Содержание

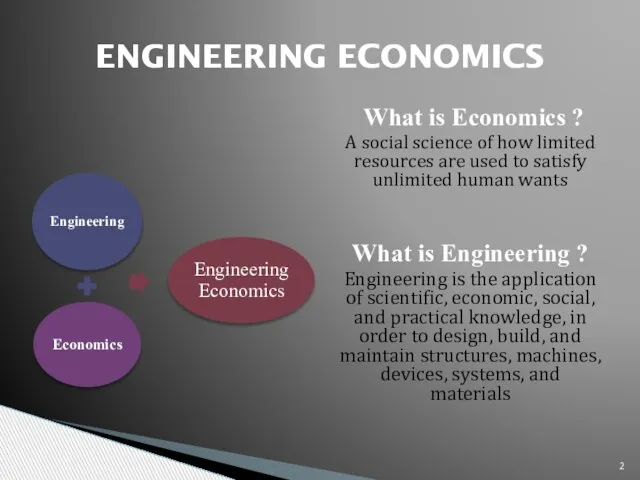

- 2. What is Economics ? A social science of how limited resources are used to satisfy unlimited

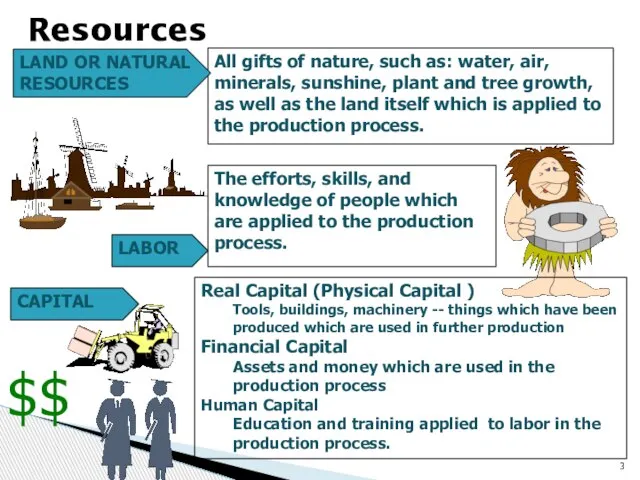

- 3. Resources All gifts of nature, such as: water, air, minerals, sunshine, plant and tree growth, as

- 4. Engineering Economics, previously known as engineering economy, is a subset of economics for application to engineering

- 5. WHY DO ENGINEERS NEED TO LEARN ABOUT ECONOMICS? Ages ago, the most significant barriers to engineers

- 6. What is Engineering Economics? Engineering Economics is about making decisions Engineering Economics is the application of

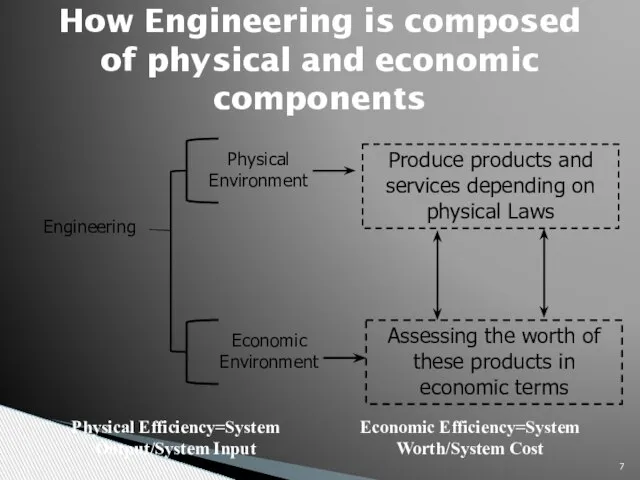

- 7. How Engineering is composed of physical and economic components Engineering Assessing the worth of these products

- 8. Engineering Economics: Origins The development of EI methodology is relatively recent A pioneer in the field

- 9. Cost Concepts Time Value of Money Cash-Flow Concepts Comparing Alternatives Evaluating Projects Benefit-Cost Analysis Course Topics:

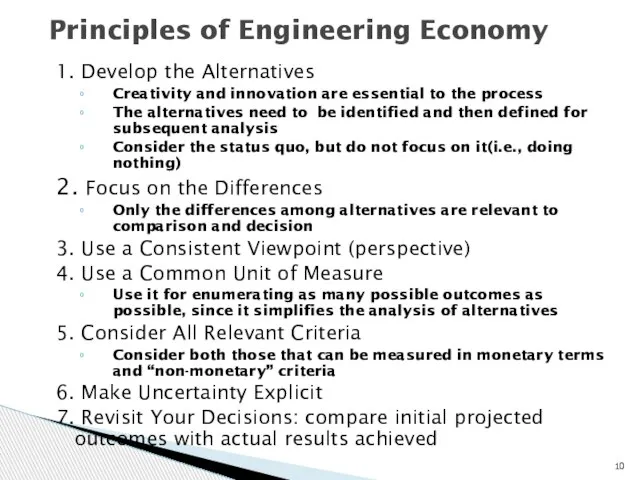

- 10. 1. Develop the Alternatives Creativity and innovation are essential to the process The alternatives need to

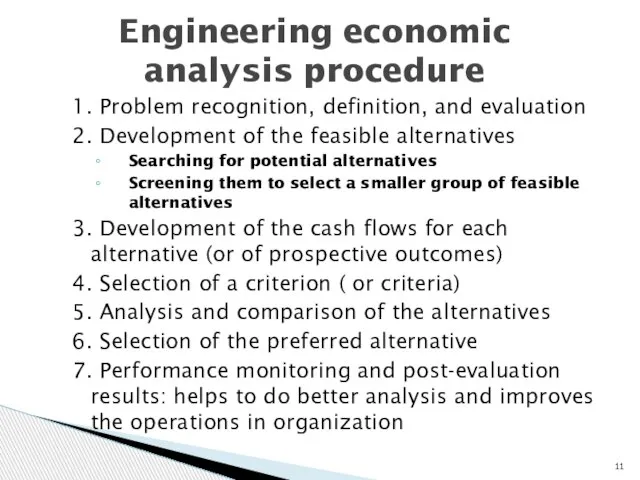

- 11. 1. Problem recognition, definition, and evaluation 2. Development of the feasible alternatives Searching for potential alternatives

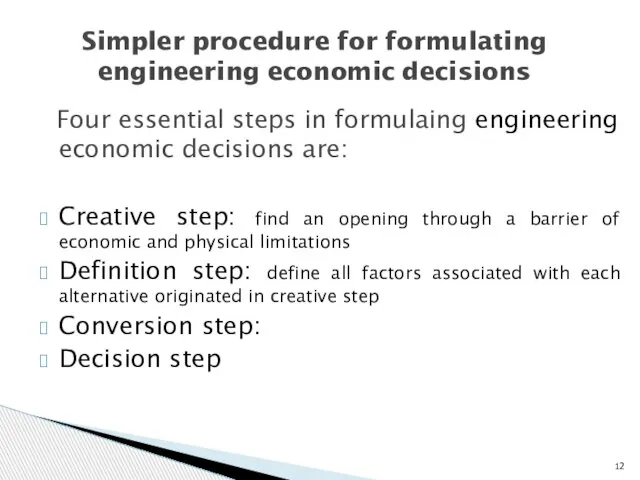

- 12. Four essential steps in formulaing engineering economic decisions are: Creative step: find an opening through a

- 13. The creative step consists of finding an opening through a barrier of economic and physical limitations

- 14. In the definition step, we define the alternatives originated or selected for comparison Choice is always

- 15. In order to be able to compare the alternatives we need to convert them to a

- 16. Having done all the abovementioned, we need to decide what to choose Consider multiple criteria Cancel

- 17. Engineering economics is needed for many kinds of decision making Example: Buying a car Alternatives: $18,000

- 18. Example: Buying a car Alternatives: $18,000 now, or $600 per month for 3 years (= $21,600

- 19. Would you rather have: $100 today, or $100 a year from now? Key Concept: Time Value

- 20. Would you rather have: $100 today, or $100 a year from now? Basic assumption: Given a

- 21. Most people would prefer to have it sooner. Why??? Reasons: Security ? Interests ? Inflation? Currency

- 22. One consequence of the time value of money: Suppose you are willing to exchange a certain

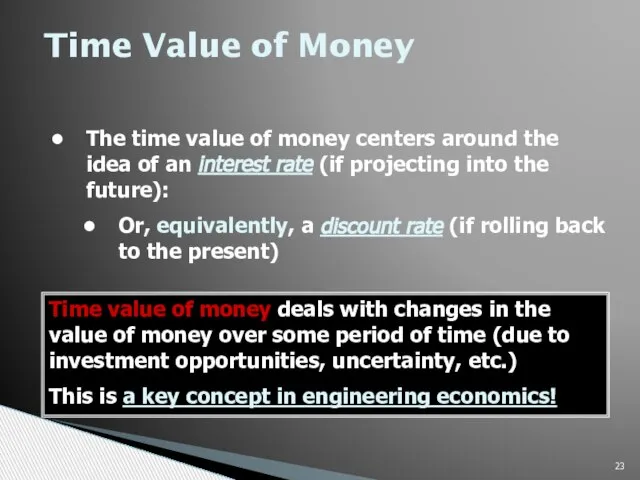

- 23. Time Value of Money The time value of money centers around the idea of an interest

- 24. In this course, we will learn methods to: Compare different cash flows over time Using the

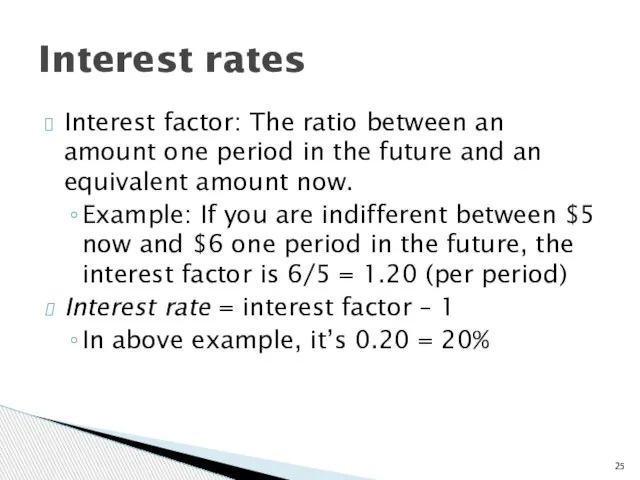

- 25. Interest factor: The ratio between an amount one period in the future and an equivalent amount

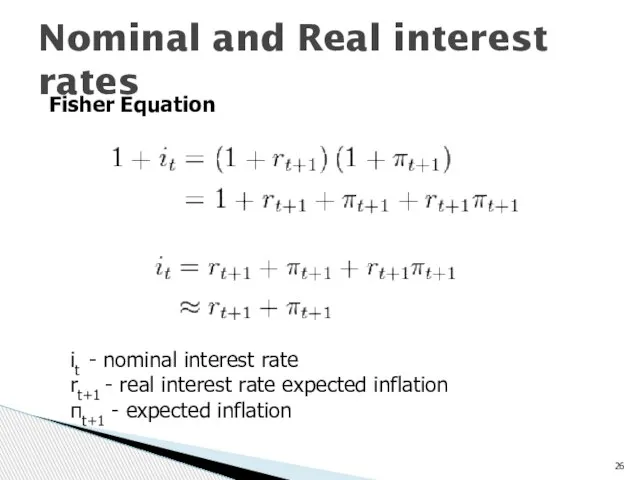

- 26. Nominal and Real interest rates Fisher Equation it - nominal interest rate rt+1 - real interest

- 27. A bank offers to pay $1,027.50 one year from now if you buy (now) a certificate

- 28. What Kinds of Questions Can Engineering Economics Answer? It will help you make good decisions: In

- 29. What Kinds of Questions Can Engineering Economics Answer? ENGINEERING ECONOMICS INVOLVES: FORMULATING, ESTIMATING, AND EVALUATING ECONOMIC

- 30. How Does It Do This? BY USING SPECIFIC MATHEMATICAL RELATIONSHIPS TO COMPARE THE CASH FLOWS OF

- 31. Where Do I Get the Data? Engineering economics is based mainly on estimates of future costs

- 32. SOME BASIC ECONOMIC CONCEPTS

- 33. Value is the worth that a person attaches to a good or service Value is inherent

- 34. Without the subjectivity of the concepts “value” and “utility” there would hardly be any room for

- 35. What If I Don’t Like the Answers? Remember: “Tools” don’t make decisions People make decisions, based

- 36. Your friend bought a small apartment building for $100,000. He spent $10,000 of his own money

- 37. Does your friend have a problem? If so, what is it? What are his alternatives? (Identify

- 38. Your friend spends each year $10,500 + $15,000 = $25,500, but receives 4 X $360 X

- 39. Option 2 Lower monthly expenses to $2,125-$∆C, so that this expenses and the interest that could

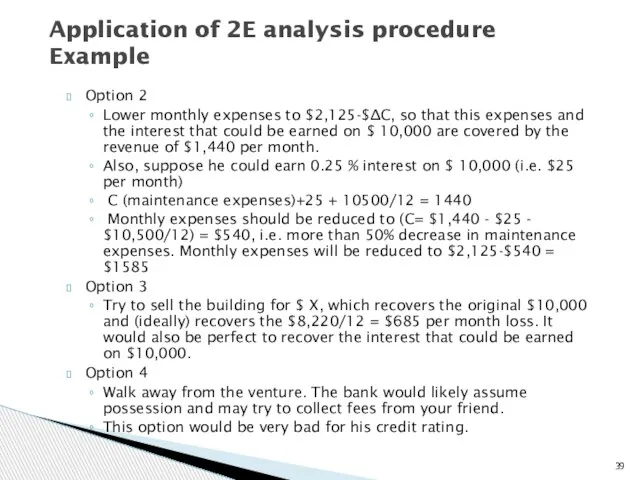

- 41. Скачать презентацию

Социальные аспекты экономического развития мира. (Тема 4)

Социальные аспекты экономического развития мира. (Тема 4) Производственная функция

Производственная функция Экономическая теория

Экономическая теория Плюсы ядерной энергетики

Плюсы ядерной энергетики Экономиалық өсу және нарық экономикасының циклділігі. Дәріс 11

Экономиалық өсу және нарық экономикасының циклділігі. Дәріс 11 Уаќыт аралыєында ґзгертілетін кґлік їрдісі

Уаќыт аралыєында ґзгертілетін кґлік їрдісі Понятие и сущность мирового хозяйства Выполнили: студенты ФТД-2 группы Т-105 Ляшков Игорь Цыпранюк Сергей

Понятие и сущность мирового хозяйства Выполнили: студенты ФТД-2 группы Т-105 Ляшков Игорь Цыпранюк Сергей Основные этапы развития капитализма свободной конкуренции

Основные этапы развития капитализма свободной конкуренции Провалы рынка как основа функционирования общественного сектора экономики

Провалы рынка как основа функционирования общественного сектора экономики О Воркутинской опорной зоне развития

О Воркутинской опорной зоне развития Економічне управління підприємством

Економічне управління підприємством Организация и нормирование труда

Организация и нормирование труда Меркантилизм в экономике

Меркантилизм в экономике Бюджетная система государства

Бюджетная система государства Методы оценки конкурентоспособности продукции

Методы оценки конкурентоспособности продукции Для чего нужна экономика (для начальной школы)

Для чего нужна экономика (для начальной школы) Моделирование как составная часть фармакоэкономических исследований

Моделирование как составная часть фармакоэкономических исследований Презентация Развитие объектов недвижимости (девелопмент, ленд-девелопмент, редевелопмент)

Презентация Развитие объектов недвижимости (девелопмент, ленд-девелопмент, редевелопмент) Theme 13. Unemployment and inflation are both manifestations of economic instability

Theme 13. Unemployment and inflation are both manifestations of economic instability Национальная экономика. Структура и средства измерения результатов её функционирования. (Тема 1)

Национальная экономика. Структура и средства измерения результатов её функционирования. (Тема 1) Соціально-еономічний зміст податкової політики

Соціально-еономічний зміст податкової політики Неоклассическая модель экономического роста Р. Солоу

Неоклассическая модель экономического роста Р. Солоу Нытва ТОСЭР. Зона особого развития для обеспечения ускоренного социально-экономического развития и создания комфортных условий

Нытва ТОСЭР. Зона особого развития для обеспечения ускоренного социально-экономического развития и создания комфортных условий Стратегия социально-экономического развития города Магнитогорска. ООО Сибпрофконсалт

Стратегия социально-экономического развития города Магнитогорска. ООО Сибпрофконсалт Кризис евро-зоны: есть ли пути выхода?

Кризис евро-зоны: есть ли пути выхода? Отчет о прохождении производственной практики в Администрации Южного внутригородского района муниципального образования

Отчет о прохождении производственной практики в Администрации Южного внутригородского района муниципального образования Экономические циклы

Экономические циклы Инфляция (виды, причины и последствия)

Инфляция (виды, причины и последствия)