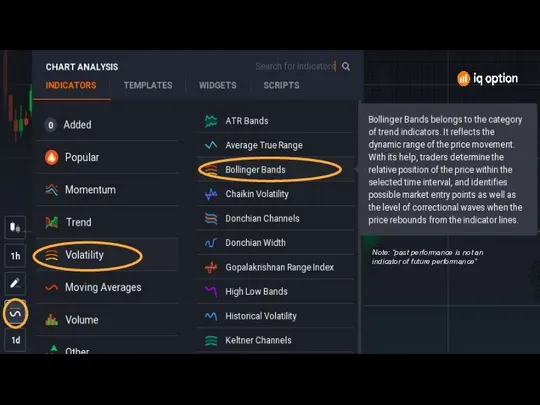

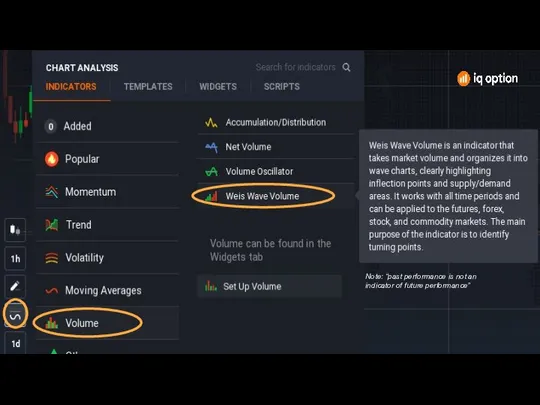

Technical indicators are heuristic or pattern-based signals produced by the price, volume, and/or open interest of an asset.

They are used by traders who follow technical analysis.

By analyzing historical data, technical analysts use indicators to predict future price movements.

What are indicators

*Indicators are never 100% guarantee of correct signals

Конструирование из кубиков

Конструирование из кубиков Введение в Интернет

Введение в Интернет Как создать ЭОР учителю с помощью некоторых сервисов: LearningApps.org, Prezi.com, Playcast, OnWebinar.ru, Moodle, Твой тест

Как создать ЭОР учителю с помощью некоторых сервисов: LearningApps.org, Prezi.com, Playcast, OnWebinar.ru, Moodle, Твой тест Указатели и работа с памятью

Указатели и работа с памятью Отношения объектов. Разновидности объектов и их классификация. (Урок 2)

Отношения объектов. Разновидности объектов и их классификация. (Урок 2) Катарсис и видеоигры

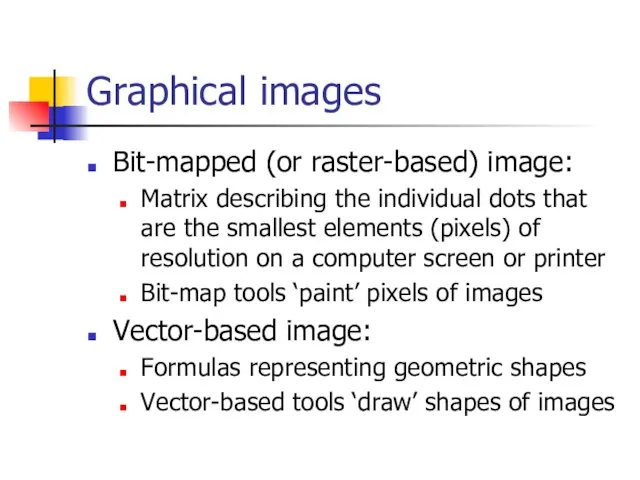

Катарсис и видеоигры Graphical images

Graphical images Компьютерная графика и геометрическое моделирование

Компьютерная графика и геометрическое моделирование Записи и файлы

Записи и файлы Научно-исследовательский вычислительный центр МГУ Интеллектуальные информационные технологии Полиморфное кодирование куб

Научно-исследовательский вычислительный центр МГУ Интеллектуальные информационные технологии Полиморфное кодирование куб Информатика в играх и задачах. Основы логики. 2 класс (4 урок)

Информатика в играх и задачах. Основы логики. 2 класс (4 урок) Защита файлов и управление доступом к ним. Борисов В.А. Красноармейский филиал ГОУ ВПО «Академия народного хозяйства при Прави

Защита файлов и управление доступом к ним. Борисов В.А. Красноармейский филиал ГОУ ВПО «Академия народного хозяйства при Прави Стать программистом. Первый шаг

Стать программистом. Первый шаг Классификация видов моделирования систем

Классификация видов моделирования систем Информационные каналы

Информационные каналы Устройство компьютера

Устройство компьютера Разработка голосового помощника

Разработка голосового помощника Управляющие конструкции

Управляющие конструкции Прикладное программное обеспечение информационных систем

Прикладное программное обеспечение информационных систем Tensilica Xtensa

Tensilica Xtensa Hyper-V. Что такое Hyper-V?

Hyper-V. Что такое Hyper-V? Воздействие анимации на пользовательский опыт в мобильных интерфейсах мобильного приложения для облачного хранения данных

Воздействие анимации на пользовательский опыт в мобильных интерфейсах мобильного приложения для облачного хранения данных Производственная практика по информатике в отделе военного комиссариата Ростовской области по городу Батайску

Производственная практика по информатике в отделе военного комиссариата Ростовской области по городу Батайску Системное программирование тема: Асинхронные вычисления. Семафор, монитор (Лекция 17)

Системное программирование тема: Асинхронные вычисления. Семафор, монитор (Лекция 17) Подпрограммы

Подпрограммы Как не заскучать в онлайне?

Как не заскучать в онлайне? Введение в системы управления базами данных (СУБД) и основные возможности реляционной СУБД MySQL

Введение в системы управления базами данных (СУБД) и основные возможности реляционной СУБД MySQL Бананы. Рекомендации по оформлению сайта

Бананы. Рекомендации по оформлению сайта