Содержание

- 2. PepsiCo, Inc. is a global food, snack and beverage company founded in 1919. The Company's brands

- 3. (5 Year) Stock Market Performance Blue line – iShares S&P Global Consumer Staples (KXI) Red line

- 4. Technical Analysis Yahoo Finance 20 and 200 day moving average over a 5-year time horizon

- 5. Yahoo Finance 20 and 200 day moving average over a 2-year time horizon

- 6. Ownership Above 10 holders comprise 22.27% of shareholders’ ownership. Data as of 30th September, 2011, Financial

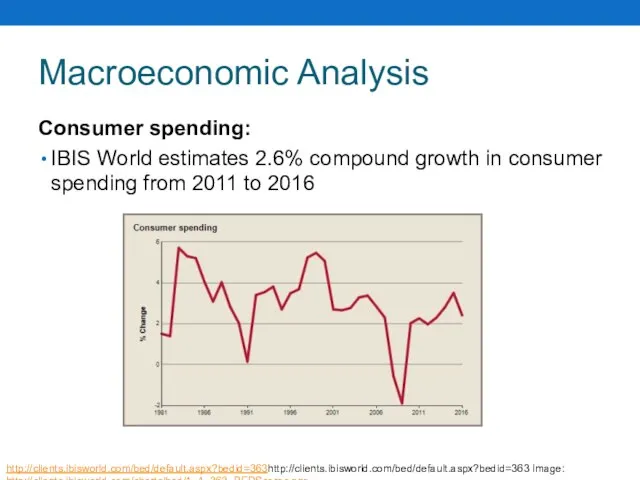

- 7. Macroeconomic Analysis Consumer spending: IBIS World estimates 2.6% compound growth in consumer spending from 2011 to

- 8. Industry Analysis Soda Production in the US: ~$17bn revenue, $2.5bn profit Performance Industry has been suffering

- 9. Industry Analysis (cont.) Snack Food Production in the US ~$28.4bn revenue, $5.9bn profit Performance Steady growth

- 10. Industry Analysis (cont.) Juice Production in the US ~$27bn revenue, $6.1bn profit Performance Recent performance has

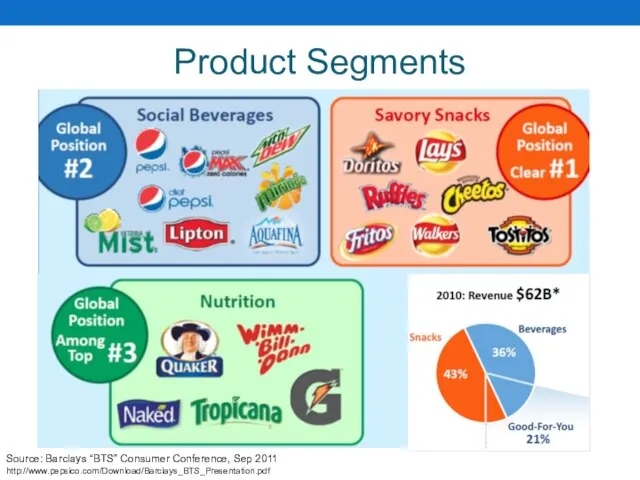

- 11. Product Segments Source: Barclays “BTS” Consumer Conference, Sep 2011 http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

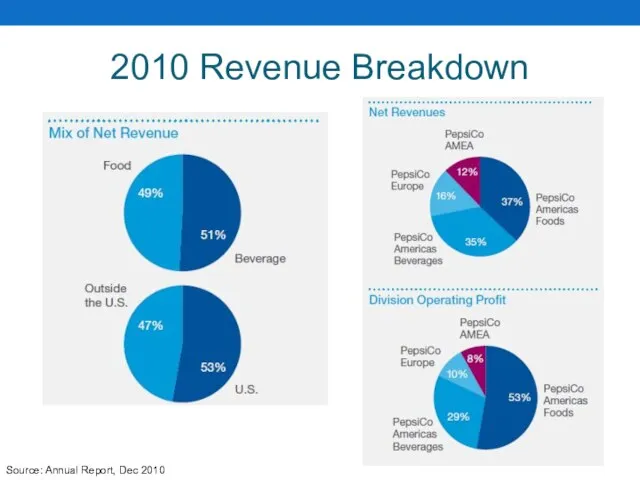

- 12. 2010 Revenue Breakdown Source: Annual Report, Dec 2010

- 13. Global Markets Exposure About $20 billion or 31% of Revenue from emerging markets in 2010 Focus

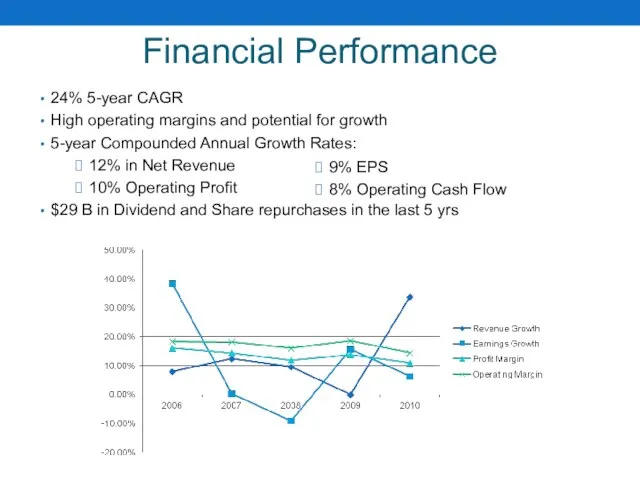

- 14. Financial Performance 24% 5-year CAGR High operating margins and potential for growth 5-year Compounded Annual Growth

- 15. Savory Snacks Frito Lay’s World’s largest Food Brand $9.4bn Doritos $4 B, Cheetos $3.1 B, Ruffles

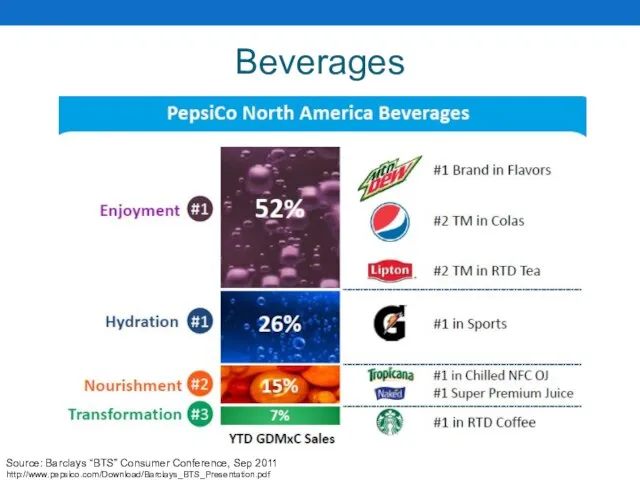

- 16. Beverages Source: Barclays “BTS” Consumer Conference, Sep 2011 http://www.pepsico.com/Download/Barclays_BTS_Presentation.pdf

- 17. Carbonated Soft Drinks Sustain powerhouse brands Sierra Mist, +7% in volume Mountain Dew, +2.5% in volume

- 18. Hydration & Nourishment Gatorade 11% Sales growth 77.3% Sports Drink market share Tropicana About 50% Sales

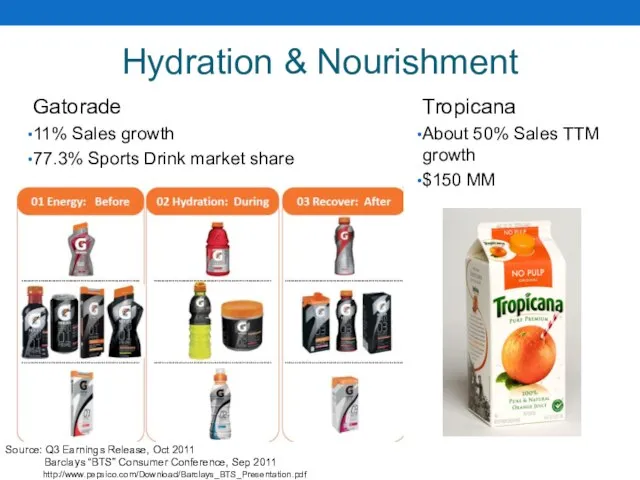

- 19. Nutrition Top 3 globally in Nutrition, aiming to be $30B business by 2020 Huge growth potential,

- 20. Recent Challenges and Concerns 2012 Pricing Strategy Commodity inflation and Demand elasticity Margins & Cost cutting

- 21. The Power of One Two powerful businesses worth $31B each Consumption: Planned together Bought together Consumed

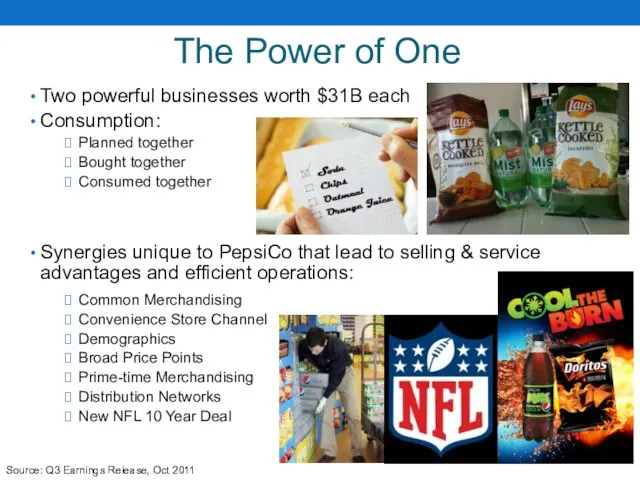

- 22. Public Comparable Analysis Quaker/Nutrition SWX:NESN Nestlé S.A. Business areas include Food and Beverage, Nestle Waters and

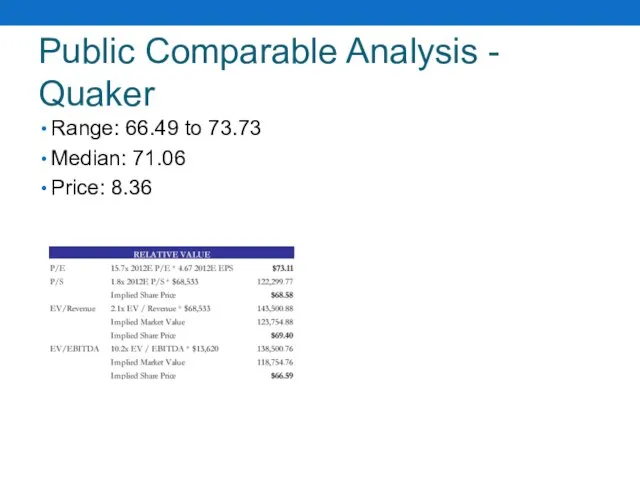

- 23. Public Comparable Analysis - Quaker Range: 66.49 to 73.73 Median: 71.06 Price: 8.36

- 24. Public Comparable Analysis (cont.) Soft Drinks NYSE:KO The Coca-Cola Company Produce over 3,500 beverages. Notable brands

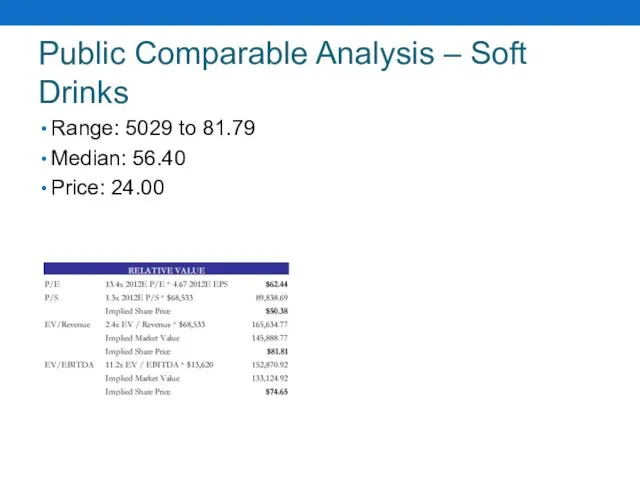

- 25. Public Comparable Analysis – Soft Drinks Range: 5029 to 81.79 Median: 56.40 Price: 24.00

- 26. Public Comparable Analysis (cont.) Frito-Lay NasdaqGS:LNCE Snyder's-Lance, Inc. Manufacturer and distributer of snack food products, including

- 27. Public Comparable Analysis – Frito-Lay Range: 21.52 to 67.22 Weight: 55.00 Other multiples low so used

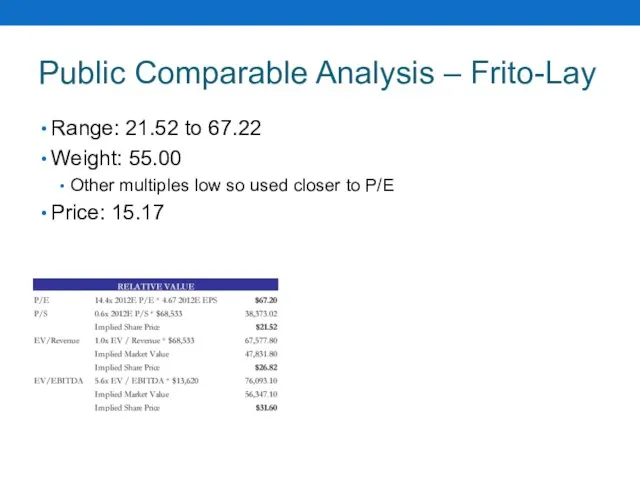

- 28. Public Comparable Analysis (cont.) Tropicana NasdaqGS:HANS Hansen Natural Corporation Develops, sells and distributes beverages. Brands include

- 29. Public Comparable Analysis - Tropicana Range: 70.11 to 148.88 Median: 109.49 Price: 19.78

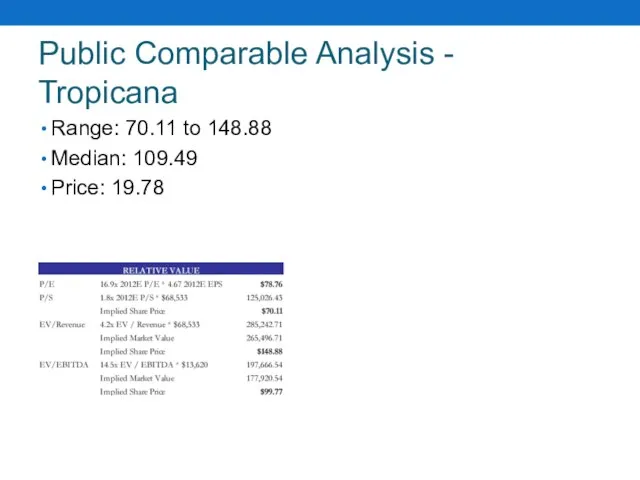

- 31. Скачать презентацию

Автоинструмент

Автоинструмент Motorcycles of Yamaha. Accessory line-up

Motorcycles of Yamaha. Accessory line-up Программа докапитализации Банка

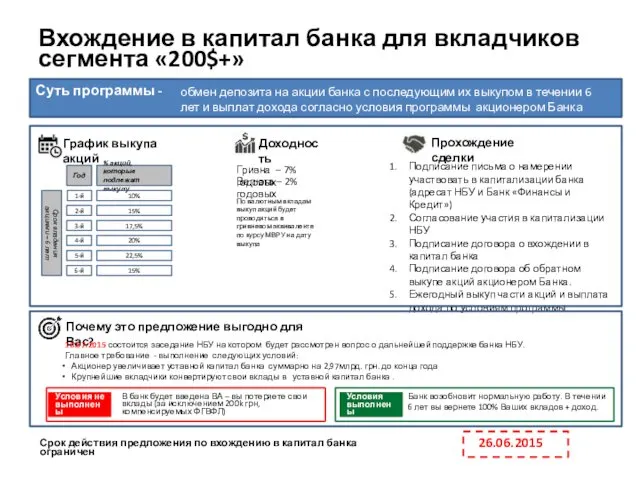

Программа докапитализации Банка Система маркетинговых исследований и маркетинговая информация

Система маркетинговых исследований и маркетинговая информация Casey Conrad. Оптимизация локальной поисковой системы (SEO)

Casey Conrad. Оптимизация локальной поисковой системы (SEO) Pushka Street – летнее арт-пространство для отдыха

Pushka Street – летнее арт-пространство для отдыха Discover the World in One University

Discover the World in One University Друк сервис - типография вашего успеха

Друк сервис - типография вашего успеха Элементы питания Maxell

Элементы питания Maxell MeViCS it’s healthcare gadget that control your spine while you are working or sitting

MeViCS it’s healthcare gadget that control your spine while you are working or sitting Студия мероприятий Orizzonte Studio

Студия мероприятий Orizzonte Studio Доширак со вкусом Шаурма

Доширак со вкусом Шаурма Фабрика мебели Happy home

Фабрика мебели Happy home Проект Яндекс. Такси Яндекс. Таксометр

Проект Яндекс. Такси Яндекс. Таксометр Triple A Leader

Triple A Leader Стратегическое планирование и роль маркетинга

Стратегическое планирование и роль маркетинга Выездной ретрит расслабления и сонастройки с собой

Выездной ретрит расслабления и сонастройки с собой Бренд NEOCUTIS

Бренд NEOCUTIS Константин Капитан. Актер театра и кино, режиссер, шоумен, сценарист, конферансье, ведущий, тамада

Константин Капитан. Актер театра и кино, режиссер, шоумен, сценарист, конферансье, ведущий, тамада Конференция профессионалов сферы гостеприимства Туризм в регионе. Перспективы развития

Конференция профессионалов сферы гостеприимства Туризм в регионе. Перспективы развития Образец для дилеров автоцентра

Образец для дилеров автоцентра Развитие механизмов резервирования товаров и давальческих материалов

Развитие механизмов резервирования товаров и давальческих материалов Черное море зовет. 12-дневное путешествие. Автономная некоммерческая организация Центр эффективных технологий образования

Черное море зовет. 12-дневное путешествие. Автономная некоммерческая организация Центр эффективных технологий образования Дослідження упаковки

Дослідження упаковки Образы в рекламе

Образы в рекламе Сухой экструдированный корм для собак супер-премиум класса Blitz

Сухой экструдированный корм для собак супер-премиум класса Blitz Организация производства и продаж прибора для неинвазивного (чрезкожного) мониторинга содержания сахара в крови человека

Организация производства и продаж прибора для неинвазивного (чрезкожного) мониторинга содержания сахара в крови человека Типы, виды и функции рекламы

Типы, виды и функции рекламы