Содержание

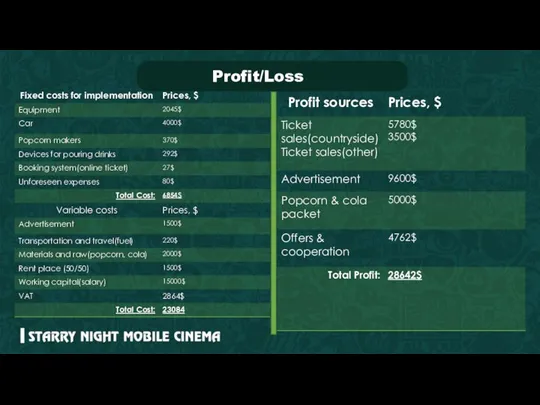

- 9. Profit/Loss

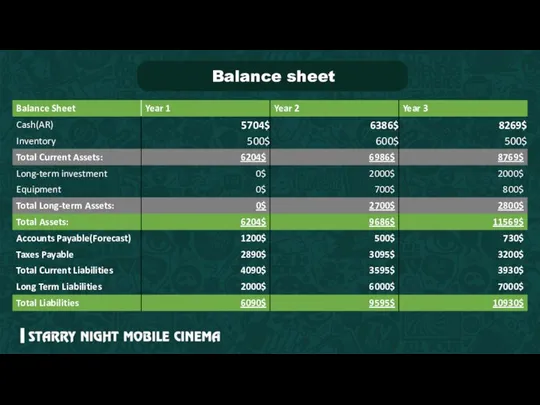

- 11. Balance sheet

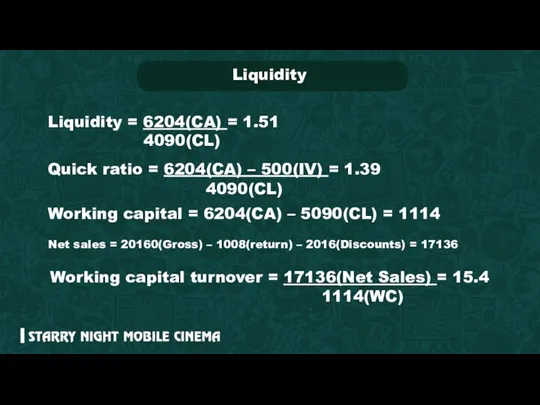

- 12. Liquidity Liquidity = 6204(CA) = 1.51 Quick ratio = 6204(CA) – 500(IV) = 1.39 Working capital

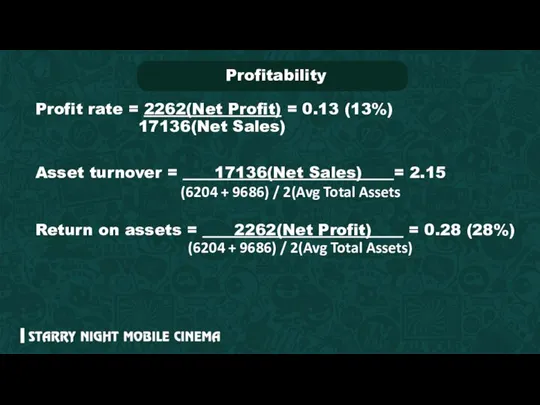

- 13. Profitability Profit rate = 2262(Net Profit) = 0.13 (13%) 17136(Net Sales) Asset turnover = ____17136(Net Sales)____=

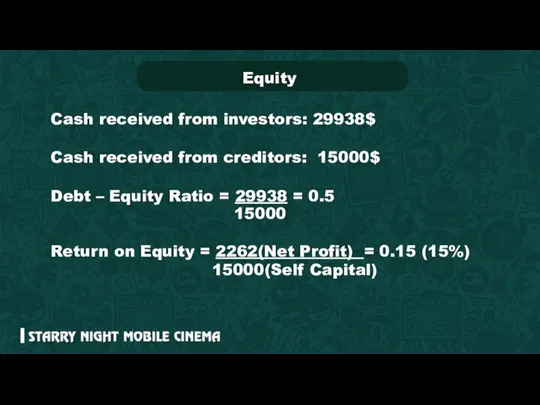

- 14. Equity Cash received from investors: 29938$ Cash received from creditors: 15000$ Debt – Equity Ratio =

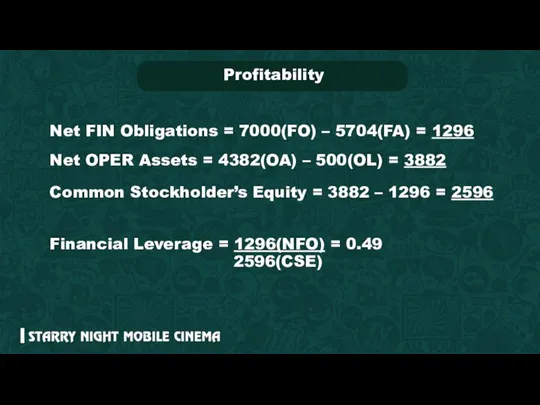

- 15. Net FIN Obligations = 7000(FO) – 5704(FA) = 1296 Net OPER Assets = 4382(OA) – 500(OL)

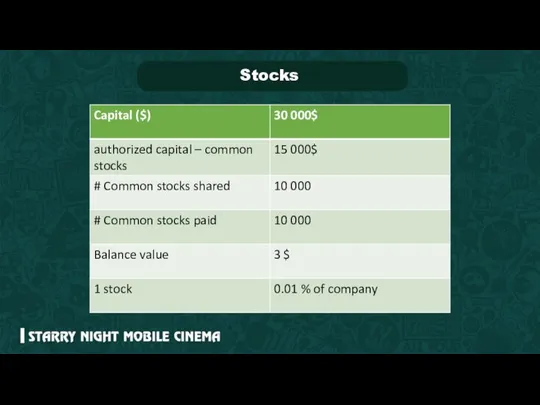

- 16. Stocks

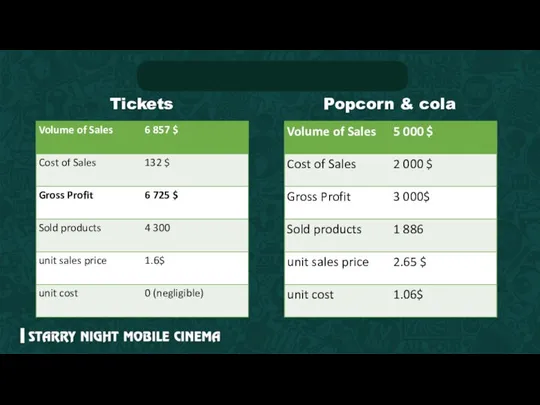

- 17. Popcorn & cola Tickets

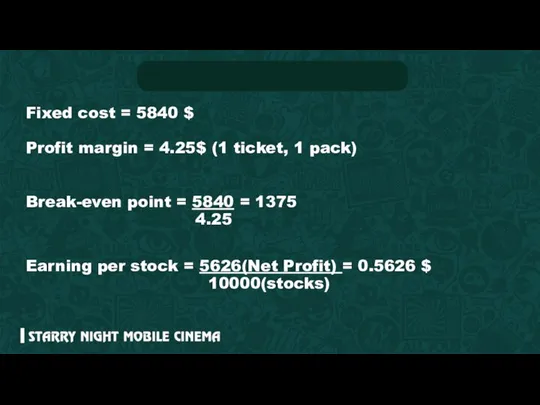

- 18. Fixed cost = 5840 $ Profit margin = 4.25$ (1 ticket, 1 pack) Break-even point =

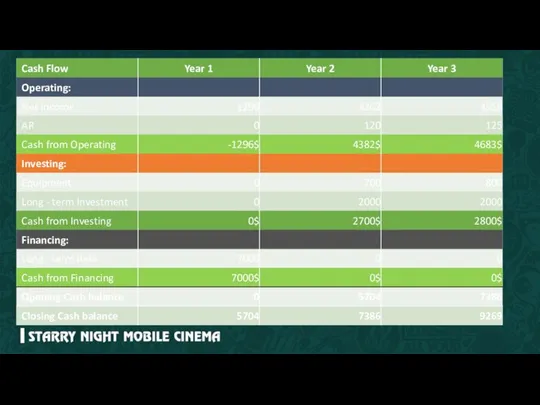

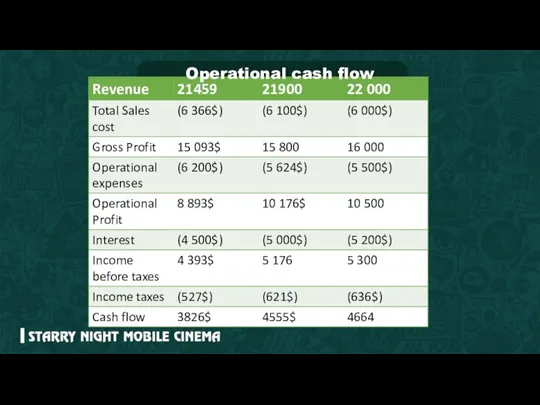

- 19. Operational cash flow

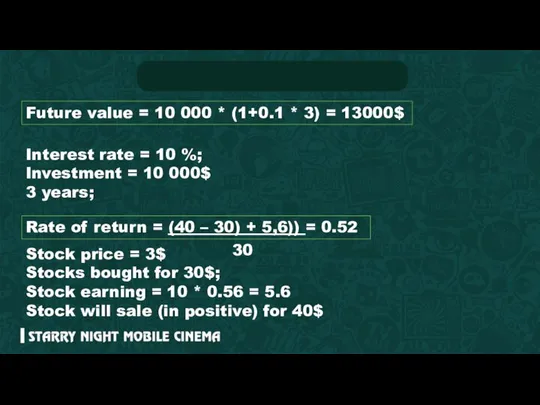

- 20. Future value = 10 000 * (1+0.1 * 3) = 13000$ Interest rate = 10 %;

- 22. Скачать презентацию

Ветряная оспа

Ветряная оспа Нестационарные торговые объекты и остановки

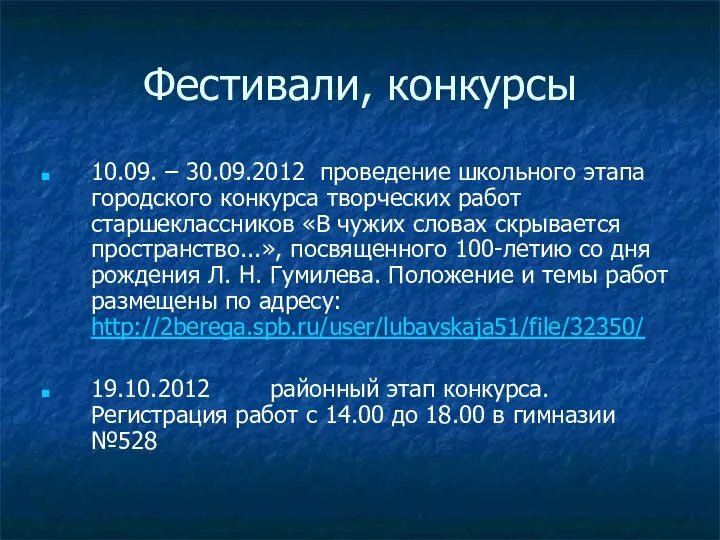

Нестационарные торговые объекты и остановки Фестивали, конкурсы 10.09. – 30.09.2012 проведение школьного этапа городского конкурса творческих работ старшеклассников «В чужих слов

Фестивали, конкурсы 10.09. – 30.09.2012 проведение школьного этапа городского конкурса творческих работ старшеклассников «В чужих слов Основы теории принятия решений

Основы теории принятия решений Традиции гостеприимства в Азербайджане

Традиции гостеприимства в Азербайджане آثار ایمان به خدا

آثار ایمان به خدا Аускультация сердца. Сердечные шумы.

Аускультация сердца. Сердечные шумы. Я і мае сябры. У доме. (Тэма 15)

Я і мае сябры. У доме. (Тэма 15) Стимулирование учения Безотметочное оценивание

Стимулирование учения Безотметочное оценивание Кручение тонкостенных профилей

Кручение тонкостенных профилей Презентация Социально-экономическая характеристика Сибирского ФО

Презентация Социально-экономическая характеристика Сибирского ФО Tatiana Ilyuchenko. Honored Sports Master of Russia (cross country skiing)

Tatiana Ilyuchenko. Honored Sports Master of Russia (cross country skiing) Лучевая диагностика заболеваний органов дыхания Основные заболевания Часть 1 Автор к.м.н. А.В.Шумаков

Лучевая диагностика заболеваний органов дыхания Основные заболевания Часть 1 Автор к.м.н. А.В.Шумаков  Аэропорт им.Карамзина в г. Ульяновске

Аэропорт им.Карамзина в г. Ульяновске Skelet_cheloveka_dlya_samopodgotovki

Skelet_cheloveka_dlya_samopodgotovki Урок 23 Сложение и вычитание двухзначных чисел - презентация для начальной школы

Урок 23 Сложение и вычитание двухзначных чисел - презентация для начальной школы Welding Manipulator

Welding Manipulator Сети ЭВМ. Основные понятия

Сети ЭВМ. Основные понятия Накопительные культуры и принцип элективности. Методы выделения культур микроорганизмов.

Накопительные культуры и принцип элективности. Методы выделения культур микроорганизмов. Радиография

Радиография Презентация ИСТОЧНИКИ ГРАЖДАНСКОГО ПРАВА

Презентация ИСТОЧНИКИ ГРАЖДАНСКОГО ПРАВА Проектно-исследовательская работа ИЗ ИСТОРИИ ВОЗНИКНОВЕНИЯ И РАЗВИТИЯ ЧИСЕЛ

Проектно-исследовательская работа ИЗ ИСТОРИИ ВОЗНИКНОВЕНИЯ И РАЗВИТИЯ ЧИСЕЛ  Презентация

Презентация Програма патріотичного виховання для учнів початкових класів з використанням комп’ютерних технологій “В моєму серці Україна”

Програма патріотичного виховання для учнів початкових класів з використанням комп’ютерних технологій “В моєму серці Україна” Простые типы данных языка С. Лекция 3

Простые типы данных языка С. Лекция 3 Основы судебной геммологии, предмет, объекты, задачи и связь с др науками

Основы судебной геммологии, предмет, объекты, задачи и связь с др науками Самоактуализация и самосовершенствование личности

Самоактуализация и самосовершенствование личности Проект «Школа будущего» Проблема стоящая перед школой до 2015 года: сохранение уровня качества образования и существующей дина

Проект «Школа будущего» Проблема стоящая перед школой до 2015 года: сохранение уровня качества образования и существующей дина