Содержание

- 2. Objective The objective is to introduce some of the concepts and mechanics of depreciation and depletion,

- 3. General Accounting General Accounting: Preparation of financial statements for a firm. A financial statement (or financial

- 4. General Accounting Balance sheet: Static picture of assets, liabilities and net worth at a single point

- 5. It is comprised of the following 3 elements: Assets: Something a business owns or controls (e.g.

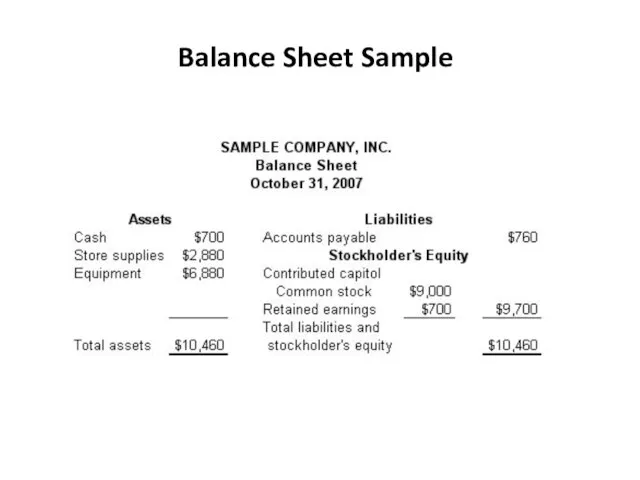

- 6. Balance Sheet Sample

- 7. General Accounting Profit and loss statement: Also called “income statement” Income Statement reports the company's financial

- 8. Income Statement Income Statement is composed of the following two elements: Income: What the business has

- 9. Cost Accounting Costs incurred to produce and sell an item or product are classified as: Direct

- 10. Direct Costs Direct material: Material whose cost is directly charged to a product Measured as the

- 11. Manufacturing Costs Factory Overhead: Indirect labor costs (sick leaves, vacations, bonuses as well as labor connected

- 12. Administrative and Selling Costs Administrative costs: Salaries of executive and clerical personnel, office space, traveling, auditing,

- 13. Depreciation As time passes, the assets lose value or depreciate Physical loss Use related Time related

- 14. DEPRECIATION Decrease in value of physical properties with passage of time and use Accounting concept establishing

- 15. PROPERTY IS DEPRECIABLE IF IT MUST : be used in business or held to produce income

- 16. DEPRECIABLE PROPERTY TANGIBLE - can be seen or touched personal property - includes assets such as

- 17. WHEN DEPRECIATION STARTS AND STOPS Depreciation starts when property is placed in service for use in

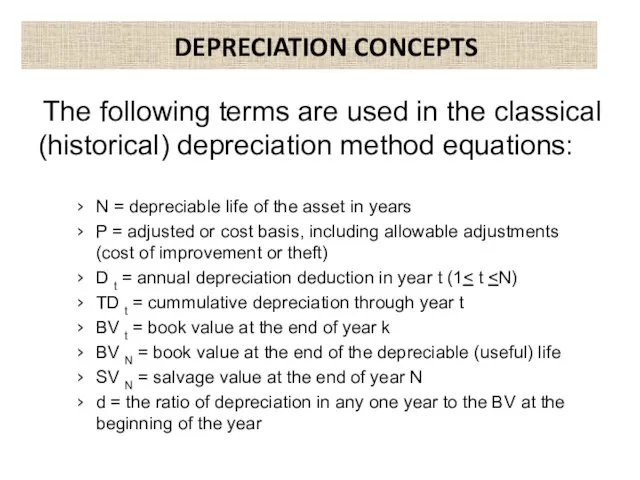

- 18. DEPRECIATION CONCEPTS The following terms are used in the classical (historical) depreciation method equations: N =

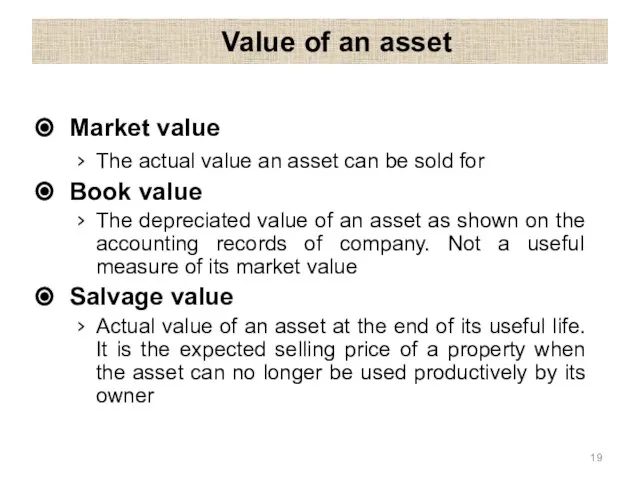

- 19. Value of an asset Market value The actual value an asset can be sold for Book

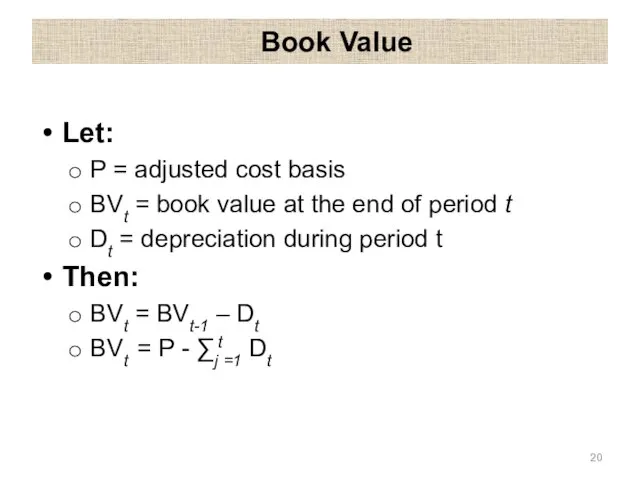

- 20. Book Value Let: P = adjusted cost basis BVt = book value at the end of

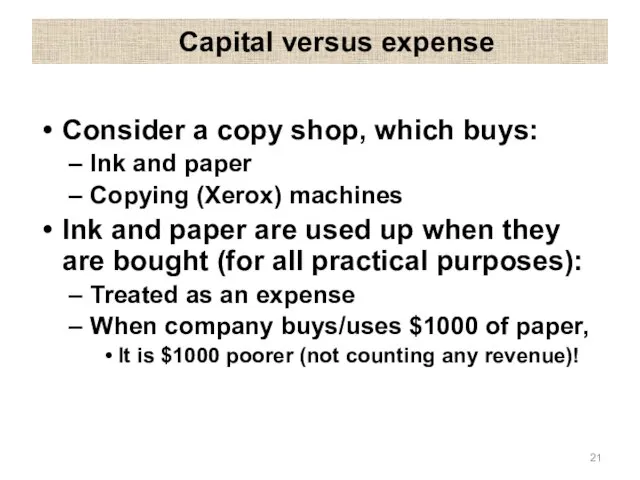

- 21. Capital versus expense Consider a copy shop, which buys: Ink and paper Copying (Xerox) machines Ink

- 22. Capital versus expense Copying (Xerox) machines are used up only slowly over time: Treated as “capital

- 23. Definitions Capital gains: Item selling price greater than purchase price Depreciation recapture: Item selling price greater

- 24. Example If at the end of 1 year I go out of business and sell my

- 25. Salvage value If a salvage value is expected, Depreciation applies to P - SV Example: If

- 26. Depreciation and taxes Depreciation is treated as an expense (i.e., a tax deduction) in computation of

- 27. Observations Depreciation methods are conventions Not based strictly on market value! Different types of assets have:

- 28. Some Depreciation Schedules Straight line method (SL) Declining Balance method (DB) Double Declining Balance (DDB) There

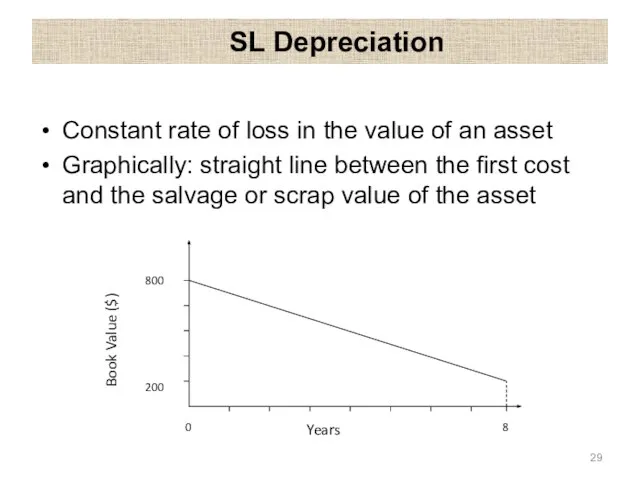

- 29. SL Depreciation Constant rate of loss in the value of an asset Graphically: straight line between

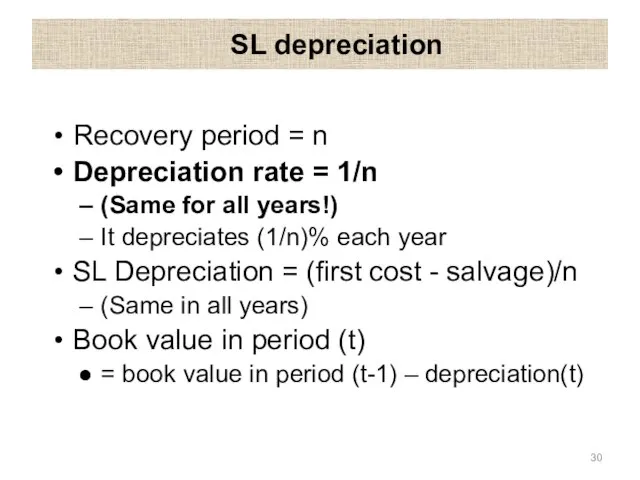

- 30. SL depreciation Recovery period = n Depreciation rate = 1/n (Same for all years!) It depreciates

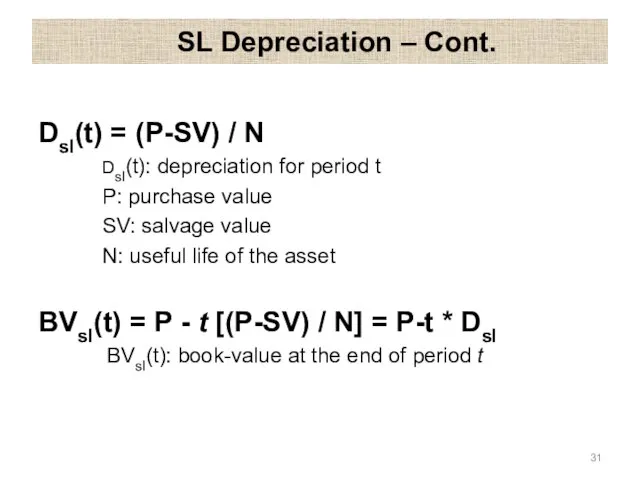

- 31. SL Depreciation – Cont. Dsl(t) = (P-SV) / N Dsl(t): depreciation for period t P: purchase

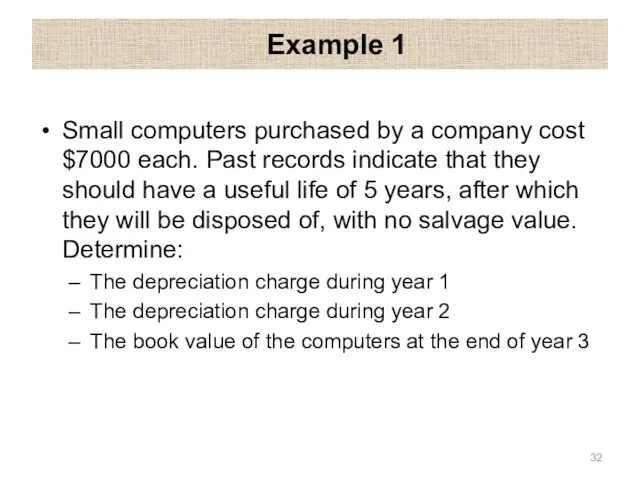

- 32. Example 1 Small computers purchased by a company cost $7000 each. Past records indicate that they

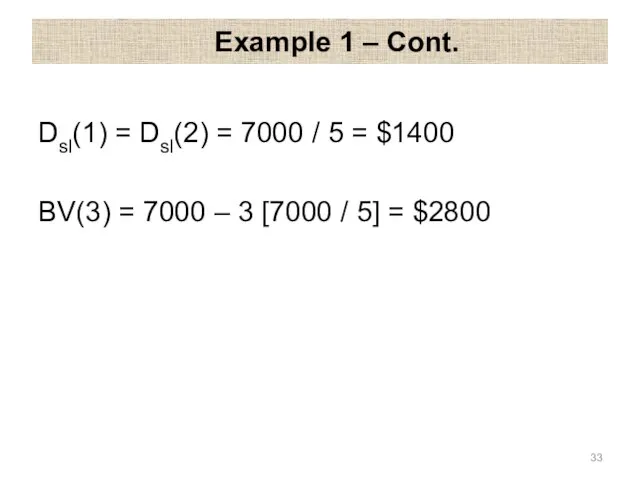

- 33. Example 1 – Cont. Dsl(1) = Dsl(2) = 7000 / 5 = $1400 BV(3) = 7000

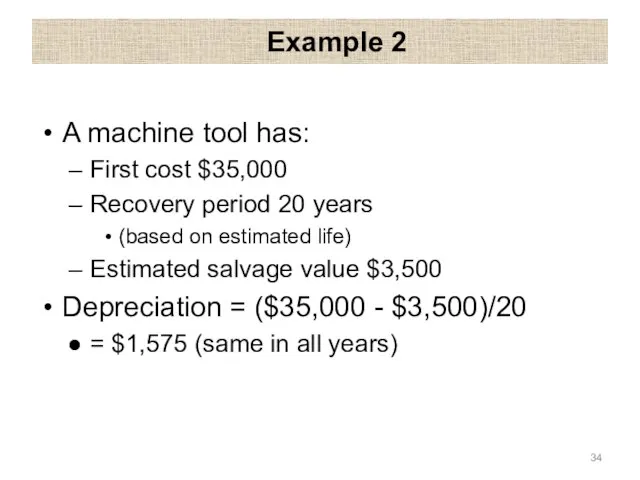

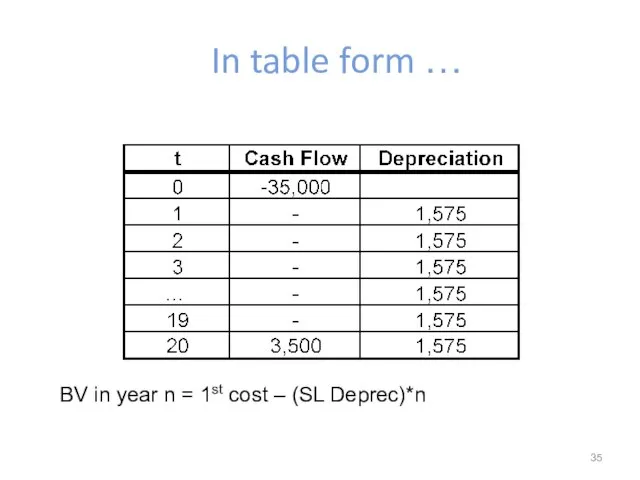

- 34. Example 2 A machine tool has: First cost $35,000 Recovery period 20 years (based on estimated

- 35. In table form … BV in year n = 1st cost – (SL Deprec)*n

- 36. Straight line depreciation Writes off capital investment linearly Estimated salvage value is considered: Only estimated! Actual

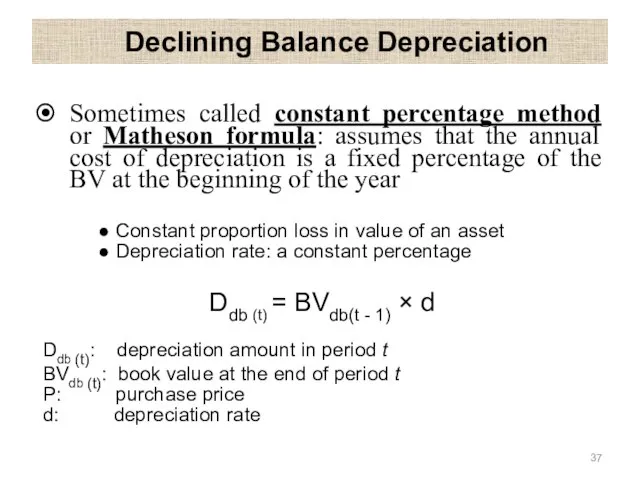

- 37. Declining Balance Depreciation Sometimes called constant percentage method or Matheson formula: assumes that the annual cost

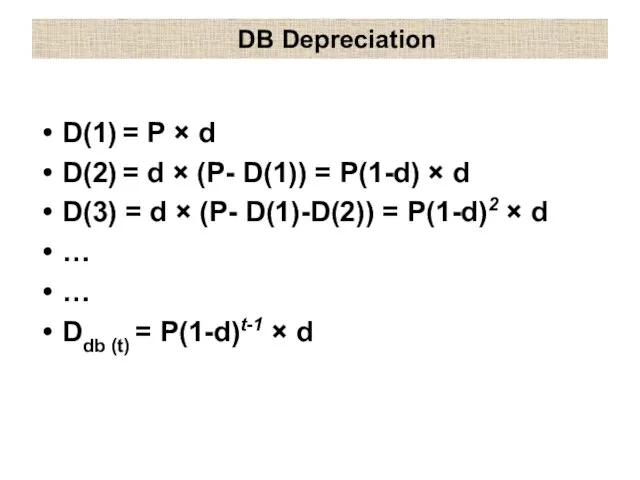

- 38. DB Depreciation D(1) = P × d D(2) = d × (P- D(1)) = P(1-d) ×

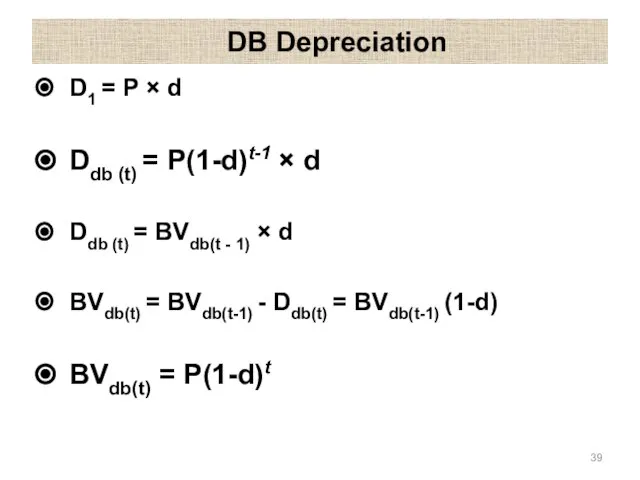

- 39. DB Depreciation D1 = P × d Ddb (t) = P(1-d)t-1 × d Ddb (t) =

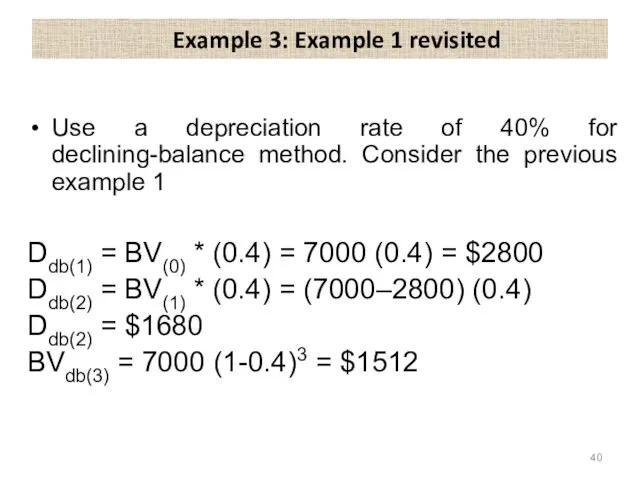

- 40. Example 3: Example 1 revisited Use a depreciation rate of 40% for declining-balance method. Consider the

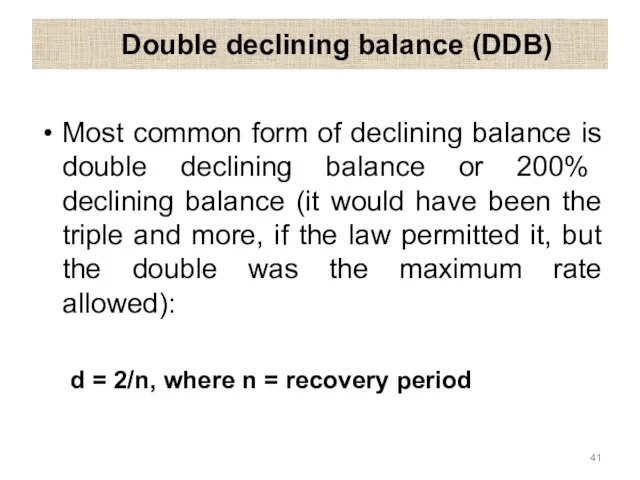

- 41. Double declining balance (DDB) Most common form of declining balance is double declining balance or 200%

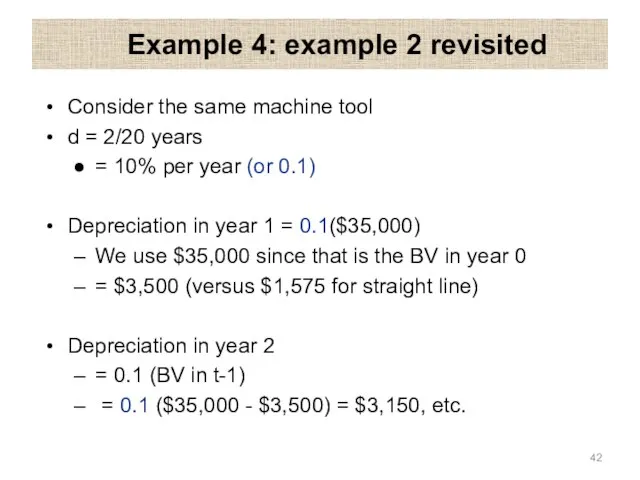

- 42. Example 4: example 2 revisited Consider the same machine tool d = 2/20 years = 10%

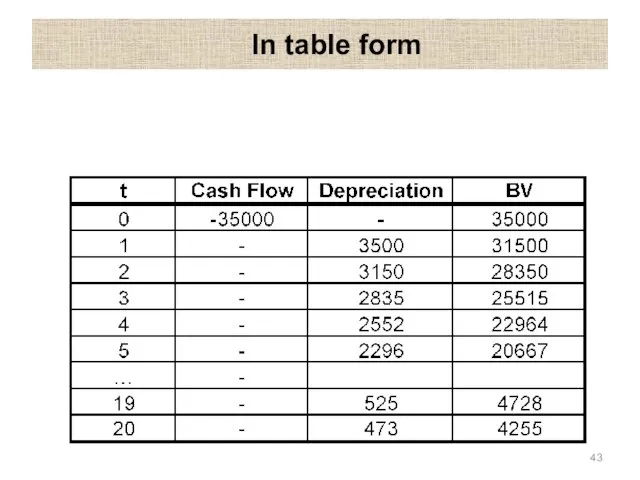

- 43. In table form

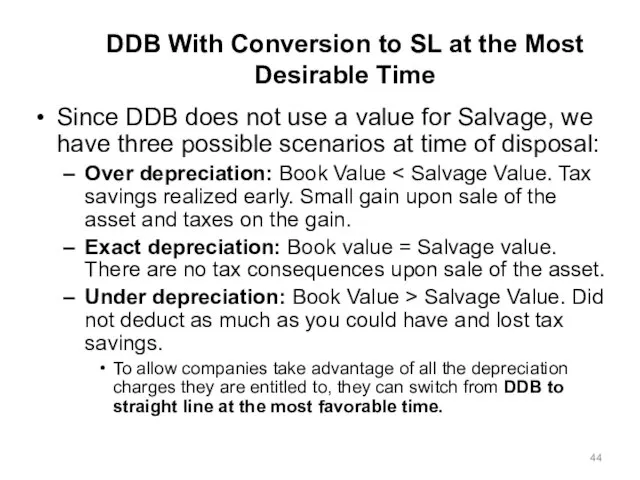

- 44. DDB With Conversion to SL at the Most Desirable Time Since DDB does not use a

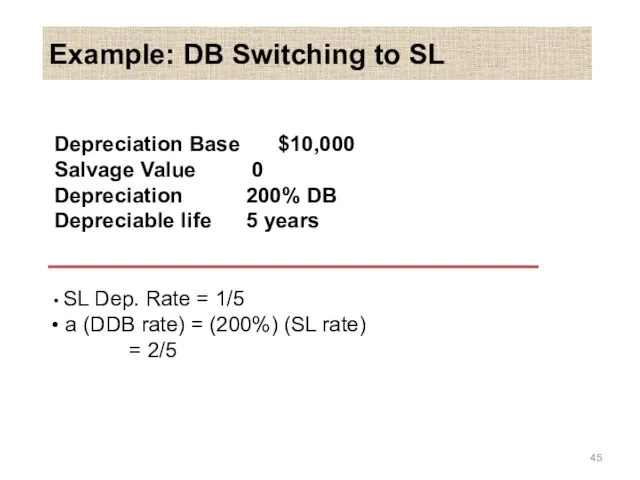

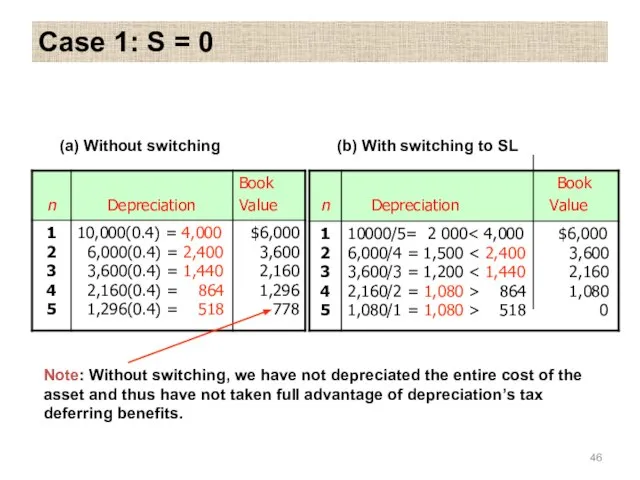

- 45. Example: DB Switching to SL SL Dep. Rate = 1/5 a (DDB rate) = (200%) (SL

- 46. (a) Without switching (b) With switching to SL Note: Without switching, we have not depreciated the

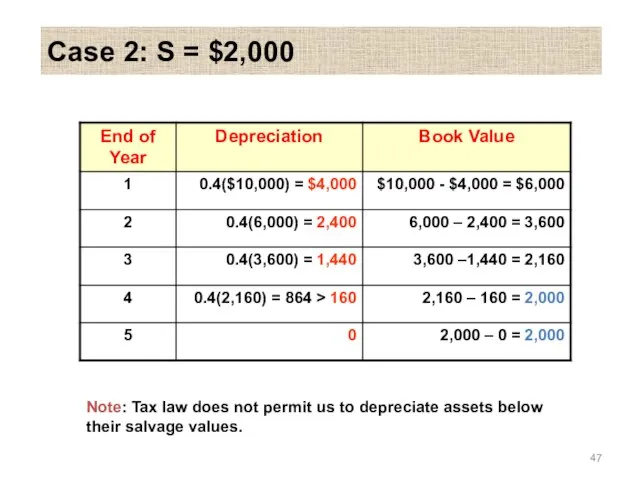

- 47. Case 2: S = $2,000 Note: Tax law does not permit us to depreciate assets below

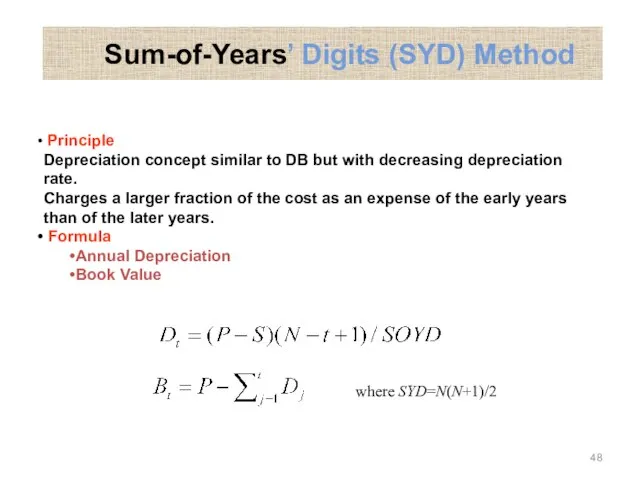

- 48. Sum-of-Years’ Digits (SYD) Method Principle Depreciation concept similar to DB but with decreasing depreciation rate. Charges

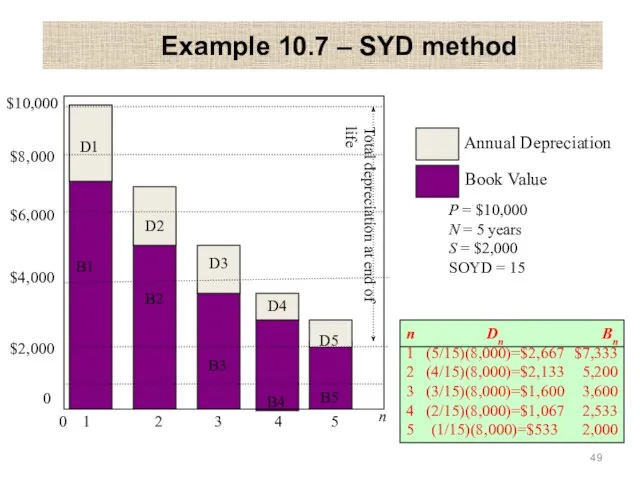

- 49. Example 10.7 – SYD method D1 D2 D3 D4 B1 B2 B3 B4 B5 $10,000 $8,000

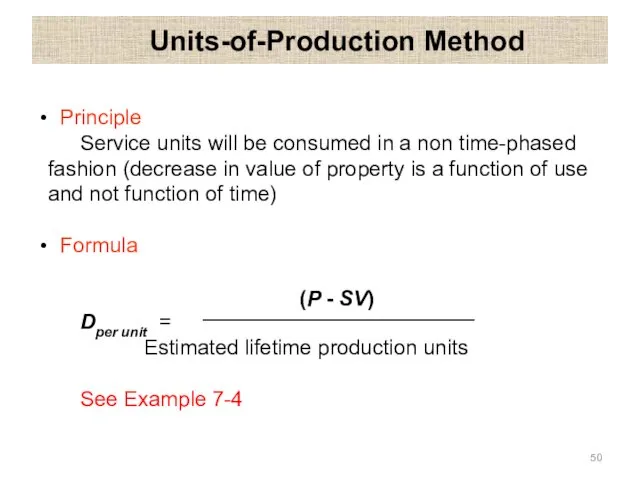

- 50. Units-of-Production Method Principle Service units will be consumed in a non time-phased fashion (decrease in value

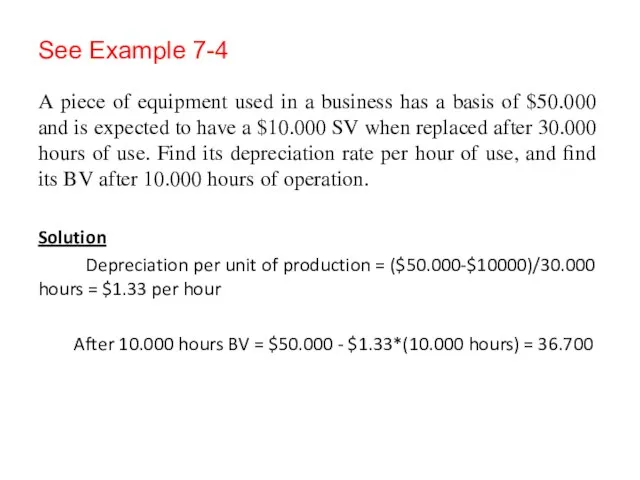

- 51. See Example 7-4 A piece of equipment used in a business has a basis of $50.000

- 52. Depletion Two methods of natural resource depletion Cost or factor depletion Percentage depletion

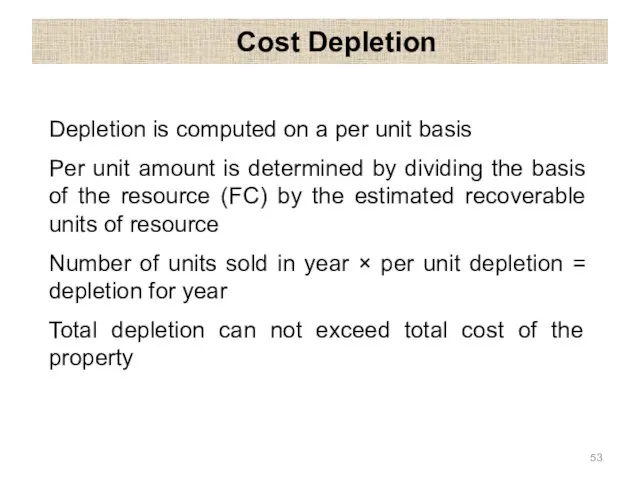

- 53. Cost Depletion Depletion is computed on a per unit basis Per unit amount is determined by

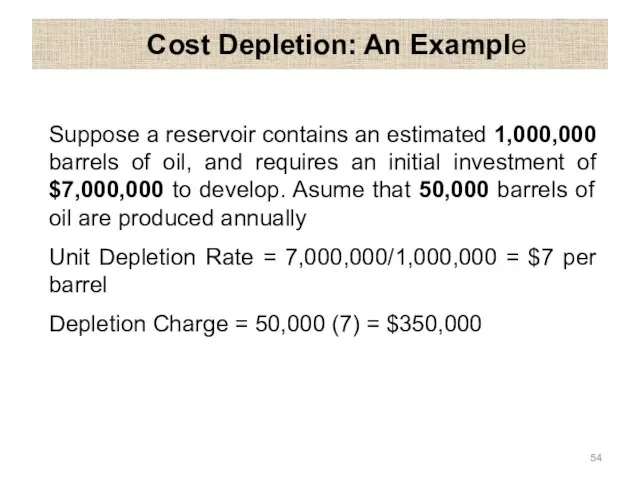

- 54. Cost Depletion: An Example Suppose a reservoir contains an estimated 1,000,000 barrels of oil, and requires

- 55. Percentage Depletion Percentage depletion Depletion is computed by using the statutory percentage rate for the type

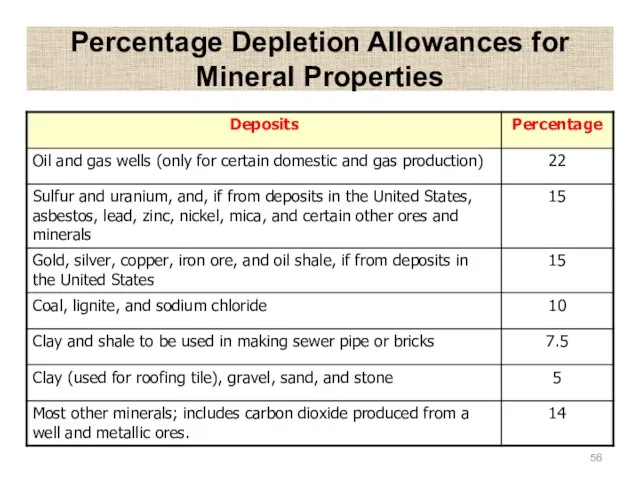

- 56. Percentage Depletion Allowances for Mineral Properties

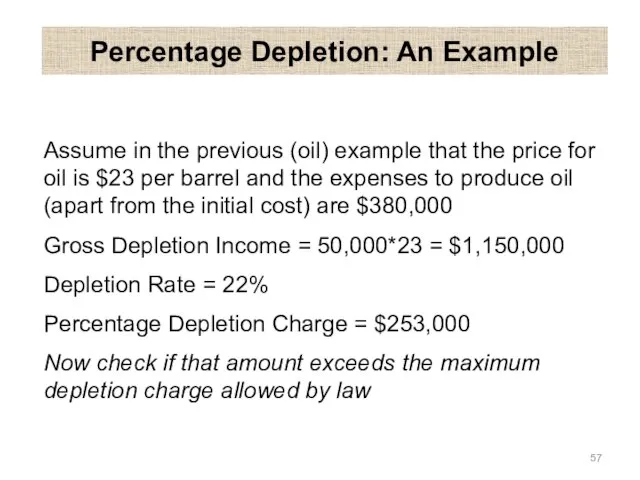

- 57. Percentage Depletion: An Example Assume in the previous (oil) example that the price for oil is

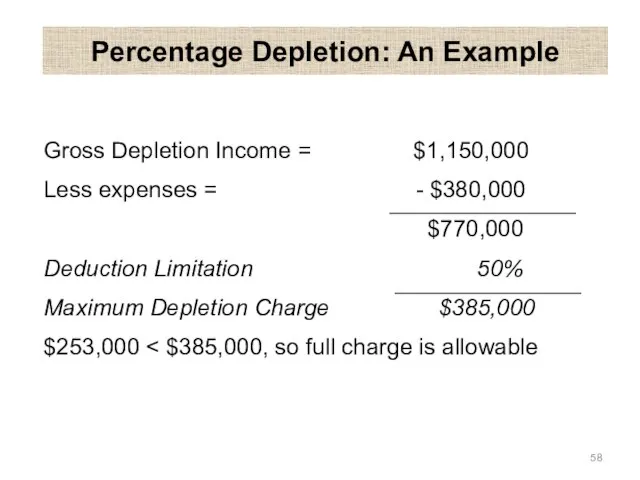

- 58. Percentage Depletion: An Example Gross Depletion Income = $1,150,000 Less expenses = - $380,000 $770,000 Deduction

- 59. Agenda for today We will learn how to determine: Before-tax cash flows Taxable income Income taxes

- 60. Agenda for today Review terms and definitions Rate of return (ROR) Tax deduction Tax credit Capital

- 61. Why do we calculate depreciation? Since depreciation is an “expense” we can use that expense to

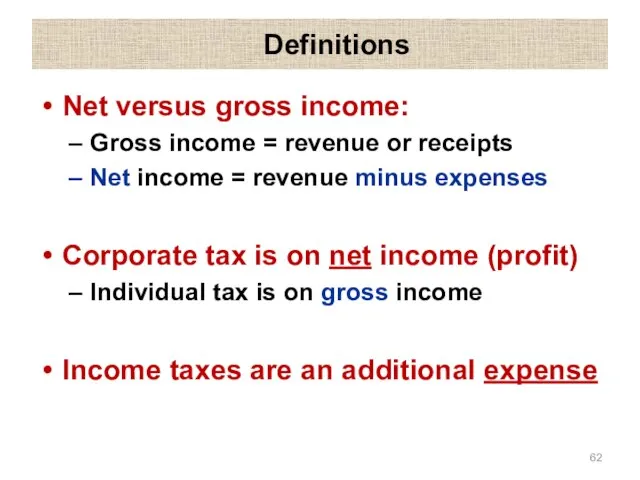

- 62. Definitions Net versus gross income: Gross income = revenue or receipts Net income = revenue minus

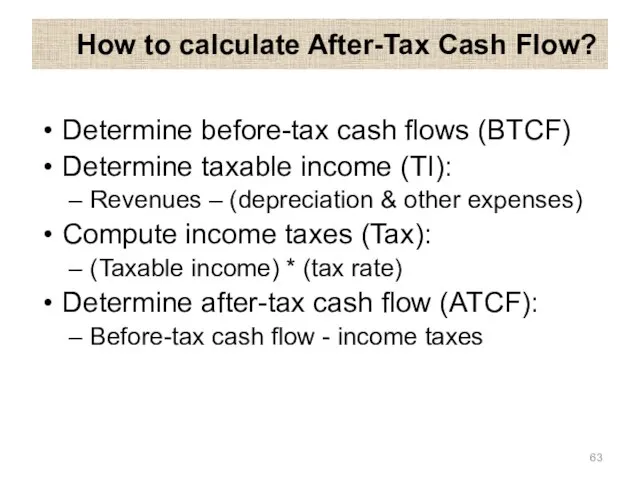

- 63. How to calculate After-Tax Cash Flow? Determine before-tax cash flows (BTCF) Determine taxable income (TI): Revenues

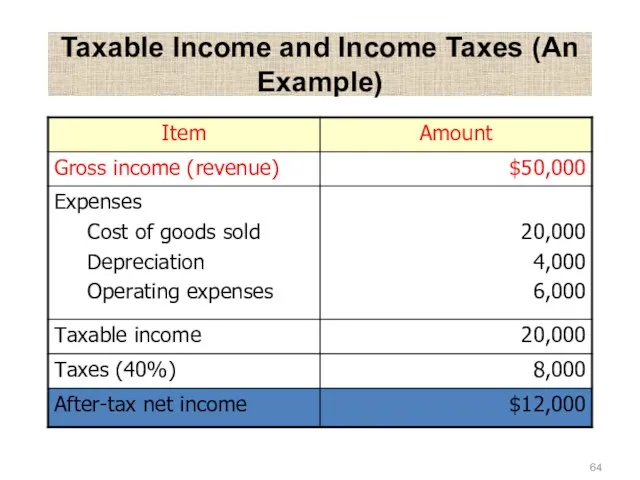

- 64. Taxable Income and Income Taxes (An Example)

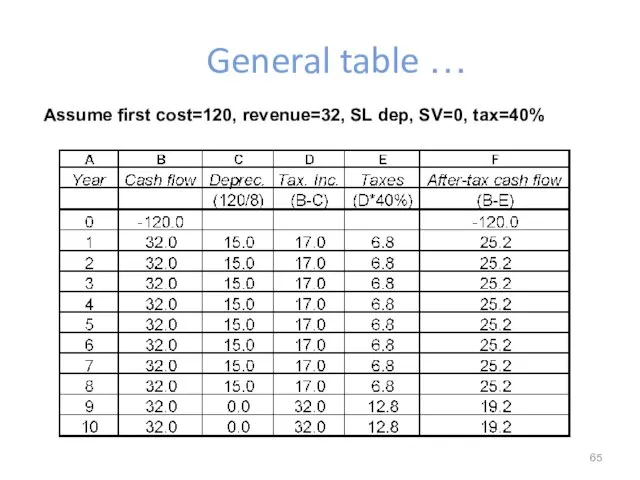

- 65. General table … Assume first cost=120, revenue=32, SL dep, SV=0, tax=40%

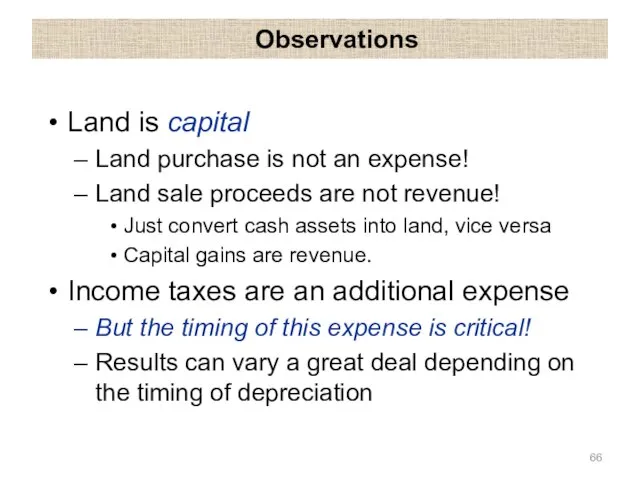

- 66. Observations Land is capital Land purchase is not an expense! Land sale proceeds are not revenue!

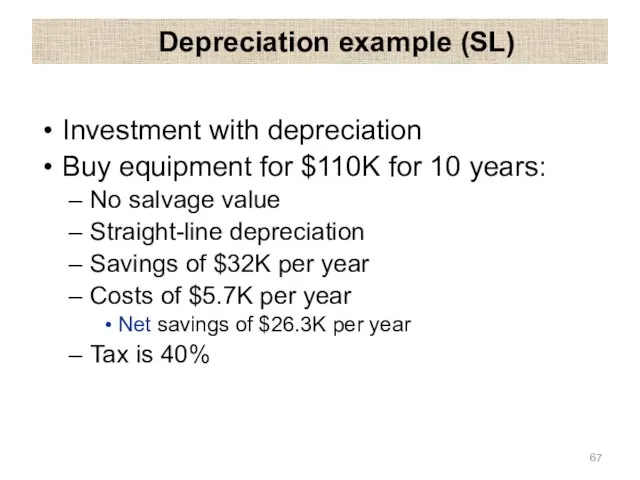

- 67. Depreciation example (SL) Investment with depreciation Buy equipment for $110K for 10 years: No salvage value

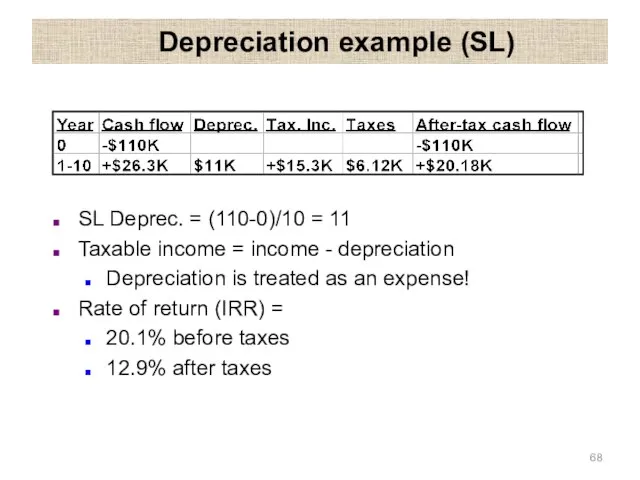

- 68. Depreciation example (SL) SL Deprec. = (110-0)/10 = 11 Taxable income = income - depreciation Depreciation

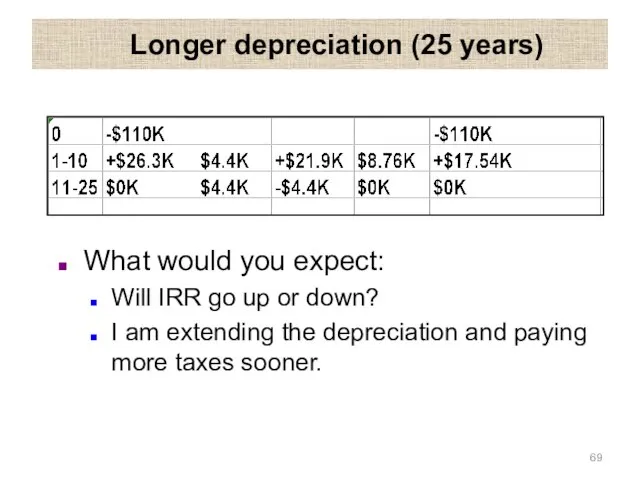

- 69. Longer depreciation (25 years) What would you expect: Will IRR go up or down? I am

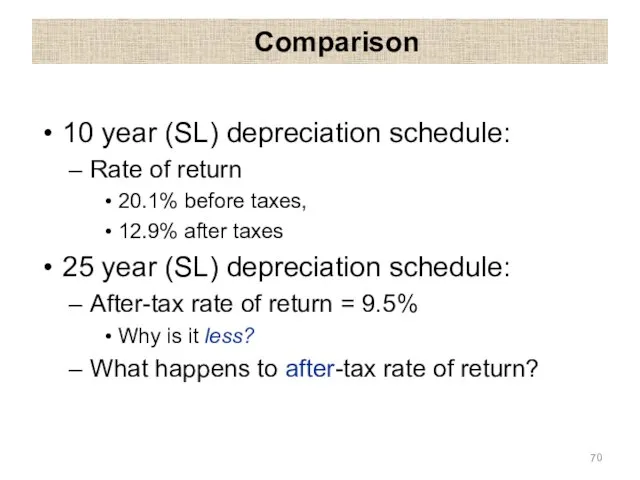

- 70. Comparison 10 year (SL) depreciation schedule: Rate of return 20.1% before taxes, 12.9% after taxes 25

- 71. Accelerated depreciation 7 year depreciation lifetime: Double declining balance for 4 years Followed by straight line

- 72. Accelerated depreciation

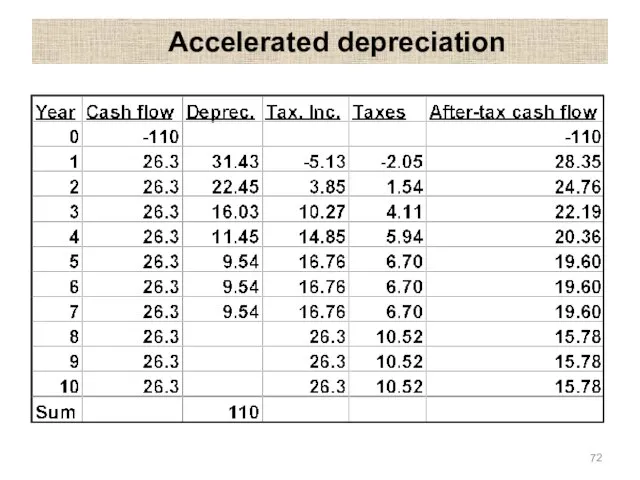

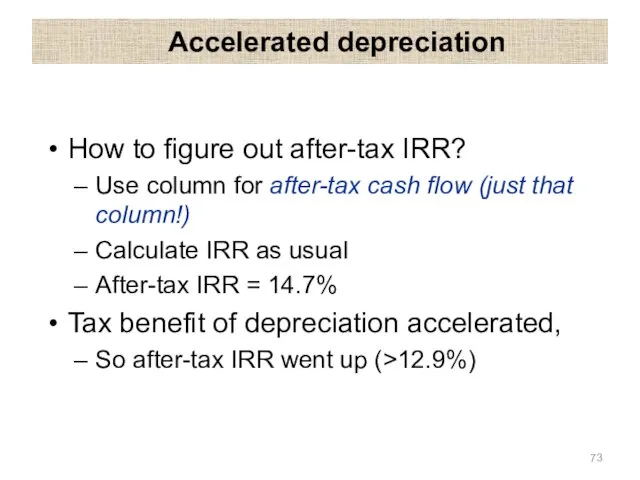

- 73. Accelerated depreciation How to figure out after-tax IRR? Use column for after-tax cash flow (just that

- 74. Net Income vs. Cash Flow Net income is an accounting means of measuring a firm’s profitability

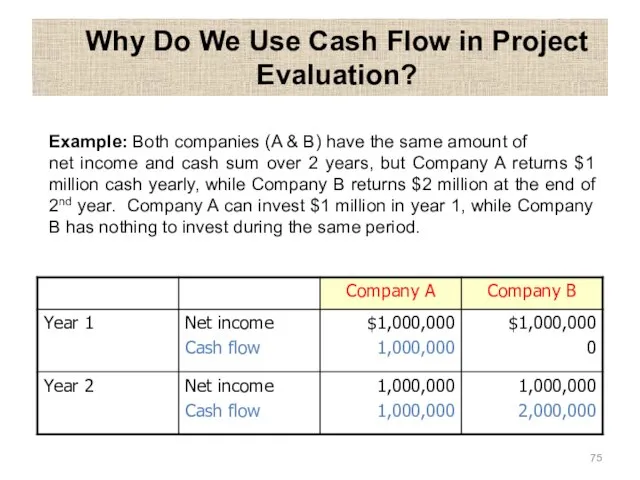

- 75. Why Do We Use Cash Flow in Project Evaluation? Example: Both companies (A & B) have

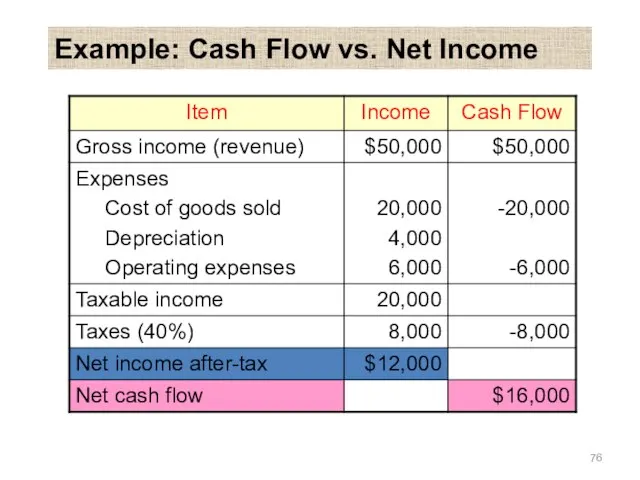

- 76. Example: Cash Flow vs. Net Income

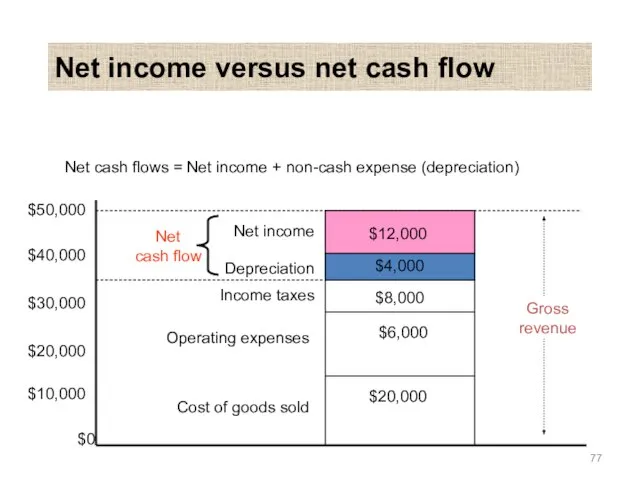

- 77. Net income versus net cash flow Net cash flows = Net income + non-cash expense (depreciation)

- 78. Definitions Tax deduction: Expense deducted from taxable income Saving = (deduction) x (tax rate) Savings are

- 79. Definitions Book value: Purchase price (for land, stocks, other non-depreciable assets) Depreciated value (for physical assets,

- 80. Definitions Capital gains: Item selling price greater than purchase price Depreciation recapture: Item selling price greater

- 81. Capital gain/loss Generally attributed to year of sale Long-term capital gains (> 1 year) Can be

- 82. Capital gain/loss Carrying backward or forward: Some businesses are very volatile E.g., oil prospecting! Some years

- 83. Example Investment with depreciation Buy equipment for $110K for 10 years: No salvage value Straight-line depreciation

- 84. Example Sell for $30K in year 8: Book value = $22K Depreciation recapture = $8K Sell

- 85. Non-depreciable example Investment with no depreciation Buy land for $110K Sell for $130K: Capital gain =

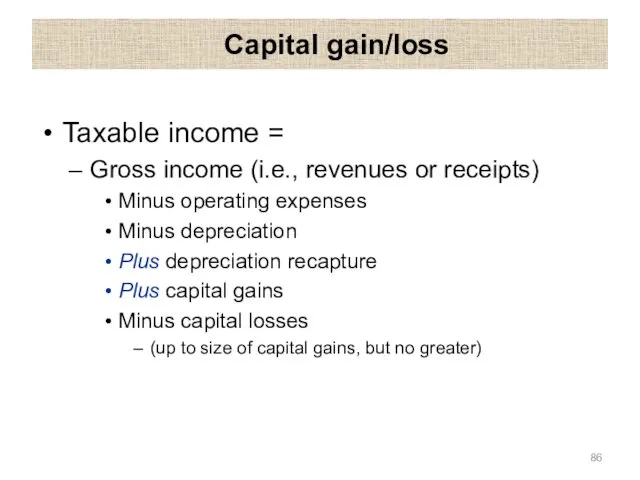

- 86. Capital gain/loss Taxable income = Gross income (i.e., revenues or receipts) Minus operating expenses Minus depreciation

- 87. Personal income tax Same general issues as corporate tax: Tax exempt income (E.g., government bonds) Tax

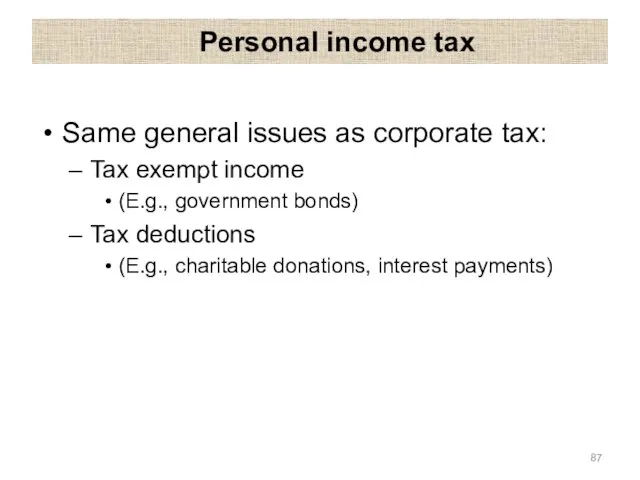

- 88. Tax-exempt example Purchase $5K bond (20 years) From phone company at 11%: $550/year, paid as $275

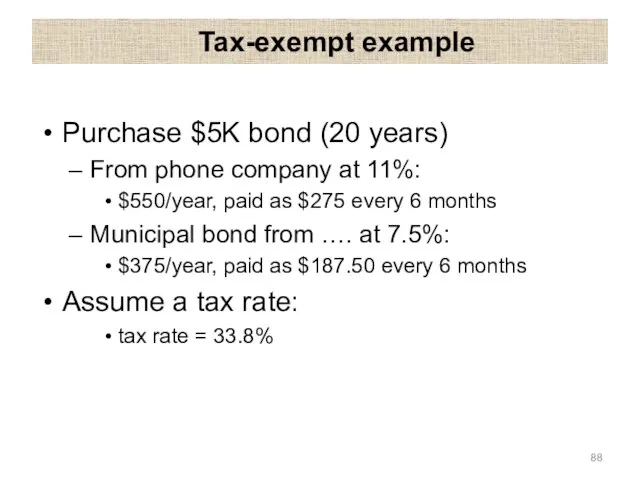

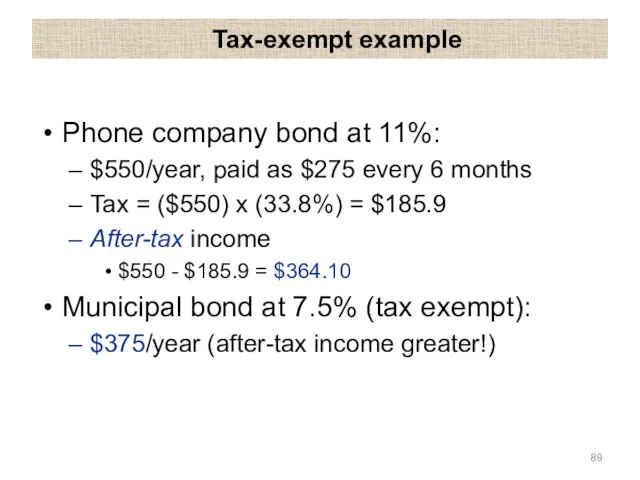

- 89. Tax-exempt example Phone company bond at 11%: $550/year, paid as $275 every 6 months Tax =

- 90. Observation A government bond (tax-exempt) at 7.5% may give higher income than a private 11% bond!

- 91. Charitable deduction example Assume the following tax rate: tax rate = 38.4% Charitable gift of $1000:

- 92. Graduated income tax Constant tax rate: “Flat tax” If tax rate is not constant: “Graduated” income

- 93. Graduated income tax Example: 15% if taxable income $7.5K + 25% of amount above $50K If

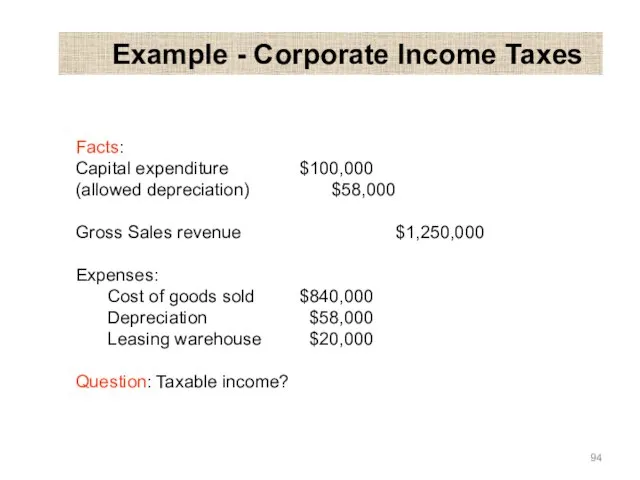

- 94. Example - Corporate Income Taxes Facts: Capital expenditure $100,000 (allowed depreciation) $58,000 Gross Sales revenue $1,250,000

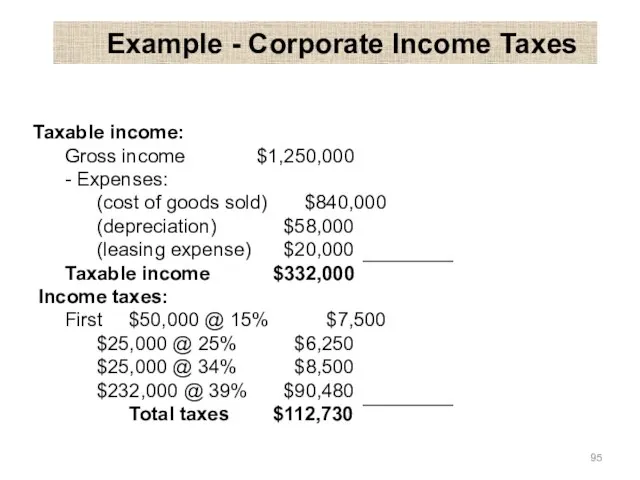

- 95. Example - Corporate Income Taxes Taxable income: Gross income $1,250,000 - Expenses: (cost of goods sold)

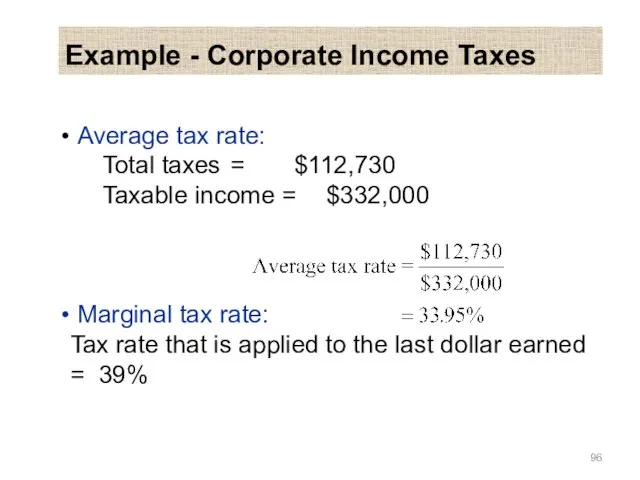

- 96. Average tax rate: Total taxes = $112,730 Taxable income = $332,000 Marginal tax rate: Tax rate

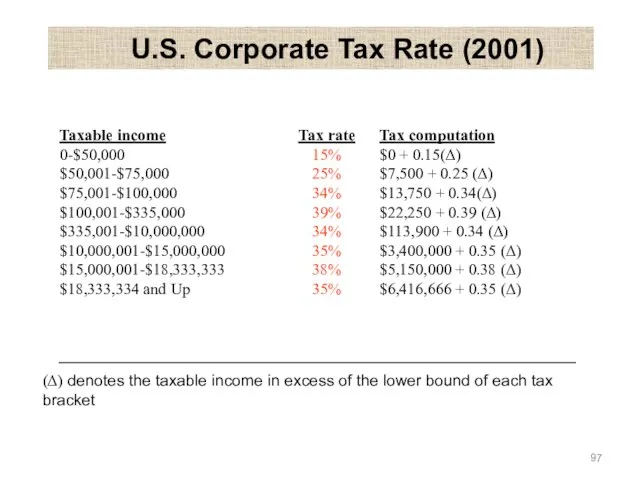

- 97. U.S. Corporate Tax Rate (2001) Taxable income 0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 $335,001-$10,000,000 $10,000,001-$15,000,000 $15,000,001-$18,333,333 $18,333,334 and

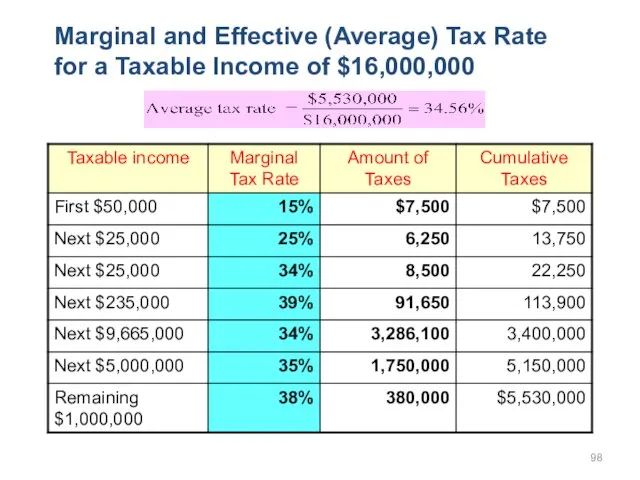

- 98. Marginal and Effective (Average) Tax Rate for a Taxable Income of $16,000,000

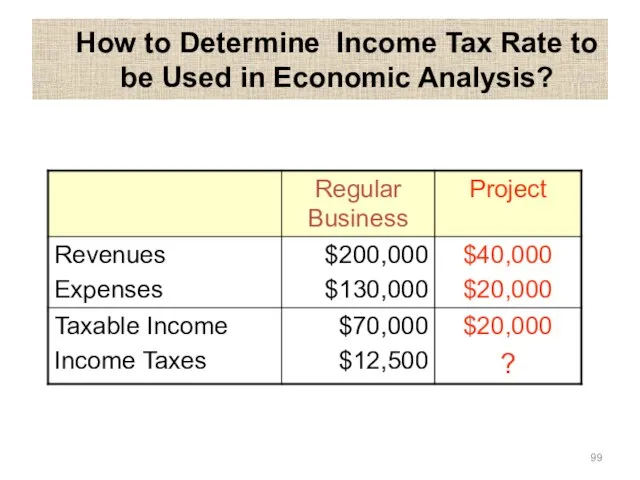

- 99. How to Determine Income Tax Rate to be Used in Economic Analysis?

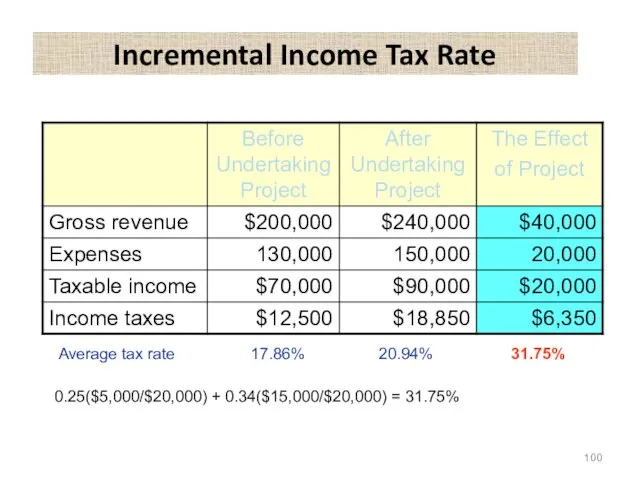

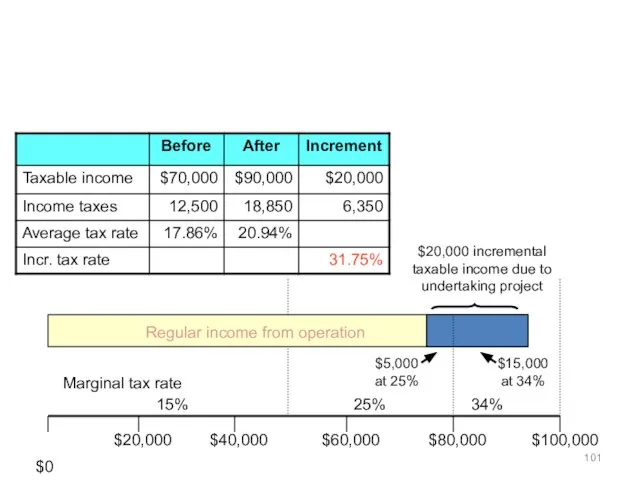

- 100. Incremental Income Tax Rate Average tax rate 17.86% 20.94% 31.75% 0.25($5,000/$20,000) + 0.34($15,000/$20,000) = 31.75%

- 101. $0 $20,000 incremental taxable income due to undertaking project

- 103. Скачать презентацию

Основы калькуляции и учета в ресторанном хозяйстве. Характеристика бухгалтерского учета

Основы калькуляции и учета в ресторанном хозяйстве. Характеристика бухгалтерского учета Рабочий отчет департамента аналитики компании IPO

Рабочий отчет департамента аналитики компании IPO Классификация банков

Классификация банков Project Expert: система имитационного моделирования предприятия

Project Expert: система имитационного моделирования предприятия Управление рыночными рисками в лизинговой компании

Управление рыночными рисками в лизинговой компании Основы финансового планирования в государственных (муниципальных) учреждениях

Основы финансового планирования в государственных (муниципальных) учреждениях Организация управленческого учета в системе контроллинга (тема 3)

Организация управленческого учета в системе контроллинга (тема 3) Денежно-кредитная политика банка России

Денежно-кредитная политика банка России Економіка, організація і планування виробництва. Розрахунок фонду оплати праці (ФОП)

Економіка, організація і планування виробництва. Розрахунок фонду оплати праці (ФОП) Антикризисное управление финансами предприятия

Антикризисное управление финансами предприятия Правовой диктант. Сфера финансов

Правовой диктант. Сфера финансов Выбор инструмента фондового рынка для привлечения капитала

Выбор инструмента фондового рынка для привлечения капитала Повышение эффективности работы предприятия на основании совершенствования управления оборотными активами (ОАО Янтарьэнерго)

Повышение эффективности работы предприятия на основании совершенствования управления оборотными активами (ОАО Янтарьэнерго) Стратегия продвижения банковских продуктов на примере АКБ СОЮЗ (ОАО)

Стратегия продвижения банковских продуктов на примере АКБ СОЮЗ (ОАО) Аналіз господарської діяльності

Аналіз господарської діяльності Понятие ценной бумаги

Понятие ценной бумаги Бюджет міста Сєвєродонецька на 2017 рік

Бюджет міста Сєвєродонецька на 2017 рік Софинансирование со стороны муниципалитета, населения и спонсоров

Софинансирование со стороны муниципалитета, населения и спонсоров -- Сущность и функции денег

-- Сущность и функции денег Общая характеристика и содержание бухгалтерского учета

Общая характеристика и содержание бухгалтерского учета Сводный рейтинг опубликованной информации в подсистеме Бюджетное планирование в разрезе муниципальных районов

Сводный рейтинг опубликованной информации в подсистеме Бюджетное планирование в разрезе муниципальных районов Правовые аспекты взаимоотношений с индустриальными партнерами и инвесторами

Правовые аспекты взаимоотношений с индустриальными партнерами и инвесторами Финансовый рынок Швеции

Финансовый рынок Швеции Структура страховых рынков ведущих стран мира

Структура страховых рынков ведущих стран мира IDC корпоративная система дистрибуции

IDC корпоративная система дистрибуции Библиотека кейсов

Библиотека кейсов Кредитная политика коммерческого банка при кредитовании юридических лиц на примере ОАО Лето Банк

Кредитная политика коммерческого банка при кредитовании юридических лиц на примере ОАО Лето Банк Личные продукт по страхованию мобильной техники, спортинвентаря, верхней одежды и ручной клади

Личные продукт по страхованию мобильной техники, спортинвентаря, верхней одежды и ручной клади