Содержание

- 2. Lecture 11. Capital Markets Murodullo Bazarov m.bazarov@wiut.uz ATB205 office hours: Tues 11:00-13:00

- 3. MEQ & RYL

- 4. Lecture Outline Purpose of the Capital Market Capital Market Participants Capital Market Trading Types of Bonds

- 5. Purpose of the Capital Market Original maturity is greater than one year, typically for long-term financing

- 6. Capital Market Participants Primary issuers of securities: Federal and local governments: debt issuers Corporations: equity and

- 7. Capital Market Trading 1. Primary market for initial sale (IPO) 2. Secondary market Over-the-counter Organized exchanges

- 8. Types of Bonds Bonds are securities that represent debt owed by the issuer to the investor,

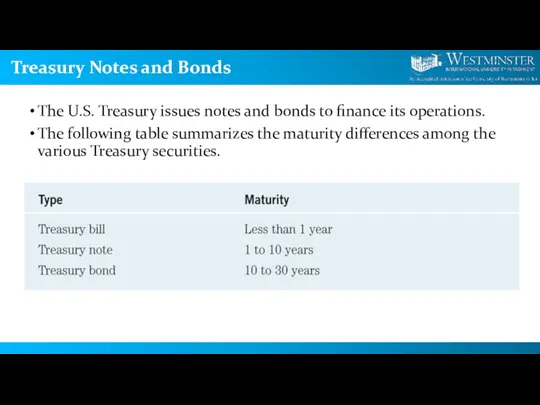

- 9. Treasury Notes and Bonds The U.S. Treasury issues notes and bonds to finance its operations. The

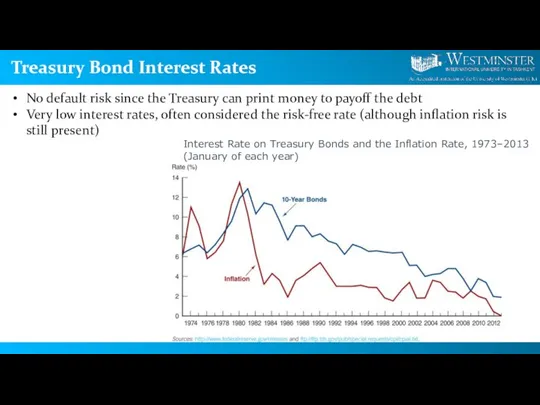

- 10. Treasury Bond Interest Rates No default risk since the Treasury can print money to payoff the

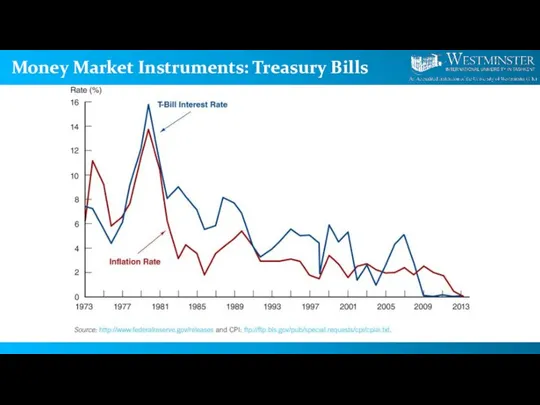

- 11. Money Market Instruments: Treasury Bills

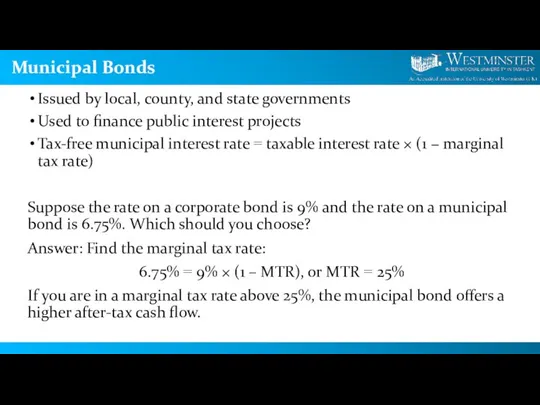

- 12. Municipal Bonds Issued by local, county, and state governments Used to finance public interest projects Tax-free

- 13. Municipal Bonds Suppose the rate on a corporate bond is 5% and the rate on a

- 14. Municipal Bonds Two types General obligation bonds Revenue bonds NOT default-free (e.g., Orange County California) Defaults

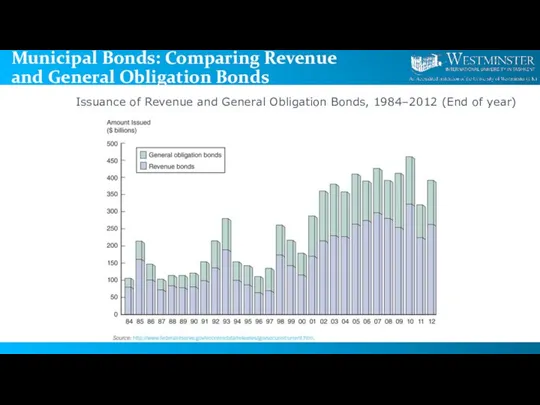

- 15. Municipal Bonds: Comparing Revenue and General Obligation Bonds Issuance of Revenue and General Obligation Bonds, 1984–2012

- 16. Corporate Bonds Typically have a face value of $1,000, although some have a face value of

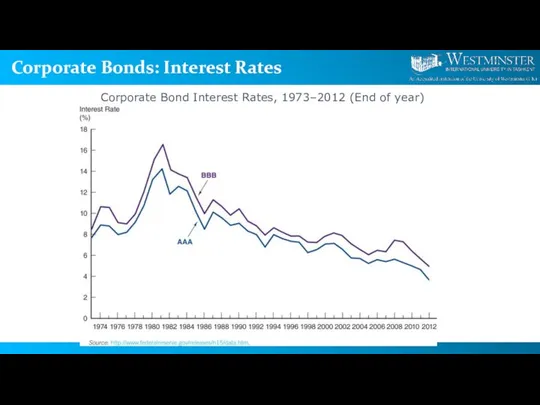

- 17. Corporate Bonds: Interest Rates Corporate Bond Interest Rates, 1973–2012 (End of year)

- 18. Characteristics of Corporate Bonds Registered Bonds Replaced “bearer” bonds Internal revenue service (IRS) can track interest

- 19. Characteristics of Corporate Bonds Secured Bonds Mortgage bonds Equipment trust certificates Unsecured Bonds Debentures Subordinated debentures

- 20. Financial Guarantees for Bonds Some debt issuers purchase financial guarantees to lower the risk of their

- 21. Investing in Bonds Bonds are the most popular alternative to stocks for long-term investing. Even though

- 22. Investing in Bonds Bonds and Stocks Issued, 1983–2012

- 23. Investing in Stocks Represents ownership in a firm Earn a return in two ways Price of

- 24. Investing in Stocks: How Stocks are Sold Organized exchanges NYSE is best known, with daily volume

- 25. Investing in Stocks: Organized vs. OTC Organized exchanges (e.g., NYSE) Auction markets with floor specialists 25%

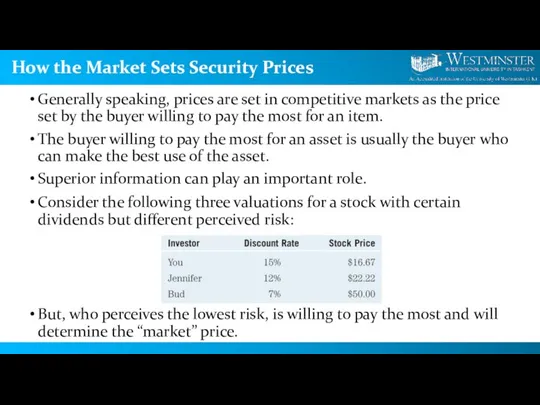

- 26. How the Market Sets Security Prices Generally speaking, prices are set in competitive markets as the

- 27. Errors in Valuation

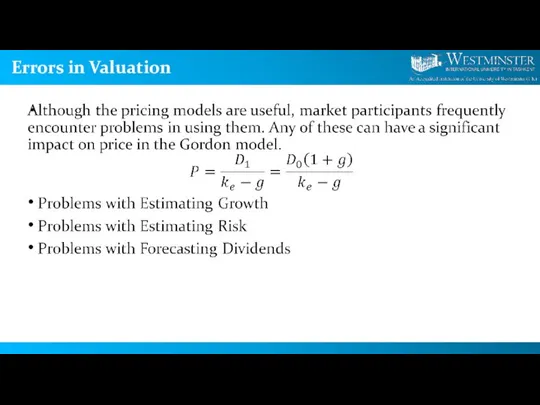

- 28. Errors in Valuation: Dividend growth rates Stock Prices for a Security with D0 = $2.00, ke

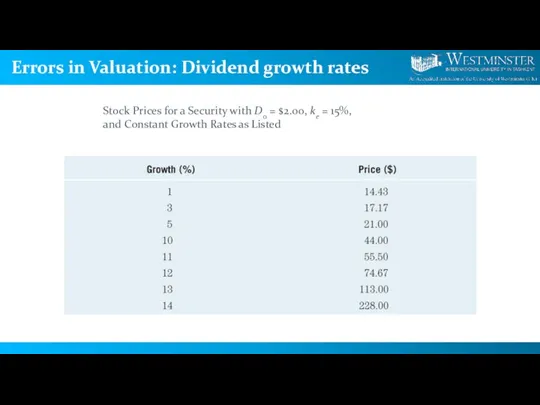

- 29. Errors in Valuation: Required returns Stock Prices for a Security with D0 = $2.00, g =

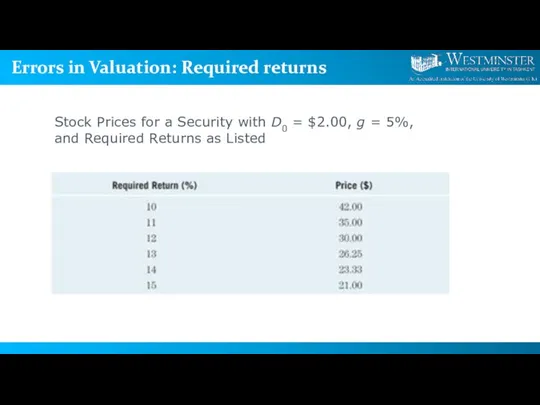

- 30. Errors in Valuation Security valuation is not an exact science! Considering different growth rates, required rates,

- 31. Case: The 2007–2009 Financial Crisis and the Stock Market The financial crisis, which started in August

- 32. Case: 9/11, Enron and the Market Both 9/11 and the Enron scandal were events in 2001.

- 34. Скачать презентацию

Оплата праці

Оплата праці Виды банковских счетов

Виды банковских счетов Производственные ресурсы: основной капитал

Производственные ресурсы: основной капитал Рынок труда и социально-трудовые отношения

Рынок труда и социально-трудовые отношения Оборотные средства предприятия

Оборотные средства предприятия Основы финансовых вычислений. Сложные проценты

Основы финансовых вычислений. Сложные проценты VIII Уральский инвестиционный форум г. Челябинск

VIII Уральский инвестиционный форум г. Челябинск Семестровая работа по дисциплине Основы экономики и финансовой грамотности

Семестровая работа по дисциплине Основы экономики и финансовой грамотности Стохастические модели динамического программирования

Стохастические модели динамического программирования Prosperity club. Живи и процветай

Prosperity club. Живи и процветай Перший Український Міжнародний Банк (ПУМБ)

Перший Український Міжнародний Банк (ПУМБ) Предпринимательская деятельность и управление финансами

Предпринимательская деятельность и управление финансами Income

Income Бюджет абинского городского поселения на 2021 год и плановый период 2022-2023 годов

Бюджет абинского городского поселения на 2021 год и плановый период 2022-2023 годов Otvety na chastye voprosy po razdelu zarabotnoj platy v programme 1SBuhgalteriya 8 dlya Kazahstana. IPN, vychety po IPN i mnogoe drugoe

Otvety na chastye voprosy po razdelu zarabotnoj platy v programme 1SBuhgalteriya 8 dlya Kazahstana. IPN, vychety po IPN i mnogoe drugoe Промышленность и инвестиции

Промышленность и инвестиции Финансовый контроль

Финансовый контроль Особенности правового регулирования труда самозанятых граждан

Особенности правового регулирования труда самозанятых граждан Налоговый вычет в 2020 году

Налоговый вычет в 2020 году Домовой классический : описание продукта, основные понятия, тарифы. Лекция 3

Домовой классический : описание продукта, основные понятия, тарифы. Лекция 3 Лекция 21 Модуль 5

Лекция 21 Модуль 5 Теоретические концепции корпоративных финансов

Теоретические концепции корпоративных финансов Лекция 3-4. Бухгалтерские информационные системы (БУИС)

Лекция 3-4. Бухгалтерские информационные системы (БУИС) Деньги и банки

Деньги и банки Ценные бумаги: как и где их покупать и продавать. Фондовый рынок как источник финансовых ресурсов для предприятий (IPO, SPO)

Ценные бумаги: как и где их покупать и продавать. Фондовый рынок как источник финансовых ресурсов для предприятий (IPO, SPO) Самые необычные денежные купюры

Самые необычные денежные купюры Облік в оподаткуванні, його зміст та організація на підприємстві

Облік в оподаткуванні, його зміст та організація на підприємстві Экономические основы производства. Прикладные понятия экономики

Экономические основы производства. Прикладные понятия экономики