Содержание

- 2. Direct Deposit: The dividend payment is transferred by electronic funds on the dividend payable date directly

- 3. ExxonMobil has a current dividend yield of about 3%. The company has grown its dividend payments

- 4. A safe bet is to expect dividend growth of about 6% per year, which is the

- 5. Latest announced dividend payment

- 6. ExxonMobil dividends per common share

- 7. Dividend should be paid in fewer amounts because if a company gains profit one year and

- 8. Exxon Mobil is as you undoubtedly know an energy company, and all commodity producers labor under

- 10. Скачать презентацию

Слайд 2

Direct Deposit: The dividend payment is transferred by electronic funds on

Direct Deposit: The dividend payment is transferred by electronic funds on

the dividend payable date directly to your checking or savings account.

Check: You may have your dividend checks sent directly to your residence or bank.

Dividend Reinvestment: You may automatically reinvest all or part of your dividends in additional shares of ExxonMobil stock through the Computershare Investment Plan for ExxonMobil Common Stock.

Check: You may have your dividend checks sent directly to your residence or bank.

Dividend Reinvestment: You may automatically reinvest all or part of your dividends in additional shares of ExxonMobil stock through the Computershare Investment Plan for ExxonMobil Common Stock.

Three ways for shareholders to receive dividends:

Слайд 3

ExxonMobil has a current dividend yield of about 3%.

The company

ExxonMobil has a current dividend yield of about 3%.

The company

has grown its dividend payments at 9.8% per year over the last decade, while EPS have grown at about 7.5% over the same time period.

The company currently has a payout ratio of about 35%, and shows no signs of increasing it in the future. As it stands, shareholders can expect dividend growth in line with overall company growth.

The company currently has a payout ratio of about 35%, and shows no signs of increasing it in the future. As it stands, shareholders can expect dividend growth in line with overall company growth.

Слайд 4

A safe bet is to expect dividend growth of about 6%

A safe bet is to expect dividend growth of about 6%

per year, which is the company’s long-term revenue per share growth rate. If ExxonMobil grows its dividend payments at 6% per year, it will have the yield on cost shown below over the following various time frames:

Current yield: 3%

Yield on cost in 3 years: 3.6%

Yield on cost in 5 years: 4.0%

Yield on cost in 10 years: 5.4%

Current yield: 3%

Yield on cost in 3 years: 3.6%

Yield on cost in 5 years: 4.0%

Yield on cost in 10 years: 5.4%

Слайд 5

Latest announced dividend payment

Latest announced dividend payment

Слайд 6

ExxonMobil dividends per common share

ExxonMobil dividends per common share

Слайд 7

Dividend should be paid in fewer amounts because if a company

Dividend should be paid in fewer amounts because if a company

gains profit one year and then pays all as dividend to their stockholders. And the next year if company does not gain any profit there will be a conflict and chaos. So company pays fewer amounts as a dividend to its shareholders to reserve funds.

Слайд 8

Exxon Mobil is as you undoubtedly know an energy company, and

Exxon Mobil is as you undoubtedly know an energy company, and

all commodity producers labor under the potential of a sudden drop in commodity price. That’s the biggest risk, and for that reason energy companies are generally afforded lower earnings multiples, and have to pay higher yields to attract investors.

According to their record Exxon has had high and fairly steady earnings, and the projects undertaken have been within their core businesses. Consequently, they could afford to pay high dividends to their shareholders to return to cash them.

According to their record Exxon has had high and fairly steady earnings, and the projects undertaken have been within their core businesses. Consequently, they could afford to pay high dividends to their shareholders to return to cash them.

Управление операционными рисками

Управление операционными рисками Управление затратами и финансирование в инновационной сфере

Управление затратами и финансирование в инновационной сфере Результаты аудита, W’22

Результаты аудита, W’22 Оборотный капитал как стоимостная категория

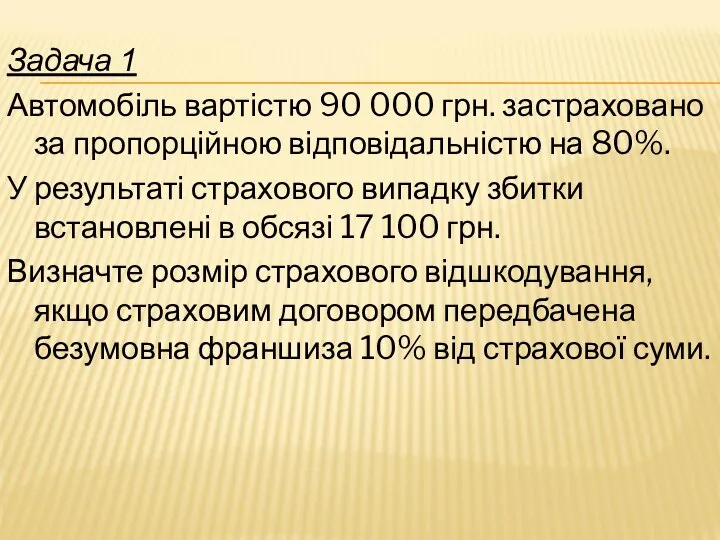

Оборотный капитал как стоимостная категория Задачі на страхування

Задачі на страхування Мокроэкономический анализ инвестиций

Мокроэкономический анализ инвестиций Стратегическое финансовое планирование

Стратегическое финансовое планирование Диверсификация и снижение риска портфеля ценных бумаг

Диверсификация и снижение риска портфеля ценных бумаг Регулювання, нагляд і контроль банківської діяльності

Регулювання, нагляд і контроль банківської діяльності Повышение исполнительской дисциплины по соблюдению нормативных требований предоставления жилищно-коммунальных услуг

Повышение исполнительской дисциплины по соблюдению нормативных требований предоставления жилищно-коммунальных услуг Основы организации расчетных операций

Основы организации расчетных операций Учет внебюджетных денежных средств, принадлежащих организации

Учет внебюджетных денежных средств, принадлежащих организации Центральный банк Франции

Центральный банк Франции Алгоритм расчета неустойки по договору долевого участия в строительстве

Алгоритм расчета неустойки по договору долевого участия в строительстве Ценные бумаги

Ценные бумаги Корпоративные финансы

Корпоративные финансы Обязательное страхование гражданской ответственности владельцев транспортных средств (ОСАГО)

Обязательное страхование гражданской ответственности владельцев транспортных средств (ОСАГО) Корпоративные финансы. (Тема 1)

Корпоративные финансы. (Тема 1) Программа добровольного медицинского страхования Противоклещевая защита

Программа добровольного медицинского страхования Противоклещевая защита Отчет ревизионной комиссии за 2020 год

Отчет ревизионной комиссии за 2020 год Основы аудита (выборочно). Сущность аудита, его цель и задачи. Лекция 1

Основы аудита (выборочно). Сущность аудита, его цель и задачи. Лекция 1 Облік процесу реалізації та визначення фінанасових результатів

Облік процесу реалізації та визначення фінанасових результатів Проектирование бизнеса. Практика 6. Денежные потоки инвестиционного проекта. Показатели эффективности

Проектирование бизнеса. Практика 6. Денежные потоки инвестиционного проекта. Показатели эффективности Развитие банковских услуг и их значение для формирования доходов АО Банк Финсервис

Развитие банковских услуг и их значение для формирования доходов АО Банк Финсервис Актуарные расчеты. Сущность, значение и задачи построения страховых тарифов. Лекция 3

Актуарные расчеты. Сущность, значение и задачи построения страховых тарифов. Лекция 3 Имущественный налоговый вычет

Имущественный налоговый вычет Открытое акционерное общество “Паритетбанк”

Открытое акционерное общество “Паритетбанк” Лекции по дисциплине Аудит. Тема 9. Организация аудиторской проверки и аудиторские процедуры

Лекции по дисциплине Аудит. Тема 9. Организация аудиторской проверки и аудиторские процедуры