Содержание

- 2. Strategic Challenge The Situation: Old Brand Needs New Life Tylenol® has been around for more than

- 3. The Category Challenge: Nothing To Say, No One To Listen Historically, the brand’s strongest equities were

- 4. Objectives Reviving the Brand in Three Ways We had three clear objectives: 1. Reverse the business

- 5. ATL

- 7. BTL BTL

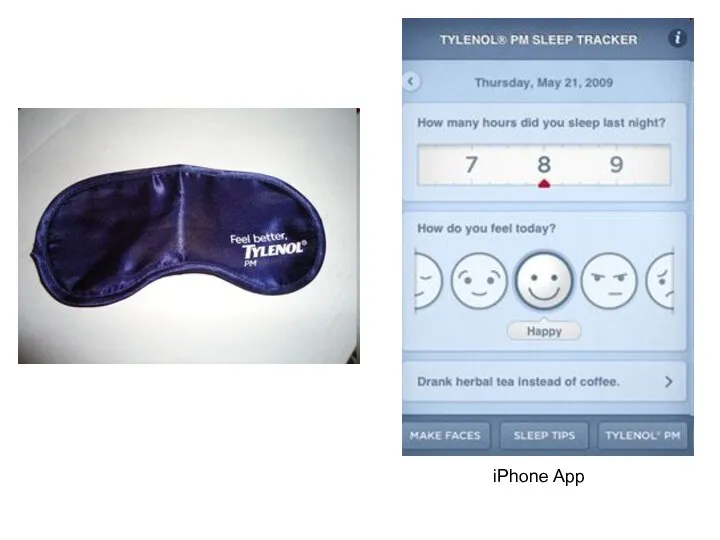

- 8. iPhone App

- 9. Tylenol "Feel Better" Sleep Exhibit

- 11. Скачать презентацию

Слайд 2

Strategic Challenge

The Situation: Old Brand Needs New Life

Tylenol® has been around

Strategic Challenge

The Situation: Old Brand Needs New Life

Tylenol® has been around

for more than 50 years, and although it is one of the most trusted brand names, the business had been trending downward since 1999. Its annual domestic sales were more than $1 billion but despite this leadership status, Tylenol had lost over two share points since 2005 (IRI, All Outlets 2007, 2008). To put that into context, each share point is roughly equivalent to $37 million (IRI FDTKS). It was an old brand that needed new life.

The Business Challenge: Do More With Less

Tylenol appeared to be a mega-brand on paper, but it certainly wasn’t showing up in the world that way. Since it houses several sub-brands that compete in different pain states (e.g., Tylenol Arthritis, Tylenol PM, Tylenol Cold, Children’s Tylenol), the master brand’s footprint was weakened and the media spend was diluted. Beyond supporting multiple sub-brands/targets, we were challenged with supporting multiple initiatives, such as the 2008 Olympics and our NASCAR partnership. We had no new significant product innovations to help create news.

Our competitors, competing in far fewer pain states, were significantly outspending us—sometimes by ninefold (TNS Strategy 2007). We faced increasing competitive pressure from private label products as they were beginning to act more and more like brands—with marketing communications support and product innovation.

The Business Challenge: Do More With Less

Tylenol appeared to be a mega-brand on paper, but it certainly wasn’t showing up in the world that way. Since it houses several sub-brands that compete in different pain states (e.g., Tylenol Arthritis, Tylenol PM, Tylenol Cold, Children’s Tylenol), the master brand’s footprint was weakened and the media spend was diluted. Beyond supporting multiple sub-brands/targets, we were challenged with supporting multiple initiatives, such as the 2008 Olympics and our NASCAR partnership. We had no new significant product innovations to help create news.

Our competitors, competing in far fewer pain states, were significantly outspending us—sometimes by ninefold (TNS Strategy 2007). We faced increasing competitive pressure from private label products as they were beginning to act more and more like brands—with marketing communications support and product innovation.

Слайд 3

The Category Challenge:

Nothing To Say, No One To Listen

Historically, the

The Category Challenge:

Nothing To Say, No One To Listen

Historically, the

brand’s strongest equities were trust and safety. Yet, our trust equity (driven largely by how the brand handled the cyanide scare in the 80’s) wasn’t one that could be explicitly leveraged—trust had to be built by what we did, not said. Our safety equity (driven largely by the unique safety advantages of the medicine) was old news to consumers.

And competitors would fight tooth and nail to prevent Tylenol from making new claims that would refresh this proposition. They continued to flood the market with new forms and claims that made efficacy the issue—an issue Tylenol can’t compete on alone. What’s more is that when we did have a competitive product advantage, we couldn’t communicate it. Although Tylenol is literally in a class by itself (it works in a different, more targeted way than all the other analgesics do) we were unable to market that fact directly because of the litigious nature of the category.

Even if we could tell a well-crafted story about the unique properties of our medicine, we wondered: would anyone pay attention? That was the real billion-dollar question. Unlike the kind of neutral low interest people have in things like toothpaste and toilet paper, analgesics were something that people were actively disinterested in because they don’t want to think about pain and suffering. In the context of no news, fragmented messages and declining sales, the Tylenol brand needed a powerful new conversation and story that could turn consumer’s active category disinterest into active Tylenol interest.

And competitors would fight tooth and nail to prevent Tylenol from making new claims that would refresh this proposition. They continued to flood the market with new forms and claims that made efficacy the issue—an issue Tylenol can’t compete on alone. What’s more is that when we did have a competitive product advantage, we couldn’t communicate it. Although Tylenol is literally in a class by itself (it works in a different, more targeted way than all the other analgesics do) we were unable to market that fact directly because of the litigious nature of the category.

Even if we could tell a well-crafted story about the unique properties of our medicine, we wondered: would anyone pay attention? That was the real billion-dollar question. Unlike the kind of neutral low interest people have in things like toothpaste and toilet paper, analgesics were something that people were actively disinterested in because they don’t want to think about pain and suffering. In the context of no news, fragmented messages and declining sales, the Tylenol brand needed a powerful new conversation and story that could turn consumer’s active category disinterest into active Tylenol interest.

Слайд 4

Objectives

Reviving the Brand in Three Ways

We had three clear objectives:

1. Reverse

Objectives

Reviving the Brand in Three Ways

We had three clear objectives:

1. Reverse

the business declines, both in sales and share.

2. Modernize and differentiate the brand. This meant influencing at least 3 out

of 4 key equity measures.

3. Increase consumer engagement in an extremely low-interest category.

2. Modernize and differentiate the brand. This meant influencing at least 3 out

of 4 key equity measures.

3. Increase consumer engagement in an extremely low-interest category.

Слайд 5

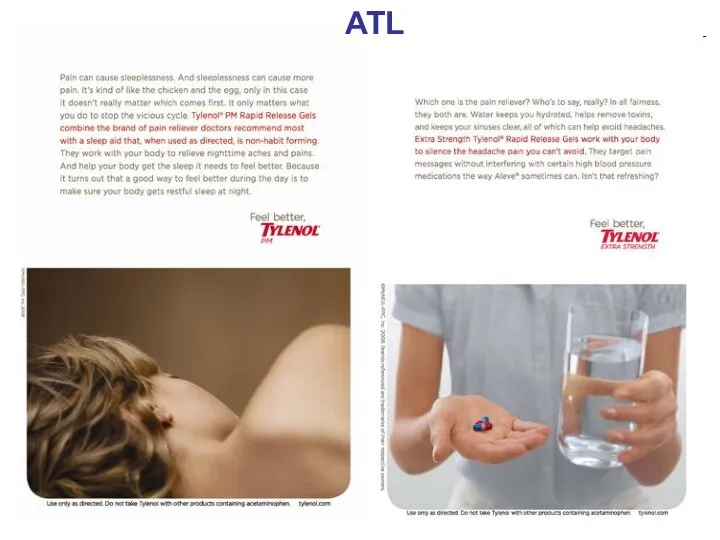

ATL

ATL

Слайд 6

Слайд 7

BTL

BTL

BTL

BTL

Слайд 8

iPhone App

iPhone App

Слайд 9

Tylenol "Feel Better" Sleep Exhibit

Tylenol "Feel Better" Sleep Exhibit

Следующая -

Транзакционные издержки и контракты

Западная школа геополитики

Западная школа геополитики Методы управления рисками. Метод компенсации рисков Выполнили: Минниахметова М., Сочнева а., Чуева в., Шипилова д.

Методы управления рисками. Метод компенсации рисков Выполнили: Минниахметова М., Сочнева а., Чуева в., Шипилова д. Государственные образования на белорусских землях в IX-XVII веках

Государственные образования на белорусских землях в IX-XVII веках Презентация на тему "Гигиена Зрения. Нарушения зрения у детей и их профилактика" - скачать презентации по Медицине

Презентация на тему "Гигиена Зрения. Нарушения зрения у детей и их профилактика" - скачать презентации по Медицине Филимоновская игрушка (для старших дошкольников)

Филимоновская игрушка (для старших дошкольников) Упражнения для ног и ягодиц

Упражнения для ног и ягодиц НЕПРОВЕРЯЕМЫЕ БЕЗУДАРНЫЕ ГЛАСНЫЕ. учитель: Громова С.А. МСОШ № 2 имени Е.В.Камышева города Гагарина.

НЕПРОВЕРЯЕМЫЕ БЕЗУДАРНЫЕ ГЛАСНЫЕ. учитель: Громова С.А. МСОШ № 2 имени Е.В.Камышева города Гагарина. Национальная программа « Образование» Подготовил студент группы Т093 Котов Павел

Национальная программа « Образование» Подготовил студент группы Т093 Котов Павел 4. Java OOP. 5. Abstract Classes

4. Java OOP. 5. Abstract Classes Сущность качества

Сущность качества Неорганические строительные материалы Керамические материалы. Фарфор. Фаянс. Керамика.

Неорганические строительные материалы Керамические материалы. Фарфор. Фаянс. Керамика. Организация технического обслуживания и ремонта автомобиля УАЗ Патриот

Организация технического обслуживания и ремонта автомобиля УАЗ Патриот Международная безопасность. Политический реализм и неореализм. (Лекция 12)

Международная безопасность. Политический реализм и неореализм. (Лекция 12) Ұлттық салт-дәстүрлеріміз, тіліміз бен музыкамыз, әдебиетіміз, жоралғыларымыз

Ұлттық салт-дәстүрлеріміз, тіліміз бен музыкамыз, әдебиетіміз, жоралғыларымыз PubMed – медициналық ақпапарттық желісі 4- топша

PubMed – медициналық ақпапарттық желісі 4- топша Псалмы

Псалмы Кодекс профессиональной этики инженерии программного обеспечения

Кодекс профессиональной этики инженерии программного обеспечения Открытый урок во 2 «А» классе по русскому языку

Открытый урок во 2 «А» классе по русскому языку Проблема - её роль, в жизни подростка. «Главное для человека не то, что есть, а то, что хочется….» Работы выполнила педагог-ор

Проблема - её роль, в жизни подростка. «Главное для человека не то, что есть, а то, что хочется….» Работы выполнила педагог-ор Суперкомп’ютери. Основні типи комп'ютерів

Суперкомп’ютери. Основні типи комп'ютерів ГСИ. Методики выполнения измерений

ГСИ. Методики выполнения измерений Изменения в нормативной базе для НФО (4937-У, 5075-У, 5084-У, 32-ФЗ)

Изменения в нормативной базе для НФО (4937-У, 5075-У, 5084-У, 32-ФЗ) Общественные пространства - 2018

Общественные пространства - 2018 Методические основы занятий физической культурой и спортом

Методические основы занятий физической культурой и спортом Международный бизнес проект PROэкспрессКарьера

Международный бизнес проект PROэкспрессКарьера Пристрої цифрової обробки радіолокаційних сигналів (заняття № 2.5)

Пристрої цифрової обробки радіолокаційних сигналів (заняття № 2.5) Концепция развития Свердловского округа г. Иркутска

Концепция развития Свердловского округа г. Иркутска Тема 1. Роль и назначение международных стандартов финансовой отчётности в гармонизации системы бухгалтерского учёта 1. Основные

Тема 1. Роль и назначение международных стандартов финансовой отчётности в гармонизации системы бухгалтерского учёта 1. Основные