Содержание

- 2. Financial Statement Analysis Financial Statements A Possible Framework for Analysis Ratio Analysis Trend Analysis Common-Size and

- 3. Examples of External Uses of Statement Analysis Trade Creditors -- Focus on the liquidity of the

- 4. Examples of Internal Uses of Statement Analysis Plan -- Focus on assessing the current financial position

- 5. Primary Types of Financial Statements Income Statement A summary of a firm’s revenues and expenses over

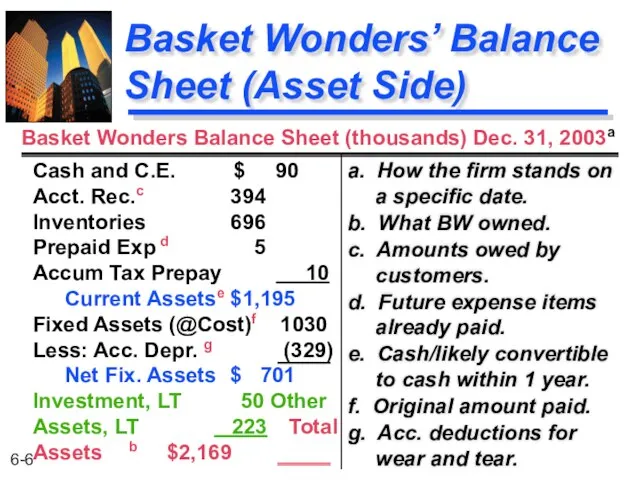

- 6. Basket Wonders’ Balance Sheet (Asset Side) a. How the firm stands on a specific date. b.

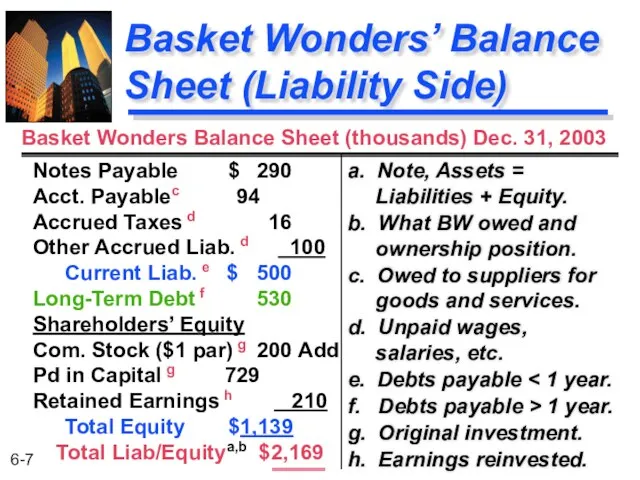

- 7. Basket Wonders’ Balance Sheet (Liability Side) a. Note, Assets = Liabilities + Equity. b. What BW

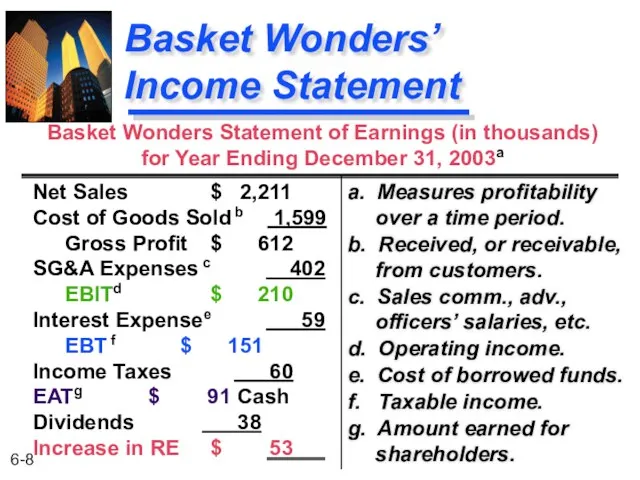

- 8. Basket Wonders’ Income Statement a. Measures profitability over a time period. b. Received, or receivable, from

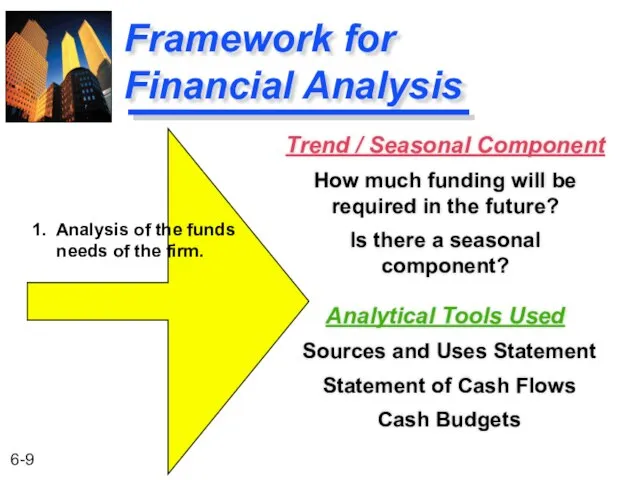

- 9. Framework for Financial Analysis Analytical Tools Used Sources and Uses Statement Statement of Cash Flows Cash

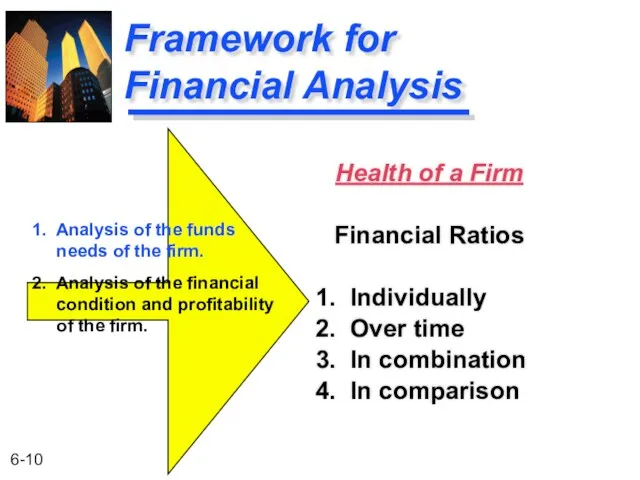

- 10. Framework for Financial Analysis Health of a Firm Financial Ratios 1. Individually 2. Over time 3.

- 11. Framework for Financial Analysis Examples: Volatility in sales Volatility in costs Proximity to break-even point 1.

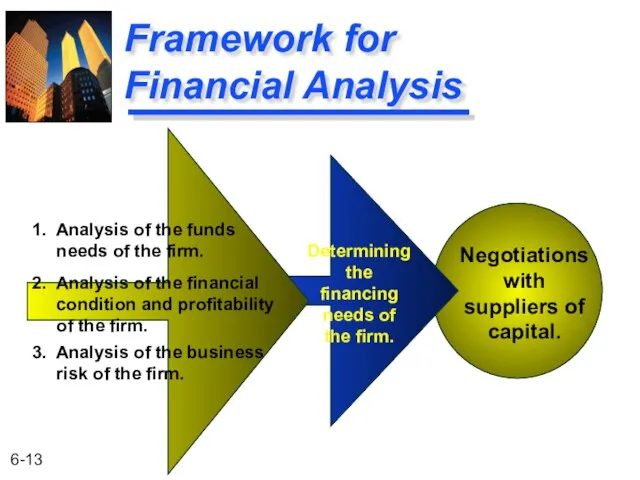

- 12. Framework for Financial Analysis A Financial Manager must consider all three jointly when determining the financing

- 13. Framework for Financial Analysis Negotiations with suppliers of capital. Determining the financing needs of the firm.

- 14. Use of Financial Ratios Types of Comparisons Internal Comparisons External Comparisons A Financial Ratio is an

- 15. External Comparisons and Sources of Industry Ratios Examples: Robert Morris Associates Dun & Bradstreet Almanac of

- 16. Liquidity Ratios Current Current Assets Current Liabilities For Basket Wonders December 31, 2003 Shows a firm’s

- 17. Liquidity Ratio Comparisons BW Industry 2.39 2.15 2.26 2.09 1.91 2.01 Year 2003 2002 2001 Current

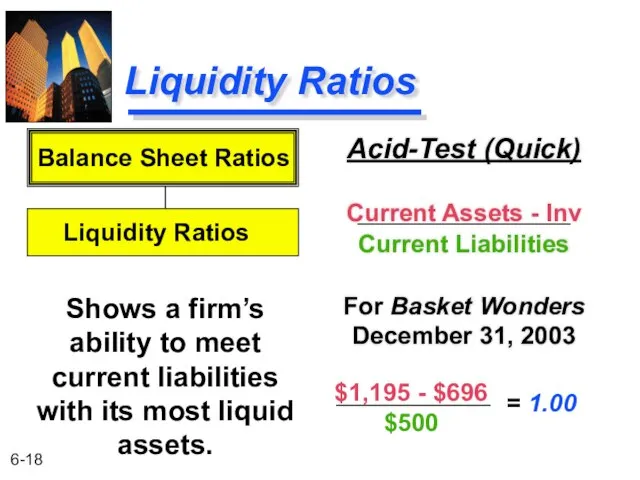

- 18. Liquidity Ratios Acid-Test (Quick) Current Assets - Inv Current Liabilities For Basket Wonders December 31, 2003

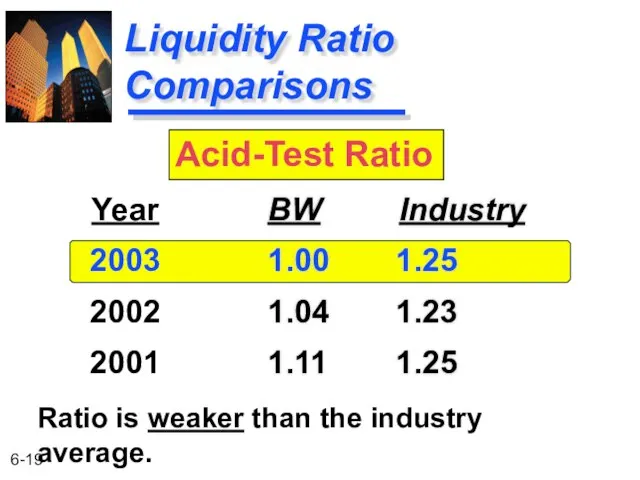

- 19. Liquidity Ratio Comparisons BW Industry 1.00 1.25 1.04 1.23 1.11 1.25 Year 2003 2002 2001 Acid-Test

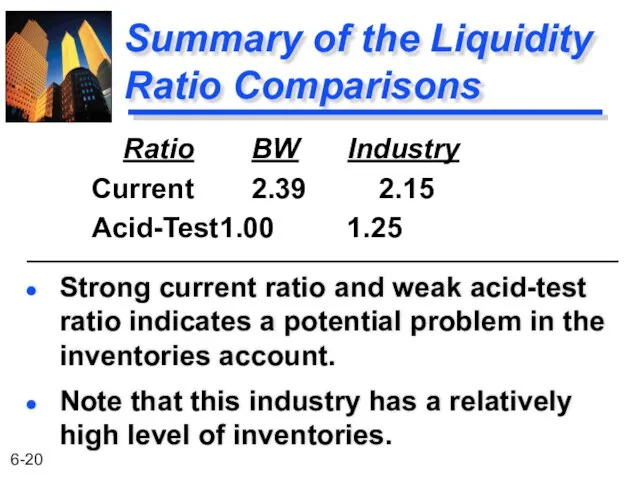

- 20. Summary of the Liquidity Ratio Comparisons Strong current ratio and weak acid-test ratio indicates a potential

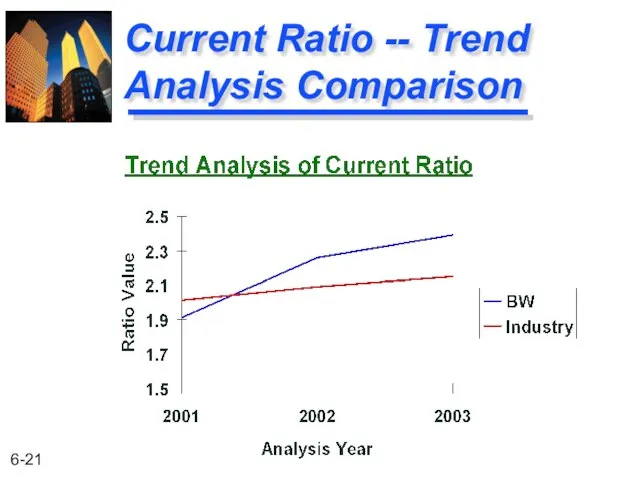

- 21. Current Ratio -- Trend Analysis Comparison

- 22. Acid-Test Ratio -- Trend Analysis Comparison

- 23. Summary of the Liquidity Trend Analyses The current ratio for the industry has been rising slowly

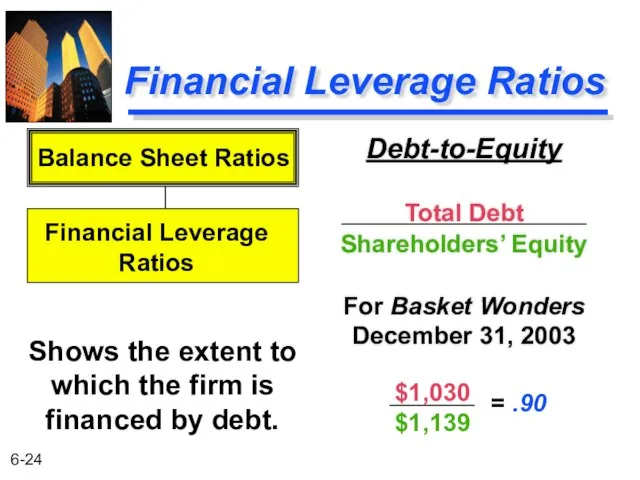

- 24. Financial Leverage Ratios Debt-to-Equity Total Debt Shareholders’ Equity For Basket Wonders December 31, 2003 Shows the

- 25. Financial Leverage Ratio Comparisons BW Industry .90 .90 .88 .90 .81 .89 Year 2003 2002 2001

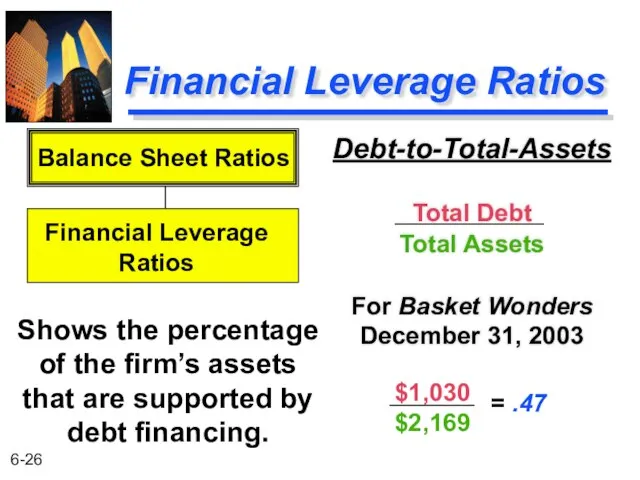

- 26. Financial Leverage Ratios Debt-to-Total-Assets Total Debt Total Assets For Basket Wonders December 31, 2003 Shows the

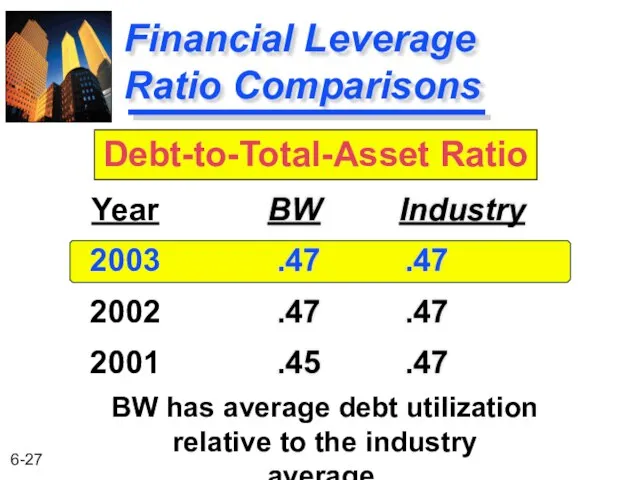

- 27. Financial Leverage Ratio Comparisons BW Industry .47 .47 .47 .47 .45 .47 Year 2003 2002 2001

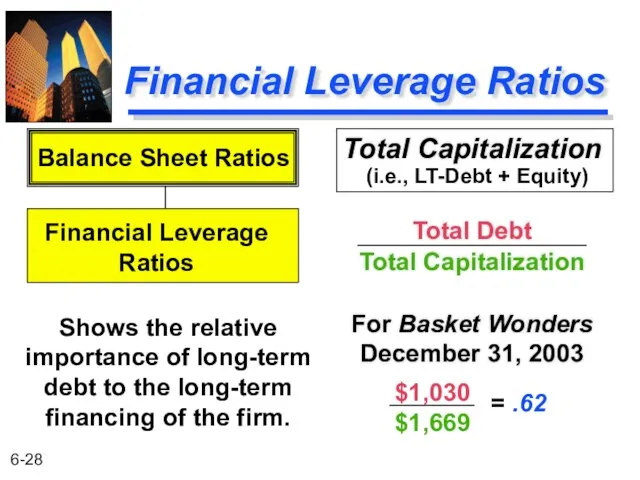

- 28. Financial Leverage Ratios Total Capitalization Total Debt Total Capitalization For Basket Wonders December 31, 2003 Shows

- 29. Financial Leverage Ratio Comparisons BW Industry .62 .60 .62 .61 .67 .62 Year 2003 2002 2001

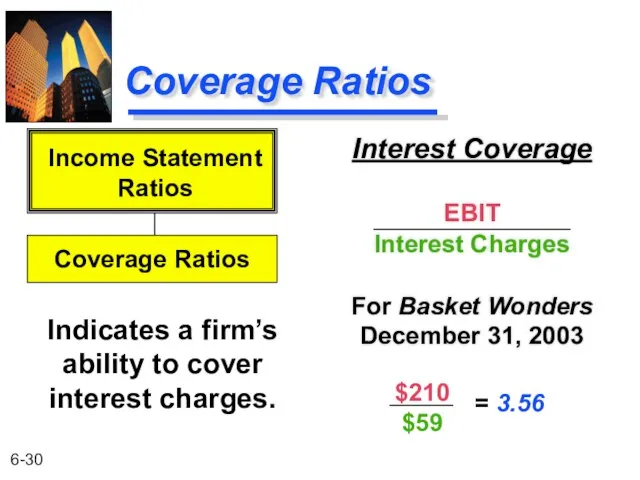

- 30. Coverage Ratios Interest Coverage EBIT Interest Charges For Basket Wonders December 31, 2003 Indicates a firm’s

- 31. Coverage Ratio Comparisons BW Industry 3.56 5.19 4.35 5.02 10.30 4.66 Year 2003 2002 2001 Interest

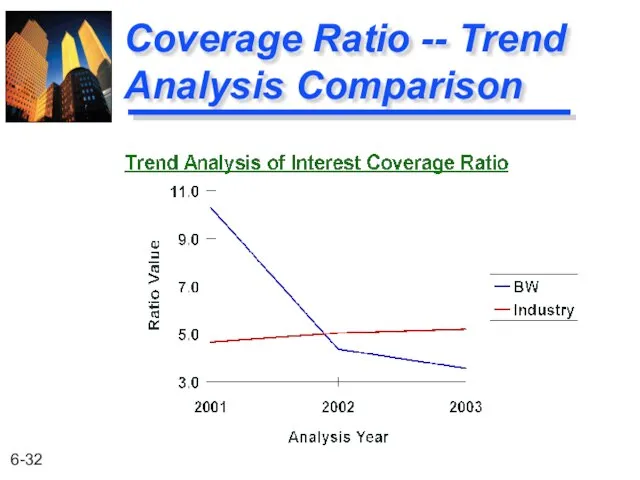

- 32. Coverage Ratio -- Trend Analysis Comparison

- 33. Summary of the Coverage Trend Analysis This indicates that low earnings (EBIT) may be a potential

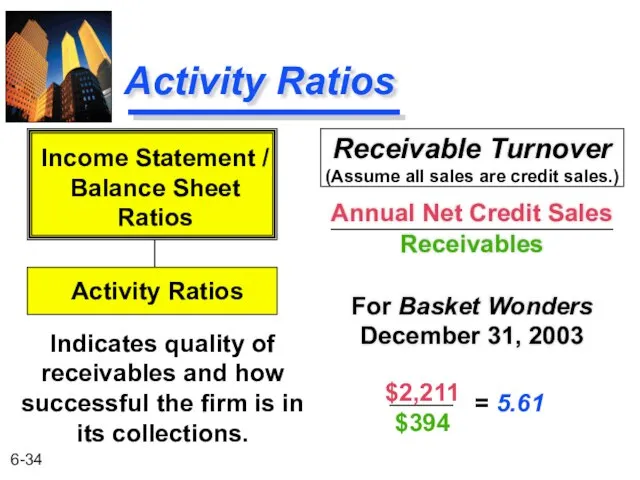

- 34. Activity Ratios Receivable Turnover Annual Net Credit Sales Receivables For Basket Wonders December 31, 2003 Indicates

- 35. Activity Ratios Avg Collection Period Days in the Year Receivable Turnover For Basket Wonders December 31,

- 36. Activity Ratio Comparisons BW Industry 65.0 65.7 71.1 66.3 83.6 69.2 Year 2003 2002 2001 Average

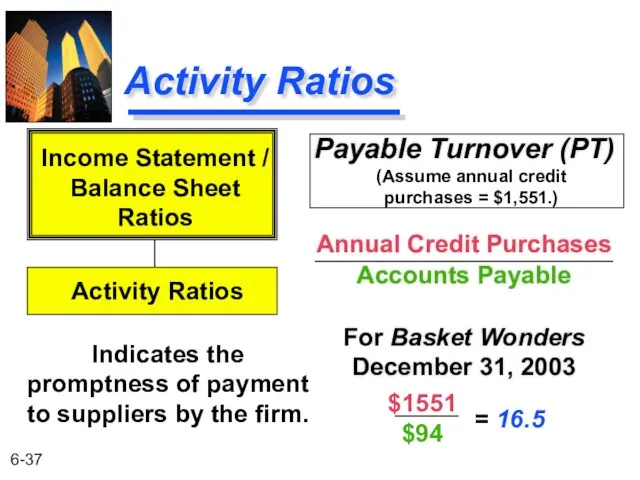

- 37. Activity Ratios Payable Turnover (PT) Annual Credit Purchases Accounts Payable For Basket Wonders December 31, 2003

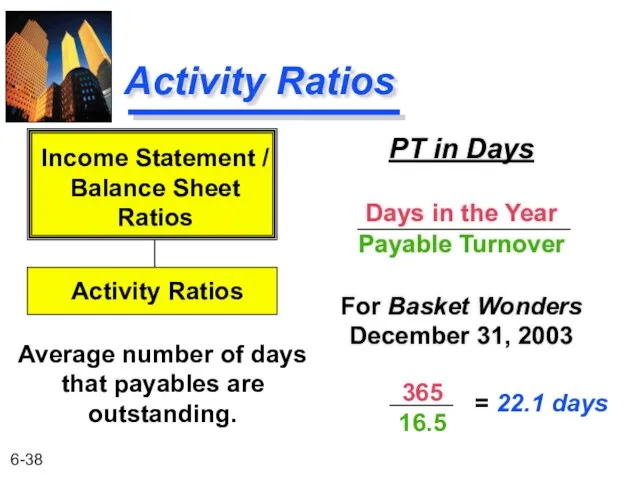

- 38. Activity Ratios PT in Days Days in the Year Payable Turnover For Basket Wonders December 31,

- 39. Activity Ratio Comparisons BW Industry 22.1 46.7 25.4 51.1 43.5 48.5 Year 2003 2002 2001 Payable

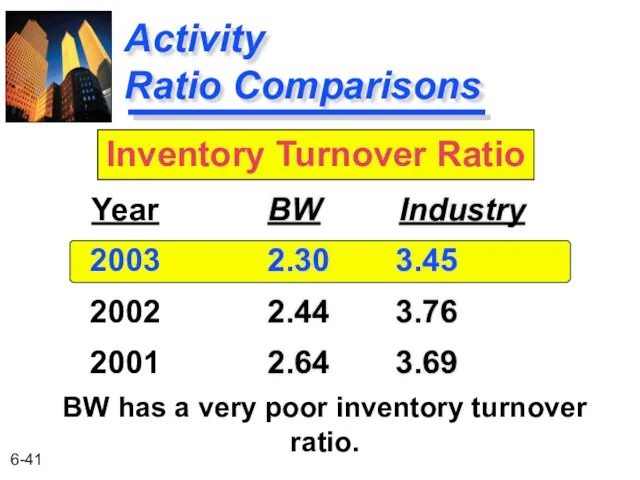

- 40. Activity Ratios Inventory Turnover Cost of Goods Sold Inventory For Basket Wonders December 31, 2003 Indicates

- 41. Activity Ratio Comparisons BW Industry 2.30 3.45 2.44 3.76 2.64 3.69 Year 2003 2002 2001 Inventory

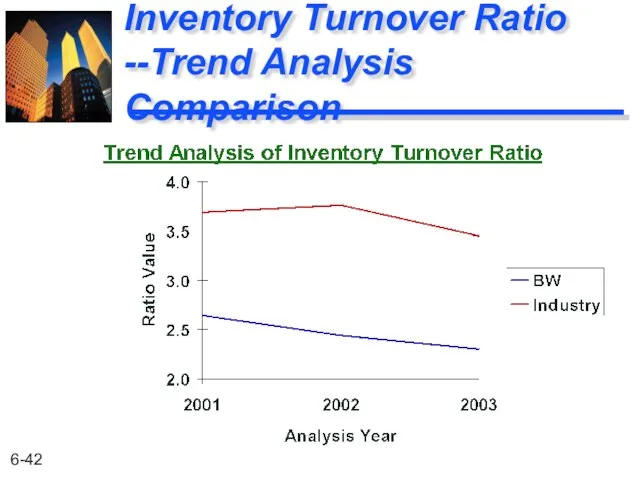

- 42. Inventory Turnover Ratio --Trend Analysis Comparison

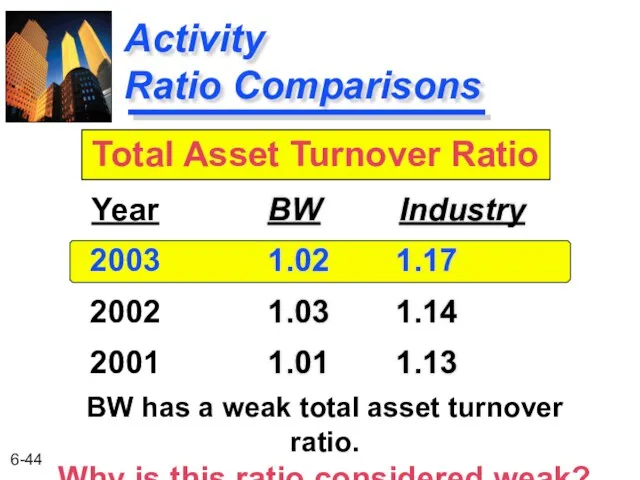

- 43. Activity Ratios Total Asset Turnover Net Sales Total Assets For Basket Wonders December 31, 2003 Indicates

- 44. Activity Ratio Comparisons BW Industry 1.02 1.17 1.03 1.14 1.01 1.13 Year 2003 2002 2001 Total

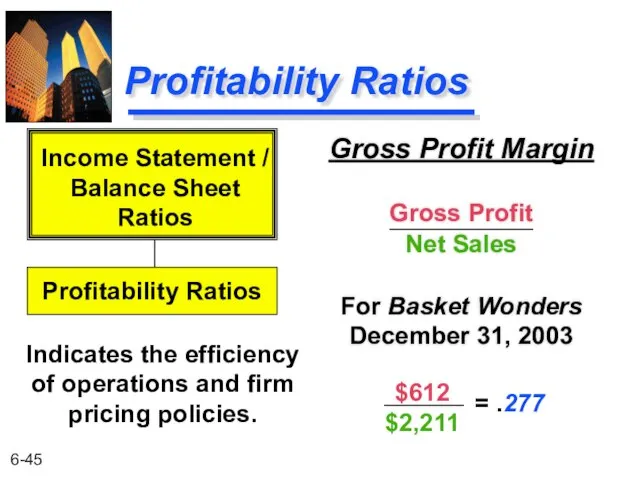

- 45. Profitability Ratios Gross Profit Margin Gross Profit Net Sales For Basket Wonders December 31, 2003 Indicates

- 46. Profitability Ratio Comparisons BW Industry 27.7% 31.1% 28.7 30.8 31.3 27.6 Year 2003 2002 2001 Gross

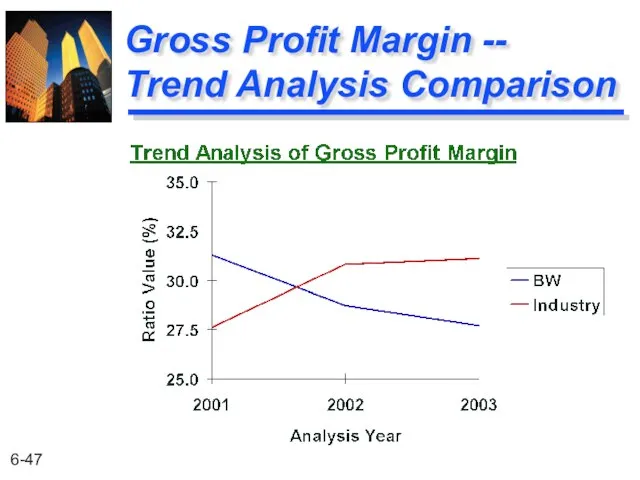

- 47. Gross Profit Margin -- Trend Analysis Comparison

- 48. Profitability Ratios Net Profit Margin Net Profit after Taxes Net Sales For Basket Wonders December 31,

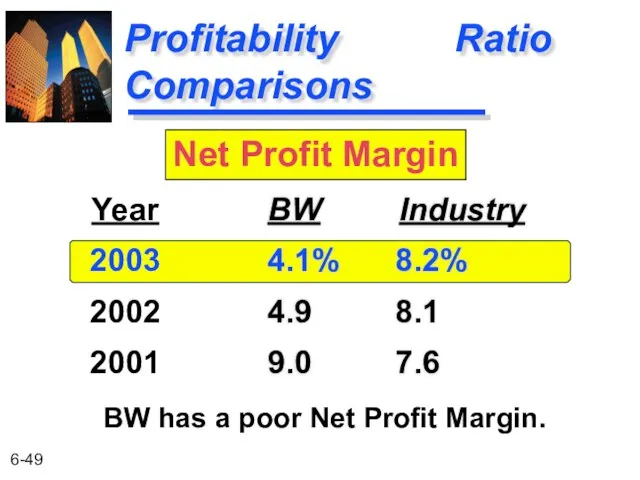

- 49. Profitability Ratio Comparisons BW Industry 4.1% 8.2% 4.9 8.1 9.0 7.6 Year 2003 2002 2001 Net

- 50. Net Profit Margin -- Trend Analysis Comparison

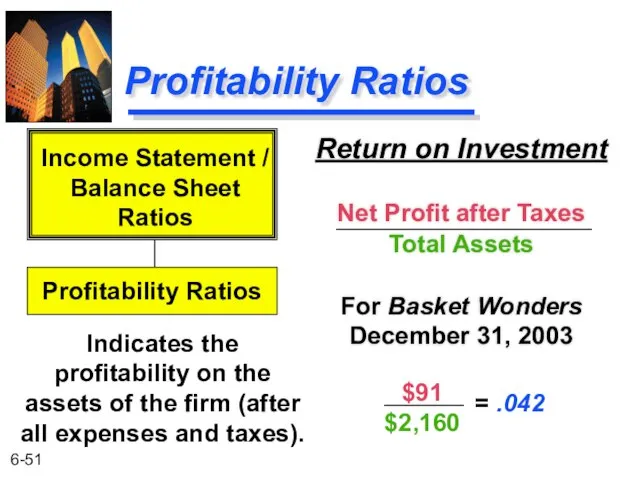

- 51. Profitability Ratios Return on Investment Net Profit after Taxes Total Assets For Basket Wonders December 31,

- 52. Profitability Ratio Comparisons BW Industry 4.2% 9.8% 5.0 9.1 9.1 10.8 Year 2003 2002 2001 Return

- 53. Return on Investment – Trend Analysis Comparison

- 54. Profitability Ratios Return on Equity Net Profit after Taxes Shareholders’ Equity For Basket Wonders December 31,

- 55. Profitability Ratio Comparisons BW Industry 8.0% 17.9% 9.4 17.2 16.6 20.4 Year 2003 2002 2001 Return

- 56. Return on Equity -- Trend Analysis Comparison

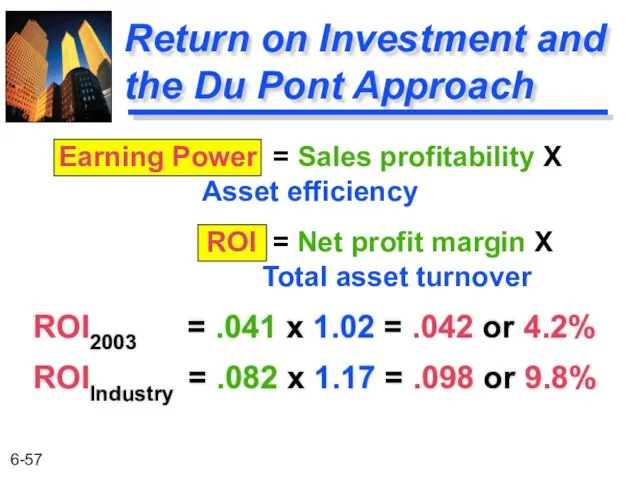

- 57. Return on Investment and the Du Pont Approach ROI2003 = .041 x 1.02 = .042 or

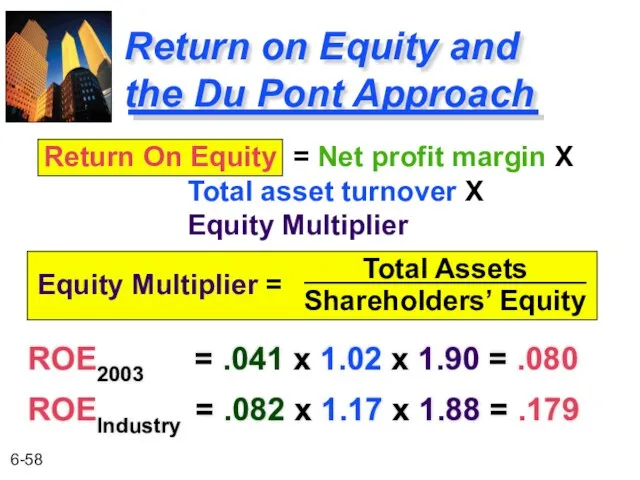

- 58. Return on Equity and the Du Pont Approach ROE2003 = .041 x 1.02 x 1.90 =

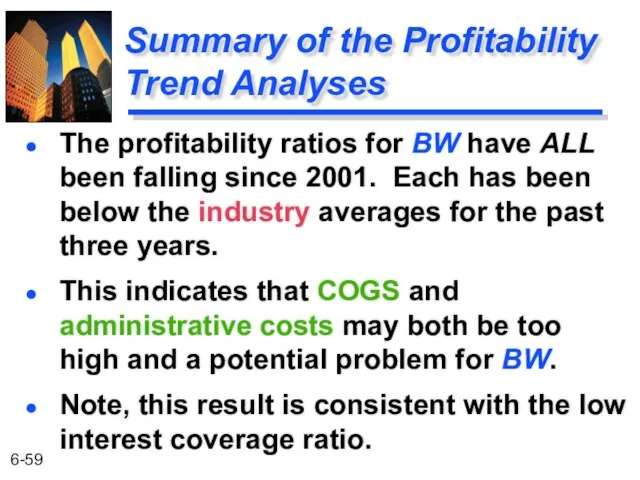

- 59. Summary of the Profitability Trend Analyses The profitability ratios for BW have ALL been falling since

- 60. Summary of Ratio Analyses Inventories are too high. May be paying off creditors (accounts payable) too

- 61. Common-size Analysis An analysis of percentage financial statements where all balance sheet items are divided by

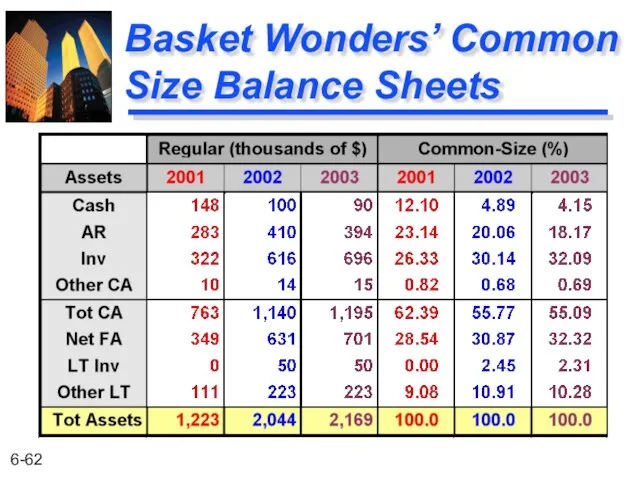

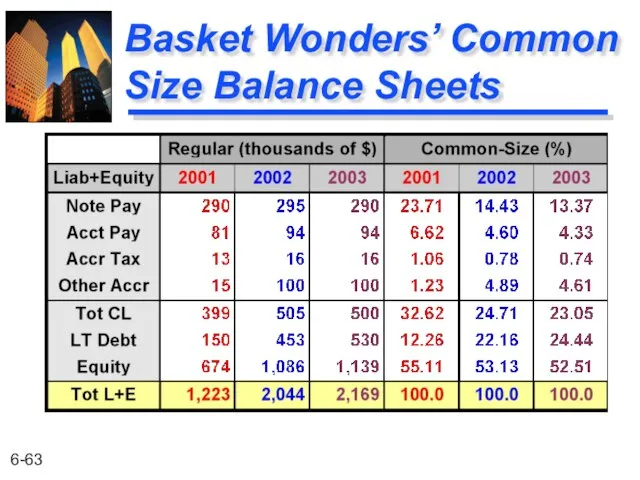

- 62. Basket Wonders’ Common Size Balance Sheets

- 63. Basket Wonders’ Common Size Balance Sheets

- 64. Basket Wonders’ Common Size Income Statements

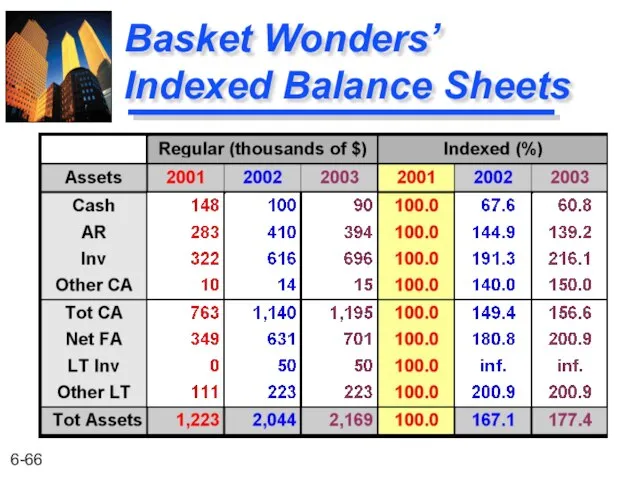

- 65. Index Analyses An analysis of percentage financial statements where all balance sheet or income statement figures

- 66. Basket Wonders’ Indexed Balance Sheets

- 67. Basket Wonders’ Indexed Balance Sheets

- 69. Скачать презентацию

Портфельное инвестрование. Сущность и виды инвестиционного портфеля

Портфельное инвестрование. Сущность и виды инвестиционного портфеля Понятие себестоимости. Роль себестоимости в обеспечении конкурентоспособности продукции предприятия

Понятие себестоимости. Роль себестоимости в обеспечении конкурентоспособности продукции предприятия Источники финансирования инвестиционной деятельности

Источники финансирования инвестиционной деятельности Государственный долг. Долговая политика РФ на современном этапе

Государственный долг. Долговая политика РФ на современном этапе VentureMeet_МИК_общая_18-08-22-1 (3)

VentureMeet_МИК_общая_18-08-22-1 (3) Деньги. Кредит. Банки

Деньги. Кредит. Банки Налоги и налогообложение. Теоретические основы налогообложения. Налоговая система РФ

Налоги и налогообложение. Теоретические основы налогообложения. Налоговая система РФ Информация по выписке счет-фактуры за наличный расчет ТОО Газпром нефть-Казахстан

Информация по выписке счет-фактуры за наличный расчет ТОО Газпром нефть-Казахстан Stock Market

Stock Market Расчетная работа ОАО Мечел. Аналитический баланс, вертикальный и горизонтальный анализ

Расчетная работа ОАО Мечел. Аналитический баланс, вертикальный и горизонтальный анализ Содержание и принципы межбюджетных отношений

Содержание и принципы межбюджетных отношений Типовой вариант экзамена

Типовой вариант экзамена Конвенция Юнситрал о международных переводных векселях и международных простых векселях

Конвенция Юнситрал о международных переводных векселях и международных простых векселях Кредитные карты. Кредит Европа Банк

Кредитные карты. Кредит Европа Банк Программа смешанного страхования жизни Гармония жизни

Программа смешанного страхования жизни Гармония жизни Своя игра. Налогообложение

Своя игра. Налогообложение Ценообразование на мировом рынке товаров и услуг

Ценообразование на мировом рынке товаров и услуг Концепция консолидированного бюджета Белгородской области

Концепция консолидированного бюджета Белгородской области Доходный подход

Доходный подход Аудит кредиторской задолженности

Аудит кредиторской задолженности История развития страхования в 21 веке в Германии

История развития страхования в 21 веке в Германии Учёт расчётных операций

Учёт расчётных операций Дебетовые карты

Дебетовые карты Презентация Болдинова

Презентация Болдинова Основи фінансової діяльності підприємства. Тема 6

Основи фінансової діяльності підприємства. Тема 6 Программа страхования имущества при оплате коммунальных платежей

Программа страхования имущества при оплате коммунальных платежей Финансовый ликбез

Финансовый ликбез Управление дебиторской задолженностью и денежными активами предприятия

Управление дебиторской задолженностью и денежными активами предприятия