Содержание

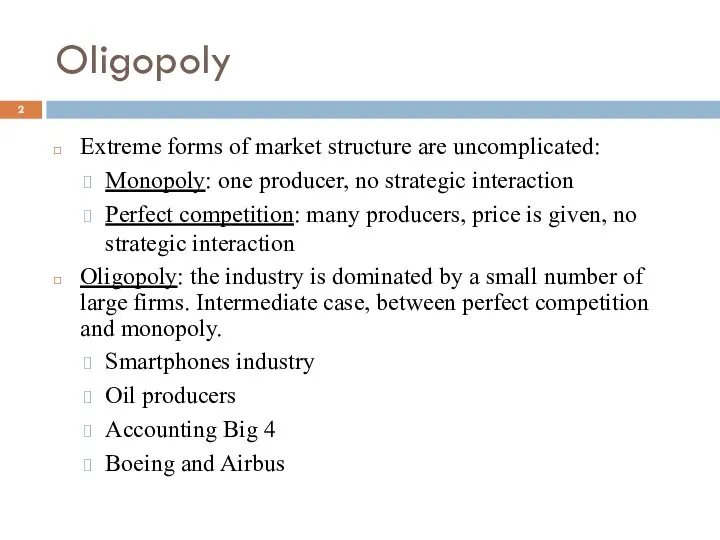

- 2. Oligopoly Extreme forms of market structure are uncomplicated: Monopoly: one producer, no strategic interaction Perfect competition:

- 3. Strategic interactions and oligopoly When making strategic decisions (on prices, quantity, advertising, innovation etc.) the oligopolist

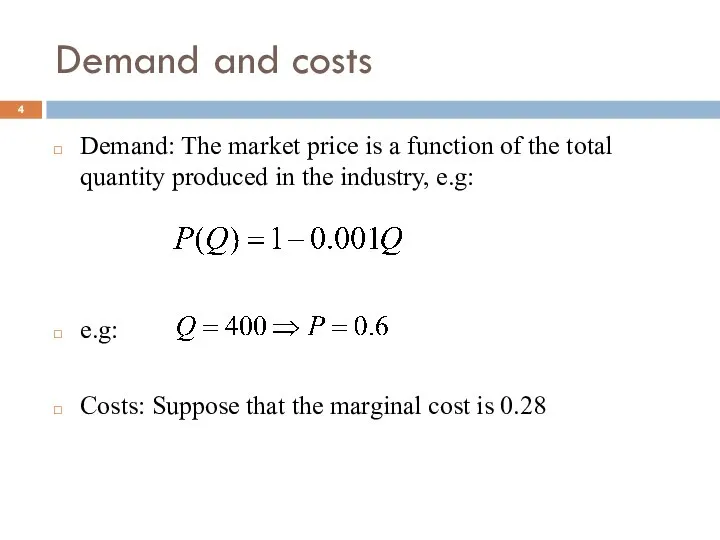

- 4. Demand and costs Demand: The market price is a function of the total quantity produced in

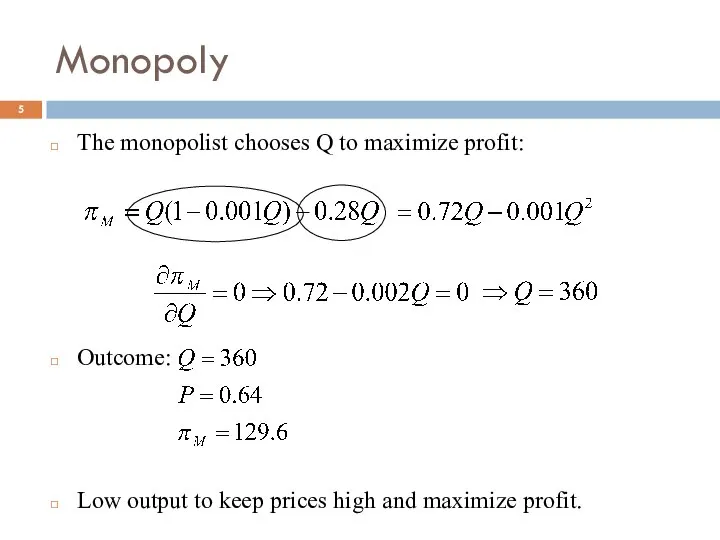

- 5. Monopoly The monopolist chooses Q to maximize profit: Outcome: Low output to keep prices high and

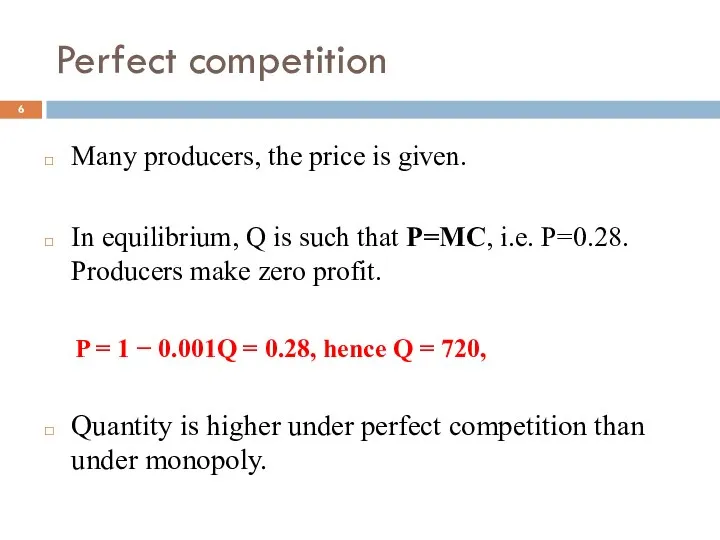

- 6. Perfect competition Many producers, the price is given. In equilibrium, Q is such that P=MC, i.e.

- 7. The Cournot model What is the Cournot model? Model of industry structure where producers’ strategic decision

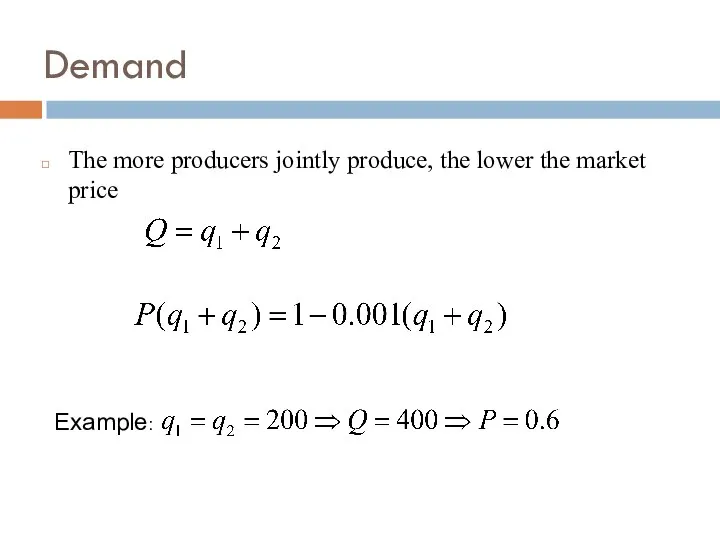

- 8. Demand The more producers jointly produce, the lower the market price Example:

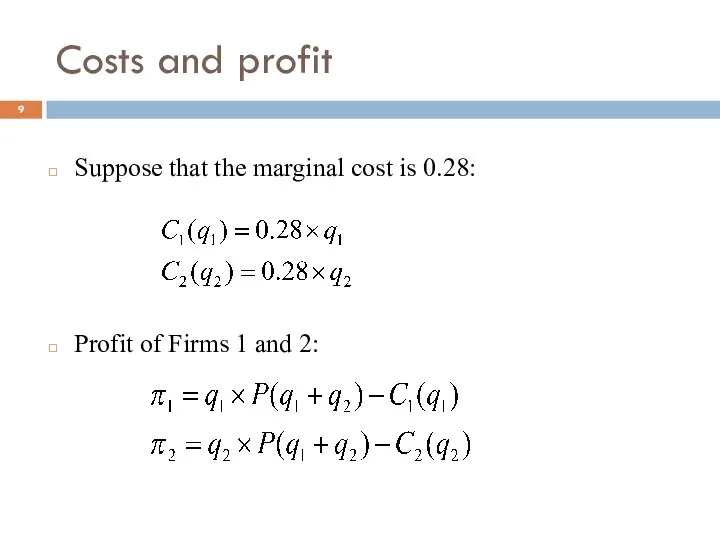

- 9. Costs and profit Suppose that the marginal cost is 0.28: Profit of Firms 1 and 2:

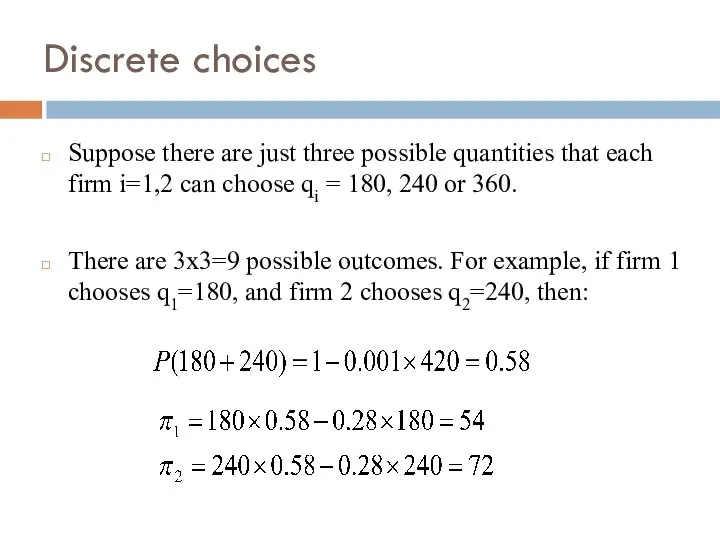

- 10. Discrete choices Suppose there are just three possible quantities that each firm i=1,2 can choose qi

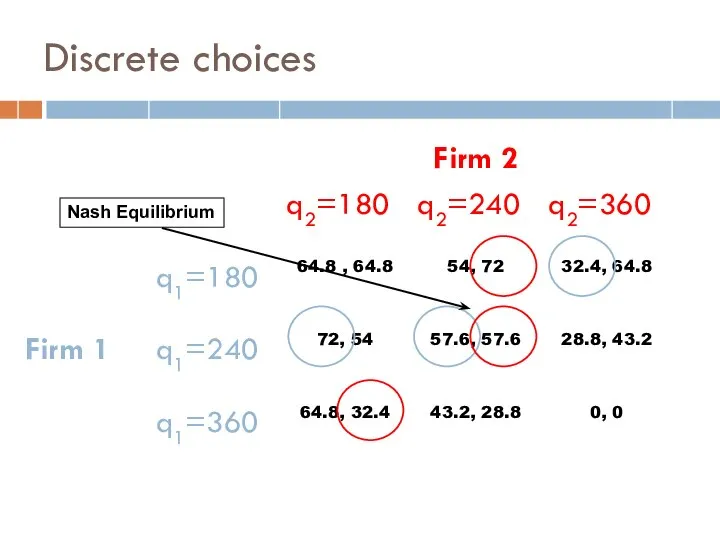

- 11. Discrete choices Nash Equilibrium

- 12. Continuous choices Discrete games are not suitable to analyze the decision of how much to produce

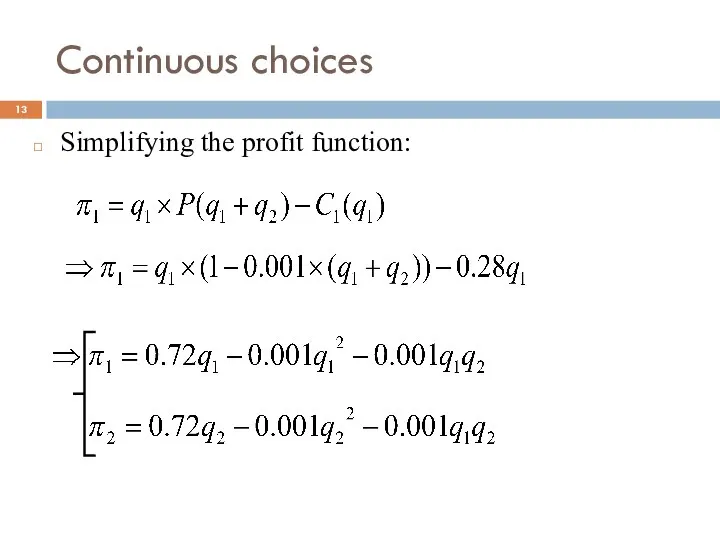

- 13. Continuous choices Simplifying the profit function:

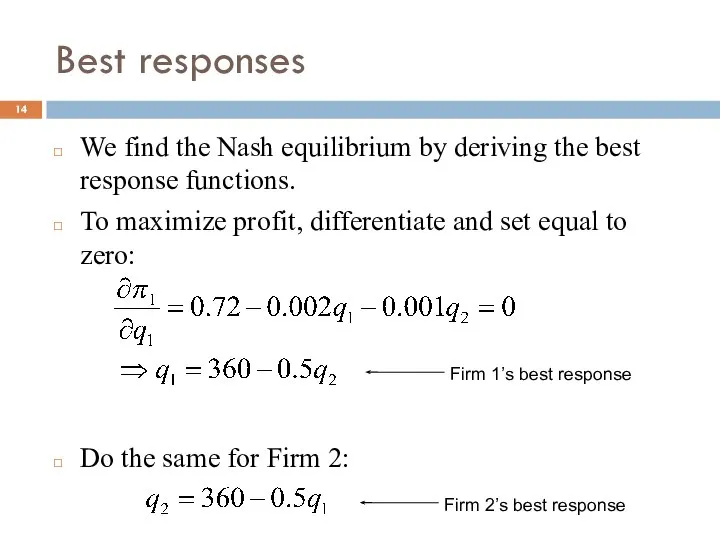

- 14. Best responses We find the Nash equilibrium by deriving the best response functions. To maximize profit,

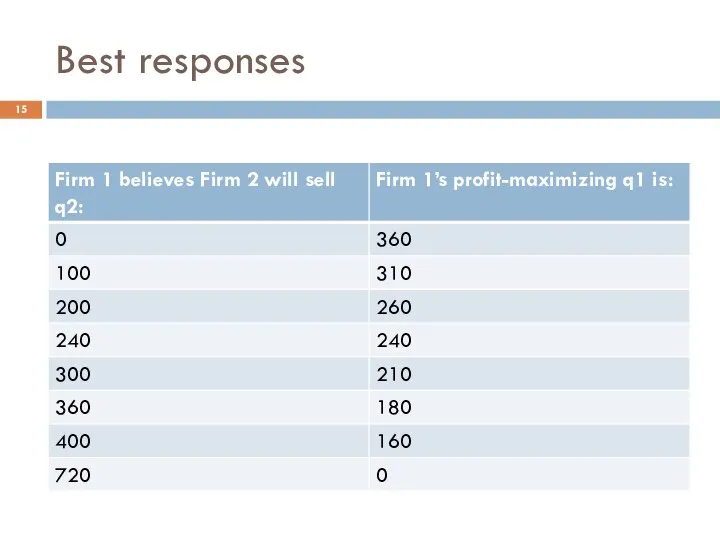

- 15. Best responses

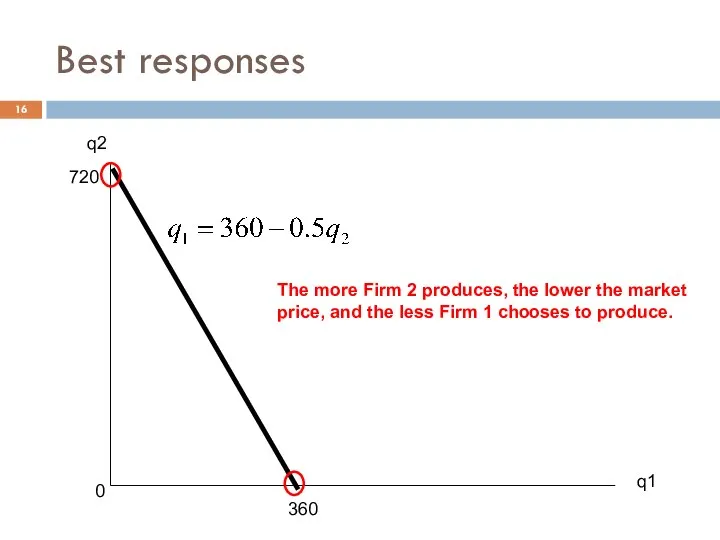

- 16. Best responses 360 720 q1 q2 0 The more Firm 2 produces, the lower the market

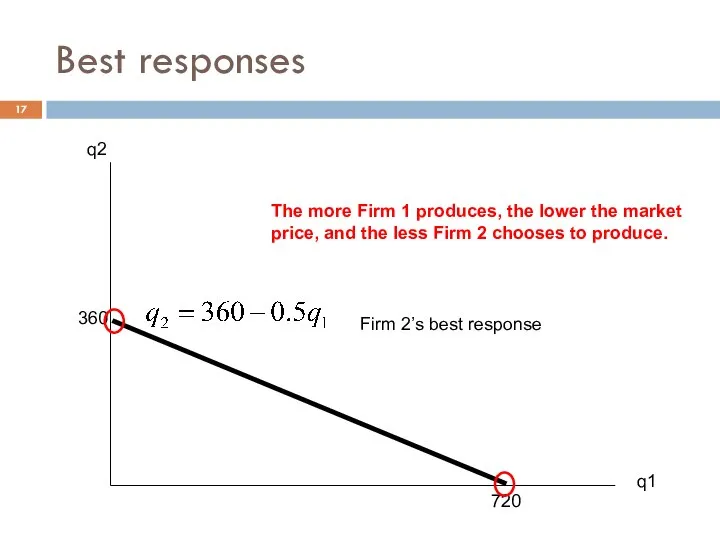

- 17. 360 720 q1 q2 Best responses Firm 2’s best response The more Firm 1 produces, the

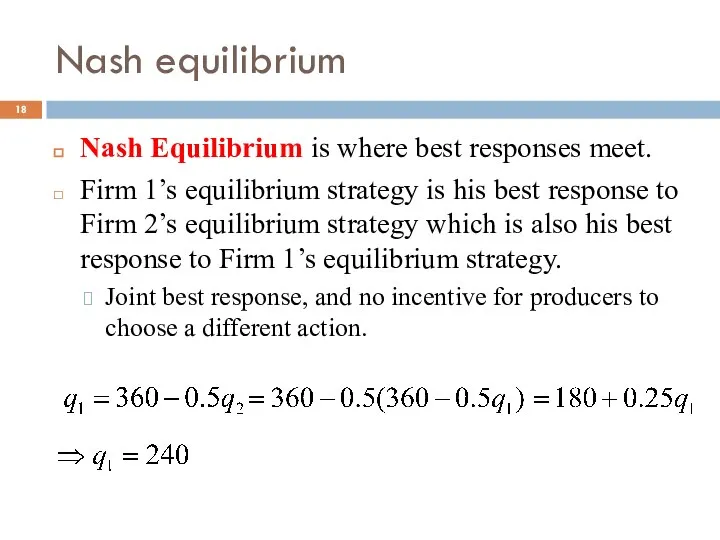

- 18. Nash equilibrium Nash Equilibrium is where best responses meet. Firm 1’s equilibrium strategy is his best

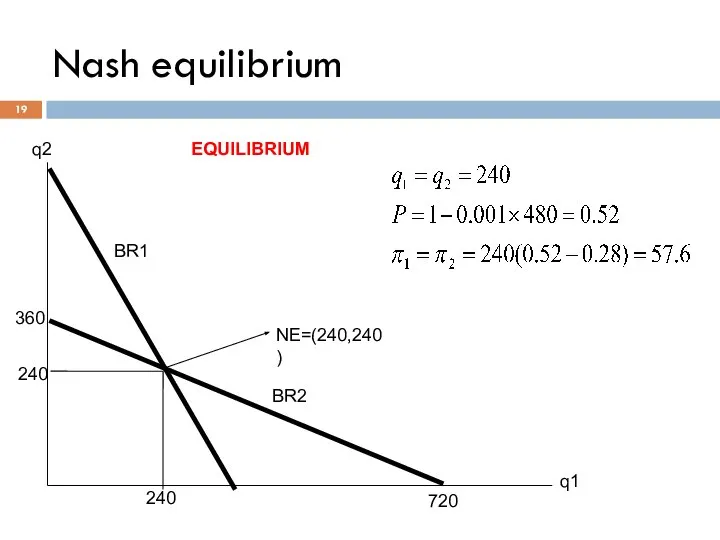

- 19. 360 720 q1 q2 NE=(240,240) Nash equilibrium EQUILIBRIUM BR1 BR2 240 240

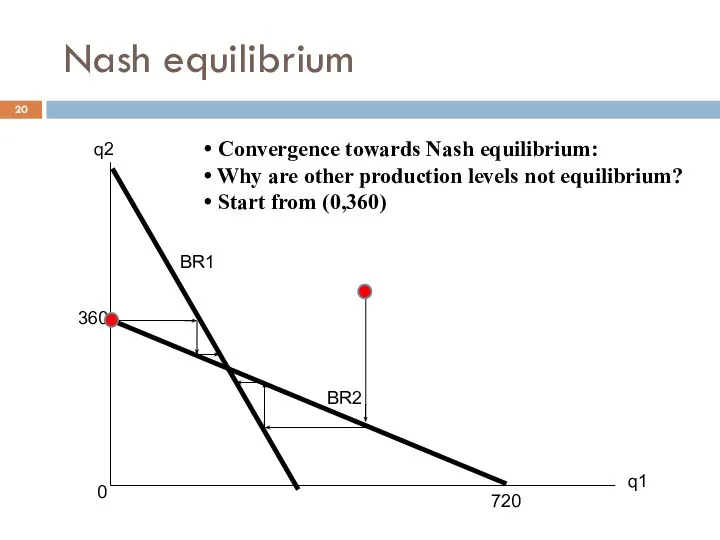

- 20. Nash equilibrium 360 720 q1 q2 Convergence towards Nash equilibrium: Why are other production levels not

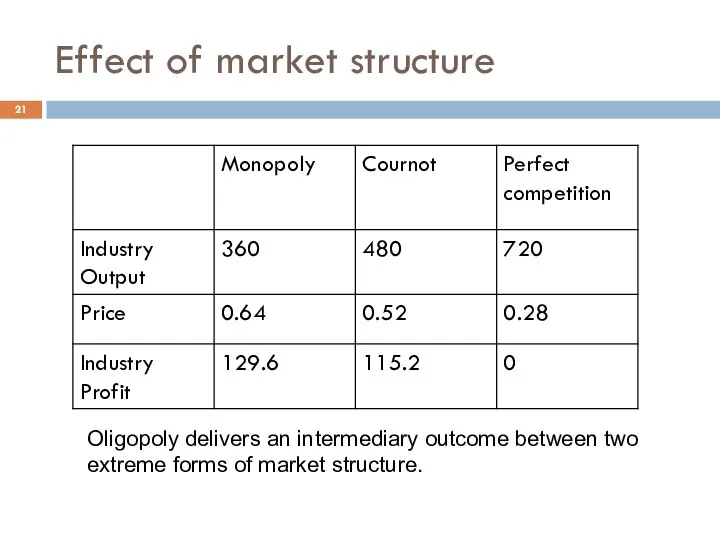

- 21. Effect of market structure Oligopoly delivers an intermediary outcome between two extreme forms of market structure.

- 22. Effect of market structure Cournot with more than 2 producers:

- 23. Effect of market structure Having fewer producers is associated with: Lower total output Higher prices Higher

- 24. Wouldn’t the two producers be better off cooperating rather than competing? YES Both producers could maximize

- 25. Cartel “The OPEC cartel agreed on Wednesday to reduce production by 2.2 million barrels a day,

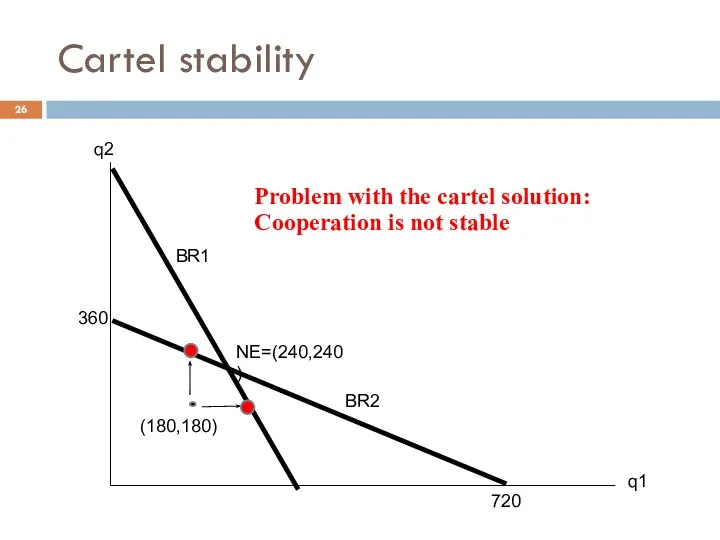

- 26. 360 720 q1 q2 NE=(240,240) Cartel stability BR1 BR2 (180,180) Problem with the cartel solution: Cooperation

- 27. Cartel stability Each producer makes more profit by deviating from the cartel quantity. For instance, if

- 28. Cartel stability “The coffee bean cartel, the Association of Coffee Producing Countries, whose members produce 70%

- 29. Cartel stability To summarize… Producers have incentive to form cartels, but cartels are unstable. Q: How

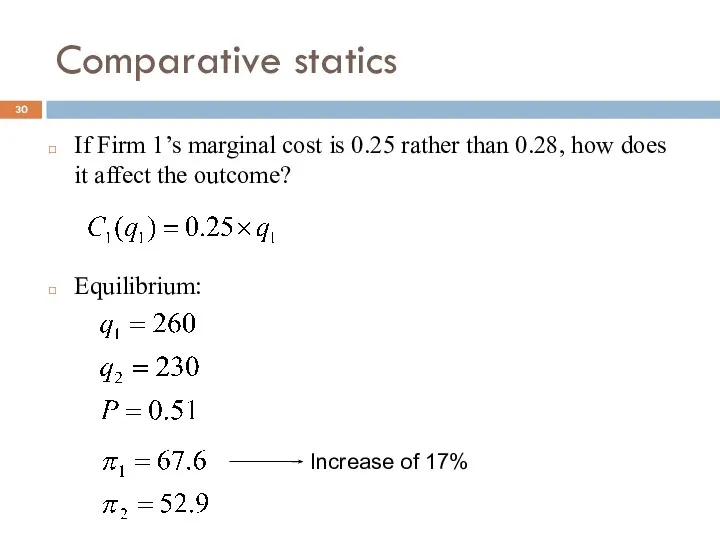

- 30. Comparative statics If Firm 1’s marginal cost is 0.25 rather than 0.28, how does it affect

- 32. Скачать презентацию

Функция y = x2 и её график

Функция y = x2 и её график Техника формирования граф логических структур

Техника формирования граф логических структур Презентация на тему Разложение на простые множители

Презентация на тему Разложение на простые множители Ранний детский аутизм (РДА)

Ранний детский аутизм (РДА) Прямоугольный параллелепипед

Прямоугольный параллелепипед Количественные характеристики случайных переменных

Количественные характеристики случайных переменных Доверительный интервал и его друзья

Доверительный интервал и его друзья Предмет цель и задачи теории массового обслуживания

Предмет цель и задачи теории массового обслуживания РЕШЕНИЕ ТРИГОНОМЕТРИЧЕСКИХ УРАВНЕНИЙ НА ИНТЕРВАЛЕ. Урок № 18

РЕШЕНИЕ ТРИГОНОМЕТРИЧЕСКИХ УРАВНЕНИЙ НА ИНТЕРВАЛЕ. Урок № 18  Математические основы описания результатов исследования

Математические основы описания результатов исследования Логика предикатов

Логика предикатов Готовимся к ЕГЭ

Готовимся к ЕГЭ Arccos. Решение уравнений cost=a

Arccos. Решение уравнений cost=a Гармония и геометрия

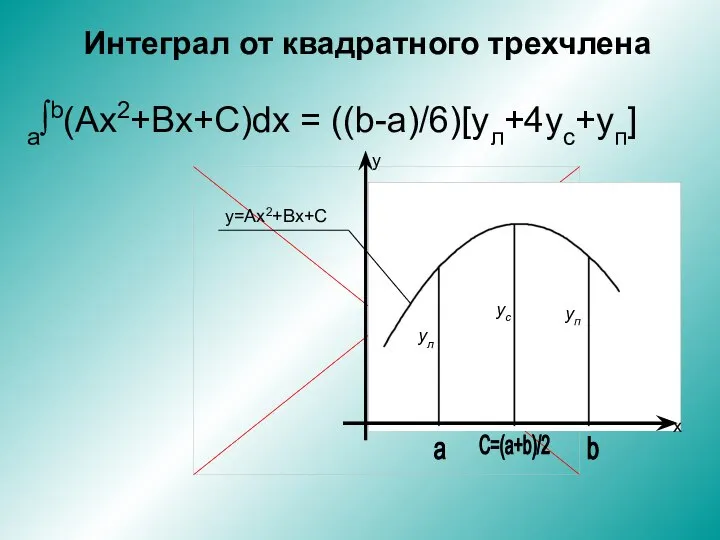

Гармония и геометрия Интеграл от квадратного трехчлена

Интеграл от квадратного трехчлена Приём умножения и деления на 10

Приём умножения и деления на 10 Математическая логика. (Тема 2)

Математическая логика. (Тема 2) Системы линейных уравнений

Системы линейных уравнений Презентация по математике "Линейные уравнения с одной переменной" - скачать

Презентация по математике "Линейные уравнения с одной переменной" - скачать  Геометрические задачи С2, по материалам ЕГЭ

Геометрические задачи С2, по материалам ЕГЭ Презентация по математике "Решение уравнений n-й степени, n>2. Нахождение корней многочленов" - скачать

Презентация по математике "Решение уравнений n-й степени, n>2. Нахождение корней многочленов" - скачать  Решение пределов

Решение пределов Рациональные числа и действия над ними

Рациональные числа и действия над ними График функции

График функции Задачи военно-прикладного характера Вклад ученых математиков в оборонную мощь страны во время Великой Отечественной войны.

Задачи военно-прикладного характера Вклад ученых математиков в оборонную мощь страны во время Великой Отечественной войны. Тема урока: Приращение функции

Тема урока: Приращение функции Применение производных в математике и физике

Применение производных в математике и физике Презентация по математике "Решение неравенств методом интервалов" - скачать бесплатно

Презентация по математике "Решение неравенств методом интервалов" - скачать бесплатно