Содержание

- 2. 01 2019 основные результаты www.stateofeuropeantech.com In Partnership with &

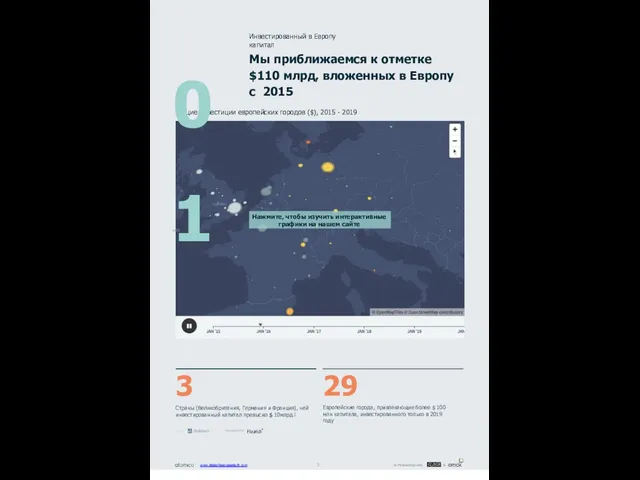

- 3. Общие инвестиции европейских городов ($), 2015 - 2019 Мы приближаемся к отметке $110 млрд, вложенных в

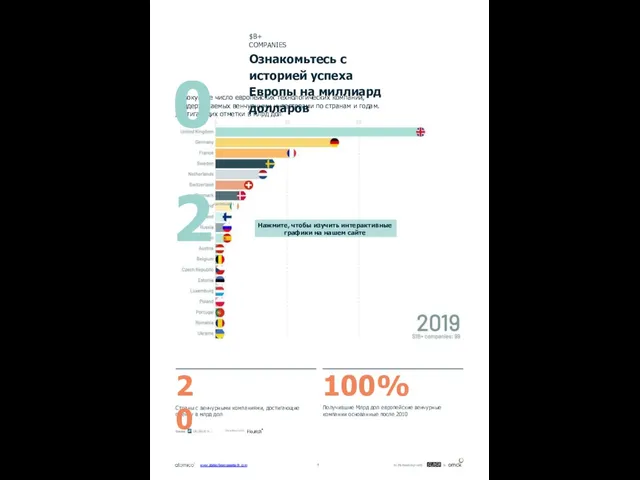

- 4. Совокупное число европейских технологических компаний, поддерживаемых венчурными инвесторами по странам и годам. достигающих отметки в млрд

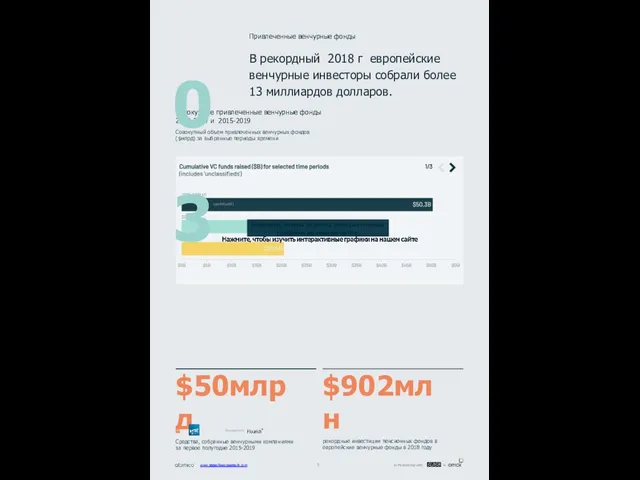

- 5. Совокупные привлеченные венчурные фонды 2010-2014 и 2015-2019 Совокупный объем привлеченных венчурных фондов ($млрд) за выбранные периоды

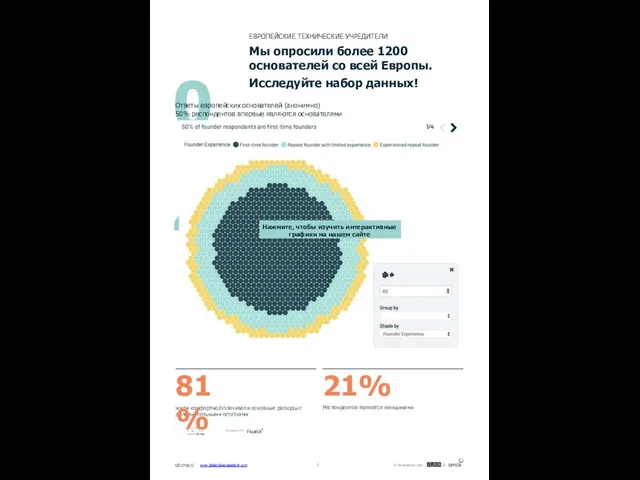

- 6. жили комфортно/оплачивали основные расходы с дополнительными остатками 81% 04sgnidnfiyeK01 21% Респондентов являются женщинами Ответы европейских основателей

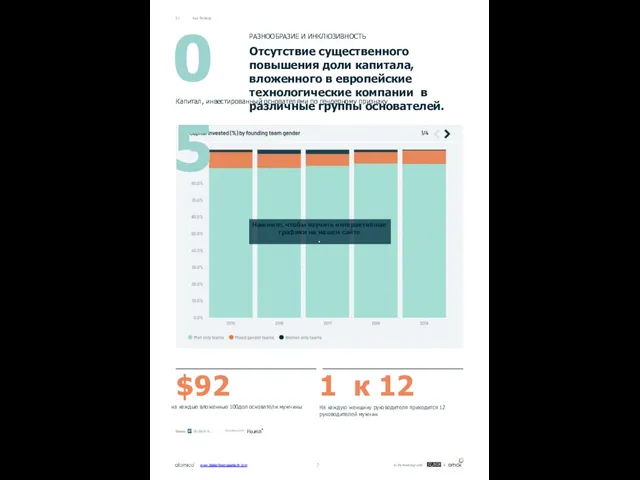

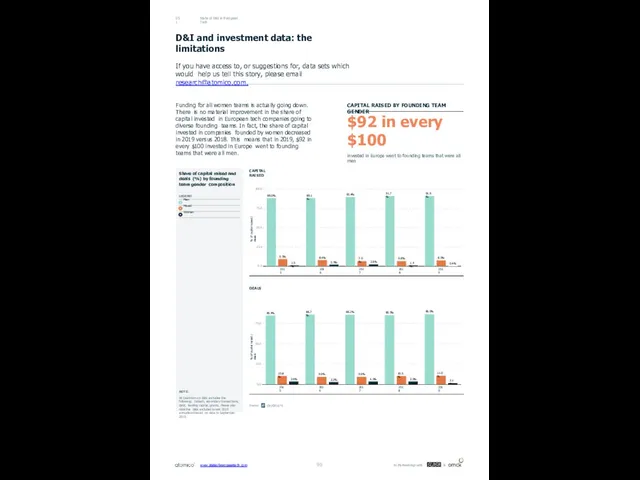

- 7. на каждые вложенные 100дол основатели мужчины $92 1 к 12 На каждую женщину руководителя приходится 12

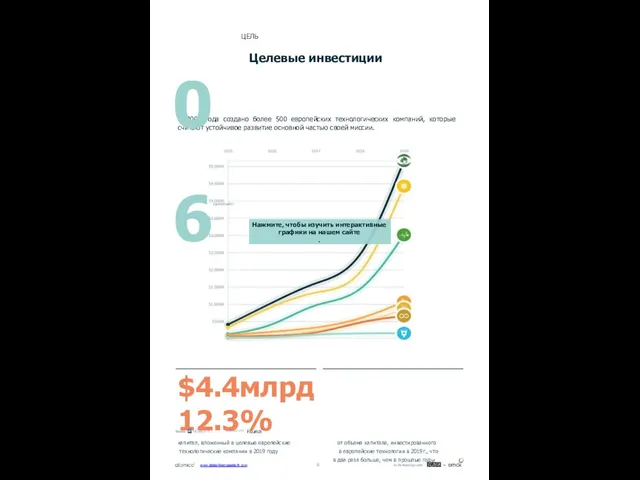

- 8. $4.4млрд 12.3% капитал, вложенный в целевые европейские от объема капитала, инвестированного технологические компании в 2019 году

- 9. 02 Состояние европейских технологий2019 Почему Европа не может заниматься технологиями? Пора перестать задавать этот вопрос. У

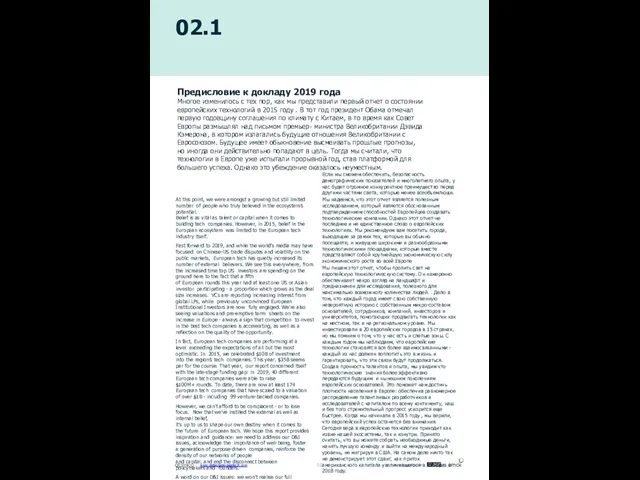

- 10. 02.1 www.stateofeuropeantech.com In Partnership with & At this point, we were amongst a growing but still

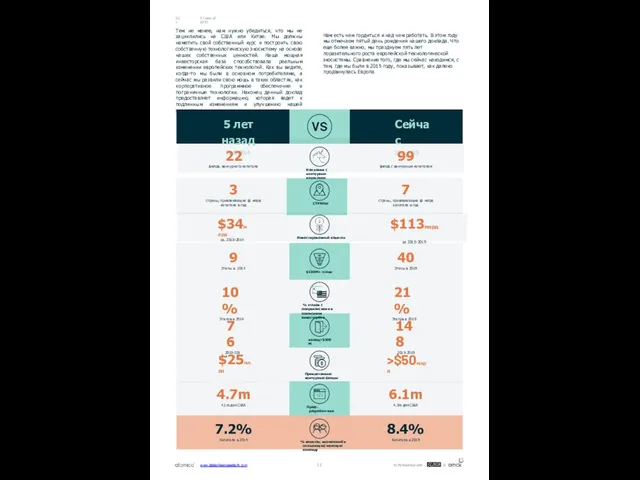

- 11. 5 Years of SOET 02.1 Тем не менее, нам нужно убедиться, что мы не зациклились на

- 12. 02.2 Основные положения www.stateofeuropeantech.com In Partnership with & В 2019 году 92% финансирования досталось мужским командам,

- 13. Executive Summary www.stateofeuropeantech.com In Partnership with & 02.2 Теперь это обещание выполняется, и двадцать стран создают

- 14. Наиболее перспективные европейские компании предпочитают больше и дольше оставаться частными, а также получают многомиллиардные оценки на

- 15. 02.3 Компания Slush www.stateofeuropeantech.com In Partnership with & Мы считаем, что предпринимательство - это один из

- 16. 02.4 Компания Orrick www.stateofeuropeantech.com In Partnership with & Развитие технологий по-прежнему опережает регулирование. Отчет демонстрирует, что

- 17. A word from Orrick 02.4 Более 85% учредителей говорят, что они заботятся о социальном и экологическом

- 18. 03 Инвестиции Сколько венчурные капиталисты вкладывают в европейские технологии? Как вы оцениваете доходность европейских технологий? Европейские

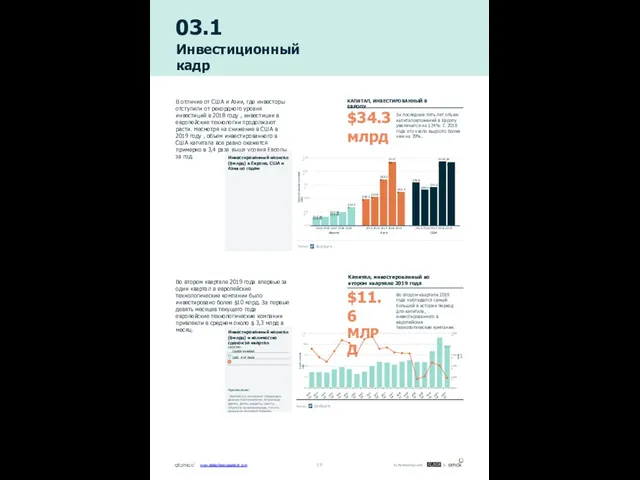

- 19. S15.3B S16.5B S22.6B S24.6B S34.3B S49.0B S52.8B S85.5B S117.8B S62.5B 2015 2016 2017 2018 2019 Европа

- 20. Похоже на то, что сейчас для Европы наступил золотой век: качество талантов, уровень амбиций и доступность

- 21. Investment Snapshot Несколько крупных сделок оказывает существенное влияние на годовой уровень капиталовложений в европейские технологические компании.

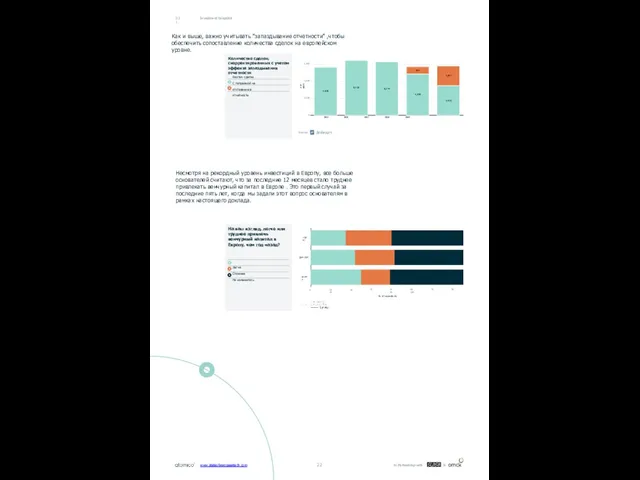

- 22. Investment Snapshot Как и выше, важно учитывать "запаздывание отчетности" ,чтобы обеспечить сопоставление количества сделок на европейском

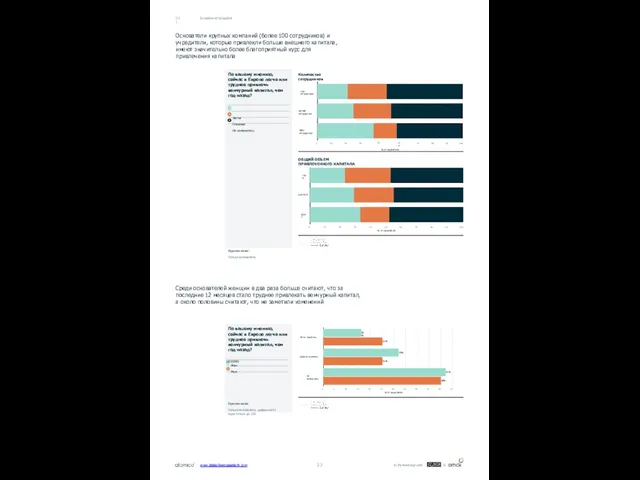

- 23. Investment Snapshot Основатели крупных компаний (более 100 сотрудников) и учредители, которые привлекли больше внешнего капитала, имеют

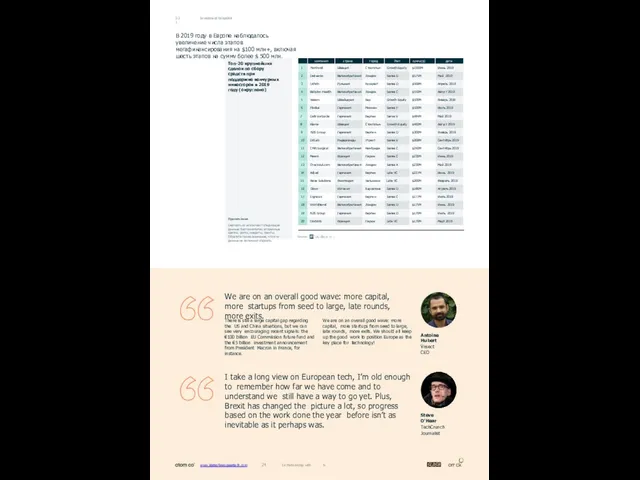

- 24. www.stateofeuropeantech.com 24 In Partnership with & Investment Snapshot В 2019 году в Европе наблюдалось увеличение числа

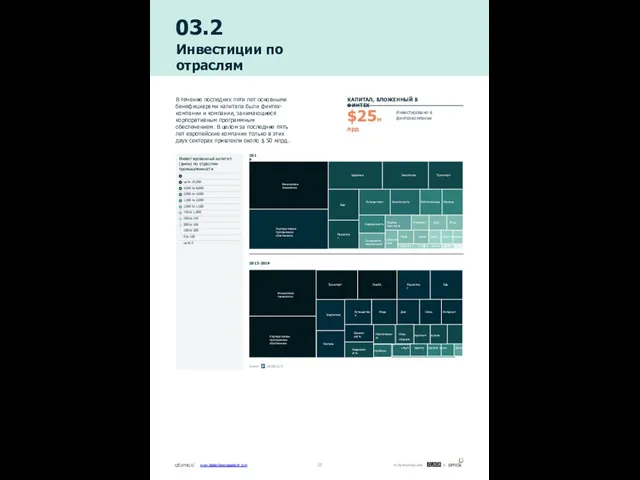

- 25. Финансовые технологии Корпоративное программное обеспечение Здоровье Энергетика Транспорт Еда Маркетинг Путешествия Безопасность Робототехника Реклама Недвижимость Проведение

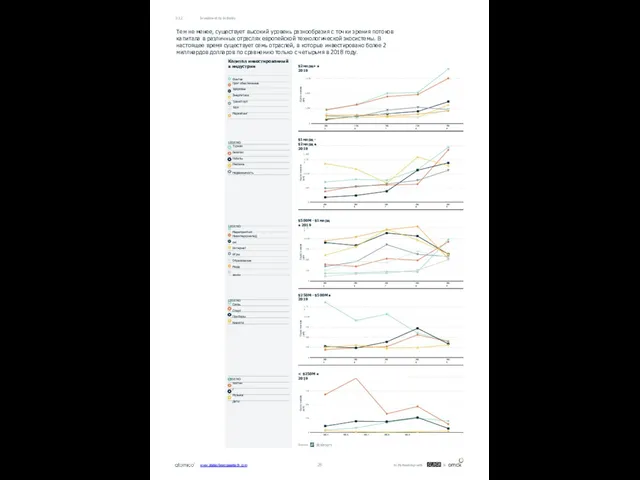

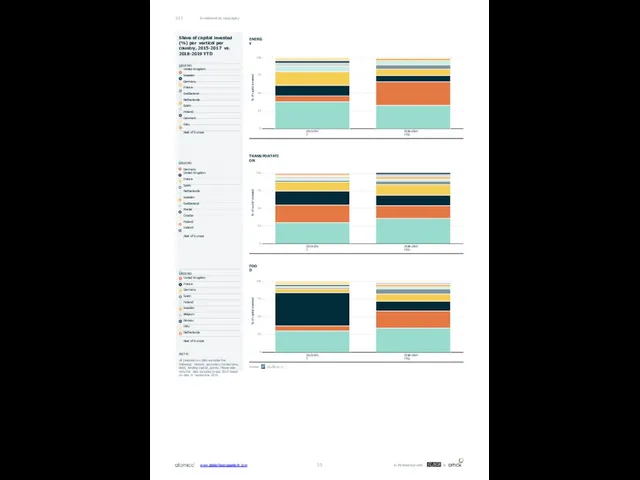

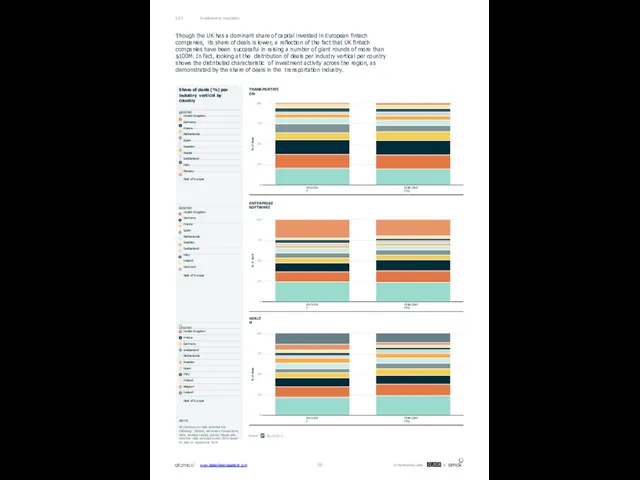

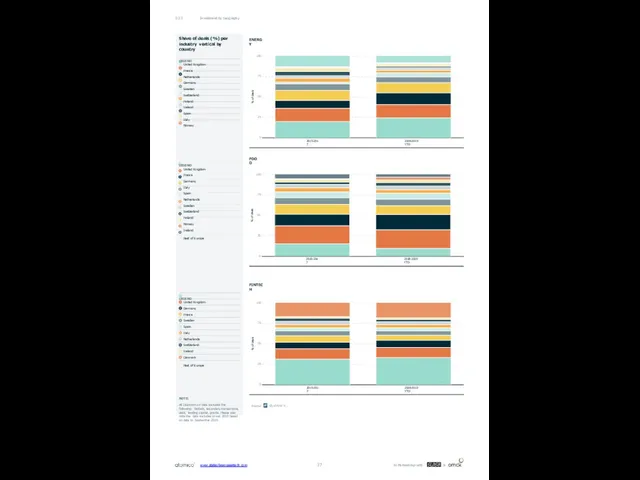

- 26. Тем не менее, существует высокий уровень разнообразия с точки зрения потоков капитала в различных отраслях европейской

- 27. www.stateofeuropeantech.com 27 In Partnership with & Investment by Industry 03.2 Я считаю, что сейчас в Европе

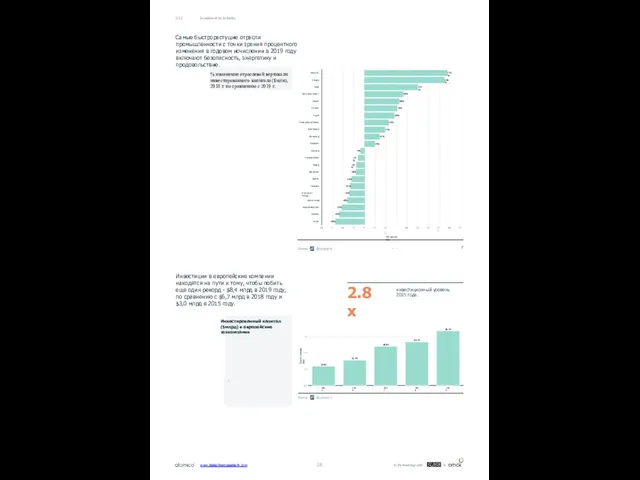

- 28. Самые быстрорастущие отрасли промышленности с точки зрения процентного изменения в годовом исчислении в 2019 году включают

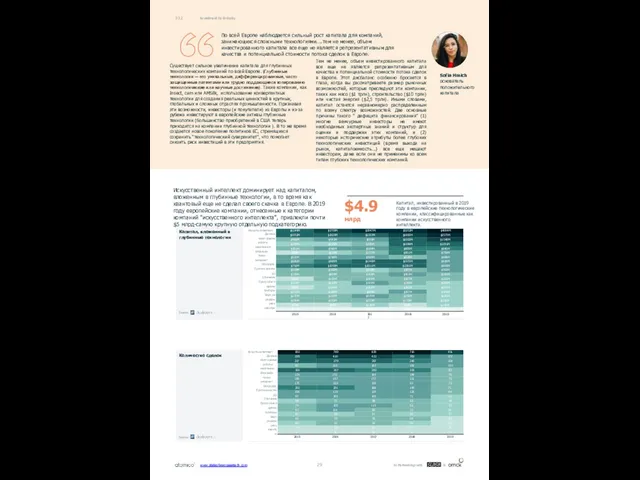

- 29. Искусственный интеллект доминирует над капиталом, вложенным в глубинные технологии, в то время как квантовый еще не

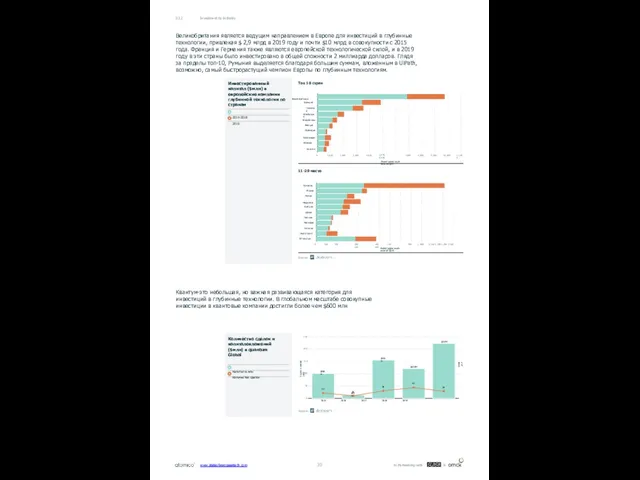

- 30. Великобритания является ведущим направлением в Европе для инвестиций в глубинные технологии, привлекая $ 2,9 млрд в

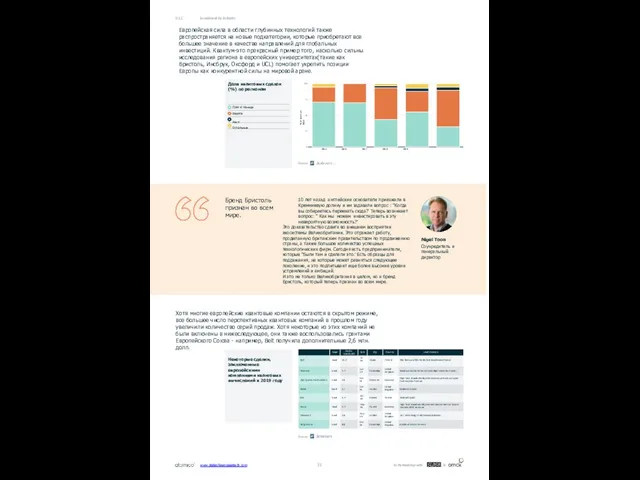

- 31. Европейская сила в области глубинных технологий также распространяется на новые подкатегории, которые приобретают все большее значение

- 32. 03.3 География инвестиций Суммарные капитальные вложения с 2015 года превысили $ 10 млрд в трех европейских

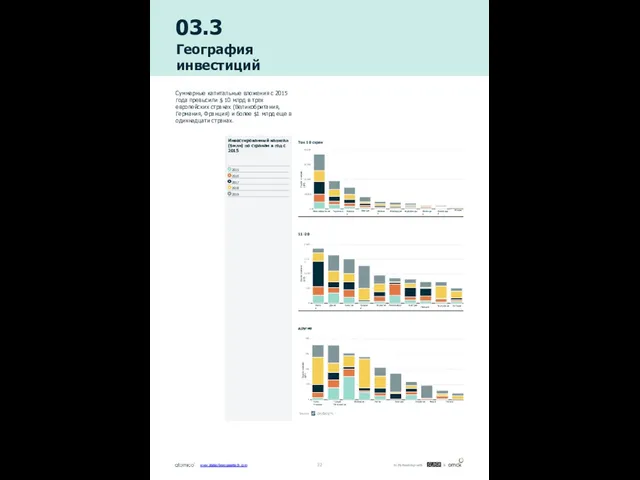

- 33. 2,747 1,183 930 776 457 437 371 359 314 302 London Paris Berlin Stockholm Amsterdam Barcelona

- 34. % of capital invested 2015-2017 2018-2019 YTD 0 25 50 75 100 % of capital invested

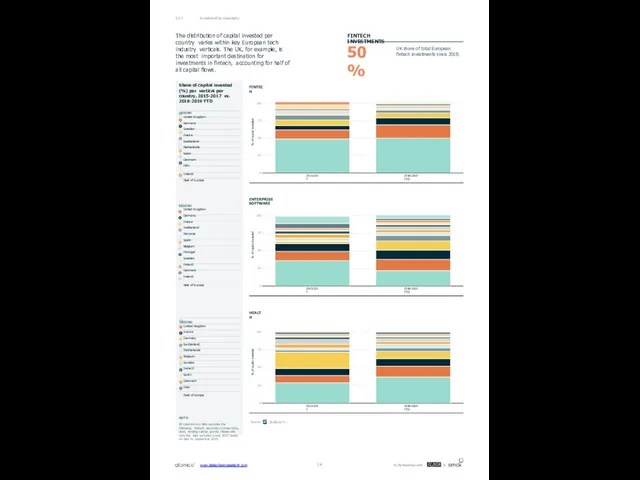

- 35. % of capital invested 2015-2017 2018-2019 YTD 0 25 50 75 100 % of capital invested

- 36. % of deals 2015-2017 2018-2019 YTD 0 25 50 75 100 % of deals 2015-2017 2018-2019

- 37. Investment by Geography 03.3 ENERGY FOOD FINTECH % of deals 2015-2017 2018-2019 YTD 0 25 50

- 38. www.stateofeuropeantech.com In Partnership with &

- 39. www.stateofeuropeantech.com In Partnership with &

- 40. www.stateofeuropeantech.com In Partnership with &

- 41. www.stateofeuropeantech.com In Partnership with &

- 42. www.stateofeuropeantech.com In Partnership with &

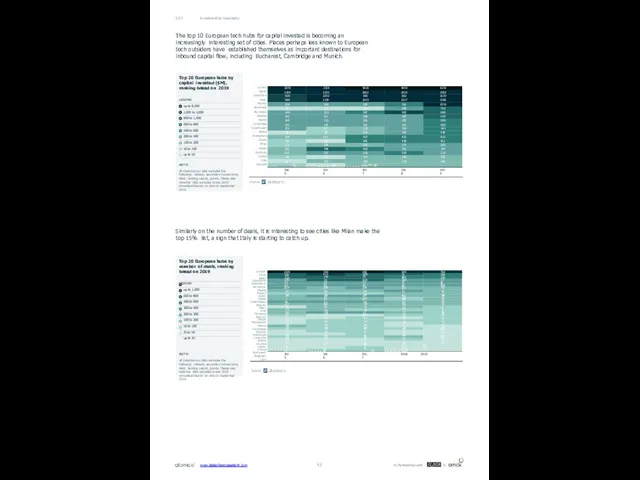

- 43. Investment by Geography 03.3 The top 10 European tech hubs for capital invested is becoming an

- 44. 03.4 $1B+ Companies There are now at least 174 European tech companies that have scaled to

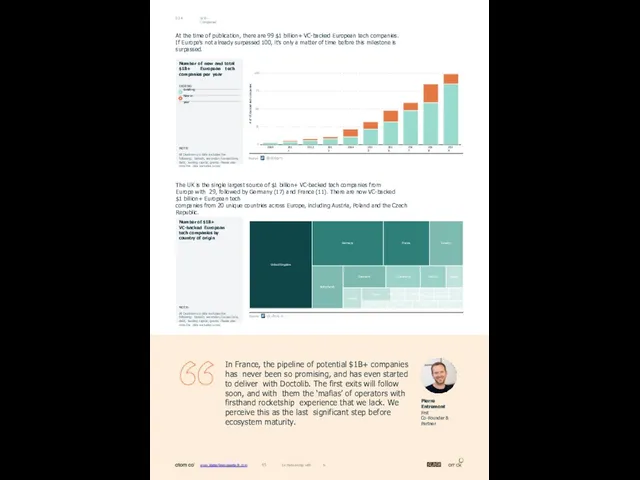

- 45. www.stateofeuropeantech.com 45 In Partnership with & $1B+ Companies 03.4 At the time of publication, there are

- 46. In Partnership with & www.stateofeuropeantech.com

- 47. 47 In Partnership with & www.stateofeuropeantech.com $1B+ Companies 03.4 The total aggregate value of $1 billion+

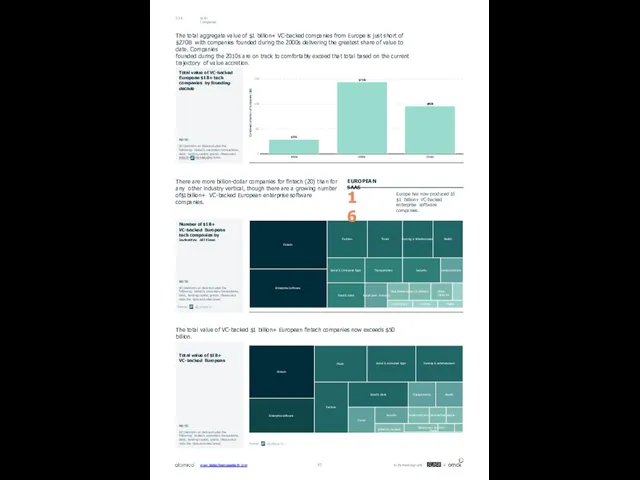

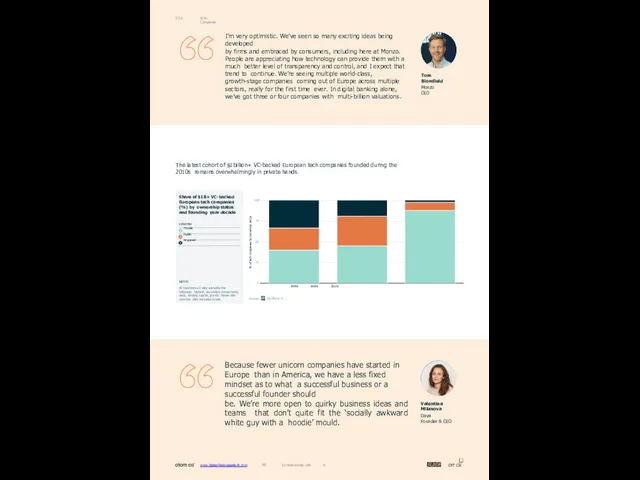

- 48. www.stateofeuropeantech.com 48 In Partnership with & $1B+ Companies 03.4 The latest cohort of $1billion+ VC-backed European

- 49. www.stateofeuropeantech.com 49 In Partnership with & $1B+ Companies 03.4 Europe’s now produced 13 $1B+ VC-backed tech

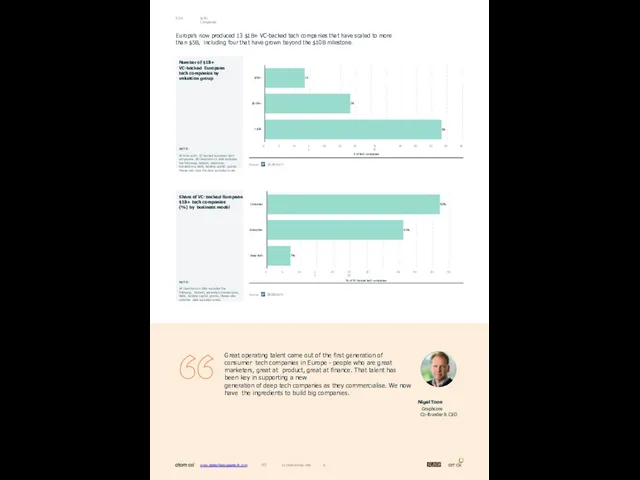

- 50. 50 In Partnership with & 03.5 European Exit Landscape Many will be surprised to know that

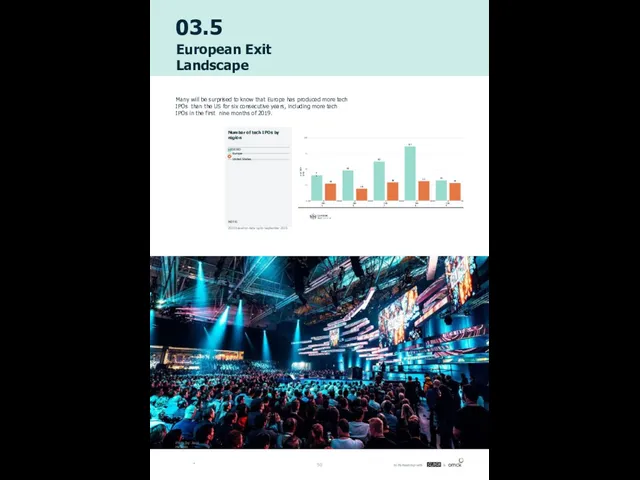

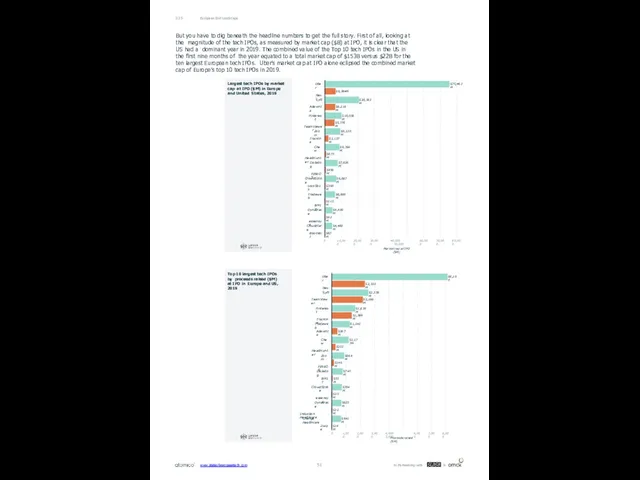

- 51. European Exit Landscape 03.5 But you have to dig beneath the headline numbers to get the

- 52. European Exit Landscape 03.5 The numbers of sponsor-backed tech IPOs per region are at similar levels

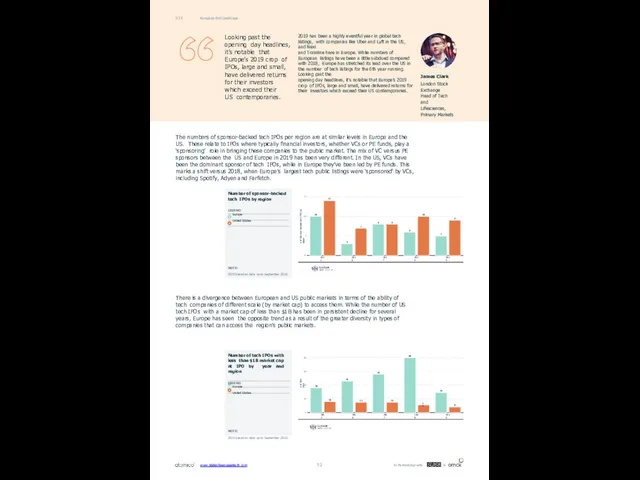

- 53. European Exit Landscape 03.5 Of course, the 2.8x difference should be put in additional context. It’s

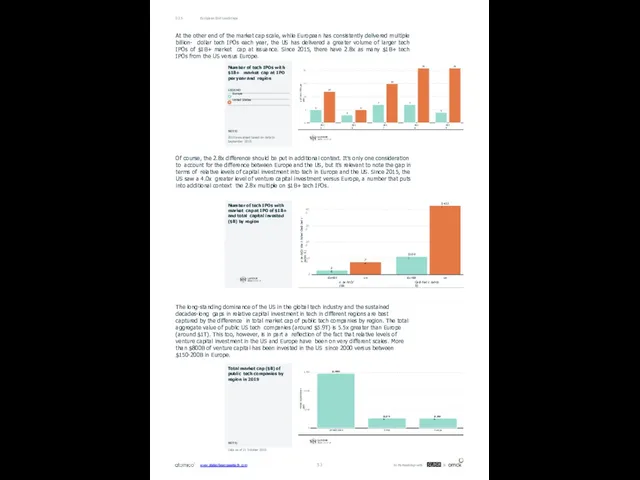

- 54. European Exit Landscape 03.5 Though Europe has yet to produce a company that comes close to

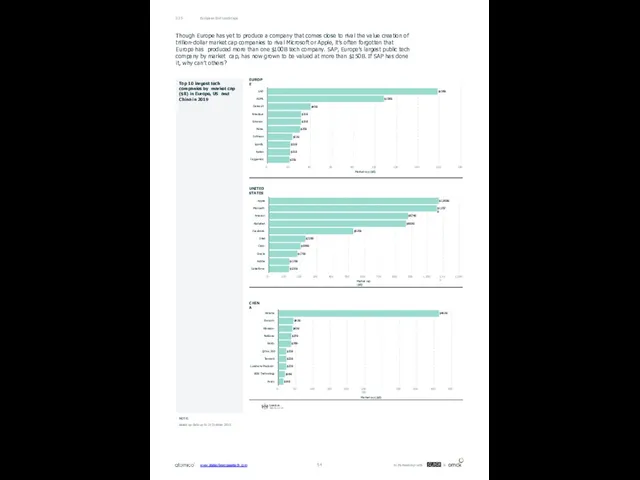

- 55. European Exit Landscape 03.5 Whilst the US had a bumper year in terms of the scale

- 56. European Exit Landscape 03.5 Besides simply looking at the scale of public tech companies, there are

- 57. European Exit Landscape 03.5 2018 was a record year for European VC-backed exits, including the IPOs

- 58. www.stateofeuropeantech.com 58 In Partnership with & European Exit Landscape 03.5 % of M&A exits 2015 2016

- 59. 59 In Partnership with & www.stateofeuropeantech.com 04 Investors What is the definition of a European tech

- 60. wwwwww..ssttatateeooffeueurroopepeaanntteecchh..ccoomm 6060 IInn PPaarrttnneerrsshhiipp wwiitthh && 04.1 VCs and LPs It’s hard to point to a

- 61. VCs and LPs 04.1 2018 was another record year with European VCs raising more than $13B,

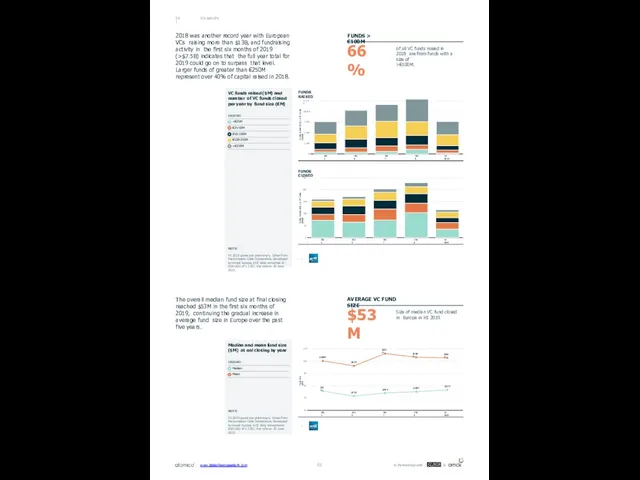

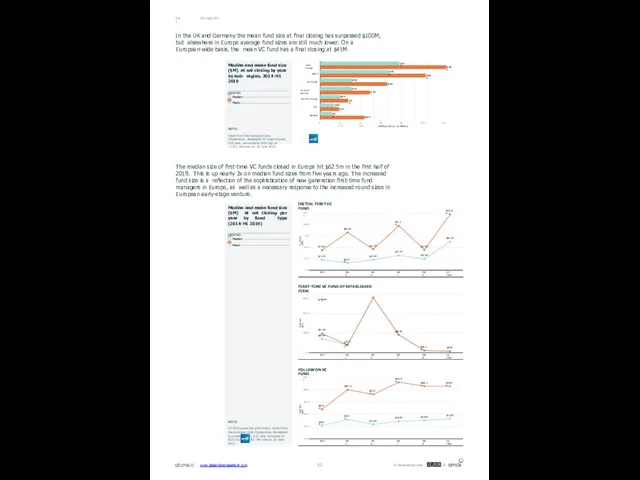

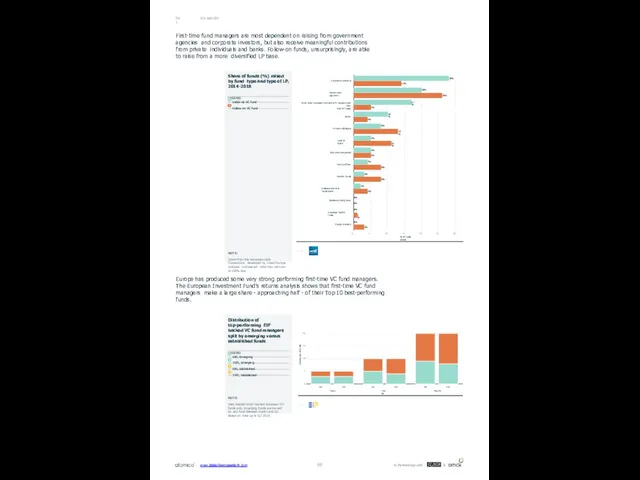

- 62. VCs and LPs 04.1 The median size of first-time VC funds closed in Europe hit $62.5m

- 63. VCs and LPs 04.1 Looking back on a cumulative basis at total funds committed to European

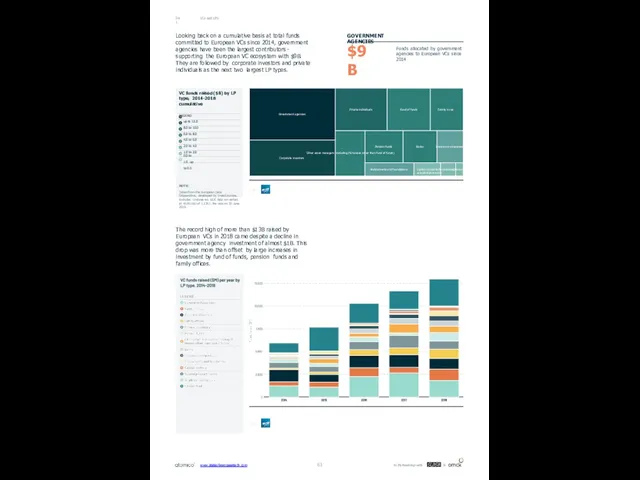

- 64. www.stateofeuropeantech.com 64 In Partnership with & VCs and LPs 04.1 Indeed, pension funds appear to be

- 65. VCs and LPs 04.1 The diversification of the LP base for GPs in different regions is

- 66. $30 $33 $23 $12 $20 $5 $0 $2 $3 $57 $57 $54 $54 $30 $18 $16

- 67. VCs and LPs 04.1 It’s interesting to look at the geographic distribution of VC funds raised

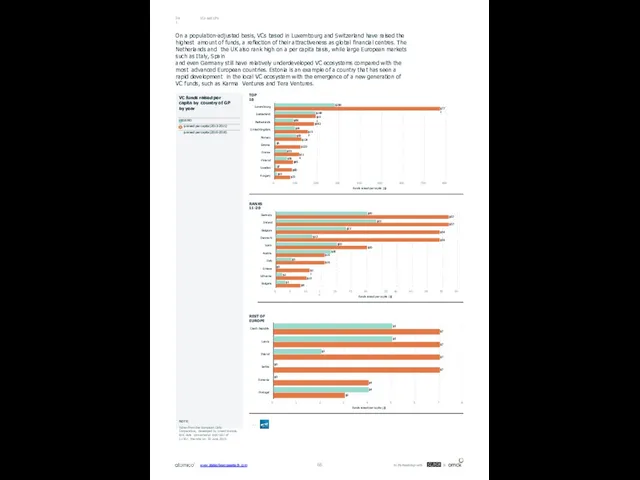

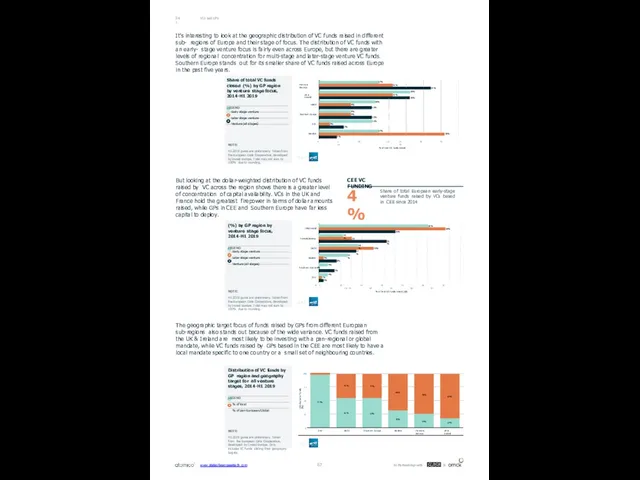

- 68. VCs and LPs 04.1 There are interesting differences in the LP composition of VC funds in

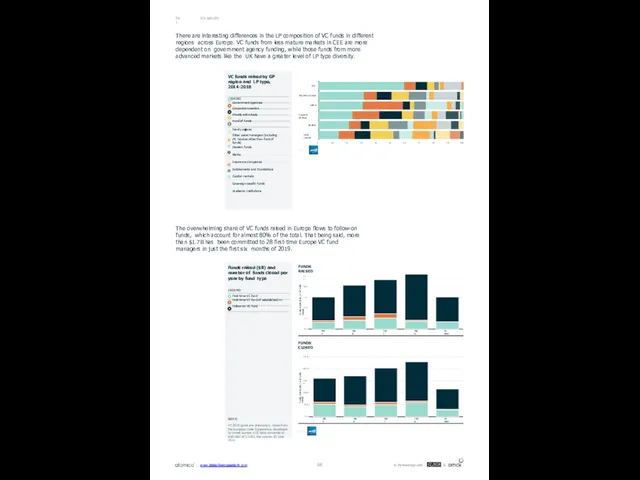

- 69. VCs and LPs 04.1 First-time fund managers are most dependent on raising from government agencies and

- 70. VCs and LPs 04.1 Based on their interactions with different LP types VC respondents to the

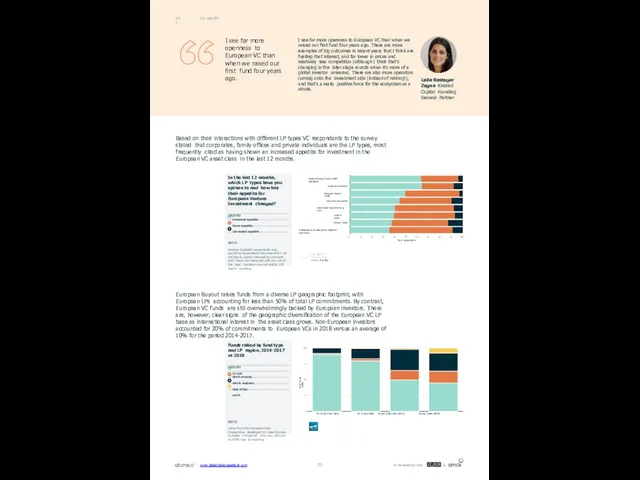

- 71. www.stateofeuropeantech.com 71 In Partnership with & As venture capital and innovation continue their global growth, Europe

- 72. VCs and LPs 04.1 The scale of European VC is small when compared against the level

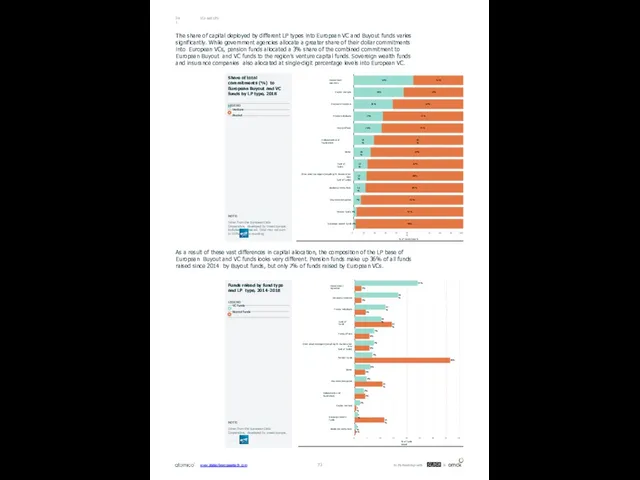

- 73. VCs and LPs 04.1 The share of capital deployed by different LP types into European VC

- 74. 04.2 Investors We asked European VCs to give their perspective on a number of trends related

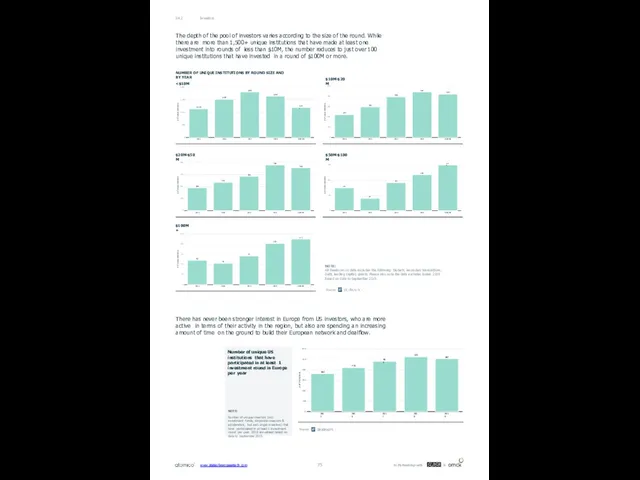

- 75. # of unique institutions 190 234 285 379 356 2015 2016 2017 2018 2019 9M 0

- 76. Investors 04.2 One in five rounds raised in Europe in 2019 involved the participation of at

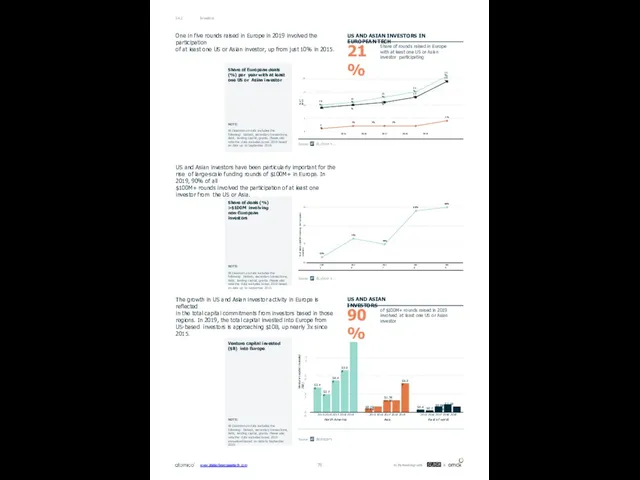

- 77. Investors 04.2 The volume of investment activity by corporate investors has also expanded considerably in recent

- 78. Investors 04.2 On the other hand, the most active Corporate VCs span a wide range of

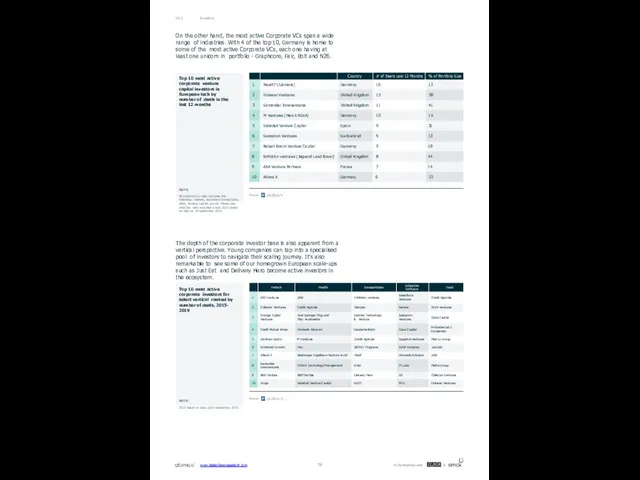

- 79. 04.3 Angels European angel investing landscape EBAN estimates that $8.6B (€7.5B) was invested across all European

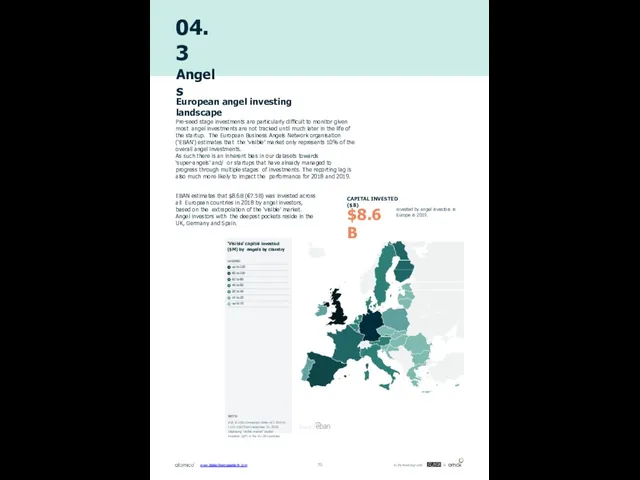

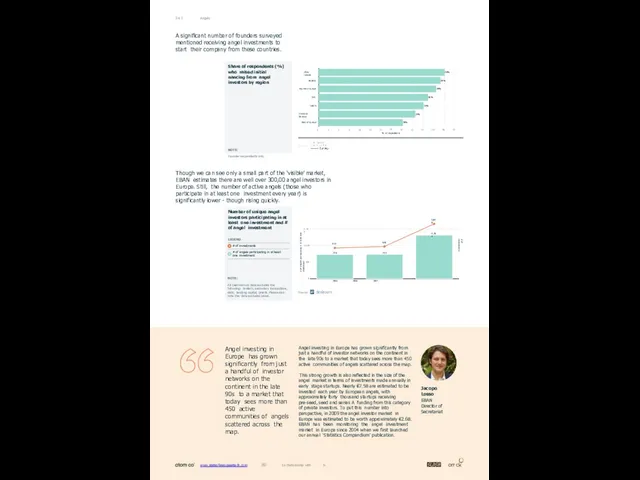

- 80. www.stateofeuropeantech.com 80 In Partnership with & Angels 04.3 A significant number of founders surveyed mentioned receiving

- 81. Angels 04.3 Founders are becoming more likely to make investments back in the ecosystem in comparison

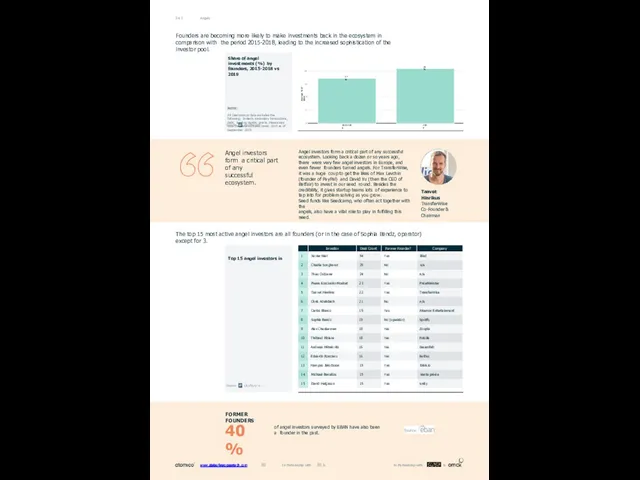

- 82. Angels 04.3 The age profile of angels varies widely. In France, the average angel investor is

- 83. www.stateofeuropeantech.com 83 In Partnership with & Angels 04.3 Roxanne Varza Station F, France Tuva Palm NordNet,

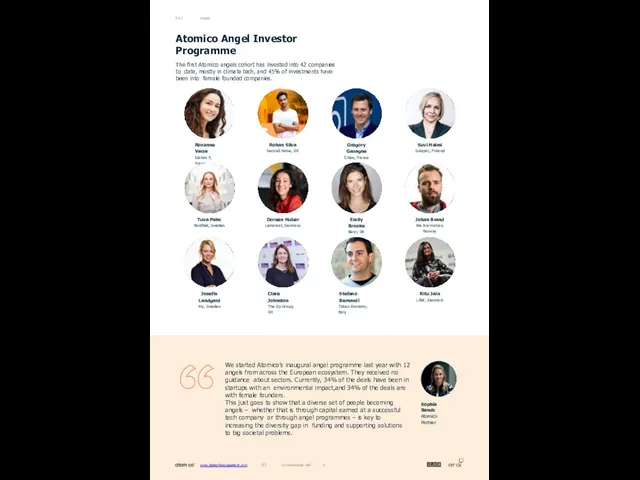

- 84. Angels 04.3 Repeat founders with significant experience in scaling a company are much more likely to

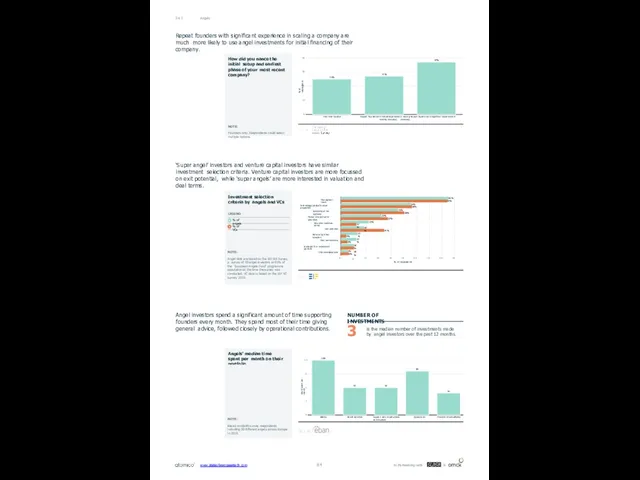

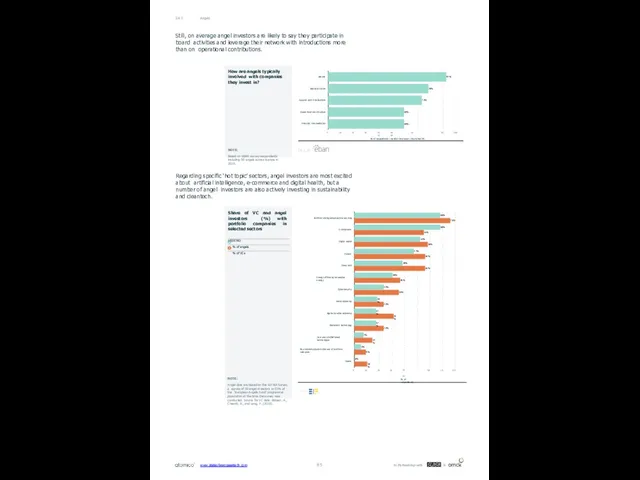

- 85. Angels 04.3 Still, on average angel investors are likely to say they participate in board activities

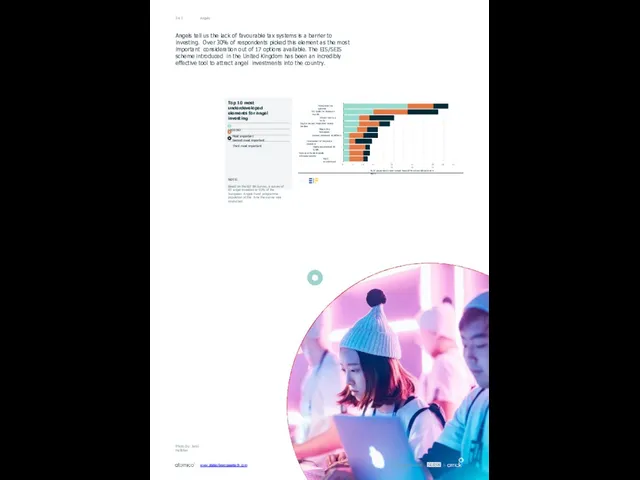

- 86. Angels 04.3 Angels tell us the lack of favourable tax systems is a barrier to investing.

- 87. 05 Diversity & Inclusion Does European tech still lack diversity and inclusion? Despiteincreasedawarenessalackofdiversity,theproblemremains entrenched. There is

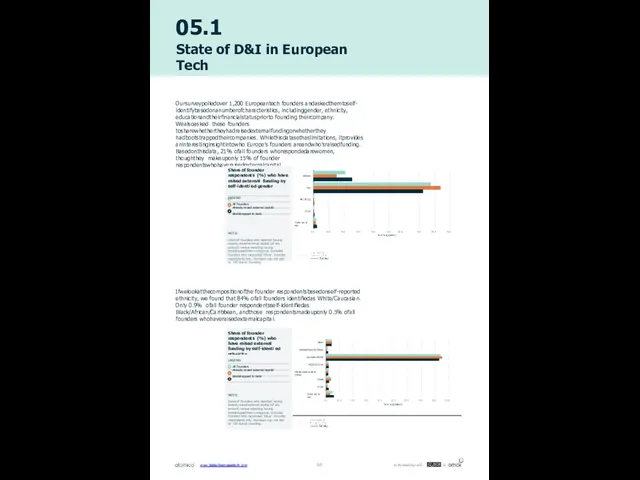

- 88. Share of founder respondents (%) who have raised external funding by self-identi ed ethnicity LEGEND All

- 89. State of D&I in European Tech 05.1 If we look at the highest educational attainment of

- 90. CAPITAL RAISED % of capital raised / deals 85.4% 86.7% 86.2% 85.5% 86.9% 10.8% 9.9% 9.9%

- 91. % of deals 86% 85% 84% 85% 4% 4% 4% 5% 3% 10% 10% 10% 12%

- 92. Czech Republic Italy Portugal Spain United Kingdom Germany Sweden Russia Switzerland Ireland Finland France Belgium Denmark

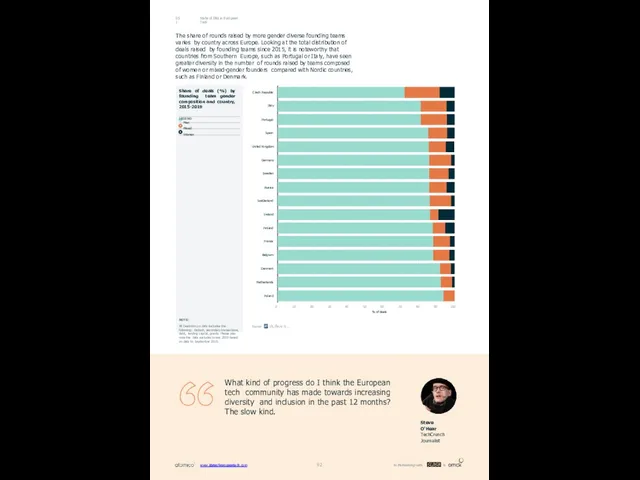

- 93. State of D&I in European Tech 05.1 It's particularly notable that, when looking at the evolution

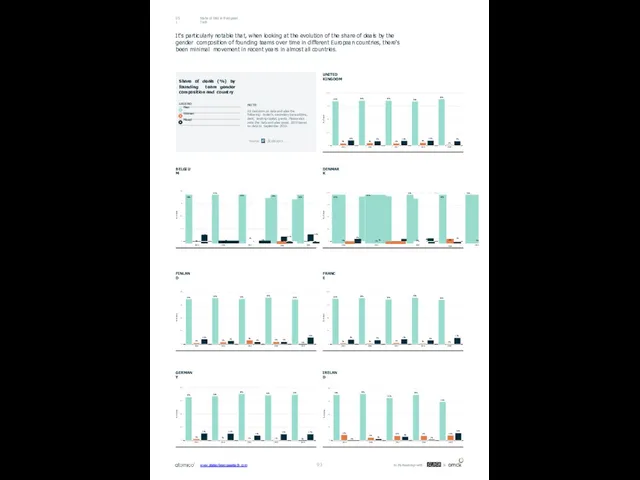

- 94. www.stateofeuropeantech.com In Partnership with &

- 95. Share of deals (%) by founder team gender and industry, 2015- 2019 LEGEND Men Women +

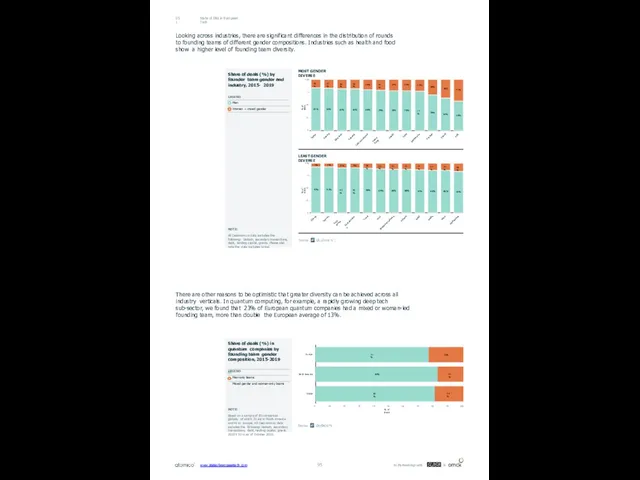

- 96. State of D&I in European Tech 05.1 The fact that Quantum is more inclusive should not

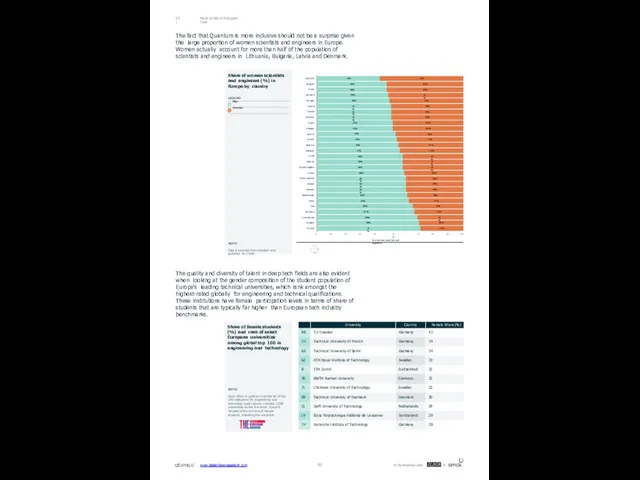

- 97. We revisited prior analysis exploring the gender composition of the leadership teams of European tech companies

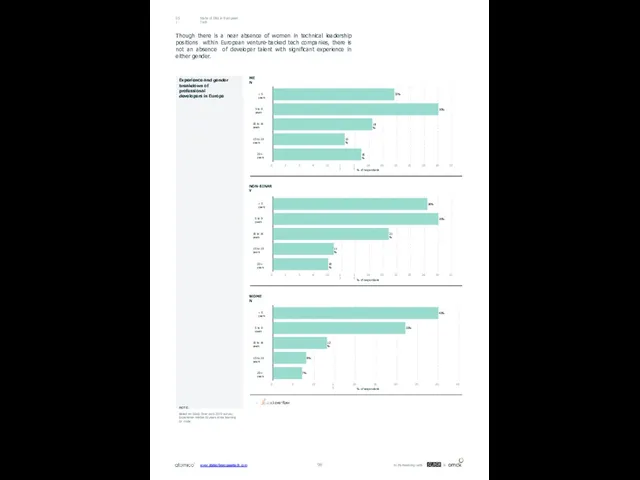

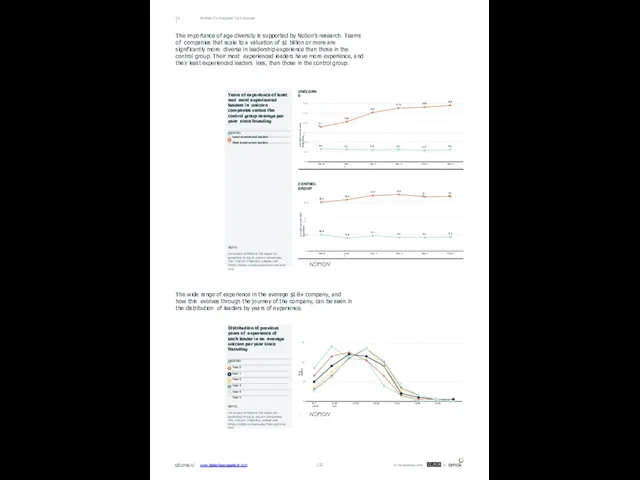

- 98. 22% 30% 18% 13% 16% 5 to 9 years 10 to 14 years 15 to 19

- 99. If investors are more representative of society's diversity, we will reach a more diverse set of

- 100. State of D&I in European Tech 05.1 Given these static numbers, it's important to examine the

- 101. State of D&I in European Tech 05.1 We also found large differences between men and women

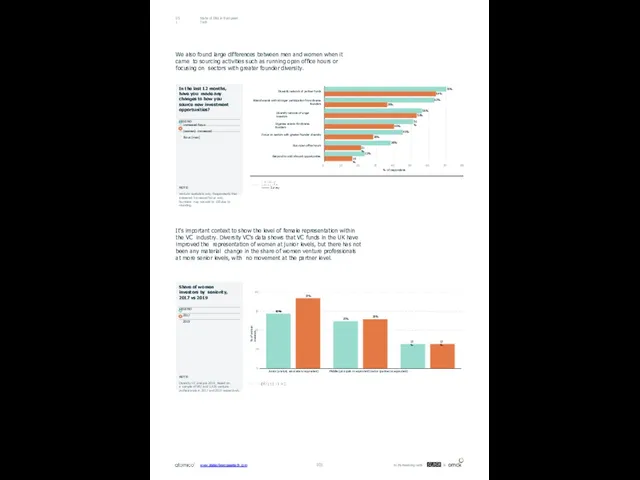

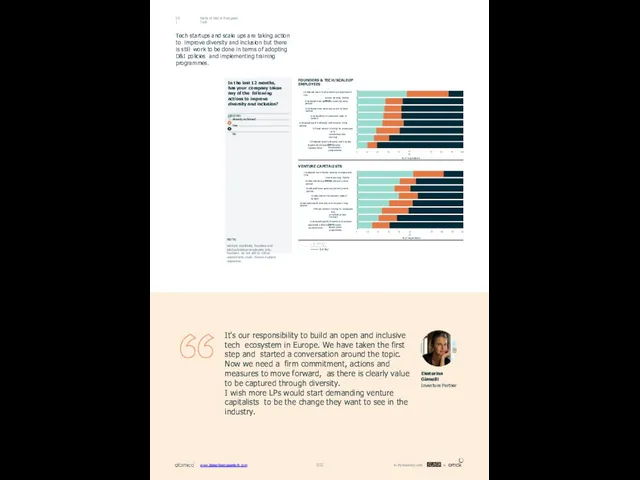

- 102. In the last 12 months, has your company taken any of the following actions to improve

- 103. In the last 12 months, have you experienced any form of discrimination while working in the

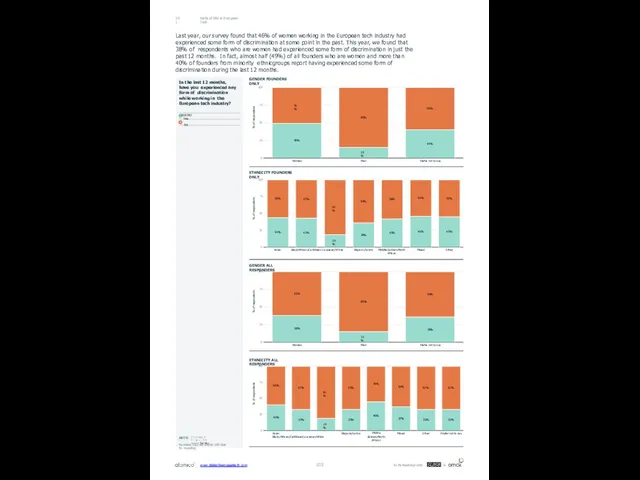

- 104. State of D&I in European Tech 05.1 Discrimination in the European tech industry takes many forms.

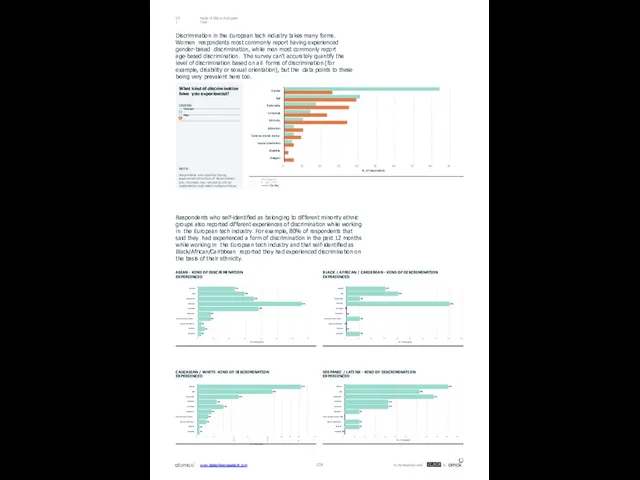

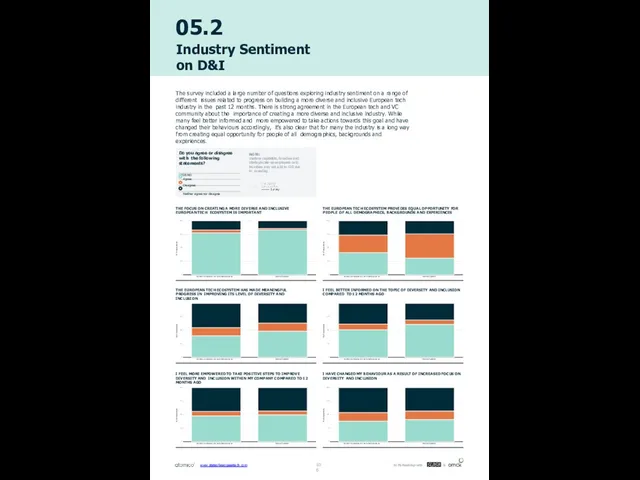

- 106. 05.1 State of D&I in European Tech 05.2 Industry Sentiment on D&I I FEEL BETTER INFORMED

- 107. In Partnership with & www.stateofeuropeantech.com

- 108. Asian Black/African/Caribbean Caucasian/White Hispanic/Latinx Middle Eastern/North African Mixed Other 0 10 20 30 40 50 %

- 109. Founder or startup/scale-up employee Venture Capitalist 0 10 20 30 40 50 % of respondents 60

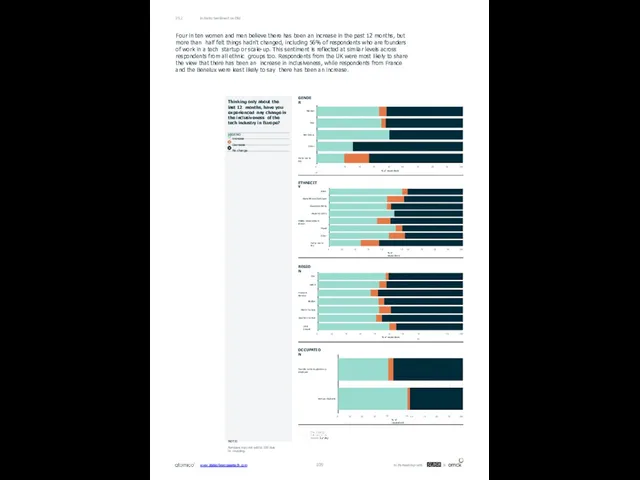

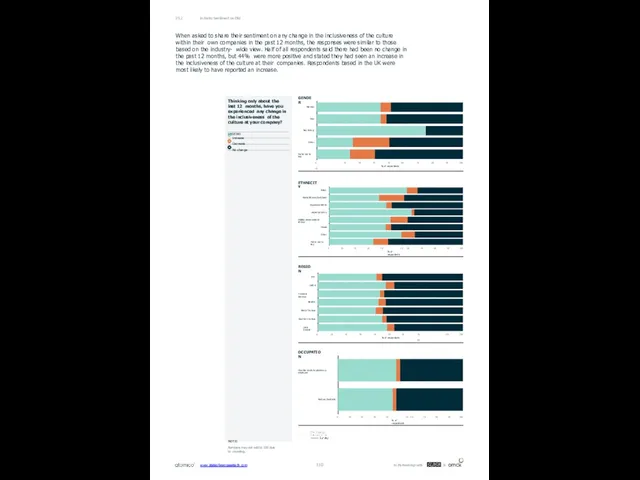

- 110. Industry Sentiment on D&I 05.2 When asked to share their sentiment on any change in the

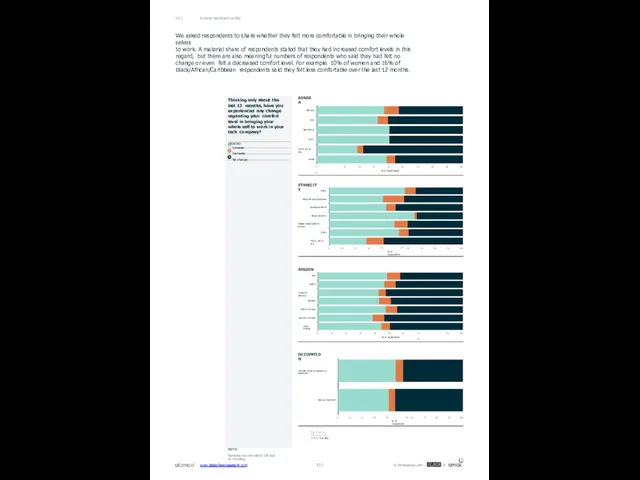

- 111. Industry Sentiment on D&I 05.2 We asked respondents to share whether they felt more comfortable in

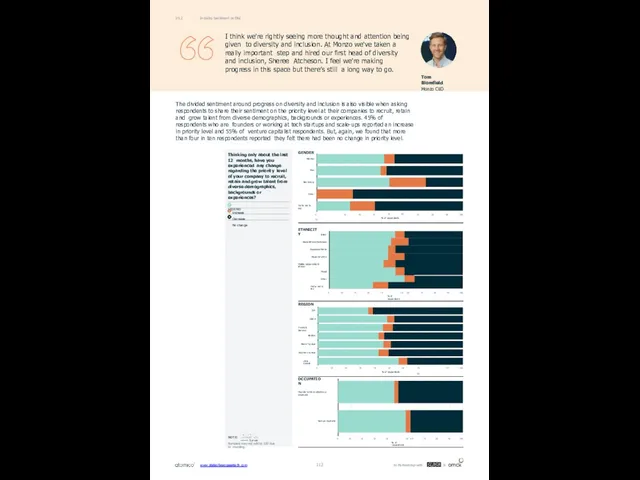

- 112. Industry Sentiment on D&I 05.2 I think we're rightly seeing more thought and attention being given

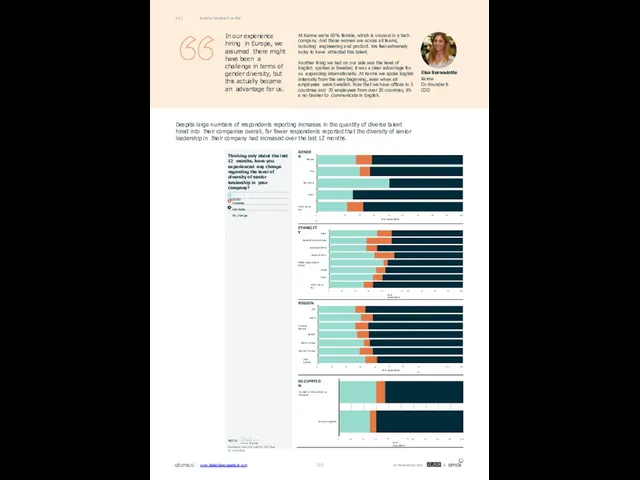

- 113. Industry Sentiment on D&I 05.2 In our experience hiring in Europe, we assumed there might have

- 114. Asian Black/African/Caribbean Caucasian/White Hispanic/Latinx Middle Eastern/North African Mixed Other Prefer not to say 0 10 20

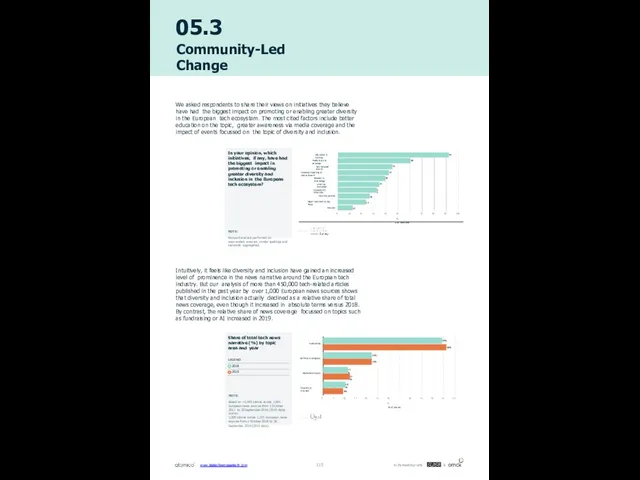

- 115. 05.3 Community-Led Change We asked respondents to share their views on initiatives they believe have had

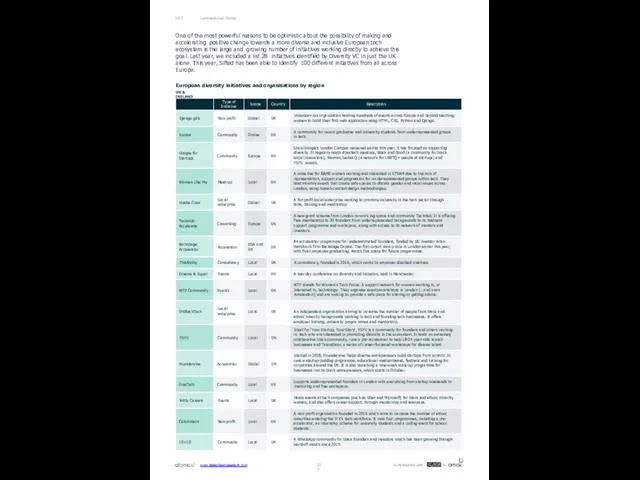

- 117. Community-Led Change www.stateofeuropeantech.com In Partnership with & 05.3 UK & IRELAND One of the most powerful

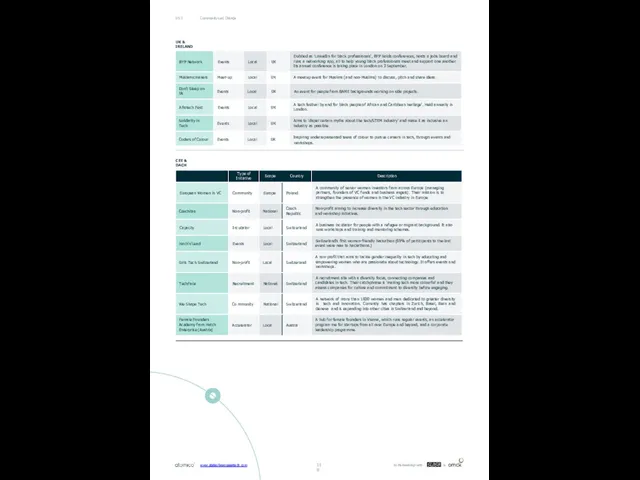

- 118. CEE & DACH Community-Led Change 05.3 UK & IRELAND www.stateofeuropeantech.com In Partnership with &

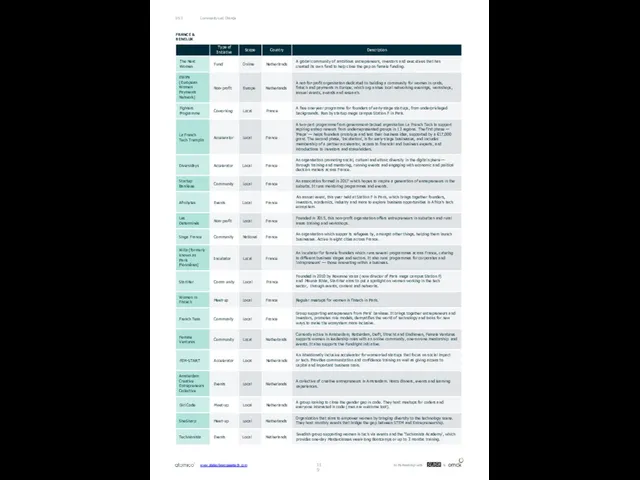

- 119. FRANCE & BENELUX www.stateofeuropeantech.com In Partnership with & Community-Led Change 05.3

- 120. FRANCE & BENELUX NORDICS Community-Led Change 05.3 120 www.stateofeuropeantech.com In Partnership with &

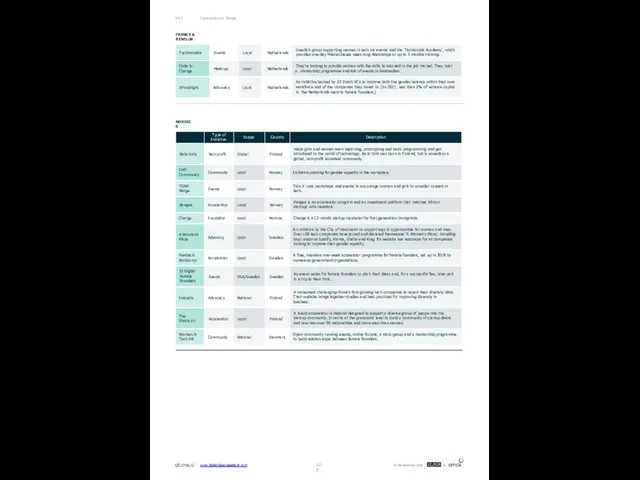

- 121. SOUTHERN EUROPE NORTH AMERICA GLOBAL Community-Led Change www.stateofeuropeantech.com In Partnership with & 05.3

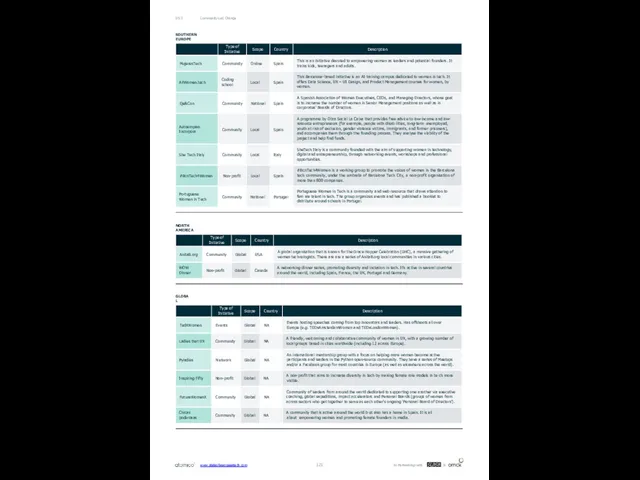

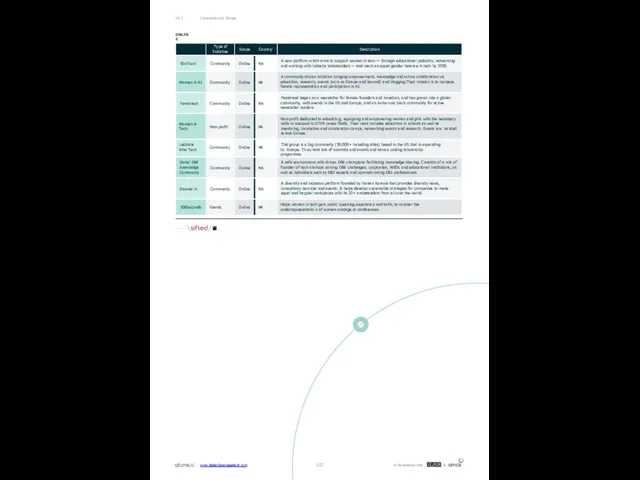

- 122. ONLINE Community-Led Change 05.3 www.stateofeuropeantech.com In Partnership with &

- 123. In some areas, European tech has certainly become more diverse in the last year. Initiatives like

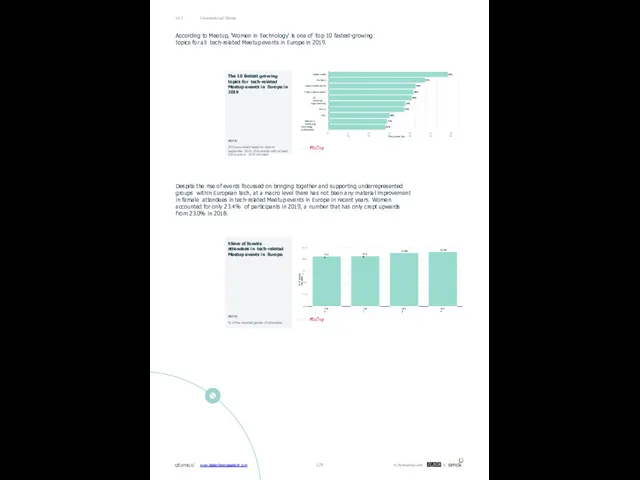

- 124. Community-Led Change 05.3 According to Meetup, 'Women in Technology' is one of Top 10 fastest-growing topics

- 125. 27.6% 27.5% 26.4% 25.9% 25.7% 25.7% 25.5% 25.5% 25.5% 25.3% Romania Latvia Germany Spain Luxembourg Ireland

- 126. 06 People What kinds of people work in European tech jobs? The archetype of a European

- 127. 06.1 Portrait of a European Tech Founder Our survey of more than 1,200 founders from across

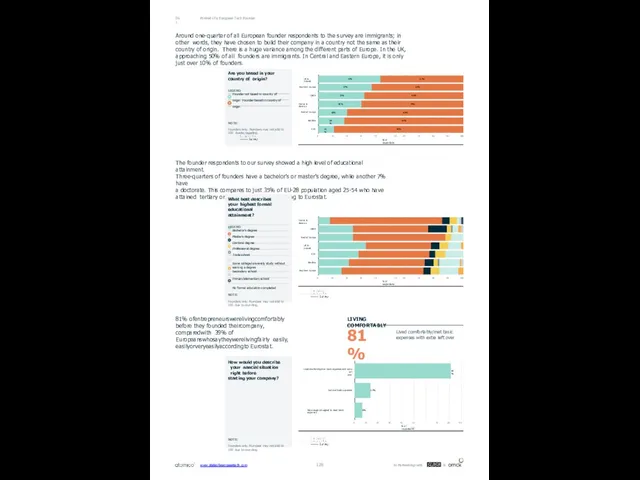

- 128. Portrait of a European Tech Founder 06.1 Around one-quarter of all European founder respondents to the

- 129. Looking only at those founders who have attained a university degree, there are interesting differences in

- 130. Portrait of a European Tech Founder 06.1 The Unicorn Trajectory In November 2019, Notion, a European

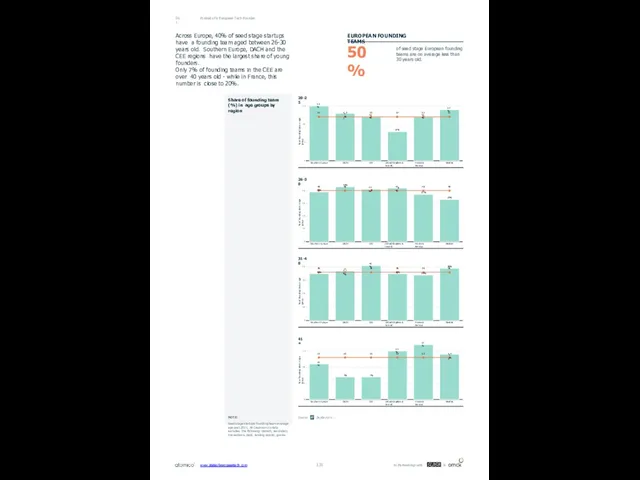

- 131. Portrait of a European Tech Founder 06.1 Across Europe, 40% of seed stage startups have a

- 132. Portrait of a European Tech Founder 06.1 # of years of prior work experience 6.5 6.2

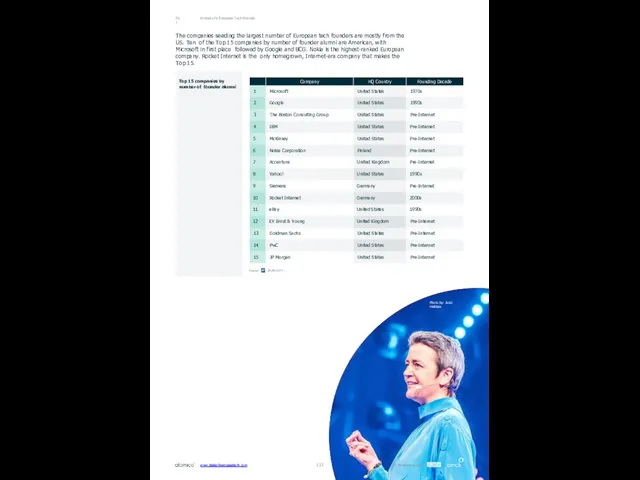

- 133. Portrait of a European Tech Founder 06.1 The companies seeding the largest number of European tech

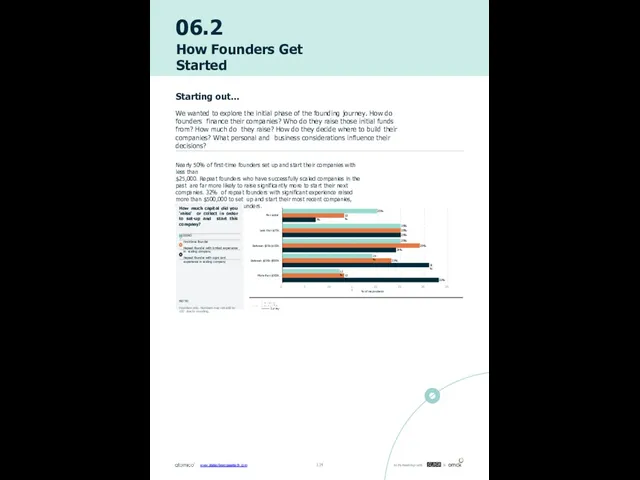

- 134. 06.2 How Founders Get Started Starting out... We wanted to explore the initial phase of the

- 135. How Founders Get Started 06.2 15% 25% 36% 17% 8% 13% 22% 26% 25% 14% No

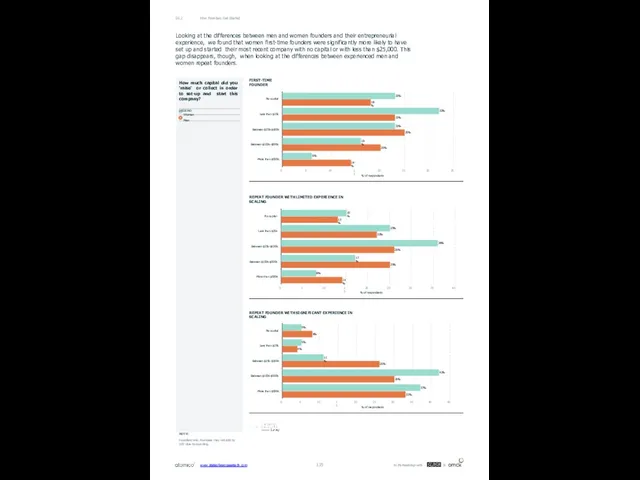

- 136. How Founders Get Started 06.2 We also observed material differences in the responses from founders who

- 137. How Founders Get Started 06.2 We also wanted to understand how founders finance the initial setup

- 138. How Founders Get Started 06.2 % of respondents 33% 24% 17% 15% 15% 14% 11% Nordics

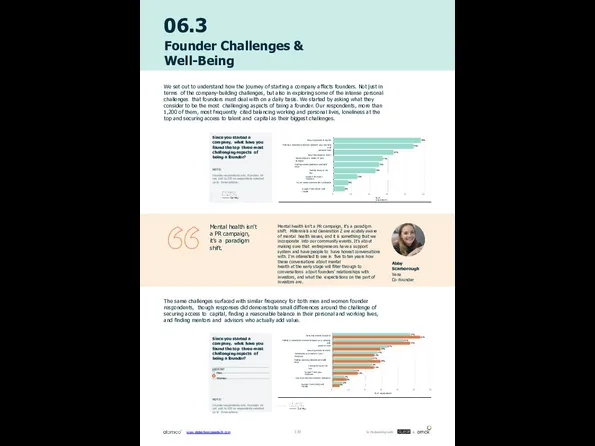

- 139. 06.3 Founder Challenges & Well-Being We set out to understand how the journey of starting a

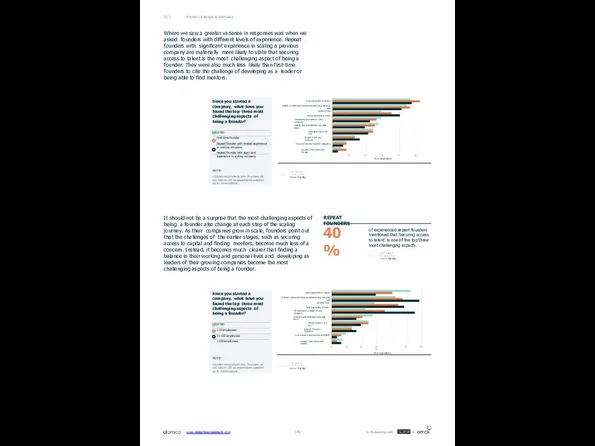

- 140. Founder Challenges & Well-Being 06.3 Where we saw a greater variance in responses was when we

- 141. Founder Challenges & Well-Being 06.3 of all founders said that starting a company mostly had a

- 142. Where we did see a larger variance was between founders of externally funded and bootstrapped companies.

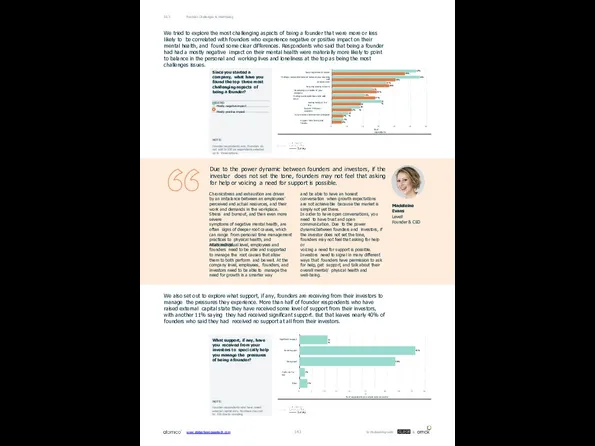

- 143. We tried to explore the most challenging aspects of being a founder that were more or

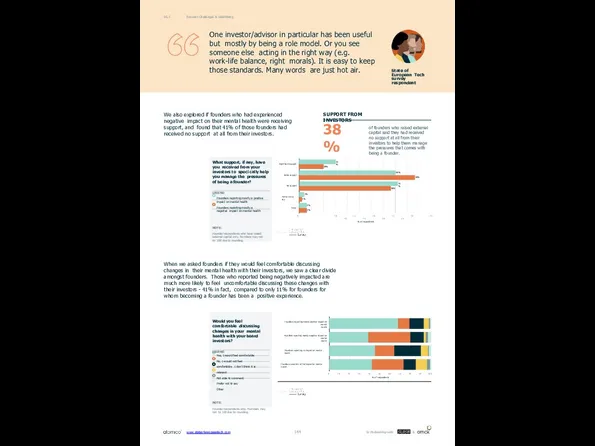

- 144. We also explored if founders who had experienced negative impact on their mental health were receiving

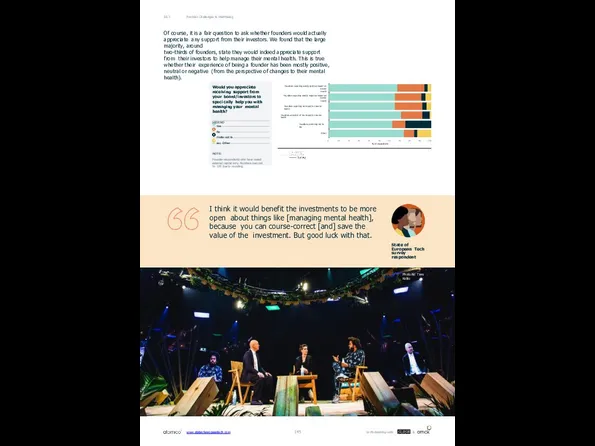

- 145. Of course, it is a fair question to ask whether founders would actually appreciate any support

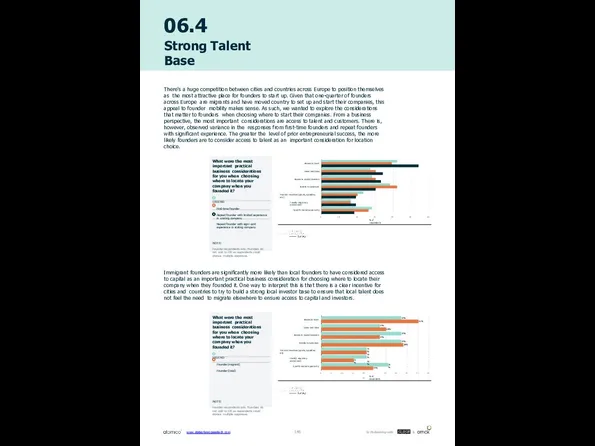

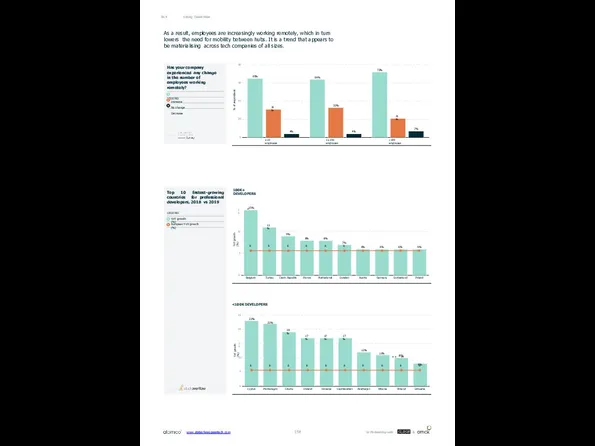

- 146. 06.4 Strong Talent Base There's a huge competition between cities and countries across Europe to position

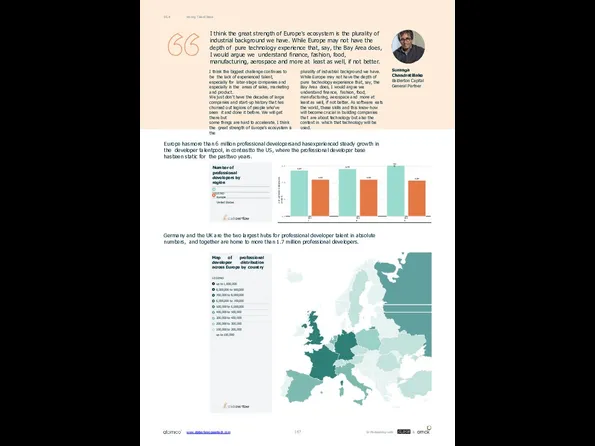

- 147. I think the great strength of Europe's ecosystem is the plurality of industrial background we have.

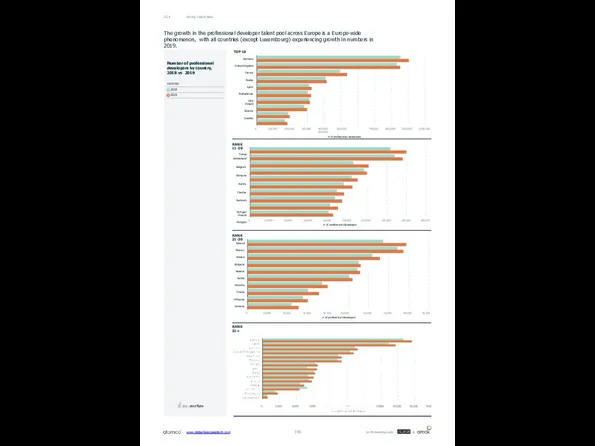

- 148. Strong Talent Base 06.4 The growth in the professional developer talent pool across Europe is a

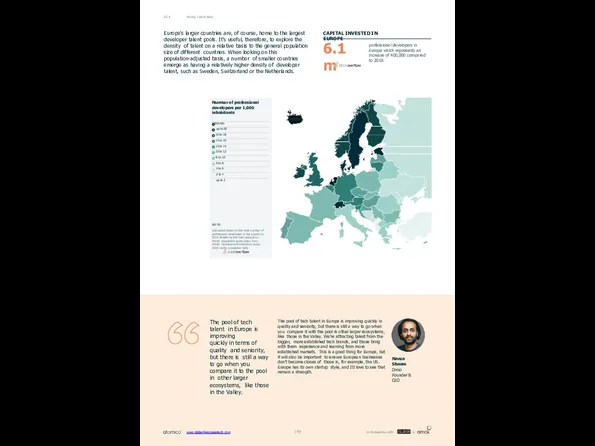

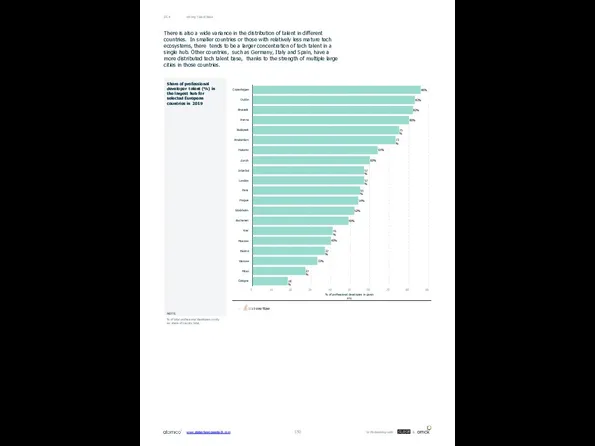

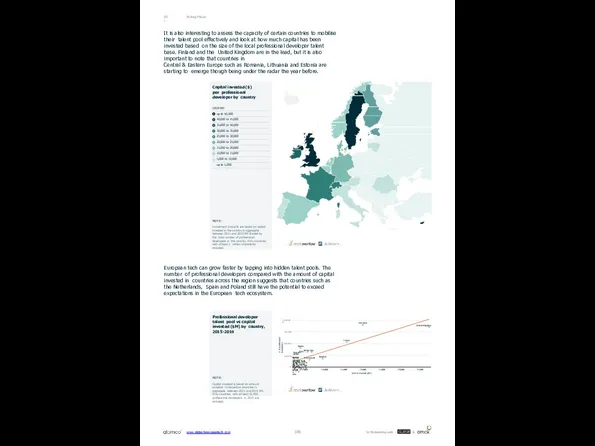

- 149. Europe's larger countries are, of course, home to the largest developer talent pools. It's useful, therefore,

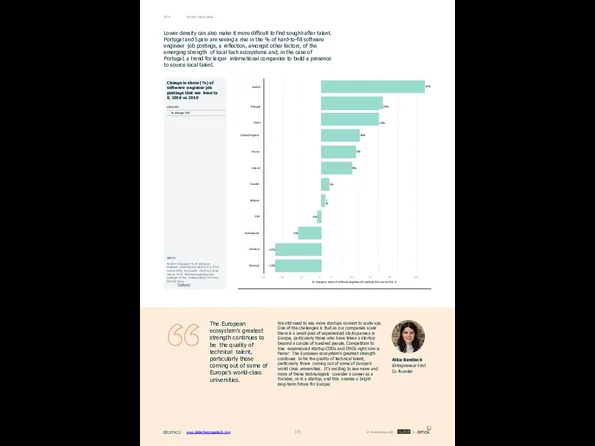

- 150. 86% 83% 82% 80% 75% 73% 64% 60% 57% 57% 55% 54% 52% 49% 41% 40%

- 151. The European ecosystem's greatest strength continues to be the quality of technical talent, particularly those coming

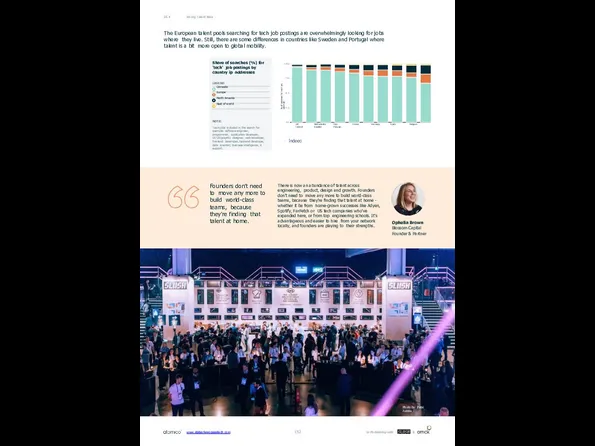

- 152. % of searches for 'tech' job postings UK Netherlands Italy France Germany Spain Belgium Ireland Sweden

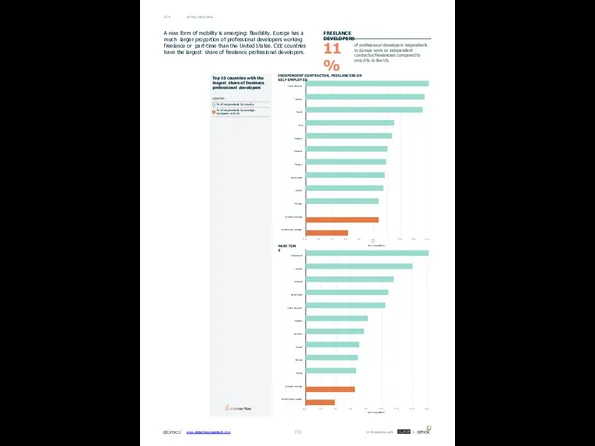

- 153. Top 10 countries with the largest share of freelance professional developers LEGEND % of respondents by

- 154. % of respondents 65% 64% 72% 31% 33% 21% 4% 4% 7% ≤10 employees 11-100 employees

- 155. The best part is that thanks to another 2019 milestone, we're open: When you join a

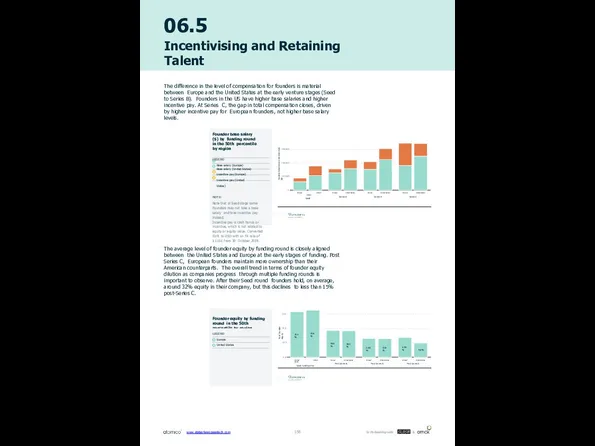

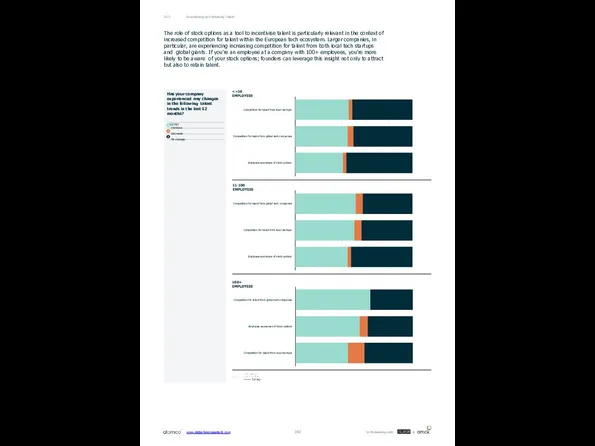

- 156. 06.5 Incentivising and Retaining Talent The difference in the level of compensation for founders is material

- 157. European tech companies have historically lagged behind those from the US in their use of stock

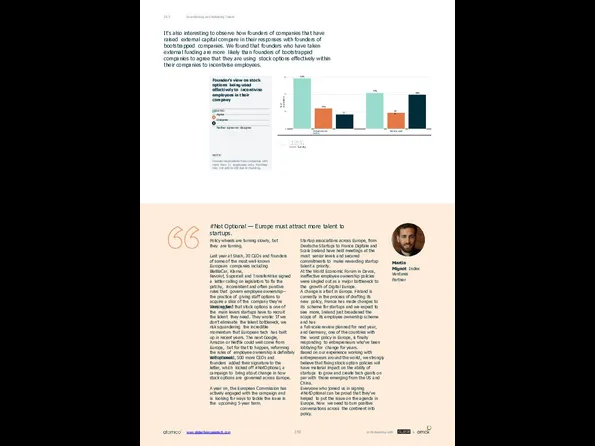

- 158. It's also interesting to observe how founders of companies that have raised external capital compare in

- 159. In Partnership with & www.stateofeuropeantech.com

- 160. Competition for talent from local startups Competition for talent from global tech companies Employee awareness of

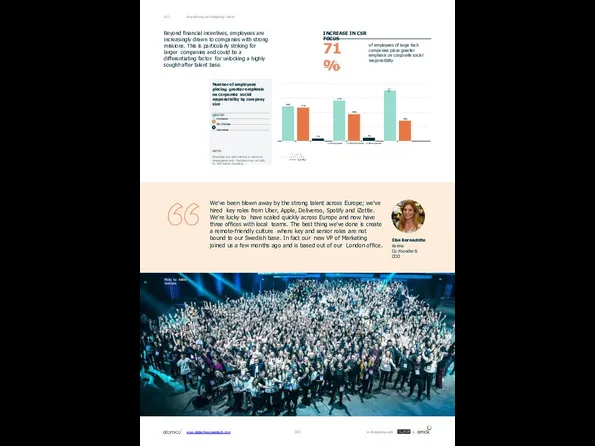

- 161. Beyond financial incentives, employees are increasingly drawn to companies with strong missions. This is particularly striking

- 162. 07 Purpose What is the definition of a purpose-driven tech startup? The EU competition commissioner Margrethe

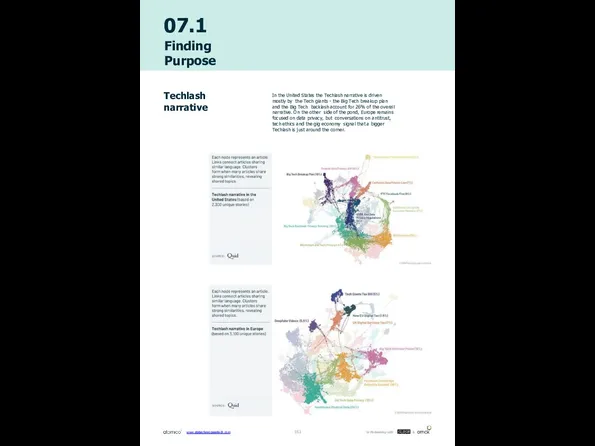

- 163. 07.1 Finding Purpose Techlash narrative In the United States the Techlash narrative is driven mostly by

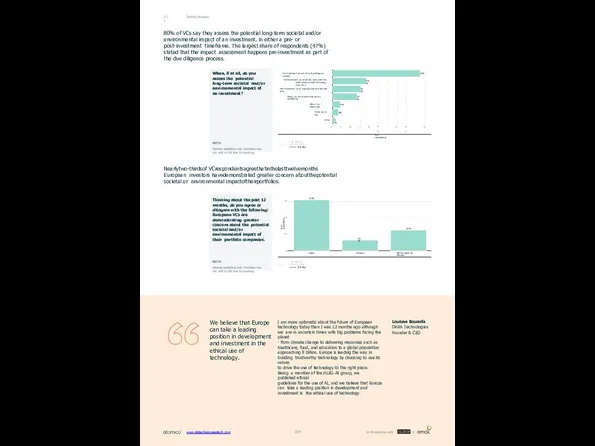

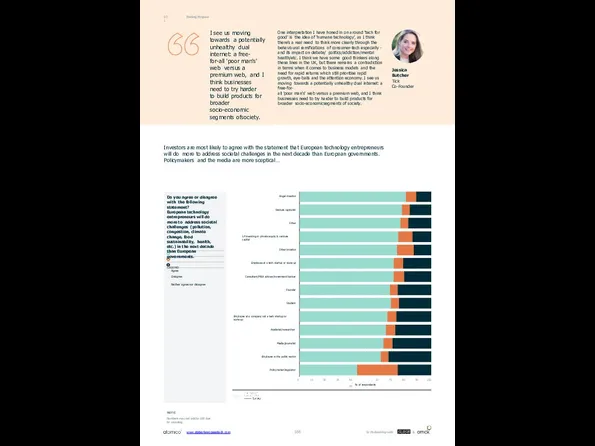

- 164. Finding Purpose 07.1 80% of VCs say they assess the potential long-term societal and/or environmental impact

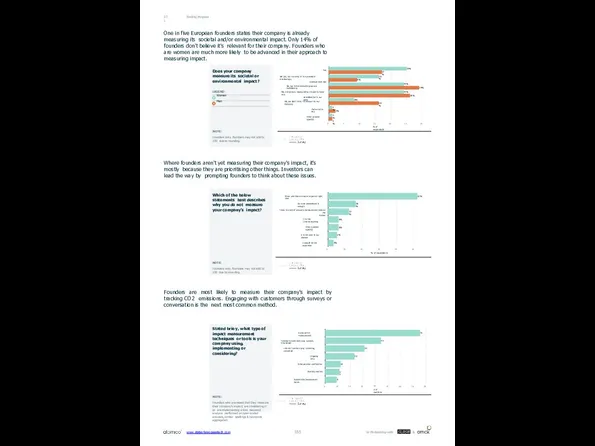

- 165. Finding Purpose 07.1 One in five European founders states their company is already measuring its societal

- 166. Finding Purpose 07.1 I see us moving towards a potentially unhealthy dual internet: a free- for-all

- 167. Finding Purpose 07.1 I'm excited to see a new generation of entrepreneurs in Europe who oppose

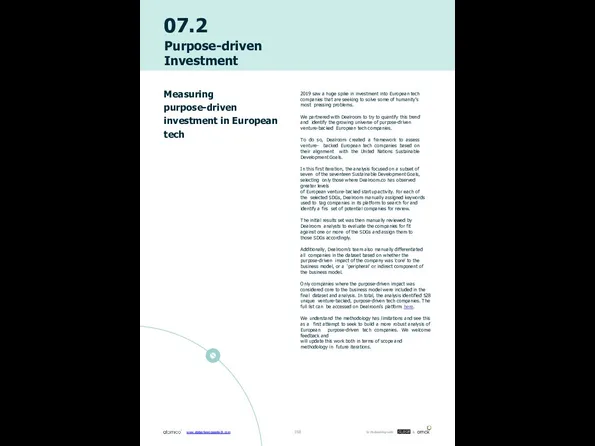

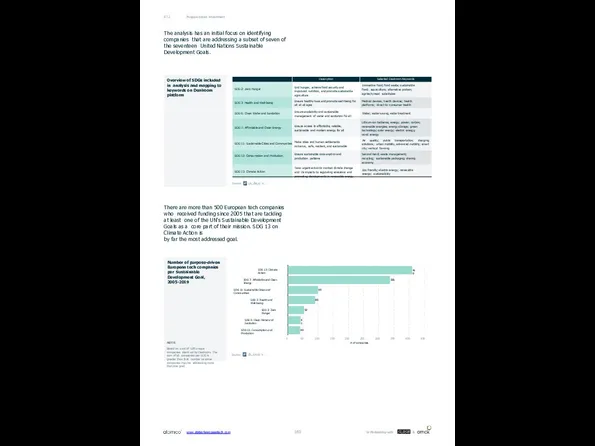

- 168. 07.2 Purpose-driven Investment Measuring purpose-driven investment in European tech 2019 saw a huge spike in investment

- 169. Purpose-driven Investment 07.2 Overview of SDGs included in analysis and mapping to keywords on Dealroom platform

- 170. Purpose-driven Investment 07.2 Germany SDG 2: Zero Hunger Netherlands SDG 3: Health and Well-being United Kingdom

- 171. In Partnership with & www.stateofeuropeantech.com

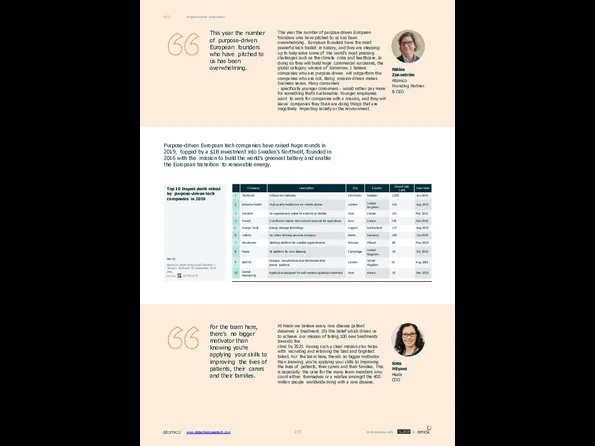

- 172. Purpose-driven Investment 07.2 This year the number of purpose-driven European founders who have pitched to us

- 173. Purpose-driven Investment 07.2 'Tech for good' generally addresses humankind's most important needs, which means the largest

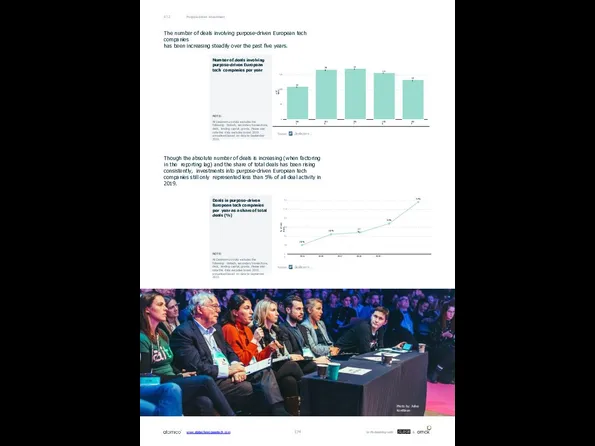

- 174. Purpose-driven Investment 07.2 The number of deals involving purpose-driven European tech companies has been increasing steadily

- 175. Purpose-driven Investment 07.2 Belgium Denmark Norway Austria Poland Portugal Russia Estonia Hungary Lithuania 0.0 0.2 0.5

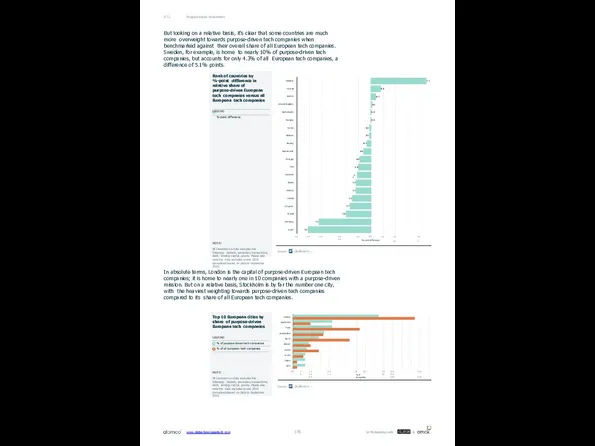

- 176. Rank of countries by %-point difference in relative share of purpose-driven European tech companies versus all

- 177. 08 Places What are the best hubs for European tech? Cluj-Napoca, Romania, Delft, the Netherlands, Minsk,

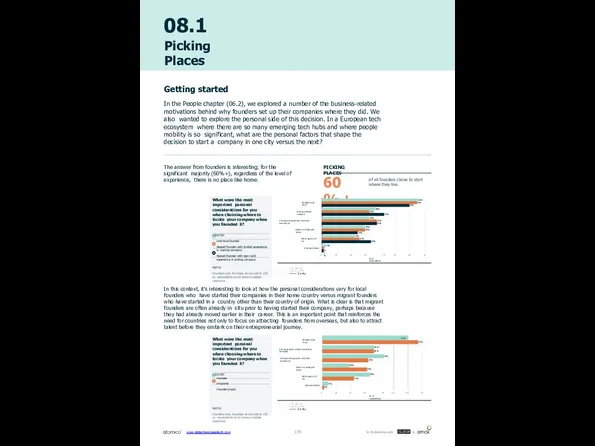

- 178. 08.1 Picking Places The answer from founders is interesting; for the significant majority (60%+), regardless of

- 179. Picking Places 08.1 Most founders alsosharedthattheyareunlikelytochangetheiroriginaldecision. Giventhechoicetostart overandto found andbuildtheircompanyagain, theoverwhelmingmajorityof founders, bothfirst-timers andrepeat, wouldchooseeithertostayexactlywheretheyareortostayin Europe,

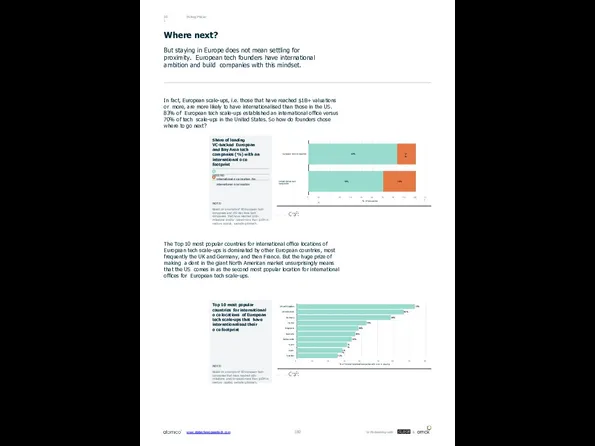

- 180. Picking Places 08.1 In fact, European scale-ups, i.e. those that have reached $1B+ valuations or more,

- 181. Picking Places 08.1 When you go to market in your own local market, you have a

- 182. $966 $364 $341 $261 $261 $239 Paris Marseille Lyon Nice Lille Bordeaux 0 100 200 300

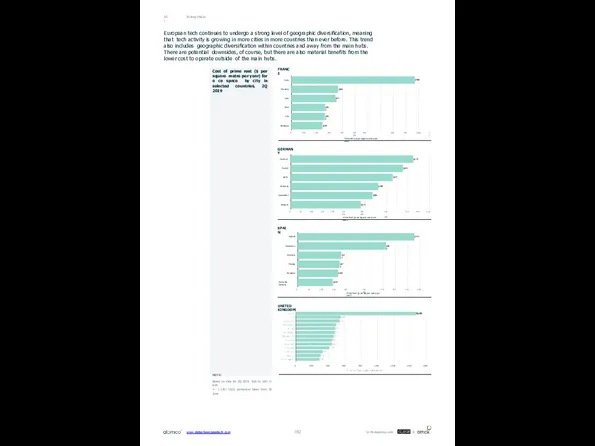

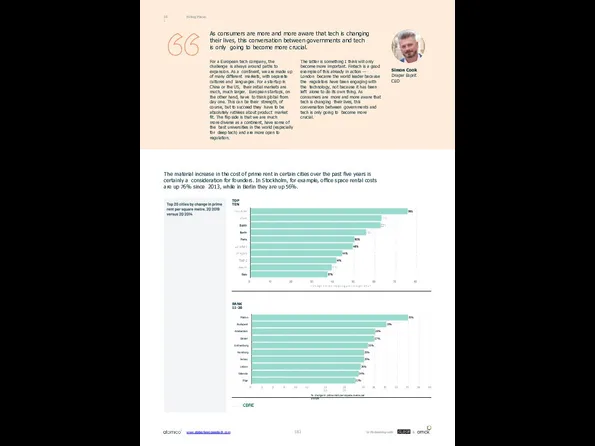

- 183. Picking Places 08.1 As consumers are more and more aware that tech is changing their lives,

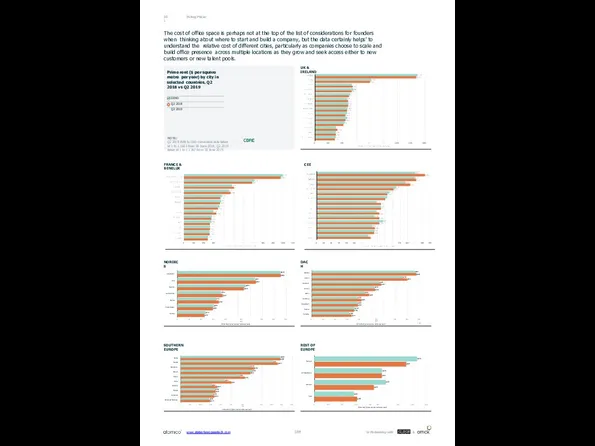

- 184. Picking Places 08.1 The cost of office space is perhaps not at the top of the

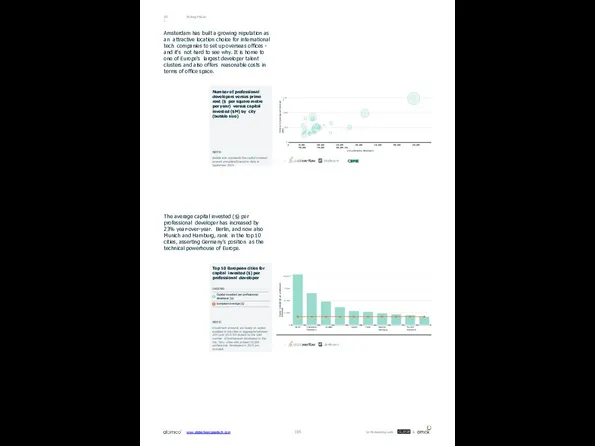

- 185. Picking Places 08.1 Amsterdam has built a growing reputation as an attractive location choice for international

- 186. Picking Places 08.1 Capital invested ($) per professional developer by country LEGEND up to 50,000 40,000

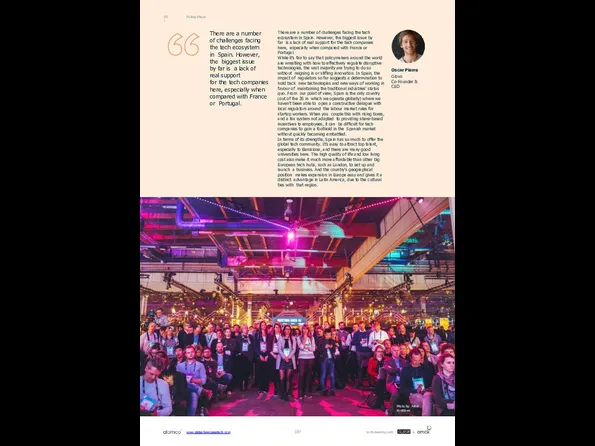

- 187. There are a number of challenges facing the tech ecosystem in Spain. However, the biggest issue

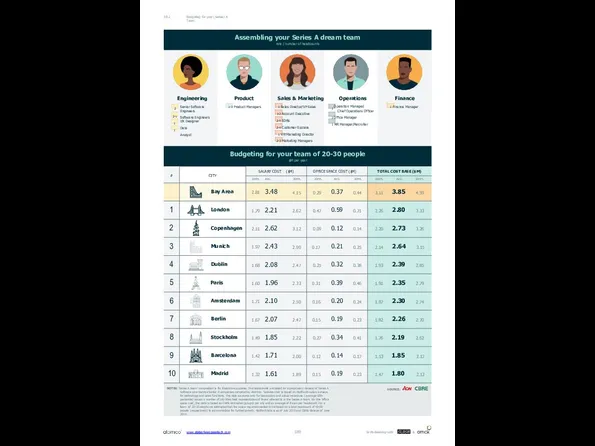

- 188. 08.2 Budgeting for your (Series) A Team 'Cheat sheet' How much does it cost to start

- 189. www.stateofeuropeantech.com In Partnership with & Budgeting for your (Series) A Team 08.2

- 190. In Partnership with & www.stateofeuropeantech.com

- 191. $529k $699k $105k $314k $168k $168k $896k $1,351k $93k $93k $470k $706k 20 people 30 people

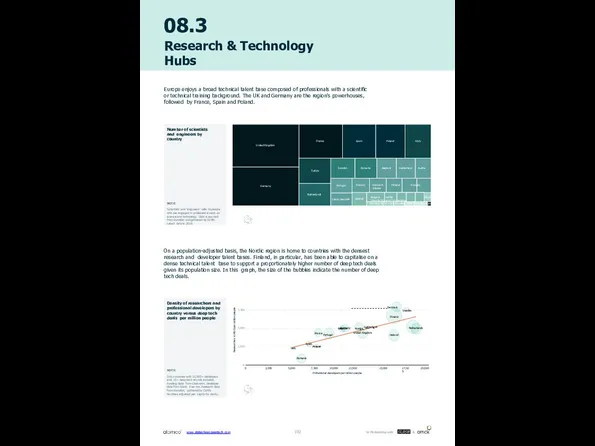

- 192. 08.3 Research & Technology Hubs Europe enjoys a broad technical talent base composed of professionals with

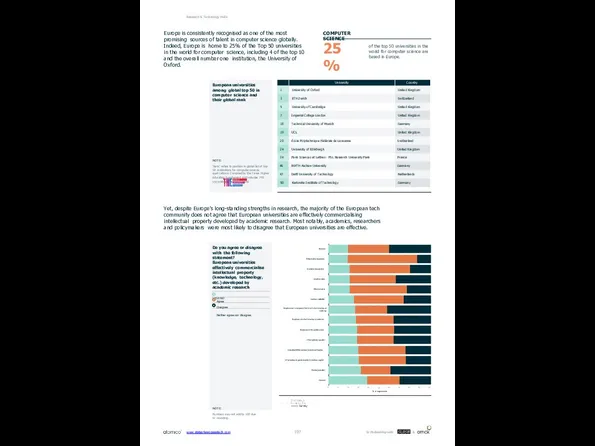

- 193. A profound and exciting wind of change is blowing through Europe. European Universities are simply among

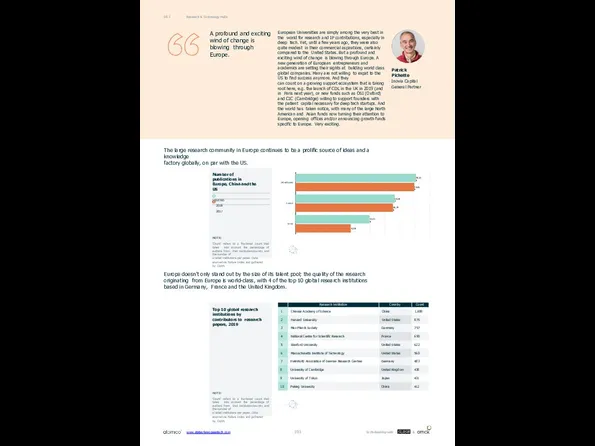

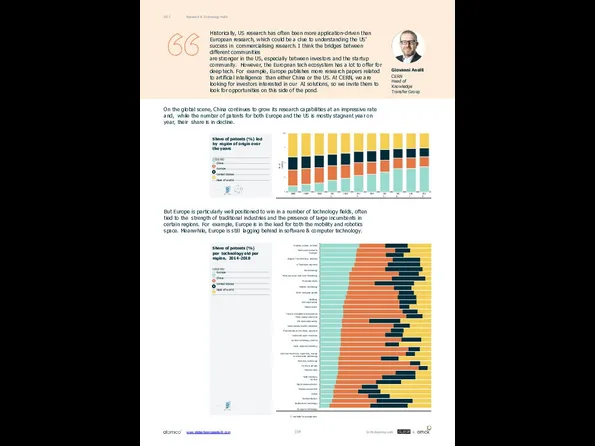

- 194. Research & Technology Hubs 08.3 Giovanni Anelli CERN Head of Knowledge Transfer Group Historically, US research

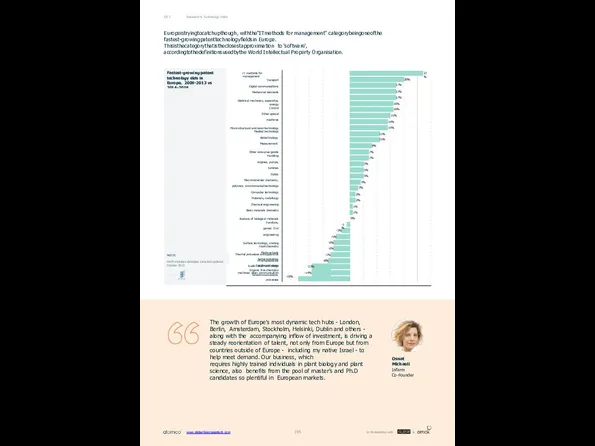

- 195. The growth of Europe's most dynamic tech hubs - London, Berlin, Amsterdam, Stockholm, Helsinki, Dublin and

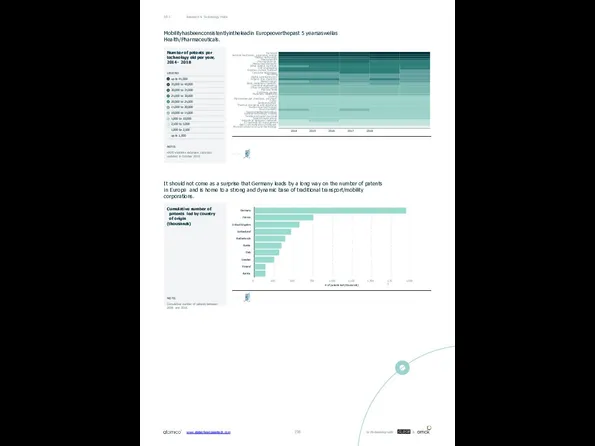

- 196. Mobilityhasbeenconsistentlyintheleadin Europeoverthepast 5 yearsaswellas Health/Pharmaceuticals. It should not come as a surprise that Germany leads by

- 197. Do you agree or disagree with the following statement? European universities effectively commercialise intellectual property (knowledge,

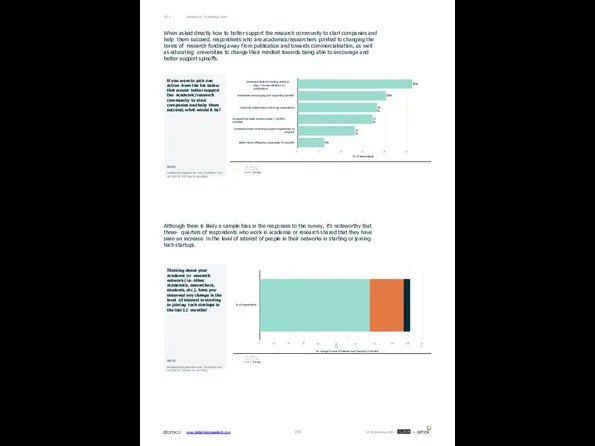

- 198. When asked directly how to better support the research community to start companies and help them

- 199. I believe the academic and business sectors are currently fragmented and stuck in tunnel vision. We

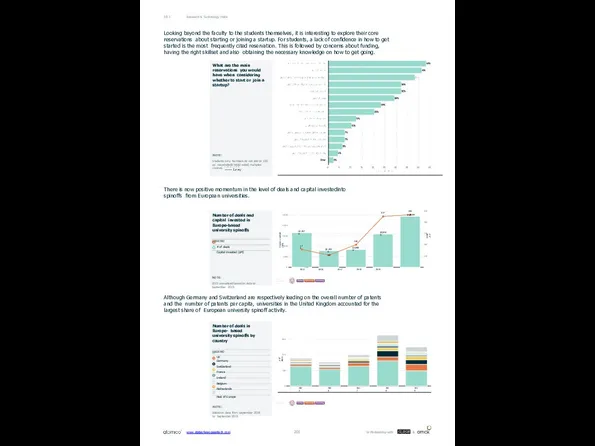

- 200. Given those concerns, it shouldn't be surprising that students themselves cite increased access to startup support

- 201. What are the main reservations you would have when considering whether to start or join a

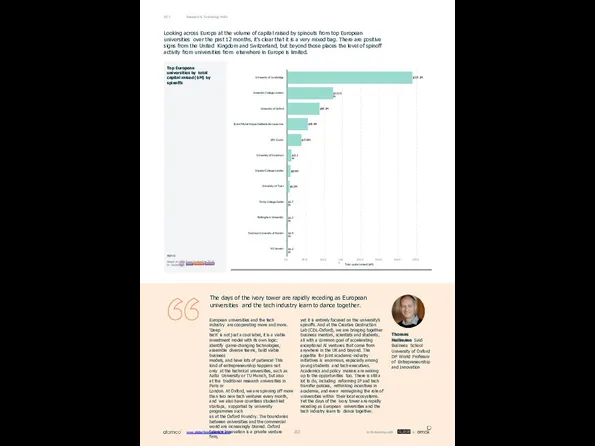

- 202. Top European universities by total capital raised ($M) by spinoffs NOTE: Based on data from September

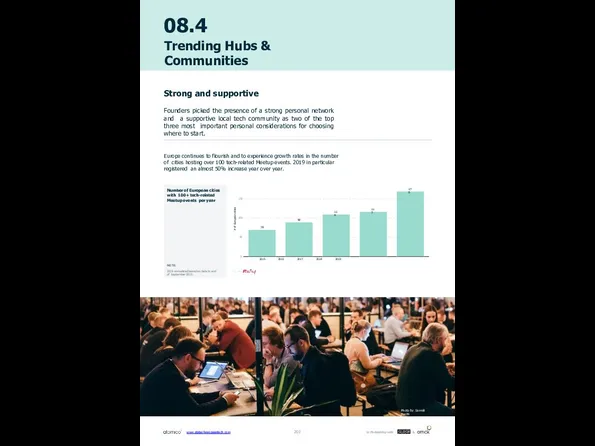

- 203. 08.4 Trending Hubs & Communities Europe continues to flourish and to experience growth rates in the

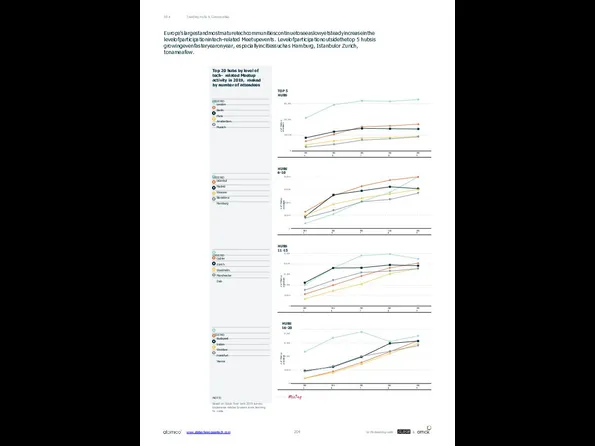

- 204. Trending Hubs & Communities 08.4 # of Meetup attendees 2015 2016 2017 2018 2019 0 20,000

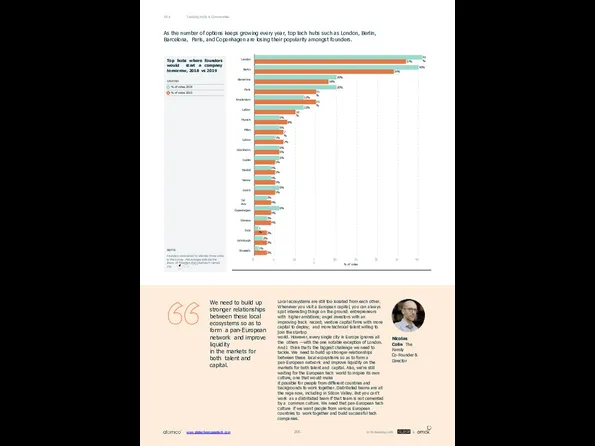

- 205. Trending Hubs & Communities 08.4 European tech communities are also expanding beyond the largest hubs. The

- 206. We need to build up stronger relationships between these local ecosystems so as to form a

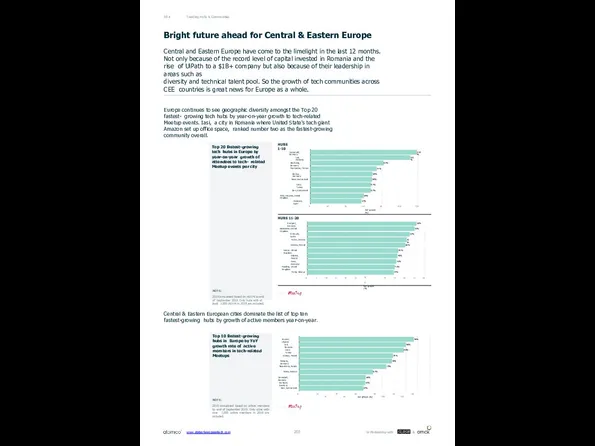

- 207. Trending Hubs & Communities 08.4 Bright future ahead for Central & Eastern Europe Central and Eastern

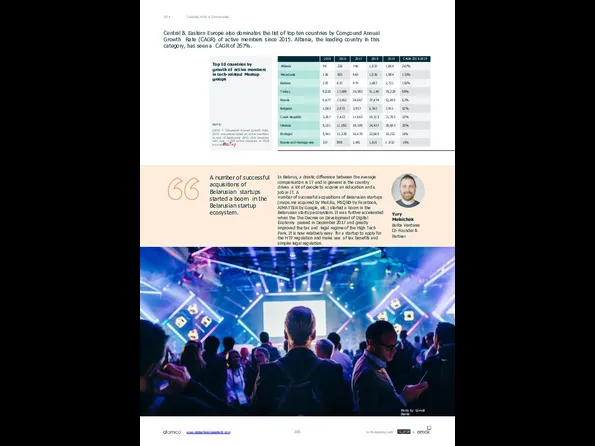

- 208. Trending Hubs & Communities 08.4 Central & Eastern Europe also dominates the list of top ten

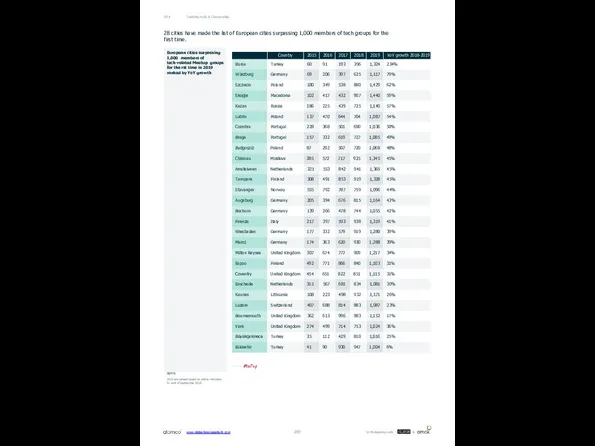

- 209. Trending Hubs & Communities 08.4 28 cities have made the list of European cities surpassing 1,000

- 210. 09 Policy What can policymakers do to best help European tech? European policymakers will play a

- 211. 09.1 Europe Policy Focus Measuring policy focus in Europe The data challenge According to our survey

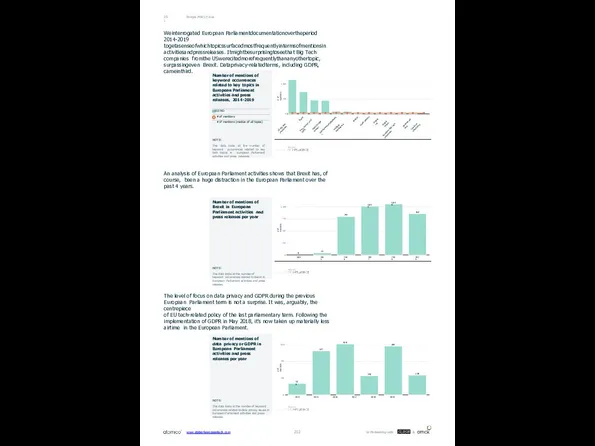

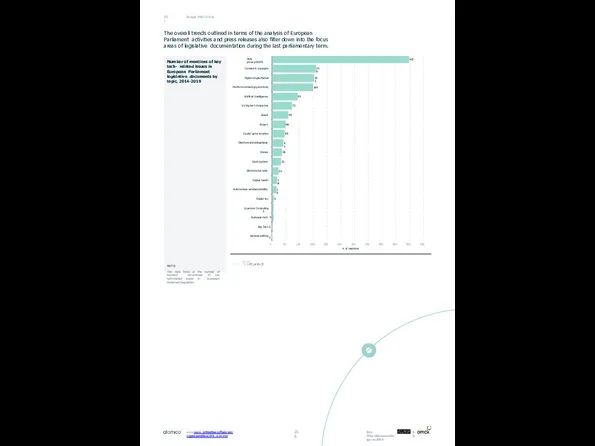

- 212. Europe Policy Focus 09.1 Weinterrogated European Parliamentdocumentationovertheperiod 2014-2019 togetasenseofwhichtopicssurfacedmostfrequentlyintermsofmentionsin activitiesandpressreleases. Itmightbesurprisingtoseethat Big Tech companies fromthe USwerecitedmorefrequentlythananyothertopic,

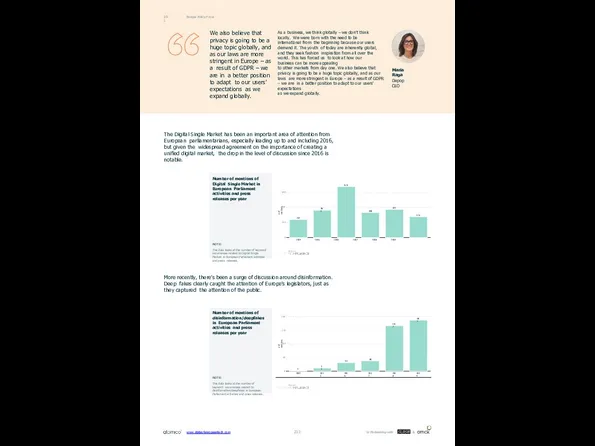

- 213. Europe Policy Focus 09.1 We also believe that privacy is going to be a huge topic

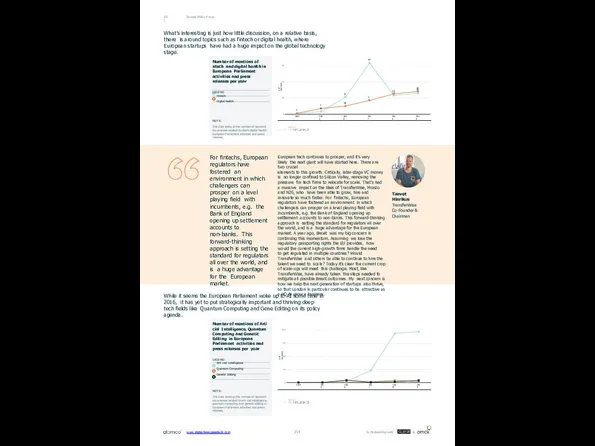

- 214. Europe Policy Focus 09.1 What’s interesting is just how little discussion, on a relative basis, there

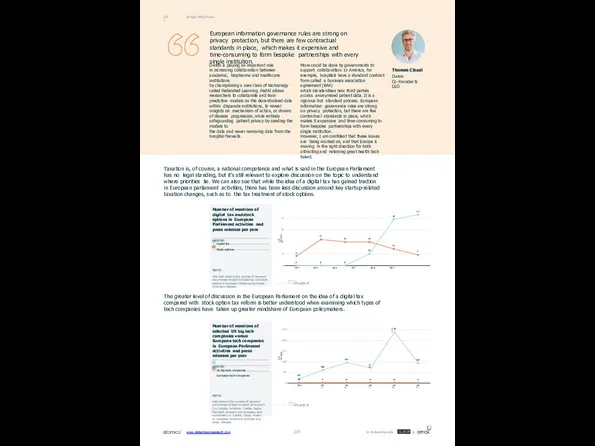

- 215. Europe Policy Focus 09.1 European information governance rules are strong on privacy protection, but there are

- 216. Europe Policy Focus 09.1 The overall trends outlined in terms of the analysis of European Parliament

- 217. The rise of AI, big data, gig workers, facial recognition technology and 5G has given rise

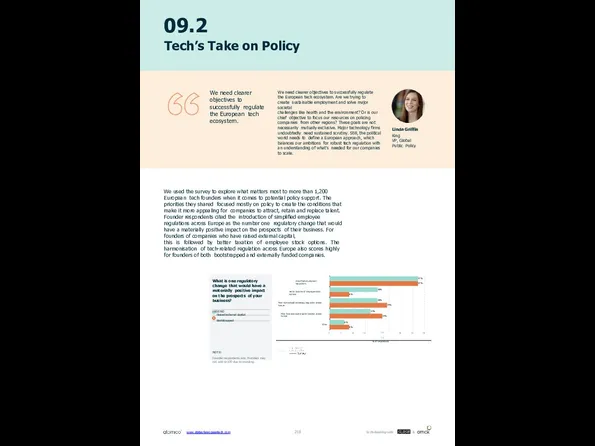

- 218. 09.2 Tech’s Take on Policy We need clearer objectives to successfully regulate the European tech ecosystem.

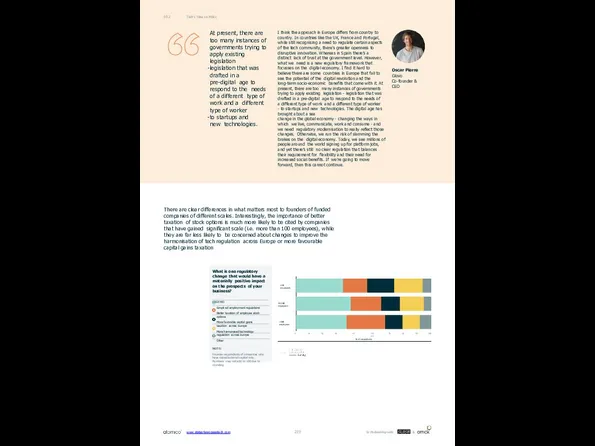

- 219. Tech’s Take on Policy 09.2 At present, there are too many instances of governments trying to

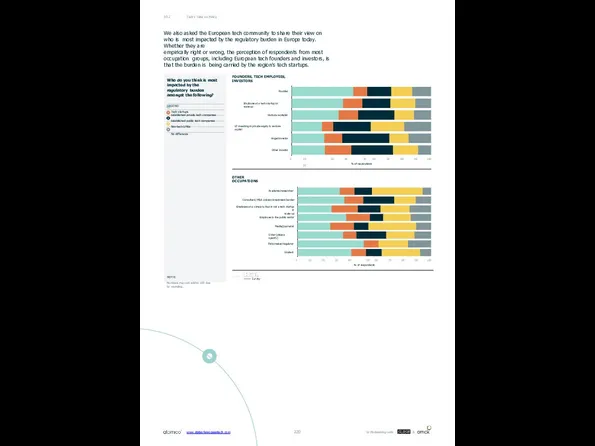

- 220. Tech’s Take on Policy 09.2 Academic/researcher Consultant/ M&A advisor/investment banker Employee at a company that is

- 221. Tech’s Take on Policy 09.2 Academic/researcher Consultant/M&A advisor/investment banker Employee at a company that is not

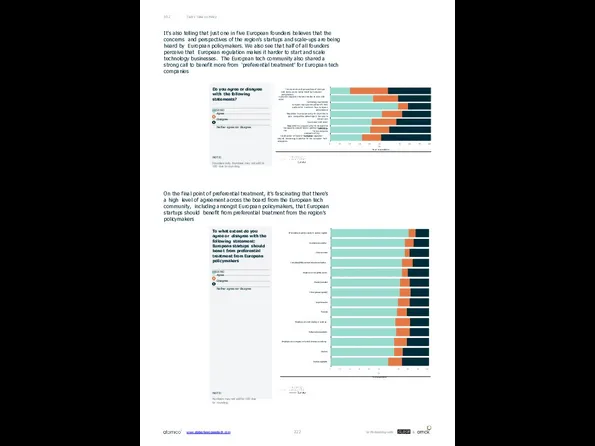

- 222. Tech’s Take on Policy 09.2 It’s also telling that just one in five European founders believes

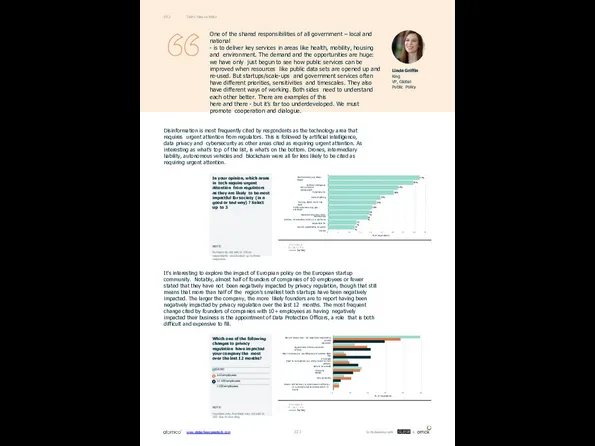

- 223. Tech’s Take on Policy 09.2 One of the shared responsibilities of all government – local and

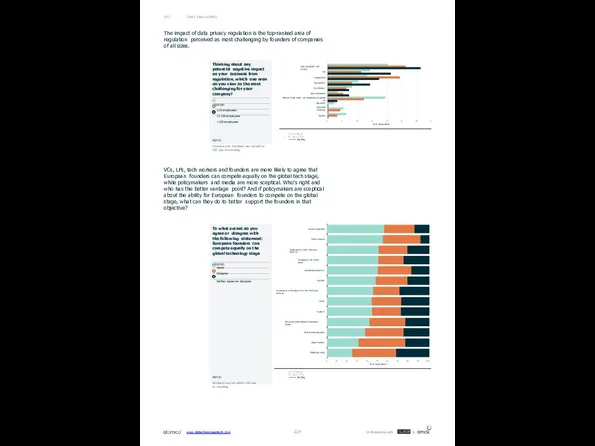

- 224. Tech’s Take on Policy 09.2 The impact of data privacy regulation is the top-ranked area of

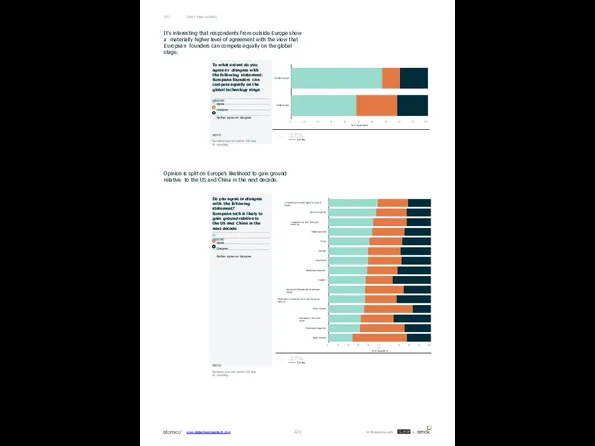

- 225. Tech’s Take on Policy 09.2 It’s interesting that respondents from outside Europe show a materially higher

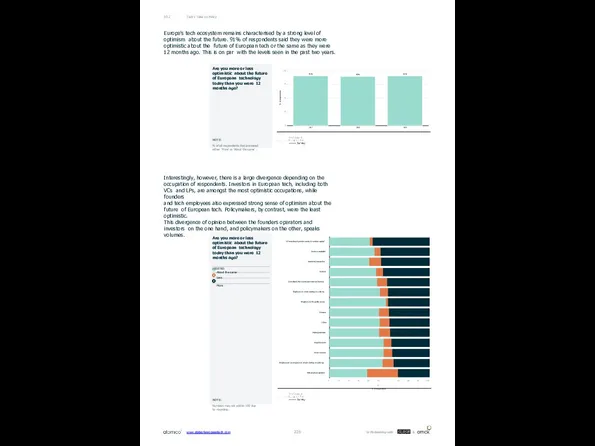

- 226. Tech’s Take on Policy 09.2 Europe’s tech ecosystem remains characterised by a strong level of optimism

- 227. Tech’s Take on Policy 09.2 There is still a wide gap between the world of policymaking

- 228. 10 About This report was produced in partnership with Slush and Orrick. Nearly 100 people and

- 229. 10.1 Our Contributors Thanks to all of the following people for their assistance and insight in

- 230. Andy Davis Backstage Capital Our Contributors 10.1 Simon Cook Draper Esprit Pierre Entremont FRST Sonali de

- 231. Our Contributors 10.1 Leila Rastegar Zegna Kindred Capital Niklas Zennström Atomico Nicky Morgan UK Secretary of

- 232. 10.2 Acknowledgements We wouldn’t have been able to put together the State of European Tech without

- 233. Our Contributors 10.1 Sarah Guemouri Atomico Ben Jakob Studio Lovelock Thierry Heles Global University Venturing Ant

- 234. Our Contributors 10.1 Tom Wehmeier Atomico Yoram Wijngaarde Dealroom The purpose-driven porpoise Self-employed Maxine Smith Atomico

- 235. 10.3 About Atomico 10.4 About Orrick www.stateofeuropeantech.com In Partnership with & But who is Orrick? Creators.

- 236. 10.4 About Slush 10.5 About Studio Lovelock www.stateofeuropeantech.com In Partnership with & Once again we’ve partnered

- 237. 11 Appendix Last but not least www.stateofeuropeantech.com In Partnership with &

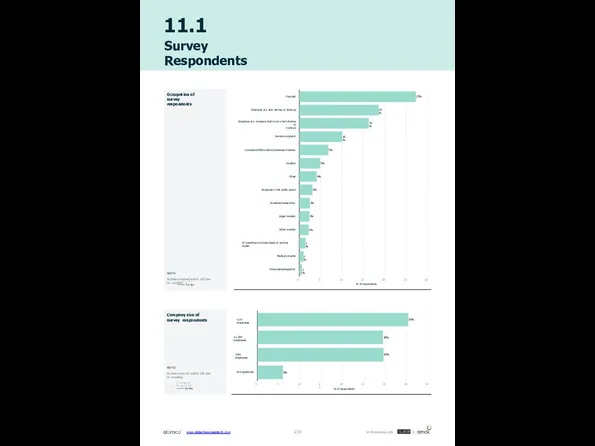

- 238. 11.1 Survey Respondents 27% 19% 16% 10% 7% 5% 4% 3% 2% 2% 2% 1% 1%

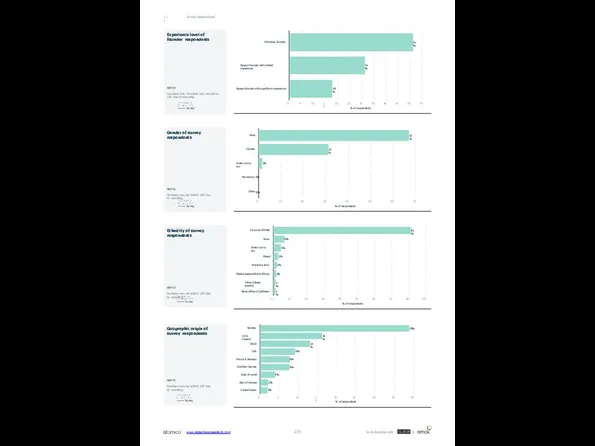

- 239. Survey Respondents 11.1 67% 31% 2% Male Female Prefer not to say Non-binary 0% Other 0%

- 240. 11.2 More About Our Data Partners Aon Radford is the technology and life sciences unit of

- 241. More About Our Data Partners 11.2 The European Business Angels Network (EBAN) EBAN, The European Business

- 242. More About Our Data Partners 11.2 Graphext Graphext provides a data science software for business decision

- 243. More About Our Data Partners 11.2 London Stock Exchange London Stock Exchange Group (LSE.L) is a

- 245. Скачать презентацию

01

2019 основные результаты

www.stateofeuropeantech.com

In Partnership with

&

01

2019 основные результаты

www.stateofeuropeantech.com

In Partnership with

&

Общие инвестиции европейских городов ($), 2015 - 2019

Мы приближаемся к отметке

Общие инвестиции европейских городов ($), 2015 - 2019

Мы приближаемся к отметке

Инвестированный в Европу капитал

01sgnidnfiyeK01

Страны (Великобритания, Германия и Франция), чей инвестированный капитал превысил $ 10млрд.l

3

29

Европейские города, привлекающие более $ 100 млн капитала, инвестированного только в 2019 году

Нажмите, чтобы изучить интерактивные графики на нашем сайте

Visualised with:

www.stateofeuropeantech.com

In Partnership with

&

Совокупное число европейских технологических компаний, поддерживаемых венчурными инвесторами по странам и

Совокупное число европейских технологических компаний, поддерживаемых венчурными инвесторами по странам и

Ознакомьтесь с историей успеха Европы на миллиард долларов

$B+ COMPANIES

02sgnidnfiyeK01

Visualised with:

Страны с венчурными компаниями, достигающие оценку в млрд дол

20

100%

Получившие Млрд дол европейские венчурные компании основанные после 2010

Нажмите, чтобы изучить интерактивные графики на нашем сайте

www.stateofeuropeantech.com

In Partnership with

&

Совокупные привлеченные венчурные фонды 2010-2014 и 2015-2019

Совокупный объем привлеченных венчурных фондов

Совокупные привлеченные венчурные фонды 2010-2014 и 2015-2019

Совокупный объем привлеченных венчурных фондов

В рекордный 2018 г европейские венчурные инвесторы собрали более 13 миллиардов долларов.

Привлеченные венчурные фонды

03sgnidnfiyeK01

$50млрд

Средства, собранные венчурными компаниями за первое полугодие 2015-2019

$902млн

рекордные инвестиции пенсионных фондов в европейские венчурные фонды в 2018 году

Нажмите, чтобы изучить интерактивные графики на нашем сайте

Visualised with:

www.stateofeuropeantech.com

In Partnership with

&

жили комфортно/оплачивали основные расходы с дополнительными остатками

81%

04sgnidnfiyeK01

21%

Респондентов являются женщинами

Ответы европейских основателей

жили комфортно/оплачивали основные расходы с дополнительными остатками

81%

04sgnidnfiyeK01

21%

Респондентов являются женщинами

Ответы европейских основателей

50% респондентов впервые являются основателями

ЕВРОПЕЙСКИЕ ТЕХНИЧЕСКИЕ УЧРЕДИТЕЛИ

Мы опросили более 1200 основателей со всей Европы.

Исследуйте набор данных!

Нажмите, чтобы изучить интерактивные графики на нашем сайте

Visualised with:

www.stateofeuropeantech.com

In Partnership with

&

на каждые вложенные 100дол основатели мужчины

$92

1 к 12

На каждую

на каждые вложенные 100дол основатели мужчины

$92

1 к 12

На каждую

Капитал, инвестированный основателями по гендерному признаку

РАЗНООБРАЗИЕ И ИНКЛЮЗИВНОСТЬ

Отсутствие существенного повышения доли капитала, вложенного в европейские технологические компании в различные группы основателей.

01 Key findings

05

Нажмите, чтобы изучить интерактивные графики на нашем сайте

.

Visualised with:

www.stateofeuropeantech.com

In Partnership with

&

$4.4млрд 12.3%

капитал, вложенный в целевые европейские от объема капитала, инвестированного

технологические

$4.4млрд 12.3%

капитал, вложенный в целевые европейские от объема капитала, инвестированного

технологические

в два раза больше, чем в прошлые годы

С

С 2005 года создано более 500 европейских технологических компаний, которые считают устойчивое развитие основной частью своей миссии.

Целевые инвестиции

ЦЕЛЬ

06sgnidnfiyeK01

Нажмите, чтобы изучить интерактивные графики на нашем сайте

.

Visualised with:

www.stateofeuropeantech.com

In Partnership with

&

02

Состояние европейских технологий2019

Почему Европа не может заниматься технологиями?

Пора перестать задавать этот

02

Состояние европейских технологий2019

Почему Европа не может заниматься технологиями?

Пора перестать задавать этот

www.stateofeuropeantech.com

In Partnership with

&

02.1

www.stateofeuropeantech.com

In Partnership with

&

At this point, we were amongst a growing but

02.1

www.stateofeuropeantech.com

In Partnership with

&

At this point, we were amongst a growing but

Belief is as vital as talent or capital when it comes to building tech companies. However, in 2015, belief in the European ecosystem was limited to the European tech industry itself.

Fast forward to 2019, and while the world’s media may have focused on Chinese-US trade disputes and volatility on the public markets, European tech has quietly increased its number of external believers. We see this everywhere, from the increased time top US investors are spending on the ground here to the fact that a fifth

of European rounds this year had at least one US or Asian investor participating - a proportion which grows as the deal size increases. VCs are reporting increasing interest from global LPs, while previously unconvinced European Institutional Investors are now fully engaged. We’re also seeing valuations and pre-emptive term sheets on the increase in Europe - always a sign that competition to invest in the best tech companies is accelerating, as well as a reflection on the quality of the opportunity.

In fact, European tech companies are performing at a level exceeding the expectations of all but the most optimistic. In 2015, we celebrated $10B of investment into the region’s tech companies. This year, $35B seems par for the course. That year, our report concerned itself with the late-stage funding gap: in 2019, 40 different European tech companies were able to raise

$100M+ rounds. To date, there are now at least 174 European tech companies that have scaled to a valuation of over $1B - including 99 venture-backed companies.

However, we can’t afford to be complacent - or to lose focus. Now that we’ve instilled the external as well as internal belief,

it’s up to us to shape our own destiny when it comes to the future of European tech. We hope this report provides inspiration and guidance: we need to address our D&I issues, acknowledge the importance of well-being, foster a generation of purpose-driven companies, reinforce the density of our networks of people

and capital, and end the disconnect between policymakers and founders.

A word on our D&I issues: we won’t realise our full potential until we stop squandering talent and value.

Если мы сможем обеспечить, безопасность демографических показателей и многолетнего опыта, у нас будет огромное конкурентное преимущество перед другими частями света, которые менее всеобъемлющи.

Мы надеемся, что этот отчет является полезным исследованием, который является обоснованным подтверждением способностей Европейцев создавать технологические компании. Однако этот отчет-не последнее и не единственное слово о европейских технологиях. Мы рекомендуем вам посетить города, выходящие за рамки тех, которые вы обычно посещаете, и живущие широкими и разнообразными технологическими площадками, которые вместе представляют собой крупнейшую экономическую силу экономического роста во всей Европе

Мы пишем этот отчет, чтобы пролить свет на европейскую технологическую систему. Он намеренно обеспечивает макро взгляд на ландшафт и предназначен для исследования, полезного для максимально возможного количества людей. . Дело в том, что каждый город имеет свою собственную невероятную историю с собственным микро-составом основателей, сотрудников, компаний, инвесторов и университетов, помогающих продвигать технологии как на местном, так и на региональном уровне. Мы инвестировали в 20 европейских городов в 15 странах, но мы помним о том, что у нас есть и слепые зоны. С каждым годом мы наблюдаем, что европейские технологии становятся все более взаимосвязанными - каждый из нас должен воплотить это в жизнь и гарантировать, что эти связи будут продолжаться. Создав прочность талантов и опыта, мы увидим что технологические знания более эффективно передаются будущим и нынешним поколениям европейских основателей. Это поможет нам достичь плотности населения в Европе: обеспечив равномерное распределение талантливых разработчиков и исследователей с капиталом по всему континенту, наш и без того стремительный прогресс ускорится еще быстрее. Когда мы начинали в 2015 году , мы верили, что европейский успех останется без внимания. Сегодня вера в европейские технологии приходит как извне нашей экосистемы, так и изнутри. Принято считать, что вы можете собрать необходимые деньги, нанять лучшую команду и выйти на международный уровень, не мигрируя в США. На самом деле ничто так не демонстрирует этот сдвиг, как приток американского капитала увеличившегося в пять раз в 2018 году.

Предисловие к докладу 2019 года

Многое изменилось с тех пор, как мы представили первый отчет о состоянии европейских технологий в 2015 году . В тот год президент Обама отмечал первую годовщину соглашения по климату с Китаем, в то время как Совет Европы размышлял над письмом премьер- министра Великобритании Дэвида Кэмерона, в котором излагались будущие отношения Великобритании с Евросоюзом. Будущее имеет обыкновение высмеивать прошлые прогнозы, но иногда они действительно попадают в цель. Тогда мы считали, что технологии в Европе уже испытали прорывной год, став платформой для большего успеха. Однако это убеждение оказалось неуместным.

5 Years of SOET

02.1

Тем не менее, нам нужно убедиться, что мы

5 Years of SOET

02.1

Тем не менее, нам нужно убедиться, что мы

Нам есть чем гордиться и над чем работать. В этом году мы отмечаем пятый день рождения нашего доклада. Что еще более важно, мы празднуем пять лет поразительного роста европейской технологической экосистемы. Сравнение того, где мы сейчас находимся, с тем, где мы были в 2015 году, показывает, как далеко продвинулась Европа.

Сейчас

2015-2019

5 лет назад

2010-2014

22

$млрд. венчурного капитала

99

$млрд с венчурным капиталом

Компании с венчурным капиталом

3

страны, привлекающие $1 млрд капитала в год

7

страны, привлекающие $1 млрд капитала в год

СТРАНЫ

$34млрд

за. 2010-2014

$113млрд

за 2015-2019

Инвестированный капитал

76

2010-2014

148

2015-2019

выход>$100M

$25млрд

>$50млрд

Привлеченные венчурные фонды

9

Этапы в 2014

40

Этапы в 2019

$100M+ этапы

10%

Этапов в 2014

21%

Этапов в 2019

% этапов с американскими и азиатскими инвесторами

4.7m

4.1m для США

6.1m

4.3m для США

Проф. разработчики

7.2%

Капитала в 2014

8.4%

Капитала в 2019

% капитал, вложенный в смешанную/женскую команду

www.stateofeuropeantech.com

In Partnership with

&

02.2

Основные положения

www.stateofeuropeantech.com

In Partnership with

&

В 2019 году 92% финансирования досталось мужским командам,

02.2

Основные положения

www.stateofeuropeantech.com

In Partnership with

&

В 2019 году 92% финансирования досталось мужским командам,

Что также становится все более очевидным, так это то, что женщины-капиталисты продолжают решать проблемы разнообразия Европы: 63% из них сообщили нам, что они увеличили свое внимание на посещение мероприятий с более активным участием различных учредителей против 36%мужчин. Это особенно проблематично, поскольку в докладе за этот год показано, что венчурные капиталисты не увеличили долю женщин на уровне партнеров. Один положительный момент - в быстро растущей отрасли глубоких технологий, мы обнаружили, что 23% европейских квантовых компаний имели смешанную или возглавляемую женщинами команду основателей, что более чем вдвое превышает средний показатель по Европе-13%.Это неудивительно, учитывая большую долю исследователей и ученых, которые являются женщинами: как показывает доклад, женщины фактически составляют более половины населения ученых и инженеров в Литве, Болгарии, Латвии и Дании.

В ходе этого процесса возник целый ряд идей, начиная от детальной информации о том, как основатели на ранних стадиях финансировали свой бизнес, и заканчивая возрастным составом компаний, которые оценивались в миллиарды долларов. Мы также смогли изучить интенсивное личное становление, которое влечет за собой строительство компании, в отчете за этот год. Мы собрали набор данных, который без сомнения демонстрирует, что многие основатели хотят получить помощь.

Целых 57% учредителей, которые привлекли внешний капитал, заявили, что они были бы признательны за поддержку со стороны Совета директоров или инвесторов. В других странах есть положительные стороны : мы обнаружили, что Европейский профессиональный союз разработчиков по- прежнему глубже, чем в США (6,1 млн против 4,3 млн), в то время как на более поздних стадиях европейские компании сокращают разрыв с США в использовании фондовых условий для стимулирования инвестиций.

Состояние разнообразия и вовлеченности

Этот отчет показывает, что европейское разнообразие и вовлеченность все еще недостаточно развиты.

Люди

Опираясь на ответы опроса учредителей , мы набросали портрет того, как выглядит типичный европейский технологический основатель в 2019 году , и как их проблемы меняются по мере увеличения их компании.

Executive Summary

www.stateofeuropeantech.com

In Partnership with

&

02.2

Теперь это обещание выполняется, и двадцать стран создают

Executive Summary

www.stateofeuropeantech.com

In Partnership with

&

02.2

Теперь это обещание выполняется, и двадцать стран создают

Место

Каждый год наши данные выделяют целый ряд технологических центров, которые показывают многообещающие результаты .

Инвесторы поддержали целевые европейские технологические компании с капиталовложениями в размере более $4 млрд в 2019 году, увеличившись более чем в 6 раз за последние пять лет - с учетом того, что совокупный объем инвестиций с 2015 года приблизился к $10 млрд. Dealroom.co была создана основа для оценки европейских технологических компаний с венчурной поддержкой на основе их соответствия целям устойчивого развития Организации Объединенных Наций. Анализ был сосредоточен на совокупности семи из семнадцати Целей устойчивого развития (ЦУР), отобрав только те, где Dealroom наблюдал более высокий уровень активности европейских венчурных стартапов. Мы обнаружили, что более 500 европейских технологических компаний, основанных с 2005 года, решают по крайней мере одну из этих семи целей в качестве основной части своей миссии.

Цель

По наблюдению Маргрет Вестэджер в настоящем докладе рассматривается вопрос о том, что европейские технологии отличаются друг от друга по целевому назначению

Слишком многие основатели все еще пребывают в неведении относительно видения европейской политики в области технологий: 40% опрошенных нами основателей и сотрудников стартапов заявили нам, что они не чувствуют себя информированными о цифровых приоритетах Европейской комиссии. Наш отчет показывает, что основатели технологий призывают к упрощенному регулированию занятости, в то время как данные Politico говорят о том, что внимание политиков находится в другом месте: они меньше сосредоточены на цифровом едином рынке, чем два года назад, и больше сосредоточены на создании цифрового налога и деятельности из крупных американских технологических фирм. Европейские истории успеха, такие как финтех и цифровое здравоохранение, также редко обсуждаются политиками. Мы должны обеспечить, чтобы европейские политики и основатели смотрели в том же направлении, если Европа хочет реализовать свой потенциал.

Политика

Чтобы реализовать потенциал европейских технологий, сложная и четкая политика будет иметь ключевое значение , поэтому необходим диалог

Наиболее перспективные европейские компании предпочитают больше и дольше оставаться частными, а

Наиболее перспективные европейские компании предпочитают больше и дольше оставаться частными, а

Во многом это было вызвано большими раундами финансирования: 40% всего финансирования, привлеченного европейскими технологическими компаниями за первые девять месяцев 2019 года, было в сделках больше $100 млн. Хотя в 2019 году не было европейского IPO с венчурной поддержкой в $1B, мы действительно видим амбиции масштабироваться до огромных результатов в экосистеме.

IPO больше не входят в повестку дня каждого основателя, но сколько бы капитала ни поступал в регион, они всегда будут осторожно относиться к повышению следующего раунда

Инвестиции

В отличие от США и Китая, инвестиции в европейские технологии продолжают расти.

Данные кембриджской ассоциации по доходности венчурных инвестиций показывают, что индексы по Европе либо находятся на одном уровне, либо значительно превосходят показатели как американских так и европейских прямых инвестиций.

Даже несмотря на то, что инвестиции государственных агентств в венчурные фонды упали почти на $1 млрд в 2018 году , фактически мы наблюдаем всплеск инвестиций в пенсионные фонды, что на 203% больше, чем в прошлом году.

Отчет этого года отслеживает больше инвесторов, чем когда- либо прежде, от новичков до 2600 уникальных институциональных инвесторов, участвующих в европейской сделке в 2019 году .

И давайте не будем забывать о корпоративных инвесторах, таких как Unilever Ventures или Next 47, которые участвовали в 1 из 5 сделок в 2019 году или рост интереса инвесторов из- за рубежа: в прошлом году 21% европейских раундов имели по крайней мере одного американского или азиатского инвестора- по сравнению с 10% в 2015 году.

Инвесторы

После успеха европейской технологической экосистемы в последние пять лет, нет ничего удивительного в том, что европейская венчурная индустрия чувствует себя вполне здорово.

Executive Summary

02.2

Photo by: Jussi Hellsten

www.stateofeuropeantech.com

In Partnership with

&

02.3

Компания Slush

www.stateofeuropeantech.com

In Partnership with

&

Мы считаем, что предпринимательство - это один из

02.3

Компания Slush

www.stateofeuropeantech.com

In Partnership with

&

Мы считаем, что предпринимательство - это один из

Однако Европа только начинает осознавать тот факт, что предпринимательство не является одинаково доступным для всех. И для того, чтобы увидеть разного рода проблемы, нужны разные люди. Slush по- прежнему стремится освещать более широкий спектр ролевых моделей для следующего поколения основателей через наши мероприятия и недавно запущенные средства массовой информации .

Учитывая эти достижения, рекордные инвестиции в европейские технологии- это явный признак динамичной экосистемы. Одним из наиболее обнадеживающих событий является рост предпринимательских амбиций, о чем свидетельствует количество инвестиционных раундов на поздних стадиях: европейские компании больше не продают свои активы на ранних сроках , а продолжают расти как самостоятельные предприятия. Это создает надежду на исключительно положительные времена, когда основатели и ключевые сотрудники этих историй успеха начинают свой второй этап построения компании.

Andreas Saari

CEO, Slush

02.4

Компания Orrick

www.stateofeuropeantech.com

In Partnership with

&

Развитие технологий по-прежнему опережает регулирование. Отчет демонстрирует, что

02.4

Компания Orrick

www.stateofeuropeantech.com

In Partnership with

&

Развитие технологий по-прежнему опережает регулирование. Отчет демонстрирует, что

Мы также призываем директивные органы рассмотреть возможности упрощения и рационализации требований к соблюдению требований, увеличивая нагрузку по мере расширения компании (и риска). Это особенно важно в сфере регулирования занятости. В противном случае мы рискуем возложить непомерное бремя на стартапы – и задушить их способность расти, внедрять инновации и создавать те самые рабочие места .

Интеграция по- прежнему является сложной задачей для данного сектора, поскольку только 8% финансирования приходится на компании, возглавляемые смешанными гендерными и женскими командами. Однако на уровне компании более 40% членов команды видят улучшение. В докладе также отмечается, что более половины инвесторов и сотрудников стартапов до сих пор не имели преимуществ от неосознанных предубеждений.

Социальная наука не оставляет никаких сомнений в том, что более инклюзивное лидерство будет порождать больше инноваций и отдачи.

Европейская комиссия должна уточнить свои приоритеты в области регулирования.

Технологии-это двигатель европейского роста, как ясно видно из отчета о состоянии европейских технологий в этом году. Технологическая экосистема Европы хорошо налажена и устойчива, с рекордным финансированием, опытными основателями и инвесторами, а также ускоряющимся ростом. Европейские технологические компании, скорее всего, достигнут $34 млрд финансирования в 2019 году, по сравнению с $25 млрд в 2018 году. За последние пять лет объем финансирования увеличился более чем вдвое. Это включает в себя более 40 $100 млн сделок в этом году – больше, чем когда-либо прежде. ПО всей Европе сейчас насчитывается 174 $ млрд+ технологических единорогов. В 2010 году их было всего 18 – Это в 10 раз больше, чем за последние десять лет. А в 20 странах сейчас есть по крайней мере один единорог, вдвое больше, чем всего пять лет назад. Сегодня в 170 городах есть технологические сообщества, по сравнению с 70 четыре года назад. Хотя в этом году число сделок по слияниям и поглощениям сократилось, за последние пять лет их было в два раза больше, чем за предыдущие пять лет. А стоимость сделки по слияниям и поглощениям уже близка к тому, чтобы превысить прошлогоднюю сумму в $100 млрд.

Что потребуется для поддержания успеха Европы? В докладе говорится о четырех вещах:

Поменять отношение к ценности интеграции; за этим должны следовать инвестиции

A word from Orrick

02.4

Более 85% учредителей говорят, что они заботятся о

A word from Orrick

02.4

Более 85% учредителей говорят, что они заботятся о

Почти 20% основателей говорят, что запуск компании оказал “в основном негативное” влияние на их психическое здоровье, а подавляющее большинство-на психическое здоровье людей. Большинство заявило, что они приветствовали бы большую поддержку со стороны инвесторов в управлении давлением, с которым они сталкиваются. Здоровье основателя является важным фактором общего здоровья экосистемы. Мы считаем, что акцент на инклюзивность может помочь и здесь. Мы невероятно благодарны компании Atomic за то, что она собрала и поделилась богатой информацией о рынке в этом отчете. В Orrick мы с нетерпением ожидаем продолжения нашей работы с Европейским технологическим сообществом для создания еще более сильной европейской платформы. За последние 15 кварталов мы консультировали больше венчурных сделок в Европе, чем любая другая юридическая фирма – в 2,5 раза. И мы поддержали более 20 компаний единорогов юридическими, нормативными и коммерческими консультациями с момента их создания. Это невероятная честь-быть частью вашей истории успеха.

Устойчивость- это верх ума – но есть место для большей сосредоточенности.

Как общество, мы должны заботиться о психическом здоровье и стабильности

Chris Grew

Партнер Группы Технологических Компаний Orrick

Photo by: Jussi Hellsten

www.stateofeuropeantech.com

In Partnership with

&

03

Инвестиции

Сколько венчурные капиталисты вкладывают в европейские технологии?

Как вы оцениваете доходность европейских

03

Инвестиции

Сколько венчурные капиталисты вкладывают в европейские технологии?

Как вы оцениваете доходность европейских

www.stateofeuropeantech.com

In Partnership with

&

S15.3B S16.5B

S22.6B S24.6B

S34.3B

S49.0B

S52.8B

S85.5B

S117.8B

S62.5B

2015 2016 2017 2018 2019

Европа

2015 2016 2017 2018 2019

Азия

2015

S15.3B S16.5B

S22.6B S24.6B

S34.3B

S49.0B

S52.8B

S85.5B

S117.8B

S62.5B

2015 2016 2017 2018 2019

Европа

2015 2016 2017 2018 2019

Азия

2015

США

S79.8B

S66.4B

S71.5B

S118.2B S116.7B

125.0

100.0

75.0

50.0

25.0

0.0

Venture capital invested (SB)

03.1

Инвестиционный кадр

В отличие от США и Азии, где инвесторы отступили от рекордного уровня инвестиций в 2018 году , инвестиции в европейские технологии продолжают расти. Несмотря на снижение в США в 2019 году , объем инвестированного в США капитала все равно окажется примерно в 3,4 раза выше уровня Европы за год.

Во втором квартале 2019 года впервые за один квартал в европейские технологические компании было инвестировано более $10 млрд. За первые девять месяцев текущего года европейские технологические компании привлекли в среднем около $ 3,3 млрд в месяц.

За последние пять лет объем капиталовложений в Европу увеличился на 124%. С 2018 года это число выросло более чем на 39%.

Во втором квартале 2019 года наблюдался самый большой в истории период для капитала, инвестированного в европейские технологические компании.

КАПИТАЛ, ИНВЕСТИРОВАННЫЙ В ЕВРОПУ

Капитал, инвестированный во втором квартале 2019 года

$11.6МЛРД

$34.3млрд

Capital invested ($B)

# of deals

2015 Q1

2015 Q2

2015 Q3

2015 Q4

2016 Q1

2016 Q2

2016 Q3

2016 Q4

2017 Q1

2017 Q2

2017 Q3

2017 Q4

2018 Q1

2018 Q2

2018 Q3

2018 Q4

2019 Q1

2019 Q2

2019 Q3

0.0

2.5

5.0

7.5

10.0

12.5

800.0

1,000.0

1,200.0

1,400.0

1,600.0

1,800.0

Инвестированный капитал ($млрд) в Европе, США и Азия по годам

Инвестированный капитал ($млрд) и количество сделок за квартал

LEGEND

Capital invested ($B) # of deals

Примечание:

Dealroom.co исключают следующие данные: биотехнологии, вторичные сделки, долги, кредиты, гранты. Обратите также внимание, что эти данные не включают Израиль.

www.stateofeuropeantech.com

In Partnership with

&

Похоже на то, что сейчас для Европы наступил золотой век: качество

Похоже на то, что сейчас для Европы наступил золотой век: качество

Европейские стартапы строят глобально определяющие потребительские и корпоративные бизнесы с большим успехом. Spotify, UiPath, Adeyn - все это яркие примеры. Я думаю, что эти и другие ролевые модели сыграли решающую роль в вдохновении нового и совершенного поколения основателей, которые теперь выбирают предпринимательство в качестве своего карьерного пути.

Sonali de Rycker

Accel Partner

Investment Snapshot

03.1

Неизбежно наблюдаются взлеты и падения с точки зрения последовательных ежеквартальных сумм, инвестируемых в европейские технологические компании, но с учетом 12-месячного обзора инвестированного капитала показывает долгосрочную восходящую траекторию вложений, инвестированного в регион

Увеличение числа крупномасштабных сделок на сумму более 100 миллионов долларов является движущей силой роста общего объема капитала, инвестированного в Европу. В 2019 году на эти сделки приходилось 36% всего финансирования, привлеченного европейскими технологическими компаниями.

# OF DEALS

CAPITAL INVESTED ($B)

Capital invested ($B)

2015 Q1 2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3

0.0

10.0

20.0

30.0

40.0

Capital invested ($M) / # of deals

2015

2016

2017

2018

2019

0.0

10.0

20.0

30.0

Capital invested ($M) / # of deals

2015

2016

2017

2018

2019

0.0

1,000.0

2,000.0

3,000.0

4,000.0

Конечный 12-месячный инвестированный капитал ($млрд)

Dealroom.co исключают следующие данные: биотехнологии, вторичные сделки, долги, кредиты, гранты. Обратите также внимание, что эти данные не включают Израиль.

Инвестированный капитал ($млрд) и количество сделок

LEGEND

$0M-$2M

$2M-$5M

$5M-$10M

$10M-$20M

$20M-$50M

$50M-$100M

$100M+

Dealroom.co исключают следующие данные: биотехнологии, вторичные сделки, долги, кредиты, гранты. Обратите также внимание, что эти данные не включают Израиль.

www.stateofeuropeantech.com

In Partnership with

&

Investment Snapshot

Несколько крупных сделок оказывает существенное влияние на годовой уровень капиталовложений

Investment Snapshot

Несколько крупных сделок оказывает существенное влияние на годовой уровень капиталовложений

От всех средств,привлечено более 100млн до

мега сделки

36%

В дополнении ежегодных капиталовложений в европейскую технологическую экосистему важно понимать, что существует существенная тенденция, которая означает, что многие раунды фиксируются только после значительной задержки. Это "отставание в отчетности" означает, что окончательные итоги не будут известны до тех пор, пока не пройдет значительный период времени после окончания рассматриваемого года. Соответственно, мы индексно скорректировали годовые итоговые показатели с учетом этого отставания в отчетности, чтобы можно было сопоставить общие тенденции инвестиций на европейском уровне.

Самые большие проблемы Европы: несмотря на весьма большой приток капитала, необходимо значительно больше средств, особенно на более поздних стадиях и фазах роста, чтобы вырастить действительно крупные европейские компании глобального значения

И нам нужно выпускать больше акций, чтобы охватить более широкую аудиторию для выгоды инвестирования стартапов. И нам все еще не хватает большого количества предпринимателей, таких как США, которые вышли из этих масштабных проектов, перерабатывающие свой капитал и таланты в технологическую экосистему. Самые сильные стороны Европы-это, безусловно, наша система образования, наше культурное разнообразие, а также огромное количество и высокое качество наших технических основателей. Это сопряжено с более низкими оценками входа по сравнению с США и Азией, что приводит к очень эффективным инвестиционным возможностям капитала.

Daniel Keiper-Knorr Основатель/партнер Speedinvest

03.1

Total capital invested ($B)

2015

2016

2017

2018

2019

0.0

10.0

20.0

30.0

Capital invested ($B)

$15.3B

$16.5B

$22.6B

$24.6B

$29.8B

$1.3B

$6.3B

2015

2016

2017

2018

2019

0.0

10.0

20.0

30.0

40.0

Total capital invested ($B) per year, divided by Top 3, 10, and all other deals

LEGEND

Все другие топ 10 сделок

Топ 3 сделки

примечание

Dealroom.co исключают следующие данные: биотехнологии, вторичные сделки, долги, кредиты, гранты. Обратите также внимание, что эти данные не включают Израиль.

Инвестированный капитал ($млрд) с поправкой на отставание в отчётности

фактическая сумма млрд

С поправкой на отставание в отчетности($млрд)

www.stateofeuropeantech.com

In Partnership with

&

Investment Snapshot

Как и выше, важно учитывать "запаздывание отчетности" ,чтобы обеспечить сопоставление

Investment Snapshot

Как и выше, важно учитывать "запаздывание отчетности" ,чтобы обеспечить сопоставление

Несмотря на рекордный уровень инвестиций в Европу, все больше основателей считают, что за последние 12 месяцев стало труднее привлекать венчурный капитал в Европе . Это первый случай за последние пять лет, когда мы задали этот вопрос основателям в рамках настоящего доклада.

03.1

# of deals

5,620

6,416

6,244

4,839

3,456

854

2,304

2015 2016 2017 2018 2019

0

2,000

4,000

6,000

<$5M

$5M-25M

$25M+

0 10 20 30

40 50 60 70 80 90 100

% of respondents

На ваш взгляд, легче или труднее привлечь венчурный капитал в Европу, чем год назад?

Легче

Сложнее

Не изменилось

Количество сделок, скорректированных с учетом эффекта запаздывания отчетности

Фактич сделки

С поправкой на отставание в отчетности

www.stateofeuropeantech.com

In Partnership with

&

Investment Snapshot

Основатели крупных компаний (более 100 сотрудников) и учредители, которые привлекли

Investment Snapshot

Основатели крупных компаний (более 100 сотрудников) и учредители, которые привлекли

Среди основателей женщин в два раза больше считают, что за последние 12 месяцев стало труднее привлекать венчурный капитал, а около половины считают, что не заметили изменений

03.1

ОБЩИЙ ОБЪЕМ ПРИВЛЕЧЕННОГО КАПИТАЛА

Количество сотрудников

≤10 сотрудников

10-100 сотрудников

100+ сотрудников

0

10

20

30

40 50 60

% of respondents

70

80

90

100

<$5M

$5M-25M

$25M+

0

10

20

30

40

50

% of respondents

60

70

80

90

100

16%

32%

52%

25%

25%

50%

Легче привлечь

Труднее привлечь

Не изменилось

0

5

10

15

20

25

30

% of respondents

35

40

45

50

55

По вашему мнению, сейчас в Европе легче или труднее привлечь венчурный капитал, чем год назад?

Легче

Сложнее

Не изменилось

Примечание:

Только основатели

По вашему мнению, сейчас в Европе легче или труднее привлечь венчурный капитал, чем год назад?

LEGEND

Жен Муж

Примечание

Только основатели, цифры могут округляться до 100

www.stateofeuropeantech.com

In Partnership with

&

www.stateofeuropeantech.com 24 In Partnership with &

Investment Snapshot

В 2019 году в Европе наблюдалось увеличение числа

www.stateofeuropeantech.com 24 In Partnership with &

Investment Snapshot

В 2019 году в Европе наблюдалось увеличение числа

We are on an overall good wave: more capital, more startups from seed to large, late rounds, more exits.

I take a long view on European tech, I’m old enough to remember how far we have come and to understand we still have a way to go yet. Plus, Brexit has changed the picture a lot, so progress based on the work done the year before isn’t as inevitable as it perhaps was.

There is still a large capital gap regarding the US and China situations, but we can see very encouraging recent signals: the €100 billion EU Commission future fund and the €5 billion investment announcement from President Macron in France, for instance.

Antoine Hubert

Ÿnsect CEO

Steve O’Hear TechCrunch Journalist

03.1

Топ-20 крупнейших сделок по сбору средств при поддержке венчурных инвесторов в 2019 году (округлено)

Примечание

Dealroom.co исключают следующие данные: биотехнологии, вторичные сделки, долги, кредиты, гранты. Обратите также внимание, что эти данные не включают Израиль.

We are on an overall good wave: more capital, more startups from seed to large, late rounds, more exits. We should all keep up the good work to position Europe as the key place for technology!

Финансовые технологии

Корпоративное программное обеспечение

Здоровье

Энергетика

Транспорт

Еда

Маркетинг

Путешествия

Безопасность

Робототехника

Реклама

Недвижимость

Проведение мероприятий

Подбор персонала

Интернет Дом Игры

Образование

Мода Закон Связь

Финансовые технологии

Корпоративное программное обеспечение

Здоровье

Энергетика

Транспорт

Еда

Маркетинг

Путешествия

Безопасность

Робототехника

Реклама

Недвижимость

Проведение мероприятий

Подбор персонала

Интернет Дом Игры

Образование

Мода Закон Связь

Красота Хостинг музыка дети

Финансовые технологии

Корпоративное программное обеспечение

Health

Энергетика

Транспорт

Еда

Маркетинг

Путешествия

Безопасность

Робототехника

Реклама

Недвижимость

Дом

Мода

Связь Интернет

приборы

спорт меропр красота закон

Игры персонал музыка образов

Дети

03.2

Инвестиции по отраслям

В течение последних пяти лет основными бенефициарами капитала были финтех-компании и компании, занимающиеся корпоративным программным обеспечением. В целом за последние пять лет европейские компании только в этих двух секторах привлекли около $ 50 млрд..

Инвестировано в финтехкомпании

КАПИТАЛ, ВЛОЖЕННЫЙ В ФИНТЕХ

$25млрд

2015-2019

2019

Инвестированный капитал ($млн) по отраслям промышленности

up to 10,000

4,000 to 8,000

2,000 to 4,000

1,500 to 2,000

1,000 to 1,500

750 to 1,000

500 to 750

200 to 500

100 to 200

0 to 100

up to 0

www.stateofeuropeantech.com

In Partnership with

&

Тем не менее, существует высокий уровень разнообразия с точки зрения потоков

Тем не менее, существует высокий уровень разнообразия с точки зрения потоков

Investment by Industry

03.2

Capital invested ($M)

2015

2016

2017

2018

2019

0

2,500

5,000

7,500

Capital invested ($M)

2015

2016

2017

2018

2019

0

500

1,000

1,500

Capital invested ($M)

2015

2016

2017

2018

2019

0

250

500

750

1,000

1,250

Capital invested ($M)

2015

2016

2017

2018

2019

0

250

500

750

1,000

1,250

Capital invested ($M)

2015 2016 2017 2018 2019

0

250

500

750

1,000

$2млрд+ в 2019

$1млрд - $2млрд в 2019

2,000

$250M - $500M в 2019

$500M - $1млрд в 2019

< $250M в 2019

Капитал инвестированный в индустрии

Финтех

Прог обеспечение

Здоровье

Энергетика Транспорт

Еда Маркетинг

LEGEND

Туризм БезопасРоботы Реклама

Недвижимость

LEGEND

Мероприятия

НаемперсоналаДом

Интернет

Игры

Образование

Мода

закон

LEGEND

Связь Спорт

Приборы Красота

LEGEND

Хостинг МузыкаДети

www.stateofeuropeantech.com

In Partnership with

&

www.stateofeuropeantech.com 27 In Partnership with &

Investment by Industry

03.2

Я считаю, что сейчас в Европе есть

www.stateofeuropeantech.com 27 In Partnership with &

Investment by Industry

03.2

Я считаю, что сейчас в Европе есть

Akshay Naheta Инвестиционный Консультант SoftBank управляющий партнер

Европейские технологические компании в области финтеха, корпоративного программного обеспечения, энергетики, здравоохранения и продовольствия стали самыми крупными бенефициарами возросших инвестиций в 2019 году, в совокупности увидев прирост капитала более чем на 11 миллиардов долларов по сравнению с 2018 годом.

$3,929M

$-53M

$-141M

M

$-308

$-333

M

$-399M

$-424M

$-757M

финтех

Прогр обеспечение

энергетика

здоровье

еда

безопасность

туризм

мероприятия

маркетинг

персонал

недвижимость

роботы

закон

игры

образование

реклама

итернет

транспорт

дом

мода

-1,000

-500 0

500

1,000

1,500 2,000

YoY growth ($M)

2,500

3,000

3,500

4,000

Абсолютное изменение по отраслевой вертикали инвестированного капитала ($млн), 2018 г. по сравнению с 2019 г.

Европа всегда имела выдающийся образовательный продукт, и это благоприятствует технологиям здравоохранения, особенно в важном слиянии биотехнологий и Информационных технологий, где выступает Оукин. Для этого требуются высокотехничные математики, инженеры и разработчики с широким кругозором. Мы можем применить свою дисциплину к сложной области систем биологии, открытию и разработке лекарств.

Наша самая большая проблема заключается в сохранении талантов и как уже упоминалось выше, я улучшаю регулятивную и инвестиционную культуру, а также некоторые реальные преимущества жизни в европейском городе, поощряя наших лучших докторов наук и специалистов для сохранения их в Европе. Оукин, например, имеет более 50 европейских ученых-исследователей, работающих над многоступенчатым анализом и интерпретируемым искусственным интеллектом, а наша лаборатория по праву признана одной из лучших в мире групп искусственного интеллекта в области естественных наук.

Thomas Clozel

Owkin

Соучредитель и генеральный директор

Самые быстрорастущие отрасли промышленности с точки зрения процентного изменения в годовом

Самые быстрорастущие отрасли промышленности с точки зрения процентного изменения в годовом

Инвестиции в европейские компании находятся на пути к тому, чтобы побить еще один рекорд - $8,4 млрд в 2019 году, по сравнению с $6,7 млрд в 2018 году и $3,0 млрд в 2015 году.

инвестиционный уровень 2015 года.

2.8x

Investment by Industry

03.2

193%

186%

124%

90%

80%

76%

69%

56%

47%

34%

23%

-9%

-15%

-19%

-20%

-30%

-33%

-35%

-40%

-53%

-59%

-68%

Security

Energy

Food

Jobs recruitment

Health

Fintech

Travel

Enterprise software

Real estate

Marketing

Robotics

Gaming

Transportation

Media

Education

Sports

Telecom

Internet of Things

Home living

Semiconductors

Fashion

Music

-100

-75

-50

-25

0

25

50 75

YoY growth (%)

100

125

150

175

200

225

Capital invested ($B)

$3.0B

$3.9B

$6.0B

$6.7B

$8.4B

2015

2016

2017

2018

2019

0.0

2.5

5.0

7.5

% изменение отраслевой вертикали инвестированного капитала ($млн), 2018 г. по сравнению с 2019 г.

Инвестированный капитал ($млрд) в европейские техкомпании

:

www.stateofeuropeantech.com

In Partnership with

&

Искусственный интеллект доминирует над капиталом, вложенным в глубинные технологии, в то

Искусственный интеллект доминирует над капиталом, вложенным в глубинные технологии, в то

Капитал, инвестированный в 2019 году в европейские технологические компании, классифицированные как компании искусственного интеллекта.

$4.9млрд

По всей Европе наблюдается сильный рост капитала для компаний, занимающихся сложными технологиями....тем не менее, объем инвестированного капитала все еще не является репрезентативным для качества и потенциальной стоимости потока сделок в Европе.

Существует сильное увеличение капитала для глубинных технологических компаний по всей Европе. (Глубинные технологии — это уникальные, дифференцированные, часто защищенные патентами или трудно поддающиеся копированию технологические или научные достижения). Такие компании, как Insect, cam или AMSilk, использование конвергентных технологии для создания реальных ценностей в крупных, глобальных и сложных отраслях промышленности. Признавая эти возможности, инвесторы (и покупатели) из Европы и из-за рубежа инвестируют в европейские активы глубинные технологии (большинство приобретений в США теперь приходится на компании глубинной технологии ). В то же время создается новое поколение политиков ЕС, стремящихся сохранить “технологический суверенитет", что помогает снизить риск инвестиций в эти предприятия.

Sofia Hmich основатель положительного капитала

Investment by Industry

03.2

2015

2016

2017

2018

2019

Искуств.интеллект

Данные комп зрение

роботы нанотехнол. Блокчейн

поиск интернет

Оборудов. Прогноз.анализ

3D

Обучение

Прогр обесп

дроны приборы

Вирт ре

радары

речь

квантум

2015

2016

2017

2018

2019

Искуств.интеллект

Данные комп зрение

роботы нанотехно Блокчейн

поиск интернет

Оборудов. Прогноз.анализ

3D

Обучение

Прогр обесп

дроны приборы

Вирт радары

речь

квантум

Капитал, вложенный в глубинные технологии

Количество сделок

Тем не менее, объем инвестированного капитала все еще не является репрезентативным для качества и потенциальной стоимости потока сделок в Европе. Этот дисбаланс особенно бросается в глаза, когда вы рассматриваете размер рыночных возможностей, которые преследуют эти компании, таких как мясо ($1 трлн), строительство ($10 трлн) или чистая энергия ($2,5 трлн). Иными словами, капитал остается неравномерно распределенным по всему спектру возможностей. Две основные причины такого " дефицита финансирования” (1) многие венчурные инвесторы не имеют необходимых экспертных знаний и структур для оценки и поддержки этих компаний, и (2) некоторые исторические атрибуты более глубоких технологических инвестиций (время выхода на рынок, капиталоемкость...) все еще мешают инвесторам, даже если они не применимы ко всем типам глубоких технологических компаний.

www.stateofeuropeantech.com

In Partnership with

&

Великобритания является ведущим направлением в Европе для инвестиций в глубинные технологии,

Великобритания является ведущим направлением в Европе для инвестиций в глубинные технологии,

Квантум-это небольшая, но важная развивающаяся категория для инвестиций в глубинные технологии. В глобальном масштабе совокупные инвестиции в квантовые компании достигли более чем $600 млн

Investment by Industry

03.2

11-20 место

Топ 10 стран

Великобритания

Франция

Германия

Швейцария

Нидерланды

Швеция

Ирландия

Финляндия

Испания

Бельгия

0

1,000

2,000

3,000

4,000

5,000 6,000

Инвестированный капитал($M)

7,000

8,000

9,000

10,000

11,000

Инвестированный капитал ($M)

Румыния

Италия

Россия

Норвегия

Австрия

Дания

Польша

Исландия

Эстония

Португалия

Остальные

0

100

200 300 400 500 600

700 800

900

1,000

1,100 1,200 1,300 1,400

Инвестированный капитал ($млн) в европейские компании глубинной технологии по странам

2014-2018

2019

Capital invested ($M)

# of deals

$101M

$13M

$155M

$120M

$222M

21

10

30

43

28

2015 2016 2017 2018 2019

0

50

100

150

200

250

Количество сделок и капиталовложений ($млн) в quantum Global

Капитал в млн

Количество сделок

www.stateofeuropeantech.com

In Partnership with

&

Европейская сила в области глубинных технологий также распространяется на новые подкатегории,

Европейская сила в области глубинных технологий также распространяется на новые подкатегории,

Хотя многие европейские квантовые компании остаются в скрытом режиме, все большее число перспективных квантовых компаний в прошлом году увеличили количество серий продаж. Хотя некоторые из этих компаний не были включены в нижеследующее, они также воспользовались грантами Европейского Союза - например, Beit получила дополнительные 2,6 млн. долл.

Бренд Бристоль признан во всем мире.

10 лет назад английские основатели приезжали в Кремниевую долину и им задавали вопрос : "Когда вы собираетесь переехать сюда?’ Теперь возникает вопрос: " Как мы можем инвестировать в эту невероятную возможность?’

Это доказательство сдвига во внешнем восприятии экосистемы Великобритании. Это отражает работу, проделанную британским правительством по продвижению страны, а также большое количество успешных технологических фирм. Сегодня есть предприниматели, которые "были там и сделали это.’ Есть образцы для подражания, на которые может равняться следующее поколение, и это подпитывает еще более высокие уровни устремлений и амбиций.

И это не только Великобритания в целом, но и бренд Бристоль, который теперь признан во всем мире.

Nigel Toon

Соучредитель и генеральный директор

Investment by Industry

03.2

% of quantum deals

2015 2016 2017 2018 2019

0

25

50

75

100

Доля квантовых сделок (%) по регионам

США И Канада

Европа

Азия

Остальные

Некоторые сделки, заключенные европейскими компаниями квантовых вычислений в 2019 году

www.stateofeuropeantech.com

In Partnership with

&

03.3

География инвестиций

Суммарные капитальные вложения с 2015 года превысили $ 10 млрд

03.3

География инвестиций

Суммарные капитальные вложения с 2015 года превысили $ 10 млрд

11-20

другие

Топ 10 стран

Capital invested ($M)

Великобритания Германия

Франция

Швеция

Испания

Швейцария Нидерланды

Исландия

Финляндия

Италия

0

10,000

20,000

30,000

40,000

Capital invested ($M)

Россия

Дания

Бельгия

Румыния

Норвегия

Люксембург Австрия

Польша

Португалия

Эстония

0

500

1,000

1,500

2,000

Capital invested ($M)

Кипр Турция Исландия Литва Венгрия Хорватия Чехия Гернси Украина Монтенегро

0

100

200

300

400

Инвестированный капитал ($млн) по странам в год с 2015

2015

2016

2017

2018

2019

www.stateofeuropeantech.com

In Partnership with

&

2,747

1,183

930

776

457

437

371

359

314

302

London

Paris

Berlin

Stockholm

Amsterdam

Barcelona

Dublin

Helsinki

Madrid

Moscow

0

250

500

750

1,000

1,250 1,500 1,750

# of unique funded companies

2,000

2,250

2,500

2,750

3,00

Я даже более оптимистична, чем 12 месяцев

2,747