Содержание

- 2. Economic Growth Economic growth is a long-term expansion of the productive potential of the economy. Growth

- 3. Rostow’s Five-Stage Model of Development Rostow's Stages of Growth model is one of the most influential

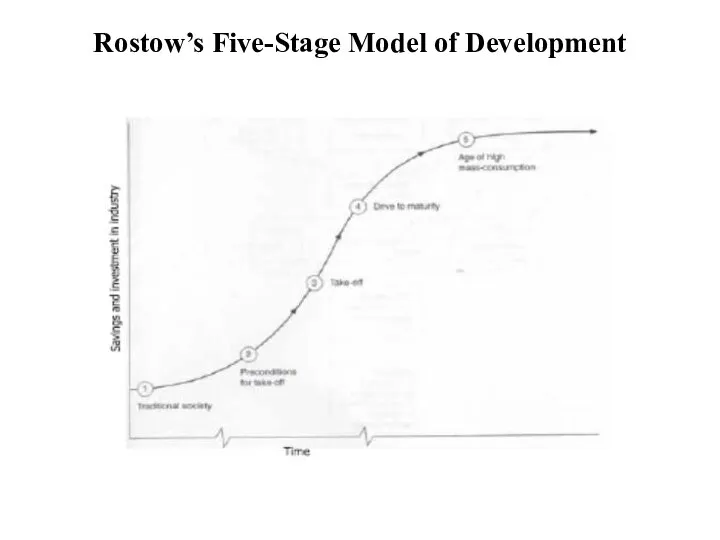

- 4. Rostow’s Five-Stage Model of Development

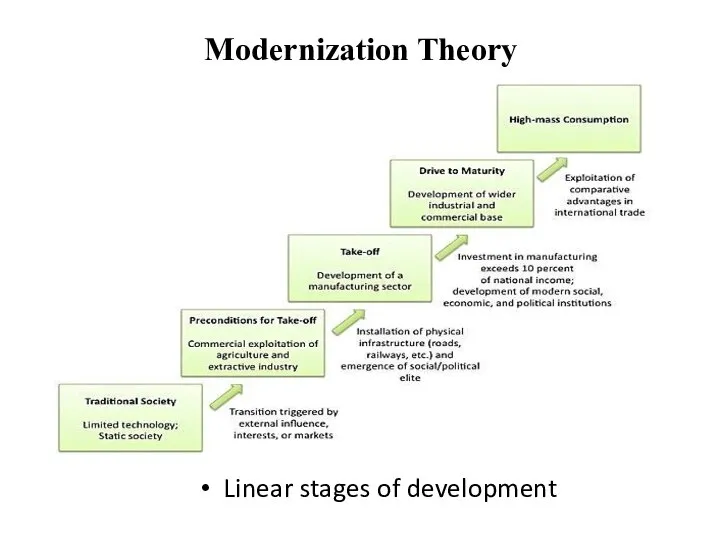

- 5. Modernization Theory Linear stages of development

- 6. Economic Growth Growth rate How rapidly real GDP per person grew in the typical year. Growth

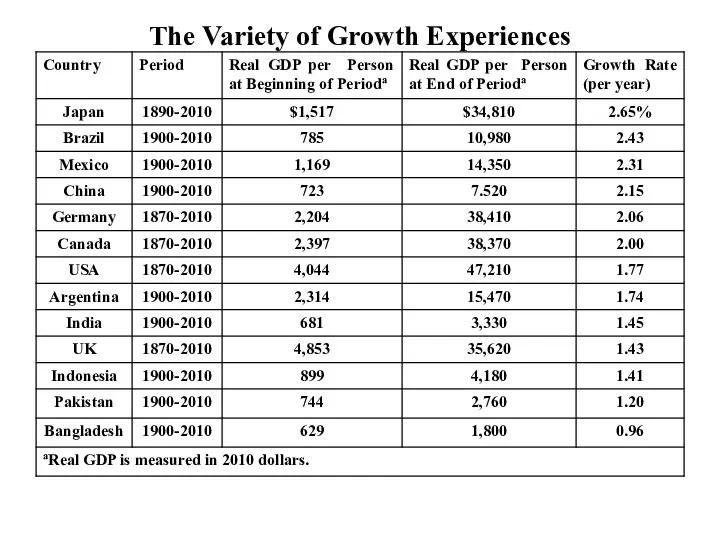

- 7. The Variety of Growth Experiences

- 8. Productivity Productivity Quantity of goods and services Produced from each unit of labor input Why productivity

- 9. Productivity Determinants of productivity Physical capital Stock of equipment and structures Used to produce goods and

- 10. Productivity Determinants of productivity Natural resources Inputs into the production of goods and services Provided by

- 11. Additionally, other explanations have highlighted the significant role of non-economic factors. These include institutional economics which

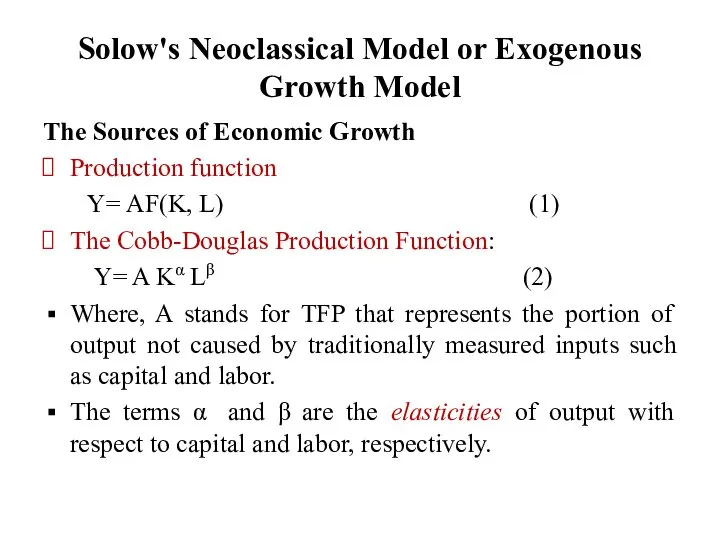

- 12. Solow's Neoclassical Model or Exogenous Growth Model The Sources of Economic Growth Production function Y= AF(K,

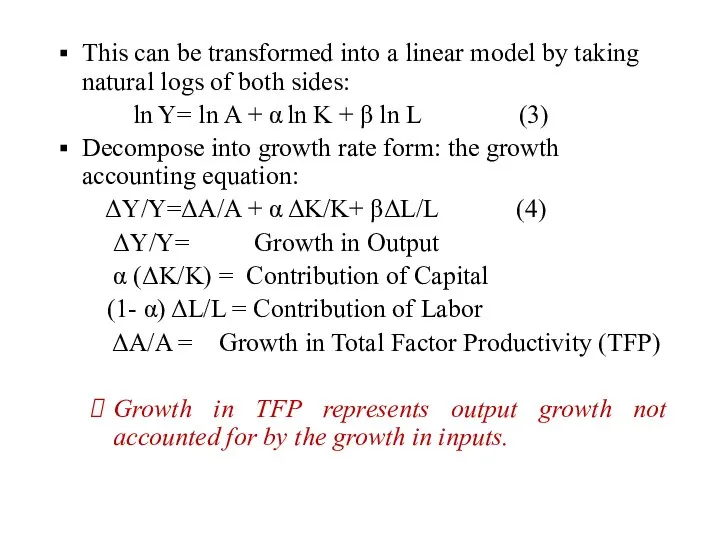

- 13. This can be transformed into a linear model by taking natural logs of both sides: ln

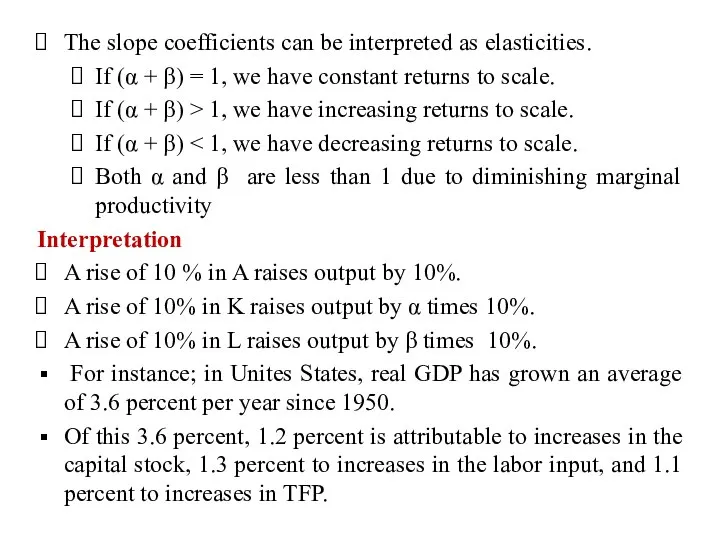

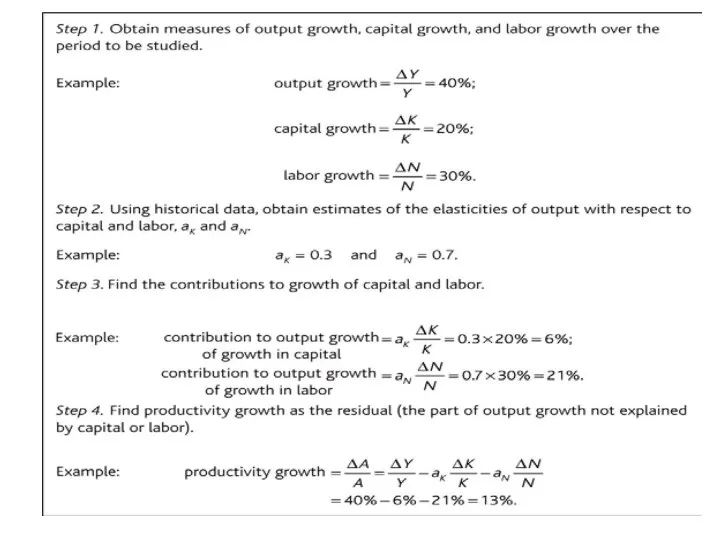

- 14. The slope coefficients can be interpreted as elasticities. If (α + β) = 1, we have

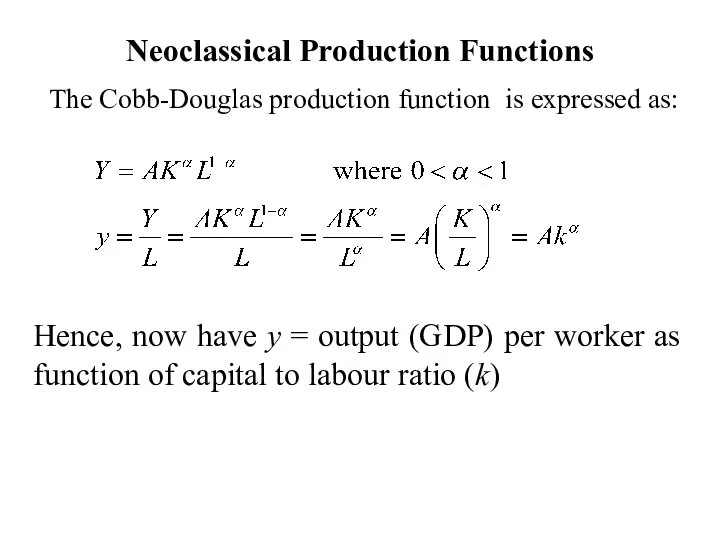

- 16. Neoclassical Production Functions The Cobb-Douglas production function is expressed as: Hence, now have y = output

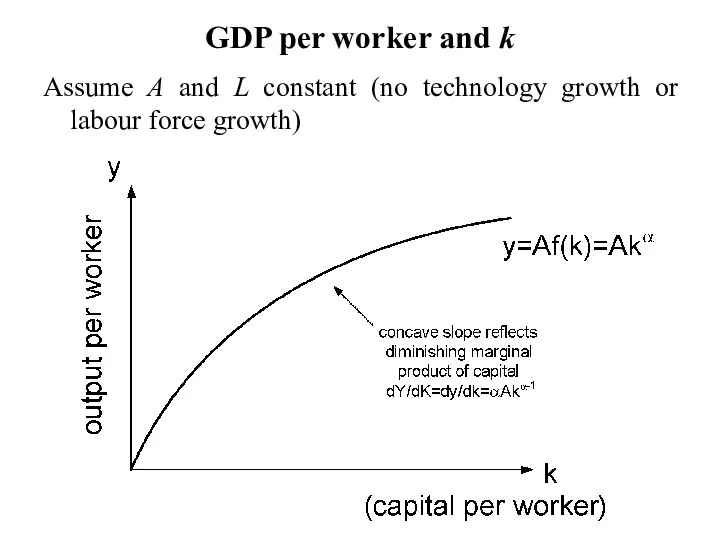

- 17. GDP per worker and k Assume A and L constant (no technology growth or labour force

- 18. Diminishing Returns The neo-classical growth theory of Solow (1956) and Swan (1956) postulates that capital accumulations

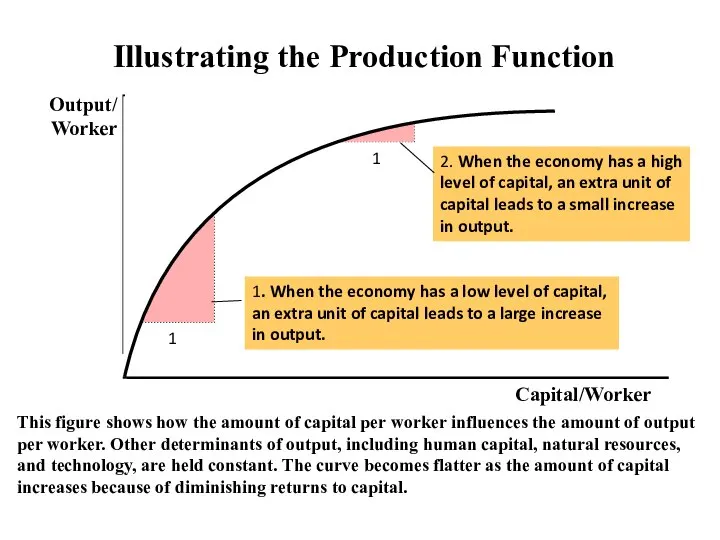

- 19. Illustrating the Production Function This figure shows how the amount of capital per worker influences the

- 20. Diminishing Returns If the variable factor of production increases, the output will increase up to a

- 21. Catch-up effect (Convergence) Countries that start off poor tend to grow more rapidly than countries that

- 22. A second approach explains convergence as resulting primarily from cross- country knowledge spillovers. The process of

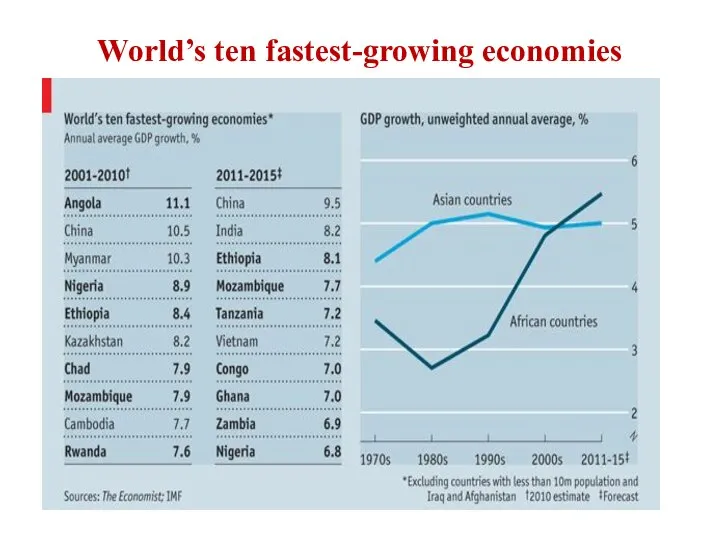

- 23. World’s ten fastest-growing economies

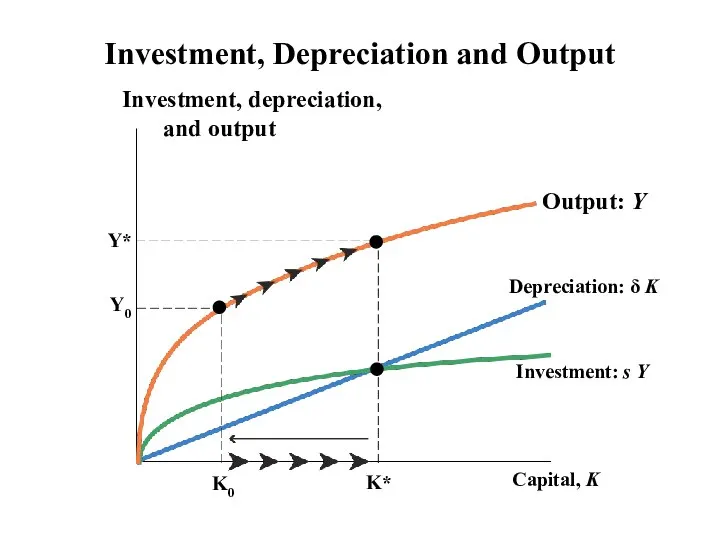

- 24. What causes the differences in income over time and across countries? The Solow growth model shows

- 25. Investment refers to the expenditure on new plant and equipment, and it causes the capital stock

- 26. Depreciation is the amount of capital that wears out each period ~ 10 percent/year. kt+1 =kt

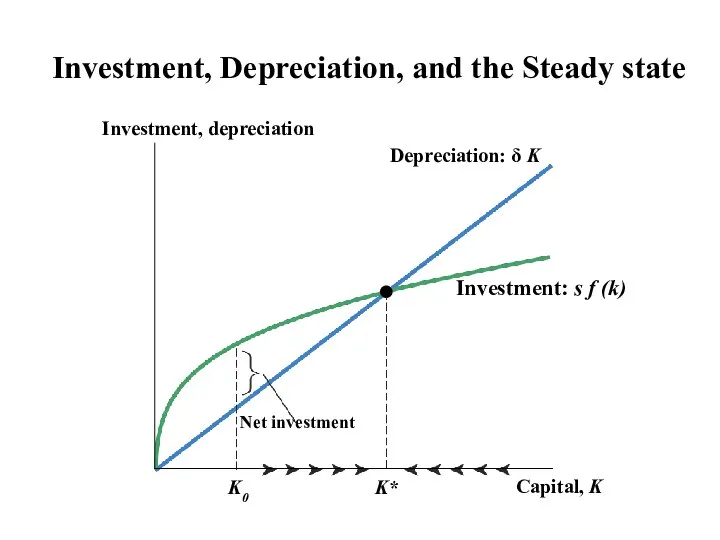

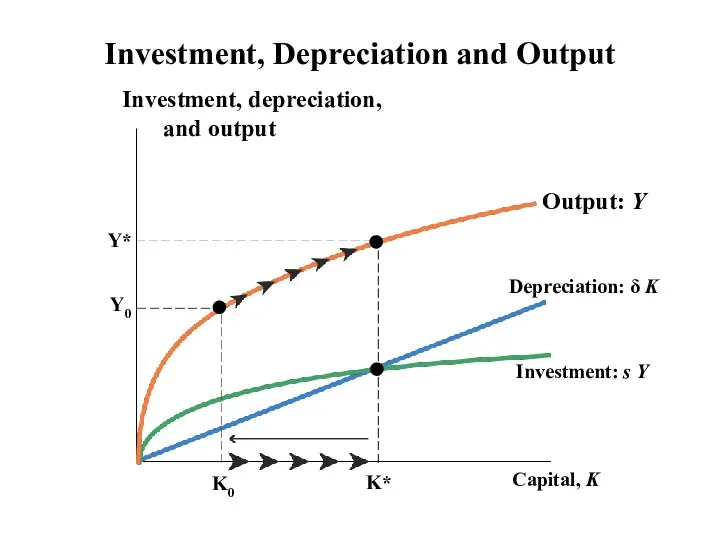

- 27. Depreciation: δ K Investment: s f (k) Investment, Depreciation, and the Steady state

- 28. The steady-state level of capital K* is the level at which investment equals depreciation, indicating that

- 29. The major accomplishment of the Solow model is the principle of transition dynamics, which states that

- 30. Investment, Depreciation and Output Output: Y Depreciation: δ K Investment: s Y

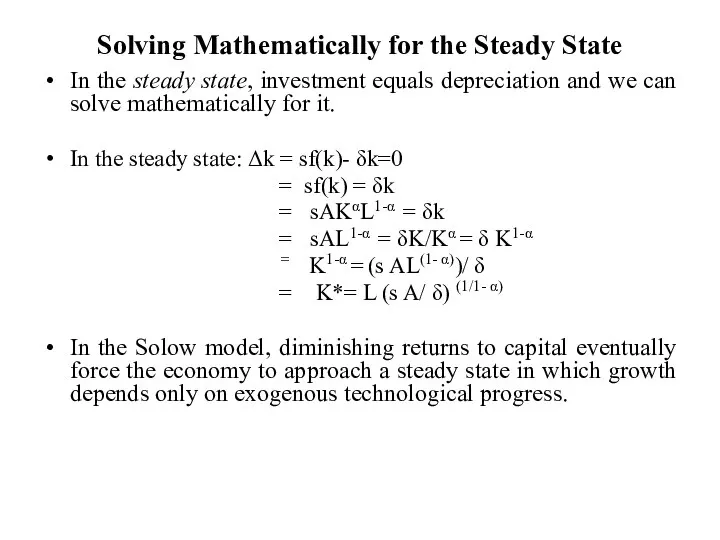

- 31. Solving Mathematically for the Steady State In the steady state, investment equals depreciation and we can

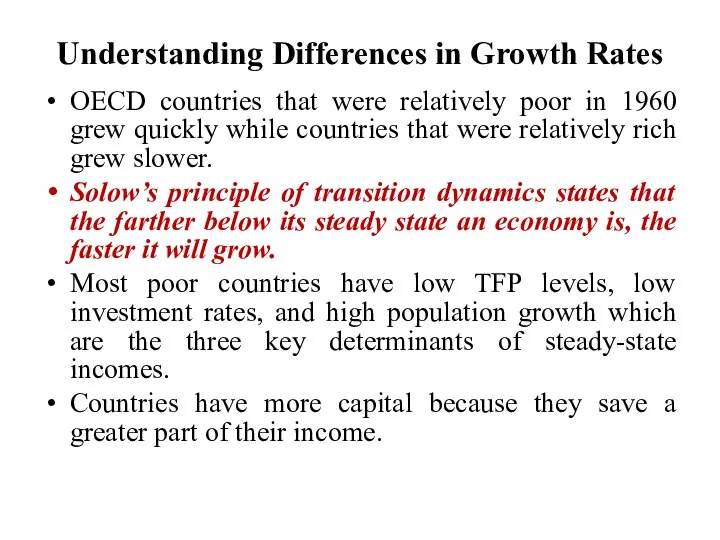

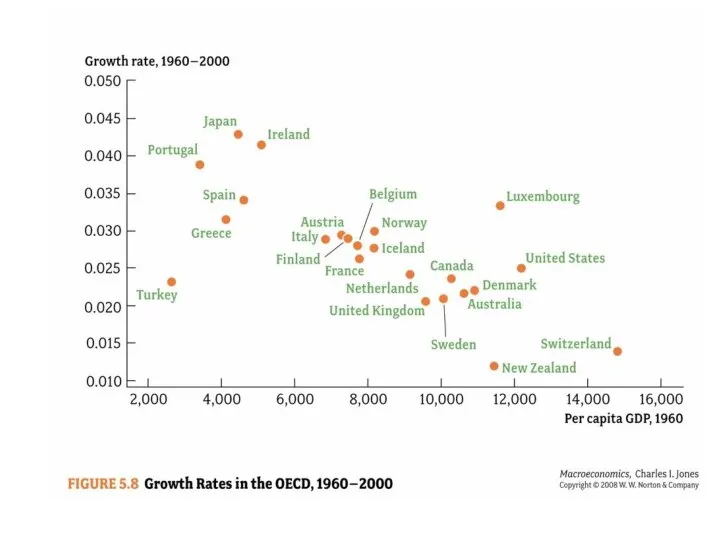

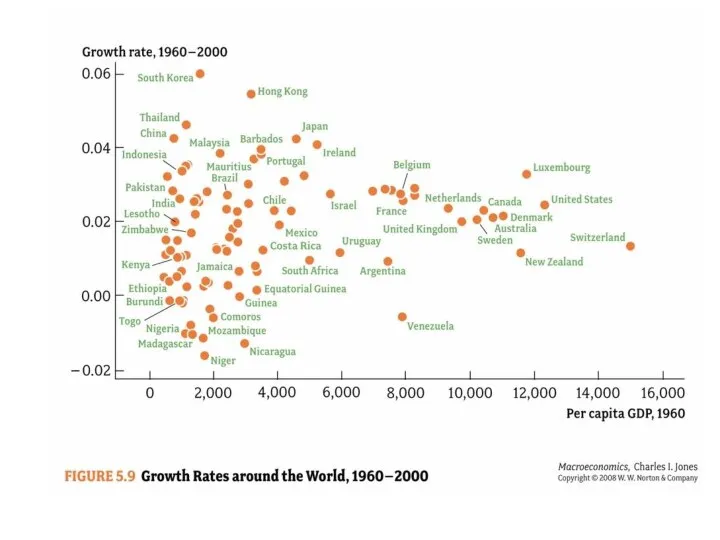

- 32. Understanding Differences in Growth Rates OECD countries that were relatively poor in 1960 grew quickly while

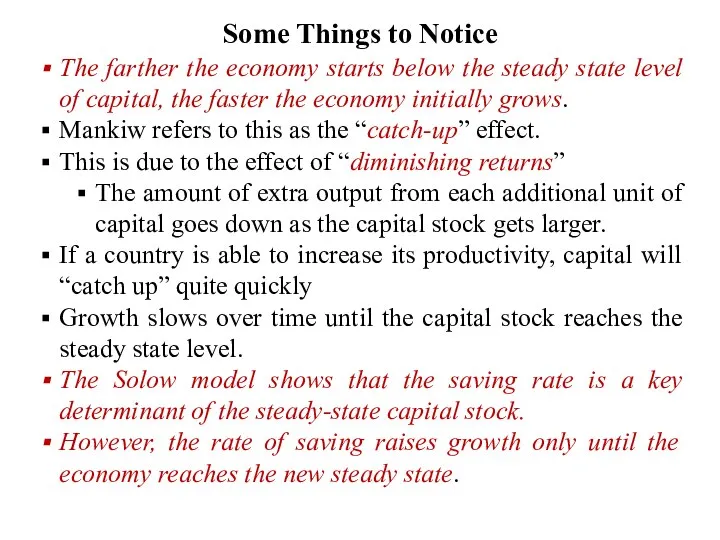

- 33. Some Things to Notice The farther the economy starts below the steady state level of capital,

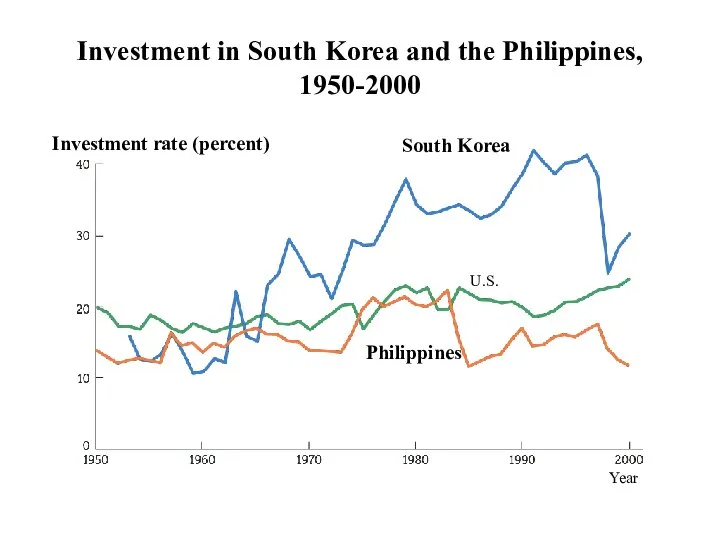

- 36. Investment in South Korea and the Philippines, 1950-2000

- 37. Brazil, S. Korea, Philippines Source: Penn World Table 6.1 (http://pwt.econ.upenn.edu/aboutpwt.html)

- 38. Application: Do Economies Converge? Unconditional (Absolute) convergence (α-Convergence) occurs when poor countries will eventually catch up

- 39. Imagine that at the end of their first year, some students have A averages, whereas others

- 40. According to the traditional neoclassical growth theory: Output growth results either from increases in labor, increases

- 41. Endogenous Growth Theory The neo-classical growth theory of Solow (1956) and Swan (1956) postulates that capital

- 42. Endogenous growth states that long-run economic growth is determined by forces that are internal to the

- 43. To introduce endogenous growth, it is necessary to have increasing (or at least non-decreasing) returns to

- 44. The largest difference between these two economic growth models is that the endogenous growth theory argues

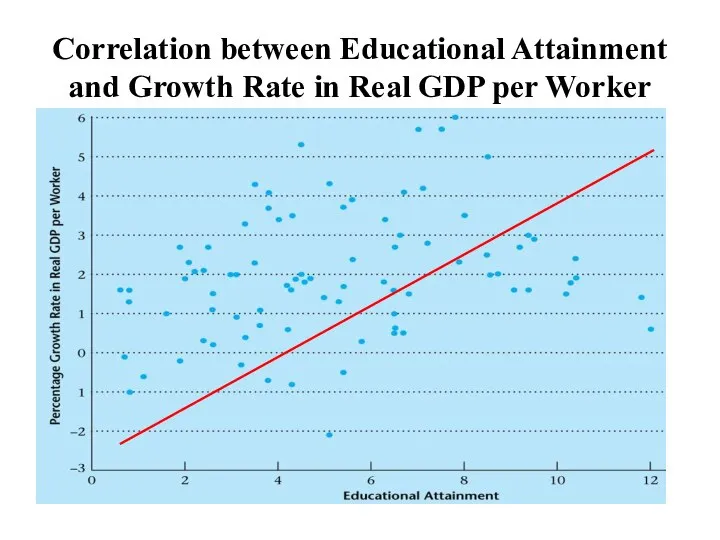

- 45. Correlation between Educational Attainment and Growth Rate in Real GDP per Worker

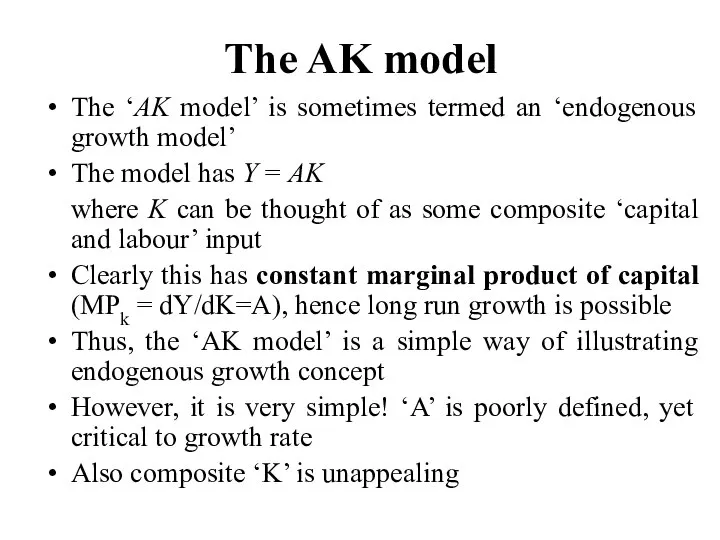

- 46. The AK model The ‘AK model’ is sometimes termed an ‘endogenous growth model’ The model has

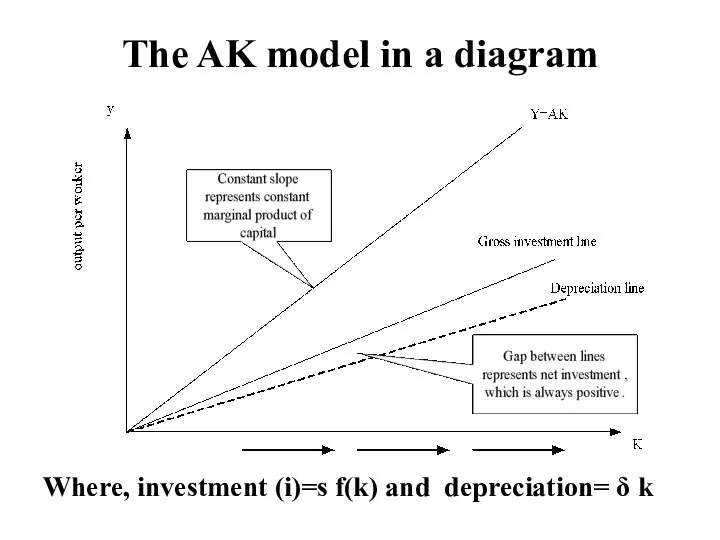

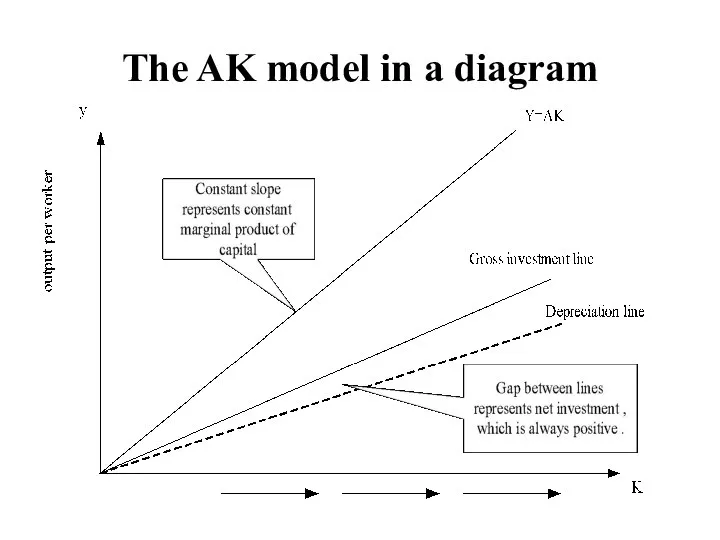

- 47. The AK model in a diagram Where, investment (i)=s f(k) and depreciation= δ k

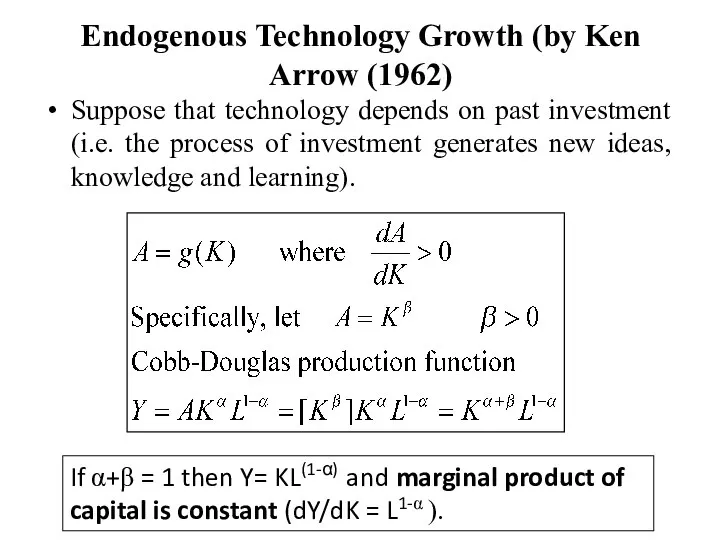

- 48. Endogenous Technology Growth (by Ken Arrow (1962) Suppose that technology depends on past investment (i.e. the

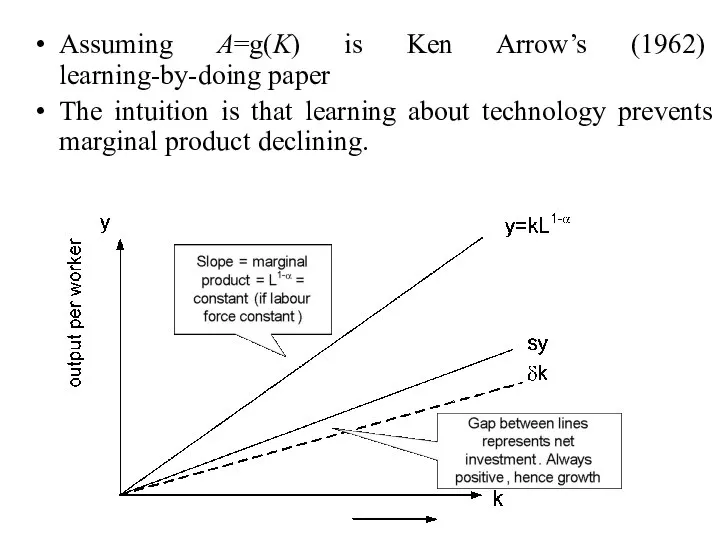

- 49. Assuming A=g(K) is Ken Arrow’s (1962) learning-by-doing paper The intuition is that learning about technology prevents

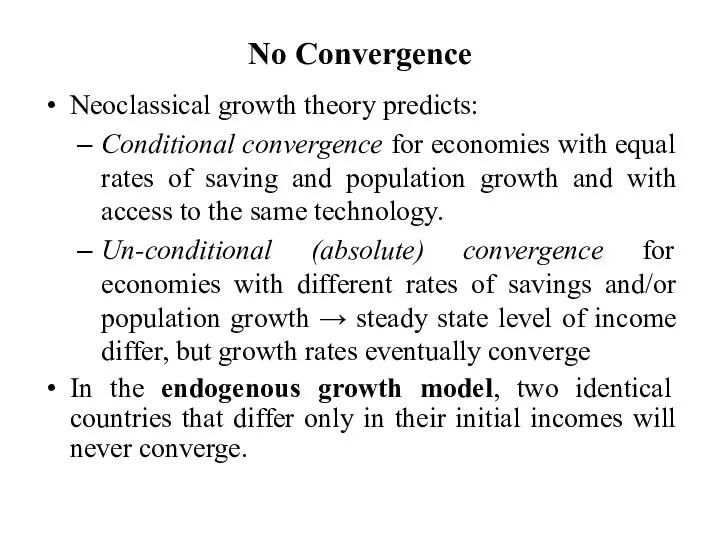

- 50. No Convergence Neoclassical growth theory predicts: Conditional convergence for economies with equal rates of saving and

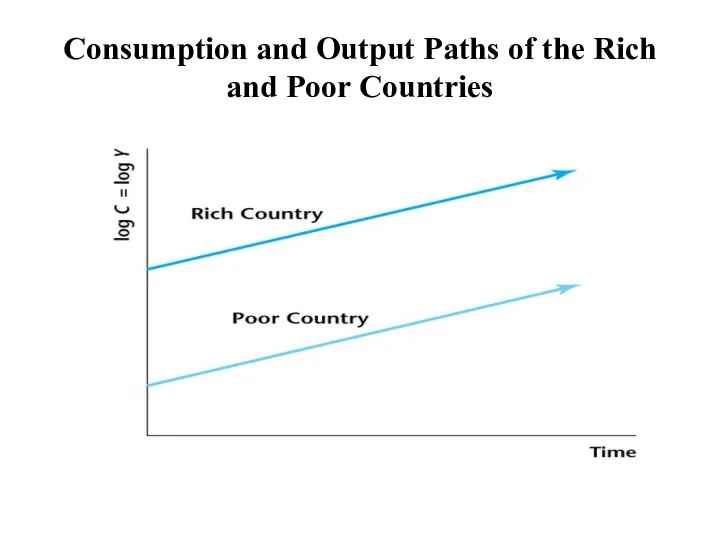

- 51. Consumption and Output Paths of the Rich and Poor Countries

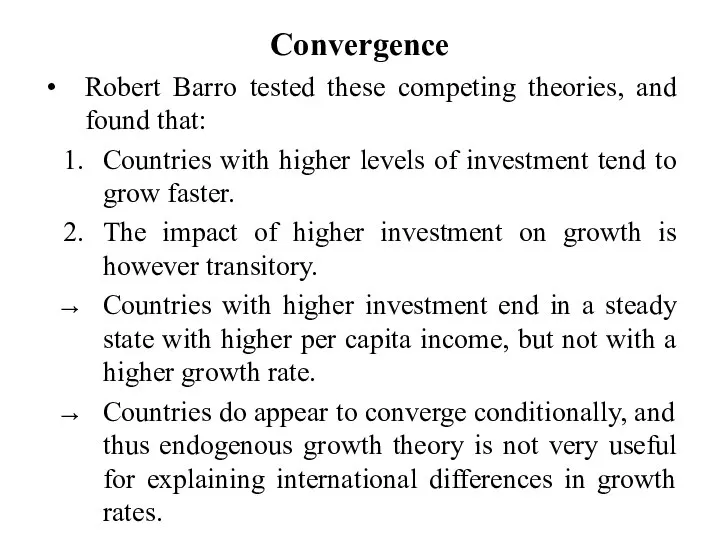

- 52. Convergence Robert Barro tested these competing theories, and found that: Countries with higher levels of investment

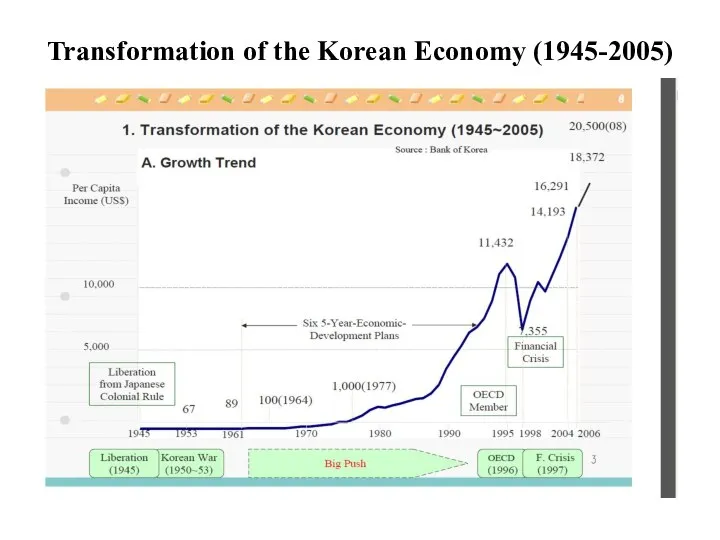

- 53. Transformation of the Korean Economy (1945-2005)

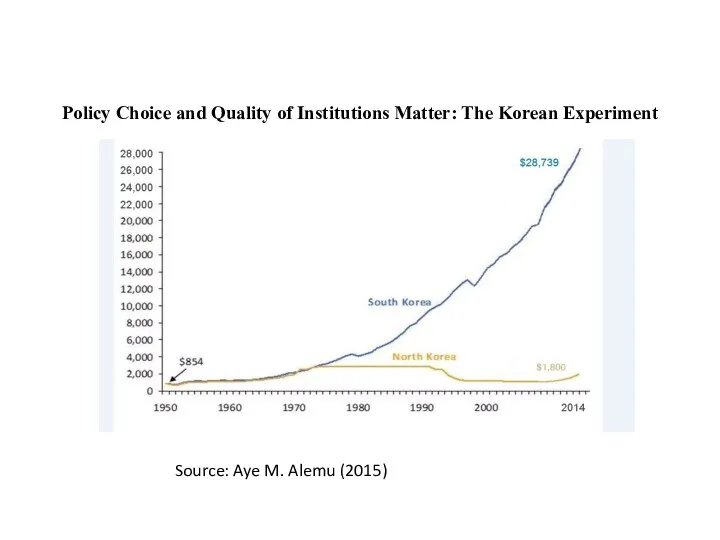

- 54. Policy Choice and Quality of Institutions Matter: The Korean Experiment Source: Aye M. Alemu (2015)

- 55. Flying geese’ pattern of economic development in East Asia The phrase “flying geese pattern of development”

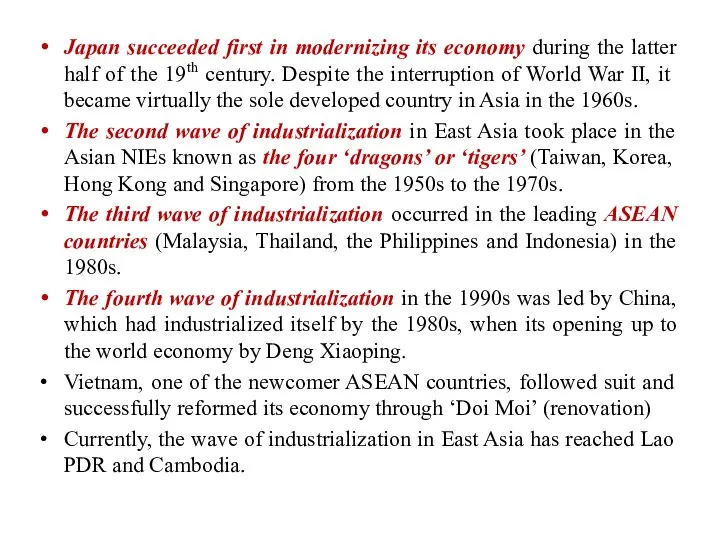

- 56. Japan succeeded first in modernizing its economy during the latter half of the 19th century. Despite

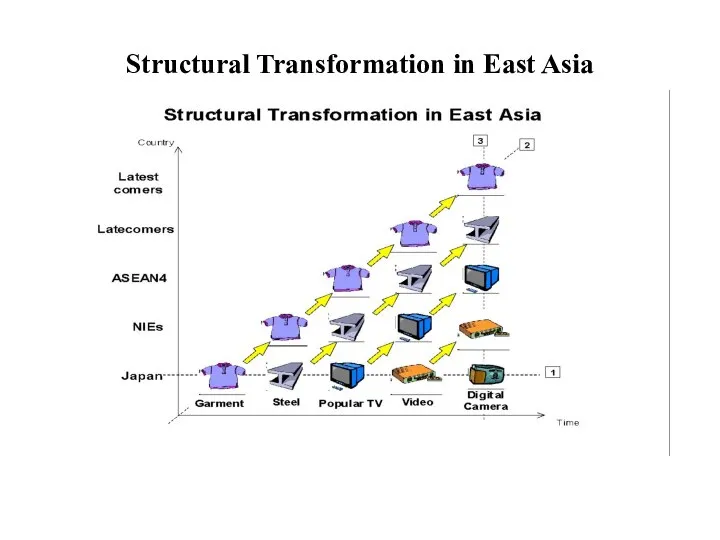

- 57. Structural Transformation in East Asia

- 58. Are natural resources a limit to growth? Argument Natural resources - will eventually limit how much

- 59. Are natural resources a limit to growth? Technological progress Often yields ways to avoid these limits

- 60. Are natural resources a limit to growth? Prices of natural resources Scarcity - reflected in market

- 61. Saving and Investment Raise future productivity Invest more current resources in the production of capital. Trade-off

- 62. Higher savings rate Fewer resources – used to make consumption goods More resources – to make

- 63. Investment from Abroad Investment from abroad Another way for a country to invest in new capital

- 64. Investment from Abroad Benefits from investment Some flow back to the foreign capital owners. Increase the

- 65. Investment from Abroad World Bank Encourages flow of capital to poor countries Funds from world’s advanced

- 66. Investment from Abroad World Bank and the International Monetary Fund Set up after World War II

- 67. Education Education Investment in human capital Gap between wages of educated and uneducated workers Opportunity cost:

- 68. Health and Nutrition Human capital Education Expenditures that lead to a healthier population Healthier workers More

- 69. Health and Nutrition Right investments in the health of the population Increase productivity Raise living standards

- 70. Health and Nutrition Vicious circle in poor countries Poor countries are poor Because their populations are

- 71. Health and Nutrition Virtuous circle Policies that lead to more rapid economic growth Would naturally improve

- 72. Property Rights & Political Stability To foster economic growth Protect property rights Ability of people to

- 73. Property Rights & Political Stability Lack of property rights Major problem Contracts are hard to enforce

- 74. Property Rights & Political Stability Political instability A threat to property rights Revolutions and coups Revolutionary

- 75. Free Trade Inward-oriented policies Avoid interaction with the rest of the world Infant-industry argument Tariffs Other

- 76. Free Trade Outward-oriented policies Integrate into the world economy International trade in goods and services Economic

- 77. Research and Development Knowledge – public good Government–encourages research and development Farming methods Aerospace research (Air

- 78. Population Growth Large population More workers to produce goods and services Larger total output of goods

- 79. Population Growth Diluting the capital stock High population growth Spread the capital stock more thinly Lower

- 80. Population Growth Promoting technological progress World population growth Engine for technological progress and economic prosperity More

- 81. Summary International differences in income per person can be attributed to either: differences in the factors

- 82. Summary The Solow growth model has emphasized the importance of savings or investment ratio as the

- 83. Technological progress, though important in the long-run, is regarded as exogenous to the economic system. The

- 84. Investment, Depreciation and Output Output: Y Depreciation: δ K Investment: s Y

- 85. The Endogenous growth theory believe that human capital and innovation capacity are the main sources of

- 86. The AK model in a diagram

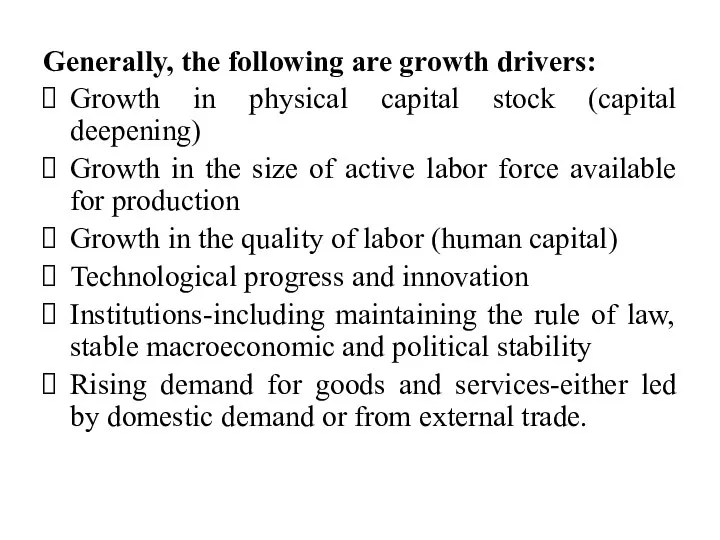

- 87. Generally, the following are growth drivers: Growth in physical capital stock (capital deepening) Growth in the

- 89. Скачать презентацию

Экономикалық жүйе

Экономикалық жүйе Несовешенства рынка. Общественные блага. Спрос и предложение на общественные блага. Трансакционные издержки

Несовешенства рынка. Общественные блага. Спрос и предложение на общественные блага. Трансакционные издержки Индекс стоимости жизни

Индекс стоимости жизни Трудовая теория стоимости. А.Смит, Д.Рикардо, К.Маркс

Трудовая теория стоимости. А.Смит, Д.Рикардо, К.Маркс Разработка мероприятий по повышению эффективности хозяйственной деятельности АО «Плава»

Разработка мероприятий по повышению эффективности хозяйственной деятельности АО «Плава» Тема научной статьи – ракурс, в котором рассматривается проблема

Тема научной статьи – ракурс, в котором рассматривается проблема Прибыль предприятия и пути ее максимизации на примере ООО «Лента»

Прибыль предприятия и пути ее максимизации на примере ООО «Лента» Aboriginal Affairs and Northern Development Canada

Aboriginal Affairs and Northern Development Canada Инновационная деятельность

Инновационная деятельность Северо-Кавказский федеральный округ

Северо-Кавказский федеральный округ Презентация Виды научных публикаций

Презентация Виды научных публикаций Институциональная экономика. Лекция 12-13. Институциональная теория государств

Институциональная экономика. Лекция 12-13. Институциональная теория государств Планирование и управление инновациями

Планирование и управление инновациями Американский и русский институционализм начала ХХ века

Американский и русский институционализм начала ХХ века Основы регионального управления

Основы регионального управления Таур қорын,қаржыны және басқа да активтерді нормалау. Тауардың босатылу көлемін қамтамасыз ету

Таур қорын,қаржыны және басқа да активтерді нормалау. Тауардың босатылу көлемін қамтамасыз ету Классификация методов товароведения

Классификация методов товароведения Las mercancías & las aduanas

Las mercancías & las aduanas Бюджетные путешествия

Бюджетные путешествия Международные аспекты экономического развития

Международные аспекты экономического развития История и методология экономической науки

История и методология экономической науки International Trade: Theory and Policy. Lecture 10

International Trade: Theory and Policy. Lecture 10 Технология разработки прогнозов разных уровней. Макроэкономическое прогнозирование

Технология разработки прогнозов разных уровней. Макроэкономическое прогнозирование Презентация Маркетинг человеческих ресурсов

Презентация Маркетинг человеческих ресурсов Cost-volume-profit (cvp) analysis

Cost-volume-profit (cvp) analysis Ұлттық экономика жүйе ретінде. Есептер мен тапсырмалар

Ұлттық экономика жүйе ретінде. Есептер мен тапсырмалар Introduction to Economics – Principles of Economics. Introductory lecture. Olzhas Kuzhakhmetov

Introduction to Economics – Principles of Economics. Introductory lecture. Olzhas Kuzhakhmetov Эффективные способы взаимодействия бизнеса и власти для развития моногородов

Эффективные способы взаимодействия бизнеса и власти для развития моногородов