Содержание

- 2. Deck 2 Agenda Free Cash flows & financing cash flows Financial statement analysis Common sized financial

- 3. Section I Free Cash flows & financing cash flows

- 4. Let’s dive into Cash Flows CF versus profit Firms with recurring negative cash flows can go

- 5. Cash flows? Free Cash Flow ? cash flow from assets FCF = Operating cash flow +

- 6. CF statement The CF Statement shows the financial flows (cash received or disbursed) when they actually

- 7. Sections in the Cash Flow Statement Cash flow from operations includes the cash flow consequences of

- 8. Free Cash Flow Free Cash Flow (FCF): cash flow that is free and available to be

- 9. Operating cash flows Cash flows linked to the core activities. Positive operating cash flow generally indicates

- 10. Computing Operating CF Operating CF = EBIT + Depreciation – taxes NB: this approach differ from

- 11. Investing cash flows Cash flows describing the investments (or divestiture) in fixed and current assets Negative

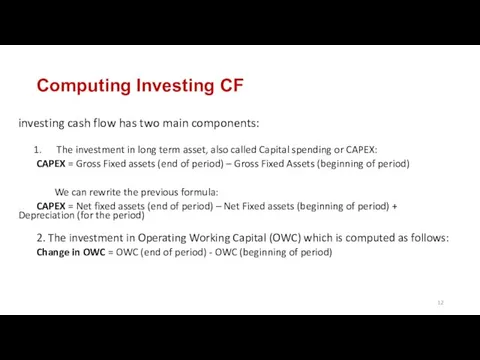

- 12. Computing Investing CF investing cash flow has two main components: The investment in long term asset,

- 13. Financing Cash Flows A firm can either receive money from or distribute money to its investors

- 14. Computing the Financing CF Financing Cash Flow = net new borrowings – interest paid + net

- 15. Cash Flow Statement Direct vs. Indirect Method –direct method (adopted by less than 3% of companies)

- 16. FCF FCF = Operating CF + investing CF When negative implies a need for further financing

- 17. Interpreting Free Cash Flows Does Positive or Negative free cash flow maximize shareholder wealth? Need more

- 18. Incremental cash flows Further, after-tax free cash flows must be measured incrementally. Determining incremental free cash

- 19. Beware of diverted cash flows Not all incremental free cash flow is relevant. Thus new product

- 20. Working capital requirement New projects require infusion of working capital (such as inventory to stock the

- 21. Sunk Costs Sunk costs are cash flows that have already occurred (such as marketing research) and

- 22. Opportunity Costs Opportunity cost refers to cash flows that are lost because of accepting the current

- 23. Overhead Costs Incremental overhead costs or costs that were incurred as a result of the project

- 24. Interest Payments and Financing Costs Interest payments and other financing cash flows that might result from

- 25. What is FCFF? The Free Cash Flow to Firm (FCFF) is a measure of the (after

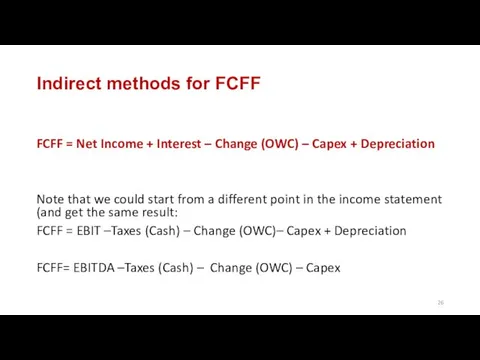

- 26. Indirect methods for FCFF FCFF = Net Income + Interest – Change (OWC) – Capex +

- 27. Section II Financial statement analysis

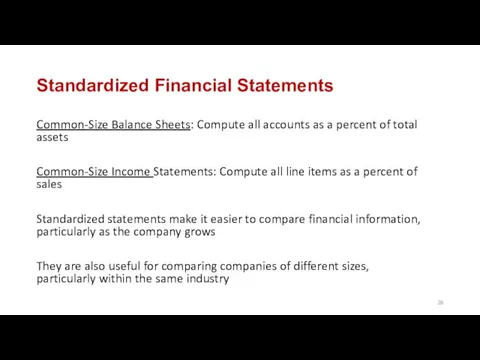

- 28. Standardized Financial Statements Common-Size Balance Sheets: Compute all accounts as a percent of total assets Common-Size

- 29. Why Use Ratios? Useful financial ratios: identify a company’s situation and its financial strengths and weaknesses

- 30. Main areas of investigation (1) The main ratios examine important questions: How liquid is the company?

- 31. Main areas of investigation (2) For publicly traded companies, market ratios: Assess relationship between Market price

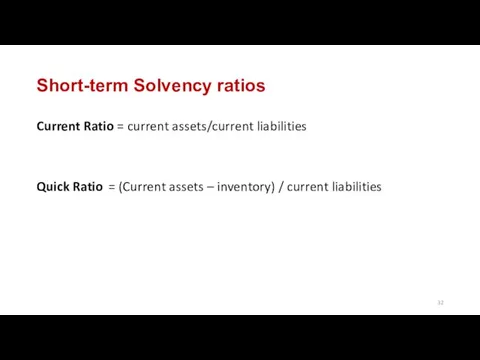

- 32. Short-term Solvency ratios Current Ratio = current assets/current liabilities Quick Ratio = (Current assets – inventory)

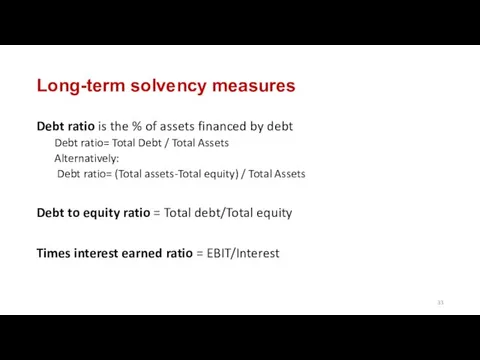

- 33. Long-term solvency measures Debt ratio is the % of assets financed by debt Debt ratio= Total

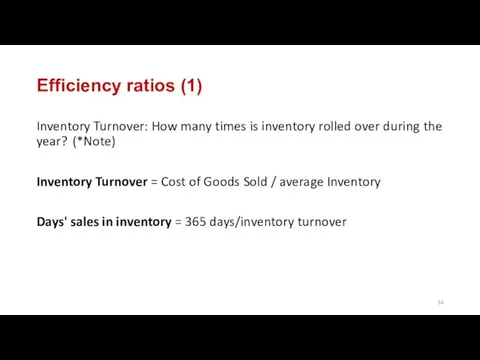

- 34. Efficiency ratios (1) Inventory Turnover: How many times is inventory rolled over during the year? (*Note)

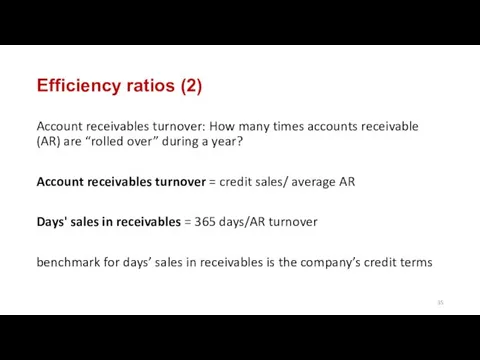

- 35. Efficiency ratios (2) Account receivables turnover: How many times accounts receivable (AR) are “rolled over” during

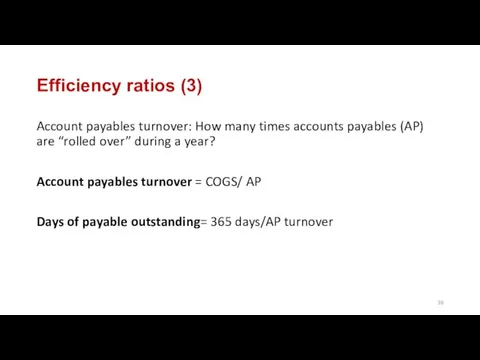

- 36. Efficiency ratios (3) Account payables turnover: How many times accounts payables (AP) are “rolled over” during

- 37. Cash Conversion Cycle Sum of the days of sales outstanding (average collection period) and days of

- 38. Asset Turnover ratios Total Asset Turnover = Sales / Total Assets NB: It is not unusual

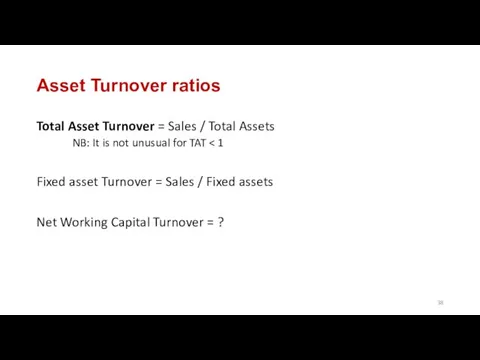

- 39. Operating Profitability measures Operating Profitability measures focus on the core results of a business before the

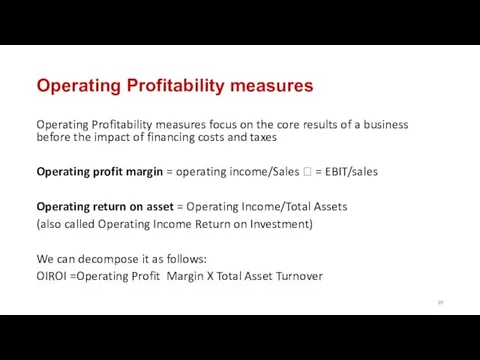

- 40. Net Profitability measures The focus here is on the bottom line Net profit margin = Net

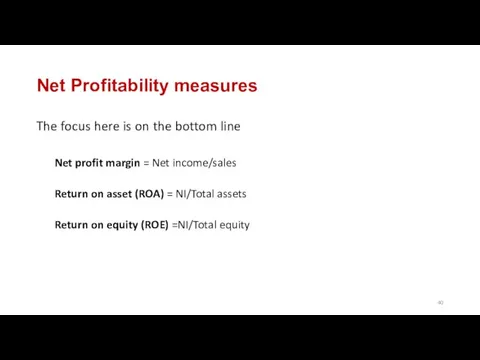

- 41. Deriving the DuPont Identity ROE = NI / Total Equity Multiply by (TA/TA) and then rearrange

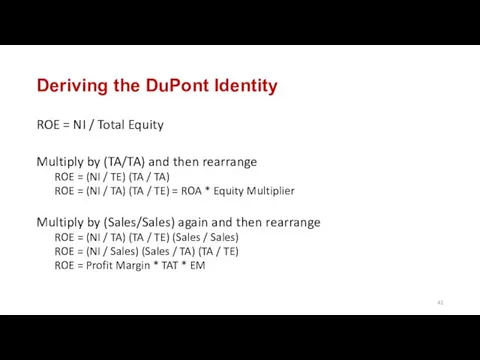

- 42. Using the DuPont Identity ROE = Profit Margin * Total Asset Turnover * Equity Multiplier Profit

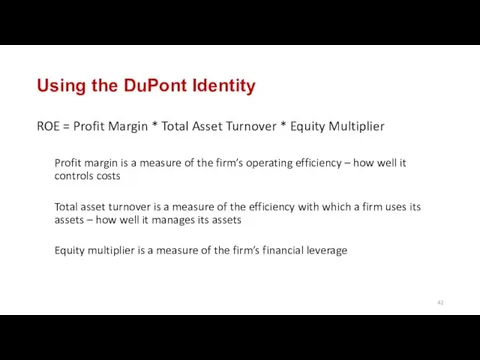

- 43. Market ratios (1) Earnings per share= total Net Income / # of shares Market to book

- 44. Market ratios (2) Market ratios reflect investors’ expectations How could you interpret a high PE versus

- 45. Remember why we compute ratios A ratio needs to tell you something about the company you

- 46. Benchmarking (1): Trend analysis Analyzing data through time: Quarterly evolutions: spots seasonality and or extraordinary events

- 47. Benchmarking (2): Peer group and competitor analysis Makes sense both from a managerial and an investment

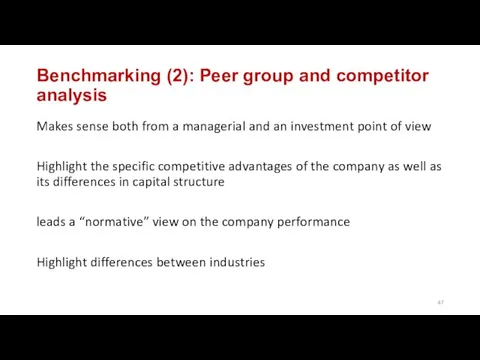

- 48. Limitations of Ratio analysis Differences in accounting practices Subjectivity in the interpretation of ratios Seasonal biases

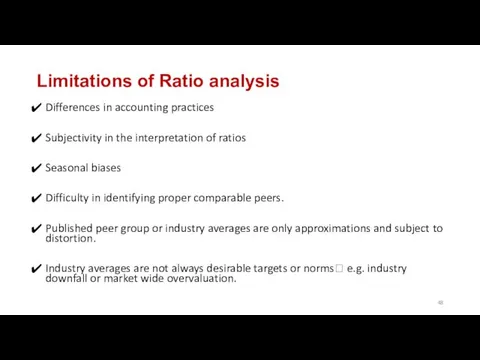

- 50. Скачать презентацию

Бюджет семьи. Доходная и расходная части бюджета

Бюджет семьи. Доходная и расходная части бюджета Вклады, проценты по вкладам

Вклады, проценты по вкладам Вопросы государственного пенсионного обеспечения. Инновации в пенсионной сфере

Вопросы государственного пенсионного обеспечения. Инновации в пенсионной сфере Анализ финансового состояния

Анализ финансового состояния РоссельхозБанк. Государственная программа Комплексное развитие сельских территорий

РоссельхозБанк. Государственная программа Комплексное развитие сельских территорий Тема 5. Планирование изменения себестоимости продукции

Тема 5. Планирование изменения себестоимости продукции Курс Основы финансовой грамотности. Принципы инвестирования

Курс Основы финансовой грамотности. Принципы инвестирования Управление инвестиционным портфелем

Управление инвестиционным портфелем Банки и управление активами. Финансовые, денежно-кредитные методы регулирования экономики. Венчурное и мезонинное финансирование

Банки и управление активами. Финансовые, денежно-кредитные методы регулирования экономики. Венчурное и мезонинное финансирование Системы электронных паспортов транспортных средств и электронных паспортов самоходных машин и других видов техники

Системы электронных паспортов транспортных средств и электронных паспортов самоходных машин и других видов техники Международные финансы

Международные финансы Наращение и дисконтирование. Тема 2

Наращение и дисконтирование. Тема 2 Международный финансовый рынок. Валютный рынок Forex

Международный финансовый рынок. Валютный рынок Forex Ндфл. Налогоплательщики

Ндфл. Налогоплательщики Бухгалтерский учет и аудит в малом предприятии

Бухгалтерский учет и аудит в малом предприятии Федеральная программа по стимулированию предпринимательской активности молодежи

Федеральная программа по стимулированию предпринимательской активности молодежи Risc si asigurari

Risc si asigurari Денежно-кредитная политика: основные направления, инструменты, проблемы

Денежно-кредитная политика: основные направления, инструменты, проблемы Бухгалтерский учет финансовых результатов деятельности организации ООО Лидер строй

Бухгалтерский учет финансовых результатов деятельности организации ООО Лидер строй Изменение порядка применения КОСГУ в 2019 году

Изменение порядка применения КОСГУ в 2019 году Организация безналичных расчетов

Организация безналичных расчетов Банковские денежные отношения

Банковские денежные отношения Банковская система: экономико-правовой аспект

Банковская система: экономико-правовой аспект Деньги и их функции. Инфляция

Деньги и их функции. Инфляция Деньги. Вчера, сегодня ,завтра

Деньги. Вчера, сегодня ,завтра Создание Центра мониторинга и реагирования на компьютерные атаки в кредитно-финансовой сфере

Создание Центра мониторинга и реагирования на компьютерные атаки в кредитно-финансовой сфере Метод бухгалтерского учета

Метод бухгалтерского учета Статистический анализ рисков при формировании кредитного портфеля банка

Статистический анализ рисков при формировании кредитного портфеля банка