Содержание

- 2. Outline

- 3. What is a profit and loss account? A profit and loss account shows a company’s revenue

- 4. What does a profit and loss account include? Operating section Revenue Expenses Cost of Goods Sold

- 5. Calculating net profit To calculate net profit, follow this path: Deduct discounts and allowances from your

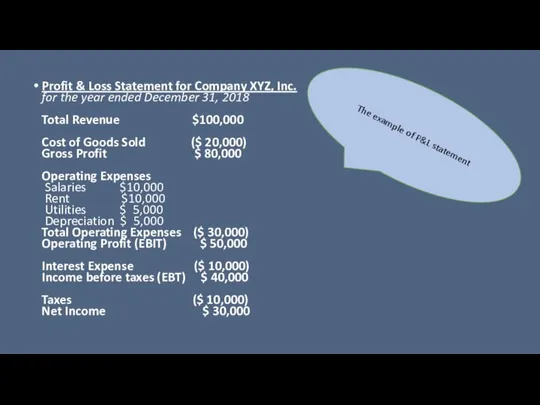

- 6. Profit & Loss Statement for Company XYZ, Inc. for the year ended December 31, 2018 Total

- 8. Скачать презентацию

Outline

Outline

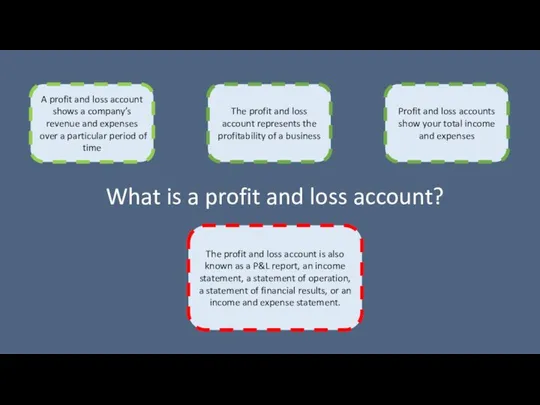

What is a profit and loss account?

A profit and loss account

What is a profit and loss account?

A profit and loss account

The profit and loss account represents the profitability of a business

Profit and loss accounts show your total income and expenses

The profit and loss account is also known as a P&L report, an income statement, a statement of operation, a statement of financial results, or an income and expense statement.

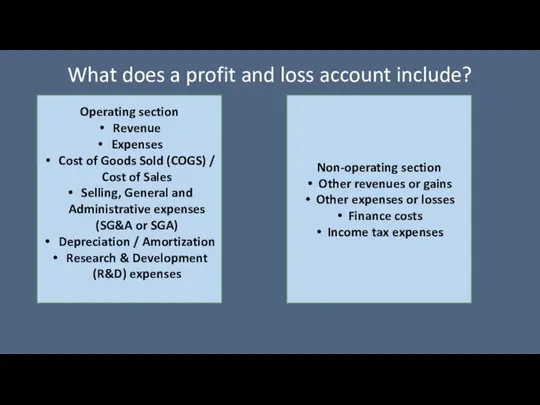

What does a profit and loss account include?

Operating section

Revenue

Expenses

Cost of Goods

What does a profit and loss account include?

Operating section

Revenue

Expenses

Cost of Goods

Selling, General and Administrative expenses (SG&A or SGA)

Depreciation / Amortization

Research & Development (R&D) expenses

Non-operating section

Other revenues or gains

Other expenses or losses

Finance costs

Income tax expenses

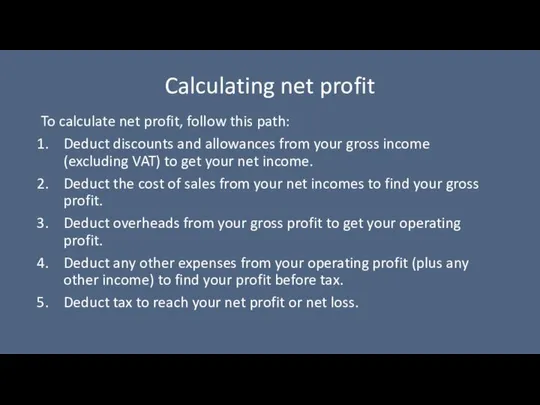

Calculating net profit

To calculate net profit, follow this path:

Deduct discounts and

Calculating net profit

To calculate net profit, follow this path:

Deduct discounts and

Deduct the cost of sales from your net incomes to find your gross profit.

Deduct overheads from your gross profit to get your operating profit.

Deduct any other expenses from your operating profit (plus any other income) to find your profit before tax.

Deduct tax to reach your net profit or net loss.

Profit & Loss Statement for Company XYZ, Inc.

for the year ended December 31,

Profit & Loss Statement for Company XYZ, Inc. for the year ended December 31,

The example of P&L statement

Ввод в эксплуатацию и установка

Ввод в эксплуатацию и установка Interessante Fakten über Deutschland

Interessante Fakten über Deutschland Психологические причины трудного поведения младших школьников

Психологические причины трудного поведения младших школьников ОПОРНЫЕ ТАБЛИЦЫ ПО МАТЕМ-КЕ - презентация для начальной школы

ОПОРНЫЕ ТАБЛИЦЫ ПО МАТЕМ-КЕ - презентация для начальной школы Где и как зарождаются интернет-проекты

Где и как зарождаются интернет-проекты  Видеорегистратор. Видеокамера

Видеорегистратор. Видеокамера Мир глазами историка - презентация для начальной школы_

Мир глазами историка - презентация для начальной школы_ Организационное поведение. Материалы к учебному курсу. Лекция 2

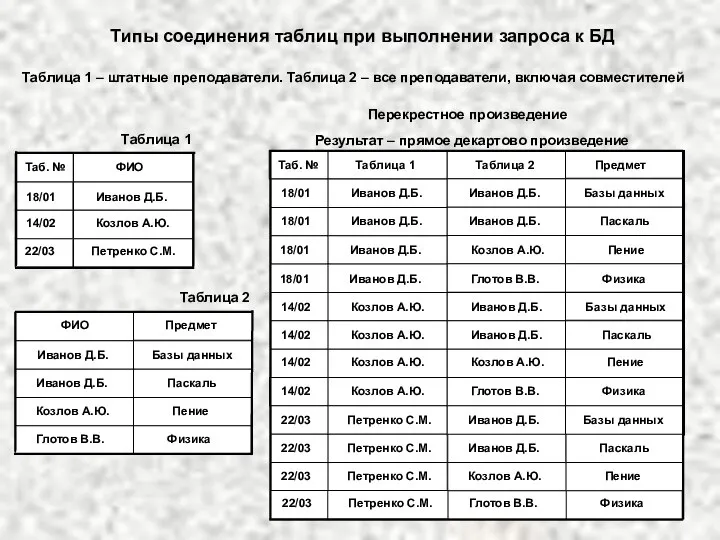

Организационное поведение. Материалы к учебному курсу. Лекция 2 Типы соединения таблиц при выполнении запроса к БД

Типы соединения таблиц при выполнении запроса к БД Работа станции в зимних условиях

Работа станции в зимних условиях  Ежелгі шығыстың таптық қоғамындағы саяси ой-пікірлер

Ежелгі шығыстың таптық қоғамындағы саяси ой-пікірлер Управление процессом обучения на промышленном предприятии На материале ОАО «Каустик» Докладчик – начальник учебного центра ОА

Управление процессом обучения на промышленном предприятии На материале ОАО «Каустик» Докладчик – начальник учебного центра ОА autumn-is-back-picture-dictionaries_101022

autumn-is-back-picture-dictionaries_101022 Аттестационная работа. Формирование у учащихся представления о русской художественной культуре

Аттестационная работа. Формирование у учащихся представления о русской художественной культуре ВАСИЛИЙ ДМИТРИЕВИЧ ПОЛЕНОВ (1844-1927)

ВАСИЛИЙ ДМИТРИЕВИЧ ПОЛЕНОВ (1844-1927) «Физминутка на уроке – это радость на весь день.» Автор проекта: Разгуляева Кристина, ученица 5 класса МОУ Доволенской ОСШ№1 Руков

«Физминутка на уроке – это радость на весь день.» Автор проекта: Разгуляева Кристина, ученица 5 класса МОУ Доволенской ОСШ№1 Руков Изменения обязательственного права. Разграничение обязательств и смежных правоотношений

Изменения обязательственного права. Разграничение обязательств и смежных правоотношений Расчет ж/б элементов по предельным состояниям II-ой группы

Расчет ж/б элементов по предельным состояниям II-ой группы Путешествие на остров - презентация для начальной школы_

Путешествие на остров - презентация для начальной школы_ Всероссийский научно-исследовательский геологический институт им. А. П. Карпинского. Экспозиция музея

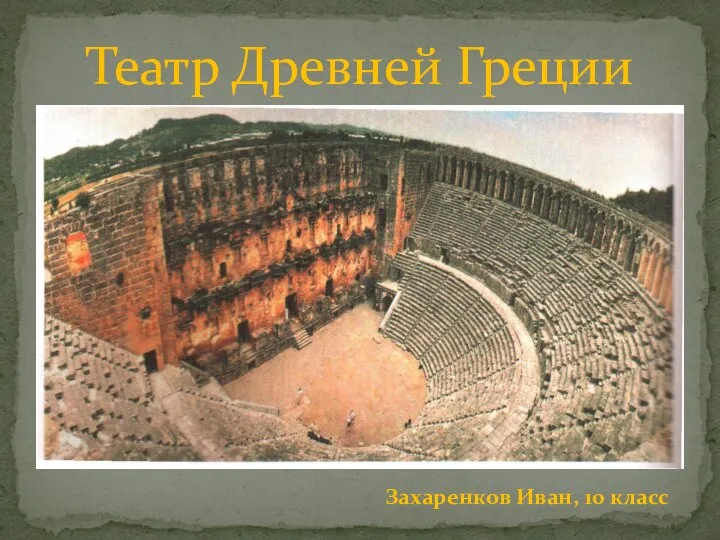

Всероссийский научно-исследовательский геологический институт им. А. П. Карпинского. Экспозиция музея Театр Древней Греции

Театр Древней Греции Лабораторная диагностика бруцеллёза

Лабораторная диагностика бруцеллёза russko-yaponskaya_voyna1

russko-yaponskaya_voyna1 Особенности меркантилизма в различных странах

Особенности меркантилизма в различных странах регуляция и патология липидного обмена

регуляция и патология липидного обмена Sights of Prague

Sights of Prague Структурное программирование сверху вниз (язык C, лекция 6)

Структурное программирование сверху вниз (язык C, лекция 6) Предмет и метод экономической теории. Экономика: потребности и ресурсы.

Предмет и метод экономической теории. Экономика: потребности и ресурсы.