Содержание

- 2. Stock Market Financial data reflect the day to day decision making of the society

- 3. Baseline We find that returns from the Google Trends strategies we tested are significantly higher overall

- 4. Google Trends Search to Sale Quantifying Trading Behavior in Financial Markets Using Google Trends. By Tobias

- 5. Results and interpretation Our Google trends algorithm slightly shows much better than the randomn model. It

- 7. Скачать презентацию

Слайд 2

Stock Market

Financial data reflect the day to day decision making of

Stock Market

Financial data reflect the day to day decision making of

the society

Слайд 3

Baseline

We find that returns from the Google Trends strategies we tested

Baseline

We find that returns from the Google Trends strategies we tested

are significantly higher overall than returns from the random strategies ( , R . US 5 0.60; t 5 8.65, df 5 97, p , 0.001, onesample t-test).

Assumptions: US users only, mouse click by a foreign Ip does not count

Moving Avg Baseline

Exponential Moving Avg

Jump to GTrends

Assumptions: US users only, mouse click by a foreign Ip does not count

Moving Avg Baseline

Exponential Moving Avg

Jump to GTrends

Слайд 4

Google Trends

Search to Sale

Quantifying Trading Behavior in Financial Markets Using Google

Google Trends

Search to Sale

Quantifying Trading Behavior in Financial Markets Using Google

Trends. By Tobias Preis, Helen Susannah Moat & H. Eugene Stanley, 25th April 2013

Google has begun to provide access to aggregated information on the volume of queries for different search terms and how these volumes change over time

Current state of the stock markets, but may have also been able to anticipate certain future trend. Analyze before buy or sell

We use Google Trends to determine how many searches n(t –1)have been carried out for a specific search term such as debt in week t– 1, where Google defines weeks as ending on a Sunday, relative to the total number of searches carried out on Google during that time.

HOLD relative less interest, BUY, SELL

WEEK TO WEEK

Decrease in search volume prompts us to buy, increase in search to sell

Specific search value terms pointing to buy/sell - Failed

Google has begun to provide access to aggregated information on the volume of queries for different search terms and how these volumes change over time

Current state of the stock markets, but may have also been able to anticipate certain future trend. Analyze before buy or sell

We use Google Trends to determine how many searches n(t –1)have been carried out for a specific search term such as debt in week t– 1, where Google defines weeks as ending on a Sunday, relative to the total number of searches carried out on Google during that time.

HOLD relative less interest, BUY, SELL

WEEK TO WEEK

Decrease in search volume prompts us to buy, increase in search to sell

Specific search value terms pointing to buy/sell - Failed

Слайд 5

Results and interpretation

Our Google trends algorithm slightly shows much better than

Results and interpretation

Our Google trends algorithm slightly shows much better than

the randomn model. It is very close to

Работа с информацией

Работа с информацией Финансовая стратегия компании

Финансовая стратегия компании Фундаментальные теоретические концепции финансового менеджмента. Тема 2

Фундаментальные теоретические концепции финансового менеджмента. Тема 2 Понятие финансового контроля

Понятие финансового контроля Кредит на развитие личного подсобного хозяйства

Кредит на развитие личного подсобного хозяйства Індивідуальна робота. Електронні банківські послуги, інструментом надання яких виступають системи дистанційного обслуговування

Індивідуальна робота. Електронні банківські послуги, інструментом надання яких виступають системи дистанційного обслуговування Системы и формы оплаты труда

Системы и формы оплаты труда Оператор Фискальных Данных. Процесс подключения и условия взаимодействия

Оператор Фискальных Данных. Процесс подключения и условия взаимодействия Движение и распределение денежных средств

Движение и распределение денежных средств Банктiк қызмет көрсету шарты

Банктiк қызмет көрсету шарты Виды, формы и системы оплаты труда. Тема 6

Виды, формы и системы оплаты труда. Тема 6 Тенденции развития финансовых рынков за рубежом и их роль в финансировании экономики

Тенденции развития финансовых рынков за рубежом и их роль в финансировании экономики Государственные внебюджетные фонды РФ. (Лекция 3)

Государственные внебюджетные фонды РФ. (Лекция 3) Я менеджер

Я менеджер Зарплатный проект ВТБ24

Зарплатный проект ВТБ24 Структура и инструменты современного мирового валютного рынка

Структура и инструменты современного мирового валютного рынка Эффективное управление личными деньгами

Эффективное управление личными деньгами Административно-правовое регулирование страховой деятельности в Российской Федерации

Административно-правовое регулирование страховой деятельности в Российской Федерации Основы теории налогообложения. Основные понятия и определения

Основы теории налогообложения. Основные понятия и определения Центральний банк у банківській системі України

Центральний банк у банківській системі України Франчайзинг, как особая форма вертикальных ограничений

Франчайзинг, как особая форма вертикальных ограничений Основные средства предприятия. Основные формулы

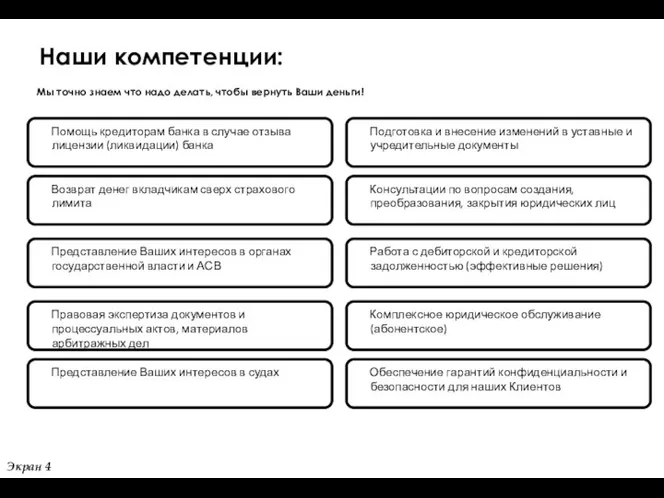

Основные средства предприятия. Основные формулы Наши компетенции: Мы точно знаем что надо делать, чтобы вернуть Ваши деньги

Наши компетенции: Мы точно знаем что надо делать, чтобы вернуть Ваши деньги О порядке составления годовой бюджетной и бухгалтерской отчетности за 2021 год

О порядке составления годовой бюджетной и бухгалтерской отчетности за 2021 год ОАО Э.ОН Россия. Система вознаграждения непроизводственного персонала филиалов

ОАО Э.ОН Россия. Система вознаграждения непроизводственного персонала филиалов Разумный инвестор. Полное руководство по стоимостному инвестированию

Разумный инвестор. Полное руководство по стоимостному инвестированию Обращение по акции. Бесплатное обслуживание Tinkoff Black

Обращение по акции. Бесплатное обслуживание Tinkoff Black Управління грошовими потоками підприємства на прикладі ПАТ Миронівський хлібопродукт

Управління грошовими потоками підприємства на прикладі ПАТ Миронівський хлібопродукт