Содержание

- 2. DISCLAIMER This presentation is prepared based on information, available to Joint Stock Company United Aircraft Corporation

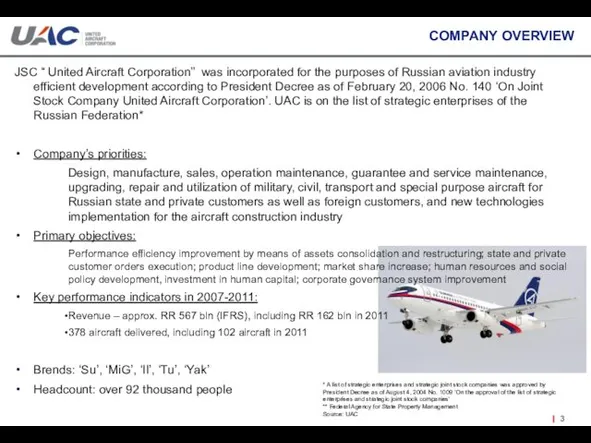

- 3. COMPANY OVERVIEW * A list of strategic enterprises and strategic joint stock companies was approved by

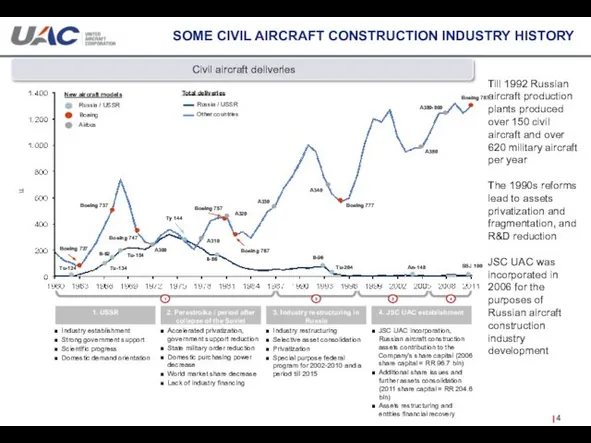

- 4. SOME CIVIL AIRCRAFT CONSTRUCTION INDUSTRY HISTORY Civil aircraft deliveries Till 1992 Russian aircraft production plants produced

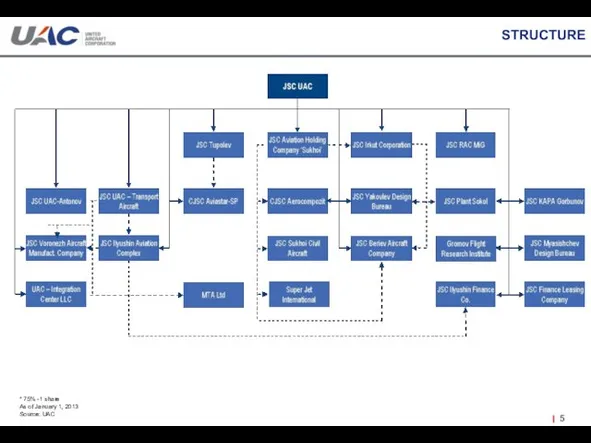

- 5. STRUCTURE * 75% -1 share As of January 1, 2013 Source: UAC

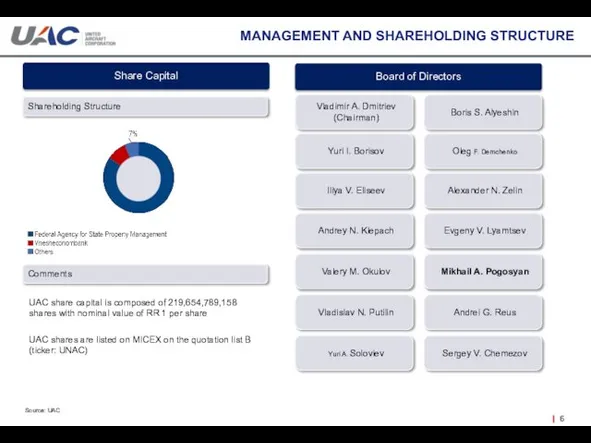

- 6. MANAGEMENT AND SHAREHOLDING STRUCTURE Source: UAC UAC share capital is composed of 219,654,789,158 shares with nominal

- 7. CIVIL AIRCRAFT PRODUCT LINE Short-haul and Medium-haul Aircraft SSJ-100 Аn-148 Тu-204/214 МS-21 Long-haul Aircraft Il-96 Source:

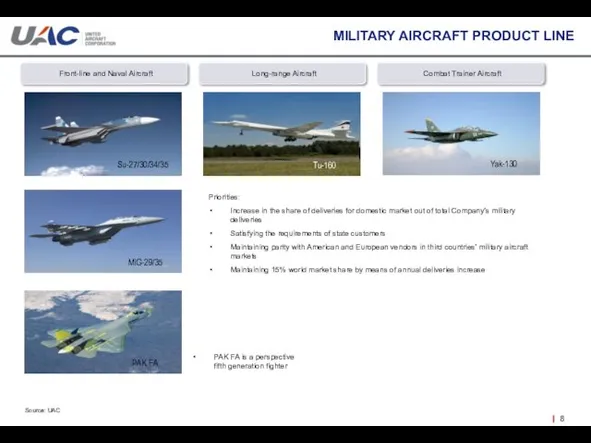

- 8. MILITARY AIRCRAFT PRODUCT LINE Source: UAC Front-line and Naval Aircraft Long-range Aircraft Combat Trainer Aircraft Su-27/30/34/35

- 9. TRANSPORT AND SPECIAL PURPOSE AIRCRAFT PRODUCT LINE Source: UAC Light and Medium Weight Transport Aircraft Heavy

- 10. 2007-2012 ACHIEVEMENTS Source: UAC Assets consolidation and restructuring Entities modernization and financial recovery Energy and resource

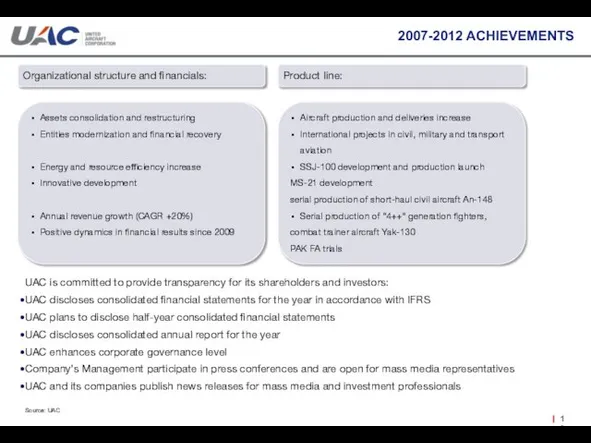

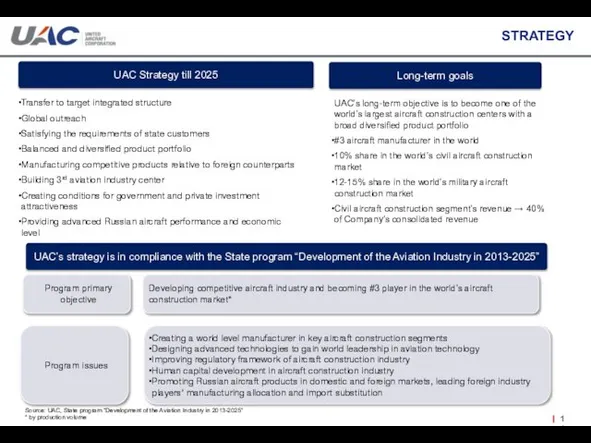

- 11. STRATEGY Source: UAC, State program “Development of the Aviation Industry in 2013-2025” * by production volume

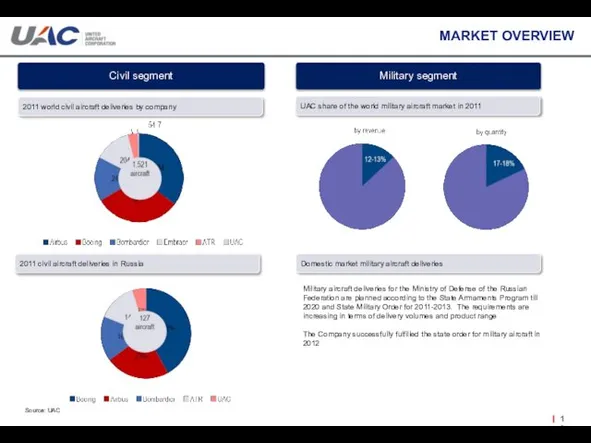

- 12. MARKET OVERVIEW Source: UAC 2011 world civil aircraft deliveries by company UAC share of the world

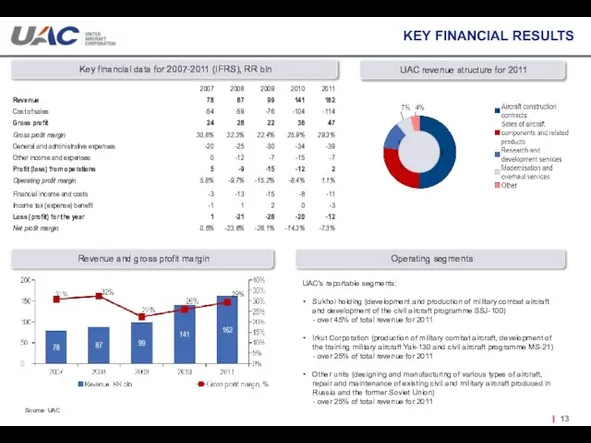

- 13. KEY FINANCIAL RESULTS Source: UAC UAC revenue structure for 2011 Key financial data for 2007-2011 (IFRS),

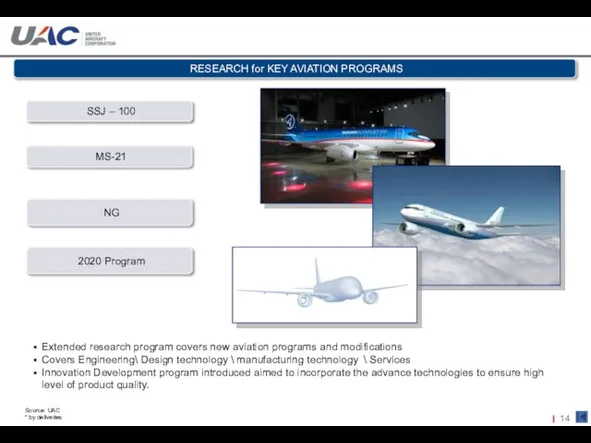

- 14. Extended research program covers new aviation programs and modifications Covers Engineering\ Design technology \ manufacturing technology

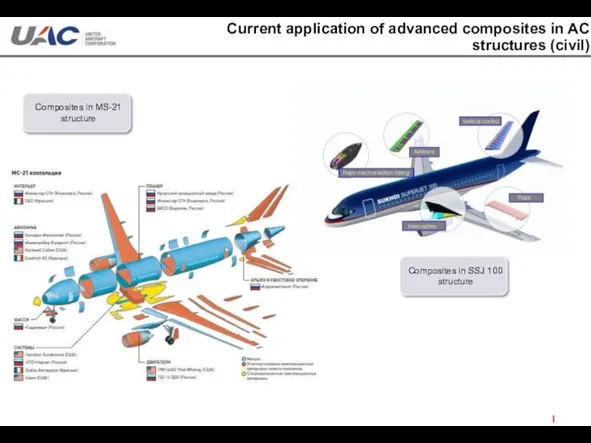

- 15. Current application of advanced composites in AC structures (civil) Composites in MS-21 structure Composites in SSJ

- 16. Design optimizations regarding to available advanced technologies Composite structure manufacturing Math modeling for structure\detail\component Certification Testing

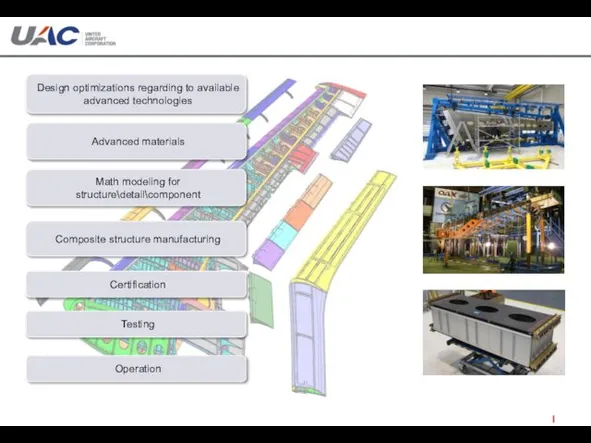

- 17. Advanced materials Include different proposals to improve the properties of existing materials, their modifications, an perspective

- 18. Mathematic modeling \analysis of: Material properties at lamina\laminate level Material engineering and properties modeling Defects in

- 19. Manufacturing technologies for CPRF Primary structure CPRF structure vacuum infusion process for manufacturing primary structures: recommendations,

- 20. Manufacturing technologies \ manufacturing process certification Certification issues for composite structure \components , overall Issues on

- 21. Tests to validate modeling Certification test for structure Components Detail Material Test methods, recommendations, equivalents etc

- 23. Скачать презентацию

Зубы и уход за ними

Зубы и уход за ними Матвієнко_А_А_менеджер_з_продажу_Стейбл_Енерджі_номер_один

Матвієнко_А_А_менеджер_з_продажу_Стейбл_Енерджі_номер_один Работа с каталогом. Общий поиск. Как найти книгу

Работа с каталогом. Общий поиск. Как найти книгу Крутиков

Крутиков Религия. Формы и виды религии. Функции религии в обществе

Религия. Формы и виды религии. Функции религии в обществе Детский телефон доверия – как помощь в трудной жизненной ситуации

Детский телефон доверия – как помощь в трудной жизненной ситуации Усовершенствования процесса дистанционного мониторинга

Усовершенствования процесса дистанционного мониторинга Театр – страна сказок и фантазий

Театр – страна сказок и фантазий Задачи на совместную работу

Задачи на совместную работу Литература периода Великой Отечественной войны (2)

Литература периода Великой Отечественной войны (2) Металлургия. География чёрной металлургии

Металлургия. География чёрной металлургии Екінші категориялы зауыттың электрмен жабдықталуы және сыртқы электрмен жабдықтау схемасының техникалық-экономикалық негіздемесі

Екінші категориялы зауыттың электрмен жабдықталуы және сыртқы электрмен жабдықтау схемасының техникалық-экономикалық негіздемесі Чудосветова. Презентация

Чудосветова. Презентация Технологии беспроводной передачи электрического тока на расстоянии как альтернатива устаревшим способам передачи тока

Технологии беспроводной передачи электрического тока на расстоянии как альтернатива устаревшим способам передачи тока 20141022_bunin

20141022_bunin Спанч Боб

Спанч Боб Современные виды печати

Современные виды печати Кунсткамера

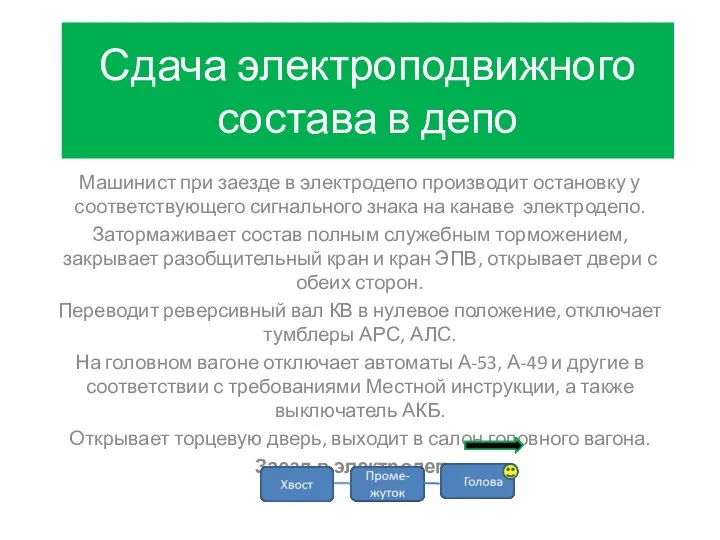

Кунсткамера Сдача электроподвижного состава в депо

Сдача электроподвижного состава в депо Включения в рубинах

Включения в рубинах Линия раздачи

Линия раздачи Еда должна быть лекарством. Меню на неделю

Еда должна быть лекарством. Меню на неделю применение интеграла

применение интеграла Территориальное общественное самоуправление Ленинградский

Территориальное общественное самоуправление Ленинградский Герои труда

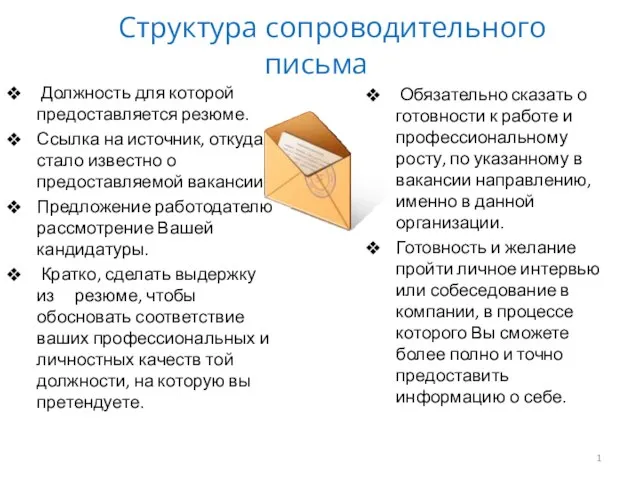

Герои труда Структура сопроводительного письма

Структура сопроводительного письма Микропроцессоры и сопроцессоры. Контроллеры, шины и порты

Микропроцессоры и сопроцессоры. Контроллеры, шины и порты 20140331_reshenie_primerov_i_zadach_v_predelakh_20_0

20140331_reshenie_primerov_i_zadach_v_predelakh_20_0