Содержание

- 2. Gurzuf, Crimea, June 2001 Contents European Call Option Geometric Brownian Motion Black-Scholes Formula Multi period Binomial

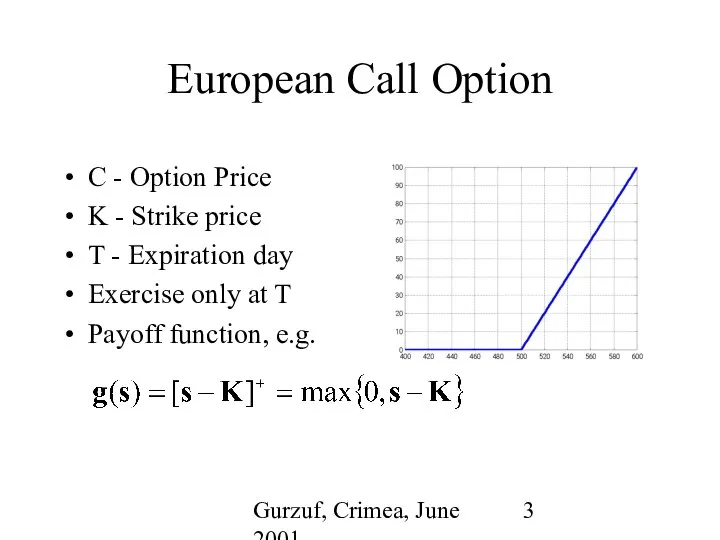

- 3. Gurzuf, Crimea, June 2001 European Call Option C - Option Price K - Strike price T

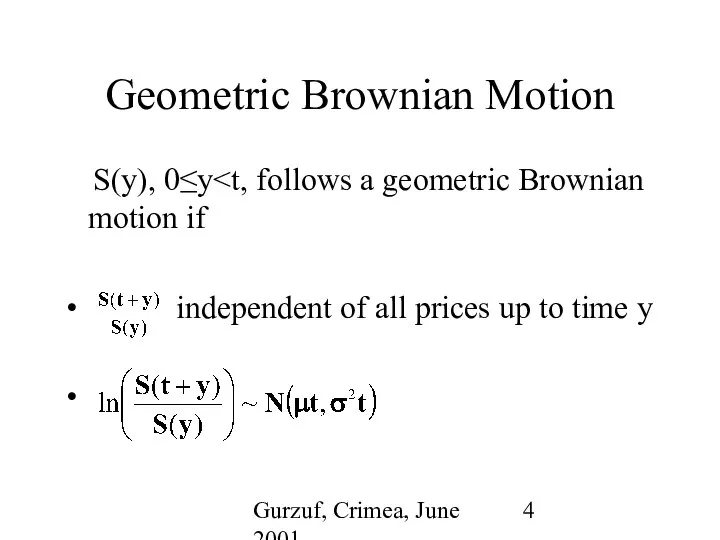

- 4. Gurzuf, Crimea, June 2001 Geometric Brownian Motion S(y), 0≤y independent of all prices up to time

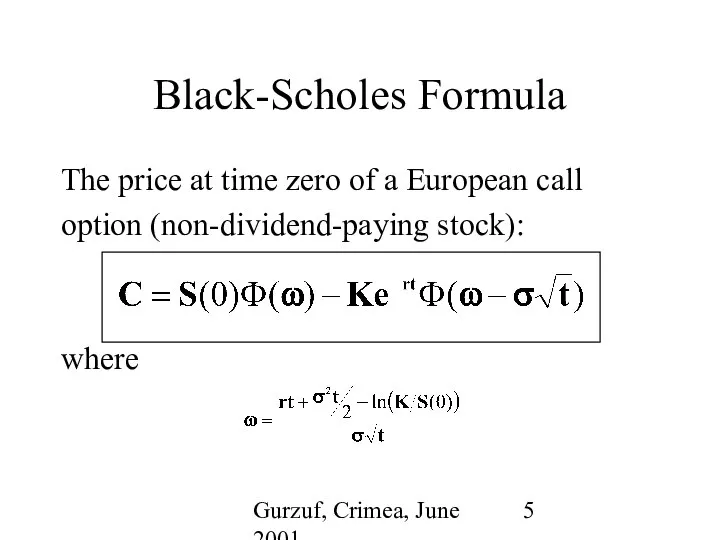

- 5. Gurzuf, Crimea, June 2001 Black-Scholes Formula The price at time zero of a European call option

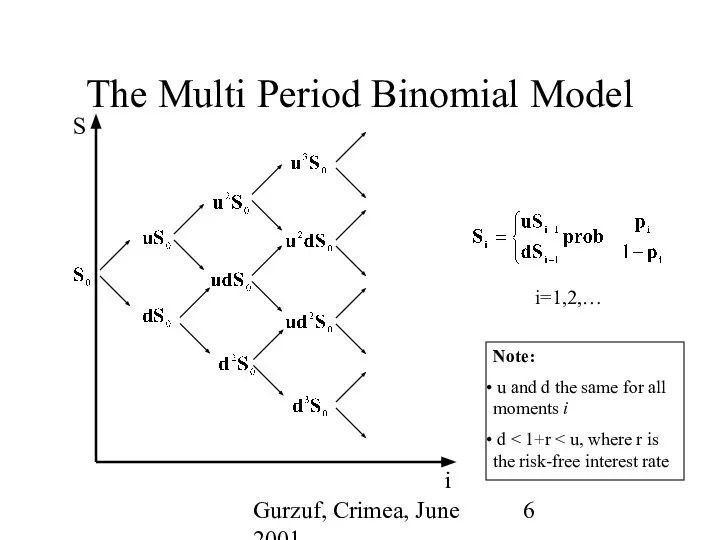

- 6. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model i S i=1,2,… Note: u and d

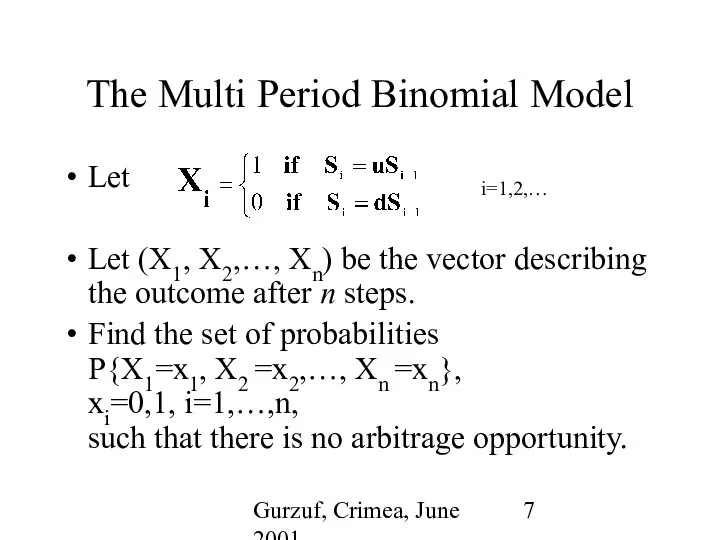

- 7. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model Let Let (X1, X2,…, Xn) be the

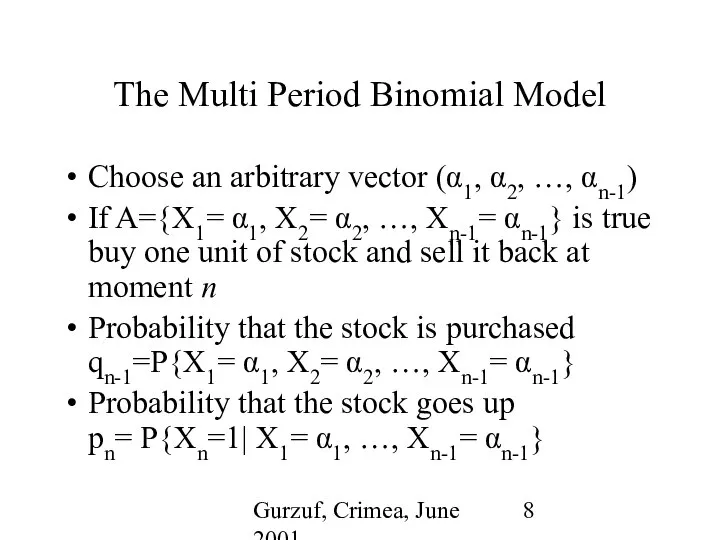

- 8. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model Choose an arbitrary vector (α1, α2, …,

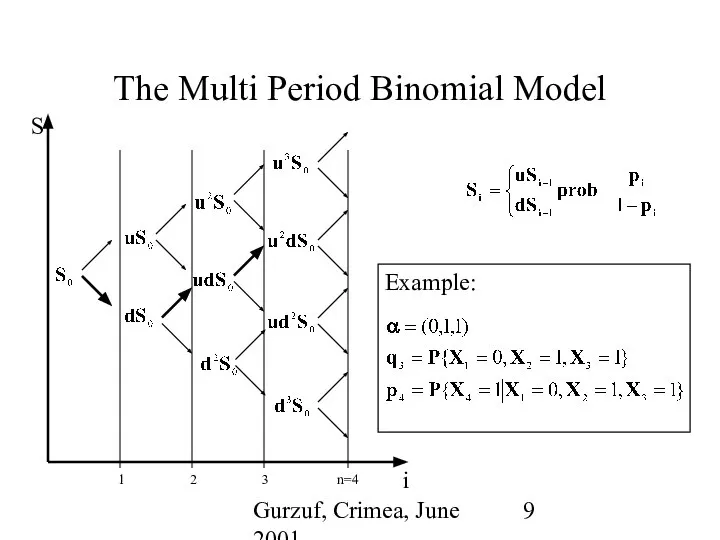

- 9. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model

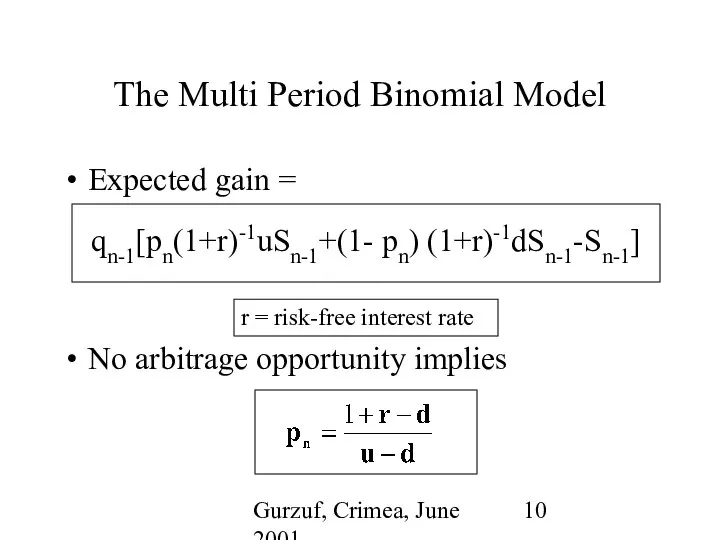

- 10. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model Expected gain = No arbitrage opportunity implies

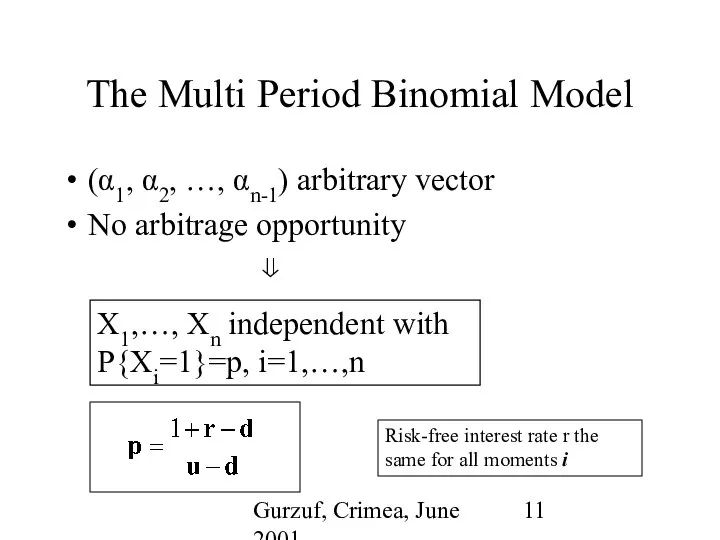

- 11. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model (α1, α2, …, αn-1) arbitrary vector No

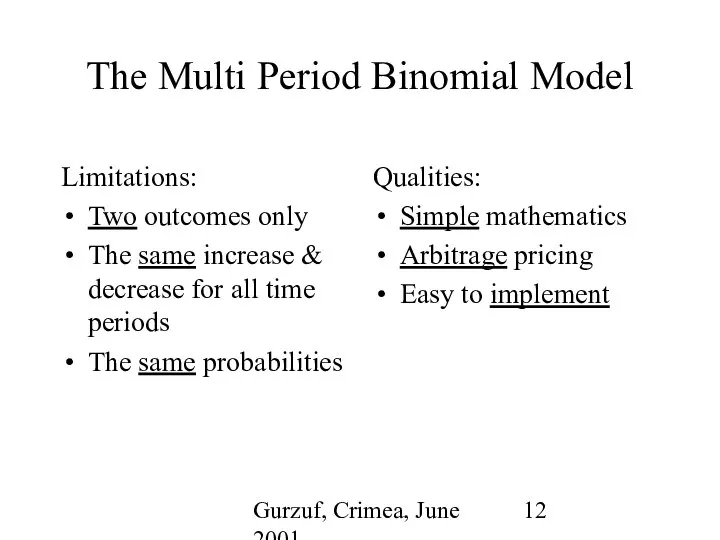

- 12. Gurzuf, Crimea, June 2001 The Multi Period Binomial Model Limitations: Two outcomes only The same increase

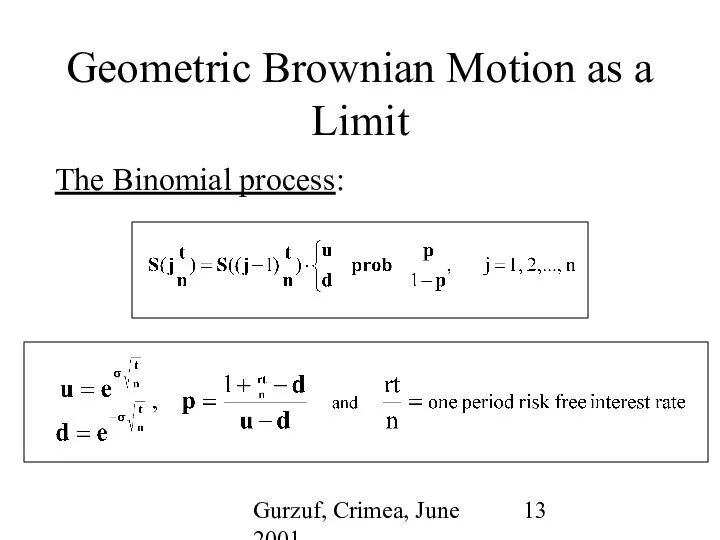

- 13. Gurzuf, Crimea, June 2001 Geometric Brownian Motion as a Limit The Binomial process:

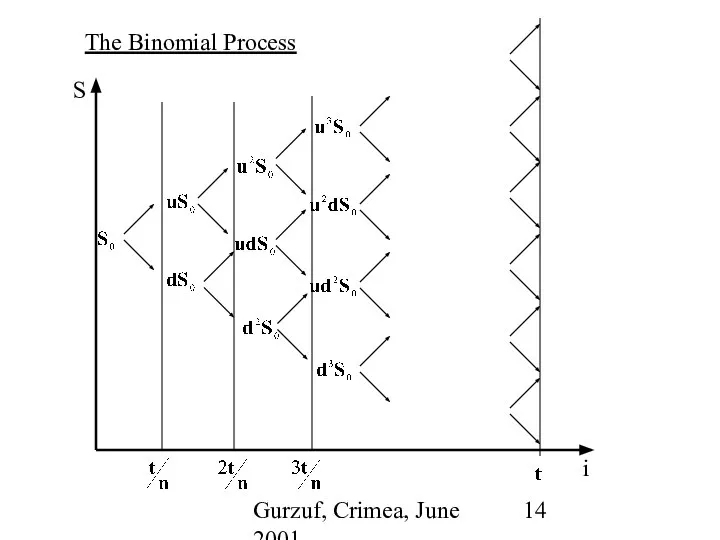

- 14. Gurzuf, Crimea, June 2001 The Binomial Process

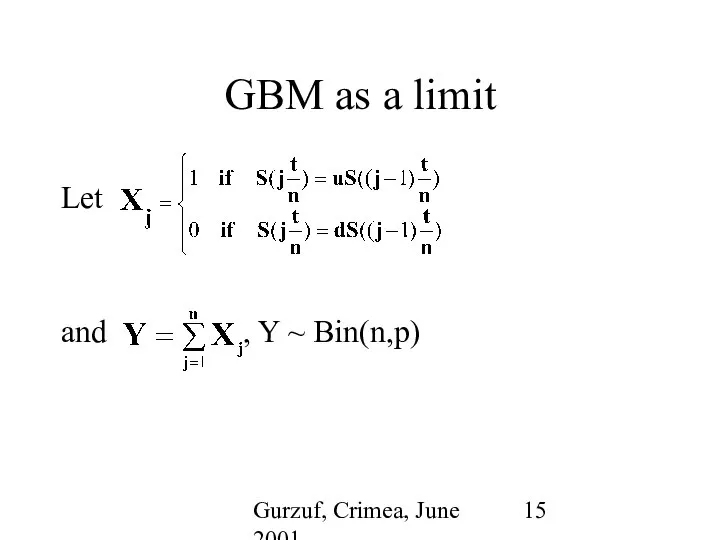

- 15. Gurzuf, Crimea, June 2001 GBM as a limit Let and , Y ~ Bin(n,p)

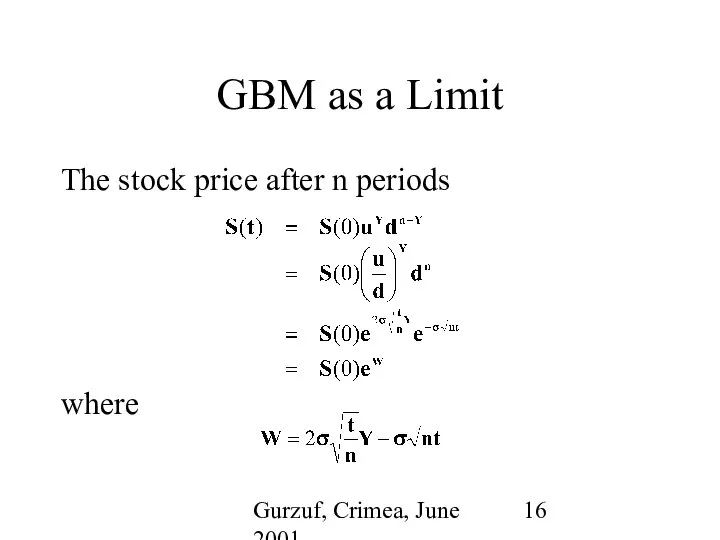

- 16. Gurzuf, Crimea, June 2001 GBM as a Limit The stock price after n periods where

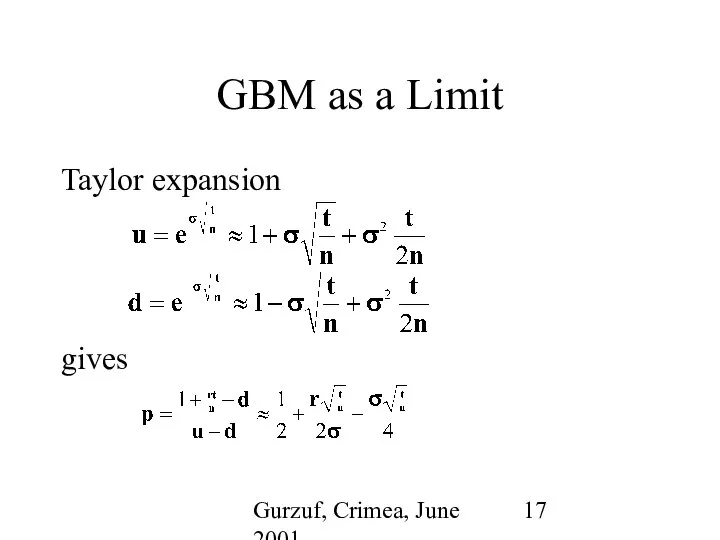

- 17. Gurzuf, Crimea, June 2001 GBM as a Limit Taylor expansion gives

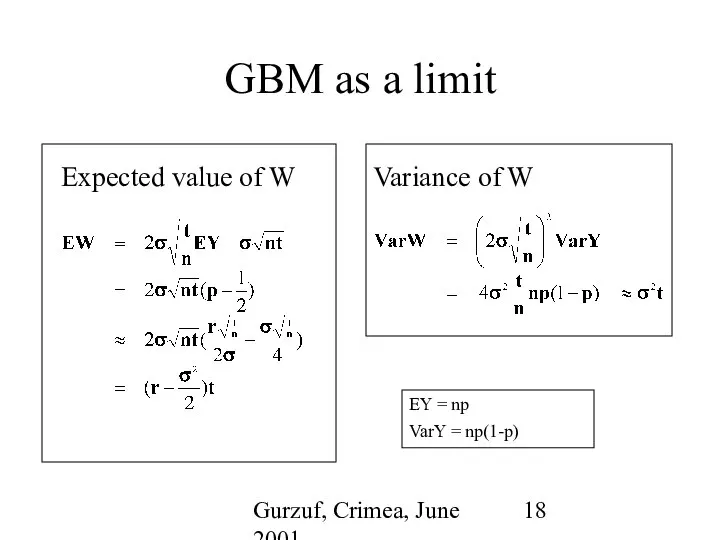

- 18. Gurzuf, Crimea, June 2001 GBM as a limit Expected value of W Variance of W EY

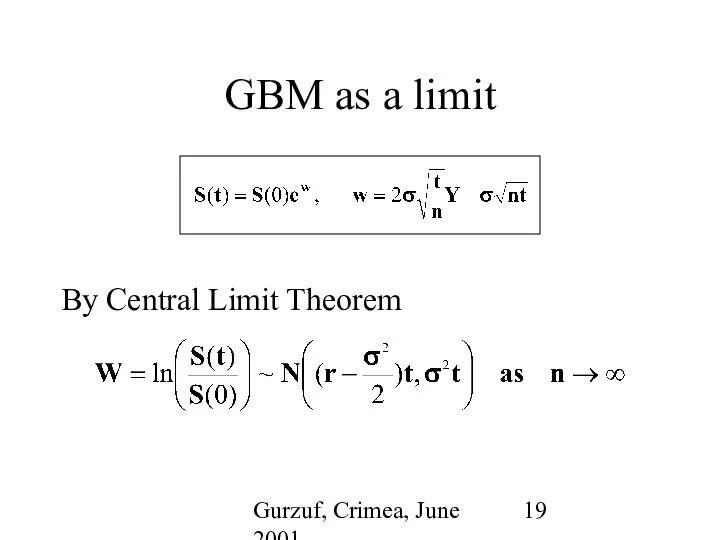

- 19. Gurzuf, Crimea, June 2001 GBM as a limit By Central Limit Theorem

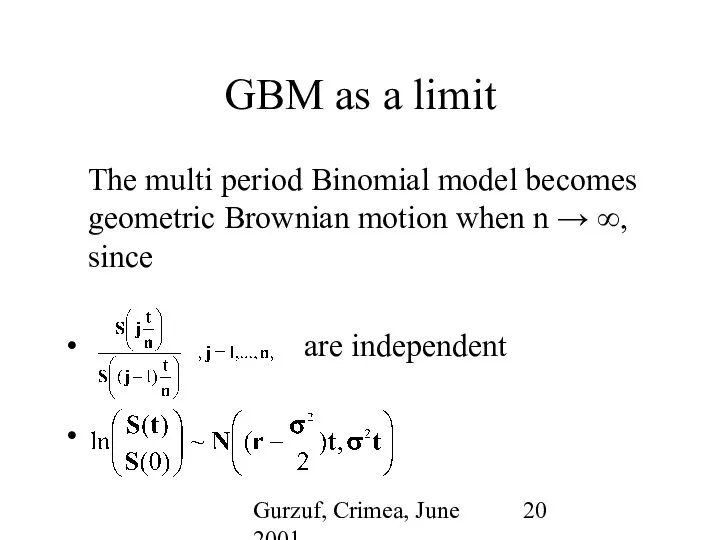

- 20. Gurzuf, Crimea, June 2001 GBM as a limit The multi period Binomial model becomes geometric Brownian

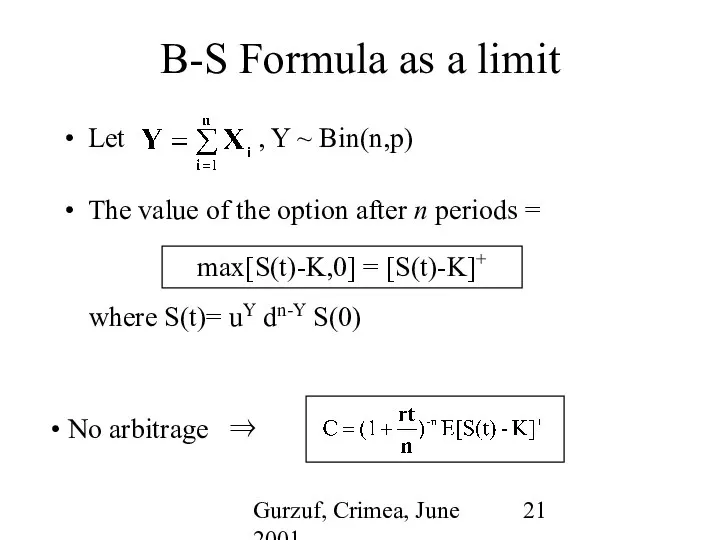

- 21. Gurzuf, Crimea, June 2001 B-S Formula as a limit Let , Y ~ Bin(n,p) The value

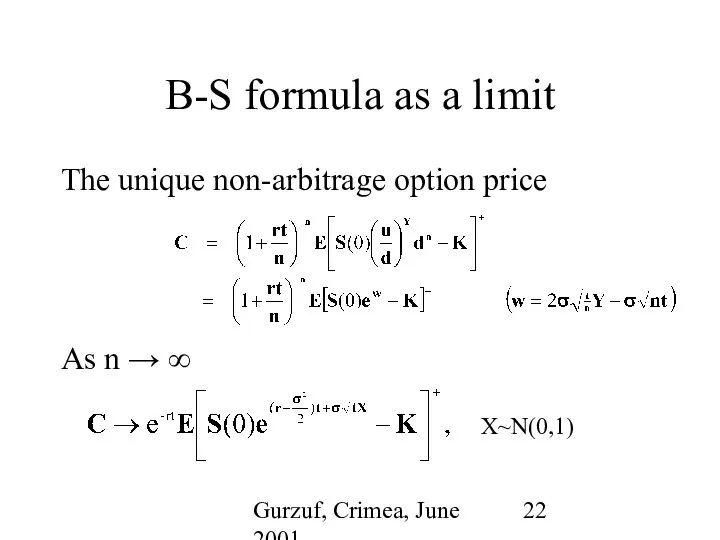

- 22. Gurzuf, Crimea, June 2001 B-S formula as a limit The unique non-arbitrage option price As n

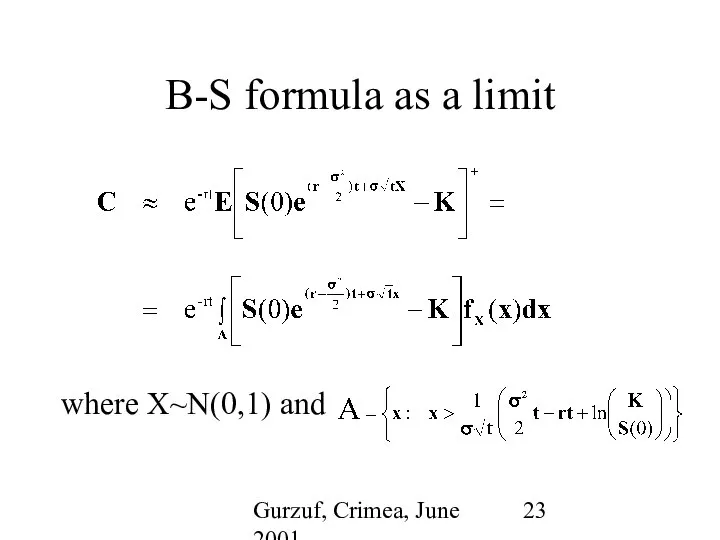

- 23. Gurzuf, Crimea, June 2001 B-S formula as a limit where X~N(0,1) and

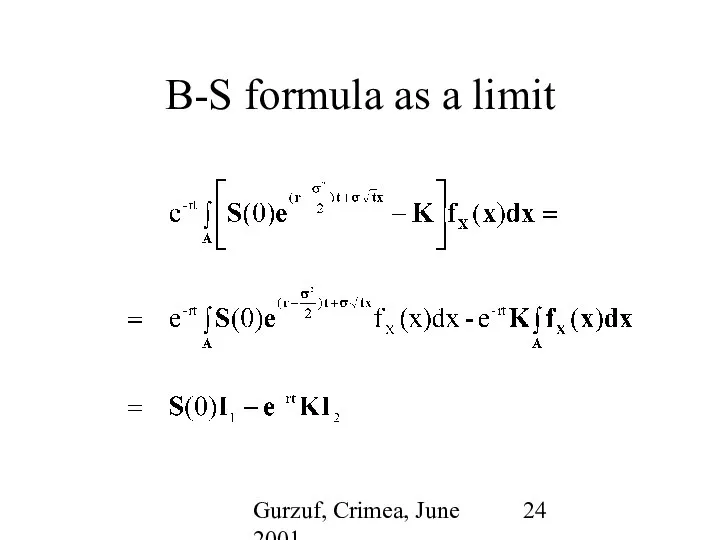

- 24. Gurzuf, Crimea, June 2001 B-S formula as a limit

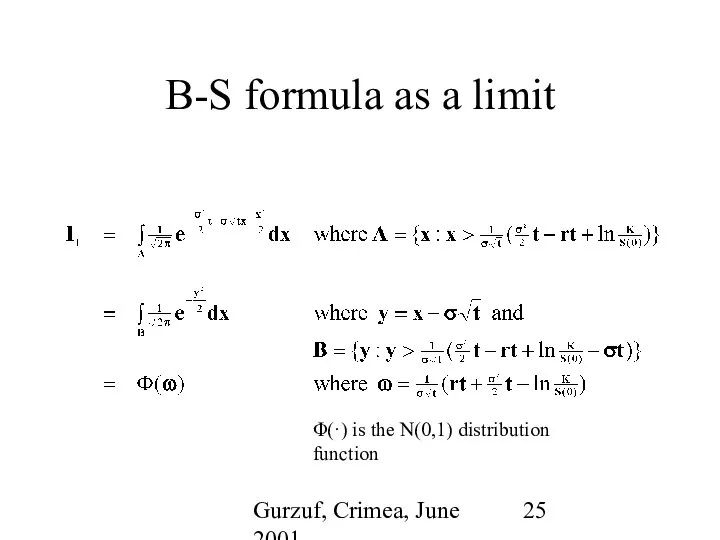

- 25. Gurzuf, Crimea, June 2001 B-S formula as a limit Φ(·) is the N(0,1) distribution function

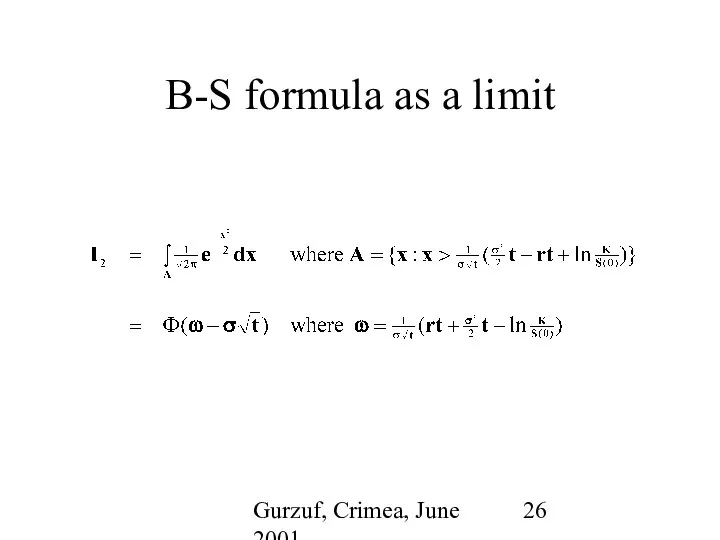

- 26. Gurzuf, Crimea, June 2001 B-S formula as a limit

- 28. Скачать презентацию

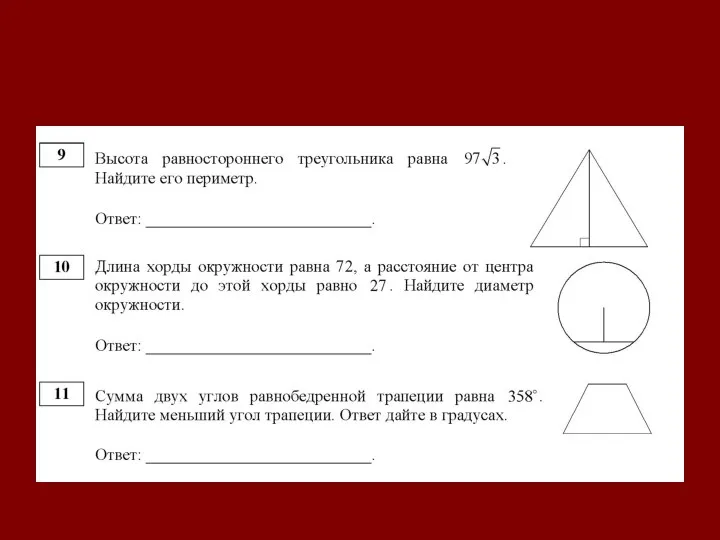

Высота. Длина. Площадь

Высота. Длина. Площадь Площадь многоугольников. Решение задач

Площадь многоугольников. Решение задач Алгоритм перевода десятичной записи числа в запись в позиционной системе с заданным основанием

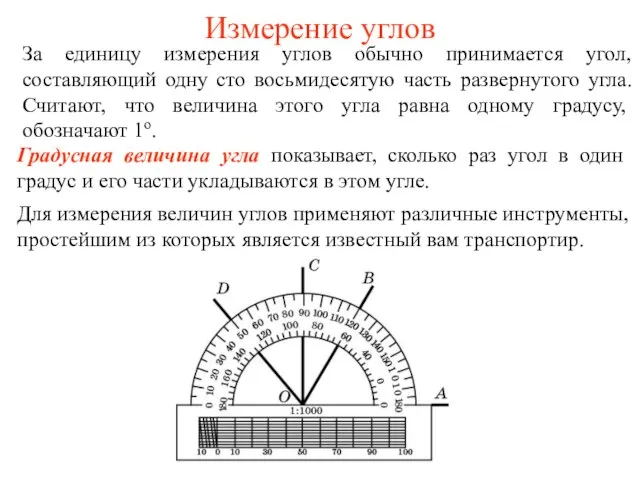

Алгоритм перевода десятичной записи числа в запись в позиционной системе с заданным основанием Измерение углов. Вопросы, упражнения

Измерение углов. Вопросы, упражнения Разложение разности квадратов на множители

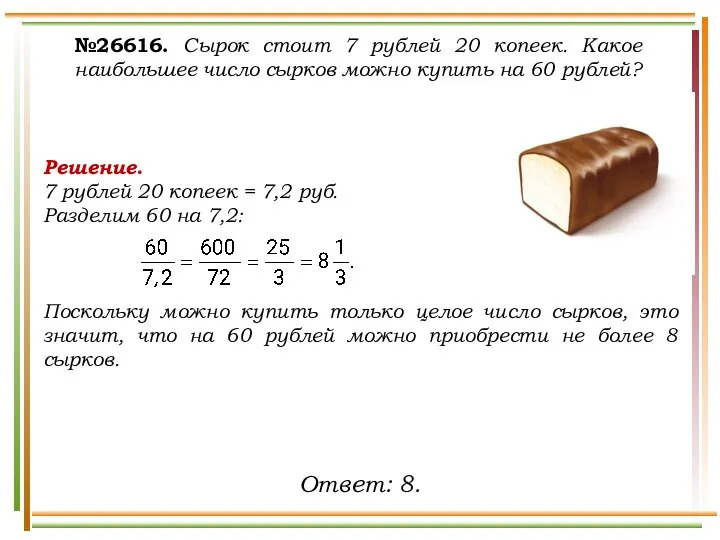

Разложение разности квадратов на множители Решения задач

Решения задач Дискретні випадкові величини. Числові характеристики. Закони розподілу

Дискретні випадкові величини. Числові характеристики. Закони розподілу Буквенные выражения. Решение задач

Буквенные выражения. Решение задач Численные методы решения обыкновенных дифференциальных уравнений

Численные методы решения обыкновенных дифференциальных уравнений Умножение и деление чисел на 10

Умножение и деление чисел на 10 Умножение и деление дробей. Решение задач. 6 класс

Умножение и деление дробей. Решение задач. 6 класс Прямоугольник. Свойство противоположных сторон прямоугольника

Прямоугольник. Свойство противоположных сторон прямоугольника Презентация по математике "Решение уравнений 6 класс" - скачать

Презентация по математике "Решение уравнений 6 класс" - скачать  Вероятность события

Вероятность события Геометрическое истолкование производной

Геометрическое истолкование производной Вычисление дифиринциальных уравнений методом Адамса

Вычисление дифиринциальных уравнений методом Адамса Выполнила: Артюшевская Елена. г. Елец, Липецкая область, МОУ лицей № 5, 8 «Б» класс.

Выполнила: Артюшевская Елена. г. Елец, Липецкая область, МОУ лицей № 5, 8 «Б» класс. Понятие многогранника. Призма

Понятие многогранника. Призма Треугольник

Треугольник Үшбұрыштың ішкі бұрыштарының қосындысы

Үшбұрыштың ішкі бұрыштарының қосындысы Презентация по математике "Равновеликие и равносоставленные плоские фигуры" - скачать

Презентация по математике "Равновеликие и равносоставленные плоские фигуры" - скачать  Нахождение площади фигуры на клетчатой бумаге. Применение формул известных площадей

Нахождение площади фигуры на клетчатой бумаге. Применение формул известных площадей Первый признак равенства треугольников. 7 класс

Первый признак равенства треугольников. 7 класс Отображение Пуанкаре

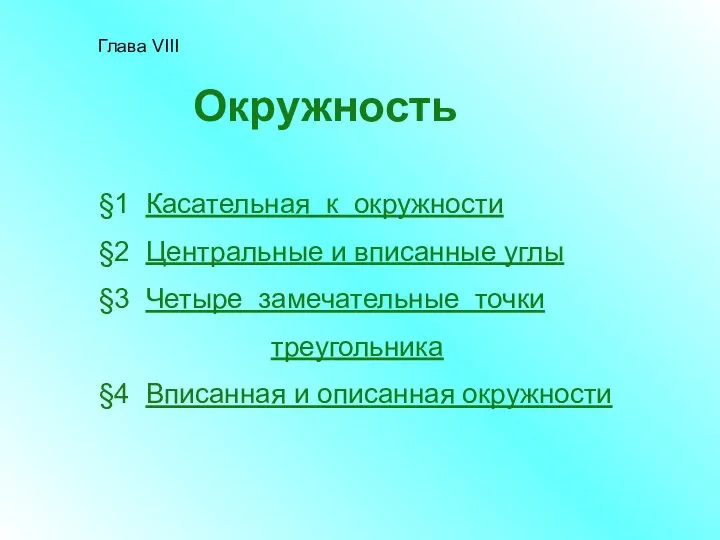

Отображение Пуанкаре Все об окружности

Все об окружности Найди ошибку. Дидактическая игра по геометрии (7 класс)

Найди ошибку. Дидактическая игра по геометрии (7 класс) Устные приёмы умножения и деления чисел в пределах 1000

Устные приёмы умножения и деления чисел в пределах 1000 Понятие графа. Решение задач

Понятие графа. Решение задач