Содержание

- 2. What is the object of the corporate income tax? Taxable income Income taxed at source of

- 3. How is taxable income? Taxable income is defined as the difference between the adjusted gross annual

- 4. The costs of the taxpayer related to obtaining the total annual income are deductible in determining

- 5. Deductions made by the taxpayer in the presence of the documents confirming the expenses incurred in

- 6. What are the stakes? 10% - applies to the taxpayer's taxable income for which the land

- 7. What set the tax period? The period for which the calculated CPN - calendar year (from

- 8. What are the deadlines for the declaration? Declaration CIT consists of a Declaration and its annexes

- 9. What are the terms of payment of the tax? Taxpayers pay the corporate income tax by

- 10. for the calculation of the period before the submission of the declaration by the CPN from

- 12. Скачать презентацию

What is the object of the corporate income tax?

Taxable income

Income taxed

What is the object of the corporate income tax?

Taxable income

Income taxed

Net income of the nonresident legal entity doing business in the Republic of Kazakhstan through a permanent establishment.

How is taxable income?

Taxable income is defined as the difference between

How is taxable income?

Taxable income is defined as the difference between

The total annual income of a resident legal entity consists of all types of income, receivable (received) them in Kazakhstan and abroad during the tax period. Main items of income - is income from the sale of goods (works, services), the income from the lease of property, income from capital gains, income from writing off liabilities, gratuitously received property, dividends, interest and other income. The total annual income of a taxpayer is subject to adjustment. For example, it excludes dividends received from a resident legal entity of the Republic of Kazakhstan, previously taxed at the source of payment in the Republic of Kazakhstan and some other types of income.

The costs of the taxpayer related to obtaining the total annual

The costs of the taxpayer related to obtaining the total annual

However, some types of expenses are deductible within the limits established by legislation, such as residues of the amount of compensation for business trips (daily maximum of 6 MCI per day within the Republic of Kazakhstan) and expenses, interest expense, income tax, the cost of fixed assets (maintenance and depreciation), the cost of training employees, etc.

Deductions made by the taxpayer in the presence of the documents

Deductions made by the taxpayer in the presence of the documents

Taxable income is subject to its further adjustment. In particular, the expenses actually incurred by the taxpayer for the maintenance of social infrastructure should be excluded from taxable income in the range of 3 percent of taxable income.

What are the stakes?

10% - applies to the taxpayer's taxable income

What are the stakes?

10% - applies to the taxpayer's taxable income

30% - applies to the taxpayer's taxable income, which adopted the generally established procedure

15% - applies to the amount of income paid (except for the income of non-residents from sources in the Republic of Kazakhstan). Some types of income are taxed at source. These include, in particular, dividend income of non-residents from sources in the Republic of Kazakhstan, the remuneration paid to legal entities, and others. The tax is withheld at source of payment in the payment of income regardless of the form and place of payment of income, and transferred, as a general rule, no later than five working days after the end of the month in which the payment was made.

Corporate income tax is calculated for the tax period by applying the rate to the taxable income, taking into account adjustments made, reduced by the amount of losses carried forward for up to 3 years inclusive of the repayment due to the taxable income of subsequent tax periods.

What set the tax period?

The period for which the calculated CPN

What set the tax period?

The period for which the calculated CPN

What are the deadlines for the declaration?

Declaration CIT consists of a

What are the deadlines for the declaration?

Declaration CIT consists of a

The final payment (payment - the difference between accrued advance payments for the reporting tax period and actually the calculus of corporate tax) for the tax period, the taxpayer shall, within ten working days after March 31.

What are the terms of payment of the tax?

Taxpayers pay the

What are the terms of payment of the tax?

Taxpayers pay the

Advance payments are calculated based on the estimated amount of corporate income tax for the current tax period, but not less than the assessed amounts of monthly advance payments in the calculation of the amount of advance payments for the previous fiscal period:

for the calculation of the period before the submission of the

for the calculation of the period before the submission of the

• on the calculation after the submission of the declaration by the CPN from April to December, shall be filed within 20 working days after the submission of the declaration, but not later than April 20.

Роль Международного Валютного Фонда (МВФ) в международных денежных отношениях

Роль Международного Валютного Фонда (МВФ) в международных денежных отношениях ВКР: Анализ ликвидности и платежеспособности коммерческой организации

ВКР: Анализ ликвидности и платежеспособности коммерческой организации Сравнение налогов Республики Казахстан и Индии

Сравнение налогов Республики Казахстан и Индии Формы государственной поддержки инноваций в России

Формы государственной поддержки инноваций в России 1. Дополнительные меры финансовой поддержки работодателей Пермского края на 2021 год

1. Дополнительные меры финансовой поддержки работодателей Пермского края на 2021 год Income

Income Муниципальные ценные бумаги, их характеристика

Муниципальные ценные бумаги, их характеристика Бюджет для граждан исполнение местного бюджета за 2020 год

Бюджет для граждан исполнение местного бюджета за 2020 год Грантовая поддержка, как современный механизм развития территорий

Грантовая поддержка, как современный механизм развития территорий Постоянные и переменные затраты. Издержки производства

Постоянные и переменные затраты. Издержки производства Аналіз стану фінансового забезпечення судів

Аналіз стану фінансового забезпечення судів Внебюджетные фонды

Внебюджетные фонды Совершенствование системы ценообразования в строительстве

Совершенствование системы ценообразования в строительстве Бюджет государства и семьи

Бюджет государства и семьи Страховые взносы в ПФР, ФСС, ФФОМС и налог на доходы. Практическое занятие 4

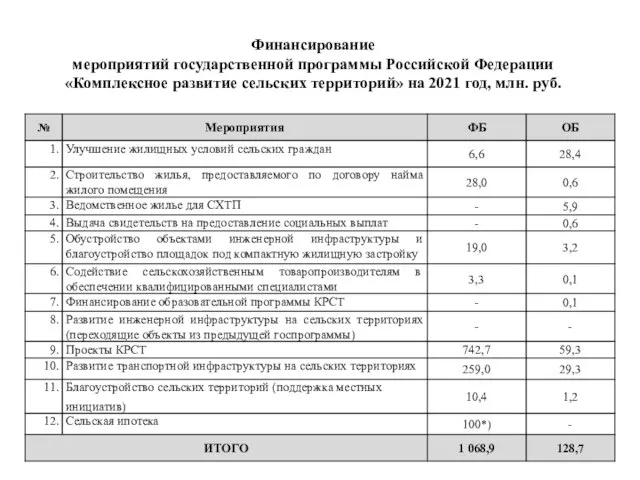

Страховые взносы в ПФР, ФСС, ФФОМС и налог на доходы. Практическое занятие 4 Финансирование мероприятий государственной программы Российской Федерации Комплексное развитие сельских территорий на 2021

Финансирование мероприятий государственной программы Российской Федерации Комплексное развитие сельских территорий на 2021 Ямайская валютная система

Ямайская валютная система Организация процедуры оценки ресурсного потенциала предприятия

Организация процедуры оценки ресурсного потенциала предприятия Типы организации и построения финансовых структур российских компаний

Типы организации и построения финансовых структур российских компаний Олимпиады и конкурсы как эффективный способ формирования финансовой грамотности школьников

Олимпиады и конкурсы как эффективный способ формирования финансовой грамотности школьников Поняття та функції податкового механізму

Поняття та функції податкового механізму Эндогенные и экзогенные деньги

Эндогенные и экзогенные деньги Организация оплаты труда в сельском хозяйстве

Организация оплаты труда в сельском хозяйстве Технологии передачи данных. Реестр ККТ: новые и старые модели

Технологии передачи данных. Реестр ККТ: новые и старые модели Риск банкротства организации и методы его предотвращения предприятия ОАО Дорисс

Риск банкротства организации и методы его предотвращения предприятия ОАО Дорисс Рентна плата

Рентна плата Концепция планирования выездных налоговых проверок

Концепция планирования выездных налоговых проверок Қазақстан Республткасының аудиториялық қызметін нормативті реттейтін жүйе

Қазақстан Республткасының аудиториялық қызметін нормативті реттейтін жүйе